EURUSD bears take a break ahead of ECBEURUSD posted the biggest daily slump in six months as Credit Suisse headlines fanned risk aversion on Wednesday. The fall, however, needs validation from the 1.0555-50 support confluence, comprising the 100-DMA and 14-week-old ascending support line, as well as the European Central Bank’s (ECB) Monetary Policy Meeting. That said, a clear break of 1.0550, accompanied by a disappointment from the ECB could quickly drag the major currency pair towards the 200-DMA support of 1.0320. However, the 38.2% Fibonacci retracement level of the pair’s September 2022 to February 2023 upside, near 1.0460, could act as an intermediate halt during the anticipated slump.

On the contrary, recovery moves require hawkish commentary, as well as a rate hike decision, from the ECB to aim for the 50-DMA hurdle surrounding 1.0725. Following that, the mid-February swing high of around 1.0810 could test the EURUSD bulls ahead of directing the run-up towards the previous monthly high, as well as the 2023 peak, of near 1.1035.

Overall, EURUSD is on the bear’s radar but the quote’s further downside hinges on the key fundamental events and important support zone break.

Eurusd-4

EURUSD 10TH MARCH 2023The EUR/USD needs to avoid the $1.0569 pivot to target the First Major Resistance Level (R1) at $1.0601. A return to $1.06 would signal a bullish session. However, the EUR/USD would need hawkish ECB chatter and US stats to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0623 and resistance at $1.0650. The Third Major Resistance Level (R3) sits at $1.0678.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0547 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0515 should limit the downside. The Third Major Support Level (S3) sits at $1.0460.

Looking at the EMAs and the 4-hourly chart, the EMAs send bearish signals. The EUR/USD sits below the 50-day EMA ($1.06006). The 50-day EMA eased back from the 100-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06006) and R1 ($1.06010) would give the bulls a run at R2 (1.0623) and the 100-day EMA ($1.06300). However, failure to move through the 50-day EMA ($1.06006) would leave S1 ($1.0547) in play. A move through the 50-day EMA would send a bullish signal.

Time and Price When price liquidating (sweeps) previous day high (same day high/ Asian high ) , and price came to liquidating the high at perfect time London open time 2 ,after collecting Buy side order (buys side liquidity ) prices will tries to push downwards . since , our htf view is bullish this one is low probable set up .. but still a Valid One

In 5 mint time frame , after liquidating pdh. we can see a clear 5 mint engulfing candle .. and price creates a inducement to sweep . we can either enter on the 5 mint candle or after price swp the inducement candle .. while placing SL right above the high and target a nearby imbalance (FVG) or previous day low .

EURUSD stays bullish unless breaking 1.0540 support confluenceAfter stalling a four-month winning streak in February, EURUSD prints mild gains so far in March. That said, the major currency pair’s latest recovery takes place from the 1.0540 support confluence comprising the 200-day Exponential Moving Average (EMA) and a three-month-old ascending support line. The upside momentum also takes clues from the upward-sloping RSI (14) line and upbeat MACD signals. As a result, the quote is well-set to challenge the last December’s peak surrounding 1.0740. Should the quote manage to remain firmer past 1.0740, which is more likely, the prices could aim for the mid-February top of around 1.0800. However, multiple hurdles could challenge the Euro bulls afterward, if not then the pair’s north-run toward the previous monthly high of near 1.1035 can’t be ruled out.

Meanwhile, a daily closing below the 1.0540 support confluence could quickly fetch the EURUSD price to January’s bottom of 1.0481 before highlighting the December 07 low near 1.0445. In a case where the pair sellers keep the reins past 1.0445, the 50% and 61.8% Fibonacci retracements of its run-up from November 2022 to February 2023, respectively near 1.0380 and 1.0230, could flash on their radar. It’s worth observing that the late October 2022 high near 1.0095 and the 1.000 level are crucial for the Euro bears to watch past 1.0230.

Overall, EURUSD remains on the bull’s radar as it stays firmer beyond the key support ahead of Fed Chair Jerome Powell’s semi-annual Testimony.

EURUSD FORECAST 6TH MARCH 2023The EUR/USD needs to avoid the $1.0620 pivot to target the First Major Resistance Level (R1) at $1.0652. A move through the Friday high of $1.06386 would signal a bullish session. However, the EUR/USD would need the retail sales numbers and Philip Lane to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0671 and resistance at $1.07. The Third Major Resistance Level (R3) sits at $1.0721.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0602 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0550. The Second Major Support Level (S2) at $1.0570 should limit the downside. The Third Major Support Level (S3) sits at $1.0519.

Looking at the EMAs and the 4-hourly chart, the EMAs send mixed signals. The EUR/USD sits below the 100-day EMA ($1.06549). The 50-day EMA narrowed to the 100-day EMA, while the 100-day EMA eased back from the 200-day EMA, delivering mixed signals.

A move through R1 ($1.0652) and the 100-day EMA ($1.06549) would give the bulls a run at R2 ($1.0671) and the 200-day EMA ($1.06804). However, a fall through the 50-day EMA ($1.06243) would bring S1 ($1.0602) and sub-$1.06 Support Levels into play. A slide through the 50-day EMA would send a bearish signal.

EURUSD MAY GO DOWNThe euro lost almost 0.7% on Thursday as better-than-expected U.S. economic data pushed the U.S. dollar higher.

Possible effects for traders

The U.S. dollar strengthened after the unemployment claims report pointed out a strong U.S. jobs market. Other data showed growing labor costs, indicating the Fed has to raise interest rates further to tame inflation. 'This move higher that you're seeing in U.S. rates is not happening in isolation. Similar developments are happening in the rest of the world, in particular in Europe, mostly notably, where the inflation data keeps on surprising relatively strong,' said Alvise Marino, the macro trading strategist at Credit Suisse. In other words, even if the Fed's policy remains hawkish, the European Central Bank will not fall behind and will continue raising the base rate.

Thus, the fundamental picture for EURUSD remains rather mixed. Today's speeches from three Fed officials after 4:00 p.m. UTC may offer some clues. The key levels for the pair to watch are 1.07000 and 1.05300.

EURUSD Forecast, 03 Mar,23At the time of writing, the EUR/USD was up 0.08% to $1.06057. A mixed start to the day saw the EUR/USD fall to an early low of $1.05946 before rising to a high of $1.06148.

The EUR/USD needs to move through the $1.0615 pivot to target the First Major Resistance Level (R1) at $1.0654 and the Thursday high of $1.06728. A return to $1.0650 would signal a bullish session. However, the EUR/USD would need the services PMIs and the Fed commentary to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0712. The Third Major Resistance Level (R3) sits at $1.0808.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0558 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0519 should limit the downside. The Third Major Support Level (S3) sits at $1.0423.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06228). The 50-day EMA fell back from the 100-day EMA, with the 100-day EMA easing back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06228) would support a breakout from R1 ($1.0654) and the 100-day EMA ($1.06581) to target the 200-day EMA ($1.06836) and R2 ($1.0712). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06228) would leave the Major Support Levels in play.

The US Session

Looking ahead to the US session, it is a busy day on the US economic calendar. The all-important ISM Non-Manufacturing PMI for February will draw plenty of investor interest.

We expect market sensitivity to the headline PMI and sub-components, with the ISM Non-Manufacturing Prices Index the one to watch.

Other stats include finalized S&P Global Services and Composite PMI numbers that should play second fiddle to the ISM survey-based numbers.

With the services sector in the spotlight, investors need to monitor FOMC member chatter. FOMC members Logan, Bostic, and Bowman will deliver speeches today. Investors will want to gauge how high and for how long the Fed will push interest rates to curb inflation and return it to target.

On Thursday, FOMC member Bostic favored a 25-basis point rate hike in March.

Important data ahead of the ECB policy meetingThe eurozone will release core inflation rate

The eurozone will release the core inflation rate based on the Harmonized Index of Consumer Price (HICP). The index tracks changes in the prices of goods and services customers buy in all eurozone countries. The report is important because the European Central Bank (ECB) will consider the data when deciding on its monetary policy. The core inflation rate will come out on 2 March at 10:00 a.m. UTC.

Key takeaways

The market expects the report to give more clues about the ECB's monetary policy and the pace of rate hikes in 2023. If inflation comes out higher than anticipated, the euro will strengthen, backed by expectations of a hawkish policy from the regulator.

The latest data showed that eurozone inflation is slowing down. However, the market already priced in a 50-basis-point rate hike by the ECB. Thus, the euro may fall significantly if core inflation figures are lower than expected.

Overall, the euro experiences downward pressure as the Federal Reserve confirms its intention to hike rates further, and the U.S. dollar is strengthening. Therefore, signs of persistent inflation will likely cause only a slight increase in currency, while lower-than-anticipated figures may cause a major euro decline.

EURUSD stays on the bear’s radar despite recent reboundEURUSD began the month of March on a positive note by crossing a one-month-old descending trend line, as well as poking the 1.0690 resistance confluence including the 200-EMA and 61.8% Fibonacci retracement of the January-February upside. The recovery also justified bullish MACD signals. However, the RSI (14) retreated from the overbought territory and triggered the quote’s pullback from the key upside hurdle. Even if the pair crosses the 1.0690 immediate resistance, a horizontal area comprising multiple levels marked since January-end, around 1.0788-805, appears a tough nut to crack for the bulls. It’s worth noting that the quote’s successful run-up beyond 1.0805 won’t hesitate to challenge January’s high of near 1.0930.

Meanwhile, pullback moves could aim for the previous resistance line from early February, close to 1.0585. Following that, lows marked during the previous month and January, near 1.0530 and 1.0480 in that order, could lure the EURUSD bears. Should the pair remains bearish past 1.0480, bottoms marked in late November around 1.0290 and 1.0220 may act as the last stops for the sellers before highlighting the parity level of 1.0000.

Overall, EURUSD is likely to grind higher for the short term but the medium-term bearish trend remains intact.

EURUSD Forecast 01/03/2023The EUR/USD needs to move through the $1.0597 pivot to target the First Major Resistance Level (R1) at $1.0621 and the Tuesday high of $1.06453. A return to $1.06 would signal a bullish session. However, the EUR/USD would need the stats and the ECB chatter to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0670 and resistance at $1.07. The Third Major Resistance Level (R3) sits at $1.0743.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0548 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0524 should limit the downside. The Third Major Support Level (S3) sits at $1.0451.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06213). The 50-day EMA slipped back from the 200-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0621) and the 50-day EMA ($1.06213) would give the bulls a run at the 100-day EMA ($1.06665) and R2 ($1.0670). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06213) would leave the Major Support Levels in play.

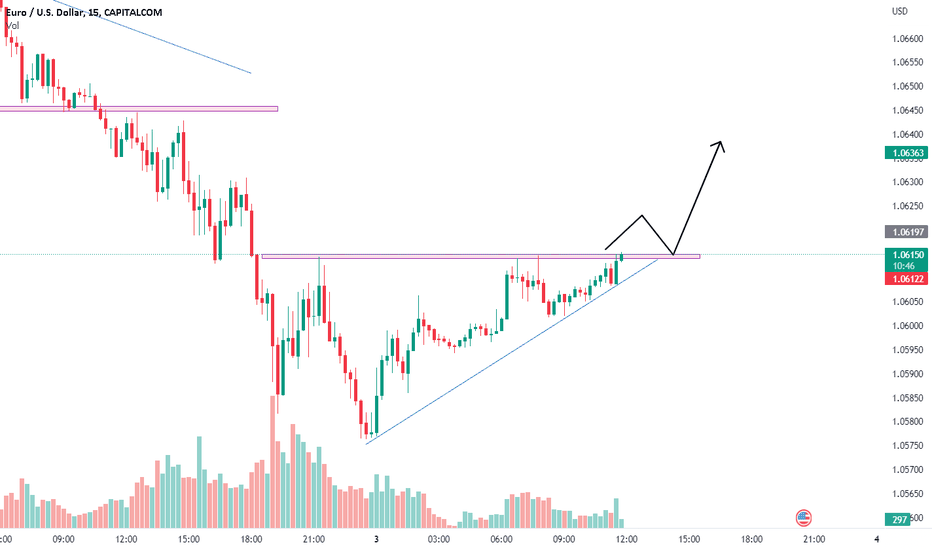

Possible C-Wave; Short term Elliotical Approach to EURUSD. Hello Traders!

1. We see a 5-wave move down, a clear impulse; then Wave A breaking into 5 parts, and then a clear Wave B breaking into further 3 parts.

2. We see a running triangle variation forming as shown in the chart and then a 5-move impulse down. Image attached.

3. A 5-move wave up can be clearly seen on the chart in the 15-minute timeframe. That will be our 1st wave.

4. Target can be anywhere between 100% of Wave B and 161.8% of Wave A. That gives us the complete green zone.

5. I've already talked about irregular correction quite in depth in the BTC idea I published recently. The link will be attached.

Do use proper risk management.

Happy Trading!

Profits,

Market's Mechanic.