EURUSD FORECAST 9TH MARCH,2023The EUR/USD needs to avoid the $1.0547 pivot to target the First Major Resistance Level (R1) at $1.0569 and the Wednesday high of $1.05739. A return to $1.0550 would signal a bullish session. However, the EUR/USD would need hawkish ECB chatter and US stats to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0596 and resistance at $1.06. The Third Major Resistance Level (R3) sits at $1.0646.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0519 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0450. The Second Major Support Level (S2) at $1.0497 should limit the downside. The Third Major Support Level (S3) sits at $1.0447.

Looking at the EMAs and the 4-hourly chart, the EMAs send bearish signals. The EUR/USD sits below the 50-day EMA ($1.06058). The 50-day EMA slid back from the 100-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0569) would give the bulls a run at R2 (1.0596) and the 50-day EMA ($1.06058). However, failure to move through the 50-day EMA ($1.06058) would leave S1 ($1.0519) in play. A move through the 50-day EMA would send a bullish signal.

Eurusdlong

EURUSD FORECAST 8th MARCH 2023The EUR/USD needs to move through the $1.0597 pivot to target the First Major Resistance Level (R1) at $1.0647. A return to $1.0550 would signal a bullish session. However, the EUR/USD would need the German and US stats to support a breakout session.

In the case of an extended rally, the bulls will likely test resistance at $1.07 but fall short of the Second Major Resistance Level (R2) at $1.0745. The Third Major Resistance Level (R3) sits at $1.0893.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0499 in play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0450 and the Second Major Support Level (S2) at $1.0448. The Third Major Support Level (S3) sits at $1.0300.

Looking at the EMAs and the 4-hourly chart, the EMAs send bearish signals. The EUR/USD sits below the 50-day EMA ($1.06231). The 50-day EMA slid back from the 100-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06231) would support a breakout from R1 ($1.0647) to give the bulls a run at $1.07. However, failure to move through the 50-day EMA ($1.06231) would leave S1 ($1.0499) in play. A move through the 50-day EMA would send a bullish signal.

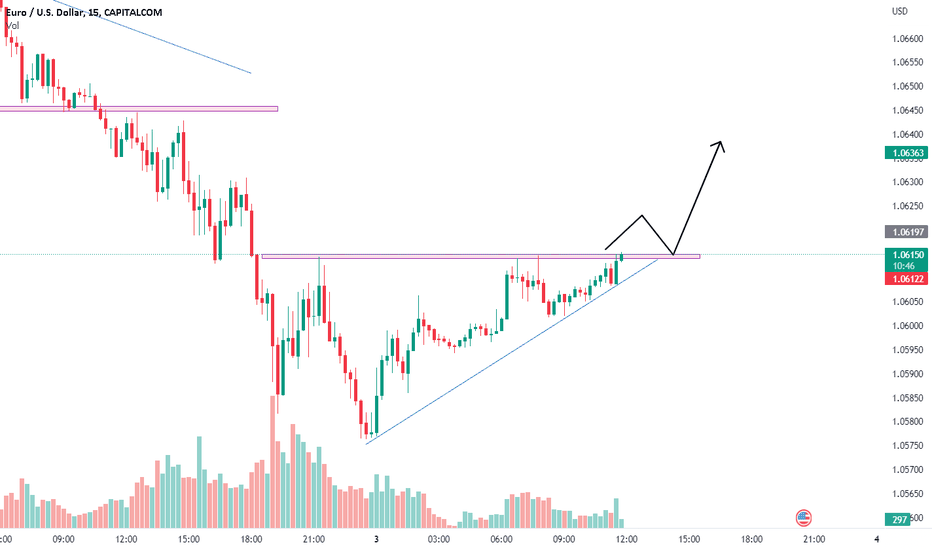

#EUR/USD Upward Movement potential with RIsk:reward =3 #FOREX#FOREX #EUR/USD Buy at 1.06583, SL 1.05933, Target 1.08489

RISK:REWARD 3

ANalysis: Broadening Triangle.

Hey Traders,

HOPE our analysis is adding value to your Stock market trading Journey.

If yes, cheer us with Thumbs up...

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading

EURUSD FORECAST 6TH MARCH 2023The EUR/USD needs to avoid the $1.0620 pivot to target the First Major Resistance Level (R1) at $1.0652. A move through the Friday high of $1.06386 would signal a bullish session. However, the EUR/USD would need the retail sales numbers and Philip Lane to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0671 and resistance at $1.07. The Third Major Resistance Level (R3) sits at $1.0721.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0602 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0550. The Second Major Support Level (S2) at $1.0570 should limit the downside. The Third Major Support Level (S3) sits at $1.0519.

Looking at the EMAs and the 4-hourly chart, the EMAs send mixed signals. The EUR/USD sits below the 100-day EMA ($1.06549). The 50-day EMA narrowed to the 100-day EMA, while the 100-day EMA eased back from the 200-day EMA, delivering mixed signals.

A move through R1 ($1.0652) and the 100-day EMA ($1.06549) would give the bulls a run at R2 ($1.0671) and the 200-day EMA ($1.06804). However, a fall through the 50-day EMA ($1.06243) would bring S1 ($1.0602) and sub-$1.06 Support Levels into play. A slide through the 50-day EMA would send a bearish signal.

EURUSD Forecast, 03 Mar,23At the time of writing, the EUR/USD was up 0.08% to $1.06057. A mixed start to the day saw the EUR/USD fall to an early low of $1.05946 before rising to a high of $1.06148.

The EUR/USD needs to move through the $1.0615 pivot to target the First Major Resistance Level (R1) at $1.0654 and the Thursday high of $1.06728. A return to $1.0650 would signal a bullish session. However, the EUR/USD would need the services PMIs and the Fed commentary to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0712. The Third Major Resistance Level (R3) sits at $1.0808.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0558 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0519 should limit the downside. The Third Major Support Level (S3) sits at $1.0423.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06228). The 50-day EMA fell back from the 100-day EMA, with the 100-day EMA easing back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06228) would support a breakout from R1 ($1.0654) and the 100-day EMA ($1.06581) to target the 200-day EMA ($1.06836) and R2 ($1.0712). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06228) would leave the Major Support Levels in play.

The US Session

Looking ahead to the US session, it is a busy day on the US economic calendar. The all-important ISM Non-Manufacturing PMI for February will draw plenty of investor interest.

We expect market sensitivity to the headline PMI and sub-components, with the ISM Non-Manufacturing Prices Index the one to watch.

Other stats include finalized S&P Global Services and Composite PMI numbers that should play second fiddle to the ISM survey-based numbers.

With the services sector in the spotlight, investors need to monitor FOMC member chatter. FOMC members Logan, Bostic, and Bowman will deliver speeches today. Investors will want to gauge how high and for how long the Fed will push interest rates to curb inflation and return it to target.

On Thursday, FOMC member Bostic favored a 25-basis point rate hike in March.

EURUSD Forecast for 28th Feb 2023The EUR/USD needs to avoid the $1.0587 pivot to target the First Major Resistance Level (R1) at $1.0642. A move through the Monday high of $1.06199 would signal a bullish session. However, the EUR/USD would need the stats and the ECB chatter to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0674 and resistance at $1.07. The Third Major Resistance Level (R3) sits at $1.0761.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0555 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0500 should limit the downside. The Third Major Support Level (S3) sits at $1.0415.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06286). The 50-day EMA slipped back from the 200-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06286) and R1 ($1.0642) would give the bulls a run at R2 ($1.0674) and the 100-day EMA ($1.06756). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06286) would leave the Major Support Levels in play.

The US Session

It is a day on the US economic calendar. Goods trade data for January will draw interest early in the session. However, barring a marked widening in the goods trade deficit, the numbers should have a muted impact on the dollar.

The US CB Consumer Confidence numbers for February will influence. A larger-than-expected rise in confidence would support the more aggressive Fed monetary policy outlook. Economists forecast the Index to increase from 107.1 to 108.5.

Other stats include house price data. However, the latest jump in US mortgage rates will mute investor sentiment towards a likely slowdown in house price growth in December.

Following the latest Core PCE Price Index numbers, investors should also monitor FOMC member chatter.

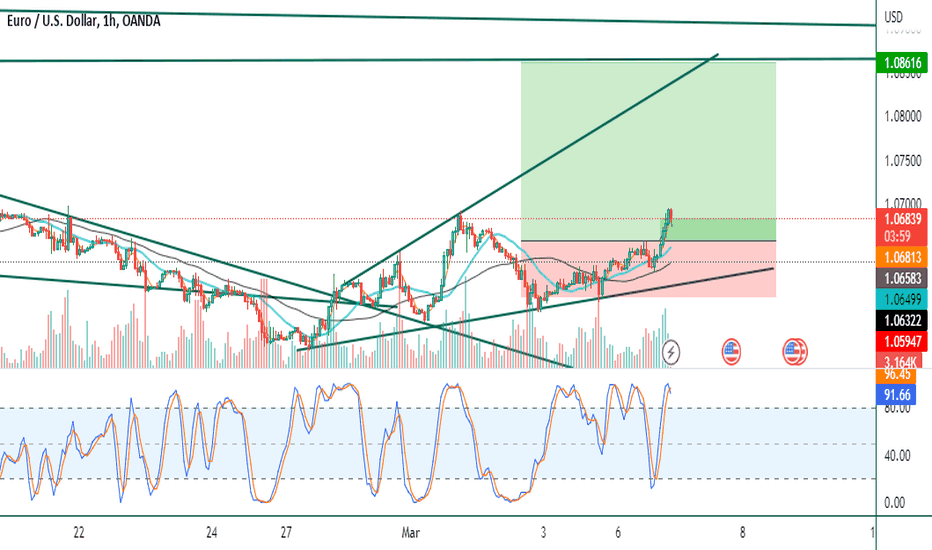

Possible C-Wave; Short term Elliotical Approach to EURUSD. Hello Traders!

1. We see a 5-wave move down, a clear impulse; then Wave A breaking into 5 parts, and then a clear Wave B breaking into further 3 parts.

2. We see a running triangle variation forming as shown in the chart and then a 5-move impulse down. Image attached.

3. A 5-move wave up can be clearly seen on the chart in the 15-minute timeframe. That will be our 1st wave.

4. Target can be anywhere between 100% of Wave B and 161.8% of Wave A. That gives us the complete green zone.

5. I've already talked about irregular correction quite in depth in the BTC idea I published recently. The link will be attached.

Do use proper risk management.

Happy Trading!

Profits,

Market's Mechanic.

EURUSD 27th Feb ForecastThe EUR/USD needs to move through the $1.0565 pivot to target the First Major Resistance Level (R1) at $1.0594 and the Friday high of $1.06143. A return to $1.06 would signal a bullish session. However, the EUR/USD would need the stats and the ECB chatter to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0643. The Third Major Resistance Level (R3) sits at $1.0722.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0516 in play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0450. The Second Major Support Level (S2) at $1.0487 should limit the downside. The Third Major Support Level (S3) sits at $1.0409.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06397). The 50-day EMA slid back from the 200-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0594) would give the bulls a run at the 50-day EMA ($1.06397) and R2 ($1.0643). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06397) would leave the Major Support Levels in play.

EURUSD Forcast 24/02/2023The EUR/USD needs to avoid a fall through the $1.0600 pivot to target the First Major Resistance Level (R1) at $1.0623 and the Thursday high of $1.06278. A return to $1.0620 would signal a bullish session. However, the EUR/USD would need today’s stats and the ECB chatter to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0651. The Third Major Resistance Level (R3) sits at $1.0701.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0572 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0549 should limit the downside. The Third Major Support Level (S3) sits at $1.0498.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06626). The 50-day EMA fell back from the 200-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0621) would give the bulls a run at R2 ($1.0651) and the 50-day EMA ($1.06626). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06626) would leave the Major Support Levels in play.

The US Session

It is a busy day on the US economic calendar. Personal income, spending, and inflation will be in focus. An unexpected rise in the Core PCE Price Index would fuel bets of a more hawkish Fed. Economists forecast the Core PCE Price Index to rise by 4.3% year-over-year in January. The Index was up 4.4% in December.

Later in the session, consumer sentiment and Fed chatter will also draw interest. FOMC member Loretta Mester will deliver a post-stats speech.

EURUSD Forecast for 22nd Feb,2023The EUR/USD needs to move through the $1.0660 pivot to target the First Major Resistance Level (R1) at $1.0682 and the Tuesday high of $1.06983. A return to $1.0680 would signal a bullish session. However, the EUR/USD would need today’s stats and the Fed minutes to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0721. The Third Major Resistance Level (R3) sits at $1.0782.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0621 in play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0550. The Second Major Support Level (S2) at $1.0599 should limit the downside. The Third Major Support Level (S3) sits at $1.0538

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06954). Following the bearish cross on Wednesday, the 50-day EMA pulled further back from the 200-day EMA, with the 100-day EMA closing in on the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0682) and the 50-day EMA ($1.06954) would give the bulls a run at R2 ($1.0721) and the 200-day EMA ($1.07255). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06954) would leave the Major Support Levels in play.

It is a relatively quiet day on the US economic calendar. There are no US economic indicators for investors to consider today. The lack of stats will leave the Fed in the spotlight. Late in the US session, the FOMC meeting minutes will draw plenty of interest.

Following the latest round of US economic indicators and hawkish Fed chatter, the markets will dissect the minutes to gauge how far the Fed is willing to go. FOMC member chatter will also influence the dollar, with FOMC member Williams speaking late in the session.

Euro Price ForecastEUR/USD ANALYSIS

Better than expected EZ PMI and ZEW economic sentiment aren’t enough to hold back risk-off environment.

Falling wedge in play which could point to subsequent upside to come.

EURO FUNDAMENTAL BACKDROP

The European trading session kicked off in a positive light this Tuesday from an economic standpoint; beginning with eurozone PMI data (see economic calendar below) which beat expectations on the composite read. Although manufacturing numbers were slightly off the mark, the overall market reaction was positive in terms of the resilience of the region. Growth surprised many analysts considering the winter months which traditionally weighs negatively on the statistic and bodes well for the first quarter period. Declining energy pressures have aided in the disinflationary impact on goods and services thus increasing consumer demand.

That being said, the services sector is still being plagued by sticky wage costs that will continue to add hawkish pressure on the European Central Bank (ECB). The PMI data was then supplemented by a considerable beat on ZEW economic sentiment for February and has reached its highest level since February 2022 reinforcing the optimism within the region.

EURUSD Forecast 20th Feb,2023Today we may see a small correction and then again a rally into a Bull Section. Please pay attention to the mentioned levels for any trade set up.

18th Feb

DH - 1.06986

DL - 1.06126

20TH FEB,2023

R1- 1.0724, S1- 1.0638

R2- 1.0754

R3- 1.0840, S3 - 1.0583

The EUR/USD needs to avoid a fall through the $1.0668 pivot to target the First Major Resistance Level (R1) at $1.0724. A return to $1.07 would signal a bullish session. However, the EUR/USD would need ECB member chatter and today’s stats to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0754. The Third Major Resistance Level (R3) sits at $1.0840.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0638 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.06 and the third Major Support Level (S3) at $1.0583.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.07131). Following the bearish cross on Wednesday, the 50-day EMA pulled further back from the 200-day EMA, with the 100-day EMA narrowing to the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.07131) and R1 ($1.0724) would give the bulls a run at the 200-day ($1.07328) and the 100-day ($1.07456) EMAs. A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.07159) would leave the Major Support Levels in play

EURUSD Ahead Of CPI Today , 16th Feb ,2023The euro lost 0.43% yesterday as the U.S. Dollar Index (DXY) climbed to a six-week high after better-than-expected U.S. retail sales data was released.

Possible effects for traders

Upbeat economic data has fueled more hawkish expectations on the U.S. interest rate. According to Reuters, the Federal Reserve's (Fed) terminal rate has been adjusted to about 5.25%. Thus, the fundamental pressure on the DXY remains bullish, so EURUSD weakened. Still, the euro rebounded slightly during the Asian session earlier today but failed to hold above the important 1.07100 level.

Today, there are two crucial events traders should focus on: the release of the U.S. Producer Price Index (PPI) data and the publication of the latest U.S. Jobless Claims. Both reports will be released at 1:30 p.m. GMT. These data can potentially deepen the short-term bearish trend in EURUSD. However, if PPI figures come out below expectations, EURUSD may rally above 1.07500.