Eurusdtrade

EURUSD 6th APRIL FORECAST We can see a strong resistance at 1.08833 it it is broken then we can expect a Bear Move to 1.07863

The EUR/USD needs to move through the $1.0921 pivot to target the First Major Resistance Level (R1) at $1.0951 and the Wednesday high of $1.09696. A return to $1.0950 would signal a bullish session. However, the EUR/USD needs hawkish ECB chatter and hotter-than-expected industrial production figures to support a pre-US session breakout.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.1000. The Third Major Resistance Level (R3) sits at $1.1078.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0872 in play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.080. The Second Major Support Level (S2) at $1.0842 should limit the downside. The Third Major Support Level (S3) sits at $1.0764.

Looking at the EMAs and the 4-hourly chart, the EMAs send bullish signals. The EUR/USD sits above the 50-day EMA ($1.08678). The 50-day EMA pulled further away from the 100-day EMA, with the 100-day EMA widening from the 200-day EMA, delivering bullish signals.

A hold above S1 ($1.0872) and the 50-day EMA ($1.08678) would support a breakout from R1 ($1.0951) to give the bulls a run at R2 ($1.1000). However, a fall through S1 ($1.0872) and the 50-day EMA ($1.08678) would bring S2 ($1.0842) into play. A fall through the 50-day EMA would send a bearish signal.

EURUSD FORECAST 29TH MARCH 2023EUR/USD Bulls to Target $1.0850 on German Consumer Confidence

It is a relatively busy day for the EUR/USD, with German and French consumer confidence and ECB commentary to draw interest.

The EUR/USD needs to avoid the $1.0829 pivot to target the First Major Resistance Level (R1) at $1.0862. A move through the Tuesday high of $1.08485 would signal a bullish session. However, the EUR/USD needs hawkish ECB chatter and better-than-expected consumer confidence numbers to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0882 and resistance at $1.09. The Third Major Resistance Level (R3) sits at $1.0936.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0809 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.075. The Second Major Support Level (S2) at $1.0775 should limit the downside. The Third Major Support Level (S3) sits at $1.0721.

Looking at the EMAs and the 4-hourly chart, the EMAs send bullish signals. The EUR/USD sits above the 50-day EMA ($1.07746). The 50-day EMA pulled away from the 100-day EMA, with the 100-day EMA widening from the 200-day EMA, delivering bullish signals.

A hold above the Major Support Levels and the 50-day EMA ($1.07746) would support a breakout from R1 ($1.0862) to give the bulls a run at R2 ($1.0882) and $1.09. However, a fall through S1 ($1.0809) would bring S2 ($1.0775) and the 50-day EMA ($1.07746) into play. A fall through the 50-day EMA would send a bearish signal.

EUR/USD to Target $1.09 on Easing Bank Jitters and ECB ChatterThis morning, the EUR/USD was up 0.13% to $1.08107. A mixed start to the day saw the EUR/USD fall to an early low of $1.07949 before rising to a high of $1.08195. The First Major Resistance Level (R1) at $1.0817 capped the upside.

The EUR/USD needs to avoid a fall through the $1.0781 pivot to retarget the First Major Resistance Level (R1) at $1.0817 and the morning high of $1.08195. A move through the morning high would signal a bullish session. However, the EUR/USD needs hawkish ECB chatter and better-than-expected business survey numbers to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0836 and resistance at $1.0850. The Third Major Resistance Level (R3) sits at $1.0891.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0761 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.07. The Second Major Support Level (S2) at $1.0725 should limit the downside. The Third Major Support Level (S3) sits at $1.0670.

Looking at the EMAs and the 4-hourly chart, the EMAs send bullish signals. The EUR/USD sits above the 50-day EMA ($1.07576). The 50-day EMA pulled away from the 100-day EMA, with the 100-day EMA widening from the 200-day EMA, delivering bullish signals.

A hold above S1 ($1.0761) and the 50-day EMA ($1.07576) would support a breakout from R1 ($1.0817) to give the bulls a run at R2 ($1.0836) and $1.0850. However, a fall through S1 ($1.0761) and the 50-day EMA ($1.07576) would bring S2 ($1.0725) into play. A fall through the 50-day EMA would send a bearish signal.

EURUSD FORECAST 16TH MARCH 2023The EURUSD pair’s strong decline stopped at 1.0515 yesterday, which formed solid support against the price, to rebound bullishly and start building bullish wave on the intraday basis, motivated by stochastic positivity.

Therefore, we expect to witness more bullish bias in the upcoming sessions, and the targets begin at 1.0640 and extend to 1.0745 after surpassing the previous level.

On the other hand, we should note that breaking 1.0515 will stop the expected rise and press on the price to suffer additional losses that reach 1.0440.

The expected trading range for today is between 1.0515 support and 1.0680 resistance.

The expected trend for today: Bullish

U.S. inflation reports and the ECB's interest rate U.S. will release CPI and PPI data on 14 and 15 March at 12:30 p.m. UTC

The Consumer Price Index (CPI) is a monthly report measuring differences in prices of goods and services consumers buy. Producer Price Index (PPI) shows changes in the price of goods and services producers purchase. Both reports are popular inflation indicators, and inflation is the most important data for the Federal Reserve (Fed) to plan its monetary policy.

CPI and PPI reports will give clues on the outcome of the next Fed's policy meeting on 21–22 March. The market expects inflation to slow only a little, meaning the Fed will have to provide more rate hikes. If reports indicate a substantial slowdown in inflation, it will surprise the market and bring down the U.S. dollar.

The ECB's interest rate decision is due on 16 March at 1:15 p.m. UTC.

The market is firmly sure that the European Central Bank will deliver a 50-basis points (bps) rate hike. If these expectations of a 50-bps hike are met, EURUSD will rise slightly as the rate increase is already priced in. In case the rate hike is smaller than expected, the euro will drop sharply. However, this scenario is highly unlikely to happen.

EURUSD 10TH MARCH 2023The EUR/USD needs to avoid the $1.0569 pivot to target the First Major Resistance Level (R1) at $1.0601. A return to $1.06 would signal a bullish session. However, the EUR/USD would need hawkish ECB chatter and US stats to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0623 and resistance at $1.0650. The Third Major Resistance Level (R3) sits at $1.0678.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0547 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0515 should limit the downside. The Third Major Support Level (S3) sits at $1.0460.

Looking at the EMAs and the 4-hourly chart, the EMAs send bearish signals. The EUR/USD sits below the 50-day EMA ($1.06006). The 50-day EMA eased back from the 100-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06006) and R1 ($1.06010) would give the bulls a run at R2 (1.0623) and the 100-day EMA ($1.06300). However, failure to move through the 50-day EMA ($1.06006) would leave S1 ($1.0547) in play. A move through the 50-day EMA would send a bullish signal.

EURUSD FORECAST 8th MARCH 2023The EUR/USD needs to move through the $1.0597 pivot to target the First Major Resistance Level (R1) at $1.0647. A return to $1.0550 would signal a bullish session. However, the EUR/USD would need the German and US stats to support a breakout session.

In the case of an extended rally, the bulls will likely test resistance at $1.07 but fall short of the Second Major Resistance Level (R2) at $1.0745. The Third Major Resistance Level (R3) sits at $1.0893.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0499 in play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0450 and the Second Major Support Level (S2) at $1.0448. The Third Major Support Level (S3) sits at $1.0300.

Looking at the EMAs and the 4-hourly chart, the EMAs send bearish signals. The EUR/USD sits below the 50-day EMA ($1.06231). The 50-day EMA slid back from the 100-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06231) would support a breakout from R1 ($1.0647) to give the bulls a run at $1.07. However, failure to move through the 50-day EMA ($1.06231) would leave S1 ($1.0499) in play. A move through the 50-day EMA would send a bullish signal.

EURUSD FORECAST 7TH MARCH 2023The EUR/USD needs to avoid the $1.0665 pivot to target the First Major Resistance Level (R1) at $1.0708. A move through the Monday high of $1.06943 would signal a bullish session. However, the EUR/USD would need the German stats and Fed Chair Powell to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0737 and resistance at $1.0750. The Third Major Resistance Level (R3) sits at $1.0810.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0636 into play. However, barring a Fed-fueled sell-off, the EUR/USD pair should avoid sub-$1.060 and the Second Major Support Level (S2) at $1.0593. The Third Major Support Level (S3) sits at $1.0521.

Looking at the EMAs and the 4-hourly chart, the EMAs send more bullish signals. The EUR/USD sits above the 200-day EMA ($1.06799). The 50-day EMA narrowed to the 100-day EMA, with the 100-day EMA closing in on the 200-day EMA, delivering bullish signals.

A hold above the 200-day EMA ($1.06799) would support a breakout from R1 ($1.0708) to give the bulls a run at R2 ($1.0737). However, a fall through the 200-day ($1.06799) and 100-day ($1.06567) EMAs would bring S1 ($1.0636) and the 50-day EMA ($1.06345) into play. A slide through the 50-day EMA would send a bearish signal.

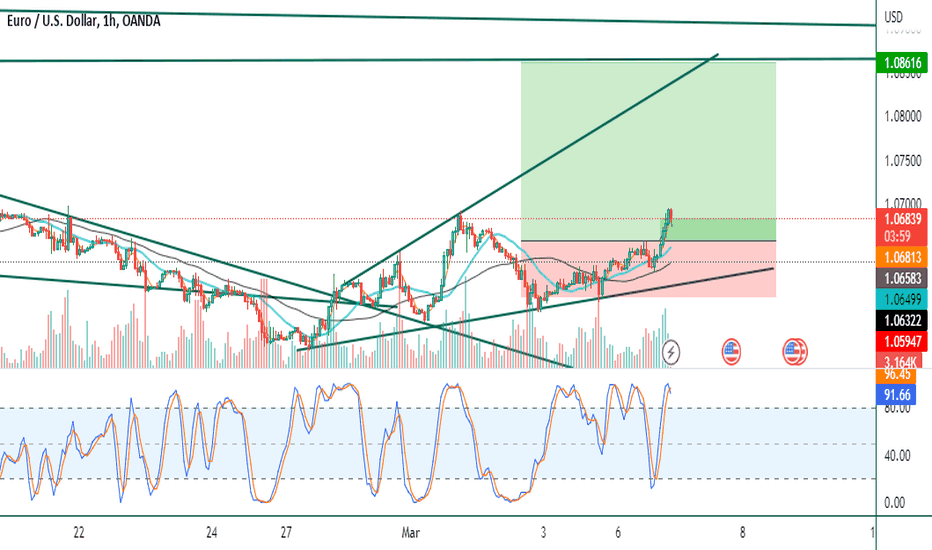

#EUR/USD Upward Movement potential with RIsk:reward =3 #FOREX#FOREX #EUR/USD Buy at 1.06583, SL 1.05933, Target 1.08489

RISK:REWARD 3

ANalysis: Broadening Triangle.

Hey Traders,

HOPE our analysis is adding value to your Stock market trading Journey.

If yes, cheer us with Thumbs up...

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading