Eurusdtradeidea

EUR/USD to Target $1.09 on Easing Bank Jitters and ECB ChatterThis morning, the EUR/USD was up 0.13% to $1.08107. A mixed start to the day saw the EUR/USD fall to an early low of $1.07949 before rising to a high of $1.08195. The First Major Resistance Level (R1) at $1.0817 capped the upside.

The EUR/USD needs to avoid a fall through the $1.0781 pivot to retarget the First Major Resistance Level (R1) at $1.0817 and the morning high of $1.08195. A move through the morning high would signal a bullish session. However, the EUR/USD needs hawkish ECB chatter and better-than-expected business survey numbers to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0836 and resistance at $1.0850. The Third Major Resistance Level (R3) sits at $1.0891.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0761 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.07. The Second Major Support Level (S2) at $1.0725 should limit the downside. The Third Major Support Level (S3) sits at $1.0670.

Looking at the EMAs and the 4-hourly chart, the EMAs send bullish signals. The EUR/USD sits above the 50-day EMA ($1.07576). The 50-day EMA pulled away from the 100-day EMA, with the 100-day EMA widening from the 200-day EMA, delivering bullish signals.

A hold above S1 ($1.0761) and the 50-day EMA ($1.07576) would support a breakout from R1 ($1.0817) to give the bulls a run at R2 ($1.0836) and $1.0850. However, a fall through S1 ($1.0761) and the 50-day EMA ($1.07576) would bring S2 ($1.0725) into play. A fall through the 50-day EMA would send a bearish signal.

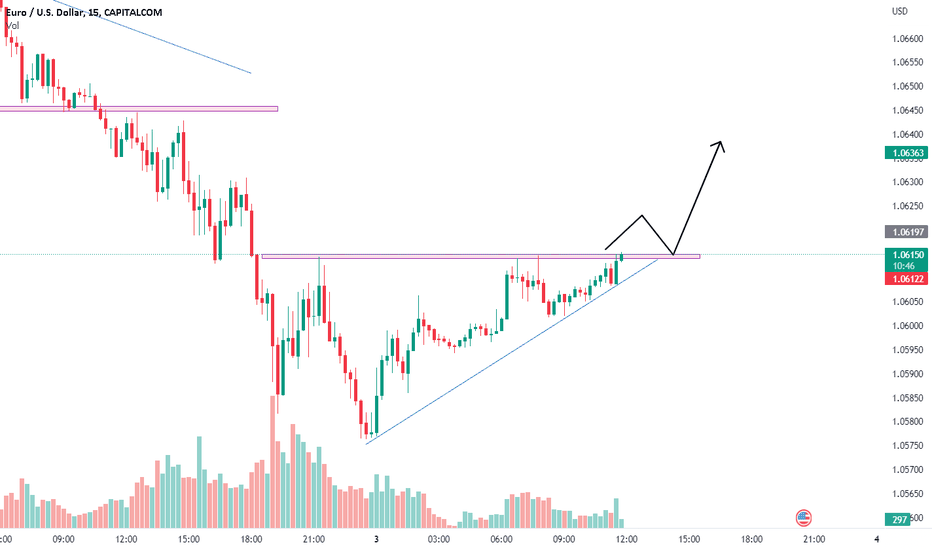

EURUSD FORECAST 22ST MARCH 2023 As per the chart pattern we can easily see that EURUSD is forming a Bearish Pattern On 1 Hour Time Frame.

If we take a Short Position now we can easily Achieve a target till 1.06653.

PS: If you like our Updates please follow , Share and support us .

Also if you want personalized Signals on EURUSD , you can also Message Us here . Thanks

EURUSD FORECAST 16TH MARCH 2023The EURUSD pair’s strong decline stopped at 1.0515 yesterday, which formed solid support against the price, to rebound bullishly and start building bullish wave on the intraday basis, motivated by stochastic positivity.

Therefore, we expect to witness more bullish bias in the upcoming sessions, and the targets begin at 1.0640 and extend to 1.0745 after surpassing the previous level.

On the other hand, we should note that breaking 1.0515 will stop the expected rise and press on the price to suffer additional losses that reach 1.0440.

The expected trading range for today is between 1.0515 support and 1.0680 resistance.

The expected trend for today: Bullish

EURUSD FORECAST 9TH MARCH,2023The EUR/USD needs to avoid the $1.0547 pivot to target the First Major Resistance Level (R1) at $1.0569 and the Wednesday high of $1.05739. A return to $1.0550 would signal a bullish session. However, the EUR/USD would need hawkish ECB chatter and US stats to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0596 and resistance at $1.06. The Third Major Resistance Level (R3) sits at $1.0646.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0519 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0450. The Second Major Support Level (S2) at $1.0497 should limit the downside. The Third Major Support Level (S3) sits at $1.0447.

Looking at the EMAs and the 4-hourly chart, the EMAs send bearish signals. The EUR/USD sits below the 50-day EMA ($1.06058). The 50-day EMA slid back from the 100-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0569) would give the bulls a run at R2 (1.0596) and the 50-day EMA ($1.06058). However, failure to move through the 50-day EMA ($1.06058) would leave S1 ($1.0519) in play. A move through the 50-day EMA would send a bullish signal.

EURUSD FORECAST 6TH MARCH 2023The EUR/USD needs to avoid the $1.0620 pivot to target the First Major Resistance Level (R1) at $1.0652. A move through the Friday high of $1.06386 would signal a bullish session. However, the EUR/USD would need the retail sales numbers and Philip Lane to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0671 and resistance at $1.07. The Third Major Resistance Level (R3) sits at $1.0721.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0602 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0550. The Second Major Support Level (S2) at $1.0570 should limit the downside. The Third Major Support Level (S3) sits at $1.0519.

Looking at the EMAs and the 4-hourly chart, the EMAs send mixed signals. The EUR/USD sits below the 100-day EMA ($1.06549). The 50-day EMA narrowed to the 100-day EMA, while the 100-day EMA eased back from the 200-day EMA, delivering mixed signals.

A move through R1 ($1.0652) and the 100-day EMA ($1.06549) would give the bulls a run at R2 ($1.0671) and the 200-day EMA ($1.06804). However, a fall through the 50-day EMA ($1.06243) would bring S1 ($1.0602) and sub-$1.06 Support Levels into play. A slide through the 50-day EMA would send a bearish signal.

EURUSD Forecast for 28th Feb 2023The EUR/USD needs to avoid the $1.0587 pivot to target the First Major Resistance Level (R1) at $1.0642. A move through the Monday high of $1.06199 would signal a bullish session. However, the EUR/USD would need the stats and the ECB chatter to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0674 and resistance at $1.07. The Third Major Resistance Level (R3) sits at $1.0761.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0555 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0500 should limit the downside. The Third Major Support Level (S3) sits at $1.0415.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06286). The 50-day EMA slipped back from the 200-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06286) and R1 ($1.0642) would give the bulls a run at R2 ($1.0674) and the 100-day EMA ($1.06756). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06286) would leave the Major Support Levels in play.

The US Session

It is a day on the US economic calendar. Goods trade data for January will draw interest early in the session. However, barring a marked widening in the goods trade deficit, the numbers should have a muted impact on the dollar.

The US CB Consumer Confidence numbers for February will influence. A larger-than-expected rise in confidence would support the more aggressive Fed monetary policy outlook. Economists forecast the Index to increase from 107.1 to 108.5.

Other stats include house price data. However, the latest jump in US mortgage rates will mute investor sentiment towards a likely slowdown in house price growth in December.

Following the latest Core PCE Price Index numbers, investors should also monitor FOMC member chatter.

EURUSD Forecast for 22nd Feb,2023The EUR/USD needs to move through the $1.0660 pivot to target the First Major Resistance Level (R1) at $1.0682 and the Tuesday high of $1.06983. A return to $1.0680 would signal a bullish session. However, the EUR/USD would need today’s stats and the Fed minutes to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0721. The Third Major Resistance Level (R3) sits at $1.0782.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0621 in play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0550. The Second Major Support Level (S2) at $1.0599 should limit the downside. The Third Major Support Level (S3) sits at $1.0538

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06954). Following the bearish cross on Wednesday, the 50-day EMA pulled further back from the 200-day EMA, with the 100-day EMA closing in on the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0682) and the 50-day EMA ($1.06954) would give the bulls a run at R2 ($1.0721) and the 200-day EMA ($1.07255). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06954) would leave the Major Support Levels in play.

It is a relatively quiet day on the US economic calendar. There are no US economic indicators for investors to consider today. The lack of stats will leave the Fed in the spotlight. Late in the US session, the FOMC meeting minutes will draw plenty of interest.

Following the latest round of US economic indicators and hawkish Fed chatter, the markets will dissect the minutes to gauge how far the Fed is willing to go. FOMC member chatter will also influence the dollar, with FOMC member Williams speaking late in the session.

EURUSD Forcast for 15th Feb,2023As a result of CPI, EURUSD touched the 1.08 level on 14th Feb but there was a strong resistance and hence it fell down almost 800 Pips. For a proper trade set up please keep in mind the following levels.

14th Feb

DH - 1.08044

DL - 1.07072

15th Feb

Pivot - 1.0749

R1- 1.0792, S1- 1.0694

R2- 1.0847, S2- 1.0651

R3- 1.0945, S3- 1.0554

* EURUSD should break the pivot in the upward direction to target 1.0792 and 1.08044

* A return to 1.0750 will mark a bullish behavior

* If the Pivot is not broken in the upward direction then we can see a fall to 1.0694

* If the price reaches 1.0650 level then it would probably limit the sell off .

* If the price moves above 1.07438 and 1.07527 then it could give a bull run to 1.07762 and 1.0792

* If it is unable to break 1.07438 then it can come down to 1.0694

If you like our analysis then please Share, Like & Follow US as it highly Motivates us to work harder. Also if you want us to analyses on any other Pairs please feel free to Inbox for leave us a comment. Thanks

EURUSD Forcast for 14th Feb,2023The instrument has finally given up on the bearish scale and now have started showing Bull Trend. Following are some of the levels which needs to be kept in mind while trading today.

13th Feb -

DH - 1.07299

DL - 1.06555

14th Feb

PIVOT - 1.0701

R1- 1.0747, S1- 1.0673

R2- 1.0776, S2- 1.0627

R3- 1.0850, S3- 1.0552

* EURUSD should avoid going below the pivot , so that it can target R1 1.0747

* A move above 1.07299 would signal a bullish session.

* If it falls through the Pivot then it can go down to S1 1.0673

* To avoid extra sell off it should avoid levels below 1.06

* A move above 1.07438 and 1.0747 would give a bull run to 1.07553 and 1.0776

* Failure to break 1.07438 level in the upwards direction would bring EURUSD down to 1.0673

If you love our work please support us by liking and Sharing it. Thanks

#EURUSD Trading Plan 28-29 Jan 2022After 2 trending day driven by news-related events - we expect this major forex pait to consolidate for a while now and largely trade flat. Here's our trading plan for the day:

In this chart of OANDA:EURUSD I have marked 4 price levels which have been determined based on a proprietary calculation that I have developed. The zone between the top-most and bottom-most price levels is a strict "No Trade Zone".

If EUR/USD's price crosses the top-most price level, we will be looking for long opportunities and if EUR/USD's price crosses the bottom-most price level, we will be looking for short opportunities.

Entry criteria:

Bullish case: Enter as soon as a 5-minute candle CLOSES above the top-most price level.

Bearish case: Enter as soon as a 5-minute candle CLOSES below the bottom-most price level.

Stop Loss criteria:

Risk: 2% of capital of per trade.

Bullish case: Just below the second price level from the top.

Bearish case: Just above the second price level from the bottom.

Take profit criteria:

I personally follow a system wherein I do nothing until 1:1 RR is achieved. But post 1:1 RR is achieved, I adjust stop loss to cost. I then exit 1/3rd of entered quantity based on 5 minute candle close below ( bullish case) or above ( bearish case) 15 EMA . I exit 1/3rd of entered quantity at fixed take-profit level of 1:3 RR. And I exit the final 1/3rd of entered quantity based on a system of setting stop losses that are dynamically adjusted to the nearest retracement after a Day High Breakout (in bullish case) or Day Low Breakout (in bearish case).

I have also experimented with systems wherein you can set take-profit at a fixed level of 1:3 RR or alternatively after 1:1 is achieved book full quantity vased on 5 minute candle close below ( bullish case) or above ( bearish case) 15 EMA . Both of these alternative systems have also been profitable.

Please note the given zones are valid only until the end of the day. Any open positions must be closed by 03:25 AM IST which is around when the day is about to end in the forex markets.

Also please note: according to the rules of my system, I don't take more than 3 trades per day on any asset.