Eurusdtrend

EURUSD 6th APRIL FORECAST We can see a strong resistance at 1.08833 it it is broken then we can expect a Bear Move to 1.07863

The EUR/USD needs to move through the $1.0921 pivot to target the First Major Resistance Level (R1) at $1.0951 and the Wednesday high of $1.09696. A return to $1.0950 would signal a bullish session. However, the EUR/USD needs hawkish ECB chatter and hotter-than-expected industrial production figures to support a pre-US session breakout.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.1000. The Third Major Resistance Level (R3) sits at $1.1078.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0872 in play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.080. The Second Major Support Level (S2) at $1.0842 should limit the downside. The Third Major Support Level (S3) sits at $1.0764.

Looking at the EMAs and the 4-hourly chart, the EMAs send bullish signals. The EUR/USD sits above the 50-day EMA ($1.08678). The 50-day EMA pulled further away from the 100-day EMA, with the 100-day EMA widening from the 200-day EMA, delivering bullish signals.

A hold above S1 ($1.0872) and the 50-day EMA ($1.08678) would support a breakout from R1 ($1.0951) to give the bulls a run at R2 ($1.1000). However, a fall through S1 ($1.0872) and the 50-day EMA ($1.08678) would bring S2 ($1.0842) into play. A fall through the 50-day EMA would send a bearish signal.

EURUSD FORECAST 29TH MARCH 2023EUR/USD Bulls to Target $1.0850 on German Consumer Confidence

It is a relatively busy day for the EUR/USD, with German and French consumer confidence and ECB commentary to draw interest.

The EUR/USD needs to avoid the $1.0829 pivot to target the First Major Resistance Level (R1) at $1.0862. A move through the Tuesday high of $1.08485 would signal a bullish session. However, the EUR/USD needs hawkish ECB chatter and better-than-expected consumer confidence numbers to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0882 and resistance at $1.09. The Third Major Resistance Level (R3) sits at $1.0936.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0809 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.075. The Second Major Support Level (S2) at $1.0775 should limit the downside. The Third Major Support Level (S3) sits at $1.0721.

Looking at the EMAs and the 4-hourly chart, the EMAs send bullish signals. The EUR/USD sits above the 50-day EMA ($1.07746). The 50-day EMA pulled away from the 100-day EMA, with the 100-day EMA widening from the 200-day EMA, delivering bullish signals.

A hold above the Major Support Levels and the 50-day EMA ($1.07746) would support a breakout from R1 ($1.0862) to give the bulls a run at R2 ($1.0882) and $1.09. However, a fall through S1 ($1.0809) would bring S2 ($1.0775) and the 50-day EMA ($1.07746) into play. A fall through the 50-day EMA would send a bearish signal.

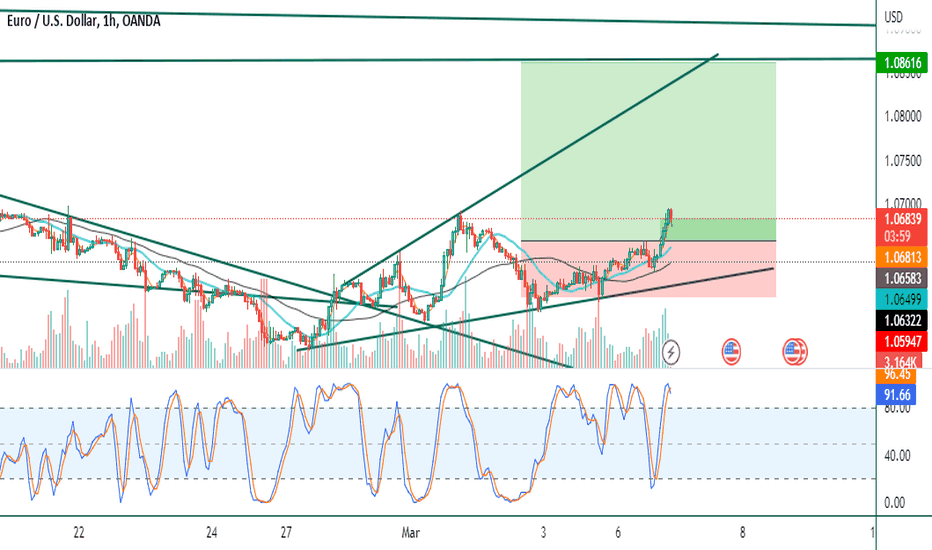

#EUR/USD Upward Movement potential with RIsk:reward =3 #FOREX#FOREX #EUR/USD Buy at 1.06583, SL 1.05933, Target 1.08489

RISK:REWARD 3

ANalysis: Broadening Triangle.

Hey Traders,

HOPE our analysis is adding value to your Stock market trading Journey.

If yes, cheer us with Thumbs up...

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading

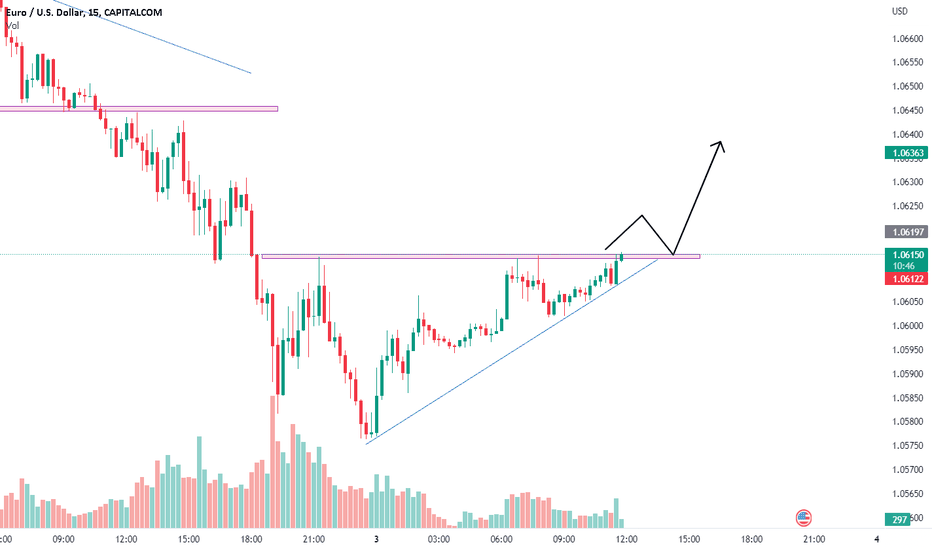

EURUSD Forecast, 03 Mar,23At the time of writing, the EUR/USD was up 0.08% to $1.06057. A mixed start to the day saw the EUR/USD fall to an early low of $1.05946 before rising to a high of $1.06148.

The EUR/USD needs to move through the $1.0615 pivot to target the First Major Resistance Level (R1) at $1.0654 and the Thursday high of $1.06728. A return to $1.0650 would signal a bullish session. However, the EUR/USD would need the services PMIs and the Fed commentary to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0712. The Third Major Resistance Level (R3) sits at $1.0808.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0558 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0519 should limit the downside. The Third Major Support Level (S3) sits at $1.0423.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06228). The 50-day EMA fell back from the 100-day EMA, with the 100-day EMA easing back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06228) would support a breakout from R1 ($1.0654) and the 100-day EMA ($1.06581) to target the 200-day EMA ($1.06836) and R2 ($1.0712). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06228) would leave the Major Support Levels in play.

The US Session

Looking ahead to the US session, it is a busy day on the US economic calendar. The all-important ISM Non-Manufacturing PMI for February will draw plenty of investor interest.

We expect market sensitivity to the headline PMI and sub-components, with the ISM Non-Manufacturing Prices Index the one to watch.

Other stats include finalized S&P Global Services and Composite PMI numbers that should play second fiddle to the ISM survey-based numbers.

With the services sector in the spotlight, investors need to monitor FOMC member chatter. FOMC members Logan, Bostic, and Bowman will deliver speeches today. Investors will want to gauge how high and for how long the Fed will push interest rates to curb inflation and return it to target.

On Thursday, FOMC member Bostic favored a 25-basis point rate hike in March.

EURUSD Forcast 24/02/2023The EUR/USD needs to avoid a fall through the $1.0600 pivot to target the First Major Resistance Level (R1) at $1.0623 and the Thursday high of $1.06278. A return to $1.0620 would signal a bullish session. However, the EUR/USD would need today’s stats and the ECB chatter to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0651. The Third Major Resistance Level (R3) sits at $1.0701.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0572 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0549 should limit the downside. The Third Major Support Level (S3) sits at $1.0498.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06626). The 50-day EMA fell back from the 200-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0621) would give the bulls a run at R2 ($1.0651) and the 50-day EMA ($1.06626). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06626) would leave the Major Support Levels in play.

The US Session

It is a busy day on the US economic calendar. Personal income, spending, and inflation will be in focus. An unexpected rise in the Core PCE Price Index would fuel bets of a more hawkish Fed. Economists forecast the Core PCE Price Index to rise by 4.3% year-over-year in January. The Index was up 4.4% in December.

Later in the session, consumer sentiment and Fed chatter will also draw interest. FOMC member Loretta Mester will deliver a post-stats speech.

EURUSD Forecast for 22nd Feb,2023The EUR/USD needs to move through the $1.0660 pivot to target the First Major Resistance Level (R1) at $1.0682 and the Tuesday high of $1.06983. A return to $1.0680 would signal a bullish session. However, the EUR/USD would need today’s stats and the Fed minutes to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0721. The Third Major Resistance Level (R3) sits at $1.0782.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0621 in play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0550. The Second Major Support Level (S2) at $1.0599 should limit the downside. The Third Major Support Level (S3) sits at $1.0538

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06954). Following the bearish cross on Wednesday, the 50-day EMA pulled further back from the 200-day EMA, with the 100-day EMA closing in on the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0682) and the 50-day EMA ($1.06954) would give the bulls a run at R2 ($1.0721) and the 200-day EMA ($1.07255). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06954) would leave the Major Support Levels in play.

It is a relatively quiet day on the US economic calendar. There are no US economic indicators for investors to consider today. The lack of stats will leave the Fed in the spotlight. Late in the US session, the FOMC meeting minutes will draw plenty of interest.

Following the latest round of US economic indicators and hawkish Fed chatter, the markets will dissect the minutes to gauge how far the Fed is willing to go. FOMC member chatter will also influence the dollar, with FOMC member Williams speaking late in the session.

EURUSD FORCAST FOR 16TH FEB,2023Please pay attention to the following levels and trade set up before opening any position.

15th Feb

DH- 1.07445

DL- 1.06624

16TH FEB

PIVOT - 1.0697

R1- 1.0734, S1- 1.0650

R2- 1.0781, S2- 1.0529

R3- 1.0865, S3- 1.0529

* Pivot needs to be broken in the upward direction to target R1 1.0734 and 1.07445

* Return to 1.07 level shows a bullish behavior

* If the Pivot is not broken then it can come down to S1 1.0650.

* Levels below 1.06 shall be avoided and it may cause major sell off.

* Breakthrough above 1.0734 would give a bull run to 1.07402 and 1.07410.

* A move above 1.07402 would give a bullish signal and can touch R2 1.0781

* Failure to break 1.07402 in the upward direction can bring it down to S1 1.0650

Please support our work by Liking , Following and sharing the Ideas. Thanks

EURUSD | Good Buy Opportunity!If you find this technical analysis useful, please like & share our ideas with the community.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.