"reconnect people by a futuristic way of travel,"🟢 Olectra Greentech Ltd – Positional Breakout Setup in EV Segment ⚡

CMP: ₹1280.90 | NSE: OLECTRA

🔹 Strong trendline support maintained for over 2 years

🔹 Multiple MACD (6/19, 13/55, 20/89) showing early crossover signals

🔹 RSI breakout above 50, now forming higher lows – momentum picking up

🔹 Ichimoku cloud breakout confirmation awaited – early signs of reversal

🔹 Volume holding well, OBV flat – potential accumulation zone

📈 Price breaking out from a long-term triangle pattern; if sustained, targets could open up toward ₹1450–₹1600 in coming months.

📊 Sector tailwind: EV, battery, and green mobility themes remain strong

🌱 Fundamentals supported by order book visibility, policy tailwinds, and infrastructure push

🎯 Ideal for positional traders & long-term investors with a medium-term view.

📝 Note: Please do your own due diligence. This is not a recommendation, just a view based on charts and fundamentals.

🧠 Disclaimer: For educational and research purposes only. No buy/sell advice.

📝 Chart Purpose & Disclaimer:

This chart is shared purely for educational and personal tracking purposes. I use this space to record my views and improve decision-making over time.

Investment Style:

All stocks posted are for long-term investment or minimum positional trades only. No intraday or speculative trades are intended.

⚠️ Disclaimer:

I am not a SEBI registered advisor. These are not buy/sell recommendations. Please consult a qualified financial advisor before taking any investment decision. I do not take responsibility for any profit or loss incurred based on this content.

Evstocks

"All-electric Future. From India. For the world."Ola Electric Mobility Ltd

About

Founded in 2017, Ola Electric Mobility Limited is an electric vehicle company that primarily manufactures electric vehicles and core components for electric vehicles. These components include battery packs, motors, and vehicle frames, all produced at the Ola Futurefactory.

Key Points

Market Leadership Co. is the largest E-Scooter Manufacturing company in India, with 31% market share in the E2W sector, selling 329,618 scooters in FY24.

Product Portfolio

1. Ola S1 Pro: A premium scooter with a 195 km range, 120 kph top speed, and a 7-inch touchscreen.

2. Ola S1 Air: Offers a 151 km range, 6 kW motor power, and a 7-inch touchscreen.

3. Ola S1 X+: A budget-friendly model with a 151 km range, keyless unlock, and a 5-inch display.

4. Ola S1 X: Mass-market scooters with up to 190 km range, available in 2 kWh, 3 kWh, and 4 kWh battery options, with a 3.5-inch display.

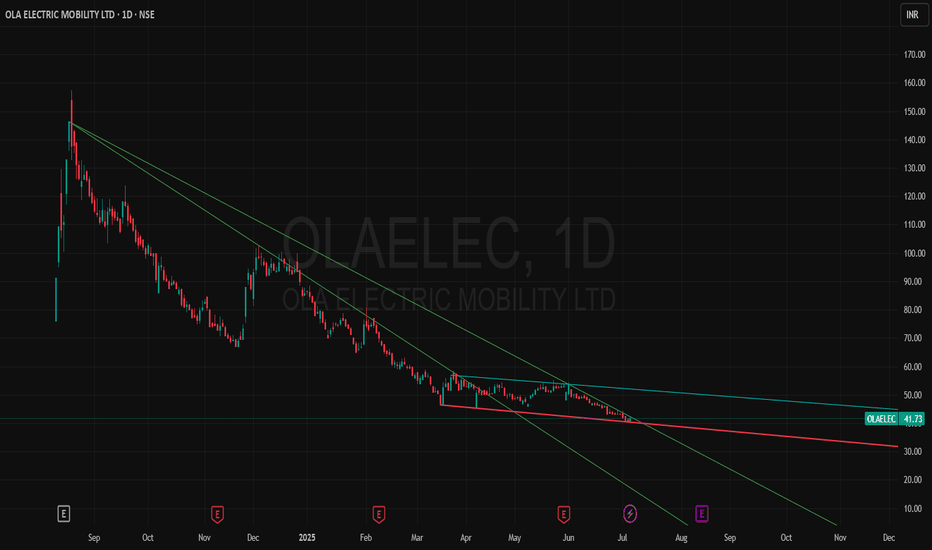

⚡ Ola Electric – Early Signs of Revival?

CMP: ₹41.73 | View: High-Risk Accumulation | Timeframe: Daily Chart | Sector: EV

🛵 Technical View:

Ola Electric has been in a steady downtrend since its listing but now showing signs of base formation near ₹40.

MACD on multiple settings is flattening and attempting crossover.

RSI has bounced from oversold zones and moving upward.

ADX/DMI showing reduction in negative strength – trend reversal possible.

Ichimoku cloud flattening – early signal for sideways to positive shift.

🔹 Key Price Levels:

🔸Support: ₹38.5 – ₹40

🔸Breakout Zone: ₹44.5 – ₹47

🔸Resistance: ₹51.5 / ₹60

📊 Volume:

Gradual rise in volumes with sideways consolidation. First green daily candle after long lower highs.

🔍 Fundamentals & Progress:

From Screener:

Not yet profitable, but business is capital-intensive and scaling.

Valuations currently not attractive, but price is near listing lows, making risk-reward favorable for high-risk investors.

🚀 Company Developments:

✅ Ola is rapidly expanding its EV scooter sales & showroom network

✅ Ola official site: Announced upcoming electric motorcycles and focus on battery innovation

✅ Government push for EV adoption will benefit Ola long-term

✅ Founder Bhavish Aggarwal aims to build an EV ecosystem (batteries + charging infra + vehicles)

🧠 Why Watch This Stock?

Sentiment may shift as markets look for beaten-down growth stories

Ola has brand recall, scale, and distribution

Any positive update (sales, production ramp-up, JV) can trigger a move

⚠️ Disclaimer:

This is a high-risk idea, suitable only for long-term investors or speculators with risk appetite. Not a recommendation. Do your own research.

📝 Note: Please do your own due diligence. This is not a recommendation, just a view based on charts and fundamentals.

🧠 Disclaimer: For educational and research purposes only. No buy/sell advice.

📝 Chart Purpose & Disclaimer:

This chart is shared purely for educational and personal tracking purposes. I use this space to record my views and improve decision-making over time.

Investment Style:

All stocks posted are for long-term investment or minimum positional trades only. No intraday or speculative trades are intended.

⚠️ Disclaimer:

I am not a SEBI registered advisor. These are not buy/sell recommendations. Please consult a qualified financial advisor before taking any investment decision. I do not take responsibility for any profit or loss incurred based on this content.

"Retailer Trap in Action? | TATAMOTORS✅"Tata Motors (-3.8%) has hit its lowest point since January, down 28% from July highs. Are you buying the dip?"

✅"Inducement is a process where market movements are manipulated to encourage traders to take positions that are likely to fail. The idea is that large institutions can influence price movements to attract various traders and trap them in losing trades."

💡Insight:

📍Business Split: Tata Motors is separating its Passenger and Commercial Vehicle businesses to streamline operations, with a Jaguar Land Rover IPO expected soon

📍Sales Boosting Discounts: October 2024 sees major festive discounts on models like the Nexon and Harrier to regain market share

📍Sales Performance: A 2% year-over-year increase in Q1 FY25, led by strong growth in commercial vehicles despite slight dips in passenger vehicles

💡✍️Applied Tools:-

1️⃣Trap Trading

2️⃣Strong order block zone

3️⃣Fake channel breakout

4️⃣Inducement Strategy

✅Check out my TradingView profile to see how we analyze charts and execute trades.

⭕️ Swing Trading opportunity: Price Action Analysis Alert !!!⭕️

💡FNO Stocks📉📈📊

🙋♀️🙋♂️If you have any questions about this stock, feel free to reach out to me.

📍📌Thank you for exploring our idea! We hope you found it valuable.

🙏FLLOW for more !

👍LIKE if useful !

✍️COMMENT Below your view !

Endurance-A good auto ancillary stock for long termCurrently, stock has given breakout from resistance and can be taken as a quick swing trade for 2300 target.

Stock has a strong trendline supply zone which is around 2300.

If this level breaks out, we can see huge rally in the stock and can be held for long term.

Stock has good fundamentals and only around 2% is public holding. Good bet in EV sector theme.