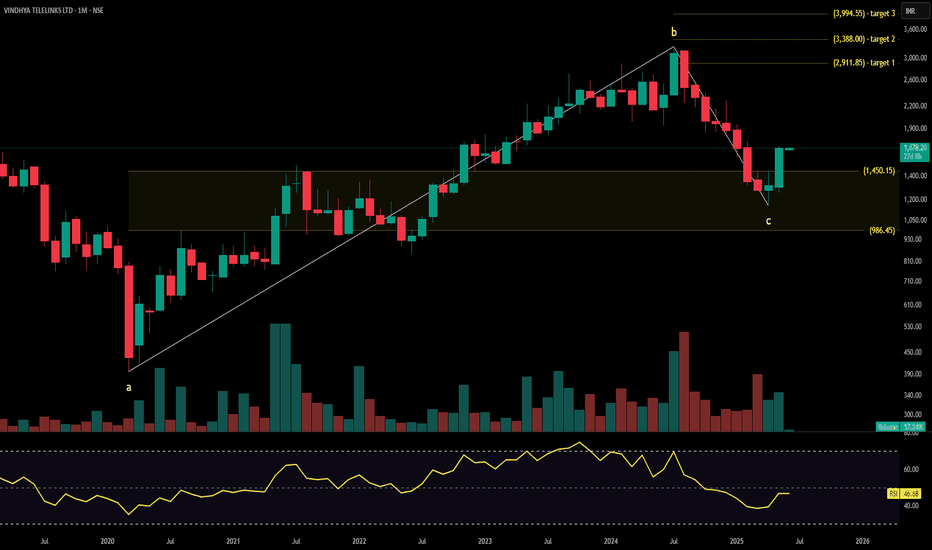

VINDHYA TELELINKS technical analysisVindhya Telelinks Ltd. (NSE: VINDHYATEL) is currently trading at INR 1,678.20. The company specializes in telecommunication cables, EPC (Engineering, Procurement, and Construction) services, and optical fiber solutions, serving industries such as telecom, infrastructure, and defense.

Key Levels

Support Level: INR 1,278.90

Swing Level: INR 1,911.40

Possible Upside Levels: INR 2,911.85, INR 3,388.00, INR 3,994.55

Technical Indicators

RSI: The Relative Strength Index (RSI) is at 46.68, indicating neutral momentum. The stock is neither overbought nor oversold, suggesting consolidation before a decisive move.

Volume: Trading volume is moderate, showing steady investor participation. Volume confirmation around resistance or support levels will be critical for future price direction.

Sector and Market Context

Vindhya Telelinks operates within the telecommunications infrastructure and EPC sector, which has seen consistent demand growth due to India’s push for digital connectivity, fiber network expansion, and smart city developments. The company benefits from government-backed projects and private sector investments in high-speed broadband infrastructure. However, macroeconomic factors, competition from domestic and international players, and execution challenges can influence stock performance.

Latest News and Developments

Market Trends: Increased private investment in 5G infrastructure and fiber optic network expansion, benefiting telecom cable providers.

Analyst Ratings: Recent reports highlight stable revenue generation, though margins remain sensitive to raw material costs and contract execution timelines.

Quarterly Results: Vindhya Telelinks reported steady earnings, supported by robust order flows and improved operational efficiencies.

Dividend Update: The company has declared a final dividend of ₹16 per share (160%) for 2025. In the previous year (2024), it announced a ₹15 per share (150%) final dividend. This consistent payout reflects financial stability and commitment to shareholder returns.

Analysis Summary

Vindhya Telelinks Ltd. presents a neutral-to-bullish technical outlook, with RSI reflecting steady positioning and volume trends confirming continued investor engagement. The stock’s sector alignment with India’s fiber expansion plans supports long-term growth potential, though macro risks—such as contract execution and supply chain volatility—should be monitored. Investors should track price movement near swing levels, sector-wide developments, and company-specific financial updates before making strategic decisions.

Fibonacci

BREAKOUT IN GRSE -- BULLISH VIEW-- Educational purposeBREAKOUT ABOVE 52 WEEK HIGH-- BULLISH VIEW

Fresh breakout seen above 52 week high

Increased volumes seen since last 2-3 months

Entry level : 2815 (retest) Need to wait for retest level.

Fibo Targets :

Target 1 : 4445 (35%)--12 months

Target 2 : 6085 (116%)--36 months

Stoploss : weekly closing below 2345 (-18%)

ONLY INVESTMENT VIEW-- NOT FOR SHORT TERM

Bank Nifty Weekly Insights: Key Levels & TrendsBank Nifty ended the week at 55,749.70 with a gain of 0.63%

Key Levels for the Upcoming Week

🔹 Price Action Pivot Zone:

The critical range to monitor for potential trend reversals or continuation is 55,632 to 55,869

🔹 Support & Resistance Levels:

Support Levels:

S1: 55,280

S2: 54,810

S3: 54,303

Resistance Levels:

R1: 56,224

R2: 56,698

R3: 57,073

Market Outlook

✅ Bullish Scenario: A sustained move above 55,869 could trigger buying momentum, potentially driving Bank Nifty towards R1 (56,224) and beyond.

❌ Bearish Scenario: If the index falls below 55,632, selling pressure may increase, pulling it towards S1 (55,280) and lower levels.

Disclaimer: lnkd.in

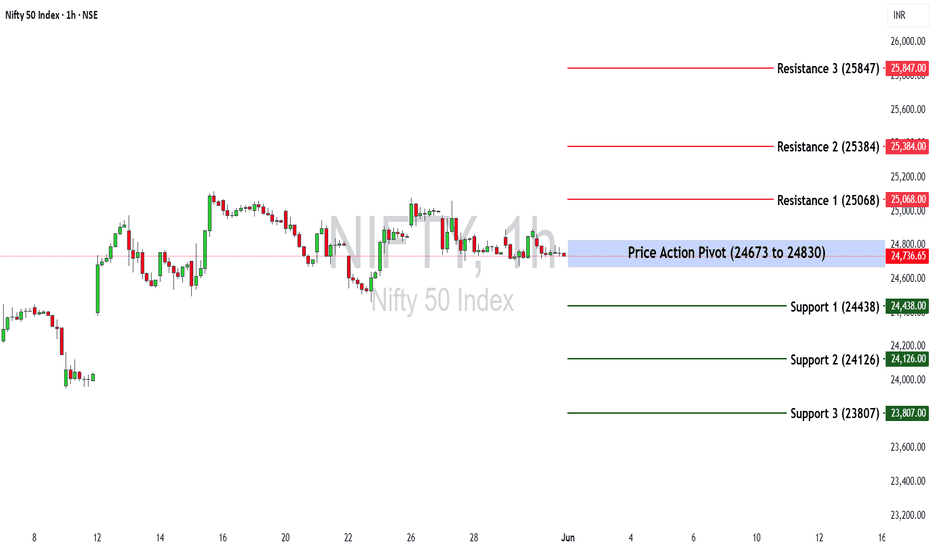

Nifty 50 at a Turning Point? Key Levels & Market Outlook AheadThe Nifty 50 ended the week at 24,750.70 with a loss of (-0.41%)

If Nifty sustains below 24,673, selling pressure may increase. However, a move above 24,830 could restore bullish momentum.

Key Levels for the Upcoming Week

🔹 Price Action Pivot Zone:

The crucial range to watch for potential trend reversals or continuation is 24,673 -24,830.

🔹 Support & Resistance Levels:

Support:

S1: 24,438

S2: 24,126

S3: 23,807

Resistance:

R1: 25,068

R2: 25,384

R3: 25,847

Market Outlook

✅ Bullish Scenario: A sustained breakout above 24,830 could attract buying momentum, driving Nifty towards R1 (25,068) and beyond.

❌ Bearish Scenario: A drop below 24,673 may trigger selling pressure, pushing Nifty towards S1 (24,438) or lower.

Disclaimer: lnkd.in

Zigzag in Play- Can Wave C deliver the goods for ESCORTS KUBOTA?ESCORTS KUBOTA – A Zigzag Taking Shape

Structure Summary:

ESCORTS may be unfolding a classic Zigzag correction (5–3–5) from the low at ₹2,825.20. Wave A formed a clean leading diagonal. Wave B is currently developing and is expected to end near the 0.382–0.5 retracement of Wave A.

If this structure holds, we could soon see a powerful Wave C impulse aiming for the 4,000+ zone.

Elliott Wave View:

Wave A : Leading diagonal from ₹2,825.20 to ₹3,616.60

Wave B : Still developing – may complete near ₹3,233.80 (0.5 retracement)

Wave C : Expected to be a 5-wave impulse targeting:

₹4,025.60 (1.0 × Wave A)

₹4,514.70 (1.618 × Wave A)

Key Levels to Watch:

Wave B Support Zone: ₹3,233–₹3,102

Target 1: ₹4,025.60 (equal to Wave A)

Target 2: ₹4,514.70 (1.618 × Wave A)

Invalidation : Below ₹3,102 → Zigzag scenario fails, alternate count required

Note:

Wave C, if it triggers, should develop as a 5-wave impulse. Price action around the retracement zone will decide whether bulls still have control.

Disclaimer:

This is part of the educational WaveTracker series. It is not a trading recommendation.

Always DYOR and manage risk wisely.

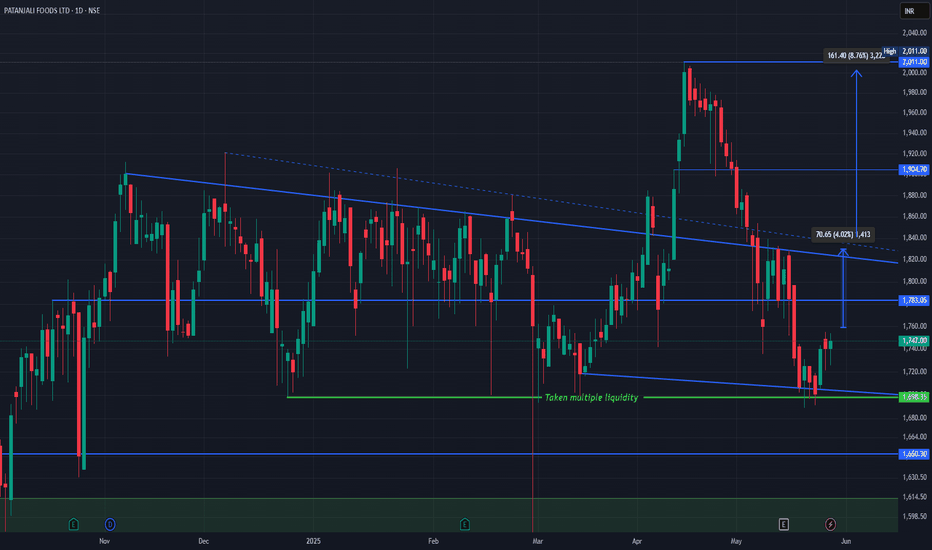

Patanjali Foods Ltd (NSE: PATANJALI) technical chart breakdown.Patanjali Chart Structure & Price Action

The stock has been trading within a descending channel, bounded by the blue trendlines.

It recently bounced from a major demand zone (~₹1,698) marked by the green support line that has absorbed liquidity multiple times ("Taken multiple liquidity").

Price is now slowly recovering from this base.

Current Scenario

CMP: ₹1,747

Immediate Resistance:

₹1,783 (horizontal level)

₹1,818–₹1,835 zone (upper boundary of the falling channel)

Break and sustain above ₹1,783–₹1,835 could trigger a trend reversal.

Upside Targets

Target 1: ₹1,830/Target 2: ₹1,904

Previous structural high Target 3: ₹2,011 Recent swing high Total upside from breakout: ~8.76%

Support Levels

₹1,698 – Critical demand zone (green)

₹1,650 – Next strong support

₹1,570 – Long-term support base (green zone)

Simple Explanation

Patanjali Foods rebounded from a high-liquidity support area and is now showing signs of bullish recovery. A breakout above ₹1,783 could take it back to the ₹1,900–₹2,000 range. Risk is well-defined below ₹1,698. Watch for volume and price action confirmation near the upper channel.

Like, comment your thoughts, and share this post

Explore more stock ideas on the right hand side your feedback means a lot to me!

Disclaimer: This post is for educational purposes only and should not be considered a buy/sell recommendation.

VPRPL - NSE | Daily Timeframe📊 VISHNU PRAKASH R PUNGLIA LTD (VPRPL) – NSE | Daily Timeframe

📅 Date: May 29, 2025

📈 CMP: ₹190.49 (−0.41%)

📌 Ticker: NSE:VPRPL

🧠 Technical Overview

✅ Cup & Handle Pattern in Formation 🍵

Price action is carving out a clean Cup & Handle base near the ₹195.80 resistance zone. A breakout above this neckline could ignite a fresh upside rally. The symmetry, volume spike, and recent bullish structure are all supporting potential continuation.

🧪 Volume Analysis

Noticeable volume increase as the price nears breakout zone, indicating accumulation and rising interest.

📍 Key Levels to Watch

🟡 Breakout Resistance:

₹195.80 (horizontal neckline)

🟢 Support Zone:

₹174.50 (base support of the cup)

₹165 (lower handle risk zone)

🎯 Potential Targets (Post Breakout):

₹220

₹240

₹265 (pattern-measured target zone)

💡 Trade Plan

Entry (on breakout): ₹196+ (with strong volume confirmation)

Stop Loss: Below ₹174

Target Range: ₹220–₹265

Risk-Reward: ~1:2.5+

⚠️ Disclaimer

This chart analysis is for educational purposes only. Always DYOR (Do Your Own Research) and consult a financial advisor before making investment decisions.

BALRAMPUR CHINI MILLS technical analysisBalrampur Chini Mills Ltd. (NSE: BALRAMCHIN) is currently trading at INR 585.15. The company is one of India's leading integrated sugar manufacturers, engaged in sugar production, ethanol manufacturing, and cogeneration of power from sugarcane byproducts.

Key Levels

Support Level: INR 391.30, INR 455.55, INR 483.40, INR 523.25

Swing Level: INR 585.15

Possible Upside Levels: INR 656.65, INR 721.25, INR 803.55

Technical Indicators

RSI: The Relative Strength Index (RSI) is currently at 60.36, suggesting strong momentum as the stock approaches the overbought zone. This indicates bullish sentiment with potential for further price gains.

Volume: Trading volume is 9.07M, reflecting high investor participation. Increased volume around key price levels may confirm breakouts or trend reversals.

Sector and Market Context

Balrampur Chini Mills Ltd. operates in the sugar industry, which remains highly cyclical and dependent on government policies, weather conditions, and global sugar prices. The ethanol blending initiative in India has boosted industry-wide demand, with sugar mills increasingly focusing on ethanol production to diversify revenue streams. Additionally, government-imposed minimum support prices for sugarcane and export restrictions continue to shape pricing dynamics. The broader market outlook suggests positive momentum for sugar stocks, driven by higher ethanol demand, stable domestic sugar consumption, and global supply constraints.

Latest News and Developments

Market Trends: Institutional investors remain bullish on sugar stocks due to strong ethanol demand and favorable regulatory policies.

Analyst Ratings: Some analysts forecast steady revenue growth, highlighting ethanol's increasing contribution to earnings.

Quarterly Results: The company reported improved earnings, supported by higher sugar prices and stable ethanol production margins.

Dividend Update: The firm has maintained a consistent dividend payout, reinforcing confidence in long-term profitability.

Analysis Summary

Balrampur Chini Mills Ltd. exhibits strong technical momentum, with RSI and volume indicating continued investor interest. Sector dynamics remain favorable, driven by government support for ethanol and steady sugar consumption. Investors should monitor commodity price trends, policy developments, and macroeconomic indicators before making strategic decisions. A balanced approach is advisable, considering cyclical industry risks alongside growth opportunities.

KIRLOSKAR INDUSTRIES technical analysisKirloskar Industries Ltd. (NSE: KIRLOSIND) is currently trading at INR 3,742.10, reflecting a 24.25% increase. The company operates in the industrial and engineering sector, specializing in infrastructure, manufacturing, and capital goods, with a strong footprint in real estate and investments.

Key Levels

Support Level: INR 2,377.60, INR 3,301.25, INR 3,728.40

Swing Level: INR 4,296.05

Possible Upside Levels: INR 6,208.45, INR 7,132.10, INR 8,308.65

Technical Indicators

RSI: The Relative Strength Index (RSI) is at 49.25, indicating neutral momentum. The stock is hovering in a balanced state, neither overbought nor oversold, signaling potential stability.

Volume: Trading volume has increased, suggesting heightened investor interest and potential price momentum confirmation toward resistance levels.

Sector and Market Context

Kirloskar Industries Ltd. operates in the capital goods and diversified engineering sector, which benefits from government-backed infrastructure development, industrial modernization, and investment-led growth strategies. The industry has witnessed steady expansion, bolstered by manufacturing incentives, technological upgrades, and increasing demand for engineering solutions. However, raw material cost fluctuations, supply chain efficiency, and cyclical economic impacts could influence long-term trends.

Latest News and Developments

Market Trends: Strong institutional inflows into industrial stocks amid optimism surrounding India’s manufacturing growth.

Analyst Ratings: Recent outlooks suggest potential scalability, driven by diversified business verticals and positive earnings revisions.

Quarterly Results: The company posted robust revenue growth, supported by improved operational efficiencies and higher real estate holdings.

Dividend Update: No recent dividend announcements, signaling a reinvestment strategy for capacity expansion.

Analysis Summary

Kirloskar Industries Ltd. exhibits stable technical momentum, with RSI suggesting neutral positioning. Volume trends reinforce continued investor participation, while sector tailwinds align with long-term growth potential. Investors should monitor price action near key levels, macroeconomic indicators, and sector-wide performance before making investment decisions. A balanced approach is recommended, considering market trends and operational execution.

Forecast for Long Term for INJUSDT -- Current Market Overview --

Price (as of May 28, 2025): INJ/USDT is trading at approximately $15.01, with a 24-hour increase of 4.93–10.79% and a weekly gain of 23.1–24.94%.

# Market Sentiment: Recent Wave indicate bullish sentiment, with analysts noting a breakout from a monthly demand zone and support at a weekly fair value gap (iFVG). The price has broken a higher-time-frame (HTF) downtrend, suggesting potential for further upside.

Market Cap and Volume: INJ has a market cap of $1.5B and a 24-hour trading volume of $218.9M, reflecting strong liquidity and interest.

-- Technical Analysis --

Price Action and Key Levels

# Support: The price recently found support at the $9.32–$10.00 demand zone, with a low of $6.5 in the past six months. The weekly iFVG and monthly demand zone around $10–$11 have held, acting as strong support.

Resistance: Key resistance levels are at $16.13 (short-term), $20–$25 (weekly target), and $33 (top of a multi-year descending wedge). A break above $16.13 could signal a mid-term swing toward $48.

Price Structure: INJ is in a bullish phase, having broken out from a descending wedge on the weekly chart and reclaiming the 21-day EMA. The price is trading above the 50-day SMA ($10.02) and 200-day SMA ($14.03 projected for June), indicating bullish momentum.

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

Boost and comment will be highly appreciated

IFCI: Explosive Move Hits a Key WallTechnical Setup – IFCI Ltd. on the weekly timeframe chart

Current Price: ₹70.31

Breakout Confirmation: Price broke above major trendline resistance (dotted line) with strong volume

Volume Profile: Highest traded zone was around ₹42–₹50 (base built here)

Fibonacci Levels: 61.8% broken = bullish signal

Targets: 🎯 ₹91.56 (100% Fib level) 🎯 ₹161.79 (161.8% extended Fib target – long term)

📊 Fundamental Story – Government owned NBFC

Focused on infrastructure and industrial finance

Recent market rally shows renewed investor interest

Benefits from:

• PSU sector momentum

• Government capex push

• Improved asset quality & restructuring progress

Turnaround story in the making, driven by fundamentals + reform

Like, comment your thoughts, and share this post!

Explore more stock ideas on the right hand side your feedback means a lot to me!

Disclaimer: This post is for educational purposes only and should not be considered a buy/sell recommendation.

Nifty’s Final Shakeout? Ending Diagonal May Be the Exit ClueNifty appears to be unfolding a WXY corrective structure:

Wave W ended at 24,462.40

Wave X bounced up to 25,079.20

The current decline looks like Wave Y, forming a classic ending diagonal

Ending Diagonal Details:

Overlapping waves with a contracting structure

Final Wave 5 of the diagonal may be unfolding now

Invalidation level (for stop-loss logic): 24,864.25

If price moves above this, the wave structure is likely invalid

Target Zone:

Wave 5 projected to complete between

24,522.55 and 24,311.50

(using 1x to 1.618x of Wave 1 within the diagonal)

Summary:

If the diagonal plays out, a breakdown toward the green box is likely.

Above 24,864 , the setup is invalid. Watch price action closely.

DHAMPUR SUGAR MILLS technical analysisDhampur Sugar Mills Ltd. (NSE: DHAMPURSUG) is currently trading at INR 142.82. The company is a leading player in the sugar industry, involved in sugar manufacturing, ethanol production, and cogeneration of power from sugarcane byproducts.

Key Levels

Support Level: INR 97.06

Swing Level: INR 160.92

Possible Upside Levels: INR 289.80, INR 338.70, INR 400.95

Technical Indicators

RSI: The Relative Strength Index (RSI) is currently at 38.39, indicating bearish momentum, with the stock nearing oversold territory, which could signal a reversal if buying interest increases.

Volume: Trading volume is stable, showing consistent investor participation, though a volume spike near key levels would be needed to validate directional movements.

Sector and Market Context

Dhampur Sugar Mills operates in the sugar and ethanol production sector, which has been influenced by government policies on ethanol blending, agricultural yield fluctuations, and global sugar pricing. Recent trends suggest positive growth in ethanol demand, backed by India’s push for ethanol-based fuel diversification. However, commodity price volatility, policy changes, and export restrictions could impact industry margins. The broader market sentiment toward cyclical stocks remains mixed, with investors cautiously tracking demand and regulatory shifts.

Latest News and Developments

Market Trends: Institutional investors are showing interest in ethanol-driven growth stories, positioning sugar stocks favorably.

Analyst Ratings: Some analysts suggest potential upside, citing stable earnings and ethanol sector expansion.

Quarterly Results: Dhampur Sugar Mills reported steady revenue, though raw material costs have impacted margins.

Dividend Update: No recent dividend announcements, indicating reinvestment focus on capacity expansion and modernization.

Analysis Summary

Dhampur Sugar Mills Ltd. has entered a key technical zone, with RSI signaling possible stabilization near current levels. Volume activity remains steady, but confirmation through increased participation will be crucial for trend validation. Sector tailwinds—such as ethanol expansion and sugar consumption growth—support long-term prospects, though macro risks should be monitored. Investors should track regulatory developments, commodity price trends, and upcoming financial disclosures before making strategic decisions.

Cholamandalam Finance - Cup & Handle PatternFinance Industry is bullish. Murugappa group of companies are good performers. EID Parry, CG Power, Chola Fin, Chola Holdings, Wendt etc...

Cholamandalam Finance has made cup & handle pattern. 30% potential. 161.8% Fib level, Pivot R3 (W), cup height as target all are in that level. Wave 5 could reach that point.

GREENPANEL INDUSTRIES technical analysisGreenpanel Industries Ltd. (NSE: GREENPANEL) is currently trading at INR 261.55. The company specializes in medium-density fiberboard (MDF) and plywood manufacturing, serving both domestic and export markets with a strong focus on innovation and sustainable production.

Key Levels

Support Level: INR 198.75

Swing Level: INR 305.60

Possible Upside Levels: INR 574.65, INR 675.75, INR 804.50

Technical Indicators

RSI: The Relative Strength Index (RSI) is at 41.86, indicating neutral momentum with a slight downward bias. RSI below 50 often suggests mild bearish sentiment.

Volume: Trading volume is moderate, reflecting steady investor participation. Increased volume near resistance levels could validate upward movement, while declining volume near support may suggest consolidation.

Sector and Market Context

Greenpanel Industries operates within the building materials and furniture manufacturing sector, which has witnessed steady demand growth due to urbanization, real estate expansion, and rising consumer preference for MDF-based furniture. However, the sector is also subject to commodity price fluctuations, interest rate cycles affecting real estate, and import-export policy changes. Market conditions indicate cautious optimism, with investors tracking housing sector performance and raw material cost trends.

Latest News and Developments

Market Trends: Institutional interest in building materials stocks remains strong, though rising input costs could pressure margins.

Analyst Ratings: Recent reports suggest mixed sentiment, with some analysts projecting gradual demand recovery in the domestic market.

Quarterly Results: Greenpanel Industries posted stable revenue, though margins saw compression due to rising material costs.

Dividend Update: No recent dividend announcements, indicating continued reinvestment in operational efficiency and expansion.

Analysis Summary

Greenpanel Industries Ltd. presents a balanced technical outlook, with RSI and key levels indicating potential price stabilization before trend confirmation. The stock benefits from sector tailwinds, though macroeconomic risks—such as input costs and demand cycles—must be monitored. Investors should watch price action near swing levels, volume trends, and sector-wide developments before making decisions. A calibrated approach is advisable, considering both the growth potential and inherent market risks.

Setup Intact, Eye on Wave 5?This is a follow-up to my earlier analysis on Canara Bank, where we identified the completion of an ABC correction and the start of a fresh impulse.

What’s happened since:

Price respected the projected Wave 3 (yellow) target of 109.50 – exactly 1x of Wave 1.

A healthy correction is underway, likely forming Wave 4 (yellow) .

The pullback is holding within the 0.236–0.382 retracement zone (105.12 to 102.63) – make-or-break zone .

What’s next:

If the structure holds above 102.63, a bullish Wave 5 (yellow) may extend the rally toward the 120+ zone, completing Wave 3 (green).

Break below 102.63 invalidates the count and opens the door to a more complex correction.

This is for educational purposes only.

JIOFIN – Expanded Flat? Wave C on RadarSince the last analysis, price dipped to ₹270.35 (near 0.236 retracement), then bounced sharply to ₹284.70 — breaking the Wave 5 high.

This move confirms a Wave b rally that extends 159% of Wave a, a classic signature of an Expanded Flat correction.

What this means:

Wave b has trapped breakout buyers.

Expect Wave c next — likely a sharp decline below ₹270.35 to complete the correction.

RSI still shows divergence and momentum looks tired.

Watching for:

₹265–₹255 as potential Wave c landing zone.

Reclaiming ₹285+ invalidates this short-term correction view.

Structure remains educational. Stay sharp.

Technical Analysis of DXY (US Dollar Index) for the Week of May # Current Price Action and Market Context

Recent Price Movement: As of May 23, 2025, the DXY closed at approximately 99.11, down 0.85% from the previous session's close of 99.96. The index has been trending downward, testing two-week lows near 99.14 after failing to reclaim the 100.50 level.

Bearish Momentum: The break below 97.50 on the monthly chart signals a bearish structure with lower highs and lower lows, suggesting continued selling pressure. The next major downside target is around 96.00, with a potential longer-term target near 92.00.

Key Fundamental Drivers: Recent weakness in the DXY is attributed to President Trump’s proposed 50% tariffs on European imports, which have undermined bullish momentum in the dollar. Additionally, anticipation of Federal Reserve interest rate decisions, upcoming US inflation data, and employment reports (e.g., Non-Farm Payrolls) will play a significant role in the DXY’s direction.

-- Chart for your reference --

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources and X posts. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

Reliance Nears Lifetime High After Rebounding Strongly from TechTopic Statement:

Reliance is in a strong bullish phase, continuing its recovery momentum after a solid technical reversal.

Key Points:

The stock reversed sharply from a double bottom pattern at the 38.2% Fibonacci retracement level, offering strong support.

It received an additional bullish push at the 23.6% level, reinforcing upward momentum.

The price is approaching its lifetime high of 1161, where a double top formation is likely and could act as a profit-booking zone due to expected resistance.

Now trading above the 180-day EMA, the stock is technically overbought, suggesting a potential pause or pullback near the peak.