OFSS: Setting Up for a Relief Rally?🔍 Introduction

This analysis starts from the 1-hour timeframe, where price action shows signs of exhaustion at the tail end of a 5-wave decline. A classic ending diagonal in wave c, along with bullish RSI divergence, points toward a potential short-term reversal — possibly the start of Wave B in a larger A-B-C corrective structure. We then zoom out to place this setup within a broader W-X-Y correction that began from the 13,220 high.

🕐 1H Chart: Ending Diagonal + RSI Divergence into Key Zone

Following the peak at 9775, price has been declining in what appears to be a ABC zigzag correction. Subwave 5 (within wave c) exhibits ending diagonal behavior, with overlapping internals and weakening thrust. Importantly, RSI has been printing higher lows, diverging strongly against lower price lows — a signal of potential bottoming.

Price is also testing the 1.618 Fibonacci extension level. A decisive breakout above the upper trendline would confirm a likely transition into Wave B.

🟢 Watching closely for a decisive breakout / close above the channel.

📆 Daily Chart: W-X-Y Structure from 13,220 High

Zooming out, ORACLE FIN SERV is unfolding a W-X-Y correction from its 13,220 high:

Wave W completed as a zigzag down to 7038.

Wave X unfolded as a zigzag rally, peaking at 9775. Notably, Wave C of X did not reach 100% of Wave A — signaling internal weakness.

Wave Y is now developing as a red A-B-C structure, with Wave A possibly ending near the 8930 level.

🧠 Conclusion & Key Levels to Watch

Wave A of Y appears to be nearing completion, supported by:

Ending diagonal structure in wave C (1H)

RSI bullish divergence

Price stalling at 1.618 extension

A breakout above the channel could mark the start of Wave B — potentially retracing 38–61.8% of the drop from 9775

📌 This setup offers both short-term and structural clues. I’ll post follow-ups as this unfolds.

⚠️ Disclaimer

This post is for educational purposes only and does not constitute financial advice. Please do your own research and manage risk appropriately.

Fibonacci Extension

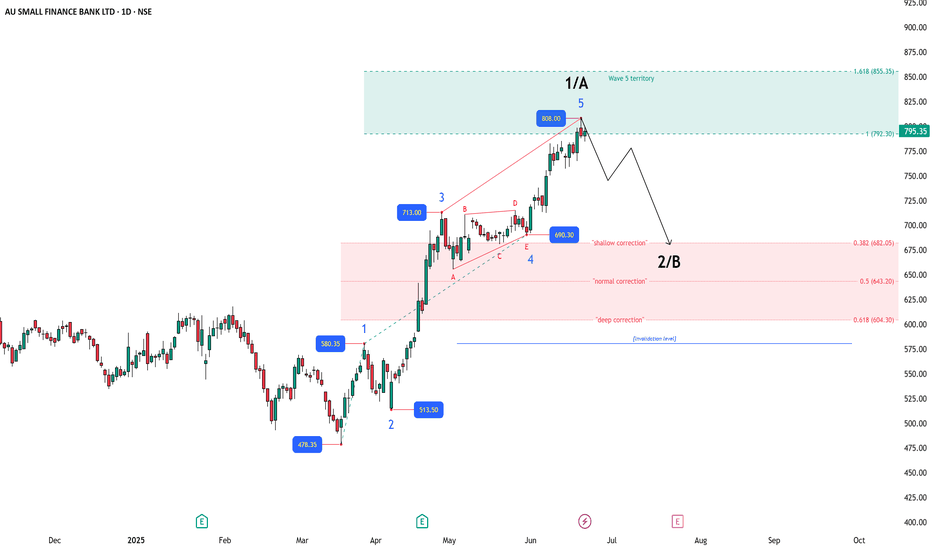

AU Small Finance: Final Push or Start of a Pause?AU Small Finance Bank has delivered a impulsive rally over the last few months. Starting from the March lows near 478, price unfolded into a clean 5-wave structure that carries all the classical Elliott Wave characteristics. Each leg followed the rules beautifully — with Wave 3 extending nicely, Wave 4 forming a triangle, and Wave 5 launching higher from there.

At present, Wave 5 has already reached 808, which satisfies the minimum Fibonacci projection of 1.0 (792) measured from Waves 1 through 3. However, it remains slightly open whether this fifth wave has fully matured. The upper target zone extends toward 1.618 projection, near 855, and price action in the coming sessions will be crucial in determining if there's a final push left before the larger corrective phase kicks in.

Should Wave 5 be complete — or once it completes — the market would likely transition into a corrective phase labeled here as Wave 2 or B, depending on whether this rally was the beginning of a larger impulsive sequence or part of a more complex corrective structure. Typically, corrections following a full 5-wave impulse retrace deeper than most traders expect. The initial shallow support may emerge near the 0.382 retracement around 682, but more meaningful supports sit at 0.5 retracement near 643 and potentially even 0.618 near 604. These zones will be critical to watch as the structure unfolds.

Invalidation for this entire bullish structure would sit below the origin of Wave 1, meaning any sustained breakdown below 580 would negate the bullish scenario entirely. But for now, the focus remains on watching how price behaves inside this final leg of Wave 5 — whether it's already done, or teasing a last-minute extension toward 855 before correcting.

As always, market structure will continue to guide the next moves, and updates will be made as price action evolves.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

BEL hits key level, a cool off ahead before next leg up?Bharat Electronics is unfolding a clean impulse. After completing Wave ii at 304.80, price surged into Wave iii, which has now reached the 1.618 Fibonacci extension near 410. Interestingly, while price made new highs, RSI is showing early signs of bearish divergence, hinting at a possible Wave iv pullback. The retracement zone between 385 and 370 may act as support before the uptrend resumes. As long as price holds above 319, the bullish structure remains valid.

Disclaimer:

This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

VPRPL - NSE | Daily Timeframe📊 VISHNU PRAKASH R PUNGLIA LTD (VPRPL) – NSE | Daily Timeframe

📅 Date: May 29, 2025

📈 CMP: ₹190.49 (−0.41%)

📌 Ticker: NSE:VPRPL

🧠 Technical Overview

✅ Cup & Handle Pattern in Formation 🍵

Price action is carving out a clean Cup & Handle base near the ₹195.80 resistance zone. A breakout above this neckline could ignite a fresh upside rally. The symmetry, volume spike, and recent bullish structure are all supporting potential continuation.

🧪 Volume Analysis

Noticeable volume increase as the price nears breakout zone, indicating accumulation and rising interest.

📍 Key Levels to Watch

🟡 Breakout Resistance:

₹195.80 (horizontal neckline)

🟢 Support Zone:

₹174.50 (base support of the cup)

₹165 (lower handle risk zone)

🎯 Potential Targets (Post Breakout):

₹220

₹240

₹265 (pattern-measured target zone)

💡 Trade Plan

Entry (on breakout): ₹196+ (with strong volume confirmation)

Stop Loss: Below ₹174

Target Range: ₹220–₹265

Risk-Reward: ~1:2.5+

⚠️ Disclaimer

This chart analysis is for educational purposes only. Always DYOR (Do Your Own Research) and consult a financial advisor before making investment decisions.

DIVISLAB - Cup Pattern Breakout with Bullish Flag Consolidation📊 DIVISLAB – Cup Pattern Breakout with Bullish Flag Consolidation

🕰️ Timeframe: 1W | 🔍 Pattern: Cup Formation + Bullish Flag | 🚀 Long-Term Breakout Potential

📈 Technical Breakdown:

DIVISLAB has formed a massive Cup pattern on the weekly timeframe and is currently consolidating inside a Bullish Flag after hitting the neckline breakout. This is a classic continuation setup following a long accumulation.

Post breakout, the price tested the upper region and is now preparing for a potential next leg toward Fibonacci extension levels.

🔑 Key Support & Resistance Levels:

🔵 Resistance / Upside Targets:

₹6,485.00 (Cup breakout top)

₹8,829.30 (Fib extension 161.8%) 🟦

🔴 Support Zones:

₹5,290.20 – Local horizontal support

₹5,035.95 – Fib 61.8% retracement (strong support)

₹4,588.30 – Fib 50%

₹4,140.70 – Fib 38.2%

₹2,691.65 – Long-term base (0% Fib)

🧭 Strategic View:

🟢 Bias: Bullish

🔁 Retest Zone: ₹5,290–₹5,035 can be re-entry zones

🎯 Target Zones: ₹6,485 followed by ₹8,829 for positional long

🛑 Invalidation: Below ₹5,000 zone

⚠️ Disclaimer: This is an educational chart setup and not trading advice. Please conduct your own research and risk management.

📣 Follow @PriceAction_Pulse for more such clean breakouts and chart pattern analysis!

🔁 Drop a comment if DIVISLAB is on your radar for the next breakout rally 📈

Shocked by Nifty50's sharp correction? Don't worry!Today NIFTY has crashed by 350+ points and reached 23165, a correction from 23800 levels .

Let me explain, This Nifty Daily chart is a classic example of how many fundamentals of Technical Analysis are satisfied.

1) Old resistances in 2024 at 22800 will now become Support levels

2) If it goes to 23000 and stops at 22800 levels it also fulfils the Wave 4 criteria, which says that Wave 4 never gets in Wave 1 territory

3) If this happens, the chart also completes an Inverse Head and Shoulder's Right Shoulder bottom to make an up-move towards the Neck.

4) if it crosses the Neck, the targets of Nifty will be above 25500, which will be 2500+points.

Technicals are beautiful only when you practice them.

USD/INR - Where the rupee is heading, Will it reach the 90s?FX_IDC:USDINR

Looking at the daily chart of USD/INR we can see a breakout at 86.68 level. And now there is a retracement from 87.95 levels. The question is whether it will make a new high or not, should we remain bullish on USD?

Let's refer the history to find a high probability answer.

From Oct'18 prices consolidation for 1.5 years. During this period there was cup and handle (C&H) formation followed by a breakout in Feb-20 @72.5 INR.

Note that the base of the handle was at 70.55 INR.

The momentum continued till 77 Rs in Apr-20.

If we draw a fibo extension from 70.55 to 77 (Δ 6.45), and apply it from the next C&H breakout at 77 Rs in May-22. The upmove followed this breakout made a high @ 83.285Rs. which is approx equal to (B/o pt + Δ) = (77+6.45 = 83.45).

Now Lets apply this concept to find the high of current bull run.

Let draw Fibo extension from base of the handle to top of the the entire run i.e from 75.288 to 83.285 (Δ ≈ 8)

And apply it from the B/o of C&H pattern @83.41 Rs.

So the next targets are {(B/o pt + Δ) = (83.41+8 = 91.41)} or {(B/o pt + 1.618*Δ) = (83.41+1.618*8 = 96.35)}

Nifty50 - November 2024 viewIn my October view, I had mentioned that it is time to be cautious as Nifty was near an important zone of 26240-26270 and we have seen more than 2000 points fall since then.

FIIs have sold more than 1.3 lakh crore of equity in last 40 days.

Let's analyze what can be expected in this month. We have seen nearly 10% correction from ATH in Nifty50. 23900 is acting as a support currently which is also its 78.6 % fib extension.

On the downside:-

Below 23900, I am expecting at least 23300 which is near the trendline support.

On the upside:-

24300, 24800 & 25000 would act as a strong resistance.

Current view is sideways to bearish till 25000 is breached on weekly closing basis

Till then, market will remain on sell at high.

Nifty 50 - Portfolio Colour similar to color of Christmas?Year endings have historically been famous for a big correction and 2024 is no different.

As I had mentioned in my previous idea, 23900, 23300 are crucial support to Nifty and 24300, 24800 are strong resistances

We had seen a good bounce from 23300 to 24780 and then a good fall once 24300 was broken again.

23200-23300 will be a key level to understand next trend for Nifty.

As we can see, there is a confluence of trendlines and demand zone around 23200.

If we see a bear trap forming at this zone, one can expect 25000+ levels in January 2025.

But if 23200 is broken, bloodbath may continue till budget with next key support zones being 22700, 22000, 21500.

Market is going to be volatile as we are going to see a change in lot size of Nifty 50 from new year.

It is better to be sector specific for swing trading.

ZOMATO A CHANNEL CONSOLIDATION WILL IT BREAKOUT OR FIZZLE OUT ?Zomato Ltd. is an interesting chart in momentum with following

1. RSI on all time frames (D/W/M) above 60

2. Narrowing Bollinger Bands on daily chart with price walking near Upper Band

3. Four months long consolidation in range of 240 to 295 zone

4. ABCD pattern under formation on weekly chart

5. Major Price Supports as under:

20 SMA (daily ) 263

50 EMA (daily ) 264

20 SMA (weekly) 261

with cluster of supports in range of 260-264 can be a good risk reward trade. Fibonacci projection tool projects targets of 333 and 358 Lets see if it sustains the trend or fizzles out

Lets See How it Evolves.

Disclaimer: NOT A BUY / SELL RECOMMENDATION I am not an expert I just share interesting charts here for educational purpose and not to be taken as buy/sell recommendation. Please seek expert opinion before investing and trading as trading/ investing in market is subject to market risks. I do not hold any position in the stock as on date but I may look to take some position with my own Risk Reward matrix.

Low risk buying in RELIANCEA low-risk high probability buying setup is forming in RELIANCE.

Price is taking support at the cluster of 38.2% retracement, 100% extension of Flat correction, and trendline in red.

If the price enters and sustains in the blue channel, showing bullish pressure, it will provide a good buying opportunity with a stop loss below the recent low.

Is HDFC Bank aiming to hit 2200+ in the coming months?Reason for going long on HDFC:

Ichimoku:

HDFC stock has been sideways for years but is slowly turning bullish after hitting strong Ichimoku cloud support at 1350. It is now crossing the Tenkan-sen (TS) and Kijun-sen (KS) on the monthly chart.

Fibonacci + Fib Channel:

When we draw the Fibonacci channel and Fibonacci extension of swings, it looks like HDFC is set to hit 2200 in the coming months.

Buy on Dip:

The current market price (CMP) is 1604. Any good dip near 1450-1520 presents a great buying opportunity for the long term.

Disclaimer: We are not SEBI registered. The content presented here is based on our personal opinions. Conduct your own research and consult with a qualified financial advisor before making any investment decisions.

"Bank Nifty has broken all hurdles. Real breakout or fake?" Bank Nifty Monthly Chart Wave Analysis:

June Candle: 2 more days left for the candle to close.

Current Market Price: ₹51,575

We drew all possible resistance trendlines and channels, and Bank Nifty has clearly broken out above everything(just 3 days left for June candle to close), with the wave extending.

Elliot Wave Analysis : Initially, we counted the October 2021 high as wave 3 in our past charts. However, the current momentum and breakouts suggest it could be wave 1, and we are possibly in wave 3 not wave 5th.

REAL Breakout : BN will retrace slightly and then move up again with strong candles in the coming months and it shouldn't enter the big purple color channel and close below 50,100(July Candle closing).

Buy on Dip: A good dip near 50,600-800 is a place to go long with a small stop loss below a 49900 day candle close. If entering at the current market price, the SL is the same.

Possible Upside Targets : 53,700, 57,000

FAKE Breakout : The July candle will break the purple color fib channel, retest, and come down with huge red candles. The candle shouldn't close above the purple channel again.

Sell on Rise: Sell only if the price breaks below the channel, around 49,900. In this case, short with a small SL.

Possible Targets : 44,444, 40,000

Disclaimer: We are not SEBI registered. The content presented here is based on our personal opinions. Conduct your own research and consult with a qualified financial advisor before making any investment decisions

Is IEX ready for a 100% upmove? Charts says YESIs Indian Energy Exchange (IEX) all set to fire up?

We are expecting big targets based on the following key technical points:

Great Correction (Fib):

The price underwent a deep correction of more than 61.8%, almost reaching the 0.786 Fibonacci retracement level from the top.

Price Action Structure Change:

The price has changed structure since it broke the previous high on the monthly time frame and sustained weekly candle.

Ichimoku Confirmation:

There is a strong TS & KS breakout, and it looks poised to break the cloud as well. A strong base has been created, and a breakout has occurred.

Fib Channel + Fib Extension:

The price respected the channel bottom and reversed strongly. Based on the channel targets, there is a high chance of hitting 360+ in the coming months.

Wave Analysis and Targets:

The stock is in either Wave C or Wave 3. The minimum targets for Wave C are 287 (61.8%) and 394 (100%). Any move beyond this is a bonus.

Use Ichimoku (Daily Time Frame) for Higher Profits:

Disclaimer: We are not SEBI registered. The content presented here is based on our personal opinions. Conduct your own research and consult with a qualified financial advisor before making any investment decisions.

FASP levels for Bank Nifty 24/04/2024The FASP for BankNifty is listed for 24-04-2024. You can add this levels to your trade setup for better results. This should not be the only indicator but an additional tool to increase your winning possibilities.

What is Fibolysis Anchor SupRes Points(FASP)?

It is a unique level arrived by using Fibonacci Retracement , Fibonacci Extension , Standard Pivot levels under various Timeframes. It is an extensively analyzed level to draw the support and resistance levels for the next day. You can use these levels along with your trade setup to increase your winning odds.

Validity of the levels: 1 Day

How to use these levels?

The three levels on both sides are usually easily achievable. The Targets above are bit difficult to achieve in a single trading session. I use this fact to write intraday positions and to buy options.

Color Coding: Green is regular support and buying area, Red is strong exit area

Disclaimer: This is shared in the interest of educational purpose and for knowledge enhancement. Kindly refer it in the same light. I am not responsible for any profits or loss incurred based on this information.

FASP levels for Nifty 24/04/2024The FASP for Nifty is listed for 24-04-2024. You can add this levels to your trade setup for better results. This should not be the only indicator but an additional tool to increase your winning possibilities.

What is Fibolysis Anchor SupRes Points(FASP)?

It is a unique level arrived by using Fibonacci Retracement , Fibonacci Extension , Standard Pivot levels under various Timeframes. It is an extensively analyzed level to draw the support and resistance levels for the next day. You can use these levels along with your trade setup to increase your winning odds.

Validity of the levels: 1 Day

How to use these levels?

The three levels on both sides are usually easily achievable. The Targets above are bit difficult to achieve in a single trading session. I use this fact to write intraday positions and to buy options.

Color Coding: Green is regular support and buying area, Red is strong exit area

Disclaimer: This is shared in the interest of educational purpose and for knowledge enhancement. Kindly refer it in the same light. I am not responsible for any profits or loss incurred based on this information.

FASP levels for Nifty 12/04/2024The FASP for Nifty is listed for 12-04-2024. You can add this levels to your trade setup for better results. This should not be the only indicator but an additional tool to increase your winning possibilities.

What is Fibolysis Anchor SupRes Points(FASP)?

It is a unique level arrived by using Fibonacci Retracement , Fibonacci Extension , Standard Pivot levels under various Timeframes. It is an extensively analyzed level to draw the support and resistance levels for the next day. You can use these levels along with your trade setup to increase your winning odds.

Validity of the levels: 1 Day

How to use these levels?

The three levels on both sides are usually easily achievable. The Targets above are bit difficult to achieve in a single trading session. I use this fact to write intraday positions and to buy options.

Color Coding: Green is regular support and buying area, Red is strong exit area

Disclaimer: This is shared in the interest of educational purpose and for knowledge enhancement. Kindly refer it in the same light. I am not responsible for any profits or loss incurred based on this information.

FASP levels for Bank Nifty 12/04/2024The FASP for BankNifty is listed for 12-04-2024. You can add this levels to your trade setup for better results. This should not be the only indicator but an additional tool to increase your winning possibilities.

What is Fibolysis Anchor SupRes Points(FASP)?

It is a unique level arrived by using Fibonacci Retracement , Fibonacci Extension , Standard Pivot levels under various Timeframes. It is an extensively analyzed level to draw the support and resistance levels for the next day. You can use these levels along with your trade setup to increase your winning odds.

Validity of the levels: 1 Day

How to use these levels?

The three levels on both sides are usually easily achievable. The Targets above are bit difficult to achieve in a single trading session. I use this fact to write intraday positions and to buy options.

Color Coding: Green is regular support and buying area, Red is strong exit area

Disclaimer: This is shared in the interest of educational purpose and for knowledge enhancement. Kindly refer it in the same light. I am not responsible for any profits or loss incurred based on this information.

FASP levels for Nifty 10/04/2024The FASP for Nifty is listed for 10-04-2024. You can add this levels to your trade setup for better results. This should not be the only indicator but an additional tool to increase your winning possibilities.

What is Fibolysis Anchor SupRes Points(FASP)?

It is a unique level arrived by using Fibonacci Retracement , Fibonacci Extension , Standard Pivot levels under various Timeframes. It is an extensively analyzed level to draw the support and resistance levels for the next day. You can use these levels along with your trade setup to increase your winning odds.

Validity of the levels: 1 Day

How to use these levels?

The three levels on both sides are usually easily achievable. The Targets above are bit difficult to achieve in a single trading session. I use this fact to write intraday positions and to buy options.

Color Coding: Green is regular support and buying area, Red is strong exit area

Disclaimer: This is shared in the interest of educational purpose and for knowledge enhancement. Kindly refer it in the same light. I am not responsible for any profits or loss incurred based on this information.

FASP levels for Bank Nifty 10/04/2024The FASP for BankNifty is listed for 10-04-2024. You can add this levels to your trade setup for better results. This should not be the only indicator but an additional tool to increase your winning possibilities.

What is Fibolysis Anchor SupRes Points(FASP)?

It is a unique level arrived by using Fibonacci Retracement , Fibonacci Extension , Standard Pivot levels under various Timeframes. It is an extensively analyzed level to draw the support and resistance levels for the next day. You can use these levels along with your trade setup to increase your winning odds.

Validity of the levels: 1 Day

How to use these levels?

The three levels on both sides are usually easily achievable. The Targets above are bit difficult to achieve in a single trading session. I use this fact to write intraday positions and to buy options.

Color Coding: Green is regular support and buying area, Red is strong exit area

Disclaimer: This is shared in the interest of educational purpose and for knowledge enhancement. Kindly refer it in the same light. I am not responsible for any profits or loss incurred based on this information.