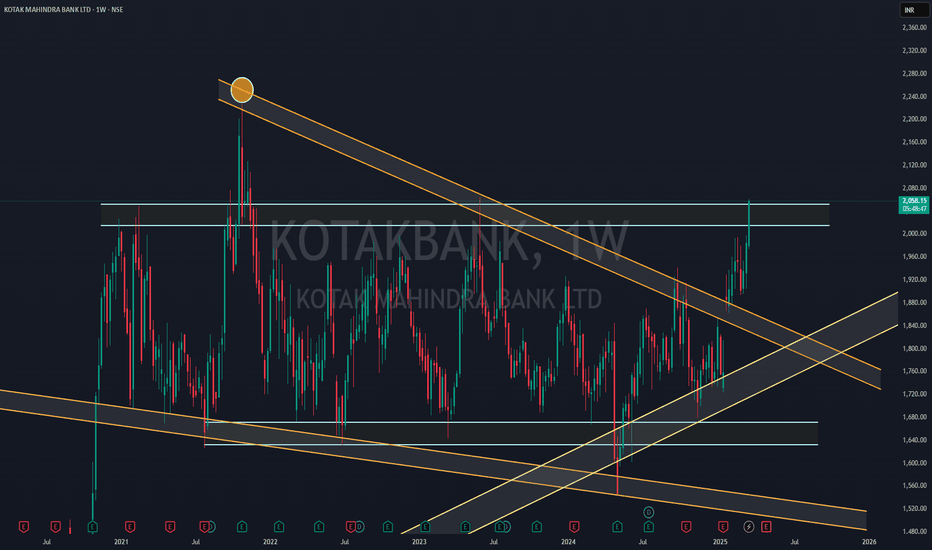

KOTAK BANK NEAR FLAG BReakoutKotakBank is nearly Flag Breakout on Monthly Candle (Wait more 7 days to Finish MOnthly Candle with Big Bull Breakout)

Wait for Proper Breakout beacuse its 4 time where Chart is going to test same Trendline.

Flag Pattern Start from 2020- After 5 years its will going to break

If we see fulll chart Stock taking support over 2013 Trendline before two months so there is more more possibility to give breakout

if we see RSI chart its also show Breakout over MOnthly RSI trendline..

## THis is my Just View, take position after all confromations and research by yourself##

also see weekly chart - weekly showing strong big bull canle ( 1more Weekly Candle Require for final conformations)

Flagformation

KIRIINDUS (Kiri Industries Ltd.): Bullish Flag BreakoutSetup:

Pattern: Kiri Industries has formed a Bullish Flag on the daily chart, signaling a potential continuation of the prior uptrend.

Breakout: The stock has recently broken out of its consolidation phase, confirming the flag pattern.

Entry Strategy:

Buy at: 613 INR. Wait for a confirmation close above the flag's resistance for entry.

Risk Management:

Stoploss: Set at 554 INR, positioned below the flag's lower trendline.

Profit Targets:

1st Target: 644 INR

2nd Target: 670 INR

3rd Target: 702 INR

4th Target: 729 INR

5th Target: 760 INR

6th Target: 788 INR

Risk/Reward:

Risk : 59 INR (Entry - Stoploss)

Rewards: Ranging from 31 INR to 175 INR, offering a strong risk-reward profile.

Notes:

Volume Confirmation: Ensure the breakout volume is higher than average to validate the setup.

Market Context: Consider the sector and broader market trends for added confidence.

Fundamentals: For long-term holds, review company fundamentals.

This setup provides traders with a clear plan for entering, managing risk, and aiming for multiple profit levels. However, always adapt your strategy to real-time market conditions.

ZOMATO A CHANNEL CONSOLIDATION WILL IT BREAKOUT OR FIZZLE OUT ?Zomato Ltd. is an interesting chart in momentum with following

1. RSI on all time frames (D/W/M) above 60

2. Narrowing Bollinger Bands on daily chart with price walking near Upper Band

3. Four months long consolidation in range of 240 to 295 zone

4. ABCD pattern under formation on weekly chart

5. Major Price Supports as under:

20 SMA (daily ) 263

50 EMA (daily ) 264

20 SMA (weekly) 261

with cluster of supports in range of 260-264 can be a good risk reward trade. Fibonacci projection tool projects targets of 333 and 358 Lets see if it sustains the trend or fizzles out

Lets See How it Evolves.

Disclaimer: NOT A BUY / SELL RECOMMENDATION I am not an expert I just share interesting charts here for educational purpose and not to be taken as buy/sell recommendation. Please seek expert opinion before investing and trading as trading/ investing in market is subject to market risks. I do not hold any position in the stock as on date but I may look to take some position with my own Risk Reward matrix.

BULL FLAG PATTERN IN INDIA CEMENTS - POSITIONAL LONG TRADESymbol - INDIACEM

CMP - 353

India Cements is forming a Bullish Flag pattern after a good run. It is consolidating at higher levels & buyers are looking strong & not giving up. Breakout of this Flag pattern can lead the stock price towards 650 which is approx. 90% upside from current price. I have made a long position at CMP and will add more position around 390, which is breakout zone. Stoploss I am following is 330.

Disclaimer - Do not consider this as a buy/sell recommendation. I'm sharing my analysis & my trading position. You can track it for educational purposes. Thanks!

Medium term trading opportunity in Aarvee Den for V. good UpsideHi,

NSE:AARVEEDEN has given a Bullish Flag Breakout on Weekly charts with very good volume.

MACD is also on the bullish side on Weekly time frames. RSI is also on the bullish side on daily, weekly and monthly time frames.

In the current market scenario, I am expecting that the bullish momentum will continue.

Complete price projection like entry, stop loss and targets mentioned on the charts for educational purpose.

Don't Forget to Follow me to get all the updates.

Please share your feedback or any queries on the study.

Disclaimer: Please consult your financial advisor before making any investment decision.

A Long ShotFlag and pole breakout

Rsi and stochastic turning positive

Target 1 distance of parallel channel

Target 2 distance of pole

Both from breakout point.

Stop loss below flag channel

Just Paper trade.

Morepen Lab - Bullish Flag and Fibonacci RetracementMorepen Lab has formed a bullish flag pattern, and today it has successfully broken out.

The price has retested the Fibonacci level at 38, where it formed a bullish piercing pattern, signaling potential upside momentum.

Price take support of 50 period EMA.

Additionally, this level coincides with a significant demand zone on the chart, suggesting strong buying interest. Keep an eye on this stock for further upward movement

Infosys ready for Flag pattern breakout in coming daysNSE:INFY Ready for flag pattern breakout in coming days

Consolidated pattern since many days now ready for breakout in coming days

Follow for more trading signals or analysis.

Target 10% approx

Stoploss 3%

Do as directed in the chart

This is not the trading recommendation or advise 🚨

Do your analysis before taking any step.

Medium term trading opportunity in ABFRL for > 25% upsideHi,

NSE:ABFRL has given a Bullish Flag Breakout on Weekly charts with very good volume.

MACD is also on the bullish side on Weekly time frames. RSI is also on the bullish side on daily, weekly and monthly time frames.

In the current market scenario, I am expecting that the bullish momentum will continue.

Complete price projection like entry, stop loss and targets mentioned on the charts for educational purpose.

Don't Forget to Follow me to get all the updates.

Please share your feedback or any queries on the study.

Disclaimer: Please consult your financial advisor before making any investment decision.

Short term trading opportunity in Hariom Pipe for > 15% upsideHi,

NSE:HARIOMPIPE has given a Bullish Flag Breakout on Daily charts with very good volume.

MACD is also on the bullish side on Weekly time frames. RSI is also on the bullish side on daily, weekly and monthly time frames.

In the current market scenario, I am expecting that the bullish momentum will continue.

Complete price projection like entry, stop loss and targets mentioned on the charts for educational purpose.

Don't Forget to Follow me to get all the updates.

Please share your feedback or any queries on the study.

Disclaimer: Please consult your financial advisor before making any investment decision.

ITC Flag & Pole patternThe stock has formed flag & pole pattern on the monthly chart.

One can enter above 511 with a strict Stoploss of 422

Target 1 - 599

Target 2 - 640

Target 3 - 697

All levels are mentioned in chart.

#LONGTERM TRADE

#FUNDAMENTALLY STRONG STOCK

#ITC

What is your view please comment it down and also boost the idea this help to motivate us. All views shared on this channel are my personal opinion and is shared for educational purpose and should not be considered advise of any nature.

DRREDDY is ready for fireIn today's trading session, the price has given a breakout of a falling trendline and flag and pole pattern. The price is trading above 14 EMA. MACD is turning positive.

Keep a close watch.

Disclaimer- I am not a SEBI registered technical analyst and adviser. Kindly trade on your risk.

Short Term Swing Trading Idea in Hindustan Zinc for 30% UpsideHi,

NSE:HINDZINC has given a Bullish Flag Breakout on Daily charts with very good volume.

MACD is also on the bullish side on Daily, Weekly and Monthly time frames. RSI is also on the bullish side on daily, weekly and monthly time frames.

In the current market scenario, I am expecting that the bullish momentum will continue.

Complete price projection like entry, stop loss and targets mentioned on the charts for educational purpose.

Don't Forget to Follow me to get all the updates.

Please share your feedback or any queries on the study.

Disclaimer: Please consult your financial advisor before making any investment decision.