Option Buying vs. Option Selling🔍 What Are Options in Simple Terms?

Options are contracts that give you the right, but not the obligation, to buy or sell a stock (or index) at a specific price (called the strike price) before a certain date (the expiry).

There are two types of options:

Call Option: Gives you the right to buy.

Put Option: Gives you the right to sell.

Now, you can either buy these options or sell/write them. This is where Option Buying and Option Selling come into play.

🎯 Option Buying – The Dreamer’s Game

✅ What is Option Buying?

You pay a premium (small amount) and get the right to benefit from a big move in the market—either up or down—depending on the type of option you buy.

If you expect the market to go up, you buy a Call Option.

If you expect the market to go down, you buy a Put Option.

✅ Why Do People Love Option Buying?

Low Capital Requirement: You can buy an option for ₹100–₹2,000 and control a large value of the index/stock.

Unlimited Profit Potential: Your losses are limited to the premium, but profits can be huge if the market moves in your favor.

Simple to Execute: Easy for new traders to understand and start with.

❌ But Here’s the Harsh Reality...

Time Decay (Theta): Every day, your option loses value if the price doesn’t move. You’re fighting time.

Low Winning Ratio: Most options expire worthless. So unless you catch a big, fast move, you lose.

Emotionally Draining: You’ll be right on direction but still lose money due to premium decay or slippage.

🔄 Real-Life Example

Imagine buying a Bank Nifty 49,000 CE for ₹150. If Bank Nifty goes to 49,200, you might make good returns. But if it stays sideways or only moves near expiry, your ₹150 can become ₹10—even though your view was right.

Option Buyer’s Risk = 100% of Premium

Option Buyer’s Reward = Unlimited (theoretically)

🛡️ Option Selling – The Smart Money’s Edge

✅ What is Option Selling?

You sell/write options and receive the premium upfront. You win if the option loses value—which is what happens most of the time.

If you believe the market will not go above a certain level, you sell a Call Option.

If you believe the market will not fall below a certain level, you sell a Put Option.

Basically, you're betting on nothing extreme happening.

✅ Why Do Institutions Prefer Option Selling?

High Probability of Profit: Around 70–80% of options expire worthless. That’s why sellers profit more often.

Theta Decay Works in Your Favor: Time works for you, not against you.

Regular Income: You can create strategies to earn consistently—especially in rangebound markets.

❌ What Are the Risks?

Unlimited Loss Potential: If the market moves against you sharply, your losses can be massive.

Needs Big Capital: Option selling requires margin, usually ₹1.5 to ₹2 lakhs per lot.

High Discipline Required: One mistake (overleveraging or wrong strike selling) can blow up your account.

🔄 Real-Life Example

Suppose you sell Nifty 23,300 CE for ₹100 and Nifty closes at 23,100 on expiry. That ₹100 premium becomes zero, and you keep it fully. But if Nifty suddenly jumps to 23,500, your ₹100 premium may become ₹400 or ₹800, and you’ll be in deep trouble unless you manage your position.

Option Seller’s Risk = Unlimited (in theory)

Option Seller’s Reward = Limited to Premium

🧠 Which One Is Better?

It depends on your mindset, capital, and risk appetite.

👉 Option Buying is better if:

You are a small retail trader with ₹5K–₹20K capital.

You have a strong directional view (especially on event days).

You can afford to lose small amounts for big returns.

You don’t want to manage complex positions or margins.

👉 Option Selling is better if:

You have ₹1–₹2 lakh+ capital and a focus on consistent profits.

You can manage risk through hedging or spreads.

You prefer high accuracy and stable income over jackpot trades.

You follow rules and don’t panic with market moves.

🧠 Smart Approach: Combine Both

Professional traders don’t pick just one—they combine both.

💡 Examples:

Buy Call, Sell Far OTM Call = Bull Call Spread

Sell Both CE & PE at Key Levels = Strangle/Straddle

Buy Put, Sell Lower Put = Bear Put Spread

These reduce risk and improve probability while keeping reward potential intact.

🧘♂️ Final Advice (From Practical Traders)

Avoid random option buying. Don’t chase cheap options blindly.

Don’t sell naked options without risk control.

Use hedging or spreads to limit both loss and margin requirement.

Focus on discipline, not thrill.

Always respect position sizing, stop loss, and capital management.

Avoid trading during low volume or uncertain news zones.

📌 Conclusion

Option Buying is like buying a lottery ticket with logic. It’s risky, but the reward can be sweet. Option Selling is like being the insurance company—it’s slow, but steady and statistically in your favor.

Forex

Option Chain Analysis + Open Interest (OI)🧠 Let’s First Understand: What is Option Chain?

An Option Chain is a table that shows available strike prices for a particular stock/index along with their Call and Put option data—like premium, volume, open interest, change in OI, etc.

✅ Where can you find it?

NSE Website (most reliable)

Trading Platforms like Zerodha, AngelOne, etc.

Apps like Sensibull, Opstra, etc.

The option chain is divided into two parts:

Left side – Call Options (CE)

Right side – Put Options (PE)

Each row shows the strike price and various data like:

LTP (Last Traded Price) – the premium.

Open Interest (OI) – total contracts outstanding.

Change in OI – new positions added or removed.

Volume – how many contracts traded today.

🔍 What is Open Interest (OI)?

OI = Open Interest = Open positions in the market.

It shows how many contracts are live at a particular strike. It’s like a pulse of the market—it tells us where the action is happening.

If OI is going up → Traders are adding positions

If OI is going down → Traders are closing positions

🔑 Why Is OI Important?

Because institutions and smart money create large positions—and OI helps us identify where they’re betting.

OI gives an idea of:

Support and Resistance zones

Strength of a trend

Where market might reverse

Where volatility might increase

📘 Understanding Support & Resistance Using Option Chain

Support and resistance levels can be seen through the OI data in the option chain.

✅ How to Identify Support?

Look at Put OI:

The strike price with highest Put OI is considered strong support.

Why? Because put writers (who are mostly smart money) don’t expect the price to fall below this level.

Example:

If 22,500 PE has the highest OI, it acts as a support level.

✅ How to Identify Resistance?

Look at Call OI:

The strike price with highest Call OI is considered strong resistance.

Why? Because call writers are betting price won’t go above this level.

Example:

If 23,200 CE has the highest OI, it acts as a resistance level.

🔁 Change in OI – Fresh Positions vs Exits

Don't just look at total OI—look at the change in OI today.

Increase in OI = Fresh positions are being added

Decrease in OI = Traders are squaring off positions

It helps confirm if the current market move is genuine or fake.

Example:

If Nifty is going up and Call OI at 23,000 is increasing, it means fresh selling → possible resistance.

But if Call OI is decreasing, it means sellers are exiting → breakout possible.

🧩 How Option Chain + OI Help in Intraday Trading

Find Support & Resistance Zones

Use highest OI levels to set your boundaries.

Avoid buying near strong resistance; avoid selling near strong support.

Use OI to Validate Breakouts

Watch how OI changes near key strike prices.

If resistance strike sees short covering (OI falling), breakout is real.

Trend Confirmation

Long buildup (Price ↑, OI ↑) = Uptrend

Short buildup (Price ↓, OI ↑) = Downtrend

Expiry Day Strategy

Focus on where OI is building rapidly.

Use max pain and max OI to sell straddles/strangles safely.

🧠 Advanced Concepts

🔸 Max Pain Theory

Max Pain is the strike price where the most option buyers lose money on expiry. It is the level where option sellers are most profitable. It usually acts like a magnet near expiry.

Example:

If Max Pain for Nifty is 23,000, market may stay near this level on expiry day.

🔸 PCR (Put Call Ratio)

PCR = Total Put OI / Total Call OI

PCR > 1: More Puts than Calls → Bullish sentiment

PCR < 1: More Calls than Puts → Bearish sentiment

PCR near 1 = Neutral/Rangebound market

Use it with caution—extremely high or low PCR may signal reversal zones.

🛠️ Tools to Use (Free)

NSE India Website – Best for raw data

Sensibull, Opstra, Quantsapp – Visual OI charts

TradingView – Combine charts + option levels

Telegram OI Bots – For quick OI updates

📌 Do's & Don'ts in Option Chain + OI Analysis

✅ Do:

Use OI + Price + Volume together

Watch OI shifts during the day (especially 9:30–10:30 AM and 2–3 PM)

Combine with support/resistance zones from charts

❌ Don’t:

Trade blindly based only on highest OI

Ignore rapid changes in OI—it could signal smart money exit

Confuse high OI with direction—it just means “interest,” not bias

🎯 Final Words

Option Chain + OI analysis isn’t just a tool—it’s your insight into the mind of the market. It tells you what others are doing, especially the big players who move the markets.

To master it, keep practicing:

Observe how OI builds around events (like RBI policy, earnings)

Watch price + OI behavior on breakout and breakdown days

Pair OI with basic technical analysis for solid confidence

Price Action Trading What is Price Action Trading?

Price Action Trading means making trading decisions based on the actual price movement on the chart—nothing else. No RSI, no MACD, no fancy indicators. Just candlesticks, structure, support/resistance, and patterns.

Think of it like this: If the market is a language, price action is learning to read, write, and speak it fluently.

🤔 Why Use Price Action?

Because indicators are lagging. They react after the move has happened. Price action is real-time, showing what’s happening right now.

Benefits:

Helps identify real support/resistance zones

Tells you the story of buyers vs sellers

Works on any time frame (1-min, 5-min, daily, etc.)

No dependency on tools—just your eyes and chart reading skills

🔍 Key Elements of Price Action

1. Market Structure

This is the foundation of price action. Market moves in three ways:

Uptrend (Higher Highs, Higher Lows)

Downtrend (Lower Highs, Lower Lows)

Range (Sideways, Consolidation)

If you understand structure, you already know:

Where the trend is

When it's changing

Where you can enter/exit

2. Support and Resistance

These are areas where price reacts repeatedly. In price action, these are called zones, not exact lines.

How to Identify?

Look for areas where price bounced or reversed multiple times.

These become decision zones for future trades.

Support = Price zone where buyers come in

Resistance = Price zone where sellers push price down

3. Trendlines & Channels

Drawing trendlines connecting swing highs/lows gives you:

A guide to trend strength

Breakout/breakdown points

Dynamic support/resistance

Channels help identify range-bound moves and reversal points at the edges.

4. Breakouts & Fakeouts

Price often breaks out from:

Ranges

Trendlines

Chart patterns

But not all breakouts are real. Some are fakeouts to trap retail traders.

A good price action trader waits for confirmation (like a strong candle close) before reacting.

📘 How to Trade Using Price Action – Step-by-Step

Let’s now apply this knowledge in a live trading-style thinking process.

✅ Step 1: Understand the Trend (Structure)

On a clean chart (no indicators), mark recent swing highs/lows

Ask: Is the market making Higher Highs and Higher Lows (uptrend)?

If yes → look only for buy opportunities

✅ Step 2: Identify Key Zones

Mark:

Major support and resistance

Previous day’s high/low

Intraday breakout zones

These are your action points.

✅ Step 3: Wait for Price Reaction

At those zones, wait for:

Reversal patterns like pin bar, engulfing

Breakout candles with strong body (not doji)

Volume spike (optional)

✅ Step 4: Entry and Stop-Loss

Entry: After confirmation candle closes (not before)

Stop-loss: Just below/above the zone or candle wick

Target: Use recent structure zones or risk-reward ratio (e.g., 1:2)

✅ Step 5: Trade Management

If price moves in your favor, trail SL (e.g., to break even)

Watch for reversal signs to exit manually if needed

Never hold hoping for miracle recovery

🎯 Price Action Trading in Intraday (Example with Bank Nifty)

Check 5-min and 15-min chart.

Mark:

Opening range high/low

Pre-market support/resistance

Day’s high/low from yesterday

Wait for price to reach these zones.

Watch for:

Rejection candles (pin bar, inside bar)

Breakout retests

Place trade with small SL and clear RR.

Example Scenario:

Bank Nifty opens near yesterday’s high

You see a bearish pin bar on 5-min rejecting resistance

You short with SL above the high, target recent swing low

Risk = 30 pts, Reward = 70 pts → good setup

🧠 Psychological Side of Price Action

Trading price action requires:

Patience (waiting for setups)

Discipline (following rules, not emotions)

Chart reading skill (comes with time and practice)

Don’t try to force trades. If price doesn’t reach your zone or give confirmation — stay out.

No trade is better than a bad trade.

🧪 Tools That Help (Optional)

Although price action is tool-free, these tools can support your analysis:

TradingView – for clean charts

Volume – to confirm strength of moves

Sessions Indicator – mark Asia/Europe/US zones

❗ Mistakes to Avoid

Trading every candle — wait for context + confirmation

Ignoring market structure — never go against strong trend

Jumping in during volatile news — sit out

Not marking clean zones — messy chart = messy trades

No stop-loss — one big loss can kill weeks of gains

✨ Summary – Price Action Trading Blueprint

Component Role in Trading

Market Structure Understand the trend

Support/Resistance Identify key decision zones

Candles Watch for rejection/confirmation

Entry Rules Confirm with candle close

SL & RR Define before entry

Patience Only trade A+ setups

💬 Final Thoughts

Price action trading is a skill, not a hack.

It takes practice, patience, and screen time. But once you understand it deeply, you don’t need indicators or news. The chart will tell you everything.

You’ll start seeing things others can’t:

Why that candle reversed exactly there

Why the market faked out and then reversed

Where buyers/sellers are hiding

And most importantly—you’ll gain confidence in your own decisions.

Institutional Order Flow / Smart Money Concepts🚀 What is Institutional Order Flow?

Institutional Order Flow simply means tracking how big players are placing their buy and sell orders, and using that data to trade alongside them — not against them.

Big players can’t enter or exit in one go. If they do, they’ll move the market too much. So they:

Split their orders

Use liquidity zones

Create traps and fakeouts to fill their orders

Your job as a retail trader is to spot these footprints.

💡 Why is it Important?

Most retail traders:

Follow indicators

Chase breakouts

React late

Institutions:

Create liquidity traps

Use retail mistakes to enter their positions

Push price into zones that force emotional trading

By understanding Institutional Order Flow or Smart Money Concepts, you’ll stop being the one getting trapped—and start trading with the whales.

🔍 Key Concepts of Smart Money / Institutional Order Flow

Let’s now break down the core principles and tools.

1. Liquidity Zones

Institutions need liquidity — meaning many buyers or sellers to fill their orders.

They create fake breakouts, stop hunts, or news spikes to force retail traders to enter or exit — and then they do the opposite.

Example:

Price breaks above resistance — retail buys breakout

Institutions sell into that liquidity

Price reverses sharply = retail gets trapped

Your job: Identify where liquidity is sitting (above highs, below lows).

2. Breaker Blocks

A breaker block is an OB that failed, but now acts as the opposite side’s zone.

Example:

Price breaks bullish OB and comes back → now it acts as support.

Same with bearish OB → becomes resistance.

These show who is now in control — buyers or sellers.

3. Market Structure Shifts (MSS)

Smart money tracks structure, not indicators.

A Market Structure Shift happens when:

The trend breaks (HH → LL or LL → HH)

A new direction is confirmed

Institutions often wait for MSS before executing large orders.

Your job: Don’t jump in early. Wait for structure change to confirm smart money is switching sides.

4. Fair Value Gap (FVG)

An FVG is a price imbalance between candles — where price moved too fast, leaving a “gap” in liquidity.

FVG means:

A zone where institutions might revisit

Often gets “filled” later

Use for entries, targets, or rejections

How to spot: In a strong move, look between the first candle’s high and the third candle’s low (or vice versa) – this is your FVG.

5. Internal vs External Liquidity

Institutions use both:

External Liquidity = above highs / below lows (stop-loss areas of retail traders)

Internal Liquidity = inside the range (consolidation, breaker retests)

They:

Grab external liquidity

Fill internal orders

Then move price in their actual direction

This explains why breakouts fail — they were designed to!

🔁 Typical Smart Money Price Flow (Simple)

Accumulate (Sideways range)

Manipulate (Fake breakout or stop hunt)

Distribute (Strong move in real direction)

If you know this sequence, you can start trading the traps, not falling for them.

🛠 How to Trade Smart Money Concepts – Step by Step

Let’s bring it all together in a logical workflow:

✅ Step 1: Analyze Market Structure

On higher timeframes (1H, 4H, Daily), check:

Trend (bullish/bearish)

Breaks in structure (HH/LL change)

Are we in consolidation?

✅ Step 2: Identify Key Zones

Mark:

Order blocks (the last opposite candle before big move)

FVGs (imbalances)

Equal highs/lows (liquidity)

Swing points (for stop hunts)

✅ Step 3: Wait for Liquidity Grab

Watch for:

Wicks above highs or below lows

Aggressive moves into zones

Quick rejections

These are signs smart money is active.

✅ Step 4: Confirmation

MSS: Wait for structure to shift

Candle Confirmation: Engulfing, Break of structure candle

FVG Fill or OB tap

Only enter when confluence builds — not just one clue.

✅ Step 5: Risk-Managed Entry

Entry: After confirmation near OB or FVG

SL: Just outside OB/FVG

TP: Next liquidity zone or opposite OB

Always maintain minimum 1:2 RR.

😱 Common Mistakes Retail Traders Make

Trading breakouts blindly

Entering before confirmation (no MSS or candle clue)

Ignoring structure for indicators

Thinking OB is one candle – it's a zone

No patience – chasing price instead of letting price come to you

🎯 Why Institutions Need You to Lose

Yes — if you lose, they win.

Your stop-loss is their entry liquidity

Your breakout buy is their exit plan

Your emotional trading funds their smart entries

That's why they manipulate, trap, and fake moves to create liquidity.

But with knowledge of Institutional Order Flow — you flip the script.

💬 Final Thoughts

Institutional Order Flow / Smart Money Concepts aren’t a secret strategy — they’re simply a deeper understanding of how the market actually works.

Instead of being manipulated, you become the one who reads the manipulation.

It’s not about predicting the market — it’s about reacting to what smart money is doing, with patience, precision, and process.

Advanced Option StrategiesWhat are Options?

Before we dive into advanced stuff, here’s a quick refresher.

An Option is a contract that gives you the right (but not the obligation) to buy or sell a stock/index at a certain price, on or before a certain date.

There are 2 types:

Call Option – Right to BUY

Put Option – Right to SELL

Buyers pay a premium. Sellers receive a premium and take on the obligation.

💼 Why Use Advanced Strategies?

If you only buy calls or puts, you might:

Lose 100% of your capital quickly

Get the direction right, but still lose due to time decay

Suffer from high premiums or volatility crush (IV crush)

Advanced strategies help you:

✅ Reduce risk

✅ Lock-in profits

✅ Earn from sideways markets

✅ Trade during high volatility events

✅ Create income strategies

🧠 1. Bull Call Spread – Directional but Risk-Defined

Used when: You’re moderately bullish, but don’t want to spend too much on a call.

How it works:

Buy 1 ATM Call

Sell 1 higher strike OTM Call

Example:

Nifty at 22000

Buy 22000 CE @ ₹100

Sell 22200 CE @ ₹40

Net Cost = ₹60

Max Profit: ₹200 (22200–22000) – ₹60 = ₹140

Max Loss: ₹60 (net premium paid)

👉 This strategy caps your risk and reward but is cost-efficient and smart in range-bound bull moves.

🧠 2. Bear Put Spread – Controlled Downside Betting

Used when: You’re mildly bearish and want to control losses.

How it works:

Buy 1 ATM Put

Sell 1 lower strike Put

Example:

BankNifty at 48500

Buy 48500 PE @ ₹120

Sell 48000 PE @ ₹60

Net Cost = ₹60

Max Profit: ₹500 – ₹60 = ₹440

Max Loss: ₹60

👉 Ideal for limited downside moves — cheaper than naked Put.

🧠 3. Iron Condor – The Sideways Market King

Used when: Market is flat or expected to stay in a range.

How it works:

Sell 1 OTM Call + Buy 1 higher OTM Call

Sell 1 OTM Put + Buy 1 lower OTM Put

You make money if market stays between the 2 sell strikes.

Example:

Nifty is at 22500

Sell 22800 CE, Buy 23000 CE

Sell 22200 PE, Buy 22000 PE

👉 You collect premiums from both sides.

Max Profit = Net Premium

Max Loss = Difference between strikes – Net Premium

👉 Works great in expiry week or low-volatility phases.

🧠 4. Straddle – Big Move Expected, Direction Unknown

Used when: A major move is expected (news, event, earnings), but unsure about direction.

How it works:

Buy ATM Call and ATM Put of the same strike & expiry.

Example:

Stock at ₹500

Buy 500 CE @ ₹20

Buy 500 PE @ ₹25

Total Cost = ₹45

If stock moves big — say ₹60 or more either way — you profit.

👉 High risk due to premium decay if market stays flat.

Need volatility to spike.

🧠 5. Strangle – Cheaper than Straddle, Wider Range

Used when: You expect a big move but want lower cost than a straddle.

How it works:

Buy OTM Call and OTM Put (strikes wider apart than ATM).

Example:

Nifty at 22500

Buy 22800 CE @ ₹12

Buy 22200 PE @ ₹10

Total Cost = ₹22

You profit if the move crosses either strike + premium.

👉 Needs bigger move than straddle but less premium at risk.

🧠 6. Calendar Spread – Play with Time

Used when: You expect price to stay near a level short term, but may move later.

How it works:

Sell near-term option

Buy far-term option (same strike)

Example:

Sell 22500 CE (weekly) @ ₹50

Buy 22500 CE (monthly) @ ₹70

Net Cost = ₹20

👉 You make money if price stays near 22500 by expiry of short leg.

Profits from time decay of the short leg.

🧠 7. Ratio Spreads – Advanced Directional with a Twist

Used when: You expect a move in one direction, but want to reduce cost.

Bull Call Ratio Spread

Buy 1 lower Call

Sell 2 higher Calls

Example:

Buy 22000 CE @ ₹100

Sell 2× 22200 CE @ ₹60 each

Net Credit = ₹20

If market moves moderately up — you profit.

But if it rises too fast — risk increases.

👉 Suitable for experienced traders only — manage risk carefully.

🧠 8. Covered Call – Income Strategy for Investors

Used when: You hold stocks and want to earn extra income.

How it works:

Hold 100 shares of a stock

Sell 1 OTM Call

Example:

You own 100 shares of Reliance @ ₹2500

Sell 2600 CE @ ₹20

If Reliance stays below ₹2600, you keep the premium.

If it rises above ₹2600, your shares get sold, but you still profit.

👉 Perfect for long-term investors.

🧠 9. Protective Put – Insurance for Your Stock

Used when: You own shares but want downside protection.

How it works:

Hold stock

Buy 1 ATM/OTM Put

Example:

Own Infosys @ ₹1500

Buy 1480 PE @ ₹20

If stock falls below ₹1480, your loss is capped.

👉 It’s like buying insurance for your portfolio.

🧠 10. Butterfly Spread – Range-Bound Precision Strategy

Used when: You expect minimal movement and want low-risk, high-RR trade.

How it works (Call Butterfly):

Buy 1 lower strike Call

Sell 2 middle strike Calls

Buy 1 higher strike Call

Example:

Buy 22000 CE

Sell 2× 22200 CE

Buy 22400 CE

You earn if market expires at the middle strike.

Max loss = Net debit

Max profit = At middle strike

👉 Best for expiry day premium decay strategies.

Common Mistakes to Avoid

Not understanding strategy risk

Using high-margin strategies without protection

Overtrading in expiry week

Not adjusting trades as market moves

Ignoring volatility impact (IV crush)

🛠 Tools to Use

Option Chain (for strike selection)

IV (Implied Volatility) data

Open Interest (OI)

Strategy Builder platforms (e.g. Sensibull, Opstra, or TradingView)

🎯 Final Thoughts

Advanced options trading isn’t gambling — it’s about smart risk management.

These strategies:

Give you control

Limit losses

Provide flexibility across different market types

RELIANCE 1D TimeframeStock Data (1D Time Frame)

Current Market Price: ₹1,403 – ₹1,405 (Approx.)

Change Today: ▼ Down ~1.5%

Previous Close: ₹1,425

Day’s High: ₹1,427

Day’s Low: ₹1,398

52-Week High: ₹1,551

52-Week Low: ₹1,115

🧾 Intraday Performance Summary

Reliance opened mildly negative and continued a downward trend due to broader market weakness.

The stock touched an intraday low near ₹1,398 as profit-booking continued post its recent rally.

Despite reporting record profits in Q1, investor sentiment remains cautious due to underperformance in its Oil-to-Chemicals (O2C) and Retail segments.

🧠 Technical View (1-Day Time Frame)

Indicator Status

Trend Short-term Weak/Bearish

RSI (Relative Strength Index) Near 45 – slightly weak

Support Level ₹1,390 – ₹1,350 zone

Resistance Level ₹1,430 – ₹1,470

Volume Above average during dips

Stock is trading below key moving averages (20 and 50 DMA).

Break below ₹1,390 may lead to further correction toward ₹1,350.

Upside momentum may resume only if it breaks and sustains above ₹1,430–₹1,440 levels.

🧮 Fundamental Insights

💼 Q1 FY26 Highlights:

Net Profit: Around ₹30,783 crore, helped by a one-time gain from stake sales.

Core Business Growth: Adjusted profit growth (excluding exceptional items) is about 25% year-over-year.

Retail & O2C: Both divisions saw margin pressure despite revenue growth.

Jio Platforms: Continued to show strong performance through ARPU improvement and subscriber growth.

New Energy Segment: Investment in green energy, solar, and hydrogen tech continues to build momentum.

📈 Key Growth Drivers Ahead

Jio Expansion – Increased monetization from 5G and digital platforms.

Retail Scaling – Aggressive expansion through online + offline strategies.

Green Energy Push – Investments in solar panels, hydrogen energy, and battery storage to become significant in 2025–26.

Potential IPOs – Jio and Retail business listing possibilities can unlock value.

🛑 Risks to Watch

Pressure on global refining margins may continue to affect the O2C segment.

Delay in clean energy execution can lead to valuation stress.

Macro market correction or FII selling could drag heavyweights like Reliance.

🔮 Outlook

Short Term: Cautious-to-bearish unless ₹1,430 is reclaimed. ₹1,350 is a critical support.

Medium to Long Term: Remains fundamentally strong. New growth drivers (Jio, Retail, Energy) support a positive outlook beyond 3–6 months.

BTCUSD 1D Timeframe✅ Current Market Data

Current Price: ~$118,420 USD

Day’s High: ~$119,210

Day’s Low: ~$117,428

Previous Close: ~$118,004

Change Today: +$416 (around +0.35%)

📈 Price Behavior Today

Bitcoin is showing range-bound movement between $117K and $119K after a strong rally in the past few days.

The current price action suggests market indecision, with neither bulls nor bears taking clear control.

Momentum indicators are neutral, with RSI hovering around 52–55, indicating sideways consolidation.

🧠 Key Drivers Behind Price Action

Profit Booking: After recent rallies above $120K, traders are taking profits, keeping the price in check.

Strong Institutional Demand: ETFs and institutional buying continue to offer long-term support to Bitcoin.

Favorable Crypto Regulations: Recent developments in U.S. crypto policies are boosting confidence in Bitcoin as a store of value.

On-Chain Strength: Network health (hash rate, wallet activity, HODL behavior) remains strong, signaling long-term bullishness.

🔍 Technical Levels to Watch

Zone Price Range (USD)

Support 1 $117,000

Support 2 $115,000

Resistance 1 $119,500–$120,000

Resistance 2 $123,000–$125,000

A close above $120K could initiate a bullish breakout targeting $125K–$130K.

A fall below $117K may invite a deeper pullback toward $115K or even $111K in the short term.

🔄 Market Sentiment

Neutral-to-Bullish in the short term.

Strong Bullish in the long-term due to adoption, policy support, and demand.

Investors are cautiously optimistic, awaiting stronger volume and breakout confirmation.

🎯 Outlook Ahead

Short-Term View: Consolidation between $117K–$120K likely to continue unless a strong volume breakout occurs.

Medium-Term View: A confirmed move above $120K may push BTC toward new highs of $130K–$138K.

Risk Zone: If Bitcoin fails to hold $115K, it could enter a corrective phase down to $111K.

✅ Summary

Bitcoin is currently in a sideways consolidation phase, with strong support around $117K and resistance just below $120K. The broader outlook remains positive, but the market is waiting for a fresh trigger—either a breakout above $120K or a breakdown below $115K—for the next decisive move.

BANKNIFTY 1D Timeframe Key Data (as of early afternoon):

Current Price: ~57,080

Opening Price: 57,316

Day’s High: 57,316

Day’s Low: 56,851

Previous Close: 57,210

Net Change: –128 points (around –0.22%)

Intraday Price Action Summary

Bearish Start: Opened near the high and immediately faced selling pressure, especially in major private banks.

Dip to Support: Price dropped to 56,851, testing key intraday support.

Mild Recovery Attempt: Found some buying interest near the support but still trading below the day’s open.

📊 Technical Levels – 1D View

Level Type Value (Approximate)

Resistance 1 57,300

Resistance 2 57,600

Support 1 56,850

Support 2 56,500

Trend Bias Neutral to Bearish

RSI Level (Est.) 48–50 (sideways zone)

A break above 57,300 could resume bullish momentum.

A fall below 56,800 may extend the decline toward 56,500.

Why Bank Nifty Is Weak Today

Profit Booking: After recent gains, traders are squaring off long positions.

IT Sector Drag: Broader market weakness (led by IT) has spilled over into banking.

Global Cues: No strong global signals to support risk-on sentiment.

Mixed Bank Performance: While PSU banks like Canara Bank and PNB are showing strength, private banks such as Axis, ICICI, and Kotak are under pressure.

Intraday Trading Strategy

If you’re Bullish:

Look for a breakout above 57,300 for confirmation.

Targets could be 57,600 and 58,000 with a stop below 56,850.

If you’re Bearish:

Wait for a break below 56,800.

Downside targets may be 56,500 and 56,300.

Sideways Play: If the index continues to hold between 56,850–57,300, focus on range-bound scalping or wait for a breakout.

Conclusion

Bank Nifty is trading in a consolidation-to-weak zone today. The index is at a technical crossroads—holding above 56,850 keeps hopes for a bounce alive, while a fall below it could invite fresh selling. Eyes should be on private sector banks and broader market sentiment for the next directional cue.

NIFTY 1D Timeframe📌 Current Data (as of early afternoon):

Current Price: Around 25,060

Opening Price: Approx. 25,200

Day’s High: ~25,246

Day’s Low: ~25,018

Previous Close: 25,216

Net Change: Down by ~155 points (–0.62%)

🔍 Intraday Price Action Analysis

Opening Weakness: Nifty opened lower than yesterday’s close due to weak global cues and selling in major sectors.

Bearish Pressure: Sellers dominated early in the day, dragging the index below 25,100.

Support Level Tested: Nifty hovered near 25,050, which acted as a short-term support.

Limited Bounce: Despite attempts to recover, resistance near 25,200–25,250 is capping upside movement.

📊 Technical Summary – 1D Timeframe

Type Range / Value

Support Levels 25,050 / 25,000

Resistance Levels 25,200 / 25,250

Trend Bias Slightly Bearish

Momentum Weak, with mild recovery attempts

Volatility Moderate

If Nifty holds above 25,050, it could try to reclaim 25,200–25,250.

A break below 25,018–25,000 may trigger further downside toward 24,950.

🧠 Why Nifty Is Down Today

IT Sector Weakness: Poor performance in tech stocks after recent earnings reports is dragging the index.

Banking Stocks Pressure: Major private and PSU banks are showing weakness due to profit booking.

Profit Booking: Traders are cashing out after last week's rally near all-time highs.

Global Market Impact: Uncertainty in international markets and trade concerns are weighing on sentiment.

🎯 What Traders Should Watch Next

Key Intraday Level: 25,050 — If Nifty stays above this level, short-term stability is possible.

Breakout Point: 25,250 — A close above this may indicate fresh bullish momentum.

Breakdown Point: Below 25,000 — Could lead to deeper correction toward 24,950–24,900.

Volatility Spike?: Stay alert around closing hours—FII/DII data and global market opening will affect the closing trend.

✅ Conclusion

Nifty 50 is under pressure today due to sectoral weakness and lack of strong domestic triggers. The index is currently range-bound between 25,000–25,250. Traders should monitor these levels closely for the next directional move.

SENSEX 1D Timeframe✅ Key Index Data:

Current Level: ~82,200 (as of early afternoon)

Opening: Around 82,780

Day’s High: 82,784

Day’s Low: 82,047

Previous Close: 82,726

Intraday Change: Down ~520 points (–0.63%)

🔍 Market Behavior (1-Day Time Frame)

Opening Session: The Sensex opened flat but slightly negative, quickly slipping below 82,600 as traders booked profits from recent highs.

Mid-Morning Session: The index continued to slide, breaching key support levels near 82,200–82,100.

Support Zone Tested: Sensex touched a low of around 82,047 before bouncing slightly.

Volatility: The index remained volatile due to global weakness and profit-booking in large-cap stocks.

🧠 Technical Insight (1-Day Chart Perspective)

Level Type Range (approx.)

Resistance 82,700 – 82,800

Support 82,000 – 82,050

Trend Bias Weak / Bearish

RSI (1D est.) Around 45–50 (neutral-to-weak zone)

Market Mood Cautious to bearish

📉 What’s Causing the Decline Today?

Weak IT and Banking Stocks: Both sectors are under pressure due to poor Q1 guidance and weak global cues.

Profit Booking: Investors are trimming positions after recent highs, leading to broad-based selling.

Global Uncertainty: Mixed international signals and concerns over trade policies are affecting sentiment.

Lack of Strong Domestic Triggers: No major positive domestic news to support buying.

🎯 What to Watch Next

Short-Term Trend: Watch if Sensex can hold above 82,000. If broken, more downside toward 81,800–81,500 is possible.

Upside Resistance: If recovery comes, resistance will be strong near 82,700–82,800.

Sector Focus: Banks, IT, and auto are likely to drive further movement.

Learn Institutional Trading📌 What is Institutional Trading?

Institutional trading refers to trading done by large financial organizations like:

Hedge Funds

Mutual Funds

Foreign Institutional Investors (FIIs)

Domestic Institutional Investors (DIIs)

Insurance Companies

Proprietary Trading Firms (Prop Desks)

Investment Banks

🧭 Why Should You Learn Institutional Trading?

Most retail traders:

Enter trades based on emotions or random indicators

Chase price or react late

Trade without understanding who controls the market

But institutions:

Trade with logic, precision, patience, and volume

Follow clear rules based on liquidity, risk, and timing

Use data-driven strategies and structure-based entries

Learning institutional trading means:

✅ You no longer follow retail traps

✅ You align your trade with the market’s real direction

✅ You understand where and why price truly moves

🧱 Key Concepts to Learn in Institutional Trading

1. Market Structure (MS)

Institutional traders analyze price based on structure, not indicators.

They study:

Higher Highs / Higher Lows (HH/HL)

Lower Highs / Lower Lows (LH/LL)

Break of Structure (BOS)

Change of Character (CHOCH)

💡 Pro Tip: Price never moves randomly — it follows structure. Learning how price breaks previous structure shows when the trend is shifting.

2. Liquidity & Smart Money Concepts

Institutions need liquidity to place big orders. So, they look for:

Retail stop-loss zones

Breakout traders’ entries

Obvious support/resistance

Then, they:

Create fake breakouts to grab liquidity

Enter in the opposite direction

Leave behind “footprints” like Order Blocks or FVGs

📌 Important Concepts:

Liquidity Pools

Inducement Zones

Order Blocks (last candle before the move)

Fair Value Gaps (FVG)

Mitigation Zones

📊 Institutions don’t chase price — they manipulate it. Learn to trade where they are entering, not where retailers are exiting.

3. Volume Analysis & Order Flow

Institutions trade with massive capital, so their footprints show up in:

Volume spikes

Imbalance between buyers/sellers

Absorption (when large orders block the market)

Rejections at key zones

🔧 Tools used:

Volume Profile

Delta Volume / Footprint Charts

VWAP (Volume Weighted Average Price)

4. Options Data & Open Interest (OI)

Institutions use option chains to trap or hedge retail participants. They track:

Open Interest Build-up (Call or Put side)

Max Pain Level (where most options lose value)

Put/Call Ratio (PCR)

Option Writers’ Zone (where institutions want expiry)

💡 Example: If 80% OI is built on 22,000CE and price is near it, chances are high that institutions will protect that zone and keep price below it.

5. Institutional Tools & Analysis

Institutions use:

Multi-Timeframe Analysis (MTA)

News + Event Flow

Economic data + earnings

Position sizing based on volatility

Algo-driven execution

Retail traders often focus only on technical indicators — institutions use a combination of fundamentals, sentiment, macroeconomics, and flow.

🧠 Skills Needed to Trade Like Institutions

Chart Reading Without Indicators

Master price action

Understand structure, CHOCH, BOS

Supply and Demand Zone Identification

Mark strong OBs (Order Blocks)

Confirm with imbalance or FVG

Liquidity Mapping

Where will retail place SL?

What’s the inducement?

Volume + OI Reading

Use OI charts to avoid traps

Match price with volume for confirmations

Emotional Discipline

Trade with confidence

Trust your setup — not noise or tips

Risk Management

Fixed % per trade (0.5% to 1%)

SL below valid structure

📈 Example of an Institutional Setup (Bank Nifty)

Structure: Market is in a strong uptrend (HH-HL forming)

Liquidity: Price dips below previous swing low — stop-hunt likely

Order Block: 15-minute bullish OB forms with FVG

Volume: Spike seen + high OI on 49,500 PE

Entry: Bullish candle close in OB

SL: Just below OB

Target: Next liquidity zone or supply area

🔁 RR Ratio: 1:3 or better

🛠️ Tools You Can Use to Learn Institutional Trading

TradingView – Charting, structure, OBs

Chartink / Trendlyne – Option OI analysis

Sensibull / Obstra / Quantsapp – Option strategy + data

Volume Profile – Spot accumulation/distribution

ForexFactory / Investing.com – Economic calendar

Smart Money YouTube / Discord / Telegram Groups – Practice setups

🧩 Step-by-Step Plan to Learn Institutional Trading

Foundation: Learn market structure + price action

Deep Dive: Understand liquidity & smart money concepts

Tools Mastery: Volume, VWAP, OI, Option Chain

Live Practice: Backtest institutional setups

Risk System: Use proper SL, position sizing, and journaling

Mindset: Stay patient and emotion-free

Repeat: Improve setup confidence & refine edge

🚀 Final Thoughts: Trade Like an Institution, Not a Retailer

If you trade based on what’s obvious — you’re likely wrong.

If you trade based on what’s behind the move — you trade like the pros.

Institutional trading is not about complexity.

It’s about thinking ahead, managing risk, and waiting for real opportunities — not noise.

Institutional Intraday option Trading🧠 What is Institutional Intraday Options Trading?

Institutional intraday options trading refers to short-term options strategies executed by large institutions with the intent to profit from price movements, volatility, and order flow within a single trading session.

Unlike positional or swing trading, intraday strategies demand high accuracy, precision, and speed, which institutions handle using advanced systems and huge capital.

🏢 Who Are the Institutions?

Institutions that dominate intraday options trading include:

Hedge Funds

Proprietary Trading Desks (Prop Desks)

Foreign Institutional Investors (FIIs)

Domestic Institutional Investors (DIIs)

Investment Banks

Market Makers

These players have access to deep capital, faster execution platforms, and exclusive market data.

🔄 Institutional Objectives in Intraday Options

Capture Short-Term Volatility

Using strategies like Straddles, Strangles, Iron Condors.

Targeting events like news, economic data releases, or earnings.

Liquidity Management

Institutions provide liquidity through market-making and benefit from spreads.

Risk Hedging

Intraday options are also used to hedge large cash or futures positions.

Arbitrage Opportunities

Spot-Future arbitrage

Volatility arbitrage

Calendar spread arbitrage

📈 Common Institutional Intraday Option Strategies

1. Delta Neutral Scalping

Strategy: Sell ATM straddle and keep delta hedged.

Objective: Earn from theta decay and re-hedging.

2. Gamma Scalping

Based on buying options and adjusting delta frequently as prices move.

Profitable during high intraday volatility.

3. Option Writing with IV Crush

Institutions short options during events like RBI policy, Budget, or results.

Profits from rapid drop in Implied Volatility after the event.

4. Directional Betting with Flow Analysis

Tracking aggressive option buying/selling in OTM/ATM strikes.

Directional trades using high-volume & OI shifts.

5. Statistical Arbitrage

Using quant models to exploit temporary mispricings.

🧩 Institutional Footprints on Option Charts

Retail traders can spot institutional footprints by:

Large ATM Straddle positions

IV divergence in option chain

Open Interest buildup without price movement (Smart money quietly entering)

Options being written at key support/resistance zones

Example:

If Bank Nifty is consolidating near a resistance and suddenly 2 lakh OI is built up in 50 point OTM Calls with low IV – this may be Call writing by institutions expecting price rejection.

⚠️ Risks and Control Measures Used by Institutions

Real-time Risk Monitoring Tools

Delta/Gamma/Vega Exposure Management

Limit on maximum intraday drawdown

AI-driven decision engines to avoid emotional trades

✅ How Can Retail Traders Learn from Institutions?

Follow Open Interest + Volume Patterns

Observe institutional behavior on expiry days

Study option flow at key market levels

Backtest Straddles/Strangles on high IV days

Use Option Greeks for proper understanding

Always trade with risk-defined strategies (no naked selling without hedge)

📌 Final Thoughts

Institutional Intraday Options Trading is not about gambling or just clicking buy/sell — it’s an advanced, mathematically balanced, and data-backed approach to generate consistent intraday alpha from the market. Institutions often move ahead of retail due to technology, access, discipline, and experience.

Retail traders can’t copy the scale but can adapt the logic:

Focus on analyzing institutional footprints

Learn to read the option chain like a map

Use data, not emotions

Trading Master Class With Experts🎯 Objective of the Master Class

To turn intermediate or beginner traders into independent, high-probability traders.

To teach institutional strategies, advanced technical analysis, and options trading mechanics in a structured manner.

To prepare you to read price action, understand market psychology, and act with professional-level discipline.

🧑🏫 Who Are the Experts?

The instructors in a true master class are:

Institutional Traders

Full-time Professional Derivatives Traders

Algo Strategists

Portfolio Managers

Ex-Prop Desk Heads or FIIs Participants

These experts bring real P&L experience, not just theoretical certifications. They share their actual setups, mental models, risk frameworks, and do’s and don’ts from years of screen time.

📦 What You Will Learn – Detailed Modules

Module 1: Market Structure Mastery

Institutional order flow

Supply-demand vs. retail S/R

Liquidity traps and smart money movement

Module 2: Price Action + Volume Profiling

Multi-timeframe analysis

Candle psychology + Volume interpretation

How institutions "hide" their entries

Module 3: Advanced Options Trading

Intraday & positional strategies

Greeks mastery: Delta, Vega, Theta, Gamma

Hedging tactics used by professionals

Nifty & Bank Nifty strategy building

Module 4: Institutional Strategy Replication

Intraday straddle/strangle writing

IV crush exploitation during events

Option chain decoding for retail edge

Module 5: Trade Management & Psychology

Risk per trade, max drawdown, win/loss ratio

Building discipline like a hedge fund

Overcoming emotional sabotage in trading

Module 6: Live Market Sessions

Daily planning with expert insights

Live trades with explanation

Review of success/failure transparently

⚙️ Tools & Platforms You’ll Use

Option Chain Analyzers (like Sensibull, Opstra, or Greek tools)

TradingView & charting setup with expert templates

Journaling tools (Edgewonk, Notion)

Algo tools (optional module)

🧩 Who Should Join?

✅ Aspiring Traders (with some basic knowledge)

✅ Traders struggling with consistency

✅ Intraday or options traders wanting a structured framework

✅ Professionals looking to shift to full-time trading

✅ Students of finance or markets seeking practical skills

🏆 Key Benefits

Real strategies shared by real traders

Mentorship: Learn not just from books, but from mistakes and success of mentors

Live sessions to build confidence under pressure

Lifetime recording access in most premium programs

Community access for continuous growth & trade sharing

💼 Career & Income Impact

After attending this masterclass, traders often:

Gain clarity on their trading edge

Improve win-rate and risk-adjusted returns

Start coaching others or creating communities

Join or create proprietary trading setups

📅 Duration & Format

Duration: 1 Week to 6 Weeks (varies by provider)

Format: Live Zoom + Recorded + Assignments

Support: Telegram/Slack group, weekly Q&A, live trading calls

🔚 Final Thoughts

The “Trading Master Class with Experts” is not just another online program. It's a live, applied, market-tested mentorship where real experts guide you step-by-step in mastering trading psychology, strategy, and discipline.

If you're serious about scaling your trading journey, this is the fastest shortcut to reach professional-level execution and understanding.

Master Institutional Trading🎯 Introduction

Master Institutional Trading is the advanced art and science of trading the financial markets the way big institutions do — with deep capital, strategic precision, and unmatched risk management.

Unlike retail trading, which often relies on basic indicators and emotions, institutional trading follows a rule-based, data-driven, and psychology-controlled framework. Mastering this approach means stepping into the mindset and strategy of hedge funds, mutual funds, proprietary desks, and investment banks.

If you want to trade with consistency, clarity, and capital preservation, mastering institutional trading is the next step.

💡 What is Institutional Trading?

Institutional trading refers to the activities of large financial entities that control significant capital and influence market movement through their trades.

Examples include:

Hedge Funds

Mutual Funds

FIIs (Foreign Institutional Investors)

DIIs (Domestic Institutional Investors)

Pension Funds

Proprietary (Prop) Trading Desks

These institutions operate based on in-depth research, order flow analysis, macroeconomic models, and advanced risk frameworks.

🧠 What Does “Master Institutional Trading” Mean?

It means gaining the skills, tools, mindset, and techniques to:

Analyze market movements through institutional logic

Identify smart money footprints

Build trades based on volume, order flow, and positioning

Manage risk with capital preservation like pros

Avoid retail traps and fakeouts set by institutions

You’re not just reacting to the market—you’re reading what the big players are doing and aligning with them.

🧩 Core Concepts in Master Institutional Trading

1. Market Structure Analysis

Understand liquidity zones, order blocks, and institutional S/R

Learn why institutions build positions over time, not all at once

2. Volume & Open Interest Analytics

Spot unusual volume spikes

Understand Open Interest traps in options

Decode what institutions are betting on

3. Smart Money Concepts

Accumulation and Distribution phases

Wyckoff Theory in modern application

Spotting manipulation and liquidity grabs

4. Advanced Risk Management

Never risk more than 1–2% per trade

Use position sizing based on volatility

Focus on capital efficiency, not revenge trading

5. Price Action + Institutional Candle Patterns

Recognize imbalance zones, breaker blocks, and engulfing traps

Use tools like VWAP, Delta Volume, and Footprint Charts

6. Trade Execution Techniques

Partial entries

Scaling in/out like funds

Managing trade lifecycle like a desk trader

🛠 Key Strategies in Master Institutional Trading

A. Liquidity Hunting

Institutions place orders where most retail SLs are placed

Then reverse price after triggering retail orders

B. Options Positioning & IV Play

Use of Straddles/Strangles for theta decay

Selling volatility pre-event, buying it post-event

C. Delta Neutral & Gamma Scalping

Market-neutral strategies hedged with futures or stocks

Designed to profit from volatility swings

D. Accumulation/Distribution Mapping

Long consolidation = institutional entry/exit

Price reacts to volume shifts more than indicator signals

🔥 Institutional Footprint Examples (Nifty/Bank Nifty)

ATM Straddle OI surge with no move in price

→ Market makers hedging aggressively = big move coming

Sudden OTM Put buying with high IV on a flat day

→ Institutions betting on downside volatility = potential crash setup

VWAP deviation rejection

→ Institutions use VWAP as a fair value; moves away from it often reverse

👨🏫 How to Master Institutional Trading?

✅ Step-by-step Learning Path:

Study Market Microstructure

Understand how orders get matched, what limit/market orders do.

Learn Option Greeks & Institutional Strategies

Especially delta, gamma, and IV crush.

Use Volume Profile, VWAP, OI data together

Build your view based on multi-layered confirmation.

Follow FIIs/DII Data Daily

Learn how they position in equities, derivatives, and sectors.

Backtest Institutional Setups

Focus on risk-reward, not just accuracy.

Use Trading Journals

Analyze what works, improve continuously.

⚠️ Common Mistakes Traders Make (That Institutions Don’t)

Chasing trades emotionally

Overtrading low-conviction setups

No journaling or review process

Relying on random indicators instead of structure

Ignoring risk-to-reward or capital management

🧘♂️ Mindset of Institutional Traders

"Protect capital first, profits will follow."

Trade like a sniper, not a machine gun.

Think in terms of probabilities, not guarantees.

Never marry your analysis; adapt to new information.

💼 Who Should Learn Master Institutional Trading?

Intermediate to advanced traders

Full-time traders or those planning to go full-time

Derivatives traders (Nifty, Bank Nifty, Options)

Students of technical analysis who want a deeper, real-world edge

🔚 Final Words

Master Institutional Trading is the next-level evolution of your trading journey. It’s about stepping away from noise and hype, and embracing how real money trades.

You don’t need a hedge fund job to trade like one—you just need the knowledge, tools, and discipline. When you think and act like an institution, you stop being prey and start playing the game with the big players.

Advance Option Trading💡 Why Advance Option Trading?

While beginner traders focus on price movement, advanced traders focus on:

Time decay (theta)

Volatility (vega)

Delta hedging

Neutral or range-bound markets

Income generation through spreads and option writing

This style of trading provides better capital efficiency, defined risk, and consistent performance across all market conditions (bullish, bearish, or sideways).

2. Implied Volatility (IV)

Higher IV = Expensive options

Lower IV = Cheap options

Key for strategies like IV Crush, Calendar Spreads, or Vega-neutral plays

3. Volatility Smile/Skew

Institutions track which strikes have higher IV. Advanced traders position accordingly.

🔧 Common Advanced Strategies

✅ 1. Straddle & Strangle (Neutral Volatility Strategy)

Straddle: Buy/Sell ATM Call + Put

Strangle: Buy/Sell OTM Call + Put

Use when expecting big movement or no movement (based on IV)

✅ 2. Iron Condor (Range-Bound Strategy)

Sell OTM Call and Put, Buy further OTM Call and Put (as hedge)

Best for sideways markets

Generates consistent income with limited risk

✅ 3. Calendar Spread (IV-Based Strategy)

Sell near-expiry option and buy same strike of a later expiry

Profits from increase in IV and time spread

✅ 4. Butterfly Spread (Limited Risk Strategy)

Example: Buy 1 OTM Call, Sell 2 ATM Calls, Buy 1 ITM Call

Small risk and good reward if price stays within expected range

✅ 5. Ratio Spread

Sell more options than you buy (e.g., sell 2 OTM Calls, buy 1 ITM Call)

Advanced version of directional bet with built-in hedge

✅ 6. Delta Neutral / Gamma Scalping

Balancing option position so that price movement doesn’t affect value

Common in institutions for high-frequency trading

📈 How to Select Right Strategy

✅ Identify Market Trend: Bullish, Bearish, Sideways

✅ Measure IV: Is it high or low?

✅ Track OI (Open Interest): Where are institutions positioning?

✅ Calculate Risk-to-Reward: Does your strategy offer good payoff?

✅ Time to Expiry: Shorter expiry = faster theta decay

⚠️ Risk Management in Advanced Option Trading

Professional traders always:

Set max loss per trade (usually <2% of capital)

Use hedged strategies (never naked short)

Adjust positions if the market breaks range

Keep an eye on Greeks changing with time

Track IV movement before entering trades

📊 Tools Used by Advanced Option Traders

Tool Purpose

Option Chain + OI Analysis Track smart money activity

Greeks Calculator (Sensibull, Opstra) Real-time risk data

IV Charts & Skew Analysis Measure volatility pricing

Backtesting Engines Validate strategies over past data

Algo Execution Tools Automate multi-leg strategies

🧠 Institutional Tactics in Advanced Option Trading

Institutions and prop firms often:

Build delta-neutral portfolios

Sell options with high IV and buy protection

Trade around key levels (VWAP, ATR ranges)

Use gamma scalping for directional bias

Exploit retail option traps near expiry

🔁 Adjustment Techniques (When Trade Goes Wrong)

Rolling the Position – Move strikes up/down or to next expiry

Convert into Ratio Spreads or Butterfly

Hedge with Futures

Close partially and rebalance

Switch to opposite bias if directional conviction is lost

💼 Who Should Learn Advanced Option Trading?

Traders already familiar with basic Calls & Puts

Intraday or swing traders wanting consistency

People managing 6- or 7-figure capital

Option sellers who want defined risk strategies

Anyone seeking market-neutral strategies for steady income

🔚 Final Thoughts

Advanced Option Trading is not about taking more trades — it's about trading smarter, with risk-managed, probability-based setups. When you learn how to use Greeks, volatility, and structure trades, you gain a huge edge over emotional retail trading.

Institutional Objectives in Options Trading1. ✅ Hedging Existing Positions

Primary use of options by institutions is to hedge large portfolios against downside risk.

Example:

A mutual fund holding ₹100 crore of Nifty 50 stocks may buy ATM or slightly OTM Put options to protect against market correction.

Protective puts and collars are commonly used to limit drawdowns while staying invested.

🧠 Why?

Institutions can’t exit positions quickly without affecting prices. Hedging gives them protection without selling.

2. 💸 Generating Consistent Premium Income

Institutions frequently sell options (especially OTM calls or puts) to generate passive income.

Strategies like:

Covered Call Writing

Iron Condors

Short Strangles

They profit from time decay (theta) and the fact that most options expire worthless.

🧠 Why?

Consistent income + statistical edge + capital utilization = institutional trading edge.

3. 📊 Volatility Trading

Institutions exploit differences between implied volatility (IV) and expected volatility (realized).

If IV is overpriced: they sell options (e.g., strangles, straddles)

If IV is underpriced: they buy options (vega-positive strategies)

They may also trade volatility directionally, using long vega positions before events, then closing post-event for IV crush profits.

🧠 Why?

Volatility is measurable, forecastable, and less random than price.

4. ⚖️ Market-Neutral Strategies (Delta-Neutral Trading)

Institutions construct delta-neutral portfolios using options + futures or stock positions.

Aim: To remain neutral to price movement and profit from volatility or theta decay.

Example: Sell ATM straddle, hedge delta with futures, adjust gamma regularly.

🧠 Why?

Neutral strategies reduce directional risk and offer better control over large portfolios.

5. 🧮 Arbitrage Opportunities

Institutions exploit pricing inefficiencies between:

Spot and Futures vs. Options

Call-Put Parity violations

Time spread (Calendar arbitrage)

Skew arbitrage (buy underpriced, sell overpriced)

These strategies are often automated and require fast execution & deep capital.

🧠 Why?

Low-risk opportunities with high-frequency trading models.

6. 🧱 Portfolio Construction & Rebalancing

Options help institutions structure complex multi-asset portfolios using derivatives to offset sectoral risk, beta exposure, and drawdowns.

Example:

Hedging a tech-heavy portfolio by buying sector puts or using index options to balance exposure.

🧠 Why?

Options allow flexible risk management without directly altering core holdings.

7. 🔍 Event-Based Positioning

Institutions position themselves before key events:

Central bank meetings

Earnings reports

Budgets & elections

Fed rate decisions

They use options to:

Capture volatility spikes

Benefit from large moves

Hedge against adverse outcomes

Common strategy: Buy straddles or strangles pre-event, close post-event.

🧠 Why?

Leverage big events for volatility profit, while limiting risk to premium paid.

8. 🔐 Capital Efficiency and Leverage

Options allow institutions to:

Take positions with lower capital

Control large amounts of underlying using premiums

Enhance portfolio yield without leveraging core assets

Example: Buying call options instead of holding stocks for limited upside exposure.

🧠 Why?

Use of derivatives increases return-on-capital with controlled downside.

9. 🧠 Strategic Positioning via Open Interest (OI)

Institutions often create positions in options to:

Build pressure zones

Influence price action at key strikes (especially on expiry)

Track and trap retail option buyers (via fake breakouts or max pain theory)

🧠 Why?

Control over OI levels gives them an edge over uninformed players.

10. 🔁 Rolling, Adjusting & Managing Large Positions

Institutions don’t just enter and exit. They:

Roll positions across strikes or expiries

Adjust delta/gamma exposure

React to market shifts quickly without liquidating core holdings

Example:

Rolling a short call up if market is bullish

Converting short put into put spread if volatility increases

🧠 How Can Retail Traders Learn from Institutional Objectives?

Avoid naked option buying unless IV is low

Learn to sell options in range-bound or high-IV markets

Use Greeks to manage risk and adjust positions

Start tracking OI shifts before expiry

Never trade based on emotions — trade based on structure

🔚 Conclusion

Institutional options trading is driven by clear objectives, probability-based decisions, and risk frameworks. They use options not to gamble, but to optimize performance, protect portfolios, and generate edge.

If retail traders start thinking like institutions — by focusing on risk, volatility, structure, and data, rather than emotions — they’ll not only survive in the market, but begin to thrive.

Technical Class🎯 What is a “Technical Class”?

A Technical Class is a structured learning session or course designed to teach technical analysis – the skill of forecasting price movement in financial markets based on charts, price patterns, indicators, volume, and historical data.

It’s one of the most essential skillsets for traders and investors, especially those involved in stock trading, intraday trading, swing trading, options, forex, or crypto.

📘 Purpose of a Technical Class

The main goal of a technical class is to train participants to:

Read and analyze price charts confidently

Use indicators and tools to generate buy/sell signals

Recognize institutional footprints and volume patterns

Make independent, logic-based trading decisions

Avoid emotional or speculative trades

🧱 What Topics Are Covered in a Technical Class?

✅ 1. Chart Reading Basics

Candlestick types (Doji, Hammer, Engulfing, Marubozu)

Price vs. Volume relationship

Support & Resistance levels

Timeframes: Intraday (5m/15m), Positional (1D/1W)

✅ 2. Price Action Trading

Trend structure: HH-HL / LH-LL sequences

Breakouts & Fakeouts

Supply-Demand zones

Liquidity traps

✅ 3. Technical Indicators

Trend Indicators: Moving Averages (SMA/EMA), MACD

Momentum Indicators: RSI, Stochastic, CCI

Volume Indicators: VWAP, OBV, Volume Profile

Volatility Indicators: Bollinger Bands, ATR

✅ 4. Chart Patterns

Continuation Patterns: Flags, Pennants, Triangles

Reversal Patterns: Head & Shoulders, Double Top/Bottom, Wedges

Range Patterns: Rectangles, Channels

✅ 5. Support & Resistance Mastery

Dynamic (Moving averages, trendlines)

Static (Horizontal S/R, Round numbers)

Institutional S/R zones with Volume & OI

✅ 6. Trend Analysis

Identifying Bullish, Bearish, and Sideways markets

Role of Volume in confirming trends

Using Dow Theory and Market Structure

✅ 7. Advanced Concepts

Divergence (Price vs. RSI/MACD)

Multi-Timeframe Analysis (MTA)

Fibonacci Retracement & Extensions

Chart psychology (why price behaves irrationally)

🧠 Skills You Gain from a Technical Class

How to time entries and exits based on confirmation

How to avoid false breakouts

When to use indicators and when to trust price action

How to combine volume + price for high-probability setups

How to align with smart money and institutional footprints

🎓 Who Should Attend a Technical Class?

✅ New traders wanting a strong foundation

✅ Intraday and swing traders aiming for consistency

✅ Investors looking to time entry/exit better

✅ Option traders who want to read chart behavior

✅ Crypto/forex traders who rely on pure price movement

📈 Real-World Applications

Identify trend reversals before they happen

Spot breakouts with volume confirmation

Align trades with institutional positioning

Reduce overtrading and increase accuracy

Make data-backed decisions, not emotional guesses

⚠️ Common Mistakes Covered in a Technical Class

❌ Overuse of indicators (indicator overload)

❌ Trading without stop-loss

❌ Misreading breakouts and breakdowns

❌ Ignoring volume and confirmation

❌ Lack of patience or plan in trade execution

🔚 Final Thoughts

A Technical Class is more than just learning chart patterns — it’s about understanding how the market thinks, how price reacts, and how you can trade in sync with logic, not emotion.

Whether you're into stocks, futures, options, or crypto — a strong technical foundation increases your edge, reduces losses, and boosts confidence.

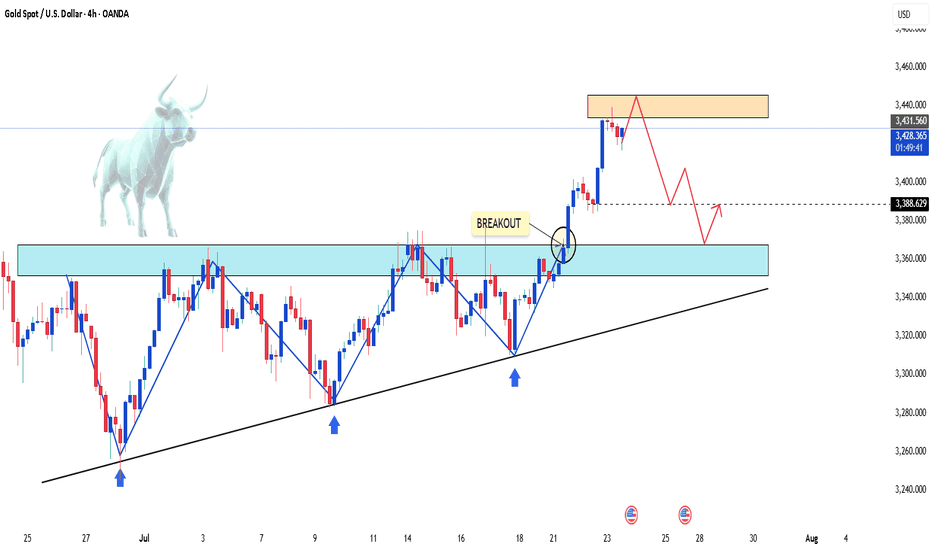

Gold :Back in range , again ??We have seen solid rally over the last two weeks, but that momentum seems to be losing steam. In yesterday’s session, price faced a sharp rejection near 3440 (Near to major resistance of 3450) and closed below the key 3400 level which is a clear warning sign for the bulls. Even though price is still holding above last week’s high (around 3377) and Weekly R1, the failure to sustain above 3400 weakens the bullish structure. If gold dips back below last week’s high, it could open the door for deeper correction and possibly trigger more selling pressure.

On the upside, a decisive move and close above 3400 is needed for buyers to regain control and attempt another leg higher. Until then, upside looks capped and short-term sentiment has turned cautious. Immediate support now lies around 3345, which is also the weekly pivot level, followed by 3333.

The price action suggests that gold may be slipping back into a range-bound phase, with no clear directional strength unless key levels break decisively. For now, the bias remains neutral to slightly bearish unless we see a strong reclaim of 3400 with momentum.

XAUUSD – Is a Deep Correction Just Around the Corner?Gold just took a brutal hit, plunging over 3,728 pips in a single session — down 1.10%, marking the sharpest drop in weeks.

Why?

Jobless claims dropped → Labor market too strong

Flash Manufacturing PMI beat expectations → U.S. economy remains resilient

The Fed is likely to keep rates higher for longer → USD strengthens → Gold gets dumped hard.

Currently, price is testing the FVG zone and the channel support. If it fails to hold above 3,363, the next target could be 3,344.5 or even lower.

Strategy: Look for SELL opportunities if price fails to reclaim 3,402.4, followed by a potential break of support and deeper drop.

Gold Breaks $3,400 – Bullish Momentum BuildsGold is gaining strong upside momentum, breaking above the $3,400 mark to hit a fresh five-week high.

This sharp rally in the precious metal comes alongside a renewed pullback in the US dollar. Declining Treasury yields across the curve and ongoing trade tensions are also fueling gold’s recovery as a safe-haven asset.

Currently trading around $3,426, gold may see a slight pullback to consolidate before resuming its bullish run.

What’s your take on gold today?

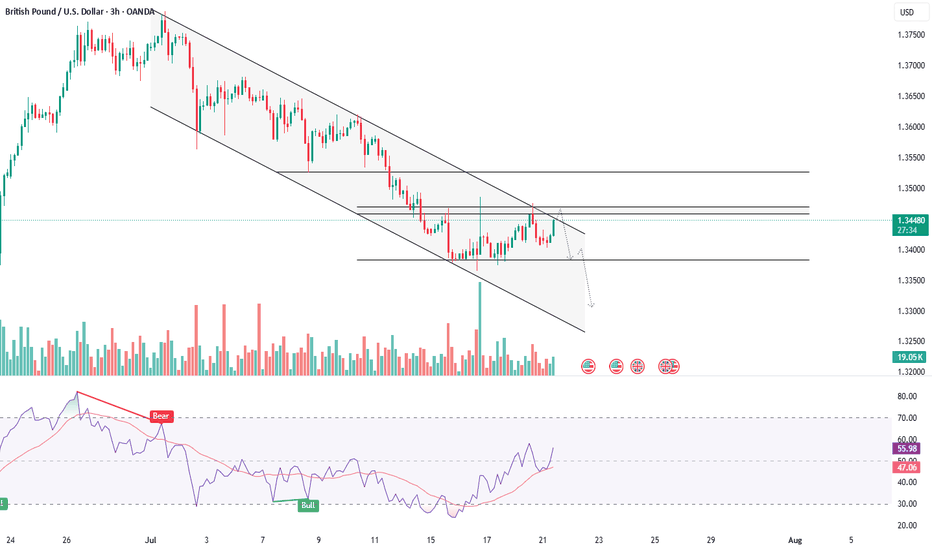

GBPUSD - NEAR RESISTANCE, BEARISH CONTINUATION IN SIGHTSymbol - GBPUSD

CMP - 1.3460

The GBPUSD currency pair is currently undergoing a countertrend correction, aligning with a broader retracement in the US dollar. This movement presents an opportunity for the pair to test the prevailing trend resistance and consolidate within a key liquidity zone. Market participants should closely monitor the immediate resistance level at 1.3467, which coincides with a significant concentration of liquidity pool relative to the local trend structure.

Given the prevailing bearish market sentiment, a confirmed breakout above the 1.3467 resistance level could serve as a potential catalyst for a reversal or short-term pullback, reflecting a reassertion of the dominant downtrend.

Key Resistance Levels: 1.3467

Key Support Levels: 1.3370

Should the pair fail to sustain upward momentum during a retest of the aforementioned liquidity zone, and if the price subsequently falls back below 1.3467, it could signal a renewed opportunity to engage in short positions aligned with the broader trend direction.

institutional Nifty-50 option tradingInstitutional Nifty-50 option trading refers to the strategic use of Nifty-50 options (CE & PE) by FIIs, DIIs, Hedge Funds, and Banks to hedge, speculate, or manage risk on large capital positions. Unlike retail, their trades are data-driven and volume-heavy.

Key Institutional Strategies:

Delta-Neutral Strategies – Like Long Straddles or Strangles, where institutions profit from volatility.

Covered Call / Protective Puts – To hedge large Nifty portfolios.

Bull/Bear Spreads – Deployed when directional conviction is strong but limited in risk appetite.

Option Writing – Writing options at OI resistance/support to generate premiums.

Calendar Spreads – Leveraging time decay while anticipating movement.

📈 How to Track Institutional Activity:

Option Chain Analysis: Spot high OI shifts with unusual volumes.

OI + Volume + IV: Use combined data to infer institutional positioning.

Change in PCR (Put Call Ratio): Signals sentiment shift at index levels.

FII-DII Daily Derivative Data: Published by NSE after market hours.

Strike-wise Open Interest Heatmaps: Help identify resistance/support zones built by institutions.

Institutional Intraday option Trading High Volume Trades: Institutions trade in huge lots, often influencing Open Interest.

Data-Driven Strategy: Backed by proprietary models, AI, and sentiment analysis.

Smart Order Flow: Institutions use algorithms to hide their positions using Iceberg Orders, Delta Neutral Strategies, and Volatility Skew.

⚙️ Tools & Indicators Used:

Option Chain Analysis

Open Interest (OI) & OI%

Put Call Ratio (PCR)

Implied Volatility (IV)

Max Pain Theory

Gamma Exposure (GEX)

🧠 Common Institutional Strategies:

Covered Calls – Generate income on large stock holdings.

Protective Puts – Hedge downside risk.

Iron Condor / Butterfly Spread – Capture premium with neutral view.

Long Straddle/Strangle – Expecting big move post-news.

Synthetic Longs/Shorts – Replicating stock exposure using options.