Liquidity Sweep Complete – Bullish Continuation Ahead?GOLD ANALYSIS 31/07: Liquidity Sweep Complete – Bullish Continuation Ahead?

🔍 Technical View | XAUUSD | 2H Chart | End of Month Setup

Gold has completed a final liquidity sweep around the 3269–3271 zone and has since rebounded strongly, in line with the prevailing bullish structure. The sharp drop yesterday during the FOMC rate statement appears to have served its purpose: grabbing final sell-side liquidity before preparing for the next bullish leg.

As of now, price is reacting at the 3295 zone, which coincides with the M30 CP (Change of Character) Zone, showing minor intraday retracement. A healthy pullback is likely before a potential bullish breakout of the descending trendline that has been holding price down over recent sessions.

🔵 BUY Strategy: Trend Continuation Setup

We’re watching for potential re-entries on a dip toward the OBS Buy Zone (3286–3284), created after the recent bullish move. This could be the last opportunity to catch the next impulsive leg higher.

Buy Zone: 3286–3284

Stop Loss: 3278

Targets: 3290 → 3294 → 3298 → 3304 → 3308 → 3312 → 3316 → 3320 → 3330 → ???

Key breakout confirmation will come if price closes strongly above 3313 (first key resistance). If broken, this opens the door toward the VPOC zone at 3328–3330, where a high-volume cluster awaits.

🔴 SELL Strategy: Short-Term Rejection Levels

Shorts only become favorable below the VPOC Sell Zone (3328–3330). If price closes above this area, bearish pressure is likely to fade, and bulls will dominate the next leg.

Sell Zone: 3328–3330

Stop Loss: 3335

Targets: 3324 → 3320 → 3315 → 3310 → 3305 → 3300

⚠️ Important: Selling inside a bullish breakout structure is high-risk unless the market gives clear rejection at major supply. Always wait for price action confirmation.

🕯️ Monthly Candle Insight (July Close)

Today marks the final trading day of July. Notably, the last two monthly candles have closed as Doji with long wicks, reflecting deep indecision and ongoing liquidity grabs. This aligns with the upcoming interest rate cut discussions at the next FOMC, which could ignite significant volatility.

📌 Summary:

Liquidity sweep at 3269–3271 is likely complete.

Price now retracing after strong bullish rebound from OBS Buy Zone.

Watch for confirmation above 3313, then 3328–3330 for breakout toward higher zones (335x–337x).

End-of-month close + macro narrative (FOMC) will be crucial to confirm direction.

💡 Pro Tip: Avoid entering late into reactive moves. Wait for retests of clean liquidity zones and use volume-based confluences to validate bias.

📲 Follow us @MMFlowTrading for real-time updates, macro analysis, and market structure insights on gold & major pairs.

Forexsignals

GOLD: Is This a Bottom or the Calm Before the Storm?🌐 Fundamental & Macro Landscape

The recent US–EU trade and defense pact has temporarily reduced gold’s appeal as a safe haven.

The US Dollar and stock markets remain strong thanks to positive macroeconomic data.

Current sentiment is risk-on, which typically shifts capital away from metals and into riskier assets.

But the real volatility could come later this week:

📅 High-Impact Events to Watch:

US ADP Employment Report

FOMC Statement + Nonfarm Payrolls (NFP)

These will likely decide whether gold resumes its uptrend or continues sliding lower.

📊 Technical Outlook (H1–H4)

Gold is currently trading within a parallel bullish channel after rebounding from local lows.

However, price is now approaching a key resistance zone around 3342, where we might see either a breakout or a rejection, depending on market sentiment during the upcoming data releases.

🔍 Key Price Zones

🔺 Short-Term Resistance: 3342

🔺 Major Supply Zone: 3369–3388 (Order Block + FVG + Fib 0.5–0.618)

🔻 High-Liquidity Demand Area: 3293–3290

🔻 Deep Demand Zone (FVG): 3275–3273

🔺 Long-Term Resistance Target: 3416

📈 Trade Plan – Based on Price Reaction, Not Prediction

The best trades come from waiting for the right reaction at key zones. No chasing. No guessing.

✅ Scenario 1 – Buy the Dip (Scalp Setup)

Entry: 3293 – 3291

Stop Loss: 3286

Targets: 3296 → 3300 → 3304 → 3308 → 3312 → 3315 → 3320 → 3330

🟢 Works well in high-liquidity zones for quick short-term gains.

✅ Scenario 2 – Buy from Deeper Support (Swing Setup)

Entry: 3275 – 3273

Stop Loss: 3269

Targets: 3280 → 3284 → 3288 → 3292 → 3300 → 3305 → 3310 → 3320 → 3330

🟢 Great setup if price absorbs selling pressure and reverses from FVG demand.

❌ Scenario 3 – Short from Short-Term Resistance

Entry: 3340 – 3342

Stop Loss: 3346

Targets: 3335 → 3330 → 3325 → 3320 → 3310

🔴 Valid only if price fails to reclaim above 3342.

❌ Scenario 4 – Short from Major Supply Zone

Entry: 3369 – 3372

Stop Loss: 3376

Targets: 3365 → 3360 → 3355 → 3350 → 3345 → 3340 → 3330 → 3320

🔴 Higher risk – only act after confirmation (e.g., rejection wicks or bearish candle pattern).

⚠️ Risk Management Tips

Avoid entering right at London or New York opens – too much volatility and false breakouts.

Always wait for confirmation (candle rejection, pin bars, engulfing, etc.).

Use strict stop-loss rules – FOMC + NFP can spike price in both directions.

💡 Final Tips for Indian Traders

Trade with patience – the best setups often appear when others are panicking.

Respect your capital – don’t overleverage during high-volatility news events.

Focus on price action – not emotions or fixed bias.

📌 If you found this gold analysis helpful, feel free to drop your thoughts in the comments or follow for daily updates on XAU/USD.

Let’s grow and trade smarter, one setup at a time.

Namaste 🙏 | Trade safe, trade with clarity.

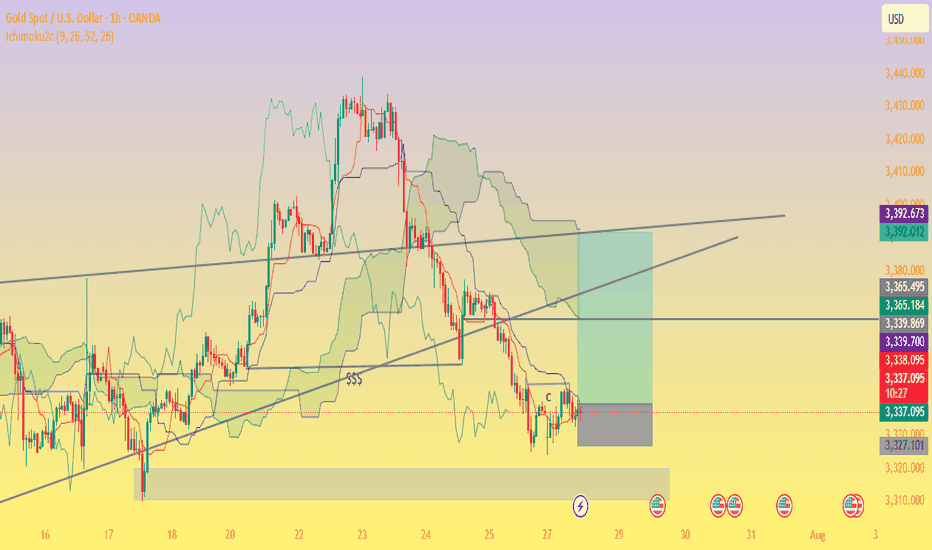

XAU/USD 1H – Range Consolidation Below Ichimoku Cloud. Chart Review & Technical Insight

1. Ichimoku Cloud & Overall Structure

Price is below the Ichimoku Cloud, with the cloud ahead sloping downward—indicative of bearish short‑term momentum and resistance overhead as long as the cloud holds above price.

The Kijun-sen (blue) line is above the Tenkan-sen (red), reinforcing the bearish bias on this timeframe.

2. Price Action & Key Zones

A support zone around 3,327–3,330 USD/oz is visible, underpinned by multiple rejection taps and price consolidation (“$$$” zone). A clean break below could open the path toward the 3,320’s or lower imbalance region.

On the upside, resistance lies near 3,339–3,340, backed by the cloud’s lower boundary and the Kijun-sen level.

The highlighted green rectangle appears to signal a potential bullish breakout target zone toward 3,365–3,392, contingent on recovery above the cloud.

3. Momentum & Trade Considerations

Momentum is weak, with price moving sideways inside a low‑volatility rectangle on diminishing volume and few directional impulses.

Possible ABC corrective structure is forming as marked, suggesting price may oscillate sideways or continue correcting within established bounds.

A bullish scenario would require clearing the Ichimoku Cloud and resistance at 3,340–3,360 USD.

Conversely, a bearish breakdown below ~3,327 could confirm continuation deeper into the 3,320s or toward the next significant demand zone near 3,300 USD.

✅ Summary

Bias: Slightly bearish to neutral until price can clear the Ichimoku Cloud.

Key Levels to Watch:

Support: 3,327–3,330 (immediate), then 3,320–3,300.

Resistance: 3,339–3,365, cloud top near 3,365, further target zone 3,392.

Scenarios:

Bullish breakout: Close above cloud → potential rally toward 3,365–3,392.

Bearish breakdown: Close below 3,327 → deeper correction toward 3,320 and lower imbalance areas.

Gold (XAU/USD): Supply Zone Rejection & Bearish Breakdown Chart Breakdown:

Supply zone rejection: Gold revisited the “supply zone” (light green/grey area) and failed to break above — a classic signal of seller dominance.

Uptrend invalidated: A sharp rise (steep black trendline) ended with a peak marked by the green arrow, followed by a decisive breakdown.

Ichimoku Cloud test: Prices slipped through the Ichimoku components, reinforcing the shift to bearish sentiment.

Potential targets: The red/green risk‑reward box highlights a short position, targeting ~3,347 then ~3,318 levels (blue labels) as initial support zones.

Strong supply base: The extensive grey zone below marks a "stronger supply zone" — this could cap any modest bounce and keep the downtrend intact.

🔍 Interpretation:

Bias: Bearish — sellers have taken control after a failed breakout.

Strategy: Short on rallies toward the mid‑green/red box (~3,373–3,380), targeting ~3,347 first and then ~3,319. Watch for support at the strong supply region (~3,292) for potential reversal or consolidation.

Risk management: Keep stop above the red zone—above recent highs (~3,380+) to limit risk.

🚀 In a nutshell: After failing to break supply and losing its short‑term uptrend, gold appears poised for a pullback. The next key levels to watch are ~3,347 and ~3,319—where buyers might step back in, or the downtrend continues toward the deeper supply base.

Critical Breakdown: BTC/USD Poised to Fall — Waiting on H4 CloseAnalysis of the BTC/USD 4‑Hour Chart

From the chart you provided, here's how the technical situation looks:

Ascending trendline support has been tested multiple times and was recently breached this afternoon, signaling a possible shift from the bullish setup to a bearish continuation.

The price is now trapped within a descending triangle formation beneath a well‑defined swing high resistance zone. This reflects indecision in the market, with neither buyers nor sellers in clear control

Business Insider

+15

Fxglory Ltd

+15

Bitcoin News

+15

.

Key levels to monitor:

Support zone: ~$115,500, extending down to ~$111,300 and ~$105,600 as deeper targets if bearish momentum strengthens.

Resistance zone: ~$119,000–120,000 area, forming strong overhead supply

Economies.com

DailyForex

Bitcoin News

.

The chart’s annotations align with a classic breakout strategy—with the caveat: wait for a confirmed close below the trendline before considering short positions (as noted in your “wait for this candle to close in red” comment).

Breakout confirmation would likely pave the way toward your indicated profit zones near ~$111k and ~$105k, with a larger potential down to ~$99.8k if further downside pressure builds.

🔍 What the Broader Market Signals

Technical sentiment from sources covering today’s analysis shows BTC/USD hovering just under $120,000, stuck within the defined range of $115.5k support to $120k resistance

Economies.com

.

While there’s still neutral momentum in indicators like RSI and MACD, the short-term direction leans bearish if the breakdown is confirmed on the H4 timeframe

Fxglory Ltd

.

Analysts emphasize that sustained movement above $116.5k could retarget resistance near $119–120k. A failure there and a move below $115.5k may thrust price deeper toward your downside zones

DailyForex

.

✅ Trading Strategy Overview

Scenario Trigger Target Levels

Bearish Breakdown H4 candle closes below trendline ~$115.5k $111.3k → $105.6k → possible $99.8k zone

Bullish Rejection Bounce back above ~$116.5k and trending above resistance $119k–120k retest, potential breakout if sustained

Neutral / Wait-and-see No decisive candle close yet Hold for confirmation

⛳ Final Thoughts

chart highlights a critical point: don’t act prematurely. Wait for a decisive H4 candle close below the trendline before committing to shorts. Confirmed bearish action around the breakout could open the path to the lower targets you identified. However, if price rebounds above support and climbs above $116.5k, a short-term retest of $119k–120k is still in range.

Traders should maintain prudent risk management—watching the unfolding price action around these pivot points without overreaching. Let me know if you'd like help crafting entry/exit zones or risk profiles for this setup!

Gold Tests Key Support – Time to Buy or More Downside Ahead?🌐 Market Overview

Gold remains under pressure following yesterday’s sharp sell-off, driven largely by macro-political tensions and profit-taking at recent highs.

🔻 On July 24th, former President Trump made a surprise visit to the Federal Reserve headquarters — a move interpreted by markets as subtle pressure on the Fed to start cutting rates.

While the Fed hasn’t signaled any immediate easing, short-term bond yields have dipped slightly — reflecting growing rate-cut expectations.

The US Dollar, however, remains firm, showing markets are still hesitant to fully price in a Fed pivot after strong economic data.

📊 Technical Outlook

On the H2 timeframe, gold continues to trade within a broader bullish structure, but price action is now hovering near a critical Keylevel at 3338, aligned with a rising trendline and VPOC zone. A breakdown below this level could open the door for deeper liquidity grabs toward 332x and even 329x.

Volatility is high, and price is moving in wide ranges — ideal conditions for short-term scalp setups.

🎯 Trading Strategy

🔽 Scalp Buy (Short-Term Bounce Opportunity)

Entry: 3338 – 3336

Stop Loss: 3332

Targets: 3342 – 3346 – 3350 – 3354 – 3360 – 3365 – 3370 – 3380

🟢 Buy Zone (Deeper Pullback, Reversal Potential)

Entry: 3312 – 3310

Stop Loss: 3305

Targets: 3316 – 3320 – 3325 – 3330 – 3340 – 3350 – 3360 – 3370 – 3380

🔻 Sell Zone (If Price Retests Resistance)

Entry: 3374 – 3376

Stop Loss: 3380

Targets: 3370 – 3366 – 3360 – 3355 – 3350 – 3340 – 3330

🧭 Key Price Levels

Support: 3350 – 3338 – 3325 – 3310 – 3294

Resistance: 3374 – 3390 – 3400 – 3421

⚠️ Risk Management & Notes

As we head into the weekend, the market is prone to unexpected liquidity sweeps and sharp reversals.

Only consider short-term BUY positions for today. Avoid holding long-term buys until there's confirmation that the lower liquidity zones have been fully swept.

Strictly follow TP/SL discipline to protect capital — especially in volatile, low-news sessions like this.

💬 Enjoying these detailed trade plans?

📈 Follow the MMF TradingView channel for daily market updates, high-probability trade setups, and pro-level insights designed for serious traders.

Watch for a Potential Pullback (July 23) - GOLD PLAN XAUUSD – Is the Bullish Wave Losing Steam? Watch for a Potential Pullback (July 23)

📰 Market Overview

Gold made a strong rally last night, fueled by:

Fed Chair Powell’s speech, which avoided any controversial remarks or hints about stepping down.

Rising geopolitical tensions between the US, China, and the EU, with August 1st looming as a critical deadline.

A dip in US bond yields and the dollar, giving risk assets — including gold — room to rise.

While there’s no major news on today’s calendar, the market could remain volatile within a wide range.

📉 Technical Outlook

Gold seems to be wrapping up its bullish wave as seen on the H4 chart. On the H1 and M30 timeframes, reversal candles are starting to form — an early signal of potential correction.

The short-term support at 3412 – 3410 is the key zone to watch. If that breaks and we get a clean breakdown from the trendline, a deeper pullback could be underway — possibly heading toward liquidity zones lower down.

Two main Fair Value Gap (FVG) areas on H1 are also in play as high-probability liquidity targets.

Down at the 335x region, we have a confluence of FIB 0.618 retracement and historical buying interest — making it an attractive zone for long setups if the price reacts properly.

📌 Trade Setups for Today

🔻 SELL ZONE: 3469 – 3471

Stop Loss: 3475

Take Profits: 3465, 3460, 3455, 3450, 3445, 3440, 3430, 3420

→ Ideal zone to look for bearish setups after a retest.

🔸 BUY SCALP: 3385 – 3383

Stop Loss: 3379

Take Profits: 3390, 3394, 3398, 3402, 3406, 3410

→ Short-term buy for intraday traders catching the pullback.

🔹 LONG-TERM BUY ZONE: 3356 – 3354

Stop Loss: 3350

Take Profits: 3360, 3364, 3368, 3372, 3376, 3380, 3390, 3400

→ This is the deep liquidity zone worth watching for high-conviction buy entries.

⚠️ Risk Reminder

With fewer news catalysts, gold may trap traders by sweeping liquidity in both directions.

Stick to your plan, follow TP/SL strictly, and avoid chasing price. Let the market come to you.

💬 Sometimes the best trade is waiting for the right level. Stay patient, stay sharp.

institutional Nifty-50 option tradingInstitutional Nifty-50 option trading refers to the strategic use of Nifty-50 options (CE & PE) by FIIs, DIIs, Hedge Funds, and Banks to hedge, speculate, or manage risk on large capital positions. Unlike retail, their trades are data-driven and volume-heavy.

Key Institutional Strategies:

Delta-Neutral Strategies – Like Long Straddles or Strangles, where institutions profit from volatility.

Covered Call / Protective Puts – To hedge large Nifty portfolios.

Bull/Bear Spreads – Deployed when directional conviction is strong but limited in risk appetite.

Option Writing – Writing options at OI resistance/support to generate premiums.

Calendar Spreads – Leveraging time decay while anticipating movement.

📈 How to Track Institutional Activity:

Option Chain Analysis: Spot high OI shifts with unusual volumes.

OI + Volume + IV: Use combined data to infer institutional positioning.

Change in PCR (Put Call Ratio): Signals sentiment shift at index levels.

FII-DII Daily Derivative Data: Published by NSE after market hours.

Strike-wise Open Interest Heatmaps: Help identify resistance/support zones built by institutions.

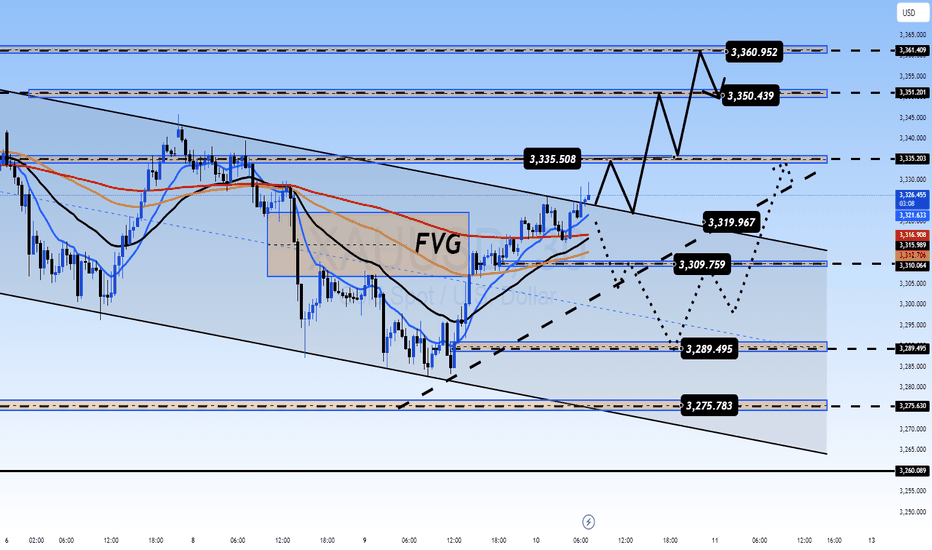

Gold’s Recent Movement and Market SentimentXAUUSD: Gold Bounces Strongly From the Bottom, Is This the Start of a New Uptrend?

🌍 Macro Overview – Gold’s Recent Movement and Market Sentiment

Gold recently experienced a strong bounce from the 3.282 USD/oz low, reaching up to 3.317 USD/oz. This move has sparked some optimism, but let’s take a look at the key macro factors that might be affecting gold:

📉 US bond yields have dropped, signaling that market risk aversion is starting to return

💵 The USD remains strong, but buying interest for gold in Asia is increasing, as confidence in fiat currencies begins to wane

🇪🇺 The EU is pushing ahead with negotiations with the US on tariffs before the August 1st deadline. If these talks break down, gold could benefit significantly

🏦 The Fed is maintaining interest rates, but the market is betting that cuts could come in September if inflation remains under control

📊 US unemployment data and the Fed’s speech tonight will be key, with the market waiting anxiously for clues on the Fed’s next move

📊 Technical Analysis – Gold Approaching Key Resistance Zones

Gold is trading within a descending channel, but signs of a breakout are emerging after a solid test of the bottom.

Key resistance levels are around 3330 – 3340, and these will be crucial in determining whether gold can continue its upward momentum.

Fair Value Gap (FVG) has appeared between 3310 – 3320, which suggests that if buying pressure remains, a breakout could be on the horizon.

🎯 Trading Strategy for Today – Focused on Clear Entry Points

🟢 BUY SCALP:

Entry: 3310 – 3308

SL: 3304

TP: 3314 → 3318 → 3322 → 3326 → 3330

🔵 BUY ZONE (safer entry points):

Entry: 3290 – 3288

SL: 3284

TP: 3294 → 3298 → 3302 → 3306 → 3310 → 3320 → 3330

🔴 SELL SCALP (if price hits resistance levels):

Entry: 3335 – 3337

SL: 3342

TP: 3330 → 3325 → 3320 → 3315 → 3310 → 3300

⚫ SELL ZONE (strong resistance at 3360-3362):

Entry: 3360 – 3362

SL: 3366

TP: 3356 → 3352 → 3348 → 3344 → 3340 → 3336 → 3330

📌 Note:

Always place SL and TP to protect your account, especially in a market that may experience significant volatility.

Monitor the volume from London and New York sessions for clearer market direction. A strong breakout above resistance could signal the start of a new uptrend.

💬 Gold has bounced strongly, but is this the start of a larger rally, or just a brief pullback? What do you think about today’s potential trend? Share your thoughts in the comments below!

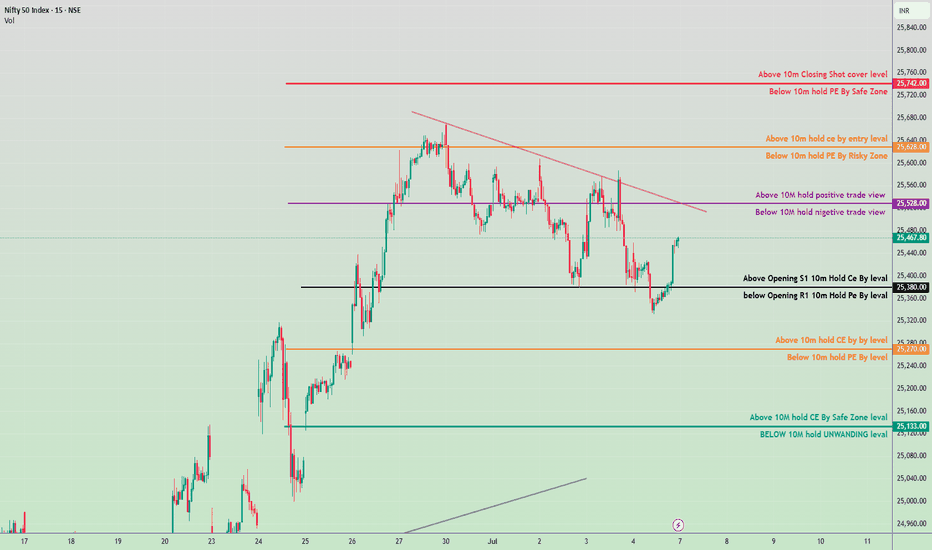

Nifty 50 Intraday Trade Plan - 7 July 2025✅ Bullish Zones (Call Option - CE Buy Levels):

Above 25,133 ➤ Hold CE by Safe Zone level

Above 25,270 ➤ Hold CE by key level

Above 25,380 ➤ Opening S1 Breakout – Hold CE

Above 25,528 ➤ Positive Trade View (10M volume base)

Above 25,628 ➤ Entry level for CE holding

Above 25,742 ➤ Closing Shot – Cover Short Positions

🔻 Bearish Zones (Put Option - PE Buy Levels):

Below 25,133 ➤ Unwinding Level – Hold PE

Below 25,270 ➤ Key level – Hold PE

Below 25,380 ➤ Opening R1 Breakdown – Hold PE

Below 25,528 ➤ Negative Trade View

Below 25,628 ➤ Risky Zone for holding PE

Below 25,742 ➤ Safe Zone for holding PE

🔁 Trendline & Structure Notes:

Downtrend resistance visible around 25,528–25,628 zone.

If price breaks above trendline and sustains, expect bullish momentum.

Support near 25,133 and strong base seen around 25,000 zone.

Trading with Professionalsnvesting Basics

Investing involves allocating money into assets with the expectation of generating income or profit over time. Unlike trading, investing usually focuses on long-term wealth building.

Investment Vehicles:

Stocks: Equity ownership in companies.

Bonds: Fixed-income securities.

Mutual Funds: Pooled investments managed by professionals.

ETFs: Funds that track indices and can be traded like stocks.

Real Estate: Property investments.

Investment Strategies:

Value Investing: Buying undervalued stocks.

Growth Investing: Investing in companies with high growth potential.

Dividend Investing: Focusing on stocks that provide regular income.

Risk Management in Investing:

Diversification across sectors and asset classes.

Regular portfolio rebalancing.

Long-term focus to absorb short-term volatility

USDJPY Trade Recommendation – Second SELL Entry (15-Min Chart)🔻 Strategy: Continue selling with the short-term downtrend, entering on technical pullback

🎯 Trade Setup:

Sell Entry Zone: 143.94 – 144.00

Stop Loss (SL): 144.45 (just above SMA89 and minor resistance zone)

Take Profit (TP): 143.28 – 143.36

Risk:Reward Ratio: Approx. 1:2.5 to 1:3

📊 Technical Analysis:

1. Trend Direction:

The market is clearly in a short-term downtrend on the 15-minute timeframe.

Price has been forming lower highs and lower lows, indicating strong bearish pressure.

2. Dynamic Resistance – SMA89:

SMA89 (red line) is acting as dynamic resistance, consistently rejecting price.

The entry zone aligns with previous minor resistance and the down-sloping SMA, making it ideal for re-entry short positions.

3. Target Zone – Technical Support:

TP zone (143.28 – 143.36) is a recent swing low/support level, likely to be revisited if bearish momentum continues.

=> Fl and tradding with me!

Institutional Option Trading Part -4Common Institutional Option Strategies

Covered Call Writing: Selling call options against stock holdings to generate income.

Protective Puts: Buying puts to insure portfolios against downside risk.

Spreads (Vertical, Horizontal, Diagonal): Limiting risk while aiming for a defined profit range.

Straddles and Strangles: Betting on volatility, regardless of market direction.

Iron Condors: Selling out-of-the-money calls and puts to profit from low volatility.

Tools and Platforms

Order Management Systems (OMS): To handle complex orders efficiently.

Execution Management Systems (EMS): For rapid and algorithmic order execution.

Advanced Analytical Software: For options pricing, risk assessment, and scenario analysis.

Advantages of Institutional Option Trading

Ability to execute large trades without significant slippage.

Access to lower fees due to trade volume.

Enhanced risk management capabilities.

Learn Institutional Trading Part-2What is Investing?

Investing involves committing your money to various assets like stocks, mutual funds, gold, real estate, or bonds to grow your wealth over time. Investing is generally a long-term strategy, focusing on the gradual accumulation of wealth.

Key Types of Investments

Stock Market Investments: Buying shares of companies.

Mutual Funds: Pooling money with other investors.

Bonds: Lending money to companies or governments for interest.

Gold & Real Estate: Physical assets that typically grow over time.

Investment Strategies

Value Investing: Buying undervalued stocks.

Growth Investing: Investing in companies with high growth potential.

Dividend Investing: Investing in companies that pay regular dividends.

Benefits of Investing

Builds wealth over time.

Helps fight inflation.

Provides financial security.

Learn Institutional Option Trading Part-3In India, options are traded primarily on:

NSE (National Stock Exchange)

BSE (Bombay Stock Exchange)

The Securities and Exchange Board of India (SEBI) regulates the derivatives market and ensures fair practices.

Why is Option Trading Popular in India?

Leverage: Traders can control large positions with small capital.

Hedging: Investors use options to protect their portfolios from market fluctuations.

Income Generation: Strategies like covered calls can provide regular income.

Speculation: Traders can bet on price movements with limited risk.

XAU/USD Bullish Breakout from Flag PatternBullish Flag Formation: The price consolidated in a downward-sloping flag after a sharp bullish move. A breakout has occurred, signaling renewed buying pressure.

Support Zone: The breakout aligns with the horizontal support area around 3,392, reinforcing the bullish bias.

Upside Targets: Based on price structure and measured move projection:

First target: 3,435 – 3,452

Final target zone: 3,500+

Momentum Confirmation: The Ichimoku cloud supports bullish continuation as price trades above it, showing strong upward momentum.

Conclusion:

Gold appears to be resuming its uptrend after a brief consolidation. As long as price holds above the breakout level (around 3,392), the bullish targets remain valid. Ideal scenario for continuation traders looking for entries on minor pullbacks

Gold Eyes Breakout from Ascending Channel Toward $3,500📈 Chart Analysis

1. Rising Channel Structure

Gold (XAU/USD) has been trading within an upward-sloping channel, marked by the blue trendlines connecting interior lows and highs, culminating at point C (~$3,497). The latest bounce off the lower channel near “B” reinforces bullish bias – if this trendline holds, another leg higher toward resistance around $3,497–$3,500 is likely.

2. Support & Resistance Confluence

The purple trendline and the dotted horizontal green level (~$3,498) converge near the projected breakout point. This synergy provides a strong pivot zone — a successful breakout would validate targets near channel highs.

3. Harmonic Pattern in Play

The chart displays a bullish harmonic structure (likely a Bat or Gartley formation), with retracement ratios (0.719, 1.627) anchoring reversal areas. These reinforce the bounce at B and the potential move toward point C.

4. Trade Scenarios

Bullish Scenario (primary): A bounce off the trendline triggers a rally to the channel top and resistance zone ($3,497–$3,500).

Bearish Caution: A drop below the trendline invalidates the pattern, potentially bringing prices back to horizontal support around $3,296 or even $3,120, as indicated at point A.

🛠️ Technical & Market Context

Technicals: Daily trend remains bullish as long as price holds above ~$3,340–$3,350, with resistance forming in the $3,380–$3,400 range

.

Fundamentals: Geopolitical tension (e.g., Middle East conflict) and safe-haven inflows continue to underpin gold — though Citi expects prices to eventually correct toward $3,300–$3,500 mid‑term

Sentiment: Some analysts advocate “selling the rallies,” especially into the $3,450–$3,500 zone . But central banks’ ongoing buying and potential Fed rate cuts support a stronger floor

.

✅ Trade Strategy

Scenario Entry Zone Target Stop Loss Placement

Play the Bounce ~$3,350–$3,360 $3,497–$3,500 Below trendline near B zone (~$3,320)

Breakout Trade On momentum above $3,400 $3,497–$3,550 Below breakout (sub-$3,380)

Bearish Trigger Break & close below trendline Back to $3,296 / 3,120 Just above trendline ($3,360)

🔍 Summary

Gold remains in a structurally bullish setup inside an ascending channel. The confluence of harmonic reversal, strong trendline support, and pending fundamental catalysts presents a high-probability opportunity to push toward the $3,500 area—provided the trendline and $3,340–$3,350 support hold. A drop below would invalidate the bullish outlook and favor deeper retracement.

EUR/USD Potential Reversal from Resistance Zone –Bearish OutlookThe EUR/USD pair has been trading within a well-defined ascending channel for several weeks. Price recently tested a strong resistance zone near 1.15850 – 1.16000, which aligns with the upper boundary of the channel and a previously marked supply area.

Key observations:

The price action shows signs of rejection from the resistance zone with a potential double-top or fakeout pattern forming.

A projected bearish trajectory is marked, suggesting a possible break below the channel support.

Immediate bearish targets are set at key demand zones around 1.14500, 1.12500, and further down to 1.10500.

A large red arrow indicates the strong downside bias if the price confirms the breakdown.

Conclusion:

If EUR/USD fails to sustain above the 1.15850 resistance zone and breaks below the ascending channel, a strong bearish correction is anticipated. Traders should watch for confirmation of the breakdown before entering short positions.

Gold on the Rise! – Bullish Setup in Focus The chart shows a repeating consolidation‑then‑breakout pattern, with Gold forming ascending swing structures, consolidating in rectangles (green), then riding higher along a rising trendline (purple). Price has just bounced off that trendline again, signaling a possible new leg up—potentially targeting the upper range near $3,448–3,450. A clear breakout above that level could open the door toward $3,500+.

📍 Trading Plan

🎯 Entry

Long on breakout above recent consolidation highs (~$3,440–3,448).

Alternatively, buy the dip near the purple trendline (~$3,385–3,390), with confirmation (hammer candle, bounce).

🛑 Stop‑Loss

For breakout: just below the top of the rectangle consolidation (~$3,389).

For trendline entry: slightly below recent swing low (~$3,358–3,360).

🎯 Profit Targets

Primary: upper rectangle level (~$3,448–3,450).

Extension: historic all‑time high region (~$3,500) → next major zone.

🎥 Path

Potential minor pullback toward trendline.

Bounce establishes support.

Surge toward top of range.

Breakout with trend continuation to new highs.

📊 Trade Risk & Reward

Target ~60–100 pts above entry, stop ~50 pts below → ideal Risk:Reward ≥ 1:1.2.

📌 Key Levels to Monitor

Level Role

$3,360 Swift dip support (green base line)

$3,390–3,400 Trendline confluence zone

$3,440–3,450 Breakout area & top of rectangle

$3,500 Next major resistance/all‑time high

🧭 Market Context & Drivers

Broad uptrend remains intact amid geopolitical tensions, especially the Israel–Iran situation, which continues to support safe-haven flows

investing.com

+15

reuters.com

+15

barrons.com

+15

forex24.pro

+1

goldpredictors.com

+1

.

Markets are positioning ahead of Fed’s June 18 decision; dovish signals could fuel continuation toward new highs (~$3,500+)

fxempire.com

.

Technical structure reflects bullish momentum—ascending wedge patterns with shallow dips and strong trendline bounces

fxstreet.com

.

✅ Summary

Bias: Bullish – uptrend intact.

Strategy: Go long on dip near trendline or on breakout above $3,445.

Stop‑Loss: Just below last swing low ($3,360).

Targets:

Near-term: $3,448–3,450

Medium-term: $3,500+

Stay tuned for Fed statements and Middle East headlines—they’ll be catalysts.

Option Trading Master class Part -7Fundamentals of Stock Investing

Types of Investors:

Value Investors: Focus on undervalued companies

Growth Investors: Target high-growth potential stocks

Dividend Investors: Prefer regular income from dividends

Research Parameters:

Earnings per Share (EPS)

Price-to-Earnings Ratio (P/E)

Return on Equity (ROE)

Debt-to-Equity Ratio

Industry Trends

Tools for Investing:

Demat and Trading Account

Research Platforms (e.g., TradingView, Screener.in)

Portfolio Tracker (e.g., Zerodha Console)

BTC/USDT Bullish Reversal Zone AnalysisSupport Zone:

The horizontal purple box (~104,000 USDT area) has acted as a strong support/resistance flip zone multiple times.

Falling Wedge Breakout:

The price action broke out of a falling wedge pattern earlier, confirming bullish momentum.

Flag Formation (Current):

A smaller bullish flag/pennant appears to be forming, and a breakout above could trigger a strong upward move.

Projected Move:

The black arrow indicates a potential bounce from this support zone, with the price targeting the 111,000–112,000 USDT zone (highlighted in the top purple box).

Volume Spike:

Notable volume spike near the bottom supports the idea of accumulation and possible reversal.

📈 Conclusion:

If the support zone holds and price breaks above the minor flag, a bullish continuation is likely toward the 111,000–112,000 resistance area. Traders should watch for confirmation of a breakout and volume increase for validation.

AUD/USD at Critical Resistance — Bearish Outlook Below 0.65381. Major Resistance Zone: 0.65380

Price is currently testing a strong horizontal resistance level at 0.65380, a level that has been tested multiple times (as shown by the pink circles).

This level has acted as a historical turning point, which increases its significance.

2. Price Structure: Lower Highs and Equal Highs

The chart reveals a potential double top or distribution pattern, forming under the 0.65380 resistance.

This suggests weakening bullish momentum and increases the probability of a bearish reversal.

3. Projected Bearish Path (White Dotted Lines):

If price fails to break above 0.65380 decisively, the expected move is a stepwise decline.

The projected path targets several support levels:

0.65003

0.64647

0.64213

0.63957

Final target: 0.63627, a key support from early May.

4. Support & Resistance Zones:

Resistance Levels:

0.65380 (Major)

0.65003

Support Levels (Sequential Targets):

0.64647

0.64213

0.63957

0.63627

5. Confluence with Fundamentals:

U.S. economic events (highlighted at the bottom with calendar icons) may act as volatility triggers, potentially accelerating this move.

✅ Summary & Trading Implications:

Bias: Bearish below 0.65380

Trade Idea: Watch for rejection at resistance or break below 0.65003 for confirmation.

Bearish Targets: Gradual move toward 0.63627 with key pauses at intermediate support levels.

Invalidation: Daily close above 0.65380 would negate the bearish setup and open potential for new highs.