Fundamentalstrategy

Gold (XAU/USD) Breakout Setup – Bullish Reversal from RBR Zone!🔹 Trade Idea: Long (Buy) Setup

📈 Targeting a price rally from a demand zone!

---

🔵 .ENTRY ZONE (Buy Area)

🟦 Marked between 3,039.773 – 3,043.052

📍 Located in the RBS + RBR zone (Resistance becomes Support + Rally-Base-Rally)

💡 Price dipped here and bounced — showing bullish intent

🔻 .STOP LOSS

🚨 Placed at 3,014.537

🛡️ Protects you in case the price drops below the zone

✋ Risk is clearly defined here

🎯 .TARGET POINT (Take Profit)

🚀 Aiming for 3,115.910

💸 A high reward area if momentum continues

🔥 Great R:R ratio (~1:3) — solid risk/reward

📊 .Technical Confirmation

📌 Price has moved above the 9-period DEMA (3,043.052)

⚡ Signals bullish momentum

🕯️ Strong bullish candles forming after the bounce — confirming entry.

🔍 .Market Structure Notes

⬇️ Previous trend was down

🔄 Now forming a potential reversal

🧱 Support holding strong near 3,014–3,030

✅ Summary: 💥 Buy idea from demand zone

🔝 Targeting new highs

🛑 Stop loss tightly managed

⚖️ Clean setup with momentum on your side

USD/JPY 4H Chart Analysis:Trend Break & Support-Based Long Setup1. Previous Uptrend Channel

📈

Price moved in a rising channel

Lower trendline acted as support ✅

Then came the trend line break ⚠️ — signal of trend reversal

2. Major Drop

🔻💥

After breaking support, the price fell sharply

Strong bearish momentum took over

Sellers dominated the market

3. Support Zone Identified

🟦 Support Box (146.110 - 145.156)

Buyers stepped in at this level

Possible bounce or consolidation

Price currently at 147.014 — just above support

4. Trade Setup Idea

🛒 Buy Opportunity (if price holds support)

📌 Entry Zone: Around 146.110

🎯 Target: 150.260

🛑 Stop Loss: 145.156

📊 Risk:Reward = ~1:2 — solid R:R setup!

5. Indicators & Confirmations

🟠 DEMA (9): Sitting at 146.110 — aligns with support!

✅ Extra confluence for the bounce!

Summary

If price holds above support:

Buyers might push toward 150.260

If it breaks below 145.156:

Sellers may regain control

Gold Price Analysis:Key Supply & Demand Zones with Potential Bkl🔥 Key Levels & Zones

🔵 Supply Zone (3,135-3,140 USD) 📉

Acts as resistance where selling pressure increases.

If price reaches here, expect a potential pullback.

🟢 Demand Zone (3,085-3,095 USD) 📈

Strong support area with buying interest.

Price has tested this zone multiple times = accumulation.

🎯 Target Point (~3,167 USD) 🚀

If price breaks out, it may rally towards this level!

❌ Stop Loss (~3,080 USD) ⛔

Marked below demand zone to limit risk.

---

📊 Trend Analysis

🔹 Trend Line Break ⚡

The price broke the previous uptrend = potential reversal or deeper correction.

🔹 Market Structure 🏗️

Price consolidating inside the demand zone = possible bullish move ahead.

🔹 Double Bottom Formation (DBF) at Supply Zone 🔄

Shows failed breakout attempts = strong resistance.

---

🔍 Indicators & Insights

📌 DEMA (9 close) at 3,099 USD 📈

Price hovering around this moving average = market indecision.

---

🚦 Possible Scenarios

✅ Bullish Scenario:

If price holds the demand zone & breaks above 3,110 USD, it could rally to supply zone (~3,135 USD).

A breakout above 3,140 USD could lead to the target zone (~3,167 USD) 🚀.

❌ Bearish Scenario:

If price breaks below 3,085 USD, it may hit stop loss (3,080 USD) and continue lower.

---

🎯 Trading Plan

🟩 Long Entry ➡️ Around 3,090-3,100 USD 📊

🛑 Stop Loss ➡️ Below 3,080 USD 🚨

🎯 Target ➡️ 3,135-3,167 USD 🎉

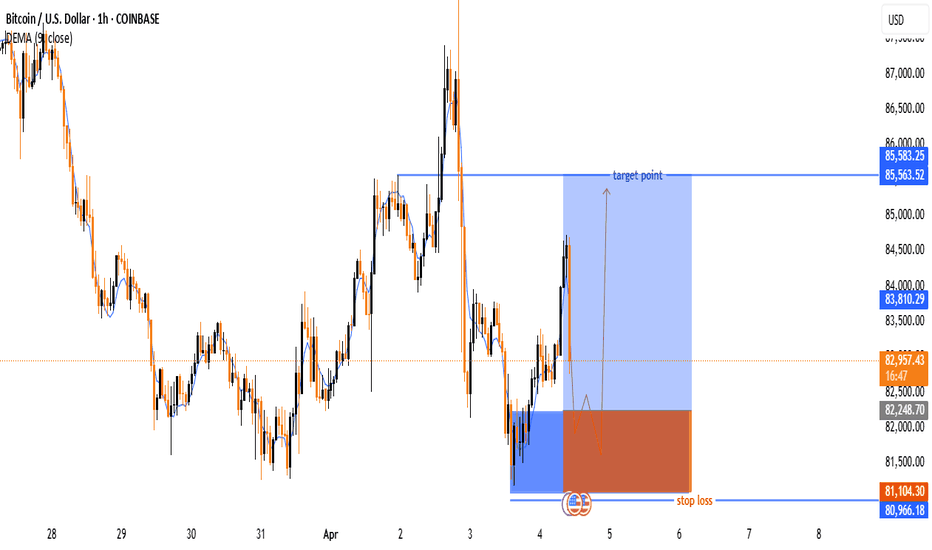

Bitcoin (BTC/USD) Trade Setup & Analysis🔹 Trend Analysis:

📉 The chart shows a downtrend followed by a reversal attempt.

📈 The price bounced off a support zone and is moving upwards.

🔹 Indicators:

📊 The 9-period DEMA (83,805.38) is slightly above the current price, acting as a resistance level.

🔹 Trade Setup:

🟢 Entry Zone: Around 82,943 (Current Price)

🔴 Stop-Loss: 81,183.22 ❌ (Below support level)

🎯 Target Point: 85,563.52 ✅ (Upper resistance level)

🔵 Strategy: The trade anticipates a price dip before

WTI CRUDE OIL TRADE SETUP : BREAKOUT OR BREAKDOWN ?📊 Key Observations:

🔹 Trend:

🚀 Strong bullish move followed by a correction 📉

🔻 Price is testing a support zone

🔹 Pattern Formation:

📏 Descending channel or flag-like structure

📍 Price is near a breakout point

🔹 Trade Setup:

✅ Entry Zone: Around 70.77

🛑 Stop Loss: 70.44 - 70.49 (Risk limit ❌)

🎯 Target Point: 71.80 (Profit zone ✅)

🔹 Indicators & Confirmation:

📊 DEMA (9) at 70.92 → Price is slightly below short-term momentum

🔥 A breakout above resistance could confirm a bullish move 🚀

📌 Conclusion:

✅ If price breaks the trendline upwards → Buy 📈 aiming for 71.80 🎯

❌ If support at 70.44-70.49 fails → More downside possible ⚠️

🚀 Watch for volume & candlestick confirmation before entering!

Amazing breakout on Weekly Timeframe - CUBCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN LOWER TIMEFRAME AND RETRACE IF NEEDED. SL IS NEARER SUPPORT ZONE IN Daily TIMEFRAME.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Nahar Capital & Financial Services LtdNahar Capital & Financial Services Ltd

is a non-deposit taking NBFC. It is engaged in investment in shares, debentures, stock, bonds, and securities of all kinds.

FUMDAMENTALS:

Market Cap = ₹ 576 Cr. ROCE= 6.05 % ROE= 6.91 %

D/E RATIO= 0 PROFIT 3 YEAR = 207% SALES 3 YEAR = 22.8

This is nbfc stock in strong momentum. you can see strong positive rsi above 55 level.

this is debt free company. and profit making company. keep in your radar .

this is just educational purpose only. i am not sebi reg. financial adviser.

if you like my ideas follow me and boost my ideas for motivate.

#Schaeffler is leading the Auto Industries #SuperChartzKey Levels:

Support: 3050

Resistance: 3233 3333 3433 3733

Description:

Overall Performance:

Sustained growth in Q3 and nine months of 2023 in both top-line and bottom-line.

Robust GDP growth in India, particularly in sectors such as steel, cement, and commercial vehicles.

Mixed performance in the automotive sector, with passenger vehicles and commercial vehicles showing growth while two-wheelers remain flat.

New Business Wins:

Significant new business wins in the automotive sector, especially in commercial and passenger vehicles.

Diversification into industrial divisions with wins in industrial automation, railway, and two-wheeler sectors.

Revenue and Business Mix:

Positive growth in domestic segments, contrasting with export business facing challenges due to weak demand in Europe and China.

Export decline attributed to external demand issues rather than internal inventory challenges.

Financial Performance:

Strong earnings quality with sustained EBIT margin and profit after tax margin.

Emphasis on working capital management and cash flow generation.

Other income growth driven by interest income from old refunds and improved yields on cash.

Growth Outlook and Operations:

Targeting minimum double-digit growth with capex supporting growth realization.

Seasonal dip in Q3 automotive aftermarket revenues, with expectations of a bounce-back in Q4.

Continued focus on organic growth and strategic expansion in the Indian market.

Manufacturing plants operating at over 80% utilization, with new plant construction underway but no relocation plans.

Best Multibagger Stocks For This Week #swingtrading , #breakoutsignals

In this video, we're going to share with you our top 8 #breakoutstocks for tomorrow! These stocks are poised to make big moves in the coming days, so be sure to check them out!

And finally, in this video, we'll give you some tips on how to invest in breakout stocks. We'll share with you our tips on how to find breakout stocks, how to trade them, and how to find :-

multibagger stocks,stock market,multibagger stocks 2023,multibagger stocks for 2023,best multibagger stocks for 2023,multibagger stock,multibagger,multibagger penny stock list,stock market for beginners,multibagger stocks 2023 india,future multibagger stocks 2023,list of multibagger stocks stocks,multibagger stocks moneycontrol,best multibagger shares 2023,stocks to buy now,multibagger penny stocks,small cap multibagger stocks 2023,stocks

archean chemical industries ipo,archean chemical industries,investors,anil singhvi,zee business,latest share market news,latest share news,latest share market tips,latest share market videos,latest share market news in hindi,latest share recommendations,latest stock market news,latest stock market recommendations,latest stock market news india,latest stock news india,latest stock picks,latest stock market analysis market watch,latest stock market videos

stock247,quality stock,equity shares,strong fundamentals stock,strong stock,growth stocks,chemical sector,chemical stocks,best chemical stock,deepak nitrate,chambal fertilizer,laxmi chemical,laxmi organics share,best stock to buy now,reliance industries,jio financial services,itc share,stock to buy now,penny stock,tata motors,tata power,best penny shares,multibagger stocks,stocks to hold for long term,stocks to hold forever india

------------------------------------------------------------------------------------------------------------------------

Welcome to the official youtube channel of India's first Retail Investors community BREAKOUT SIGNALS!

The purpose of this channel is to spread knowledge and awareness about the Stock Market for free. We do extensive fundamental and technical analysis and give recommendations solely based on our research.

Disclaimer: We are not SEBI registered. All the content (videos, comments, posts, community posts, live streaming, etc) of this channel is for educational and informational purposes only, Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions.

-----------------------------------------------------------------------------------------------------------------------------

#breakoutsstocksfortomorrow

#swingtradestrategy #tradingstrategies #tradingstrategy #tradingstrategies #swingtrader #swingtrading #swingstocks #swingidea

Multibagger Stocks for 2X Gain | Best stock to buy now!Multibagger Stocks for 2X Gain | Best stock to buy now!

"Unlocking the Potential: Discovering Multibagger Stocks for Impressive Returns | Stock Market Analysis"

Welcome to our YouTube channel, where we delve into the world of multibagger stocks and guide you towards potential wealth creation opportunities in the stock market. In this series, we provide in-depth analysis and insights on promising stocks that have the potential to deliver significant returns over time.

Join our expert team of analysts as they uncover hidden gems and identify stocks with strong fundamentals, growth prospects, and favorable market trends. We delve into various sectors and share valuable investment strategies to help you make informed decisions and navigate the complexities of the stock market.

Whether you are a seasoned investor or just starting your investment journey, this channel is designed to empower you with knowledge and equip you with the tools to identify multibagger stocks. Stay tuned for regular updates, stock recommendations, market trends, and exclusive interviews with industry experts.

Don't miss out on the opportunity to unlock the potential of multibagger stocks. Subscribe to our channel now and embark on a rewarding investment journey!

Hashtags:

#MultibaggerStocks #StockMarketAnalysis #WealthCreation #InvestmentOpportunities #StockRecommendations #MarketTrends #InvestmentStrategies #StockAnalysis #FinancialGrowth #StockMarketEducation #StocksAndShares #InvestmentJourney #StockMarketInsights

The purpose of this channel is to spread knowledge and awareness about the Stock Market for free. We do extensive fundamental and technical analysis and give recommendations solely based on our research.

Disclaimer: We are not SEBI registered. All the content (videos, comments, posts, community posts, live streaming, etc) of this channel is for educational and informational purposes only, Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions.

-----------------------------------------------------------------------------------------------------------------------------

Resistance BrokenREC Ltd broken a resistance of nearly 8 months and close above 107. I am picking this stock for both investment as well as short term trade. Reasons for picking this trade are :

1. Broken a trendline resistance

2. Good amount of OI added.

3. maintaining consistent numbers in Quarterly results.

4. Giving a rich dividend yield consistently.

This trade is for educational purpose

TATVA ready for some good movesTatva Chintan Pharma Chem Limited is a manufacturer of a diverse portfolio of structure Directing Agents, Phase Transfer Catalysts, electrolyte salts for batteries, and Pharmaceutical and Agrochemical Intermediates, and other Speciality chemicals.

WHY IT MIGHT GIVE A GOOD MOVE NOW:

Tatva's IPO's QIB was oversubscribed by 185.23 times. Meaning, institutions that planned to buy 50,000 shares got only 269 shares in the allotment. After the IPO Listing, the price dropped by 20.62% obviously due to listing gains enjoyed by retailers. For 11 weeks the share price formed a base and gave good time for big hands to accumulate. On the 12th week the price broke out of the IPO Listing price with huge volumes (the day before & the day after also) Out of 5.29 lac shares traded that day, 3.23 lac were traded in the last 30 minutes. This confirms my hypothesis of the Entry of big hands during the breakout. The price then tested 2 times the IPO listing high and took good support on it.

Tatva's Q2 results also dropped on 22nd October (before 3 big volume days) and the Q2 numbers beat both QoQ & YoY numbers which might be the trigger.

Key Points of the Company

Leading Chemical Manufacturer

Tatva Chintan operates in the space of niche specialty chemicals and is a globally recognized specialty chemical player with several market-leading products in its portfolio. The co. is the largest and only commercial manufacturer of structure-directing agents for zeolites in India (second globally) and caters to a wide range of industries across the globe.

Product portfolio: The company has manufactured over 154 products which can be divided into the following four broad categories

Structure Directing Agents (40% of the revenue) The Company’s SDAs are quarternary salts which are chemicals used in the Zeolite application. Zeolites have varied applications it is promoted with transition metals such as copper and iron to be active for selective catalytic reduction.

Phase Transfer Catalysts (27% of the revenue) PTC’s are widely used in green chemistry applications and are used for a variety of industrial processes. Phase transfer catalysts are a type of catalyst that allows a reactant to be migrated from one phase to another.

Electrolyte salts for supercapacitor batteries (1% of the revenue) The Company’s electrolyte salts are used in the manufacture of supercapacitor batteries, which are used in automobile batteries and other batteries. The Company is the largest producer of electrolyte salts for supercapacitor batteries in India.

Pharmaceutical, agrochemicals, and other specialty chemicals (30% of the revenue) The products manufactured by the company under this category are used in the manufacture of various pharmaceutical and agrochemical products as intermediates, disinfectants, and catalysts, and solvents. In addition, the company also manufacture specialty chemicals under this category that are used in dyes and pigments, personal care ingredients, flavor, and fragrance sectors

The Company has 47 products under their SDA product portfolio, 48 products under the PTC product portfolio, 6 products under the electrolyte salts for supercapacitor batteries portfolio, and 53 products under their PASC portfolio.

Manufacturing facilities

The Company operates through two manufacturing facilities situated at Ankleshwar and Dahej in Gujarat, both of which are strategically located very close to the Hazira port. These manufacturing facilities have an annual installed reactor capacity of 280 KL and 17 Assembly Lines.

Exports-driven

The company derives a majority of its revenue through exports (71% of the revenue) with Germany, the U.S., and China together accounting for 54.20%. Its top 10 customers constitute 60% of revenue.

Clientele List

The customers of the Company include Merck, Bayer AG, Asian Paints Ltd., Ipox Chemicals KFT, Laurus Labs Ltd, Tosoh Asia Pte. Ltd., SRF Limited, Navin Fluorine International Limited, Oriental Aromatics Ltd., Atul Limited and many others.

R&D Infrastructure

The company has a dedicated R&D facility, recognized by the DISR at Vadodara, Gujarat. The company has developed 53 products in the last three years which contributed 6.5 Crs revenue for the company.

Successful listing

The company got listed on the secondary exchanges on July 29 2021 with a 114% premium from its issue price. The 500 Crs issue got subscribed 180 times and became the most over subscriber IPO of 2021. The issue constituted of 275 Crs Offer for sale by the promoters and a fresh issue of 225 Crs.

Growth Strategies:

Expanding the Manufacturing Capabilities:

The Company has consistently grown its manufacturing and production capabilities. The Company’s aggregate manufacturing capacity has increased at a CAGR of 20.59% from an aggregate reactor capacity of 82 KL and zero Assembly Lines in FY2010 to 280 KL Reactor Capacity and 17 Assembly Lines as of FY21. The company will expand its Dahej Manufacturing facility and upgrade its R&D Infra with a CAPEx to the tune of 170 Crs.

Expand the existing product portfolio

The Company plans to continue to increase offerings in their current business segments as well as diversify into new products by tapping into segments which in the view of the company’s management have attractive growth prospects.

Masfin stock analysis

1. Today we'll discuss another company which is MAS FINANCIAL SERVICES LTD

2. Today Date is 12-09-2021.

3. Currently stock is trading at 758.40 which is shown in candle chart.

4. There is short term target which is 972, which is shown in image above, from 758.40 to 972, which is approximately 28% gain. Stock is now trading at support level.

5. How much time it takes to reach target, according to my analysis, it takes maximum 2-3 month.

6. About company:- MAS Financial Services Ltd is giving Micro loan, Small and Medium Enterprise loans, Two Wheeler Loan and Commercial Vehicle Loans etc. Furthermore information you can visit company official website.

IMPORTANT RULES

07. Only invest 3 % of your capital in one stock, Please don't ignore this rule because we are investing our hard-earn money here so risk management is best part of trading.

08. We never sell stock in loss.

09. We are investing in equity share.

10. Patience is the key in equity, sometime great company went down that is the opportunity to buy these companies because we know they will come back very quickly.

Disclaimer:- I'll post here stocks analysis for educational purpose where you can learn, not a recommendation of stocks buy or sell. Before buying or selling any stock

HESTER BIO SCIENCE,DAILY LINE CHART HESTER BIO SCIENCE,DAILY LINE CHART

STUDY AND INVEST ,not a buy recommendation

CHART LOOKS GOOD,

CURRENTLY STOCK PRICE Moving through a short term descending channel the trendline ,200 DAY MA is immediate support .STUDY THE FUNDAMENTALS ,Watch concalls and investor presentation for more idea about future plans of the company.

LOOKS TOO GOOD TO ACCUMULATE AT THESE LEVELS!!!This simply looks too good, both, technically and fundamentally as well, the formations are good, stock seems to be retesting the breakout levels and this is considered to be one of the best times to get into any stock, a buy is strongly recommended in the bracket of 1010-1050 with a stop-loss of 980 for higher targets.

Happy Investing :)