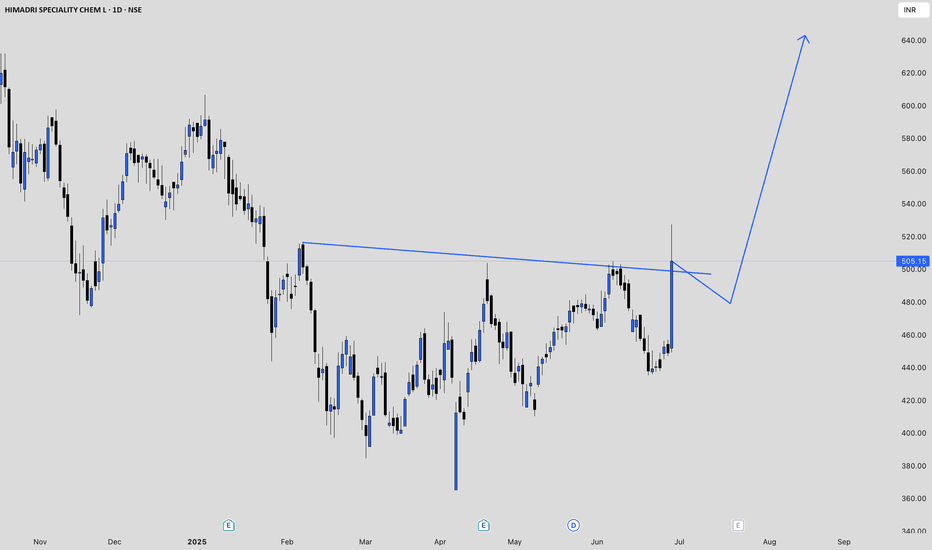

HSCL Price actionHimadri Speciality Chemical Ltd has shown a strong bullish reversal in its latest trading sessions. The stock jumped over 12% in a single day, closing above ₹505 after a previous close near ₹449, supported by high trading volumes and renewed buying interest. Over the past week, the share price has gained nearly 15%, and its three-month return is above 17%. Despite this surge, the stock is still about 24% below its 52-week high, indicating it is recovering from a broader correction.

Technically, a bullish signal was triggered with a recent short-term moving average crossover, which often points to further short-term gains. The company’s fundamentals remain solid, highlighted by strong return on equity, low debt, and a high growth trend, but the stock is trading at elevated valuations compared to sector averages.

In summary, Himadri Speciality Chemical Ltd is experiencing strong short-term momentum with positive technical and fundamental signals, though it remains in recovery mode after earlier declines and is trading at a premium valuation.

Gartley

KIRLOSBROS Price actionKirloskar Brothers Ltd (KIRLOSBROS) has experienced a strong upward trend recently, with the stock price rallying sharply from lower levels earlier in June 2025. The price reached a high above 2,200 INR before encountering some resistance and pulling back slightly. This surge was accompanied by increased trading volumes, indicating heightened interest from market participants.

The overall trend remains positive, supported by the company's solid annual financial performance, despite a dip in the most recent quarterly earnings. The stock is currently trading near the upper end of its recent range, which can sometimes lead to short-term corrections or consolidation as traders take profits. However, the long-term outlook is constructive, with forecasts suggesting the potential for further gains if the positive momentum continues and the company maintains its growth trajectory.

In summary, KIRLOSBROS is in a strong uptrend with notable volatility. Short-term pullbacks are possible, but the underlying fundamentals and recent price action indicate continued investor confidence in the stock’s prospects.

KAYNES Price actionKaynes Technology has demonstrated strong financial performance, with significant growth in both sales and profits over the past year. Net sales increased by over 55% and net profit rose nearly 75%, supporting its position as a market leader with robust fundamentals and high institutional confidence. The stock has outperformed the broader market, delivering a return of over 43% in the past year.

Recently, the stock has shown some volatility. After reaching highs above 6,000 INR in May and early June 2025, the price has pulled back, with recent closes in the 5,700–5,900 INR range. Short-term technical indicators present a mixed picture: the RSI is around 55, suggesting neither overbought nor oversold conditions, while the MACD is slightly negative, indicating mild bearish momentum. The technical strength is rated as mildly bearish, but profitability remains strong.

Despite the recent dip, long-term forecasts remain positive, with projections suggesting potential for double-digit percentage gains over the next year and substantial growth over a five-year horizon. Institutional holdings are high, reflecting continued confidence from large investors. In summary, Kaynes Technology combines strong financials and market leadership with short-term technical caution, but its long-term outlook remains constructive.

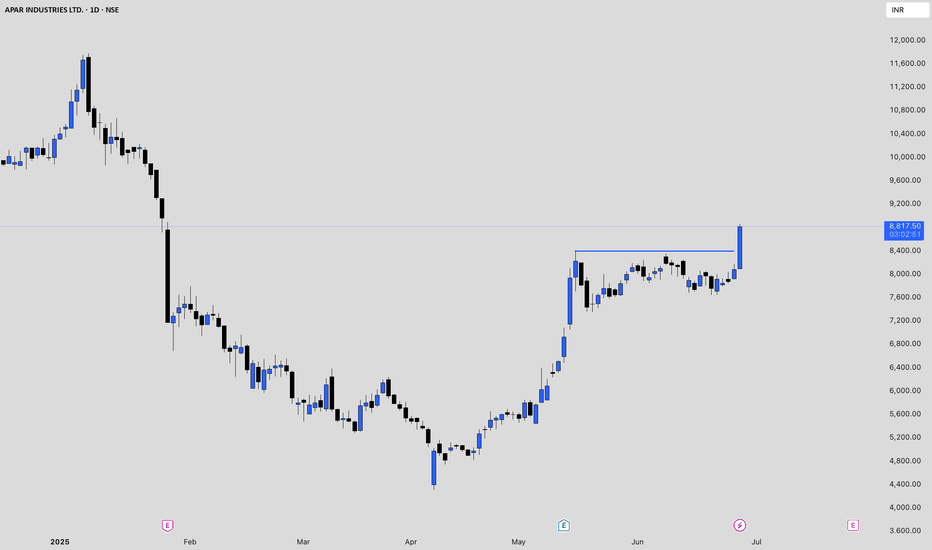

APARINDS Price actionAPAR Industries (APARINDS) is currently trading between ₹8,083 and ₹8,620 per share as of June 26, 2025. The stock is down about 31% from its 52-week high of ₹11,779.90 (reached in January 2025), but it remains 85% above its 52-week low of ₹4,308.05 (from April 2025). Over the past six and twelve months, APARINDS has delivered negative returns of -22.68% and -16.58%, respectively, reflecting a significant correction after a strong rally earlier in the year.

Valuation-wise, the stock has a price-to-earnings (P/E) ratio of around 39, which is lower than the industry average of 59.33 but still considered high. The price-to-book (P/B) ratio stands at 7.21, and the dividend yield is modest at about 0.63%. The company’s earnings per share (EPS) for the trailing twelve months is ₹204.46.

Financially, APARINDS reported revenue of ₹185.81 billion and a net profit of ₹8.21 billion for the trailing twelve months, with a net profit margin of roughly 4.4%. The company maintains a low debt-to-equity ratio of 0.13 and a strong return on equity (ROE) of 18.24%. Growth remains robust, with standalone net sales up 17.87% year-on-year in March 2025 and quarterly net profit rising by 2.45% year-on-year.

Analysts forecast an average one-year target price of ₹9,122, with estimates ranging from ₹6,672 to ₹11,025, suggesting about 8% upside from current levels. Over the next three years, revenue and net income are expected to grow at a compound annual rate of 14–17% and 15–18%, respectively, while EPS is projected to increase by about 15.3% per year. ROE is expected to reach around 20% within three years.

Key strengths for APARINDS include strong revenue and earnings growth, high promoter holding (57.77%), low leverage, and a robust ROE. The main risks are its high valuation, which may limit near-term upside, and the recent negative returns, which indicate some profit-taking or correction after earlier gains.

In summary, APARINDS remains fundamentally strong with solid growth prospects, but investors should be mindful of its premium valuation and recent price volatility when considering entry.

NEWGEN Price Action**NEWGEN (Newgen Software Technologies) Price Analysis – June 2025**

**Current Price & Trend**

- Latest price: Around ₹1,148 as of June 16, 2025.

- The stock has recently shown a mildly bearish technical trend, with daily moving averages and the monthly MACD indicating caution.

- Short-term signals (as of early June) are bearish, with a 5-day EMA crossover and stochastic crossover suggesting further downside. Historically, such signals have led to average declines of 3–11% over the following days and weeks.

**Technical Indicators**

- Most short-term moving averages are giving sell signals, and several oscillators (Stochastic, CCI, Williams %R) are in oversold territory.

- RSI is neutral, and the MACD is mixed (bullish weekly, bearish monthly).

- Pivot points suggest support near ₹922–₹928 and resistance around ₹931–₹936.

**Fundamentals**

- FY25 net profit: ₹315 crore (+20.5% YoY); revenue: ₹1,487 crore (+19.5% YoY), driven by strong growth in APAC and US markets.

- The company is almost debt-free and has delivered 34% CAGR profit growth over five years.

- Return on equity (ROE) is strong at 23%, and ROCE is 28.6%.

- Dividend yield is 0.44%.

- The stock is considered overvalued, trading at a P/E of 51.6 and nearly 11 times book value.

**Other Points**

- Promoter holding has slightly decreased in the last quarter.

- Working capital days have increased, which could affect cash flows.

**Summary**

NEWGEN is fundamentally strong, with robust profit and revenue growth, high ROE, and almost no debt. However, the stock is currently overvalued and showing mildly bearish technical signals in the short term. Investors should be cautious at current levels and watch for a technical reversal or improved valuations before considering fresh entries.

JUBLFOOD price actionJUBLFOOD (Jubilant Foodworks) is currently trading at ₹681.45 as of June 13, 2025, up 2% for the day. Over the past year, the stock has gained about 26.5%, though it remains roughly 14% below its 52-week high of ₹796.75 and about 30% above its 52-week low of ₹522.25.

Technically, the stock is showing mixed signals. The RSI is neutral around 49.5, while MACD and ADX are giving sell signals. However, most short-term moving averages (except the 5 and 50-day) are showing buy signals, and the price is currently above the VWAP, indicating some short-term strength. The Stochastic RSI is in the overbought zone, suggesting caution.

Fundamentally, JUBLFOOD is trading at a high P/E of 197, which points to an expensive valuation. Its book value is ₹31.9, with the stock trading at over 21 times book value. The dividend yield is low at 0.18%, and the average ROE over three years is moderate at 13.8%. The company remains a leader in the quick-service restaurant sector in India, holding franchise rights for Domino’s, Dunkin’ Donuts, and Popeyes.

Analysts have a wide range of price targets, from as low as ₹516 to as high as ₹1,000. While the company’s fundamentals are strong, the high valuation and mixed technicals suggest investors should be cautious. The short-term trend is up, but further upside will depend on sustained buying and a breakout above resistance levels.

BIRLACORPN Price actionBirla Corporation Ltd (BIRLACORPN) closed at approximately ₹1,385.20 on June 6, 2025, reflecting a 1.65% gain over the previous session . The stock has shown strong recent momentum, rising 31.34% over the past month . However, over the past year, the company’s market capitalization has slightly declined, currently standing at around ₹10,642 crore .

The stock’s 52-week high is ₹1,656.10 (reached on June 27, 2024), and its 52-week low is ₹901.85 (on March 4, 2025), indicating significant volatility within the past year . Birla Corporation’s all-time high is ₹1,801.25, set in February 2024 .

On the financial front, for the quarter ended in 2025, Birla Corporation reported a consolidated profit of ₹256.60 crore on total income of ₹2,863.14 crore. For the year ended 2024, profit stood at ₹420.56 crore on revenue of ₹9,662.72 crore . Despite this, the company’s sales growth has been modest, with a 5.91% increase reported recently .

Analyst sentiment has turned positive following recent quarterly results, with ICICI Securities issuing a ‘Buy’ rating and a target of ₹1,540, citing the stock’s upward momentum after strong Q4 performance .

In summary, Birla Corporation is experiencing a strong short-term rally and has rebounded sharply from its 52-week low. While profitability and revenue remain solid, overall sales growth has been modest. The stock is currently trading closer to the upper end of its yearly range, and analyst outlook is optimistic following its latest results .

ADANIGREEN Price actionAdani Green Energy Ltd (ADANIGREEN) closed at ₹1,009.50 on June 6, 2025. The stock has shown notable volatility in recent months. Over the past month, it gained nearly 10%, and over the last three months, it’s up 18.25%. However, longer-term performance is weaker, with a 6-month decline of 18.38% and a significant 45% drop over the past year .

The stock’s 52-week high is ₹2,091, while the 52-week low is ₹758, indicating substantial price swings. ADANIGREEN trades at a high valuation, with a P/E ratio of 112.77 and a P/B ratio of 7.21, both well above sector averages (sector P/E: 20.60; sector P/B: 3.07), suggesting the stock is priced at a premium .

Operationally, Adani Green has reported robust growth, with revenue expanding at an average annual rate of 38.37% over the last five years, significantly outpacing the industry average. The company continues to expand its renewable energy capacity, targeting 5 gigawatts of new installations this year and aiming for 50 gigawatts by 2030. Despite project delays and regulatory challenges, Adani Green has improved its financial position through cost reductions and refinancing, and it remains well-funded for future growth .

Analyst sentiment is generally positive, with most recommending a ‘buy’ at current levels, citing strong operational performance and growth prospects. However, the high volatility (nearly four times that of the Nifty index) and premium valuation mean the stock carries elevated risk .

In summary, Adani Green Energy is a leader in renewable energy with strong growth and expansion plans, but its stock is highly volatile and currently trades at a substantial premium. Investors should weigh the company’s aggressive growth trajectory and industry leadership against its recent price declines and high valuation multiples.

KEC Price ActionKEC International’s share price as of June 6, 2025, is around ₹889.25, reflecting a 2.16% increase from the previous close. Over the past month, the stock has surged by 28.8%, and it is up 6.83% in the last week, showing strong short-term momentum. However, over the last six months, the stock is down by 26.85%, indicating significant volatility in the medium term .

The company is currently trading at a price-to-earnings (P/E) ratio of 40.6 and a price-to-book (P/B) ratio of 4.33, both of which are considered high compared to the sector average P/E of 28.9. This suggests that the stock is priced at a premium relative to its peers . The dividend yield stands at 0.63% .

KEC International recently secured new orders worth ₹2,211 crore across various segments, including Transmission & Distribution, Oil & Gas Pipelines, and Cables. This has contributed to a 40% year-to-date growth in orders and strengthened its international order book. As a result, analysts maintain a ‘Buy’ rating, with target prices ranging from ₹911 to ₹998, and some suggesting a potential 10% upside from current levels .

Financially, the company’s trailing twelve-month earnings per share (EPS) has grown by 58.95% year-on-year, and the company has a market capitalization of about ₹23,295 crore . The stock hit its 52-week high at ₹1,313.25 and its 52-week low at ₹627.45, highlighting its volatility over the past year .

In summary, KEC International is showing positive short-term momentum, backed by strong order inflows and optimistic analyst ratings. However, its high valuation multiples and recent volatility suggest that investors should approach with some caution, balancing growth prospects against the premium pricing and market fluctuations .

IDEAFORGE Price action## ideaForge Technology Ltd (IDEAFORGE) Price Analysis

**Current Price and Recent Performance**

As of June 3, 2025, ideaForge Technology Ltd (IDEAFORGE) is trading at approximately ₹529 on the NSE . The stock has experienced significant volatility in recent months, with a 52-week high of ₹864 and a low of ₹301 . Over the past few weeks, the price has rebounded sharply from the ₹360–₹400 range in early May to above ₹520 by the end of May, indicating strong recent momentum .

**Valuation and Financials**

- Market capitalization stands at about ₹2,413 crore .

- The stock is trading at roughly 3.9 times its book value, which is considered high for its sector .

- Return on capital employed (ROCE) is negative at -9.36%, and return on equity (ROE) is also negative at -9.81% for the latest period, reflecting operational challenges or recent losses .

- The company is almost debt-free, which is a positive factor for financial stability .

- No dividends have been declared, and the company’s interest coverage ratio is low, suggesting limited ability to cover interest expenses from profits .

**Operational Highlights and Risks**

- ideaForge operates in the unmanned aircraft systems (UAS) segment, a high-growth and innovative sector .

- Promoter holding is relatively low at 29.2%, which may affect investor confidence .

- The company’s debtor days and working capital days have increased significantly, indicating potential challenges in cash flow management .

- Over the last three years, ROE has averaged just 0.86%, highlighting weak profitability .

**Recent Price Action**

- After a sharp rally from ₹360 in early May to over ₹530 by the end of the month, the stock has stabilized in the ₹528–₹559 range in early June .

- Trading volumes have been high during this period, suggesting increased investor interest and possible speculative activity .

**Summary**

ideaForge Technology Ltd has shown strong recent price momentum but faces fundamental challenges, including negative returns, high valuation relative to book value, and growing working capital requirements. The company’s debt-free status and position in a high-potential industry are positives, but weak profitability and low promoter holding are key risks. Investors should monitor operational improvements and cash flow management before considering long-term positions .

Nalwa Sons Investment Ltd. (NSIL) Price Analysis### Nalwa Sons Investment Ltd. (NSIL) Price Analysis as of April 1, 2025:

#### **Current Price and Recent Trends**

- **Current Price (April 1, 2025):** ₹6,594.30 (Range: ₹6,268.53 - ₹6,895.56)

- **Previous Close (March 31, 2025):** ₹6,449.86

- **52-Week Range:** ₹2,245.15 - ₹9,974.00

- **All-Time High:** ₹9,974.00

#### **Key Metrics**

- **Market Cap:** ₹3,113 crore .

- **P/E Ratio (TTM):** 42.08 (High compared to sector average of 31.94)

- **Book Value Per Share:** ₹15,518.22 .

- **Dividend Yield:** 0%

#### **Technical Indicators**

- **Technical Strength:** Strong bullish momentum observed recently

- **RSI and EMA Trends:** Indicate positive momentum with potential for short-term gains

- **Volume Trends:** Average 20-day volume at 12,620 shares with a delivery percentage of 65.43%

#### **Forecast**

- **Short-Term Forecast (April 2, 2025):** Projected price range of ₹6,320.26 - ₹6,934.05 with an expected close around ₹6,613.46

- **Long-Term Outlook:** Potential growth of approximately 6.81% in one year with a target price of ₹6,570.93

#### **Strengths and Weaknesses**

**Strengths:**

- Excellent stability and strong technical indicators.

- Low Price-to-Book ratio of 0.39 suggests undervaluation relative to book value

**Weaknesses:**

- High P/E ratio indicates expensive valuations.

- Low profitability metrics such as ROA (0.45%) and ROE (0.53%)

Graphite Price analysisGraphite India Ltd's share price is currently around ₹530.95 to ₹555.45 as of May 29, 2025. The stock has shown strong short-term momentum, gaining over 20% in the past month and more than 40% in the last three months. However, its one-year return is negative, down about 4–6%, underperforming the broader Sensex, though its five-year return remains impressive at over 190% .

Analyst sentiment is positive, with both covering analysts rating the stock as a "Strong Buy." Their average 12-month target price is ₹654, representing an upside of about 20–23% from current levels . The highest target is ₹718 and the lowest is ₹590 .

From a valuation perspective, Graphite India trades at a price-to-earnings (P/E) ratio of about 22–23x, which is significantly lower than its peer average (42x) and the broader Indian electrical industry average (nearly 40x). This suggests the stock is relatively undervalued compared to its sector . The estimated fair value per discounted cash flow models is around ₹421, so the current price is above fundamental fair value, but still below the fair P/E valuation of 49.8x .

Recent financials show volatility: revenue and net income have fluctuated quarter to quarter, with a notable recovery in Q1 FY25 after a loss in the previous quarter. Net profit margin also rebounded to 7.36% in the latest quarter .

Technically, the stock is experiencing mixed signals. Weekly indicators like MACD and Bollinger Bands suggest a mildly bullish trend, but monthly indicators remain sideways to mildly bearish. The daily trend is mildly bearish, reflecting some short-term caution despite strong recent gains .

In summary, Graphite India has recently rebounded sharply but remains below its 52-week high. It is seen as undervalued relative to peers, with analysts expecting further upside. However, technical and fundamental signals are mixed, so investors should watch for continued volatility and monitor quarterly performance for sustained recovery .

Sobha Ltd's Price AnalysisSobha Ltd's share price as of late May 2025 is trading in the range of ₹1,349.60 to ₹1,386.10, with recent sessions showing minor fluctuations and a slight upward move from the previous close. Over the past year, the stock has declined by nearly 29%, though its longer-term performance remains strong, with a five-year return exceeding 600% .

From a valuation perspective, Sobha is trading at a high price-to-earnings (P/E) ratio of about 225–241, which is significantly above the industry average and suggests the stock is priced for substantial future growth or that current earnings are relatively low. Its price-to-book (P/B) ratio is also elevated, at around 4.25–5.85 times, indicating a premium to its book value. The intrinsic value estimate is much lower than the current market price, at approximately ₹538.36, suggesting the stock is overvalued by fundamental metrics .

Analyst sentiment remains largely positive, with about 76% of analysts recommending a buy and an average target price of ₹1,580.88, indicating a potential upside of around 15% from current levels. The highest analyst target is ₹2,459, while the lowest is ₹1,150, reflecting a wide range of expectations .

Recent financial trends show revenue growth over the last three quarters, with net profit margins improving but still modest. Mutual fund holdings have slightly increased, and promoter holdings remain stable, both of which are generally positive indicators. However, the company has a low interest coverage ratio and has delivered poor sales growth over the past five years, signaling some underlying financial risks .

Technically, the stock has shown short-term bearish signals, with a recent moving average crossover historically leading to declines in the following week. Despite this, the long-term outlook from analysts remains constructive, and historical data shows that Sobha has often delivered positive returns in May, with an average change of 6.85% for the month over 17 years .

In summary, Sobha Ltd's stock is currently trading at a premium, with high valuations and mixed short-term signals, but it remains favored by analysts for its long-term growth potential. Investors should weigh the optimistic forecasts against the elevated risk implied by current valuations and recent negative momentum.

Trident Ltd. Price Analysis (as of May 23, 2025)#### **Current Price and Recent Movement**

- **Latest Price:** ₹32.11 (down 2.32% from the previous close) .

- **1-Week Return:** +9.29%

- **1-Month Return:** +9.11%

- **1-Year Return:** -15.39%

- **3-Year Return:** -32.89%

#### **Technical Analysis**

- **Buy Signal:** A 200-day moving average crossover occurred on May 21, 2025. Historically, this signal has led to an average gain of 6.61% within 30 days .

- **Momentum Indicators:**

- **RSI:** 62.17 (shows moderate bullish momentum)

- **MACD:** 0.535 (bullish signal)

- **Stochastic:** 75.40 (approaching overbought zone)

- **Supertrend:** 26.03 (bullish)

- **ROC:** 10.87 (positive momentum)

- **Analyst Sentiment:** 100% of analysts currently recommend a "Buy" with an average target price of ₹38, indicating a potential upside of ~15.6% .

#### **Fundamental Overview**

- **P/E Ratio:** 44.50–45.65 (well below the industry average of 126.09, but still high relative to earnings growth)

- **Price-to-Book Ratio:** 3.62–3.88

- **Dividend:** Announced ₹0.5 per share (record date: May 27, 2025) .

- **Net Profit Margin:** 5.78% (FY24)

- **Return on Equity:** 9.04% (FY24)

- **Debt/Equity:** 0.48 (moderate leverage)

- **Intrinsic Value Estimate:** ₹9.73 (suggests current price is at a premium to intrinsic value)

#### **Recent Financial Performance**

- **Q3 FY25 Revenue:** ₹1,667.09 crore (down 9.17% YoY)

- **Profitability:** Net profit/share for FY24 was ₹0.76, down from ₹0.83 in FY23

- **Expense Management:** Interest expense is low at 1.86% of operating revenue; employee cost is 13.2%

#### **Strengths**

- Strong technical momentum and recent bullish crossover.

- Consistent dividend payout.

- Low interest expense and moderate leverage.

#### **Weaknesses**

- Declining revenue and profit over the last few quarters.

- High valuation relative to earnings and intrinsic value.

- Long-term returns have been negative over 1 and 3 years.

#### **Outlook**

Analysts remain bullish in the short term, buoyed by technical signals and an expected price target of ₹38 . However, fundamental concerns such as declining profits, high P/E, and premium to intrinsic value warrant caution for long-term investors.

---

**Summary:**

Trident Ltd. is showing short-term bullish momentum with positive technical indicators and analyst sentiment. However, investors should be cautious due to weak long-term performance, high valuation, and recent declines in revenue and profit .

FSL price actionFirstsource Solutions Ltd (FSL) on the NSE is trading at ₹385.55 as of May 23, 2025 . The stock has shown strong performance over the past year, with a return of 87.31% and a five-year return exceeding 1,100% . FSL’s 52-week high is ₹422.30, while the 52-week low is ₹176.25 .

Recent price action shows that after peaking near its all-time high in January 2025, FSL corrected but has since rebounded sharply from the ₹320–₹330 range in early May to the current levels. Trading volumes have been robust during this rally, indicating strong market participation.

Technically, FSL is in a bullish trend, but short-term volatility remains high. Key support is seen around ₹355–₹360, while resistance is near ₹385–₹422. Sustained trading above ₹385 could open the way for a retest of the all-time high. The stock is considered high risk, being over three times as volatile as the Nifty index .

Fundamentally, FSL reported a 29.4% year-on-year revenue growth in Q4 FY25, driven by its healthcare and banking verticals. The company is focusing on client diversification and operational efficiency, with a projected 12–15% revenue growth for FY26. Its P/E ratio is 43.34 and P/B ratio is 6.96, both above the sector average, reflecting premium valuations .

In summary, FSL is in a strong uptrend with positive momentum and robust financial performance, but short-term volatility and premium valuations warrant cautious optimism for new investors .

ASTRAL price action analysis Astral Ltd (ASTRAL) has shown a mix of volatility and recovery in May 2025. After a sharp decline earlier in the month, the stock rebounded, with recent prices moving from the ₹1,330–₹1,350 range up to ₹1,377.70 as of May 21, 2025. The trading volumes have remained strong, indicating active participation from both buyers and sellers.

Technically, Astral is trading above its short-term volume-weighted average price (VWAP) of around ₹1,362.9, which is a positive sign for near-term momentum . The price action over the past week has included both sharp drops and quick recoveries, suggesting a tug-of-war between bulls and bears. Oscillators and moving averages currently indicate a neutral to mildly bullish setup, with the stock having recovered from oversold levels seen earlier in May.

Astral’s 52-week high is ₹2,454, and the 52-week low is ₹1,232, showing that the current price is closer to the lower end of its yearly range . The price-to-earnings (P/E) ratio remains high (around 70), and the price-to-book (P/B) ratio is also elevated, reflecting premium valuations . The company’s fundamentals remain strong, but the high valuation and recent volatility suggest that further upside may require continued earnings growth or positive sector developments.

In summary, Astral is currently in a recovery phase after recent volatility. The technical outlook is neutral to slightly positive as long as the stock holds above the VWAP and key short-term support levels. Investors should watch for sustained moves above ₹1,380–₹1,400 for confirmation of renewed bullish momentum, while a drop below ₹1,350 could signal renewed weakness.

KSCL chart analysisKaveri Seed Company Ltd (KSCL) has recently experienced significant volatility. After reaching a peak above ₹1,480 in mid-May 2025, the stock corrected sharply, falling to the ₹1,305–₹1,345 range by May 16, marking a notable pullback of nearly 9% in a single session. Trading volumes have been high, indicating strong market participation during both the rally and the subsequent sell-off.

From a technical perspective, KSCL’s price remains above its 50-day, 100-day, and 200-day exponential moving averages, which suggests that the longer-term trend is still bullish. However, momentum indicators such as the Relative Strength Index (RSI) and Commodity Channel Index (CCI) are both in oversold territory, signaling that the recent correction may have been overdone and that a technical bounce could be possible if market sentiment improves. The Moving Average Convergence Divergence (MACD) is below its signal line, and the Average Directional Index (ADX) indicates the presence of a short-term downtrend.

Immediate support for KSCL is seen around ₹1,232, with further support at ₹1,174 and ₹1,116. On the upside, resistance is expected near ₹1,399, then at ₹1,457 and ₹1,515. The near-term pivot area is around ₹1,340–₹1,350.

Recent company developments—including the acquisition of a 30% stake in Aditya Agri Tech Pvt Ltd and the release of Q4 and FY25 results—may be influencing the current price action. The company has also been working to address challenges in receivables management, which could impact future performance.

In summary, KSCL is in a corrective phase after a strong rally, with oversold technical indicators suggesting potential for a short-term rebound if support holds. However, the short-term trend remains down, so traders should watch for stabilization above key support levels before considering new long positions. The longer-term outlook stays positive as long as the price remains above major moving averages, but caution is advised due to ongoing volatility and bearish momentum signals.

## NORTHARC Price Action Analysis

### **Recent Price Performance**

- **Current Price:** As of the latest available data, Northern Arc Capital Ltd (NORTHARC) is trading around ₹208–213.

- **Volatility:** The stock is showing a volatility of about 4.14% with a beta of 1.37, indicating higher-than-market volatility.

- **52-Week Range:** The price has ranged from a low of ₹141.47 (April 7, 2025) to a high of ₹350.00 (September 24, 2024).

- **Recent Trend:** NORTHARC has fallen by about 8% over the past week but is up nearly 14% over the past month. Over the last year, the stock is down 39% from its highs.

### **Technical Indicators**

#### **Moving Averages**

- **Short-term (20-day EMA/SMA):** Price is near or slightly below the 20-day EMA (₹201.94) and SMA (₹201.11), both indicating a neutral trend.

- **Medium-term (50-day EMA/SMA):** The price is below the 50-day EMA (₹216.61) and SMA (₹218.06), also signaling a neutral to weak trend.

#### **Oscillators**

- **RSI (14):** 34.43, indicating a downtrend and approaching oversold territory .

- **Stochastic RSI (14):** 0.41, signaling a strong downtrend.

- **CCI (14):** -97.09, also confirming a downtrend .

- **MFI:** 25.56, suggesting strong selling pressure and a strong downtrend.

#### **Support and Resistance Levels**

- **Immediate Support:** ₹188.54

- **Key Support:** ₹185.85, ₹181.19

- **Immediate Resistance:** ₹195.89

- **Next Resistance:** ₹200.55, ₹203.24

- **Pivot Level:** ₹193.2

### **Order Book and Liquidity**

- **Order Book:** There is active buying interest around ₹207–208 and selling interest around ₹210–215, indicating a tight trading range and liquidity at current levels.

- **Volume:** Trading volume is robust, with recent daily volumes exceeding 1.6 million shares.

### **Fundamental and Event Context**

- **Recent One-Time Provision:** NORTHARC recorded a significant one-time provision (impairment of ₹1,200 crore) in Q4 FY25, sharply reducing reported profits. Excluding this, underlying business performance was strong, and some analysts expect a rebound in the coming months.

- **Valuation:** The stock is trading at a price-to-book (P/B) ratio of 1.02 and a trailing P/E of 9.49, both below the sector average, suggesting attractive valuations if underlying fundamentals remain stable.

### **Technical Summary**

- **Overall Technical Rating:** Mixed signals. Moving averages are neutral, but oscillators indicate a downtrend and possible oversold conditions.

- **Short-Term Outlook:** The stock is near key support levels, with oscillators hinting at potential for a technical bounce if selling pressure abates. However, sustained weakness below ₹188 could trigger further downside.

- **Medium-Term Outlook:** Recovery potential exists if the stock holds above support and market absorbs the impact of the one-time provision.

---

**In summary:** NORTHARC is currently consolidating near its recent lows, with technical oscillators in a downtrend but approaching oversold territory. The price is below key moving averages, and significant support exists around ₹185–188. The stock may see a technical bounce if support holds, but further downside is possible if it breaks below these levels. The impact of the recent one-time provision is a key factor, with some market participants expecting a rebound as fundamentals normalize.

## CreditAccess Grameen (CREDITACC) Share Price Analysis- As of May 2, 2025, CreditAccess Grameen (CREDITACC) traded around ₹1,121–₹1,145, which is approximately 52% above its 52-week low of ₹750.20 (set in January 2025), but below its 52-week high of ₹1,551.95 (set in June 2024) .

- The stock has shown volatility over the past year, with a notable decline from its peak, reflecting both sector trends and company-specific events .

**Valuation and Financial Metrics**

- **P/E Ratio (TTM):** 20.3–21.2, indicating moderate valuation relative to earnings .

- **Book Value:** ₹438 per share, with the stock trading at about 2.6 times book value, which is considered on the higher side for the sector .

- **Dividend Yield:** Around 0.86–0.89%, with recent dividend payouts .

- **Return on Equity (ROE):** 24.8% (latest year), reflecting strong profitability .

- **Return on Capital Employed (ROCE):** 14.8% .

**Growth and Profitability**

- The company has delivered robust profit growth (35% CAGR over the last 5 years) and strong median sales growth (31.6% over 10 years)

- However, profit growth has turned negative in the trailing twelve months (-35%), primarily due to higher provisioning and write-offs in recent quarters

- The company reported a loss of ₹99.5 crore in Q3 FY25, mainly due to early risk recognition, conservative provisioning, and accelerated write-offs, but management expects this to safeguard future profitability as growth normalizes

**Operational Highlights**

- **Assets Under Management (AUM):** Grew by 6.1% YoY to ₹24,810 crore in Q3 FY25

- **Borrower Base:** Increased by 2.4% YoY to 48.05 lakh customers

- **Branch Network:** Expanded by 8.7% YoY to 2,059 branches

- **Collection Efficiency:** Remained robust at 93.3% (excluding arrears) and 94.1% (including arrears), with improving trends

- **Asset Quality:** PAR 90+ at 2.64%, NNPA at 1.28%, indicating some stress but manageable levels

- **Capital Adequacy:** CRAR at 25.9%, reflecting a strong capital position

**Strengths and Risks**

**Strengths:**

- Consistent long-term growth in profits and sales

- Strong capital position and liquidity buffer

- High collection efficiency and expanding branch network

**Risks/Concerns:**

- Recent decline in promoter holding (-7.42% over three years)

- Low interest coverage ratio, suggesting higher financial risk

- Elevated provisioning and write-offs impacting near-term profitability

- Stock is trading at a premium to book value, which may limit upside if growth slows

**Relative Performance**

- Over the past year, the stock is down 24%, underperforming the broader market, but over five years, it has delivered a 154% return, broadly in line with sector peers

- In the short term (last three months), the stock has rebounded by about 13% from its lows

## Summary

CreditAccess Grameen remains a leading NBFC-MFI with a strong track record of growth and profitability. While recent quarters have seen a dip in profits due to prudent risk management and provisioning, the company’s fundamentals-such as robust capital adequacy, liquidity, and operational scale-remain intact. The stock is moderately valued but carries risks related to asset quality and sector volatility. Investors should watch for normalization of growth and profitability in upcoming quarters, as indicated by management

ERIS Lifesciences Share Price AnalysisEris Lifesciences is currently trading in the range of ₹1,371 to ₹1,474, with the latest reported price at ₹1,474.20 as of April 23, 2025. The stock has shown strong performance over the past year, delivering a return of approximately 57%. Over the last three months, the stock is up about 9%, though it has seen a slight dip of 0.57% in the past month.

**Valuation and Fundamentals**

Eris Lifesciences trades at a price-to-earnings (P/E) ratio of 57.13, which is high for the sector, and a price-to-book (P/B) ratio of 4.53. The company’s earnings per share (EPS) stands at 29.19, and its return on equity (ROE) is 12.63%, indicating moderate profitability. The market capitalization is approximately ₹18,831 crore . The dividend yield is negligible, suggesting the company focuses more on growth than on returning cash to shareholders.

**Analyst Sentiment and Targets**

Analyst sentiment is strongly positive, with nearly 89% recommending a buy and the remainder suggesting hold; there are no sell recommendations. The average long-term price target from analysts is ₹1,512.56, indicating modest upside from current levels.

**Technical and Trading Overview**

The stock has recently traded near its upper circuit of ₹1,659.60, with a lower circuit at ₹1,106.40, reflecting a relatively wide trading band and potential for volatility. Recent trading volumes have been healthy, supporting the current price momentum.

**Summary**

Eris Lifesciences has delivered strong returns over the past year and is viewed positively by analysts. However, its high P/E ratio suggests the stock is priced for continued growth, and the lack of dividend yield may not appeal to income-focused investors. The technical outlook is stable, with the stock trading near its highs and supported by robust trading activity.

NTPC price analysisNTPC is currently trading around ₹360, having shown a modest gain of about 4% over the past year. The stock reached its all-time high of ₹448.45 in September 2024 and has since pulled back, with recent price action reflecting some consolidation after a strong multi-year rally . Over the last month, NTPC has delivered a positive return of approximately 2.5%, indicating some short-term strength despite a slight decline of nearly 1.8% in the past week.

Fundamentally, NTPC remains a large-cap, stable utility with a market capitalization near ₹3.5 lakh crore and a price-to-earnings (PE) ratio of about 15.9, which is below the industry average, suggesting reasonable valuation. The company boasts a healthy dividend yield of 2.5%, and its return on equity (ROE) stands at 13.1%. Promoter holding remains steady at 51.1%, and the company continues to report strong profits, with net profit for the latest fiscal year exceeding ₹20,000 crore.

Analyst sentiment is generally positive, with some brokerages forecasting up to 35% further upside from current levels and price targets ranging between ₹305 and ₹500 for 2025.

Technical indicators and historical trends show NTPC often delivers positive returns in April, with an average gain of about 3% for the month

In summary, NTPC is viewed as a fundamentally sound, dividend-paying stock with moderate growth prospects and reasonable valuation. While the stock is off its recent highs, the outlook remains constructive, supported by positive earnings, stable fundamentals, and favorable long-term forecasts from analysts

## TORNTPHARM Price AnalysisTorrent Pharmaceuticals (TORNTPHARM) is currently trading near ₹3,254, maintaining a strong uptrend over the past several years. The stock has delivered a return of approximately 165% from July 2020 to November 2024, including a stock split, highlighting its consistent long-term growth.

**Valuation and Fair Value**

TORNTPHARM is trading well above its estimated intrinsic value. Independent valuations suggest a fair value in the range of ₹1,560 to ₹1,940 per share, meaning the current market price is overvalued by about 40%. The price-to-earnings (PE) ratio stands at approximately 59–66, which is significantly higher than the sector average of around 49, indicating a premium valuation. The price-to-book (PB) ratio is also elevated at 16, compared to the sector average of 6.29.

**Recent Performance**

The stock has shown positive momentum in the short term, with returns of 3.5% over the past week and 5.7% over the past month. Over the last year, TORNTPHARM has gained nearly 28%, and over three years, the return is more than 128%. Despite some volatility, the stock has outperformed many of its peers and the broader market.

**Fundamental Trends**

Torrent Pharma’s India business, which constitutes the bulk of its revenue, grew by 12% in Q3 FY25, driven by strong performance in branded generics. However, the company faces challenges in international markets, particularly the US, due to regulatory headwinds and pricing pressures. Revenue growth over the past five years has averaged 7% annually, slightly below the industry average, but net income growth has been robust at over 30% per year, outpacing peers.

**Analyst Outlook**

Analysts have a moderately positive outlook, with a one-year price target averaging around ₹3,600, and a range between ₹2,959 and ₹4,200 . About 68% of analysts currently rate the stock as a buy.

**Dividend and Market Cap**

The dividend yield is 0.86%, which is above the sector average, and the company’s market capitalization is approximately ₹1.1 lakh crore, placing it among the larger players in the Indian pharmaceutical sector.

**Summary**

TORNTPHARM has demonstrated strong long-term price appreciation and profitability, but it is currently trading at a significant premium to its estimated intrinsic value. Short-term technicals are mixed, with some bullish undertones, but caution is warranted due to high valuation multiples. The company’s growth is primarily driven by its domestic business, while international operations face ongoing challenges. Analyst sentiment remains positive, but the upside may be limited unless earnings growth accelerates or valuation multiples contract.

Som Distilleries & Breweries Ltd (SDBL) Price Analysis

- **Current Price:** ₹156.00 (all-time high as of April 22, 2025)

- **Day’s Range:** ₹127.66 – ₹143.40

- **Previous Close:** ₹128.38

- **Volume:** 13.36 million (well above 20-day average of 1.34 million)

- **52-Week Range:** ₹95.61 – ₹148.90 (new all-time high today)

- **VWAP:** ₹137.86

- **Market Cap:** ₹2,931 crore

### **Trend & Momentum**

- SDBL has surged sharply, breaking out to a new all-time high with exceptionally high volume, indicating strong bullish momentum

- The stock has rallied over 20% in a single session, moving far above recent resistance levels and its VWAP

- Technical patterns suggest a bullish formation with potential for further upside, possibly another 10% move, according to chartists

### **Support & Resistance**

- **Immediate Support:** ₹143.40 (today’s high), then ₹127.66 (today’s low), and ₹128.38 (previous close)

- **Resistance:** With a new all-time high at ₹156.00, the stock is in price discovery; next resistance will form as the stock trades higher

### **Valuation**

- **TTM PE:** 30.48 (sector PE: 88.54)

- **P/B:** 4.75

- **EPS (TTM):** ₹4.67 (+5.28% YoY)

- **Book Value per Share:** ₹30.02

### **Outlook**

- **Short-Term:** The breakout and volume spike suggest continued bullishness. However, after such a sharp rally, some profit booking or volatility is possible.

- **Medium-Term:** Sustained trade above ₹143–₹148 keeps the trend positive. Watch for consolidation near new highs before the next leg up.

- **Downside Risk:** If the stock falls below ₹143, it may retest support around ₹128–₹130