Gold Trend 29/09Gold rebounded from the new 2-year low. The price has been consolidating during the Asian and European sessions after the market opened at 1628 yesterday. Once the news from BOE hit the market, the surge began. At the US session opening, buying came into the market and cleared the resistance at the trendline(1). The price jumped to the day-high at 1662, with the day ending at 1659, up by USD 31.

The S-T bearish trend has ended as the price trades again above the critical 1650 support. Before it clears the current resistnace at 1660, the price is now trapped in the tight range of 1650-60(1). If the market picks up the bullish momentum later in the European and US sessions, the upside target can again be set at the upper limit of the 1660-90 range.

The gain yesterday formed a clear reversal signal. The following key resistance is now sitting at 1665(4); once it's clear, the upside target can be set at the upper limit of the downtrend channel(5) or the 20-day MA (6).

S-T Resistances:

1676

1665

1660

Market price: 1653

S-T Supports:

1650

1640

1630-28

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

Goldidea

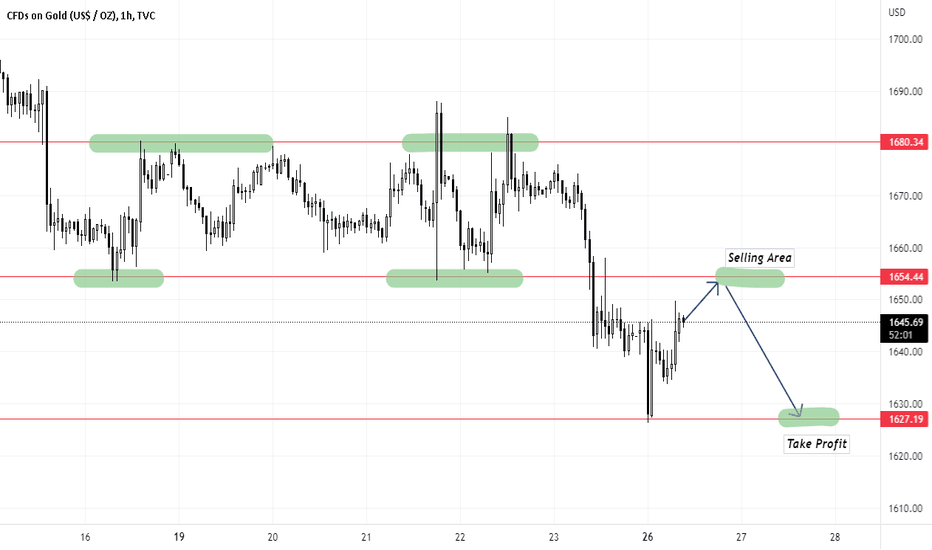

Gold Trend 27/09 - 30/09Gold tested a new 2-year low yesterday. Back from the weekend, gold has dropped to the early low near 1626 in the Asian session. However, the price has quickly rebounded. At the European session, it already reached the day-high at near 1649. Selling resumed in the late US session, where the day ended near the day-low at 1622.

The overall trend in the 1-hour chart is now bearish after the price cleared the 1650(1) support last Friday. Selling momentum so far isn't too strong; an S-T downtrend channel(2) has been formed. Before the price consolidates further, clearing the support at 1620, the downtrend channel(2) can be used as a reference while trading with the 1620-50(3) range.

While the downtrend channel(5) still affects gold's movement, the price has been moving lower tier by tier(4) on the daily chart. The range for each tier is approximately USD40 in the past 4 weeks. Expect the price to be bounded between 1610-50(4.1) temporary before the next move for now.

S-T Resistance:

1650

1645-46

1638-40

Market price: 1633

S-T Supports:

1630

1624

1620

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

Gold Trend 22/09Gold bounced but failed to break out from the range. The day began at 1664 yesterday. The price was bounded by a tight 1660-65 range early in the Asian session. It reached the early peak of 1677 at the EU session after Putin's speech. At the US Fed. The announcement, gold has rebounded quickly from the 1653 day-low to the weekly high of 1688. The day eventually ended at 1673, up slightly from yesterday.

Market reaction was mixed after the US Fed. Meeting. The price is still controlled by the S-T 1660-80(1) range in the 1-hour chart; v can continue to take advantage of this range before it escapes.

The buying support below 1665(2) remains effective as gold hasn't been able to close below it in the daily chart. It will be the first sign of the price going down if it closes below 1665 on the daily chart. On the other hand, if the price fails to sink below 1665 in the next 48 hours, a jump toward 1700 may begin.

S-T Resistances:

1680

1670

1665

Market price: 1661

S-T Supports:

1660

1650-52

1642-40

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

Gold Trend 20/09 - 23/09Gold was steady yesterday near the 2-years low yesterday. The market opens at 1657 back from the weekend. The price was rejected by the key resistance 1680 early in the Asian session, and the price kept moving lower toward the day-low near 1659 until the US session turned active. The day ended up closing at 1675, unchanged from the trading day before.

The downtrend originated from 1730 last Tuesday has completed after gold cleared the resistance from trendline(1) last Friday, and it is now officially bounded by the range 1650-90(3). A triangle pattern(2) has been formed in the past 48 hours while the market is now waiting for the announcement from US Fed. Meeting.

The gold price failed to move below 1650 after it cleared the critical support of 1680. A structural bottom is forming on the daily chart as the buying support below 1665(4) has been strong in the past 48 hours. The US Fed. The meeting will be the turning point; if the price fails to go below 1650 after the US Fed. announcement, the structural bottom will form. After the price clears the 1680 resistance, the upside target can be around 1730.

S-T Resistances:

1697-1700

1687-90

1680

Market Price: 1673

S-T Supports:

1670

1660

1650-52

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

Gold Trend 21/09Awaited Fed. rate decision, gold prices remained stable yesterday. The day began at 1675, where the price overall was trending downward throughout the early Asian and European sessions. It cleared the S-T trendline(1) at the US session and traveled all the way to 1660, the daily low from the day before. The day ended at 1664, down by USD 19.

1660-80(2) can be used as an operating range before the US Fed. An announcement later on today.

Since gold cleared the 1680 support, the downward resistance line(5) is dominating the daily chart trend. The S-T support 1665(4) is still in effect. The Fed. announcement will take over the next major movement.

S-T Resistances:

1687-90

1680

1670

Market price: 1666

S-T Supports:

1665

1660

1650-52

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

Double Top breakout or False breakout #xauusd #gold #gc #xauDouble top breakout in #xauusd. I think will get confirmed after this weeks #FOMC whether is a false one or not.

If confirmed, minimum target = 1450/1400$

Technically, dollar index #dxy looking bullish in longer time frame so quite possible of the #gold targets given above. Only time will tell.

#fingerscrossed.

Happy Trading.

Gold Trend 15/09Gold cleared the 1700 support yesterday. The day began at 1791. The trading was relatively stable during the Asian and European sessions, within the tight range of 1700-07. The price cleared the 1700(1) support late in the US session, pushing the price to the day-low near 1693. The day ended at 1696, down slightly by USD 4.

The market has been quiet since the rapid drop after the US CPIs the day before. An S-T resistance line(2)has been formed in the 1-hour chart in the past 24 hours; gold needs to clear the 1690 support in the European session today. Otherwise, the price will jump back above the downward trendline(2), triggering a new round of buying. If the price breaks the resistance line(2), the S-T upside target can be set at yesterday's high of 1707. On the other hand, 1680 remains the critical support.

The structure hasn't changed much in the daily chart; the price remains in the 1690-1730(4) range. It will be ready to move below 1680 if the price closes below 1695.

S-T Resistances:

1705-07

1700

1697

Market price: 1692

S-T Supports:

1690

1685

1680

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

Gold Trend 14/09Gold pulled back near the 1-week high yesterday. The day began at 1724. and the price was bounded by 1720-30 during the early Asian and European sessions. Once the US released its inflation figures, the price broke out from the uptrend channel(1) and dipped to the day low near 1697. The day eventually ended at 1701, down by USD 23.

Although gold fell more than USD 20 yesterday, it still maintains its position within the 1700-30(2) range in the 1-hour chart. If an S-T rebound began in early trading, the upside target could be set at 1709(3).

The selling has yet to show signs of slowing down on the daily chart. The price may test again at the bottom of the range(4) near 1690, later in the European or the US trading sessions.

S-T Resistance:

1720

1715

1709-10

Market price: 1700

S-T Supports:

1697

1690

1680

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

XAUUUSD LONG PROJECTION XAUUSD BUY PROJECTION

Technical and fundamental Reason for the XAUUSD LONG

1. Last week friday 1d candle closed above the support region of 1710 and denotes the bullish monemtum

2. single candle confirmation indicates bullish as it formed teh Inverted Bullish hammer (Bullish move continued)

3. Formed teh Triangle flag patterna and push higher

Fundamental Reason

DXY reached the 20 year High and retest teh montly low of 108.00 in the following days as expexted

Overall Projection

XAUUSD/GOLD BUY @ 1710-1715

Stoploss - 1690

Target - 1769

Target and stoploss will vary according to the market change and it just an financial advive not a confirm call

GOLDWait And Watch ??

Look for Low risk, High reward, and High Probability setups-

Things to Remember while Trading with the Trend

1. Know what the trend is.

2. The best trades are made in the direction of the trend.

3. Assume that the main trendline or moving average will hold.

4. The longer the moving average is, the better it defines the trend.

5. Wait for the pullback.

6. Don’t chase the market.

7. Don’t fight the market.

8. Even in the strongest trends there should be some retracement.

9. The closer the market is to the trendline, the better the risk/reward ratio is.

10. Use ADX to determine the strength of the trend.

11. Higher the level of ADX , the stronger the trend, below 20 consider the market to be choppy

12. Hold trades longer in a strong trend.

13. Wait for confirmation of a trendline breaking before reversing position.

14. Know where the Support levels are.

15. Place stops outside the Support levels.

Thank You..

Gold Trend 25/08Gold stayed in a tight range yesterday. The day began at 1748, and the price was bounded within 1745-50 early in the Asian & European sessions. It touched the day-low near 1742 before the US session, then the buying came into the market. The day-high reached 1755, with day ending at 1750.

The uplifting momentum has accelerated as the upward trend line shifted from (3) to (3.1) yesterday. The price has cleared the selling resistance between 1750-55 early in the Asian session today, triggered a new round of buying. Once the price clears the next resistance 1760(2), the next upside target will be at 1770-73.

The structure 1730-80(4) dominates the daily chart for now. The 10-day MA(5) is now blocking the upward movement; nce it is cleared, the next target will be at 20 day MA(6).

S-T Resistances:

1775-73

1770

1765

Market price: 1762

S-T Supports:

1759-60

1755

1750

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

Gold Trend 23/08 - 26/08Gold sunk further yesterday. The market opened at 1746. The price first touched the day-high at 1749 in the early Asian session, and the selling began. It went to day-low 1727 at the US session opening, with the day ending at 1735.

The price failed to defend the 1750 and 1740 support on the 1-hour chart, the downtrend channel(1) is still dominating the S-T trend for now. A decent rebound will only begin if the price escapes the downtrend channel(2). The price is now supporting at 1730; before the next break, expect the price to trade within 1730-50(3).

Gold touched the 38.2% retracement yesterday near 1728(5). After it cleared the support of 1750-55, the price touched the next downside support zone, 1730-40(4). If the price closes above 1735, the price should be able to reach 1750-55 in the next 24-48 hours.

S-T Resistances:

1750-55

1745

1740

Market price: 1736

S-T Supports:

1730-27

1720

1710

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

XAUUSD SHORT TERM BUY PROJECTION

XAUUSD SHORT BUY @ 1725-1730

TP 1800

SL 1720

1. Obay Strong FIBO Golden ration of 0.618

2. Respect support zone of 1725-1730

3. Due to sell pressure will retest the swing low of 1725

4. Dxy before reaching teh high of 109,00 will retest the previous low which tends gols to short term Buy

Gold Trend 19/08Gold rallied to a new weekly low yesterday. The market opened at 1761 and traded range-bound early in the Asian and European sessions. The price touched the day-high at the US session opening, then the slide began. It touched the day-low at 1755, with the day's ending at 1758.

The trend reversal signal has yet to appear, where the downtrend channel(1) is still dominating the S-T movement in the 1-hour chart. 1750(2) is still valid; if the price fails to clear the buying support within today, it should be able to stay within 1750-70(2) in the next 24-48 hours.

The breaking of support 1755(4) has not yet been confirmed. If the price breakout from 1755(4), the downside target will be at 1730-40(5).

S-T Resistances:

1765

1760

1755

Market price: 1752

S-T Supports:

1750

1740-43

1735

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

Gold Trend 16/08 - 19/08Gold pulled back from 1800 yesterday. The price has kept on moving down since the market opened at 1801 back from the weekend. After almost 12 hours of sliding, it touched the day-low near 1772 at the US session opening. The day ended at 1778, down by USD 23.

Gold escaped the uptrend channel on the 1-hour chart last week, and it has finally entered the period of consolidation after it cleared the support at 1785. Expect the price to be bearish, where 1773-1800 remains the trading range in the next few days. 1775 is the S-T resistance for now, and it will move lower toward 1755 if it clears the 1770 support.

Gold has been rejected by 1800 in the past few trading days, and the price is now moving downward. Expect the price to consolidate toward 1758(4) or the 20-day MA. The 1680-1800(3) structure can be used as the trading range for M-T.

S-T Resistances:

1800

1790-94

1785

Market Price: 1781

S-T Supports:

1780

1775-73

1770

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To