Gold PA Scalping FrameworkScanning XAUUSD to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial investment. This content is for educational purposes only and should not be considered financial advice. Trade at your own risk.

Harmonic Patterns

XAUUSD/GOLD 1H SELL LIMIT PROJECTION 06.02.26XAUUSD – 1H Sell Limit Projection | 06.02.26

“In this one-hour XAUUSD analysis, gold is currently moving within a broader corrective structure after a strong bearish impulse.

Price is approaching a key descending trendline, where we can also observe a double top formation developing near the resistance zone. This confluence area acts as a high-probability sell limit zone, aligned with previous price rejections.

The marked Resistance R1 and R2 levels highlight strong institutional supply, where sellers are expected to step back into the market. As long as price respects this trendline resistance, bearish continuation remains valid.

On the downside, the projected move targets Support S1, followed by the final bearish objective at Support S2, which also aligns with an upward trendline target acting as liquidity support.

Risk is clearly defined above the resistance zone, while reward is projected toward the lower supports, maintaining a favorable risk-to-reward structure.

This setup is purely based on price action, trendline confluence, and market structure, not indicators.

Always remember: manage risk properly and never exceed your predefined risk per trade.”

CALLED IT - Bitcoin $107K TO $66K (-40% DROP) 🚨 CALLED IT - $107K TO $66K (-40% DROP)

Remember my warning on October 18, 2025?

When everyone was screaming "TO THE MOON" at $107K, I showed you the bearish divergence and said:

"$104K breakdown could trigger a crash to $73K and $49K."

👉 RESULT: Bitcoin dropped from $107K → $66,700

That's -40% Correction, EXACTLY as predicted.

🔰PROFIT BOOKED:

→ Short from $107K to $66,700

→ $40,000+ per CRYPTOCAP:BTC move captured

→ Those who followed saved their portfolio from -40% destruction

🔰 WHAT THE CHART SHOWED:

✓ Weekly bearish divergence confirmed

✓ $104K support trendline broken

✓ Support 1 ($73K) - SMASHED

✓ Now testing $66K-$68K zone

✓ Support 2 ($48K) still possible if this breaks

🔰 THE LESSON:

This is WHY I always tell you: Never blindly follow moonboys.

Everyone wants to hear "$200K coming" but nobody wants to hear "protect your capital."

Retracements happen in EVERY market. Even in bull runs.

Am I bullish long-term? YES.

Do I ignore warning signs? NEVER.

🔰 If you followed this analysis, you either:

Saved your portfolio from -40% crash

Made massive profit on the short

Bought the dip at better prices

This is the power of REAL technical analysis, not hopium.

👉 Share this with someone who needs to see it.

More updates coming. Stay connected.

Gold at a Make-or-Break Harmonic ZoneGold is approaching a critical harmonic completion area, where price action, Fibonacci geometry, and momentum structure are converging. This setup demands attention.

🧠 Market Structure Snapshot

Price has completed a well-defined X–A–B–C structure

The market is currently progressing through the final C → D leg

This leg is projected into a high-confluence Fibonacci resistance zone (PRZ)

📌 Key Insight:

This is not a blind buy or sell zone. Opportunities exist only with structure and confirmation.

📐 Harmonic Breakdown (Step by Step)

🔹 XA — Base Impulse

Strong impulsive decline

Defines the corrective framework

🔹 AB — Corrective Retracement

AB retraced ~0.50–0.618 of XA

Current level ~0.575

✅ Valid harmonic behavior

🔹 BC — Secondary Correction

BC retraced ~0.382–0.886 of AB

Current level ~0.633

✅ Structure intact

🔹 CD — Final Expansion (Current Leg)

CD extension aligning near 1.618

⚠️ Pattern maturity approaching

🎯 PRZ — Potential Reversal Zone (Decision Zone)

🔺 Resistance Cluster

5,279 – Harmonic confluence

5,377 – Intermediate resistance

5,518 – Extreme / invalidation

📍 PRZ Range: 5,279 – 5,518

Expect high volatility and reaction inside this zone.

🟢 If You Want to BUY (Leg D Continuation Trade)

📌 This is a short-term continuation trade, not a trend reversal

Buy Zone: Near 5,000 – 5,050

Stop Loss: Below 4,944

Target (Leg D): 5,279 → 5,377

👉 This trade is valid only if price holds above support and momentum stays positive.

👉 Book profits near PRZ — do not overstay longs.

🔴 If You Want to SELL (After D Completion)

Sell Zone: 5,279 – 5,377 (after rejection)

Stop Loss: Above 5,518

🎯 Downside Targets

T1: 5,000

T2: 4,944

🧪 Confirmation Is Mandatory

Trade only after:

Rejection candles / bearish engulfing

RSI divergence or rejection

Stochastic RSI rollover

MACD momentum slowdown

🧩 Final Takeaway

Gold is in the final phase of a harmonic cycle.

📌 Two-sided Plan:

Buy from support for Leg D

Sell at PRZ after completionhase trade.

BITCOIN CRASH TO $40K INCOMING? Critical Levels You MUST Know!BITCOIN CRASH TO $40K INCOMING? Critical Levels You MUST Know!

Current Status: BTC forming Lower Lows & Lower Highs - Weakness Confirmed.

After breaking below $90K, Bitcoin tested sub-$70K as predicted, reaching a low of $59,809 yesterday before bouncing to $71,750. This volatility liquidated both high-leverage longs and shorts.

Key Levels to Watch:

Bearish Order Block: $77,516 - $79,290

Bearish Order Flow: $86,035 - $90,585

Expecting price to visit these levels before the next leg down.

Trading Plan:

✅ Short Entry Zones: $80K and $90K levels

✅ Strategy: Wait for price reaction at bearish order blocks

✅ Current LL Confirmation: Any HTF candle close above $79,290

Scenarios:

Bearish Case: If rejected from order blocks → Potential test of $50K-$40K range

Bullish Invalidation: HTF candle close above CHOCH at $97,900

Current LL at $59,809 NOT confirmed yet - waiting for HTF confirmation above $79,290.

Best Strategy: WAIT for clear confirmations at key levels before taking positions. Patience is key in this market structure.

Not Financial Advice & ALWAYS DYOR

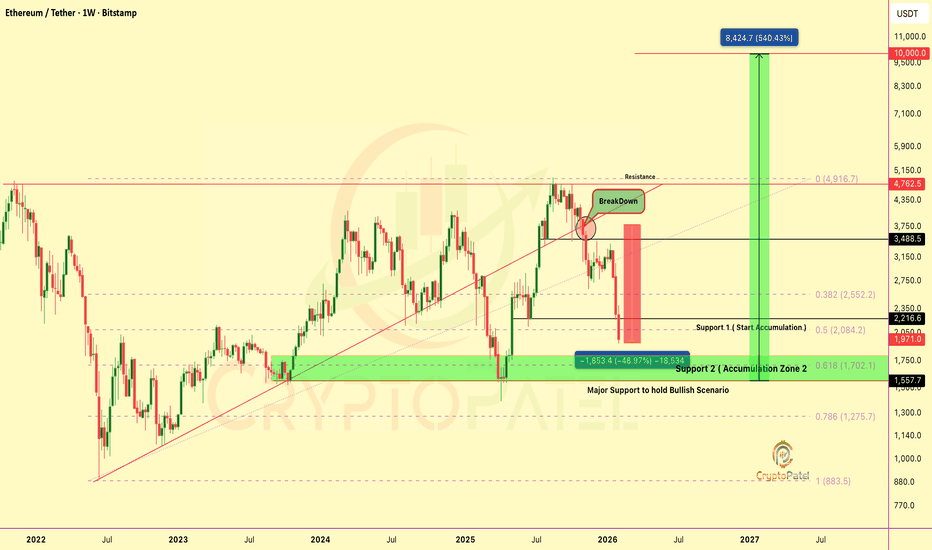

$ETH UPDATE: NOW 48% DOWN FROM MY WARNINGCRYPTOCAP:ETH UPDATE: NOW 48% DOWN FROM MY WARNING

When #ETHEREUM Broke $3,700-$3,600 Support, I warned you about a major breakdown.

✅ From $3,700 → $1,928 (48%) in Just 3 Months

✅ Previous Entry at $2,200-$2000 FILLED

NEW ACCUMULATION ZONE:

🔹 $2,000 - $1,500 (Start Building Positions)

🔹 $1,700 (0.618 Fib - Strong Support, Bid Placed)

🔹 $1,300 (0.786 Fib - Worst Case Scenario Bid)

Why I'm Still Confident:

→ $10K Target (5x from current levels)

→ $15K Target (Extended cycle target)

This is NOT for short-term trades.

This is LONG-TERM spot accumulation.

The best opportunities come when everyone else is fearful.

Fibonacci levels don't lie:

0.618 at $1,700 = Historical bounce zone

0.786 at $1,300 = Maximum pain / Maximum opportunity

My Approach:

Scale in. Don't all-in.

Place bids at key levels.

Let the market come to you.

Remember: In crypto, 500-1000% moves happen every cycle. But only for those who accumulate during fear, not FOMO.

NFA. ALWAYS DYOR.

Part 1 Intraday Institutional Trading ITM, ATM, OTM Options

These describe where the current price is compared to strike price.

a) ITM – In The Money

Call: Current price > Strike

Put: Current price < Strike

ITM options cost more.

b) ATM – At The Money

Current price ≈ Strike price

Most volatile and liquid.

c) OTM – Out of The Money

Call: Current price < Strike

Put: Current price > Strike

OTM is cheaper but risky; goes to zero quickly on expiry.

Part 5 Advance Trading Strategies Why Do Options Have Time Decay? (Theta)

Options lose value as expiry approaches.

This is called Theta Decay.

Example:

Monday premium: ₹100

Thursday premium: ₹20

Expiry day: ₹0

This happens because time is part of the option’s value. If market doesn’t move, buyer loses money; seller gains.

Part 4 Technical Analysis Vs. Institutional Option TradingPut Options (PE) Explained

Put = Right to sell

You buy a put when you expect the price to go down.

Loss is limited to premium paid.

Profit can rise significantly in sharp downtrends.

Example:

If Nifty is at 22,000 and you buy 21,900 PE, you are expecting Nifty to fall below 21,900.

NIFTY- Intraday Levels - 9th Feb 2026If NIFTY sustain above 25708 to then 25729/3347/65 above this wait more levels marked on chart

If NIFTY sustain below 25669/65 then 25630/17/02 below this bearish then around 25576 below this bearish then 25536/26 strong level below this more bearish below this wait more levels marked on chart

My view :-

"My viewpoint, offered purely for analytical consideration, The trading thesis is: Nifty (bearish tactical approach: sell on rise)

Option buyers be cautious as market may stay range bound for next two days (untill expiry) as I'm expecting expiry range between 25700 to 25500 however above this bullish and below this bearish.

This analysis is highly speculative and is not guaranteed to be accurate; therefore, the implementation of stringent risk controls is non-negotiable for mitigating trade risk."

Consider some buffer points in above levels.

Please do your due diligence before trading or investment.

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.

BLUESTARCO 1 Day Time Frame 🔹 Current Price (latest session)

• ~₹1,880.9 – ₹1,880 range (latest live price on 6 Feb 2026) — price fluctuated between ~₹1,834–₹1,886 during the session.

📊 Daily Pivot & Levels (Classic Pivot Style)

Pivot Point (PP): ~ ₹1,817–₹1,818

Resistance:

• R1: ~ ₹1,869 – ₹1,899

• R2: ~ ₹1,918 – ₹1,951

• R3: ~ ₹1,951 – ₹1,995

Support:

• S1: ~ ₹1,786 – ₹1,824

• S2: ~ ₹1,768 – ₹1,815

• S3: ~ ₹1,732 – ₹1,796

📌 What This Implies (Daily Price Action)

Bullish bias if price stays above pivot (~₹1,817):

▪ Break above R1 ~₹1,869–₹1,899 → stronger upside momentum

▪ Sustained moves above R2 ~₹1,918–₹1,951 → further strength

Bearish or corrective pressure if price drops below pivot:

▪ Slide below S1 ~₹1,786–₹1,824 → watch S2 & S3 as deeper supports

▪ Breach of S2/S3 zones suggests weakening of daily structure

📌 Note: These levels are approximate and slightly vary across data providers. Always confirm with live charts from your trading platform before placing trades or orders.

RELIANCE 1 Month Time Frame 📌 Latest Trading Price (market close Feb 6 2026): ₹1,450.85 on NSE/BSE.

📈 Key Resistance Zones (Upside)

₹1,455–₹1,460 — immediate technical resistance (pivot cluster)

₹1,470–₹1,480 — next barrier above recent highs seen in early Feb price swings

~₹1,500 — psychological resistance (round number) — watch if momentum sustains

Bullish scenario: Break and hold above ~₹1,460–₹1,470 with decent volume could point toward ₹1,480–₹1,500 next.

📉 Key Support Levels (Downside)

₹1,440–₹1,442 — first support cluster from pivots

₹1,430–₹1,435 — deeper near-term support if current level breaks

₹1,380–₹1,390 — broader monthly lower support (recent swing lows)

Bearish risk: A sustained close below ₹1,430 may shift bias lower toward ₹1,380.

📌 Quick Practical Summary

Levels to watch this month (chart/time-frame sensitive):

• Buy/Support:

₹1,440–₹1,442 (first line)

₹1,430–₹1,435 (next support)

₹1,380–₹1,390 (deeper zone)

• Sell/Resistance:

₹1,455–₹1,460 (initial resistance)

₹1,470–₹1,480 (secondary area)

₹1,500+ if strong break above

Part 3 Technical Analysis Vs. Institutional Option TradingCall Options (CE) Explained

Call = Right to buy

You buy a call when you expect the price to go up.

Your loss is limited to premium paid.

Your profit can be unlimited (theoretically).

Example:

If Nifty is at 22,000 and you buy a 22,100 CE, you are expecting Nifty to rise above 22,100 before expiry.

Profit if market rises → premium increases.

Loss if market falls → premium decreases.

Part 2 Technical Analysis Vs. Institutional Option Trading Key Components of an Option Contract

Every option contract has a few standard elements:

a) Strike Price

The price at which you can buy (call) or sell (put) the underlying asset.

b) Premium

The price you pay to buy the option.

Think of it like a ticket price to take the trade.

c) Expiry Date

Options expire on a fixed date (weekly/monthly).

If not exercised, they lose value after expiry.

d) Lot Size

You cannot buy 1 share option.

Every option contract has a fixed lot size (e.g., Nifty = 50 units).

Part 1 Technical Analysis Vs. Institutional Option Trading What Are Options?

Options are financial contracts that give you the right, but not the obligation, to buy or sell an asset at a specific price before a certain date.

Two types of options:

Call Option – Right to buy

Put Option – Right to sell

Options are written on assets like:

Stocks

Index (Nifty, Bank Nifty)

Commodities

Currencies

Concept and Characteristics of Capital FlowsConcept of Capital Flows

Capital flows refer to the movement of money for the purpose of investment, trade, or business production across national borders. These flows occur when individuals, companies, or governments invest or lend money to entities in another country. In a globalized world, capital flows play a crucial role in linking economies, influencing growth, exchange rates, financial stability, and economic development.

In simple terms, capital flows represent how savings in one part of the world are transferred to another part where investment opportunities exist. For example, when a foreign company builds a factory in India, or when global investors buy Indian stocks and bonds, capital is flowing into India. Similarly, when Indian firms invest abroad or Indians purchase foreign assets, capital flows out of the country.

Capital flows are recorded in a country’s balance of payments (BoP) under the capital account and financial account. They help bridge the gap between domestic savings and investment requirements, especially in developing economies where savings may be insufficient to fund growth.

Types of Capital Flows

Before discussing characteristics, it is important to briefly understand the major forms of capital flows:

Foreign Direct Investment (FDI)

Long-term investment where foreign investors gain ownership or control in a domestic enterprise (e.g., building factories, acquiring companies).

Foreign Portfolio Investment (FPI)

Investments in financial assets like stocks, bonds, and mutual funds without management control.

Debt Flows

Includes external commercial borrowings, foreign loans, and sovereign borrowing.

Official Capital Flows

Loans and grants from foreign governments, multilateral institutions (IMF, World Bank), and aid agencies.

Each type of capital flow has distinct risk, return, and stability features.

Characteristics of Capital Flows

1. Cross-Border Nature

The most fundamental characteristic of capital flows is that they cross national boundaries. Capital moves from one country to another in search of better returns, safety, diversification, or strategic advantage. This cross-border movement connects financial markets globally and increases economic interdependence among nations.

2. Driven by Return and Risk

Capital flows are primarily motivated by expected returns adjusted for risk. Investors seek higher interest rates, better profit prospects, or capital appreciation. At the same time, political stability, macroeconomic strength, inflation control, and currency stability influence investment decisions.

For example:

High interest rates attract debt and portfolio flows.

Stable policies and growth prospects attract FDI.

3. Sensitivity to Economic Conditions

Capital flows are highly sensitive to domestic and global economic conditions. Factors such as GDP growth, inflation, fiscal deficit, trade balance, and monetary policy directly affect the volume and direction of capital flows.

Global factors like:

US Federal Reserve interest rate changes

Global liquidity

Risk appetite

can cause sudden surges or reversals in capital flows, especially in emerging markets.

4. Volatility (Especially Short-Term Flows)

One of the most important characteristics of capital flows—particularly portfolio flows—is their volatility. Short-term capital can enter and exit a country quickly in response to market news, policy changes, or global shocks.

This volatility can:

Create asset price bubbles

Cause sudden exchange rate fluctuations

Lead to financial instability

FDI, on the other hand, is relatively stable and long-term in nature.

5. Impact on Exchange Rates

Capital flows have a direct impact on exchange rates.

Capital inflows increase demand for the domestic currency, leading to appreciation.

Capital outflows increase supply, causing depreciation.

Large inflows can make exports less competitive, while sudden outflows can cause currency crises. Hence, managing capital flows is a key challenge for central banks.

6. Role in Economic Growth

Capital flows play a critical role in economic development and growth, particularly in capital-scarce countries. They provide:

Investment funds

Technology transfer

Managerial expertise

Employment generation

FDI contributes not only capital but also improves productivity, infrastructure, and integration with global value chains.

7. Uneven Distribution Across Countries

Capital flows are not evenly distributed across the world. They tend to concentrate in countries with:

Stable macroeconomic environment

Strong institutions

Open financial markets

Predictable policies

Developed and fast-growing emerging economies attract the majority of global capital flows, while politically unstable or high-risk countries receive limited inflows.

8. Pro-Cyclical Nature

Capital flows often show a pro-cyclical pattern:

During economic booms, capital inflows rise.

During recessions or crises, capital flows reverse.

This behavior can amplify economic cycles—fueling growth during good times and worsening downturns during crises. This was evident during the Global Financial Crisis (2008) and the COVID-19 shock.

9. Policy Sensitivity

Capital flows respond strongly to government and central bank policies, such as:

Interest rate changes

Capital controls

Tax policies

Ease of doing business reforms

Countries may impose regulations to manage excessive inflows or sudden outflows to protect financial stability.

10. Long-Term vs Short-Term Orientation

Capital flows differ in their time horizon:

FDI is long-term, strategic, and relatively stable.

Portfolio and debt flows are often short-term and speculative.

This distinction is crucial because long-term flows support sustainable development, while short-term flows can increase vulnerability to financial shocks.

11. Influence on Financial Markets

Capital flows significantly affect:

Stock market performance

Bond yields

Liquidity conditions

Large inflows can drive equity market rallies, while sudden exits can cause sharp market corrections. Emerging markets are particularly sensitive to global investor sentiment.

12. Risk of Capital Flight

Another characteristic of capital flows is the risk of capital flight, where investors rapidly withdraw funds due to:

Political instability

Currency depreciation fears

Economic mismanagement

Capital flight can drain foreign exchange reserves and destabilize the economy.

Conclusion

Capital flows are a defining feature of the modern global economy. They facilitate efficient allocation of resources, promote investment and growth, and integrate national economies into the global financial system. However, their volatile and pro-cyclical nature also poses significant risks, particularly for developing and emerging markets.

Understanding the concept and characteristics of capital flows is essential for policymakers, economists, investors, and traders. Effective management of capital flows—encouraging stable long-term investment while controlling excessive short-term volatility—is key to achieving sustainable economic growth and financial stability.

Emerging Market Impact: Shaping the Global Economic Landscape1. Defining Emerging Markets

Emerging markets are economies transitioning from low-income, agrarian systems toward industrialized, market-driven structures. They typically show:

Rapid GDP growth compared to developed economies

Expanding middle classes

Increasing industrial and service-sector output

Developing financial markets and institutions

However, they also face challenges such as income inequality, infrastructure gaps, regulatory uncertainty, and vulnerability to global shocks. This mix of high growth potential and elevated risk is what defines their global impact.

2. Contribution to Global Economic Growth

Emerging markets now account for more than half of global GDP in purchasing power parity (PPP) terms. Over the past two decades, they have driven the majority of incremental global growth.

Growth Differential: While developed economies often grow at 1–2% annually, emerging markets can sustain growth rates of 4–7% over long periods.

Demographic Advantage: Younger populations in India, Southeast Asia, and Africa support productivity growth and consumption.

Urbanization: Massive migration from rural to urban areas boosts demand for housing, infrastructure, transportation, and services.

During periods when developed markets slow down—due to debt cycles, aging populations, or monetary tightening—emerging markets often act as stabilizers for global growth.

3. Impact on Global Trade and Supply Chains

Emerging markets have transformed global trade dynamics.

Manufacturing Powerhouses

China’s rise as the “world’s factory” reshaped supply chains, while countries like Vietnam, Bangladesh, and Mexico are gaining importance due to supply-chain diversification and “China+1” strategies.

Resource Suppliers

Brazil, Russia, Indonesia, South Africa, and several African economies are major exporters of commodities such as oil, metals, agricultural products, and rare earths. This gives emerging markets pricing power and strategic influence in global markets.

Trade Rebalancing

Emerging markets are increasingly trading with each other, reducing reliance on developed economies. South–South trade is now a key driver of global commerce.

4. Financial Market Influence

Emerging markets have become integral to global capital markets.

Capital Flows

Foreign direct investment (FDI) into emerging markets supports infrastructure, manufacturing, and technology transfer. Portfolio investments in equities and bonds provide liquidity but can be volatile.

Currency Dynamics

Emerging market currencies are sensitive to global interest rates, especially U.S. Federal Reserve policy. Dollar strength often leads to capital outflows, currency depreciation, and inflationary pressure in EMs.

Stock and Bond Markets

Many global indices now have significant emerging market exposure. Indian and Chinese equities, for example, influence global investor sentiment, while EM bonds affect global yield dynamics.

5. Role in Commodity Cycles

Emerging markets are central to commodity demand and supply.

Demand Side: Rapid industrialization and infrastructure spending increase demand for steel, copper, oil, and energy.

Supply Side: Many emerging economies are major producers of oil, gas, coal, metals, and agricultural goods.

Commodity supercycles are often driven by emerging market growth. For instance, China’s infrastructure boom fueled a decade-long rally in metals and energy prices, impacting inflation and monetary policy worldwide.

6. Technological Leapfrogging and Innovation

Contrary to the belief that innovation is confined to developed economies, emerging markets are becoming hubs of technological advancement.

Digital Payments: India’s UPI system and Africa’s mobile money platforms like M-Pesa have leapfrogged traditional banking models.

E-commerce and Fintech: Companies in China, India, and Southeast Asia are scaling rapidly, serving millions of new consumers.

Cost Innovation: Emerging markets often develop low-cost, scalable solutions that can be exported globally.

This technological leapfrogging improves productivity and accelerates financial inclusion, reshaping global business models.

7. Geopolitical and Strategic Impact

Emerging markets are increasingly shaping global geopolitics.

Multipolar World: The rise of China and India is shifting the balance of power away from a U.S.-centric system.

Global Institutions: Emerging economies demand greater representation in institutions like the IMF, World Bank, and UN.

Trade and Energy Security: Control over key resources and trade routes gives emerging markets strategic leverage.

Geopolitical tensions, sanctions, and trade wars often have significant spillover effects on emerging markets, influencing global risk sentiment.

8. Risks and Vulnerabilities

Despite their potential, emerging markets face structural and cyclical risks.

External Debt: Many EMs borrow in foreign currencies, making them vulnerable to exchange-rate shocks.

Political and Regulatory Risk: Policy uncertainty can deter investment and trigger capital flight.

Inflation and Monetary Constraints: Food and energy price volatility disproportionately affects emerging economies.

Climate Risk: Emerging markets are often more exposed to climate change impacts while lacking adequate adaptation resources.

These risks can amplify global financial instability during periods of stress.

9. Impact on Global Investors and Businesses

For investors, emerging markets offer diversification and higher long-term return potential, but with higher volatility. Active risk management, local knowledge, and long-term horizons are critical.

For businesses, emerging markets represent:

Large, untapped consumer bases

Cost-efficient manufacturing and services

Opportunities for brand building and market leadership

However, success requires adapting to local cultures, regulations, and income levels rather than applying developed-market strategies blindly.

10. The Road Ahead

The future impact of emerging markets will depend on structural reforms, technological adoption, and global cooperation. Countries that invest in education, infrastructure, governance, and sustainability are likely to outperform.

As the world faces challenges such as slowing growth, aging populations, climate change, and geopolitical fragmentation, emerging markets will remain central to global solutions and global risks alike. Their evolution will not just influence global GDP numbers—it will define the next phase of globalization and economic power.

Conclusion

Emerging markets are no longer just “catch-up” economies; they are co-authors of the global economic story. Their growth, innovation, and resilience shape trade flows, financial markets, commodity cycles, and geopolitics. While risks remain, their long-term impact is unmistakable. For anyone seeking to understand the future of the global economy, emerging markets are not optional—they are essential.

Yield Curve Crash: US 10-Year Treasury vs. German BundsUnderstanding the Benchmark: Why US Treasuries vs. German Bunds Matter

US Treasuries and German Bunds are the risk-free reference points for the dollar and euro systems respectively. The US 10-year yield anchors global asset pricing—from equities to emerging market debt—while German Bunds anchor European sovereign yields.

When these two yields move together, global growth expectations are relatively synchronized. When they diverge sharply, it signals fragmentation in economic outlooks, policy divergence, and capital flight from one region to another.

A “yield curve crash” in this context refers to:

Sharp declines in long-term yields due to recession fear

Sudden spread widening between US and German yields

Inversions or violent curve flattening driven by aggressive central banks

The US 10-Year Yield: Inflation, Debt, and Global Reserve Pressure

The US 10-year Treasury sits at the center of the global financial system. Its movements reflect three dominant forces:

Federal Reserve policy expectations

Inflation credibility

Global demand for dollar assets

In a yield curve crash, the US 10-year typically falls rapidly as investors rush into safety, pricing in:

Slowing economic growth

Future rate cuts

Financial stress or recession

However, unlike past cycles, modern yield crashes in the US are often partial and distorted. Massive fiscal deficits, record Treasury issuance, and foreign reserve diversification limit how far yields can fall. This creates tension: recession signals push yields down, while debt supply and inflation risk push yields up.

This tug-of-war makes US yield crashes more volatile and less “clean” than in earlier decades.

German Bunds: Growth Anxiety and Structural Stagnation

German Bund yields behave very differently. Germany’s economy is export-driven, energy-sensitive, and heavily exposed to global trade cycles. When global growth slows—or geopolitical risk rises—Bund yields tend to collapse faster than US yields.

In recent yield curve crashes, Bund yields have:

Fallen into deeply negative territory in real terms

Reacted more aggressively to recession fears

Acted as Europe’s “panic asset”

Unlike the US, Europe lacks a single fiscal authority and faces fragmented banking systems. This makes Bunds the ultimate safety asset inside Europe, even when yields approach zero.

When Bund yields crash while US yields remain elevated, it sends a clear message:

👉 Europe is pricing stagnation or recession faster than the US.

Yield Spread Dynamics: The Silent Signal

The US 10Y – German Bund spread is one of the most important yet under-discussed macro indicators.

A widening spread suggests stronger US growth, tighter Fed policy, or capital inflows into dollar assets

A narrowing spread signals global slowdown, falling US exceptionalism, or synchronized recession risk

During yield curve crashes, the spread often behaves asymmetrically:

Bund yields collapse first

US yields fall later and less aggressively

This reflects capital rotation: global investors flee European risk faster, parking funds in US Treasuries—even if US fundamentals are weakening.

Central Bank Policy Divergence and Its Role

A major driver of yield curve crashes is policy mismatch between the Federal Reserve and the European Central Bank (ECB).

The Fed tends to act earlier and more aggressively

The ECB moves slower due to political constraints

When inflation spikes, the Fed hikes faster, pushing US yields higher relative to Bunds. When growth collapses, Bund yields crash faster as Europe’s growth model cracks under pressure.

This creates violent yield movements, not because markets are irrational—but because policy reaction functions are fundamentally different.

Recession Signaling and Curve Inversion

Yield curve crashes are closely tied to curve inversion, especially in the US. When short-term rates exceed long-term rates, it reflects expectations of:

Future rate cuts

Economic contraction

Falling inflation

In Europe, curve inversion often reflects structural pessimism, not just cyclical slowdown. Germany’s aging population, de-industrialization risk, and energy transition amplify recession fears faster than in the US.

When both US and German curves invert simultaneously, it signals global recession risk, not a regional slowdown.

Capital Flows and Currency Impact

Yield curve crashes reshape global capital flows.

Falling Bund yields weaken the euro

Relatively higher US yields strengthen the dollar

Emerging markets face capital outflows as risk aversion spikes

This creates a feedback loop:

European slowdown → Bund yield crash

Capital flows to US → Dollar strengthens

Tighter global financial conditions → Growth slows further

This is why yield crashes often precede equity market corrections and currency volatility.

Equity Market Interpretation

Equity markets often misread yield curve crashes initially.

Falling yields are first seen as “liquidity positive”

Later, markets realize yields are falling due to growth fear

European equities typically underperform during Bund yield crashes, while US equities may initially hold up—until earnings expectations reset.

Banks, in particular, suffer badly as curve flattening destroys net interest margins.

What Traders and Investors Should Watch

A yield curve crash between US 10Y and German Bunds is not just a bond market event—it’s a macro regime shift.

Key signals to monitor:

Speed of yield decline (panic vs. orderly)

Spread behavior (US exceptionalism vs. global slowdown)

Central bank communication tone

Credit spreads alongside yields

When yields crash but credit spreads widen, the message is clear: risk is rising.

Conclusion: A Warning System, Not a Forecast

The yield curve crash between US Treasuries and German Bunds is one of the most reliable early-warning systems in global finance. It reflects fear, policy stress, and capital movement long before headlines catch up.

When Bund yields collapse and US yields hesitate, the world is voting on relative safety, not absolute strength. When both crash together, the message is darker: the global growth engine is stalling.

For macro traders, long-term investors, and policymakers alike, ignoring this signal has historically been expensive.

Trading with Blockchain: Transforming the Way Markets OperateUnderstanding Blockchain in Trading

At its core, blockchain is a distributed ledger technology (DLT) that records transactions across a network of computers (nodes). Instead of a single central authority maintaining records, every participant in the network holds a synchronized copy of the ledger. Transactions are grouped into blocks, verified through consensus mechanisms, and then cryptographically linked to previous blocks, making the data tamper-resistant.

In trading, this ledger can represent ownership of assets—such as cryptocurrencies, tokenized stocks, bonds, commodities, or even real estate. When a trade occurs, ownership is transferred directly on the blockchain, and the transaction becomes permanently recorded. This eliminates the need for multiple reconciliations between brokers, clearinghouses, custodians, and exchanges.

Evolution from Traditional Trading to Blockchain Trading

Traditional financial trading relies heavily on intermediaries. A simple stock trade may involve brokers, exchanges, clearing corporations, custodians, and settlement banks. This multi-layered structure increases costs, slows down settlement, and introduces counterparty risk. For example, equity trades in many markets still follow a T+1 or T+2 settlement cycle.

Blockchain trading introduces near-instant settlement. Because the ledger updates in real time, clearing and settlement can occur simultaneously with the trade, often referred to as “atomic settlement.” This reduces capital lock-up, lowers operational risk, and significantly improves market efficiency.

Cryptocurrency Trading as the First Use Case

The most visible form of blockchain trading is cryptocurrency trading. Digital assets like Bitcoin, Ethereum, and thousands of altcoins are traded on centralized exchanges (CEXs) and decentralized exchanges (DEXs). While centralized exchanges operate similarly to traditional platforms but with crypto assets, decentralized exchanges use smart contracts to enable peer-to-peer trading without intermediaries.

On a DEX, users retain custody of their funds, trades are executed automatically via smart contracts, and transparency is built into the system. This model reduces the risk of exchange hacks or mismanagement but introduces new challenges such as liquidity fragmentation and smart contract risks.

Tokenization of Assets

One of the most powerful applications of blockchain in trading is asset tokenization. Tokenization involves converting real-world assets into digital tokens that can be traded on a blockchain. These assets can include equities, bonds, commodities, real estate, art, and even carbon credits.

Tokenized assets enable fractional ownership, allowing traders and investors to buy small portions of high-value assets. This increases liquidity and democratizes access to markets that were traditionally limited to large institutional players. For example, a commercial property worth millions can be divided into thousands of tokens, each representing a share of ownership and income.

Smart Contracts and Automated Trading

Smart contracts are self-executing programs stored on a blockchain that run when predefined conditions are met. In trading, smart contracts automate order execution, margin requirements, interest payments, and settlement processes. This reduces manual intervention, errors, and operational costs.

Algorithmic and automated trading strategies can be embedded directly into smart contracts. For instance, a trader can design a strategy that automatically executes trades based on price levels, volume thresholds, or time-based rules. Once deployed, these strategies operate 24/7 without human intervention, creating a new era of decentralized algorithmic trading.

Decentralized Finance (DeFi) and Trading

Decentralized Finance, or DeFi, is a rapidly growing ecosystem built on blockchain that recreates traditional financial services in a decentralized manner. DeFi trading platforms enable spot trading, derivatives trading, lending, borrowing, and yield farming without centralized control.

Automated Market Makers (AMMs) like those used in DeFi replace traditional order books with liquidity pools. Prices are determined by mathematical formulas rather than buy-sell orders. Traders interact directly with these pools, while liquidity providers earn fees in return. This model ensures constant liquidity but can expose participants to risks like impermanent loss.

Transparency and Trust in Blockchain Trading

One of blockchain’s biggest advantages in trading is transparency. All transactions are publicly verifiable on the blockchain, allowing traders to audit market activity in real time. This reduces the possibility of manipulation, hidden leverage, or opaque balance sheets that have caused major failures in traditional and crypto markets alike.

Immutability also enhances trust. Once a trade is recorded on the blockchain, it cannot be altered or erased. This creates a reliable historical record, which is especially valuable for compliance, audits, and dispute resolution.

Risk Management and Challenges

Despite its advantages, trading with blockchain is not without risks. Price volatility in crypto markets can be extreme, leading to rapid gains or losses. Smart contract vulnerabilities can be exploited if the code is flawed. Regulatory uncertainty remains a significant challenge, as governments around the world are still developing frameworks for blockchain-based assets and trading platforms.

Liquidity can also be fragmented across multiple blockchains and platforms, making price discovery less efficient. Additionally, user responsibility is higher in decentralized systems; losing private keys can mean losing access to assets permanently.

Institutional Adoption and the Future of Blockchain Trading

Institutional interest in blockchain trading has grown rapidly. Major banks, asset managers, and exchanges are experimenting with blockchain-based settlement systems, tokenized securities, and digital asset trading desks. Central Bank Digital Currencies (CBDCs) may further integrate blockchain into mainstream financial markets by enabling programmable money and instant settlement at a national scale.

In the future, blockchain trading could lead to global, 24/7 markets where assets trade seamlessly across borders without intermediaries. Traditional and blockchain-based systems are likely to coexist, with hybrid models combining regulatory oversight with decentralized efficiency.

Conclusion

Trading with blockchain is more than a technological upgrade; it is a fundamental rethinking of how markets function. By enabling decentralization, transparency, automation, and faster settlement, blockchain has the potential to make trading more efficient, inclusive, and resilient. While challenges remain—particularly in regulation, security, and scalability—the long-term trajectory points toward deeper integration of blockchain into global trading ecosystems. For traders, investors, and institutions alike, understanding blockchain-based trading is becoming not just an advantage, but a necessity in the evolving financial landscape.

The Global Shadow Banking System: An In-Depth OverviewWhat Is Shadow Banking?

Shadow banking refers to financial institutions and activities that perform bank-like functions without access to central bank support or deposit insurance. These entities borrow short-term funds and lend or invest in longer-term, often riskier assets—mirroring traditional banking but without the same regulatory oversight.

The Financial Stability Board (FSB) defines shadow banking as “non-bank financial intermediation involving maturity transformation, liquidity transformation, leverage, and credit risk transfer.”

Key Components of the Shadow Banking System

The global shadow banking system consists of a wide range of institutions and instruments:

1. Non-Bank Financial Institutions (NBFIs)

These include:

Hedge funds

Private equity funds

Mutual funds and exchange-traded funds (ETFs)

Money market funds

Pension funds and insurance companies

They mobilize savings and allocate capital but are not subject to banking regulations such as capital adequacy norms.

2. Securitization Vehicles

Securitization involves pooling loans (mortgages, auto loans, credit card receivables) and converting them into tradable securities. Examples include:

Mortgage-Backed Securities (MBS)

Asset-Backed Securities (ABS)

Collateralized Debt Obligations (CDOs)

Special Purpose Vehicles (SPVs) or Structured Investment Vehicles (SIVs) are often used to keep these assets off bank balance sheets.

3. Repurchase Agreements (Repo Markets)

Repos allow institutions to borrow short-term funds using securities as collateral. The repo market is a critical funding source for shadow banks, but it is highly sensitive to market confidence.

4. Peer-to-Peer and Fintech Lending

Digital platforms connect borrowers directly with investors, bypassing traditional banks. While improving financial inclusion, these platforms can amplify credit risk during downturns.

Why Did Shadow Banking Grow?

Several structural factors fueled the expansion of shadow banking globally:

Regulatory Arbitrage

Stricter banking regulations—such as Basel III capital requirements—encouraged financial activity to migrate outside the regulated banking sector, where returns could be higher.

Demand for Credit

Corporations and households sought alternative sources of financing, especially when banks tightened lending standards.

Investor Search for Yield

Low interest rates pushed institutional investors toward higher-yielding products offered by shadow banking entities.

Financial Innovation

Advances in financial engineering and technology enabled complex products that could be structured, traded, and distributed globally.

Role in the Global Economy

Shadow banking plays a dual role—both beneficial and risky.

Positive Contributions

Enhances credit availability, especially to underserved sectors

Improves market liquidity

Encourages financial innovation

Supports economic growth when banks are constrained

In many emerging markets, shadow banking complements traditional banks and helps bridge funding gaps.

Systemic Risks

Despite its benefits, shadow banking introduces several vulnerabilities:

High leverage with limited capital buffers

Liquidity mismatches, borrowing short-term and lending long-term

Opacity, making risk assessment difficult

Interconnectedness with traditional banks, leading to contagion

Shadow Banking and the 2008 Global Financial Crisis

The dangers of shadow banking became evident during the 2008 crisis. Investment banks and shadow entities relied heavily on short-term funding markets. When confidence collapsed:

Repo markets froze

Securitization markets collapsed

Lehman Brothers failed

Governments were forced to intervene

The crisis demonstrated that shadow banks could create bank-like systemic risk without bank-like regulation, forcing policymakers to rethink financial oversight.

Regulatory Response and Oversight

Post-crisis reforms focused on improving transparency and reducing systemic risk without stifling innovation.

Global Efforts

The Financial Stability Board (FSB) monitors global shadow banking trends and publishes annual assessments. Regulatory measures include:

Enhanced disclosure requirements

Liquidity risk management rules

Limits on leverage

Stress testing of non-bank entities

Country-Specific Approaches

United States: Greater oversight of money market funds and repo markets

European Union: Alternative Investment Fund Managers Directive (AIFMD)

China: Tightened controls on wealth management products and off-balance-sheet lending

India: RBI oversight of NBFCs after liquidity crises (e.g., IL&FS collapse)

Shadow Banking in Emerging Markets

In emerging economies, shadow banking often grows faster due to underdeveloped banking systems. While it boosts credit access, weak regulation can magnify financial instability. Sudden capital outflows, currency depreciation, and liquidity shocks pose heightened risks.

The Future of Shadow Banking

The shadow banking system continues to evolve rather than disappear. Key trends shaping its future include:

Greater regulatory convergence between banks and non-banks

Expansion of fintech and digital lending platforms

Increased role of asset managers in credit creation

Tighter global coordination to monitor systemic risk

Central banks now recognize that financial stability depends on monitoring the entire financial ecosystem—not just banks.

Conclusion

The global shadow banking system is a powerful yet fragile pillar of modern finance. It provides liquidity, credit, and innovation that support economic growth, but it also harbors hidden risks that can destabilize the entire financial system if left unchecked. The challenge for policymakers is to strike the right balance—encouraging efficiency and innovation while preventing excess leverage, opacity, and systemic collapse.

Understanding shadow banking is no longer optional for investors, policymakers, or traders—it is essential to navigating today’s interconnected global financial markets.

Sub-Broker in India: Role, Regulation, Business Model, FutureMeaning of a Sub-Broker

A sub-broker is an individual or entity that acts as an agent of a SEBI-registered stockbroker. The sub-broker assists clients in trading securities such as equities, derivatives, commodities, and currencies through the trading infrastructure of the main broker. Importantly, a sub-broker cannot trade independently on stock exchanges; all transactions must be routed through the principal broker.

In simple terms, if a stockbroker is the backbone of trading operations, the sub-broker is the business development arm, responsible for client acquisition, relationship management, and localized market presence.

Regulatory Framework in India

Earlier, sub-brokers were registered directly with SEBI (Securities and Exchange Board of India). However, after regulatory changes introduced around 2018, SEBI discontinued fresh sub-broker registrations. Instead, individuals now operate as Authorized Persons (APs) of stockbrokers. Despite this change in terminology, the core functions remain largely similar.

Key regulatory points include:

Sub-brokers/APs must be affiliated with a SEBI-registered broker.

They must comply with KYC norms, Anti-Money Laundering (AML) guidelines, and investor protection rules.

All client funds and securities are held by the main broker, not the sub-broker.

Misconduct by a sub-broker can attract penalties for both the sub-broker and the principal broker.

This regulatory structure ensures investor safety while allowing brokers to scale efficiently.

Role and Responsibilities of a Sub-Broker

The primary role of a sub-broker is client servicing and business expansion. Their responsibilities include:

Client Acquisition

Sub-brokers identify potential investors, explain trading products, and onboard clients by completing KYC documentation.

Market Guidance and Support

While they cannot provide unauthorized investment advice, sub-brokers often guide clients on market processes, trading platforms, and basic strategies.

Relationship Management

Maintaining long-term relationships with clients is a key strength of sub-brokers, especially in regions where trust and personal interaction matter.

Order Assistance

Some clients, particularly traditional investors, rely on sub-brokers for placing trades or resolving order-related issues.

Education and Awareness

Conducting seminars, workshops, and one-to-one sessions to educate investors about stock markets is an important value addition.

Business Model and Revenue Structure

The income of a sub-broker comes from commission sharing with the main broker. This commission is a percentage of the brokerage generated by the clients introduced by the sub-broker.

Common revenue models include:

Revenue Sharing Model: The sub-broker earns 30%–70% of the brokerage charged to clients.

Hybrid Model: Fixed income plus variable incentives based on volume or client activity.

Performance-Linked Model: Higher revenue share for achieving targets such as active clients or turnover.

Sub-brokers dealing with full-service brokers generally earn higher commissions, while those tied to discount brokers rely on volume rather than per-trade revenue.

Capital and Infrastructure Requirements

One of the major advantages of becoming a sub-broker is the low entry barrier. Unlike stockbrokers, sub-brokers do not need exchange memberships or large capital investments.

Basic requirements include:

Office space (physical or virtual)

Internet connectivity and computer systems

Sales and support staff (optional but helpful)

Initial security deposit payable to the broker (varies by broker)

This makes sub-broking an attractive entrepreneurial opportunity for finance professionals, relationship managers, and local business owners.

Advantages of Becoming a Sub-Broker

Low Risk Business

Since trading infrastructure, compliance, and settlement are handled by the main broker, operational risk is minimal.

Scalable Income

Earnings grow with the client base and trading volume, offering long-term passive income potential.

Local Market Trust

Sub-brokers leverage personal relationships and regional familiarity, which large brokers often lack.

Brand Support

Association with a reputed broker provides credibility, research support, and advanced trading platforms.

Challenges Faced by Sub-Brokers

Despite its benefits, sub-broking also comes with challenges:

Margin Pressure: Discount brokers offer very low brokerage, reducing commission income.

Regulatory Compliance: Continuous adherence to SEBI and broker guidelines is mandatory.

Client Expectations: Investors increasingly demand real-time service, advanced tools, and market insights.

Technology Shift: Online platforms and DIY trading apps have reduced dependency on intermediaries.

To survive, modern sub-brokers must adapt by offering value-added services rather than just trade execution.

Sub-Broker vs Stockbroker

Aspect Sub-Broker Stockbroker

Exchange Membership No Yes

SEBI Registration Through Broker Direct

Capital Requirement Low High

Client Funds Handling No Yes

Risk Exposure Low High

This comparison highlights why sub-broking is suitable for individuals seeking market participation without heavy compliance burden.

Future of Sub-Brokers in India

The future of sub-brokers in India is transformational rather than extinct. While traditional commission-based models are under pressure, new opportunities are emerging in:

Financial literacy and advisory support

Regional investor onboarding

HNI relationship management

Hybrid online-offline service models

Sub-brokers who embrace technology, build trust, and focus on long-term client value will continue to play a vital role in India’s expanding capital markets.

Conclusion

A sub-broker in India serves as a vital link between investors and stockbrokers, enabling market access, education, and personalized service. Though regulatory frameworks and technology have reshaped the role, sub-broking remains a powerful business model when approached with professionalism and adaptability. In a country like India—where financial inclusion is still growing—sub-brokers will continue to be an important pillar of the securities ecosystem.