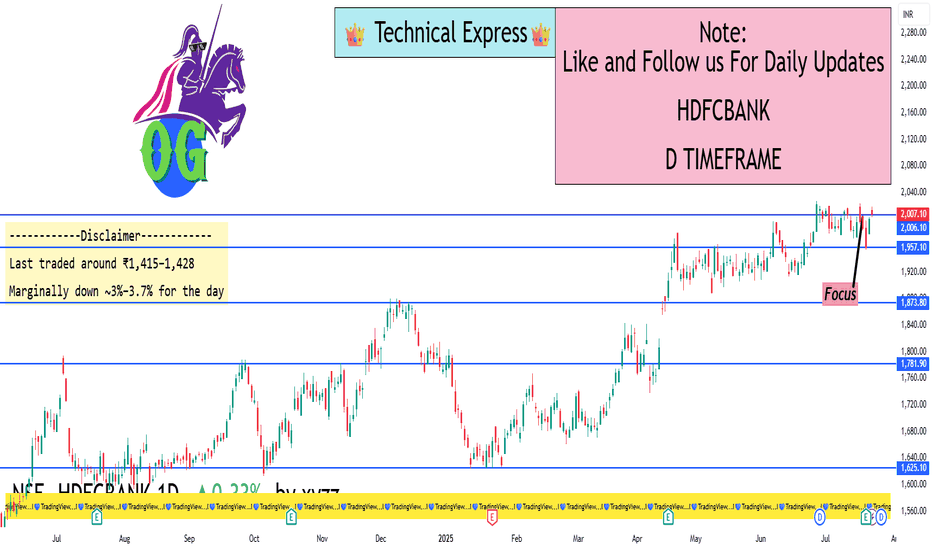

HDFCBANK 1D Timeframe📈 HDFC Bank – Intraday Overview

Opening Price: Opened strong around ₹2,005–₹2,010.

Intraday High: Touched approximately ₹2,018 during early trading.

Intraday Low: Maintained support around ₹2,000.

Current Price: Trading near ₹2,016, showing a gain of around +0.8% to +0.9%.

Previous Close: ₹2,005.

🔍 What’s Driving HDFC Bank Today

Positive Earnings Effect: Strong Q1 earnings with around 12% year-on-year profit growth, bonus share announcements, and dividends have boosted buying interest.

Sector Leadership: Among the strongest performers in the banking sector, helping to support indices like Nifty50 and Bank Nifty.

Consistent Volume: Healthy trading volumes indicate sustained institutional participation.

Strong Sentiment: Momentum remains high with overall positive cues from private banking space.

📊 Technical Summary

Support Level: Strong support exists around ₹2,000–₹2,005.

Resistance Level: Intraday resistance at ₹2,018 with major resistance near ₹2,027 (recent all-time high).

Trend Direction: Bullish trend, as it is making higher lows and maintaining strength above the psychological ₹2,000 mark

✅ Summary Conclusion

HDFC Bank is trading positively today with sustained momentum after strong earnings and corporate actions. Intraday action shows bullish strength above ₹2,000, with the possibility of new highs if it crosses ₹2,018–₹2,027 levels. Technical trend remains positive to bullish for the day.

HDFCBANK

Advance Option Trading📊 Advance Option Trading – Complete Professional Guide

Advance Option Trading focuses on mastering professional-grade strategies that go beyond simply buying Call and Put options. This approach uses multi-leg strategies, Option Greeks, and volatility analysis to help traders profit in bullish, bearish, sideways, or even volatile and low-volatility markets with better control over risk and reward.

This is how professional traders and institutions trade options — systematically, with probability, and smart risk management.

💡 What is Advanced Options Trading?

In Advanced Options Trading, you learn:

✅ Complex Strategies like Spreads, Straddles, Strangles, Iron Condor

✅ How to combine multiple options in one trade

✅ Reading and using Option Greeks to manage your trades

✅ Analyzing Implied Volatility (IV) to predict market reactions

✅ Managing risk and reward scientifically

🎁 What You Master in Advanced Option Trading

1. Option Greeks

Delta — How much option price moves with the underlying.

Theta — Time decay; how much premium you lose every day.

Gamma — Rate of change of Delta; helps in intraday adjustments.

Vega — Sensitivity to volatility changes.

Rho — Impact of interest rates (minor but useful).

➡️ Professionals use Greeks to adjust their positions and decide when to enter, exit, or hedge trades.

2. Volatility Trading

High IV Strategies → Sell Options (Iron Condor, Credit Spread).

Low IV Strategies → Buy Options (Straddle, Strangle).

IV Crush → Profit from fast drop in implied volatility after events (like earnings/news).

3. Advance Risk Management Techniques

Adjusting trades dynamically as price moves.

Hedging positions when necessary.

Avoiding big losses using proper position sizing.

Managing trades based on Greeks exposure

✅ Benefits of Advanced Options Trading

✅ Predictable Profitability — higher consistency

✅ Works in all market conditions

✅ Controlled Risk, Limited Loss

✅ Higher Win Rate Strategies

✅ Option Greeks help you stay professional

✅ Volatility analysis increases trade accuracy

📝 Who Should Learn Advanced Options Trading?

✅ Traders who know basics and want more control

✅ Those interested in hedging and capital protection

✅ Swing or positional traders wanting steady income

✅ Intraday traders aiming for high probability setups

Technical Class📊 Technical Class — Complete Guide for Technical Trading

A Technical Class is focused on teaching traders how to analyze price action, chart patterns, indicators, and market behavior using technical analysis. This class is ideal for beginners and intermediate traders who want to understand how to make trading decisions based purely on market charts — without needing insider news or fundamentals.

✅ What is Technical Trading?

Technical trading means you:

Read the charts to find trading opportunities.

Use price history, patterns, and indicators to predict future price moves.

Do not rely on news, instead focus on what the market shows through charts.

Big traders (institutions) also use technical setups, combined with liquidity and order flow, making technical analysis an essential skill.

📚 What You Will Learn in a Technical Class

1. Chart Basics

Candlestick chart vs Line chart vs Bar chart

Timeframes: from 1 minute to monthly

Volume and market sessions

2. Candlestick Patterns

Reversal Patterns: Pin Bar, Engulfing, Morning Star, Evening Star

Continuation Patterns: Inside Bar, Flags, Pennants

Indecision Candles: Doji, Spinning Top

3. Support & Resistance

How to draw key support/resistance levels

Identifying key zones where price reacts

Turning resistance into support (flip zones)

4. Trend Trading Techniques

Recognizing Higher Highs and Higher Lows (uptrend)

Spotting Lower Highs and Lower Lows (downtrend)

Using Trendlines effectively

5. Indicators Used by Pros

Moving Averages (MA) — 50 EMA, 200 EMA for trend

RSI — Overbought/Oversold zones

MACD — Trend and momentum detection

Fibonacci Retracement — Spotting pullback levels

Volume Profile — Finding high-volume zones

6. Chart Patterns

Double Top/Bottom, Head & Shoulders, Triangles

Breakout Strategies — entering after confirmation

Fakeouts and Trap Patterns

7. Risk Management & Psychology

Setting proper Stop Loss (SL) and Take Profit (TP)

Position sizing: how much to risk per trade

Building discipline and patience like a pro trader.

🎯 Benefits of Learning Technical Trading

✅ Trade any market: Forex, Stocks, Crypto, Commodities

✅ Become an independent trader — no reliance on signals

✅ Combine with institutional concepts for Smart Money Trading

✅ Understand why market moves and avoid beginner mistakes

✅ Build a professional mindset with proper risk management

🎓 After Completing Technical Class You Will Be Able To:

Analyze any chart professionally

Trade with higher win-rate setups

Control risk like institutional traders

Identify market traps and avoid fakeouts

Grow your account safely with discipline + strategy.

Trade Like Istitution💡 What It Means to Trade Like Institution

✅ You analyze the market like a pro, focusing on price action and key liquidity areas.

✅ You avoid retail traps like false breakouts and late entries.

✅ You follow smart money flow, using higher timeframes for bias and lower timeframes for precision entries.

✅ You target high-probability zones, not random entry signals.

🟣 Core Institutional Trading Concepts

1. Liquidity Hunting

Institutions know where most traders place stop-losses — above recent highs and below recent lows. They:

Push the price to grab liquidity,

Then reverse the market to their original direction.

2. Order Block Theory

An Order Block (OB) is the last bullish or bearish candle before a major move.

Institutions leave footprints at these points:

Bullish Order Block = Entry zone for long trades.

Bearish Order Block = Entry zone for short trades.

3. Market Structure

Smart money never trades randomly. Institutions:

Trade with the trend: identifying Break of Structure (BOS).

Change bias when Change of Character (CHOCH) happens.

Always trade in alignment with market structure.

4. Fair Value Gaps (FVG)

When price moves rapidly, it leaves imbalances on the chart (FVG zones). Institutions often come back to fill these gaps before continuing.

🎁 Trade Like Institution – Step-by-Step Method

Step 1: Mark Higher Timeframe Zones

Use 4H or Daily timeframe to identify major order blocks and liquidity zones.

Step 2: Track Liquidity

Look for equal highs/lows (liquidity build-up).

Wait for liquidity grabs before entering.

Step 3: Look for Break of Structure (BOS)

After liquidity is grabbed, wait for a market structure shift (BOS or CHOCH).

Step 4: Refine Entries on Lower Timeframes

Drop to 5min or 15min timeframe.

Wait for clean entry at order block or FVG, with a small stop loss.

Step 5: Manage Risk Like Institutions

Risk 1-2% per trade maximum.

Target 2:1, 3:1, or more, but exit partially at key liquidity zones.

📝 Institutional Trading Mindset

✅ Patience is Power: Institutions wait for price to come to them.

✅ Quality over Quantity: Few high-probability trades, not dozens of small trades.

✅ Risk Management First: Protect capital like a professional fund.

✅ Follow the Smart Money Flow, never the crowd.

🧩 Example Institutional Trade Setup (Simple):

✅ Timeframe: 4H for direction, 15min for entry.

✅ Mark Daily Order Block → Wait for liquidity grab.

✅ Wait for CHOCH on 15min → Enter after FVG fill.

✅ SL below OB → Target last high (RR 1:3).

HDFCBANK – Bullish Potential Post Results, But OI Shows Bearish________________________________________________________________________________📈 HDFCBANK – Bullish Potential Post Results, But OI Shows Bearish Overhang

📅 Setup Date: 17.07.2025 | ⏱ Timeframe: Daily

📍 Strategy: Post-Earnings Reaction Play with Mixed Sentiment in Options

________________________________________________________________________________

🔍 Overall View

Spot Price: ₹1957.4

Trend: Mixed – Strong Q1 results (profit ↑12%, bonus/dividend declared), but price action weak

Volatility: High IVs — Calls ~23–25%, Puts ~29–32% → post-result event premium still elevated

Ideal Strategy Mix: Neutral-to-bullish spreads with defined risk or post-IV crush contrarian longs

________________________________________________________________________________

1️⃣ Bullish Trade (Contrarian Setup with Fundamental Trigger)

Best CE: Buy 1980 CE @ ₹24.2

Why:

• Strong earnings + corporate action (bonus/dividend) → triggers potential sentiment reversal

• CE 1980 saw Short Build-Up (+144% OI), premium ↓25% → ideal for short-covering setup

• Delta ~0.41 with high IV (~24.3%) → moderate leverage & gamma in case of price breakout

• Use only if price breaks and sustains above ₹1975 with strong candle + volume

________________________________________________________________________________

2️⃣ Bearish Trade (Trend Following)

Best PE: Sell 1900 PE @ ₹16.65

Why:

• PE 1900 saw massive Long Build-Up (+70%) but IV surged → may now face decay pressure

• Selling this deep OTM PE gives ~₹57 buffer from spot (≈3% downside cushion)

• Post-results, downside may be limited → good candidate to play post-IV crush

• Spot stability around 1950–1960 invalidates aggressive downside

________________________________________________________________________________

3️⃣ Strategy Trade (Defined Risk Based on Mixed Setup)

Strategy: Bull Call Spread → Buy 1980 CE / Sell 2020 CE

→ ₹24.2 / ₹10.7

Net Debit: ₹13.50

Max Profit: ₹40 (spread width) – ₹13.5 = ₹26.5

Max Loss: ₹13.50

Risk:Reward: ≈ 1 : 1.96 ✅

Lot Size: 550

Total Risk: ₹7,425

Max Profit: ₹14,575

📊 Breakeven Point: ₹1993.5

📉 Reversal Exit Level: Exit if Spot < ₹1940 (invalidates breakout + earnings move fade)

________________________________________________________________________________

Why:

• Bullish news (Q1 beat, bonus/dividend) could trigger CE short covering if price moves above 1980

• Limited risk strategy — works well if post-result rally is moderate

• High IVs favour spread over naked options (caps loss from premium crush)

• CE OI from 1960–2060 mostly short → if momentum picks up, rally could be fast

________________________________________________________________________________

📘 My Trading Setup Rules

Avoid Gap Plays

→ Check pre-open price action to avoid trades influenced by gap-ups/gap-downs.

Breakout Entry Only

→ Enter trades only if price breaks previous day’s High (for bullish trades) or Low (for bearish trades).

Watch Volume for Confirmation

→ Monitor volume closely. No volume = No trade.

Enter on Strong Candle + Volume

→ Execute the trade only if a strong candle appears with increasing volume in the direction of the trade.

Defined Risk:Reward Only

→ Take trades only if R:R is favourable (ideally ≥ 1:2).

Premium Disclaimer

→ Option premiums shown are based on EOD prices — real-time premiums may vary during execution.

Time Frame Preference

→ Trade with your preferred time frame — this strategy works across intraday or positional setups.

________________________________________________________________________________

⚠ Disclaimer (Please Read):

• These Trades are shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

I am not responsible for trading decisions based on this post.

________________________________________________________________________________

New Hedging Opportunity: Gold Futures at IIBX1. What Is IIBX—and Why Are Gold Futures a Game Changer?

India International Bullion Exchange (IIBX), based in GIFT City, Gujarat, launched gold futures trading in July 2025.

This marks the first-ever opportunity for Indian entities to hedge gold price risk onshore but in US dollars with global pricing—bridging domestic participants and international benchmarks.

Unlike traditional futures on MCX, which are rupee-denominated and influenced heavily by Indian domestic factors, IIBX futures track international market dynamics, aligning with real-time global valuations.

Why is this significant?

India is the world’s second-largest consumer of gold—by introducing a dollar-denominated, globally priced futures contract, IIBX allows traders and jewellers to hedge currency and commodity risk simultaneously.

This initiative reduces dependence on foreign exchanges like COMEX or Singapore and supports RBI/IFSCA's goal to develop a robust, transparent bullion trading ecosystem domestically.

2. Who Can Use These Futures—and How Do They Hedge?

Eligible Participants:

Qualified jewellers

Bullion dealers

Refineries

TRQ (Tariff Rate Quota) holders (currently 441+, with more in the pipeline)

Any business entity with gold-related risk exposure

Hedging Scenarios:

Jewellers: Protect import cost from rising gold prices. If they expect gold to cost $2,000/oz in three months, they can lock in prices via futures.

Refiners and Dealers: Manage margin volatility and ensure stable profit spreads regardless of gold price shifts.

TRQ operators: Offset exposure to tariff-based import risks.

Hedging Mechanics:

Buy futures if expecting price increases, offsetting rising import cost.

Sell futures (short positions) to hedge inventory or production, locking in current prices.

Since trades occur in US dollars and settle physically or in cash, participants hedge both commodity and currency risk.

3. Contract Features: What IIBX Has Built-In

📃 Specifications:

Contract unit: 1 kg gold (approx 32.15 oz)

Denomination: U.S. dollars per Troy ounce

Tick size: $0.01 per oz

Minimum trading size: 1 kg; maximum 10 kg per order

Contracts listed: Three consecutive months plus all even-months in a 13-month window (total 8 concurrent maturities)

Trading hours: 09:00–23:30 IST—keeping sync with global gold trading sessions

Risk & Margin Management:

Initial margin: At least 6% of contract value or calculated via Value‑at‑Risk (VaR)

Extreme Loss Margin (ELM): 1% buffer

Daily Mark-to-Market (MTM) settlement

Collateral controls: Members cannot fully exhaust collateral—risk-reduction thresholds are triggered at 85–90%

Concentration & spread margins: Encourage diversification by offering margin benefits for calendar spreads

Settlement:

Daily MTM in USD

Final settlement: Cash or physical delivery, based on pre-declared intent

These features ensure transparency, member protection, and global alignment—while maintaining strong oversight by IIBX and IFSCA.

4. What Makes This Hedging Opportunity Unique Now

💱 Hedge Gold and Currency Simultaneously

Standard MCX contracts hedge gold price risk but not USD/INR fluctuations.

With IIBX’s Dollar-based futures, businesses effectively lock both gold and currency exposures in one contract—critical for imports and exports.

🌍 Real-Time Global Price Alignment

IIBX uses Bloomberg’s XAU–USD spot pricing, so domestic hedges match international market moves.

This synchronisation is ideal for global trading, arbitrage, and better risk pricing.

🏛 Onshore Containerization of Hedging

Previously, Indian entities hedged overseas or bypassed through subsidiaries abroad.

Now, they can do it in GIFT City via Indian AD banks—streamlining compliance, saving on setup costs, and avoiding legal complexities.

🚀 Liquidity Boost via LES

IIBX launched a Liquidity Enhancement Scheme to incentivize market makers through rebates and reduced fees.

This seeds the market with tight spreads, better execution, and deeper order books over time.

5. Practical Use Cases for Gold Futures Hedging

✅ A. Jeweller Importer's Playbook

Estimate gold import date/volume

Sell equivalent IIBX futures at current prices

On expiry or near import — either physically take delivery or unwind position

Lock in gold cost, simplifying pricing and margin management

✅ B. Bullion Dealer/Retailer

Holds inventory — buys futures to guard against price drop

Over time, MTM fluctuations offset spot inventory gains/losses

Enables accurate working capital forecasting

✅ C. Refinery Example

Producing gold bars from scraps or raw gold

Sells refined gold in INR, but raw gold bought internationally in INR/USD

Hedging reduces mismatch, stabilizes profit margins

✅ D. Speculative/Arbitrage Traders

Play price differentials between MCX and IIBX

Exploit basis arbitrage or global/regional price plays

(Though speculative traders must be cautious of margin and regulatory requirements

7. Broader Impacts & Market Implications

🌐 Strengthening GIFT City Ecosystem

Diversifies offerings beyond forex and securities to bullion

Supports India’s vision of GIFT City as a global commodity hub

💰 Incentivizing Domestic Financial Institutions

AD banks can provide clients with hedging capabilities

Banks earn commissions and fees while helping reduce gold dependence on cash markets

🔄 Reducing Reliance on Overseas Exchanges

By offering global pricing and technology in India, overseas trading reductions save costs and complexity

🧰 Integration with Spot & Physical Markets

IIBX also operates spot segments for gold and silver

Interlinked spot-futures structure enables improved cash management and delivery coordination

8. Outlook: What Traders and Businesses Should Do Now

Assessment: Evaluate gold/currency exposures in your business (imports, inventory, exports)

Registration: Engage with AD banks for required approval and collateral setup

Education: Use IIBX’s website tutorials and circulars to understand margining and settlement norms

Start Small: Begin with a 1–2 contract hedge; monitor margin and execution

Expand Strategy: From spot hedges to calendar spreads and global arbitrage

For traders, domestic traders and arbitragers, a new tool has entered their toolbox—one that can level the playing field vs global participants.

9. Final Thoughts

The launch of Gold Futures on IIBX is a major evolution in India’s financial markets. It brings a sophisticated hedge mechanism—previously only available via overseas platforms—into the regulatory fold of GIFT City, in US dollars, tied to international prices. For jewellers, dealers, refiners, importers, and treasury teams, this is a powerful new instrument.

If adopted well, over time, it may reduce India’s dependence on international exchanges, bring more trading depth, and reduce gold price volatility for domestic stakeholders—all while supporting GIFT City’s vision as a world-class financial hub.

Rise of Algorithmic & Momentum-Based Strategy Innovation🧠 Introduction

The world of trading has changed drastically in recent years. Gone are the days when investors made decisions based on gut feeling, tips from friends, or simply following news headlines. Today, technology and data dominate the markets. A big part of this transformation is due to two fast-evolving areas of strategy:

Algorithmic Trading (Algo Trading)

Momentum-Based Trading Strategies

Together, these innovations are not just making trading faster—they're making it smarter, more scalable, and, in some cases, more profitable. Let’s explore this rise of strategy-driven trading in simple, relatable terms.

⚙️ What Is Algorithmic Trading?

Algorithmic trading (or "algo trading") refers to using pre-programmed computer code to buy and sell stocks or other financial assets. These programs follow specific sets of rules and conditions like:

Price movements

Volume changes

Timing of the trade

Technical indicators

News sentiment (in advanced models)

Instead of a human watching charts all day, the algorithm scans multiple assets simultaneously and executes trades at lightning speed when conditions are met.

🔍 Why Is It Popular?

Speed: Algos react in milliseconds.

Accuracy: Reduces human errors.

Discipline: Emotions like fear or greed don’t interfere.

Scalability: Can track hundreds of instruments at once.

⚡ What Is Momentum-Based Trading?

Momentum trading is based on a simple principle:

"What is going up will likely keep going up (at least for a while), and what is going down will keep going down."

Momentum traders try to ride these price trends. They don’t care much about why something is moving—they care that it is moving.

A momentum-based strategy focuses on:

Relative Strength Index (RSI)

Moving Averages

Breakouts above previous highs

Volume surges

In today’s digital world, most momentum strategies are now executed through algorithms, bringing us to the heart of this innovation wave.

💡 Why Is Strategy Innovation Booming in 2025?

1. Availability of Real-Time Data

In the past, getting real-time stock prices or volume data was expensive or difficult. Today, thanks to modern brokers and APIs, anyone can access tick-by-tick data in real time. This has democratized trading innovation.

2. Cloud Computing & Machine Learning

Cloud platforms like AWS, GCP, and Azure now allow even small traders to run complex models. Add machine learning to the mix, and you can build:

Predictive price models

Auto-optimizing strategies

Real-time anomaly detectors

This tech stack is fueling rapid innovation in custom algos and momentum-based systems.

3. Rise of API Brokers

Brokers like Zerodha (via Kite Connect), Upstox, and Dhan offer APIs that allow traders to:

Place trades programmatically

Access order books

Monitor positions via code

This has opened the doors for retail coders and quant enthusiasts to create strategies from their bedrooms—something only institutions could do a decade ago.

4. Market Volatility & Liquidity

Modern markets, especially post-COVID and now with geopolitical unrest, are fast-moving and noisy. Traditional long-term investing sometimes feels too slow. This has created fertile ground for short-term strategies like intraday momentum and algo scalping.

🧬 Types of Momentum-Based Algo Strategies Gaining Popularity

1. Breakout Algos

Entry: When price breaks above a resistance level or 52-week high.

Exit: After achieving target return or on breakdown.

2. Mean Reversion Momentum

Belief: Stocks that over-extend eventually revert back to mean.

Algo buys on dips and sells on peaks, based on Bollinger Bands or Moving Average deviations.

3. Relative Momentum Rotation

Focus: Switch between sectors/stocks showing strongest momentum.

Example: If Auto sector shows higher returns than Pharma over 4 weeks, the algo reallocates capital into Auto.

4. High-Frequency Momentum

Based on volume spikes, price speed, and Level-2 data.

Needs co-location or ultra-low latency to profit from small tick movements.

📊 Real-World Examples (2025 Trends)

Nifty and Bank Nifty Momentum Bots

Retail algo traders now use trend-following strategies on Nifty weekly options, taking intraday calls when the index crosses VWAP + 2%.

SME IPO Listing Day Momentum Plays

Some traders have built algos that scan listing price action and jump in when a stock breaks opening highs with volume.

AI-Augmented Algos

AI-powered bots use NLP (Natural Language Processing) to analyze earnings calls, company announcements, and even tweets. If sentiment is strongly positive, they take long positions.

🧠 Benefits of These Innovations

✅ For Retail Traders:

Better access to tools once exclusive to hedge funds.

Ability to automate their edge.

Save time watching screens all day.

✅ For Institutions:

Lower execution costs.

Scalable strategies across global markets.

Statistical models reduce dependence on human traders.

🧱 Challenges and Limitations

❌ Overfitting in Backtests

Just because a strategy worked in the past doesn't guarantee future success. Many algos “look perfect” in backtests but fail in live trading.

❌ API Latency and Downtime

Retail infrastructure is not as reliable as institutional setups. Brokers may experience order delays or API failures.

❌ Regulation Risk

SEBI and global regulators are watching algo trading closely. Flash crashes or manipulative algos can bring scrutiny and even bans.

❌ Emotional Disengagement

Too much automation can make traders disconnected from market context. Sometimes, manual intervention is needed.

🧭 What’s the Future of These Strategies?

🔮 1. AI + Algo = Self-Learning Bots

The next wave of bots may not follow fixed rules. They may adapt automatically by learning from market behavior—almost like an evolving trader.

🔮 2. Regulation Around Algo Trading

Expect more regulation in 2025–2026 to ensure fairness and stability. SEBI may require audits or sandbox testing before public deployment.

🔮 3. Community-Based Innovation

Open-source algo trading platforms (like Blueshift, QuantConnect, etc.) are becoming collaborative hubs where traders share and upgrade each other's strategies.

🔄 How Can a Retail Trader Start?

✅ Step 1: Learn Python or Use No-Code Platforms

Python is the language of algo trading. If you can’t code, use platforms like AlgoTest, Tradetron, or Streak.

✅ Step 2: Start Small

Begin with paper trading or small capital. Don’t go all-in until you have confidence and historical data.

✅ Step 3: Choose a Clean Strategy

Start with something simple—like RSI + Moving Average crossover, and backtest on Nifty.

✅ Step 4: Track Metrics

Measure win ratio, drawdown, average profit per trade. Good algo traders analyze more than they trade.

✍️ Final Words

The rise of algorithmic and momentum-based strategy innovation is reshaping India’s trading landscape. It’s making the game smarter, faster, and more competitive. But like every tool, it depends on how you use it. These strategies aren’t magic bullets—they're systems that require patience, research, and constant optimization.

For traders willing to invest in knowledge and tools, the opportunities are exciting. For those hoping to “copy-paste” quick riches, the market may prove costly.

In 2025 and beyond, the best traders may not be those with the sharpest eyes—but those with the smartest code.

SEBI’s Derivatives Market Reforms & Jane Street Fallout1. The Bigger Picture: Why SEBI Intervened

India is currently the world’s largest equity derivatives market in terms of contracts traded. On expiry days, the trading volume in index derivatives—especially options—is often more than 300 times higher than that of the cash market. This unprecedented scale might sound like a success story at first glance, but SEBI, the Securities and Exchange Board of India, saw warning signs flashing bright red.

Over the past few years, retail traders have swarmed into the derivatives space, especially index options like Bank Nifty and Nifty 50. Most of them are drawn in by the promise of quick profits and leveraged exposure. However, a SEBI study revealed that 91% of retail traders in derivatives ended up losing money. That’s an alarming statistic. It signaled that the market was becoming speculative rather than investment-oriented.

Additionally, the structure of the market had become heavily tilted towards short-tenure options—weekly, and even daily expiries—turning it into a speculative playground. This over-dependence on weekly contracts resulted in wild swings, sharp intraday moves, and extreme volatility, especially on Thursdays (the weekly expiry day). This environment wasn't healthy—neither for long-term investors nor for the broader financial ecosystem.

SEBI saw this as a structural issue and decided to take bold steps to reform the derivatives market and make it safer, more rational, and more sustainable.

2. SEBI’s Core Reforms: Changing the Game

a) Extending Contract Tenure

One of the biggest problems SEBI identified was the overuse of ultra-short-term contracts. Weekly options had become the norm, with traders focusing on short bursts of market movement rather than making informed investment or hedging decisions.

To counter this, SEBI is planning to extend the tenure of derivative contracts. This means:

Less frequent expiries.

Longer-dated instruments becoming more liquid.

Reduced scope for expiry-based volatility and manipulation.

By pushing the market toward longer expiry contracts (like monthly and quarterly), SEBI wants to encourage thoughtful strategies, proper hedging, and discourage fast-money, short-term gambling.

b) Discouraging Retail Over-Speculation

Retail participation in the F&O market has skyrocketed, but most retail traders don’t fully understand the risks involved. SEBI has already taken several steps to discourage reckless speculation, such as:

Reducing the number of expiries per month.

Increasing the lot size of index futures and options, making it harder for small-ticket traders to over-leverage.

Introducing detailed risk disclosures on broker apps to educate traders about potential losses.

These steps are aimed at protecting small investors and bringing more stability to the market.

c) Focusing on the Cash Market

India’s cash equity market is relatively underdeveloped when compared to its derivatives segment. SEBI aims to rebalance this. By encouraging growth in the cash market, SEBI hopes to reduce the over-reliance on F&O and create a healthier, more resilient market structure.

3. The Jane Street Controversy: What Happened?

In July 2025, SEBI dropped a regulatory bombshell by banning Jane Street, a major US-based high-frequency trading (HFT) firm, from Indian markets. This wasn’t just a slap on the wrist—it was a full-blown interim order with massive consequences.

The Allegations:

SEBI alleged that Jane Street engaged in manipulative expiry-day strategies over a multi-year period. Here’s what SEBI believes happened:

In the morning of expiry days, Jane Street allegedly bought large volumes of index-heavy stocks. This artificially pushed the index higher.

At the same time, they opened short positions in index options, betting that the index would fall later.

In the afternoon, they unwound their stock positions, which pulled the index down.

As the index dropped, their short options positions profited heavily.

This strategy allowed them to make massive profits on expiry days, using their firepower to allegedly manipulate both the cash and derivative markets.

SEBI’s Action:

Barred Jane Street from trading in Indian markets.

Ordered them to deposit over ₹4,800 crore (~$570 million) in suspected unlawful gains.

Accused the firm of using its dominant market position to rig expiry-day movements.

Jane Street, of course, denied the allegations, claiming that their trades were legal arbitrage and part of liquidity provisioning. They are challenging the order in court, but the damage—both reputational and market-wide—has already been done.

4. The Immediate Fallout: Markets Take a Hit

The ban on Jane Street had a chilling effect on the market. Here's what followed:

a) Volume Drops

Jane Street was a major market maker in India’s derivatives space, especially on expiry days. After the ban:

F&O volumes dropped by over 30%.

Index options saw significantly reduced liquidity.

The premium turnover on the NSE fell by nearly 36%.

This wasn’t just a temporary blip. It revealed how dependent the Indian market had become on a few HFT firms to provide liquidity and manage spreads.

b) Volatility Dips

Interestingly, India’s volatility index (VIX) dropped to multi-month lows post the ban. With fewer players like Jane Street aggressively trading expiry moves, the markets became calmer. While this might seem good, too little volatility can reduce trading opportunities and narrow market participation.

c) Wider Spreads and Execution Slippage

With fewer market makers and less volume, traders—especially institutions—began facing wider bid-ask spreads. That means it became more expensive to execute trades, especially in large quantities. This can hurt mutual funds, FIIs, and even large domestic traders.

5. Broader Implications for the Indian Market

a) SEBI’s Strength as a Regulator

This episode showcases that SEBI is serious about enforcing discipline, even if it means challenging a global giant like Jane Street. That sends a strong signal to both domestic and international players: India’s markets are not a free-for-all.

b) Liquidity Vacuum

With Jane Street gone, there's a temporary liquidity vacuum. Other firms are cautious, unsure if they might be targeted next. SEBI needs to strike a balance—encouraging good players while weeding out bad behavior.

c) Investor Confidence and Market Maturity

While retail traders might find the new reforms and lower volatility frustrating, long-term investors and institutions are likely to benefit from a more predictable and transparent market.

6. Legal Battle and Global Ramifications

Jane Street has taken the legal route, depositing the required funds while appealing the SEBI ban. Depending on how the case proceeds:

It could set new legal precedents in Indian market jurisprudence.

It may influence how SEBI handles future cases involving algorithmic or HFT trading.

Other global firms might review or revise their India strategies, balancing opportunity with regulatory risk.

If SEBI wins the case, it strengthens its position as a tough, credible regulator. If Jane Street wins, it may force SEBI to revisit how it defines and regulates market manipulation, especially in the algo/HFT space.

7. What This Means for You (the Trader/Investor)

For Retail Traders:

Expect fewer sharp expiry-day moves. Strategies based on quick, expiry-day scalping may need to be adapted.

Market may feel slower, but potentially safer.

You’ll need to focus more on strategy, research, and planning, instead of gambling on weekly moves.

For Institutions:

Market access costs may rise due to wider spreads.

Less volatility may reduce arbitrage and quant trading opportunities.

Need for more diversified trading models, including participation in the cash and bond markets.

For Market Observers and Policy Thinkers:

This is a rare opportunity to watch a major regulatory shift unfold.

India’s market is transitioning from being a trader’s playground to an investor’s ecosystem.

8. What Comes Next?

SEBI will likely roll out more reforms—stricter monitoring, revised rules for expiry days, and enhanced surveillance.

New market makers may enter the space, possibly Indian firms or global ones with stronger compliance protocols.

Jane Street’s legal outcome will influence how aggressively foreign algo firms operate in India going forward.

✍️ Final Word

The SEBI vs Jane Street saga is more than a single enforcement action—it’s a symbol of India’s market maturity. By reforming derivatives and holding big players accountable, SEBI is trying to create a safer, more balanced market for everyone—from retail investors to institutional giants.

The road ahead may involve some pain—lower volumes, fewer trading thrills—but the foundation being laid could ensure a more sustainable, fair, and globally respected financial market

Sensex 1D Timeframe✅ Current Market Status:

Closing Price: ₹82,452.00

Change: –148.32 points

Percentage Change: –0.18%

Day’s Range: ₹82,300.70 – ₹82,892.30

52-Week Range: ₹65,302.20 – ₹83,822.00

🔍 Key Technical Levels:

📌 Support Zones:

Support 1: ₹82,200 – minor trendline support

Support 2: ₹81,800 – recent bounce zone

Support 3: ₹81,000 – strong institutional buying level

📌 Resistance Zones:

Resistance 1: ₹82,900 – intraday high rejected

Resistance 2: ₹83,400 – multi-session top

Resistance 3: ₹83,800 – all-time high zone

🕯️ Candlestick Pattern:

Candle Type: Bearish body with upper wick

Formation: Reversal candle after a small bounce

Implication: Supply seen near highs; indicates hesitation in buying

📈 Indicator Status (1D Timeframe):

Indicator Value & Signal

RSI (14) ~45 – Neutral but slipping downward

MACD Bearish crossover – sellers gaining control

20 EMA ~₹82,780 – Price below this level (short-term bearish)

50 EMA ~₹82,000 – May act as dynamic support soon

📊 Price Structure Summary:

Sensex is in a tight range between ₹81,800 and ₹83,400.

The price rejected from ₹82,900, showing sellers are active.

If ₹82,200 breaks, we might see movement toward ₹81,800 and ₹81,000.

A bullish breakout will only occur above ₹83,400 with strong volume.

🧠 Market Sentiment & Institutional View:

Volatility: Moderate — no extreme panic or euphoria

Volume: Average — no big accumulation seen

Smart Money Activity: Likely waiting near breakout levels or lower discount zones (₹81,000)

🔚 Summary:

🔴 Short-Term Bias: Slightly Bearish

🟡 Key Range: ₹81,800 – ₹83,400

✅ Buyers' Entry Point: Above ₹83,400

⚠️ Sellers' Trigger: Below ₹82,200 or ₹81,800 for more downside

Nifty 1D Timeframe✅ Current Market Status:

Closing Price: ₹24,972.50

Change: –95.20 points

Percentage Change: –0.38%

Day’s Range: ₹24,905.60 – ₹25,095.10

52-Week Range: ₹19,638.30 – ₹25,194.60

🔍 Key Technical Levels:

📌 Support Zones:

Support 1: ₹24,900 – Intraday low and key psychological level

Support 2: ₹24,750 – Previous breakout zone

Support 3: ₹24,500 – Short-term trendline base

📌 Resistance Zones:

Resistance 1: ₹25,100 – Day’s high and minor barrier

Resistance 2: ₹25,200 – All-time high

Resistance 3: ₹25,500 – Next potential rally target if breakout succeeds

🕯️ Candlestick Pattern:

Recent Candle: Bearish candle after range-bound session

Price Action: Failed to sustain above ₹25,100

Implication: Weakness around highs, possible pullback toward support

📊 Market Structure Summary:

Nifty formed a double top near ₹25,200, indicating exhaustion

Currently testing ₹24,900 – if broken, next support is ₹24,750

A breakout will only be valid above ₹25,200 with strong volume

🧠 Institutional Behavior:

Likely profit booking near highs

No major signs of heavy accumulation

May re-enter above ₹25,200 or below ₹24,500 for value buying

🔚 Summary:

🔴 Short-Term Bias: Slightly Bearish

🟡 Watch Levels: ₹24,900 (support) and ₹25,200 (resistance)

✅ Buyers: Wait for breakout above ₹25,200

⚠️ Sellers: Watch for breakdown below ₹24,900 or ₹24,750

Banknifty 1D Timeframe✅ Current Market Status:

Closing Price: ₹56,283.00

Change: –545.80 points

Percentage Change: –0.96%

Day’s Range: ₹56,204.85 – ₹56,705.15

52-Week Range: ₹47,702.90 – ₹57,628.40

🔍 Key Technical Levels:

📌 Support Levels:

Support 1: ₹56,000 – Price is hovering close to this level

Support 2: ₹55,800 – Previous low zone

Support 3: ₹55,200 – Strong buying area from last month

📌 Resistance Levels:

Resistance 1: ₹56,700 – Intraday rejection zone

Resistance 2: ₹57,100 – Swing high from earlier this week

Resistance 3: ₹57,600 – 52-week high

🕯️ Candlestick Analysis:

Candle Type: Big bearish candle with upper wick

Pattern: Bearish continuation — sellers are active

Implication: If price stays below ₹56,200, further downside possible

📈 Indicator Overview:

Indicator Signal

RSI (14) ~48 – Neutral zone, slightly bearish

MACD Bearish crossover – Downward momentum

20-Day EMA ~₹56,500 – Price below this, showing short-term weakness

50-Day EMA ~₹55,600 – Could act as support

📊 Market Sentiment:

Volatility: High intraday swings observed

Volume: Slightly above average – confirms strong seller presence

Institutional Action: Likely booking profits at higher levels

🔚 Summary & Outlook:

🔴 Short-Term Bias: Bearish

🟡 Watch Levels: ₹56,000 support and ₹56,700 resistance

✅ For Buyers: Wait for a strong close above ₹56,700

⚠️ For Sellers: Breakdown below ₹56,000 could lead to ₹55,200

Learn Institutional Trading Part-9🎯 Why Learn Advanced Option Trading?

Advanced option trading lets you:

✅ Profit in bullish, bearish, or sideways markets

✅ Use time decay to your advantage

✅ Limit risk while maximizing potential reward

✅ Create non-directional trades

✅ Build hedged and balanced positions

✅ Use data, not emotion for decision making

It shifts you from being a trader who hopes for direction to one who profits from market behavior — movement, volatility, time decay, and imbalance.

🧠 Core Concepts in Advanced Option Trading

1. Option Greeks

Understanding the Greeks is essential for advanced strategies.

Delta: Measures price sensitivity to the underlying (helps with directional trades).

Theta: Measures time decay. Option sellers use Theta to earn premium.

Vega: Measures sensitivity to implied volatility (IV).

Gamma: Measures how Delta changes — useful for adjustments and hedging.

Rho: Interest rate sensitivity (used in long-term options).

Greeks help you balance risk and reward and fine-tune your strategies based on volatility and time.

2. Implied Volatility (IV) & IV Rank

IV shows the market’s expectation of future volatility.

High IV = high premium; low IV = cheap premium.

IV Rank compares current IV to its past 52-week range — essential for deciding whether to buy or sell options.

💡 Advanced rule:

High IV + High IV Rank = Favor selling options

Low IV + Low IV Rank = Favor buying options

3. Multi-Leg Strategies

Multi-leg trades involve using more than one option to hedge, balance, or amplify your position.

Here are the most popular advanced option strategies:

🔼 Bullish Strategies

🔹 Bull Call Spread

Buy one lower strike Call, sell a higher strike Call

Profits if the market rises within a defined range

Lower cost than buying a single Call

🔹 Synthetic Long

Buy a Call and Sell a Put of the same strike

Replicates owning the underlying, but with options

🔽 Bearish Strategies

🔹 Bear Put Spread

Buy a higher strike Put, sell a lower strike Put

Profits if market falls within a defined range

🔹 Ratio Put Spread

Buy one Put, sell two lower-strike Puts

Low-cost or credit strategy with higher reward if price falls moderately

🔁 Neutral or Range-Bound Strategies

🔹 Iron Condor

Sell one Call spread and one Put spread

Profits if market stays between both spreads

Ideal in low volatility, sideways markets

🔹 Iron Butterfly

Sell ATM Call and Put, buy OTM wings

Profits from time decay and stable price

High Theta, limited risk and reward

🔹 Straddle (Buy/Sell)

Buy/Sell ATM Call and Put

Used when expecting high volatility (Buy) or low volatility (Sell)

🔹 Strangle

Buy/Sell OTM Call and Put

Lower cost than Straddle, wider profit zone

🛡️ Hedging Strategies

🔹 Protective Put

Hold underlying asset, buy a Put to limit downside

Like insurance for your long position

🔹 Covered Call

Hold stock, sell a Call to generate income

Profitable if the stock stays flat or rises slightly

🔹 Collar Strategy

Hold stock, buy Put and sell Call

Risk defined, reward capped — good for conservative investors

📊 Open Interest & Option Chain Analysis

Open Interest (OI) shows where the majority of contracts are built.

High OI + Price Rejection = Institutional Resistance/Support.

Watching Call/Put buildup gives clues about range, breakout zones, and expiry-day moves.

💡 PCR (Put Call Ratio): A sentiment indicator.

PCR > 1: More Puts → Bearish

PCR < 1: More Calls → Bullish

⏱️ Time Decay & Expiry Trades

Advanced traders use weekly options to capitalize on Theta decay. Weekly expiry strategies include:

Short Straddles/Strangles

Iron Condors

Calendar Spreads

These strategies make use of:

Fast premium decay on Thursday/Friday

Stable market periods

Defined risk setups

🧠 Advanced Psychology & Risk Control

Professional option traders don’t overtrade or overleverage. They:

Follow the 1–2% risk per trade rule

Avoid trading during event-based spikes (e.g., budget, Fed speeches)

Take non-directional trades in consolidating markets

Focus on probability over prediction

Maintain a trading journal and review setups

🎓 Pro Tips to Master Advanced Option Trading

✅ Understand the Greeks — especially Theta & Vega

✅ Use multi-leg strategies to reduce risk and cost

✅ Follow IV Rank — don’t buy expensive options

✅ Use high reward-to-risk setups

✅ Track OI build-up and option chain flow

✅ Avoid gambling — options are tools, not lottery tickets

✅ Always use hedged positions, especially when selling options

🧘 Final Words: Become the Strategist, Not the Speculator

Advanced Option Trading is not about guessing where the market will go — it’s about constructing trades that win in multiple scenarios.

It empowers you to:

Manage risk like a professional

Generate regular income from time decay

Adjust and defend trades when things go wrong

Trade with confidence, not emotion

If you’re ready to move beyond basic buying and start mastering the real edge in options, advanced strategies are your next level. This is how institutions trade. This is how real consistency is built.

Learn Institutional Trading Part-8✅ What is the Trading Master Class?

The Trading Master Class with Experts is a comprehensive and interactive program where seasoned market professionals share their knowledge, trading systems, and live market experience. It’s not just about theory — it's about real techniques that work in today’s volatile and highly manipulated markets.

You’ll learn:

How institutions really move the markets

When and why price reverses (not just where)

How to build your own strategy with risk management

Live chart reading and trade planning with expert commentary

🧠 What You’ll Learn in the Master Class

1. Market Basics to Advanced Concepts

Understand price action, market structure, order flow, and key indicators. Move from beginner to strategic thinker.

2. Smart Money Concepts

Learn how hedge funds and institutions trade. Understand concepts like:

Order Blocks

Liquidity Zones

Fair Value Gaps

Trap Moves & Stop Hunts

3. Live Market Analysis

Watch experts break down charts in real-time. Learn how they spot opportunities, manage risk, and plan entries/exits.

4. Risk Management & Trading Psychology

Know how much to risk, where to place stop-losses, and how to stay disciplined. Learn how pros control emotions and trade with confidence.

5. Strategy Building

You won’t just follow someone else’s setup — you’ll learn how to build your own based on logic and data, not guesswork.

👨🏫 Why Learn From Experts?

Books and free videos can only take you so far. Expert traders bring:

Years of market experience

Real trade breakdowns with proof

Live Q&A support

Mentorship that corrects your mistakes

You get access to tested methods, real examples, and market insight that’s hard to find elsewhere.

🚀 Who Should Join?

New traders wanting proper guidance

Retail traders tired of inconsistent results

Intermediate traders wanting to go pro

Investors looking to add short-term income through trading

🎯 Final Thought

Success in trading doesn’t come from signals, hype, or luck — it comes from education, mentorship, and practice. The Trading Master Class with Experts gives you a shortcut to years of trial-and-error by putting you in direct contact with those who have already mastered the craft.

Join the master class, learn from the best, and take your trading journey to the next level.

Learn Institutional Trading Part-7🎯 What is Institutional Trading?

Institutional trading is the process by which large entities — such as investment banks, hedge funds, mutual funds, and proprietary trading firms — participate in the market using large volumes of capital. These institutions don’t follow the strategies used by most retail traders. Instead, they use techniques that are based on market structure, liquidity, and logic, not indicators or news.

When you master institutional trading, you learn how to think like the smart money. You understand why price moves, not just how. This knowledge allows you to anticipate large moves instead of reacting to them late.

🔍 Key Concepts to Master

✅ Market Structure Phases

Institutions move through four major phases:

Accumulation – Quiet buying or selling in a range

Manipulation – False moves to trap retail traders

Expansion – Sharp move in the real direction

Distribution – Profit-taking while the crowd enters late

Understanding these phases helps you spot entries early and avoid fakeouts.

✅ Liquidity & Stop Hunts

Institutions need liquidity to enter large positions. They often drive price toward zones full of stop-losses or breakout traders, then reverse the market. These areas are called liquidity pools.

Retail traders get stopped out — smart traders enter after the trap, with the institutions.

✅ Order Blocks & Imbalances

Institutions often leave footprints through large unbalanced candles or zones (called order blocks and fair value gaps). These areas act as magnets for future price moves. Mastering these zones gives you high-accuracy entries with solid risk-reward.

💼 Why It Works

Retail traders lose because they follow emotion and indicators. Institutional traders win because they:

Wait for precision setups

Manage risk with discipline

Trade based on logic, structure, and liquidity

Don’t chase trades — they let the market come to them

When you master institutional trading, you adopt this same mindset. You become patient, calculated, and consistent

Learn Institutional Trading Part-6🧠 Who Are the Institutions?

Institutions include:

Hedge Funds

Mutual Funds

Investment Banks

Insurance Companies

Proprietary Trading Firms

They control billions in capital and cannot enter or exit the market like a small trader. Instead, they engineer price movements through smart accumulation, fakeouts, and liquidity manipulation to fill their orders efficiently.

Their goals are not to chase price, but to control it.

🔍 How Do Institutions Trade?

Institutions follow a logical and systematic approach:

Accumulate positions slowly in sideways or quiet markets.

Manipulate price to trap retail traders.

Trigger Liquidity Events (stop-loss hunting, fake breakouts).

Expand price in the true direction.

Distribute their position near highs/lows.

Reverse or Hedge their position when the market shifts.

Let’s go deeper into how to mirror these actions.

📊 Key Concepts to Trade Like Institutions

1. Market Structure Mastery

Institutions move in phases:

Accumulation: Range-bound movement where they quietly build long/short positions.

Manipulation (Fake Moves): Price breaks out and reverses — trapping retail traders.

Expansion: The real move begins after stop-losses are triggered.

Distribution: Institutions slowly exit positions while retail traders enter.

When you trade like institutions, you identify where the market is in these phases and act accordingly.

2. Liquidity Zones

Institutions need liquidity to execute big orders — they look for areas where lots of retail traders place stop-losses or entries.

They often target:

Swing highs/lows

Trendline breaks

Support/resistance levels

Breakout zones

You’ll notice price spikes into these zones, hits stops, and then reverses — this is smart money at work.

🔑 Tip: Don’t trade breakouts blindly — ask “who’s being trapped here?”

3. Order Blocks & Imbalances

An Order Block is the last bullish or bearish candle before a sharp move — representing institutional entry.

Price often returns to these zones to:

Fill remaining orders

Test liquidity

Offer re-entry for institutions

Similarly, Imbalances (Fair Value Gaps) are areas where price moved too quickly, creating a “gap” in buying/selling. These are likely targets for future reversals or pullbacks.

These zones give high probability entries when used with structure and confirmation.

4. Inducement & Manipulation

Before a big move, institutions often induce retail traders into taking the wrong position.

Examples:

False breakout above resistance (induces longs)

Sharp move below support (induces shorts)

Spike in volume, fake news-driven moves

These actions create liquidity that institutions need to enter their real positions. As a smart trader, your job is to recognize the trap and take the opposite side.

5. Risk Management Like a Pro

Institutions never bet the house. Their risk practices include:

Fixed percentage risk per trade (e.g., 0.5%–2%)

Diversified entries

Portfolio hedging (e.g., buying puts, selling covered calls)

Sticking to the strategy, not emotions

To trade like institutions:

Always calculate your risk-reward

Avoid overleveraging

Accept that not every trade wins, but your edge wins over time

6. Use of Data, Not Indicators

Institutions don’t trade off MACD or RSI. They use:

Price Action

Volume

Order Flow

Open Interest

Economic News & Macro Flow

This doesn’t mean you can’t use indicators — but use them as confirmation, not decision-makers. Price is the main truth.

Learn Institutional Trading Part-4📌 What is Institutional Trading?

Institutional trading refers to the strategies, mindset, and techniques used by large financial institutions when they participate in the markets. These entities trade with huge volumes and require liquidity, accuracy, and control in their execution.

Unlike retail traders who might buy or sell a few lots or shares, institutions often enter with millions of dollars at a time. If they enter the market carelessly, they would move the price against themselves. Hence, they use highly calculated and strategic methods to enter and exit positions without creating obvious footprints.

These strategies are often referred to as Smart Money Concepts (SMC) — techniques that revolve around price manipulation, liquidity traps, and understanding market structure.

🎯 Why Do You Need to Learn Institutional Trading?

Most retail traders lose because:

They chase price.

They follow lagging indicators.

They get trapped in fake breakouts.

They trade based on emotions, not logic.

Institutional trading flips that mindset. You learn to:

Trade with the big players, not against them.

Identify where the real buying and selling is happening.

Understand why price reverses suddenly — often after retail entries.

Predict market moves based on logic and liquidity, not noise.

By learning how institutions think and act, you become a more disciplined, data-driven trader with higher probability setups and better risk management.

🧠 Core Concepts of Institutional Trading

Let’s dive into the most important concepts every institutional trader must understand:

1. Market Structure

Institutions operate within clear phases of market movement:

Accumulation: Smart money quietly builds positions in a range.

Manipulation: They fake breakouts or induce retail traders to create liquidity.

Expansion: The actual move begins in the intended direction.

Distribution: They offload their positions to late traders before reversing.

If you can identify these phases, you’ll always know where you are in the market — and what’s likely to come next.

2. Liquidity Pools

Liquidity is the fuel institutions need to place trades. They don’t use limit orders like retail traders. Instead, they seek zones with large clusters of stop-losses, pending orders, and breakout trades to enter and exit positions.

These zones are:

Swing highs and lows

Trendline breaks

Support/resistance levels

Retail breakout levels

You’ll often see the market spike into these areas and reverse — that’s not a coincidence. That’s institutional activity.

3. Order Blocks

An order block is a candle (usually bearish or bullish) where institutions placed large orders before a major market move. These zones often act as future supply and demand levels, where price returns to fill orders again.

Order blocks help you:

Identify powerful entry points.

Predict reversals or continuations.

Understand institutional footprints on the chart.

4. Fair Value Gaps (FVG)

A Fair Value Gap is a price imbalance between buyers and sellers — often created when institutions enter with speed and aggression. The market typically returns to fill this gap before continuing the trend.

FVGs are great for:

Entry confirmations

Predicting retracements

Identifying imbalance zones where price is “unfair”

6. Inducement & Mitigation

Inducement: Institutions create fake signals to trick retail traders into entering, generating the liquidity they need.

Mitigation: Institutions revisit previous zones to close old trades or rebalance positions — often creating hidden entries.

These tactics show how institutions intentionally manipulate price to maximize their position efficiency.

📊 Tools Institutional Traders Use

While many retail traders rely heavily on indicators like RSI, MACD, or Bollinger Bands, institutional traders focus more on:

Price action

Volume analysis

Open interest in options/futures

Liquidity maps

Time-based market behavior (sessions: London, NY, Asia)

Their edge comes from understanding what the market is doing, not what an indicator is telling them.

🧱 Institutional Risk Management

Institutions don’t gamble. Every trade is backed by:

Precise entry, stop-loss, and take-profit levels

Predefined risk percentages

Diversification and hedging

Capital allocation rules

They don’t revenge trade. They don’t overtrade. They focus on high-probability setups with calculated risk.

Retail traders can learn from this by:

Sticking to a trading plan

Managing emotions

Risking only a small % of their capital

Focusing on quality over quantity

📈 Institutional Trading in Action (Example)

Let’s say the market has been ranging for 3 days. Suddenly, price spikes up through a resistance level — a breakout! Retail traders jump in long.

But then, within minutes, price reverses sharply downward. Stop-losses are hit. Panic sets in.

What happened?

Institutions induced a breakout, used retail stop-losses as liquidity, filled their short positions, and now the real move — downward expansion — begins.

Understanding this flow helps you trade with the move, not against it.

👨🏫 Who Should Learn Institutional Trading?

This approach is ideal for:

Day traders looking for accurate short-term moves

Swing traders seeking strong trend setups

Options traders who want to align positions with institutional flow

Forex and crypto traders who want to stop chasing signals and start following structure

🚀 Benefits of Learning Institutional Trading

✅ Higher accuracy entries

✅ Better reward-to-risk ratios

✅ Less emotional trading

✅ Deeper understanding of price movement

✅ Freedom from lagging indicators

✅ Long-term trading consistency

🎓 Final Thoughts: Become the Hunter, Not the Hunted

Retail traders are often the prey in a game designed by institutions. But by learning institutional trading, you flip the script. You become the hunter — identifying setups, planning moves, and acting with precision.

Institutional trading is not about being right every time — it's about being strategic, calculated, and aligned with the flow of money

Master Candle Sticks part-2🔥 What Are Candlesticks?

A candlestick is a visual representation of price movement within a specific time period (1 minute, 1 hour, 1 day, etc.). It consists of:

Body – The area between the open and close.

Wick (Shadow) – The high and low prices reached.

Color – Usually green (bullish) or red (bearish).

🧠 Why Learn Master Candlestick Patterns?

Mastering candlestick patterns helps traders:

Identify trend reversals or continuations.

Get early entry or exit signals.

Understand market psychology and price action.

Improve risk-reward ratios in trades.

🧭 Top Master Candlestick Patterns (Explained Simply)

Here are some of the most important candlestick patterns every trader should master:

1. Doji

🔍 Indecision in the market

Shape: Small body, long wicks

Meaning: Buyers and sellers are equal – could indicate a reversal if found after a trend.

Types: Standard Doji, Long-Legged Doji, Dragonfly, Gravestone

2. Hammer 🔨

📈 Bullish reversal pattern

Shape: Small body at top, long lower wick

Appears: After a downtrend

Signal: Buyers are stepping in strongly

3. Inverted Hammer

📈 Also bullish reversal

Shape: Small body at bottom, long upper wick

Appears: After a downtrend

Signal: Buyers testing resistance – may rise soon

4. Shooting Star 🌠

📉 Bearish reversal

Shape: Small body at bottom, long upper wick

Appears: After an uptrend

Signal: Sellers taking control

5. Engulfing Patterns

A. Bullish Engulfing

Two candles: First red (small), second green (larger, fully covers the red)

Appears: At the bottom of a downtrend

Signal: Strong reversal to upside

B. Bearish Engulfing

Two candles: First green (small), second red (large, covers the green)

Appears: At the top of an uptrend

Signal: Reversal to downside

6. Morning Star 🌅

📈 Three-candle bullish reversal

1st: Long red

2nd: Small (any color)

3rd: Strong green

Appears: After downtrend

7. Evening Star 🌇

📉 Three-candle bearish reversal

1st: Long green

2nd: Small (indecision)

3rd: Strong red

Appears: After uptrend

8. Marubozu

💡 Strong trend candle

No wicks (only body)

Green Marubozu: Full bullish power

Red Marubozu: Full bearish power

9. Spinning Top

🔄 Low momentum or indecision

Small body, equal upper and lower wicks

Shows uncertainty – market could reverse or consolidate

📘 Tips to Master Candlestick Reading

Don’t rely on just one candle. Always see the pattern in context of previous trend.

Use volume with candlesticks – A reversal candle with high volume is more powerful.

Combine with other tools – Support/Resistance, Moving Averages, RSI, etc.

Practice on charts daily – Backtest on historical data

✅ Final Thoughts

Master Candlestick Patterns are a foundation for price action trading. They don't work alone but when used wisely with technical indicators and proper risk management, they can give high-probability setups.

AI & Algo-Based Automated Trading🤖 What Is Algorithmic Trading?

Algorithmic Trading, or simply Algo Trading, is when computer programs automatically place buy/sell orders based on pre-defined rules, without human intervention.

Imagine giving your laptop a checklist like:

“If Nifty goes above 22,500 AND RSI is above 60 AND volume is high, then BUY.”

The computer will monitor the market 24x7—and the moment this condition is met, it will execute the trade automatically in milliseconds.

This kind of rule-based, automated trading using programs is Algo Trading.

🧠 What Is AI in Trading?

AI-based trading goes a step further.

Unlike basic algos that follow fixed rules, AI can learn, adapt, and improve with experience—just like humans.

Using technologies like:

Machine Learning (ML)

Natural Language Processing (NLP)

Neural Networks

Predictive Analytics

AI systems analyze massive amounts of data, including charts, volumes, news, tweets, macro events, and more—and predict future price movements or generate smart trading signals.

So while Algo Trading is like giving instructions to a robot, AI Trading is like training a robot to think like a trader

How Does Algo Trading Work?

Algo trading usually follows a 4-step cycle:

Strategy Design:

You create a trading rule, e.g. “Buy if 5 EMA crosses 20 EMA”.

Execution:

Set it up with your broker or software to trade automatically.

Monitoring:

Keep an eye to adjust for market conditions or technical issues.

Common Algo Strategies:

Moving average crossovers

Mean reversion

Arbitrage (buy low, sell high across markets)

Trend following

Momentum trading

Scalping (multiple small profits in quick trades)

🔮 How Does AI-Based Trading Work?

AI-based systems do all the above PLUS:

Analyze news sentiment (good or bad for a stock)

Understand social media buzz (like Twitter or Reddit)

Learn from historical chart patterns and price movements

Adjust strategies based on outcomes (self-improvement)

Example:

An AI bot could learn that when crude oil prices rise + VIX increases + USDINR weakens → certain oil & gas stocks tend to rally → it may buy those stocks automatically.

This is smart prediction, not just following a rule.

🌐 Who Uses AI & Algo Trading?

✅ Institutional Investors:

Mutual Funds

FIIs (Foreign Institutional Investors)

Insurance companies

Banks and proprietary trading desks

✅ Hedge Funds:

Quant funds like Renaissance Technologies, Two Sigma, Citadel use AI at scale

💰 Benefits of AI & Algo Trading

Speed – Trades happen in milliseconds. You can’t beat that manually.

Discipline – No emotional trading, no greed or fear.

Scalability – Run multiple strategies on multiple stocks at once.

Precision – Orders are accurate, slippages can be minimized.

⚠️ Risks & Challenges

It’s not all sunshine and profits. Here are some things to be cautious about:

Risk Description

Overfitting Your model may work in the past but fail in live market.

Black Swans Unforeseen events can destroy even smart systems.

Data Issues Bad data = bad trades. Accuracy matters.

Connectivity/Tech If system crashes mid-trade, results can be brutal.

Emotional Blindness AI can't feel panic—good for rules, bad for crisis.

🧠 Real World Use Cases

✅ Example 1: Intraday Scalping Bot

Scans top 100 NSE stocks

Enters trades on VWAP bounces with strict SL

Exits with 0.5-1% target

Runs 50 trades/day across stocks

✅ Example 2: AI News Sentiment Strategy

Uses NLP to scan headlines, tweets, earnings

Classifies news into “Positive”, “Negative”, or “Neutral”

Trades in the direction of sentiment before retail even reacts

✅ Example 3: Pair Trading Algo

Compares movement of two related stocks (e.g. HDFC Bank vs ICICI Bank)

If one deviates too far from the other, it creates a hedge

Buy one, sell the other—profit from convergence

🔁 The Future: AI + Algo + Quantum + Blockchain?

The future of markets is combining:

AI (Decision Making)

Algo (Execution)

Blockchain (Transparency)

Quantum Computing (Speed & Accuracy)

Large financial institutions are already hiring AI scientists and coders instead of traditional analysts. Markets are evolving—and so should we.

🧾 Conclusion

AI & Algo Trading is the future—and the present. It’s fast, smart, and scalable.

Big institutions are already using them to make crores from micro-movements. For retail traders, this is an opportunity to level up, automate emotions out, and trade systematically

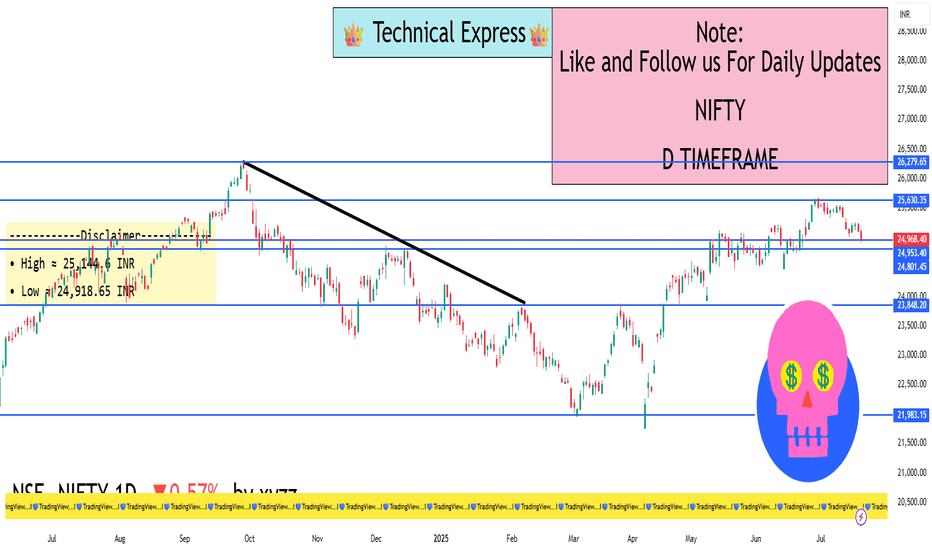

Nifty 50 - 1D Timeframe📊 Nifty 50 – Daily Chart Overview (1D Timeframe)

Current Close (July 18): Around 24,968

Change: Down ~143 points (–0.57%)

Intraday Range: High ~25,145 | Low ~24,918

52‑Week Range: 21,744 to 26,277

YTD Performance: Approximately +5.6%

📈 Technical Indicators

RSI (14-day): ~32.5

This shows that the market is entering bearish territory, but not yet oversold.

MACD: Below signal line, value ~–67

A clear sell signal, confirming negative momentum.

Stochastic Oscillator: Above 98

Indicates that the index is overbought, and a correction may be due.

ADX (Average Directional Index): ~48

Signifies a strong trend—right now, it’s favoring bearish movement.

Other Oscillators (CCI, ROC, Ultimate): Mostly giving sell signals

🧠 Market Sentiment & Context

Nifty has been bearish for the third straight week

Trading is happening below the 20-day EMA, suggesting downward pressure

Overall tone is range-bound and lacking momentum due to:

Weak quarterly earnings

Foreign investor selling

Global market uncertainty

📉 Volatility & Risk Gauge

India VIX: ~11.2 to 11.4

This is the lowest in 15 months, signaling low market fear

Low VIX often means sideways consolidation and narrow movement

📊 Put-Call Ratio (PCR) & Options View

PCR (based on open interest): ~0.80

Indicates a bearish bias

More calls being written compared to puts

🏦 Bank Nifty Overview (for Comparison)

Close: ~56,283

Drop: ~1%

RSI: ~28 (Bearish)

MACD: Sell signal

Resistance: 57,200 – 57,600

Support: 56,300 – 55,800

Bank Nifty is also showing bearish momentum and mirrors Nifty’s structure.

📅 What to Watch Next

Corporate Q1 results – especially from large caps like Reliance, HDFC, ICICI

Global cues – US inflation, interest rate decisions, global markets

India VIX – If it spikes above 14–15, market fear might return

FIIs activity – Any strong buying/selling can swing the market

✅ Summary (Daily Timeframe)

Nifty is currently weak and range-bound

Key level to hold: 24,900

Key level to break: 25,250

Momentum is with sellers; cautious approach recommended

If no trigger appears, expect sideways movement or slow decline

AXISBANK – 1D Timeframe📊 AXISBANK – DAILY CHART (1D TIMEFRAME)

📅 Date: July 18, 2025

Closing Price: ₹1,099

Change: –₹60.50 (–5.2%)

Intraday Range: ₹1,074 (Low) – ₹1,159 (High)

52‑Week Range: ₹867 – ₹1,186

YTD Return: Approx. +8%

Volume: Heavier than average, indicating strong selling pressure.

⚠️ MARKET CONTEXT & TREND

Bearish Trend: Axis Bank has broken below key support zones.

Oversold RSI: While it suggests possible short-term bounce, confirmation is needed.

Strong ADX: Indicates trend strength is increasing — in this case, on the downside.

High Volume Sell-off: Indicates institutional or heavy selling pressure.

No reversal indicators yet – MACD is still negative and falling.

🔍 SUMMARY VIEW

Trend: Strongly Bearish

Momentum: Weak, heavily oversold

Volatility: High

Reversal Signs: Not yet confirmed

Short-Term Outlook: Bearish to sideway unless price reclaims ₹1,120–1,150 zone

🔮 WHAT TO WATCH NEXT

Reversal Confirmation: Look for RSI climbing back above 30 and MACD crossover.

Volume Drop on Red Days: If selling volume dries up, it may signal weakening bears.

Breakout above ₹1,150: Could confirm fresh buying and trend reversal.

Further Drop Below ₹1,070: Could lead to panic selling and deeper correction

Option Trading✅ Why Trade Options?

📊 Profit in All Market Conditions — Whether markets go up, down, or stay flat, options allow you to build strategies for every scenario.

💰 Limited Risk, High Reward — With proper strategies like buying options, you can limit your risk to the premium paid but enjoy unlimited upside.

🔒 Hedge Existing Investments — Investors use options to protect their portfolios from market crashes.

🧩 Flexibility — Options allow for creative trade setups such as income generation, speculation, and hedging.

📉 Leverage — Control larger positions with less capital.

✅ Key Concepts in Option Trading

1. Call Option (Buy Side):

Gives the buyer the right to buy an asset at a certain price before expiry.

✅ Call Buyer profits when price goes up.

✅ Call Seller (Writer) profits when price stays flat or falls.

2. Put Option (Sell Side):

Gives the buyer the right to sell an asset at a certain price before expiry.

✅ Put Buyer profits when price goes down.

✅ Put Seller profits when price stays flat or rises.

✅ Important Terms to Know

Strike Price – The fixed price at which you can buy or sell the underlying asset.

Premium – The cost paid by the option buyer to the seller for the right to exercise.

Expiry Date – The date when the option contract becomes void.

In-the-Money (ITM) – Option has intrinsic value (profitable if exercised).

Out-of-the-Money (OTM) – Option has no intrinsic value (unprofitable if exercised).

At-the-Money (ATM) – Option strike is closest to the current market price.

✅ Popular Option Trading Strategies

1. Directional Strategies:

Long Call – Profit from rising markets.

Long Put – Profit from falling markets.

2. Non-Directional Strategies:

Iron Condor – Profit from range-bound markets.

Straddle/Strangle – Profit from big movements in either direction.

Butterfly Spread – Low-cost strategy for limited movement with high reward potential.

3. Income Strategies:

Covered Call – Selling calls on owned stocks for premium income.

Cash-Secured Put – Selling puts on stocks you want to own at a lower price.

✅ Advanced Concepts for Institutional-Level Trading

📌 Implied Volatility (IV): Measures expected future volatility; options become expensive when IV rises.

📌 Theta Decay: Time decay that eats away premium, favoring option sellers.

📌 Delta, Gamma, Vega, Theta (Greeks): Quantify how option prices react to changes in market conditions.

📌 Hedging with Options: Professionals hedge large portfolios using protective puts or collars.

📌 Liquidity and Open Interest: High open interest means better liquidity, tighter spreads, and easier trade execution.

✅ Why Institutions Prefer Option Trading

Institutions, banks, and hedge funds use options to:

Hedge large stock portfolios.

Generate steady returns through premium collection.

Manage volatility exposures.

Create complex structured products.

They use strategic adjustments, rollovers, and risk-defined positions to control large portfolios with precision.