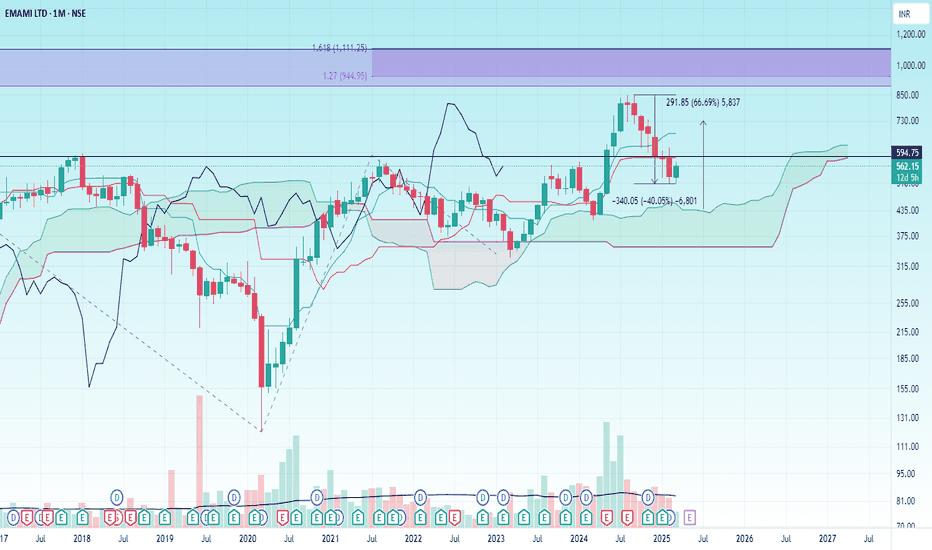

EMAMI LTDHello & welcome to this analysis

the market has taken a heavy toll across all sectors, not even sparing the defensive sector - FMCG.

What lies ahead for Emami, a fmcg co with established brands across several segments - I have in this video covered the stock across multiple time frames showing likely support areas and probable resistance areas keeping in mind the likelihood of more upside in the medium to long term based on the studies of Ichimoku & Fibonacci

Happy investing

Ichimokuchart

MFLOUR - RSI reading hint a BULLISH OUTLOOK ?MFLOUR - CURRENT PRICE : RM0.545

MFLOUR has been on a downtrend since June 2024 and began consolidation on November 2024.

Based on ICHIMOKU CHART, last Friday the share price rises and penetrated LEADING SPAN 2 - Closed inside KUMO. At the same time CHIKOU SPAN starts to move above CANDLESTICK - this shows a little bit bullish scenario.

There were also BULLISH DIVERGENCE in RSI oscillator. Interesting part is RSI break above 50 points on last Friday. This rising reading in RSI oscillator add more bullish outlook for this stock.

ENTRY PRICE : RM0.545

TARGET : RM0.575 , RM0.595

STOP LOSS : RM0.520

TAYOR !

Notes : Malayan Flour Mills Bhd. engages in the flour milling business. It operates through the following segments: Flour and Grain Trading (FGT), Poultry Integration (PI), and Others.

Is HDFC Bank aiming to hit 2200+ in the coming months?Reason for going long on HDFC:

Ichimoku:

HDFC stock has been sideways for years but is slowly turning bullish after hitting strong Ichimoku cloud support at 1350. It is now crossing the Tenkan-sen (TS) and Kijun-sen (KS) on the monthly chart.

Fibonacci + Fib Channel:

When we draw the Fibonacci channel and Fibonacci extension of swings, it looks like HDFC is set to hit 2200 in the coming months.

Buy on Dip:

The current market price (CMP) is 1604. Any good dip near 1450-1520 presents a great buying opportunity for the long term.

Disclaimer: We are not SEBI registered. The content presented here is based on our personal opinions. Conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Buy Nifty with Small SL, 23900+ target and we can trial SL.Based on Ichimoku 1 hour, we are going long in Nifty with small SL. The target can hit in 3-4 days.

Since it's positional setup, option selling with right edge is a good option.

Disclaimer: We are not SEBI registered. The content presented here is based on our personal opinions. Conduct your own research and consult with a qualified financial advisor before making any investment decisions

Is IEX ready for a 100% upmove? Charts says YESIs Indian Energy Exchange (IEX) all set to fire up?

We are expecting big targets based on the following key technical points:

Great Correction (Fib):

The price underwent a deep correction of more than 61.8%, almost reaching the 0.786 Fibonacci retracement level from the top.

Price Action Structure Change:

The price has changed structure since it broke the previous high on the monthly time frame and sustained weekly candle.

Ichimoku Confirmation:

There is a strong TS & KS breakout, and it looks poised to break the cloud as well. A strong base has been created, and a breakout has occurred.

Fib Channel + Fib Extension:

The price respected the channel bottom and reversed strongly. Based on the channel targets, there is a high chance of hitting 360+ in the coming months.

Wave Analysis and Targets:

The stock is in either Wave C or Wave 3. The minimum targets for Wave C are 287 (61.8%) and 394 (100%). Any move beyond this is a bonus.

Use Ichimoku (Daily Time Frame) for Higher Profits:

Disclaimer: We are not SEBI registered. The content presented here is based on our personal opinions. Conduct your own research and consult with a qualified financial advisor before making any investment decisions.

SOTL - Ichimoku Breakout📈 Stock Name - Savita Oil Technologies Limited

🌐 Ichimoku Cloud Setup:

1️⃣ Today's close is above the Conversion Line.

2️⃣ Future Kumo is Turning Bullish.

3️⃣ Chikou span is slanting upwards.

All these parameters are shouting BULLISH at the Current Market Price and even more bullishness anticipated AFTER crossing 543.

🚨Disclaimer: This is not a Buy or Sell recommendation. It's for educational purposes and a guiding light to learn trading in the market.

#CloudTrading

#IchimokuCloud

#IchimokuFollowers

#Ichimokuexpert

Excited about this analysis? Share your thoughts in the comments below!

👍 Like, Share, and Subscribe for daily market insights! 🚀

#StockAnalysis #MarketWatch #TradingEducation #ichimoku #midcap

SOTL - Ichimoku Breakout📈 Stock Name - Savita Oil Technologies Limited

🌐 Ichimoku Cloud Setup:

1️⃣ Today's close is above the Conversion Line.

2️⃣ Future Kumo is Turning Bullish.

3️⃣ Chikou span is slanting upwards.

All these parameters are shouting BULLISH at the Current Market Price and even more bullishness anticipated AFTER crossing 480.

🚨 Disclaimer: This is not a Buy or Sell recommendation. It's for educational purposes and a guiding light to learn trading in the market.

#CloudTrading

#IchimokuCloud

#IchimokuFollowers

#Ichimokuexpert

Excited about this analysis? Share your thoughts in the comments below!

👍 Like, Share, and Subscribe for daily market insights! 🚀

#StockAnalysis #MarketWatch #TradingEducation #ichimoku

IPCALAB - Ichimoku Breakout📈 Stock Name - Ipca Laboratories Limited

🌐 Ichimoku Cloud Setup:

1️⃣ Today's close is above the Conversion Line.

2️⃣ Future Kumo is Turning Bullish.

3️⃣ Chikou span is slanting upwards.

All these parameters are shouting BULLISH at the Current Market Price and even more bullishness anticipated AFTER crossing 1204.

🚨 Disclaimer: This is not a Buy or Sell recommendation. It's for educational purposes and a guiding light to learn trading in the market.

#CloudTrading

#IchimokuCloud

#IchimokuFollowers

#Ichimokuexpert

Excited about this analysis? Share your thoughts in the comments below!

👍 Like, Share, and Subscribe for daily market insights! 🚀

#StockAnalysis #MarketWatch #TradingEducation #ichimoku

ANGEL ONEHello & welcome to this analysis

The stock since its listing has been a rank outperformer and is currently trading at its Fibonacci trend extension of 1.27 of its 1st leg of uptrend.

It has short term support at 3400, below that at 2900-2550

Medium term resistance comes in at 5100

Appears to be a good stock to accumulate on dips with a decent risk reward ratio set up

Happy Investing

SHALBY - Ichimoku BreakoutStock Name - SHALBY Limited

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at Current Market Price

and more bullishness AFTER crossing 320

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

#CloudTrading

#IchimokuCloud

#IchimokuFollowers

#Ichimokuexpert

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, share & subscribe for daily analysis.

IRCTCWelcome to this analysis

Stock had a dream listing and a very strong 2 years bull trend. Post that it saw a sharp retracement.

Now, it appears to once again attempting another rally after making a double bottom in the weekly time frame.

Range for short term 725-690 for medium term 900-650

Happy Investing

DLF - Ichimoku BreakoutStock Name - DLF Limited

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at Current Market Price

and more bullishness AFTER crossing 575

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

#CloudTrading

#IchimokuCloud

#IchimokuFollowers

#Ichimokuexpert

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, share & subscribe for daily analysis.

Ichimoku helps in keeping calm as an INVESTORHere's an outlook on why adding ICHIMOKU to your chart helps in keeping calm, watching a broader view & not panic sell!

So Ichimoku is a trend following indicator using calculations (9.26.52) consisting of a Conversion Line (similar to 9 MA) & Base Line (Similar to 26 MA) and lagging span (price line moving 26 periods back) and cloud which moves ahead 26 periods. Instead of leaping into calculations lets keep it simple. Now let me comprehend it further so it works well when you want to know if the drop is over and about possible pullbacks. The sign of a pullback is that a right after the breakdown happens a simultaneous up move breaks back the price and we call it a pullback.

And here comes the best part during uncertain times like crisis when a lot of panic and fear is there, as an Investor, Ichimoku will keep you in the game.

If you look at the above chart. Unlike other indicators it turned the disguise into once in a decade opportunity by the price taking support at the cloud and bouncing back, during 2008 crisis and C0VID Crisis.

The idea is to not panic sell, stay invested, think long term and keep on accumulating the businesses in which you see scope and match your risk appetite.

Thanks for reading. I welcome your queries.

Not a Financial Advise! Kindly do your own research..

REPCOHOME - Ichimoku BreakoutStock Name - Repco Home Finance Limited

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at Current Market Price

and more bullishness AFTER crossing 431

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

#CloudTrading

#IchimokuCloud

#IchimokuFollowers

#Ichimokuexpert

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, share & subscribe for daily analysis.

MARUTI Hello and welcome to this analysis

Maruti has been a rank outperformer now for 2 decades. Stock has currently reacted to a resistance suggesting probability of some more pullback.

Overall stock has tremendous potential for further upside over medium to long term. Investors could look at an opportunity to add via SIP in the broader range 9500-11000 while traders can look for swing trading opportunities with resistance near 10400-500 and support at 9800-9600.

Happy Investing

Coal India LTDHello & Welcome to this analysis

A Maharatna co has done exceeding well since March lows and particularly in the month of September.

Going forward as long as it sustains above 275 it could continue its rally which next faces a major resistance near 350 in the medium term.

Happy Investing

SANGHVI MOVERSHello and welcome to this analysis

Sanghvi Movers has head a tremendous run from 2020 lows with more of a time wise correction than a sideways price correction in 2022.

Currently the stock is at the Ichimoku Price Theory target. Stock has tremendous potential for further upside in the medium to long term

One can look for further strength above 755 or on an accumulation till 575-550 where it has huge support.

All the best investing

GIPCL - Ichimoku BreakoutStock Name - Gujarat Industries Power Company Limited

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at Current Market Price

and more bullishness AFTER crossing 122

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

#CloudTrading

#IchimokuCloud

#IchimokuFollowers

#Ichimokuexpert

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, share & subscribe for daily analysis.

BHARAT ELECTRONICS LTDHello & welcome to this analysis

Stock continues to be in an uptrend in the higher time frame with resistance in the monthly/weekly time frame near 145.

In the lower time frame its forming a wedge like structure with a small triangle. Resistance at 128.50 support at 124.

The stock has been a rank outperformer and any dips to monthly / weekly support zones would be an opportunity to buy, as well as investors could continue to do SIP in it from a long term perspective.

Happy Investing

OIL INDIA LTDOil India seems a good buy at this level for a target of 220 - 236 with a SL of 191. There are multiple confirmations indicating a good short term upside in the stock , so probably it may do good in this week. Detailed explanation has been given in the chart itself, Please go through.

CHART & ANALYSIS

ADARSH DEY