JSW Infra (JSWINFRA) – Weekly Reversal Setup JSW Infra has reversed from the lower trendline of a channel, forming a strong weekly hammer candle, indicating potential trend reversal. Price is well supported by Anchored VWAP , adding strength to the setup.

Currently, the stock is trading in a low volume area , which often leads to a sharp move. As per Volume Profile , price is likely to move towards the POI / POC zone near ₹315 .

Trade Setup:

Buy : ₹276 (Current Market Price)

Targets : ₹300 – ₹315

Stop Loss : ₹260 (Closing basis)

Technical Confluence:

Channel support + reversal candle

Anchored VWAP support

Low Volume Area → Mean reversion

POC acting as magnet

JSWINFRA

Long JSWINFRA - Short term Investment# JSW Infrastructure Limited (NSE) - Technical Analysis Report

Current Price: 335.80

Key Technical Observations

**Bullish Breakout Setup**

- Breakout Level: Above 356 for conservative trade

Consolidation phase completing before potential breakout (BO) & Stock trading near resistance zone.

Price Targets

- Target 1: 352.90 (0.618 Fibonacci level)

- Target 2: 389.50 (0.786 Fibonacci level)

- Target 3: 411.30 (0.886 Fibonacci level)

- Target 4: 436.15 (1.0 Fibonacci extension)

- Moving Average: SMA showing upward momentum at 296.13

- Fibonacci Retracement : 61.8% level acting as immediate resistance

Chart Pattern Analysis

- Hidden Divergence on the chart suggesting underlying strength

- Consolidation Phase after pullback from 0.618 fib levels and Recent sideways movement indicating accumulation

Risk Management

- Support Level of the recent consolidation low around 280-300 zone

- Stop Loss: Conservative traders should consider stops below 320 on candle close basis.

Conservative Traders:

- Wait for decisive breakout above ₹356 with volume confirmation

- Enter on pullback to ₹340-345 range after breakout

- Target progressive profit booking at mentioned Fibonacci levels

Disclaimer: This analysis is for educational purposes only. Please conduct your own research and risk management before making investment decisions.

JSW Infra cmp 312 by Weekly Chart view since listedJSW Infra cmp 312 by Weekly Chart view since listed

- Support Zone 285 to 300 Price Band

- Resistance Zone 318 to 333 Price Band

- Bullish Rounding Bottoms repeated under the Resistance Zone neckline

- Stock making Higher High Lower High pattern within up-trending price channel momentum

- Stock traversing within Rising Support + Price Channel and attempting Falling Resistance + Price Channel Breakout

JSW-INFRA : Powering India’s Port Revolution – A Deep Dive into NSE:JSWINFRA

JSW Infrastructure Ltd.

🧾 Company Overview

Role: JSW Infrastructure is India's second-largest commercial port operator (after Adani Ports), and forms a core part of the JSW Group.

Operations: The company manages and operates major ports across both the east and west coastlines of India.

Revenue Streams: Primarily driven by port operations (handling bulk, breakbulk, containerized cargo), as well as integrated logistics services.

📊 FY24 Financial Snapshot

Revenue ₹3,200+Cr

EBITDA Margin 55–60%

Net Profit ₹750+Cr

Debt to Equity ~0.6x

ROCE ~15%

ROE ~13%

Positive aspects:

Asset Turnover Strong

Double-digit revenue CAGR (>20%) over the past three years.

High EBITDA margins consistent with best-in-class infra businesses.

Well-diversified cargo and customer profile, with increasing non-JSW business.

Stable long-term contracts & beneficiary of India’s logistics and trade reforms.

Risks / Weaknesses:

~70% revenue is from group companies, though diversification is underway.

Aggressive capex plans elevate financial risk.

Susceptible to regulatory, tariff, and environmental compliance changes.

📈 Technical Analysis (July 2025)

• Share Price: Trading in the ₹260–₹280 range. IPO was at ₹119 (Sep 2023); strong price appreciation since listing.

• Trend: Intact uptrend; recently consolidated between ₹240–₹260.

• Support/Resistance: Key support at ₹230–₹235; resistance at ₹285–₹300.

• Moving Averages: Stock remains above both its 50-EMA and 200-EMA — a structurally bullish indicator.

• Momentum:

o RSI: 60–65 (bullish, but approaching overbought)

o MACD: Fresh bullish crossover; volume shows accumulation near breakout.

• Outlook: Breakout above ₹285 could trigger medium-term upside toward ₹320–₹340. Buy-on-dips is favored, with strong accumulation likely in the ₹230–₹240 zone.

🚀 Growth Prospects & Strategic Moves

• Capacity Expansion: Plans to nearly double port capacity by FY30 (from ~160 MTPA to ~300 MTPA).

• Cargo Diversification: Targeting major reduction of group dependency (from ~70% to ~50%) by growing third-party cargo traffic.

• New Projects: Investment pipeline includes both greenfield and brownfield projects in Odisha, Maharashtra, and other states.

• Integrated Logistics: Deeper backward integration into rail connectivity and warehousing to capture higher value from logistics value chain.

• Macro Tailwinds

o Major government initiatives (e.g., Sagarmala) catalyzing sector growth.

o India’s trade/exports rising; strong outlook for cargo and container volumes.

o Shifts in supply chains to coastal shipping and blended logistics.

o Demand uptrend in containerization and warehousing services.

⚠️ Key Risks & Limitations

• High Capex Cycle: Expansion could elevate debt and financial leverage.

• Macro Sensitivity: Lower industrial/output growth would hit cargo volumes.

• Regulatory Overhang: Tariff and ESG regulations present chronic uncertainty.

• Group Concentration: Third-party cargo growth remains an execution challenge.

• Rivalry: Competitive intensity from Adani, DP World, and others is ramping up.

📌 Conclusion & Investment Verdict

Parameter Verdict

Fundamentals Strong, superior margins, efficient operations

Valuation Fair to premium (due to uptrend and growth)

Technical Trend Bullish, ready for potential breakout

Growth Outlook High (supported by sector tailwinds)

Risk Profile Moderate (driven by capex & regulatory factors)

For long-term investors:

JSW Infra presents a compelling case for portfolio inclusion, offering robust growth visibility, sectoral leadership, and operating excellence. Accumulation is best near ₹230–₹240 on dips.

Short-term view:

Stocks in strong uptrends may see minor corrections but are well-placed for fresh breakouts above ₹285, targeting ₹320–₹340.

The stock is ideal for investors seeking infrastructure-sector exposure with high growth potential, but one must remain mindful of execution and regulatory risks.

==============================

==============================

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

Update idea

Add note

Trade_Secrets_By_Pratik

Also on:

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

English (India)

Select market data provided by ICE Data services.

Select reference data provided by FactSet. Copyright © 2025 FactSet Research Systems Inc.

© 2025 TradingView, Inc.

More than a product

Supercharts

Screeners

Stocks

ETFs

Bonds

Crypto coins

CEX pairs

DEX pairs

Pine

Heatmaps

Stocks

ETFs

Crypto

Calendars

Economic

Earnings

Dividends

More products

Yield Curves

Options

News Flow

Pine Script®

Apps

Mobile

Desktop

Tools & subscriptions

Features

Pricing

Market data

Trading

Overview

Brokers

Special offers

CME Group futures

Eurex futures

US stocks bundle

About company

Who we are

Athletes

Blog

Careers

Media kit

Merch

TradingView store

Tarot cards for traders

The C63 TradeTime

Policies & security

Terms of Use

Disclaimer

Privacy Policy

Cookies Policy

Accessibility Statement

Security tips

Bug Bounty program

Status page

Community

Social network

Wall of Love

Refer a friend

House Rules

Moderators

Ideas

Trading

Education

Editors' picks

Pine Script

Indicators & strategies

Wizards

Freelancers

Business solutions

Widgets

Charting libraries

Lightweight Charts™

Advanced Charts

Trading Platform

Growth opportunities

Advertising

Brokerage integration

Partner program

Education program

Look First

HDFC BANK LTD

NSE•Real-time•Market closed

Edit Idea

Minimize

Close

JSW INFRA : Powering India’s Port Revolution – A Deep Dive into

NSE:JSWINFRA

JSW Infrastructure Ltd.

🧾 Company Overview

Role: JSW Infrastructure is India's second-largest commercial port operator (after Adani Ports), and forms a core part of the JSW Group.

Operations: The company manages and operates major ports across both the east and west coastlines of India.

Revenue Streams: Primarily driven by port operations (handling bulk, breakbulk, containerized cargo), as well as integrated logistics services.

📊 FY24 Financial Snapshot

Revenue ₹3,200+Cr

EBITDA Margin 55–60%

Net Profit ₹750+Cr

Debt to Equity ~0.6x

ROCE ~15%

ROE ~13%

Positive aspects:

Asset Turnover Strong

Double-digit revenue CAGR (>20%) over the past three years.

High EBITDA margins consistent with best-in-class infra businesses.

Well-diversified cargo and customer profile, with increasing non-JSW business.

Stable long-term contracts & beneficiary of India’s logistics and trade reforms.

Risks / Weaknesses:

~70% revenue is from group companies, though diversification is underway.

Aggressive capex plans elevate financial risk.

Susceptible to regulatory, tariff, and environmental compliance changes.

📈 Technical Analysis (July 2025)

• Share Price: Trading in the ₹260–₹280 range. IPO was at ₹119 (Sep 2023); strong price appreciation since listing.

• Trend: Intact uptrend; recently consolidated between ₹240–₹260.

• Support/Resistance: Key support at ₹230–₹235; resistance at ₹285–₹300.

• Moving Averages: Stock remains above both its 50-EMA and 200-EMA — a structurally bullish indicator.

• Momentum:

o RSI: 60–65 (bullish, but approaching overbought)

o MACD: Fresh bullish crossover; volume shows accumulation near breakout.

• Outlook: Breakout above ₹285 could trigger medium-term upside toward ₹320–₹340. Buy-on-dips is favored, with strong accumulation likely in the ₹230–₹240 zone.

🚀 Growth Prospects & Strategic Moves

• Capacity Expansion: Plans to nearly double port capacity by FY30 (from ~160 MTPA to ~300 MTPA).

• Cargo Diversification: Targeting major reduction of group dependency (from ~70% to ~50%) by growing third-party cargo traffic.

• New Projects: Investment pipeline includes both greenfield and brownfield projects in Odisha, Maharashtra, and other states.

• Integrated Logistics: Deeper backward integration into rail connectivity and warehousing to capture higher value from logistics value chain.

• Macro Tailwinds

o Major government initiatives (e.g., Sagarmala) catalyzing sector growth.

o India’s trade/exports rising; strong outlook for cargo and container volumes.

o Shifts in supply chains to coastal shipping and blended logistics.

o Demand uptrend in containerization and warehousing services.

⚠️ Key Risks & Limitations

• High Capex Cycle: Expansion could elevate debt and financial leverage.

• Macro Sensitivity: Lower industrial/output growth would hit cargo volumes.

• Regulatory Overhang: Tariff and ESG regulations present chronic uncertainty.

• Group Concentration: Third-party cargo growth remains an execution challenge.

• Rivalry: Competitive intensity from Adani, DP World, and others is ramping up.

📌 Conclusion & Investment Verdict

Parameter Verdict

Fundamentals Strong, superior margins, efficient operations

Valuation Fair to premium (due to uptrend and growth)

Technical Trend Bullish, ready for potential breakout

Growth Outlook High (supported by sector tailwinds)

Risk Profile Moderate (driven by capex & regulatory factors)

For long-term investors:

JSW Infra presents a compelling case for portfolio inclusion, offering robust growth visibility, sectoral leadership, and operating excellence. Accumulation is best near ₹230–₹240 on dips.

Short-term view:

Stocks in strong uptrends may see minor corrections but are well-placed for fresh breakouts above ₹285, targeting ₹320–₹340.

The stock is ideal for investors seeking infrastructure-sector exposure with high growth potential, but one must remain mindful of execution and regulatory risks.

==============================

==============================

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

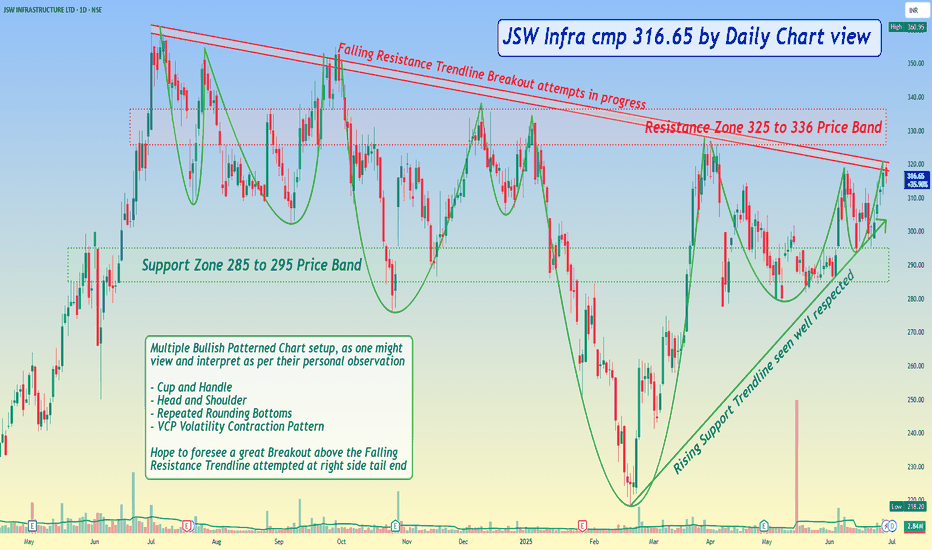

JSW Infra cmp 316.65 by Daily Chart view*JSW Infra cmp 316.65 by Daily Chart view*

- Support Zone 285 to 295 Price Band

- Resistance Zone 325 to 336 Price Band

- Rising Support Trendline seen well respected

- Falling Resistance Trendline Breakout attempts in progress

- [ b]Multiple Bullish Patterned Chart setup, as one might view and interpret as per their personal observation

- Cup and Handle

- Head and Shoulder

- Repeated Rounding Bottoms

- VCP Volatility Contraction Pattern

- [ b]Hope to foresee a great Breakout above the Falling Resistance Trendline attempted at right side tail end

JSW Infra cmp 322.90 by the Daily Chart view since listedJSW Infra cmp 322.90 by the Daily Chart view since listed

- Support Zone at 268 to 281 Price Band

- Resistance Zone at 330 to 340 Price Band

- Volumes are gradually picking up closely in sync with average traded quantity for this stock

- Stock has formed a Bullish Rounding Bottom with the neckline coinciding at Resistance Price Band

- Probable Breakout is in the making process basis Price closure above Resistance Zone for few days

"JSW Infra: Climbing the Crane of Success!""JSW Infra: Sailing Toward the Fibonacci 0.618 Dock! 🚢📈"

This means the stock is likely retracing to the golden ratio (61.8%) level, a key Fibonacci retracement point often seen as strong support or resistance in technical analysis.

🚨 Disclaimer: Not Financial Advice! 🚨

** This is for educational purposes only! 📚😂 Do your own research, consult a professional, and remember—stocks can go up, down, or sideways faster than your morning coffee spills! ☕📉📈 Invest responsibly! 🚀💸 **

JSW INFRA : Breakout or VCP formation#JSWINFRA #breakoutsoon #Vcppattern #swingtrade

JSWINFRA : Breakout or VCP Formation - there are 2 scenarios

Breakout Scenario :

>> Enter with 30% of position Sizing now

>> If Breakout happens u wont be in FOMO

>> If Breakout Sustains u can add more win Retest or Retracement

>> Swing Traders can look to book close to 10 % profits

VCP Formation :

>> Enter 30% position sizing now

>> If it starts falling, Its a Confirmation of VCP formation

>> Start Accumulatig during the Downpart of VCP

>> when VCP upside Starts it can Give Good Spike

>> In Case of VCP Breakout, Swing Traders can Look to target min 10-15% profits.

I want you all to Observe this stock setup and see what scenario plays out.

If u Like the Setup & analysis, Pls give us a Boost, Comment & Follow us

Disc : Charts Shared are for Educational purpose, so that u can Learn how to analyse Stocks and How u can plan ur Entries etc. Do not take position in it unless u consult ur Financial advisor also do ur own analysis

MACD Crossover Swing Trade📊 Script: ADANIPOWER

📊 Sector: Power Generation & Distribution

📊 Industry: Power Generation And Supply

⏱️ C.M.P 📑💰- 628

🟢 Target 🎯🏆 - 668

⚠️ Stoploss ☠️🚫 - 611

📊 Script: HUDCO

📊 Sector: Finance

📊 Industry: Finance - Housing

⏱️ C.M.P 📑💰- 233

🟢 Target 🎯🏆 - 246

⚠️ Stoploss ☠️🚫 - 228

📊 Script: JSWINFRA

📊 Sector: Marine Port & Services

📊 Industry: Miscellaneous

⏱️ C.M.P 📑💰- 259

🟢 Target 🎯🏆 - 278

⚠️ Stoploss ☠️🚫 - 250

📊 Script: METROBRAND

📊 Sector: Leather

📊 Industry: Leather / Leather Products

⏱️ C.M.P 📑💰- 1081

🟢 Target 🎯🏆 - 1153

⚠️ Stoploss ☠️🚫 - 1044

📊 Script: HBLPOWER

📊 Sector: Auto Ancillaries

📊 Industry: Auto Ancillaries

⏱️ C.M.P 📑💰- 521

🟢 Target 🎯🏆 - 559

⚠️ Stoploss ☠️🚫 - 504

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

JSW Infrastructure: Add for Portfolio during consolidationNSE:JSWINFRA is the fastest growing port-related infrastructure company in terms of growth in installed cargo handling capacity and cargo volumes handled during Fiscal 2021 to Fiscal 2023, and the 2nd largest commercial port operator in India in terms of cargo handling capacity in Fiscal 2023.

Their installed cargo handling capacity in India grew at a CAGR of 15.27% from 119.23 MTPA as of March 31, 2021 to 158.43 MTPA as of March 31, 2023. During the same period, their cargo volumes handled in India grew at a CAGR of 42.76% from 45.55 MMT to 92.83 MMT.

Technical Setup:

After a good initial rally and listing, JSW Infra is consolidating in a range. I believe levels of 230 will be held here without much issues. A new breakout above the previous all time high would mean that the stock can give much higher targets for the future. It is a portfolio grade stock for me given India's growth story. Hold for medium to long term.

Q3FY24 Highlights:

Financial Performance

• Notable year-on-year growth in cargo handling, with a 17% increase to 77.2 million tonnes for the nine-month period ending December 2023.

• Revenue for the nine months ended December 2023 stood at INR 2832 crores, reflecting an 18% growth year-on-year.

• EBITDA for the same period showed a 22% year-on-year increase.

Expansion and Acquisitions

• Acquisition of PNP Maritime Services and PNP Port, enhancing operational capabilities and expansion potential.

• Development of an all-weather deepwater greenfield port at Kenney, Karnataka, with an estimated project cost of INR 4119 crores and an initial capacity of 30 million tonnes per annum.

Operational Efficiency and Safety

• Jaigarh Port was awarded a five-star rating by the British Safety Council, underscoring JSW Infrastructure's commitment to maintaining the highest safety standards.

Future Growth Plans

• Focus on increasing third-party cargo handling to 40% in the near term.

• Continued pursuit of organic and inorganic growth opportunities to capitalize on India's infrastructure development momentum.

JSW Infra (Breakout Stock to Watch Next Week)JSW Infra has given a breakout on a daily time frame. In the coming few days, the stock can head towards the 300 level. The stop loss can be placed at the low of Friday's candle which is 243. Also good volumes can be seen on the daily chart frame.

Disclaimer: I am not a SEBI registered analyst. All the stocks are for educational purposes. Investors must consult a financial advisor before making any investment. It is not a buy or sell recommendation.