Karthikmarar

KAJARIA CERAMICSThe stock dropped 50% from the peak. Then it formed a bottom and tried to move up. It moved above the short-term moving averages. But every push upward was met with supply. Then we saw a small range to absorb the excess supply. Then the stock moved past the 200 DMA. Now it is making Higher High and Higher low. The Relative strength, Buying Pressure and Moneyflow are positive. The buy waves have started to dominate. The stock looks poised to move up further.

EDELWEISS - Moving to the Next Orbit?Stock continue to making Higher high and Higher Lows. A small consolidation and then a Break of structure with a high volume Bullish wide spread up bar. Relative strength, Money Flow and Buying pressure lending support. The stock seems poised to move in to the next orbit.

EVEREADY - POISED FOR A UPMOVEThe stock fell about 45% form it's last Peak. Then an attempt to move up and more than two months of consolidation . Now making Higher Highs and Higher lows and moving past the short term moving averages and the 200 DMA. We can see strong momentum and bullish volume and increasing Relative strength. Money Flow is positive. The stock looks poised for a good up move.

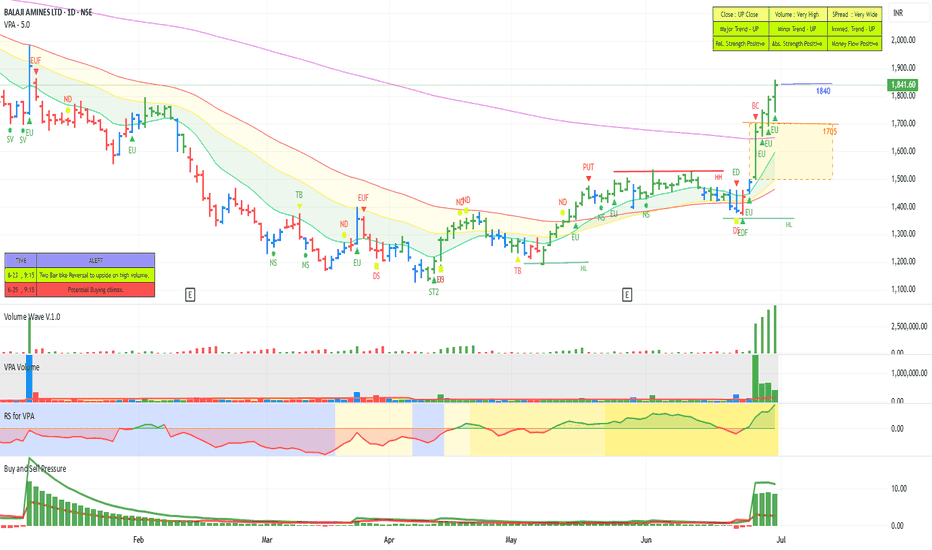

BALAJI AMINES - STEPPING INTO STAGE 2 ?The leading amine manufacturing company stocks had seen a huge down move of 50 to 60 percent. Of late many of these stocks have seen smart recovering. Leading stocks like alkyl amine, Vinati organics etc. crossed above the short-term moving averages. 200 DMA and moving up. Another stock in the group Balaji Amines has also started moving up now. After making a bottom it is now started making higher highs and Higher Lows. It also crossed above the short-term moving averages. The last few sessions we saw a huge momentum coming in with a huge Buy Wave pushing the stock above the 200 DMA. We can see that the relative strength and the absolute strength are also positive with the money also flowing into the stock. Now it is safely out above the 200 DMA with all other parameters looking positive. There is also good committed buying seen looking at the delivery volumes. The current momentum is likely to push up the stock further along in line with the other main amine manufacturing stocks.

EDELWEISS - Setting up for a good up move?One more interesting chart for study. This stock was pushed down from the top by almost 50%. As you can see, as the stock was dropping, the buy waves were getting stronger and stronger and they started dominating. As you can see, now it seems to be on the recovery path. It has gone above the supply line and moved past the short-term moving averages and also the 200 DMA. We can see marked increase in the buying pressure. Also, there is a very good volume support coming here. The Relative Strength and Money Flow are positive. Now we can see that there is a break of structure in both daily and weekly as well. The stock seems to be getting ready for a good up move and could see 140 levels as a minimum. But at this juncture, we could see a retest of the 200 DMA levels before moving up further.

CDSL - Poised for good up Move ?CDSL, another interesting chart for our study. The stock was pushed down almost 48 percent from the its high to below 200 DMA levels and also the short-term moving averages. Then it started recovering. Now it is making higher highs and higher lows on the weekly chart as well. It has gone above the short-term moving averages and the 200 DMA as well. We can see the buying waves are getting much stronger. Also, the buying pressure has been quite positive for some time. Right now, the relative strength and the money flow also have turned positive. Now it seems the stock is setting up for a much bigger move and could see 1900 levels. A pull back to the 20 SMA will be the ideal opportunity for entry.

Disclaimer: This is only for learning purpose and not a recommendation to buy and sell.

CG POWER - A stock for your WatchlistHere is another stock for your watch list, this is CG power which has been consolidating for nearly 3 months in a typical Wyckoffian accumulation zone. Now it looks ready to move out of the zone and move up further. As you can see the buy waves are getting stronger and the relative strength and the money flow are all positive. However, we need to see more volumes coming in to fuel the up move and this has to cross above the important pivot of 685, then we could see at least another 20% up move.

Kiroloskar Brothers - An Interesting ChartSharing an interesting Chart here. As you can see the stock had a massive drop of nearly 40 percent from its high and it was pushed below the 200 DMA. Then we saw some strength coming in and it started consolidating for the last two months and it was moving in a range. Now we can see that the buy waves have started to dominate. Also, the volume remained low during the consolidation or the accumulation phase. Now it has started to increase now. The stock is at the edge of the accumulation zone and we can see the relative strength, absolute strength and money flow are positive. However, the stock has not started trending up, it has to break above the consolidation zone. Now it has moved past the short-term moving averages and the 200 DMA as well. The stock is very interestingly poised. If it breaks out of this consolidation zone, then it could see 2400 levels. However, as we all know this may not be the right time given the current circumstances and also we are expecting the results next week. In fact, Q3 results were quite robust and the same robust results could continue pushing the stock up. But we need to wait for the current situation to resolve and also it may be a better idea to wait till the results are out.