Metals

Gold reaches new ATH — Smart Money rotates.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (13/01)

📈 Market Context

Gold has officially printed a new All-Time High (ATH), confirming higher-timeframe bullish dominance. However, after delivering buy-side liquidity into premium, price action is no longer impulsive. Instead, Smart Money is transitioning into controlled distribution and rotation, engineering liquidity rather than chasing continuation.

With price stretched deep into premium and resting above prior structure, today’s environment favors liquidity sweeps, inducement, and mean reversion, not blind breakout trading. Execution must be precise, level-based, and confirmation-driven.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish structure intact, but intraday corrective rotation active from premium after ATH print.

Key Idea:

Expect Smart Money to distribute near ATH supply (4630–4632), or rebalance deeply into discount (4492–4490) before the next expansion leg.

Structural Notes:

• Clear HTF BOS confirms bullish dominance

• New ATH delivered buy-side liquidity

• Price reacting from premium with corrective characteristics

• Internal FVG + liquidity pocket acting as magnet below

• Discount OB zone aligns with higher-timeframe demand

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4630 – 4632 | SL 4640

• 🟢 BUY GOLD 4492 – 4490 | SL 4482

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4630 – 4632 | SL 4640

Rules:

✔ Price taps ATH premium supply

✔ Buy-side liquidity taken above highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4588 — internal reaction

• 4560 — FVG mitigation

• Trail aggressively (intraday distribution play)

🟢 BUY GOLD 4492 – 4490 | SL 4482

Rules:

✔ Liquidity sweep into discount demand

✔ Confluence with OB + FVG + strong liquidity pool

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4520 — first reaction

• 4580 — internal liquidity

• 4630+ — ATH retest if expansion resumes

⚠️ Risk Notes

• New ATH zones are liquidity traps by nature

• Expect false breakouts and aggressive stop hunts

• No trades without MSS + BOS confirmation

• Size down near ATH — volatility can expand rapidly

📍 Summary

Gold is bullish by structure, but today is about rotation, not continuation:

• A reaction at 4630–4632 may deliver a Smart Money sell back into liquidity, or

• A sweep into 4492–4490 may reload longs for the next ATH extension.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD H4 – Correction, then ExpansionXAUUSD H4 – Pullback Then Continuation Using Fibonacci and Key Levels

Gold remains in a strong bullish trend on H4, but the current structure suggests the market needs a pullback into liquidity before the next expansion leg.

Market View

The recent rally has pushed price into premium territory, which often triggers short-term profit-taking.

Fibonacci extensions are acting as liquidity magnets: 2.618 is a key reaction zone, while 3.618 is the next expansion target.

Main approach: wait for the pullback into support/buy zones, then follow the trend.

Key Levels to Watch

Near resistance: 4546–4550 (reaction zone / key resistance)

Sell reaction zone: 4632–4637 (Fibonacci 2.618, likely to cause volatility)

Expansion target: 4707 (Fibonacci 3.618)

Buy liquidity zone: 4445–4449 (best buy area in this structure)

Strong support: 4408 (critical defensive support)

Scenario 1 – Shallow Pullback, Then Push Higher

Idea: price pulls back lightly, holds structure, and resumes the uptrend quickly.

Preferred pullback zone: 4546–4550

Expectation: move back up toward 4632–4637, and if absorbed, extend toward 4707

Confirmation to watch: H4 candles hold above 4546–4550 with clear buying response (rejection wicks, strong closes, momentum return)

Scenario 2 – Deeper Pullback to Sweep Liquidity, Then Strong Rally

Idea: price sweeps deeper into the best demand zone before the next major leg.

Deep pullback zone: 4445–4449

Expectation: bounce back to 4546–4550 → then push to 4632–4637 → and potentially extend to 4707

Confirmation to watch: strong reaction at 4445–4449 (buyers absorb, structure holds, no clean breakdown)

Important Notes

4632–4637 is a sensitive zone where profit-taking and sharp swings can appear before continuation.

If price breaks and holds below 4445–4449, shift focus to 4408 to judge whether the bullish structure is still being defended.

Conclusion

The main trend is still bullish, but the best edge comes from waiting for a pullback and buying at key levels. Focus zones: 4546–4550 (shallow pullback) and 4445–4449 (deep pullback with better R:R). If Fibonacci expansion continues, the next upside target is 4707.

If you share the same view, follow me to get the next updates earlier.

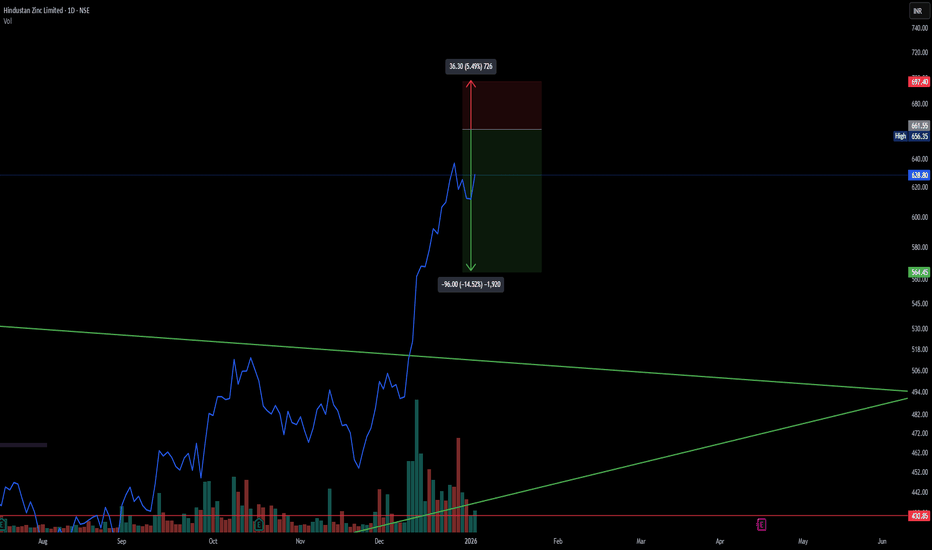

HIND ZINC SHORT TRADE -RISKYTechnical Analysis

Parabolic Extension: The stock has seen a massive, nearly vertical rally from the ~400 levels to highs near 670 in a very short span. Such parabolic moves are rarely sustainable without a significant correction or consolidation phase.

Rejection at Highs: The price action shows a sharp pullback from the recent high of 661.55, indicating that profit booking is kicking in and buyers are exhausted at these elevated levels.

Risk/Reward Ratio: The current setup offers a favorable Risk/Reward ratio for a short position. The stop loss is tight relative to the potential downside move as the stock attempts to revert to the mean.

Volume Profile: High volume during the ascent suggests strong participation, but upcoming sessions should be watched for distribution volume (selling pressure) to confirm the top.

Trade Setup (Short)

Entry Zone: 661 (Looking for rejection near the highs)

Stop Loss: 697.40 (Strict SL above recent swing high to protect against a "blow-off top")

Target: 564.45 (Targeting the gap fill/retracement to previous structure support)

Potential R:R: ~ 1:2.6

⚠️ Disclaimer: This chart analysis is shared for educational and informational purposes only. It does not constitute financial or investment advice. I am not a SEBI registered research analyst. Trading in the stock market involves a high degree of risk. Please consult with a certified financial advisor and perform your own due diligence before making any trading decisions.

XAUUSD: Bullish Breakout Confirmed? New ATH in Play!As anticipated in our weekly analysis, Gold started the week with a bang, opening with a positive gap and aggressively smashing through the previous All Time High of 4550. We are currently trading in "uncharted territory," and the price action is screaming bullish across all major timeframes.

🔍 Market Context & Drivers

The surge isn't just technical; the fundamental backdrop is fueling this "fear trade":

Geopolitical Flare-up: Tensions are peaking as the U.S. considers military options in Iran following recent unrest, alongside ongoing frictions in Venezuela.

Safe-Haven Inflow: Growing concerns over the Federal Reserve’s independence and the U.S. Supreme Court’s upcoming ruling on tariffs (expected Wednesday) are pushing investors toward the safety of gold.

Dovish Tailwinds: Last Friday's soft NFP data (only 50k jobs added) has cemented expectations for further Fed rate cuts, lowering the opportunity cost for holding Gold.

🛠 Trading Strategy

The trend is clearly your friend here. Since we have successfully breached the 4550 barrier, the focus shifts to the Daily Close.

The Confirmation: We need a solid Daily candle closing above 4550. This validates the breakout and traps the late sellers.

Buy the Dip: If we see a retest of the 4550-4540 area, it’s a high-probability "buy on dip" zone.

The Target: Once the breakout is confirmed, our primary objective is the Monthly R2 at 4731, with a secondary long-term target eyeing the 5000 milestone.

Immediate Target// 4731 Monthly R2 Pivot & psychological extension.

Breakout Zone// 4550 Previous ATH; Must close above this on the Daily to confirm.

Primary Support// 4550 - 4540 The "Flip Zone" (Old Resistance becoming New Support).

Major Support// 4500 Psychological handle & secondary structural floor.

My Entry Setup 4

Before Trade Entry Follow the Step:-(check list)

Step 1:- Identify the Trend

Step 2:- Bullish Trend Wait for Support Price & Reversal Candlestick(Take Buy)

Step 3:- Bearish Trend Wait for Resistance & Reversal Candlestick(Take Sell)

Step 4:- Fibonacci retracement confirm

Step 5:- Wait for Reversal candlestick

My Trading Role:-

1. Don't Lose capital

2. Trade less Earn More

Focus On:-

1. Quality Trades

2. Risk Management

3. Self - Discipline

RISK WARNING:- All trading involves risk. Only risk capital you're prepared to lose. This video has not given any investment advice, only for educational purposes.

Why breakout entries fail (and how I wait for confirmation)Most breakout losses happen because entries are too early.

Instead of chasing the breakout, I wait for:

1) A clearly defined range

2) A clean breakout

3) Pullback / acceptance into the range

4) Continuation confirmation

This simple framework helps avoid fake moves and improves risk–reward.

I later automated this process into a private tool to remove subjectivity,

but the logic itself is what matters most.

This chart shows one example on XAUUSD using a higher timeframe.

XAUUSD (H1) – Following the bullish channelpatience before continuation ✨

Market structure

Gold remains in a well-defined ascending channel on the H1 timeframe. Despite recent intraday pullbacks, the overall structure is still bullish with higher highs and higher lows preserved. Current price action shows consolidation inside the channel rather than any sign of trend reversal.

Technical outlook (Lana’s view)

Price is rotating around the midline of the rising channel, indicating healthy digestion after the previous impulsive leg.

The recent pullback appears to be a controlled correction, likely aimed at collecting buy-side liquidity before the next expansion.

Market is still respecting structure and trendline support — no breakdown confirmed so far.

Key levels to watch

Buy-side focus

FVG Buy zone: 4434 – 4437

A clean reaction here could offer a good continuation entry within the trend.

Major buy zone: 4400 – 4404

This is the stronger demand area aligned with channel support and previous structure.

Sell-side reaction (short-term only)

4512 – 4515

This zone aligns with Fibonacci extension and channel resistance, where short-term profit-taking or reactions may appear.

Scenario outlook

As long as price holds above the lower channel boundary, bullish continuation remains the primary scenario.

A pullback into FVG or the lower buy zone followed by confirmation would favor another push toward channel highs and liquidity above.

Only a clean break and acceptance below 4400 would force a reassessment of the bullish bias.

Lana’s trading mindset 💛

No chasing price near resistance.

Let price come back into value zones inside the channel.

Trade reactions, not predictions.

Trend is your friend — until structure says otherwise.

This analysis reflects a personal technical perspective for educational purposes only. Always manage risk carefully.

How does today’s gold top compare to the 1980 and 2011 peaks?Gold is not just at a nominal high — it is trading at the highest real (inflation-adjusted) price in modern history.

How does today’s gold top compare to the 1980 and 2011 peaks?

1️⃣ GOLD MAJOR TOPS — NOMINAL vs REAL (TODAY’S MONEY)

🔴 1980 GOLD TOP (true panic peak)

Nominal price (1980): ~$850/oz

Inflation-adjusted to today: ~$3,200–3,400/oz

What the world looked like:

Double-digit inflation

Oil crisis

Cold War escalation

Dollar confidence collapse

Real rates deeply negative

Monetary panic

Meaning: This was a once-in-a-generation monetary crisis peak.

🟠 2011 GOLD TOP (QE / crisis fear)

Nominal price (2011) : ~$1,920/oz

Inflation-adjusted to today : ~$2,600–2,700/oz

What the world looked like:

Global Financial Crisis aftermath

QE everywhere

Eurozone debt crisis

Fear of currency debasement

Inflation still relatively controlled

Meaning: This was a financial-system fear peak, not a currency collapse.

🟡 TODAY (2025–26) GOLD ~ $4,584

Nominal price : ~$4,584/oz (new high)

Inflation-adjusted: $4,584 (today’s dollars by definition)

Compared to past real peaks:

~35–45% above the 1980 real peak (~$3,300 mid-range)

~70–75% above the 2011 real peak (~$2,650 mid-range)

This is extremely important : today’s gold price is already the highest real gold price in modern history.

2️⃣ TABLE SUMMARY

| Gold Peak | Nominal Then | Real Value Today |

| 1980 panic | ~$850 | ~$3,200–3,400 |

| 2011 QE | ~$1,920 | ~$2,600–2,700 |

| Today | ~$4,584 | $4,584 |

3️⃣ WHAT MAKES TODAY DIFFERENT FROM 1980 & 2011

Today:

Inflation already happened

Debt far higher than 1980 or 2011

Central banks trapped

Geopolitical fragmentation

De-dollarization pressure

Central banks buying gold aggressively

Takeaway: Today’s price reflects structural distrust , not just panic.

4️⃣ WHAT A REAL GOLD TOP USUALLY MEANS NEXT

Historically, after gold peaks in real terms:

Nominal price may still go higher briefly

Then:

Long consolidation

Sharp correction

Or years of underperformance vs inflation

Gold doesn’t crash like silver — it bleeds purchasing power over time . That’s how tops resolve.

Disclaimer:

This post is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers should conduct their own research or consult a professional before making any financial decisions.

XAUUSD (H3) – Liam StrategyTrendline break confirms the uptrend ✅ | Buy the discount, scalp-sell at ATH

Quick overview

On the H3 chart, the story is clean: price has broken the bearish trendline and held structure after a clear BOS, which keeps the bias bullish for continuation.

But the best execution is still the same: no FOMO. I’d rather buy from discount liquidity zones than chase mid-range candles.

Key Levels (from your chart)

✅ Buy Zone 1 (re-buy): 4434 – 4437

✅ Buy Zone 2 (liquidity imbalance): 4340 – 4343 (deep sweep zone)

✅ ATH Sell scalping: 4560 (main profit-taking / reaction sell)

Technical read (Liam style)

Breaking through the trend confirms uptrend: the trendline break signals buyers are back in control.

4434–4437 is the clean re-entry area: a logical pullback zone with better R:R.

If volatility spikes and price hunts liquidity, 4340–4343 is the “best value” area to look for a strong reaction.

Trading scenarios

✅ Scenario A (priority): BUY the pullback at 4434–4437

Entry: 4434 – 4437

SL: below 4426 (or below the most recent H1/H3 swing low)

TP1: 4485 – 4500

TP2: 4560 (ATH – main target)

Logic: Uptrend confirmation is in place — I only want the pullback entry, not a chase.

✅ Scenario B (deep buy): If price sweeps down into 4340–4343

Entry: 4340 – 4343

SL: below 4330

TP: 4434 → 4500 → 4560

Logic: This is the “sweet spot” if the market does a liquidity reset before pushing higher again.

⚠️ Scenario C (scalp only): SELL reaction at ATH 4560

Entry: 4560 (only if we see clear rejection / weakness)

SL: above the sweep high

TP: 4520 → 4500 (quick scalp)

Note: This is a scalp idea at ATH — not a long-term bearish call while the bullish structure is intact.

Key notes

Avoid entries mid-range. Only execute at 4434–4437 or 4340–4343.

Wait for confirmation on M15–H1 (rejection / engulf / MSS).

Risk management: 1–2% per idea, scale out into ATH.

Are you waiting for the 4434 pullback buy, or hoping for a deeper sweep into 4340 for the cleanest entry? 👀

XAUUSD Pullback to Demand Zone @ 4400 - 4390Gold (XAUUSD) faced a strong rejection from the 4500 supply zone, triggering a healthy corrective move. Price is now approaching a key demand area between 4400 – 4390, where buyers are expected to step in.

If this support holds, we anticipate a bullish bounce with upside targets at 4425, 4435, and 4450.

This zone could offer a high-probability buy setup for short-term to intraday traders, provided bullish confirmation appears.

📌 Disclaimer:

This analysis is for educational purposes only and is not financial advice. Always manage risk and follow your trading plan.

Your feedback drives our content and keeps everyone trading smarter. Let’s make those pips together! 🚀

Happy Trading,

– The InvestPro Team

Gold pauses; rotation, not continuation.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (07/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, following a strong impulsive expansion that delivered price deep into premium. However, recent price action signals a transition from expansion into distribution, with Smart Money beginning to engineer corrective rotations rather than chasing continuation.

As the market digests USD flows, U.S. yield sensitivity, and positioning ahead of upcoming U.S. data, Gold is currently rotating between internal liquidity zones. This environment typically favors liquidity sweeps, inducement, and mean reversion, rather than clean directional breakouts.

Today’s session is best approached with level-based execution, patience, and confirmation — not prediction.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

HTF bullish structure with an active intraday corrective leg from premium.

Key Idea:

Expect Smart Money to react at internal supply (4428–4430) for short-term distribution, or at discount demand (4412–4410) for re-accumulation before the next leg.

Structural Notes:

• HTF bullish structure remains intact

• Clear BOS printed during the upside expansion

• Price rejected from premium and is rotating lower

• Internal supply at 4428–4430 acts as sell-sensitive zone

• Demand at 4412–4410 aligns with OB + EMA support + liquidity pocket

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4412 – 4410 | SL 4402

• 🔴 SELL SCALP 4428 – 4430 | SL 4438

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4412 – 4410 | SL 4402

Rules:

✔ Liquidity sweep into discount demand

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4425 — initial reaction

• 4435 — internal liquidity

• 4480–4500 — premium retest if momentum expands

🔴 SELL SCALP 4428 – 4430 | SL 4438

Rules:

✔ Price taps internal supply / EMA resistance

✔ Bearish MSS / CHoCH on lower timeframe

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4418 — first imbalance

• 4410 — demand interaction

• Trail aggressively (scalp setup)

⚠️ Risk Notes

• Premium zones favor stop hunts and fake continuations

• Volatility may expand during U.S. session

• No entries without MSS + BOS confirmation

• Scalp sells require strict risk control

📍 Summary

Gold remains structurally bullish, but today’s edge lies in Smart Money’s intraday rotation:

• A sweep into 4412–4410 may reload longs toward premium, or

• A reaction at 4428–4430 offers a controlled scalp sell back into demand.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold Structure Update – Bulls Still in Control next 4518++Hello everyone, gold is trading inside a clear rising channel, and the structure remains bullish with higher lows intact. After the recent upside move, price has pulled back toward the lower side of the channel, which is a normal and healthy move in a strong trend.

This pullback is happening exactly where buyers are expected to step in. As long as price holds above the marked support zone, the probability still favors upside continuation, not breakdown. Strong trends usually pause, shake out weak hands, and then continue.

For now, there is no sign of trend failure. Only a clean break and acceptance below support would change the view. Until then, this remains a buy-on-pullback market, not a place to panic or chase.

Key Levels to Watch

Buy Zone: 4466–4463

Stop Loss: Below 4445

1st Target: 4480

2nd Target: 4500

3rd Target: 4518

Bias: Bullish above support

Disclaimer: This analysis is for educational purposes only and should not be taken as financial advice. Please do your own research or consult your financial advisor before investing.

Analysis By @TraderRahulPal | More analysis & educational content on my profile.

If this update helped, like and follow for regular updates.

MarketViewLab | XAUUSD Breakout RetestMarketViewLab | XAUUSD Breakout Retest

XAUUSD (Gold) – 2H Chart Analysis

Structure: Consolidation breakout in progress

Market Bias: Bullish – monitoring continuation potential

Key Levels

• Support Zone: 4,390–4,410

• Resistance Zone: 4,560–4,700

Chart Context:

Price recently broke above a consolidation range after multiple tests of support.

The breakout shows improving momentum with higher lows forming.

Technical View:

• Break above range suggests strength returning to buyers.

• Retest toward 4,430–4,450 could act as a potential support zone.

• Continuation toward 4,560–4,700 remains possible if momentum holds.

(This analysis is for educational purposes only and does not constitute financial advice.)

Gold (XAUUSD) Rejects 4470 Resistance – Short-Term Sell SetupGold (XAUUSD) has shown a clear rejection from the 4470 resistance zone, signaling potential short-term exhaustion after the recent rally.

This area has acted as a strong supply zone, increasing the probability of profit booking / corrective pullback before any continuation to the upside.

📉 Trade Idea:

Look for sell opportunities in the 4462 – 4472 zone, aligning with the marked resistance and price rejection.

Targets and risk levels are clearly outlined on the chart.

⚠️ This is a counter-trend / pullback trade, best suited for intraday or short-term traders. Manage risk accordingly.

📌 Disclaimer:

This analysis is for educational purposes only and is not financial advice. Always manage risk and follow your trading plan.

Your feedback drives our content and keeps everyone trading smarter. Let’s make those pips together! 🚀

Happy Trading,

– The InvestPro Team

XAUUSD Smart Money Levels: Demand 4325, Supply 4494🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, but current price action reflects a premium-side liquidity operation rather than clean continuation. After a strong upside leg, price is now rotating inside premium where Smart Money typically distributes positions before initiating corrective delivery.

Today’s focus revolves around USD strength, U.S. yield sensitivity, and ongoing Fed rate path speculation, with traders positioning ahead of upcoming U.S. macro releases and Fed commentary. As real yields fluctuate and risk sentiment remains fragile, Gold continues to attract safe-haven flows — but not without engineered pullbacks.

This environment favors liquidity sweeps, false continuation, and inducement above highs, rather than impulsive breakout buying.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

Higher-timeframe bullish structure with an active short-term corrective leg from premium.

Key Idea:

Expect Smart Money interaction either at internal supply (4492–4494) for distribution, or HTF demand (4327–4325) for re-accumulation before the next expansion.

Structural Notes:

• HTF bullish structure remains valid

• Recent CHoCH confirms corrective rotation

• Buy-side liquidity above highs has been partially tapped

• Supply cluster at 4492–4494 acts as distribution zone

• Demand zone at 4327–4325 aligns with OB + liquidity pool

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4327 – 4325 | SL 4317

• 🔴 SELL GOLD 4492 – 4494 | SL 4500

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4327 – 4325 | SL 4317

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH confirmation on M5–M30

✔ Strong upside BOS with impulsive candles

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4390 — initial displacement

• 4450 — internal liquidity

• 4490+ — premium retest if USD weakens

🔴 SELL GOLD 4492 – 4494 | SL 4500

Rules:

✔ Reaction into premium supply zone

✔ Bearish MSS / CHoCH on lower timeframe

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4455 — first imbalance fill

• 4395 — internal discount

• 4327 — HTF demand sweep

⚠️ Risk Notes

• Premium zones favor fake breakouts and stop hunts

• Volatility may spike around U.S. data and Fed remarks

• No entries without MSS + BOS confirmation

• Stops often triggered before real displacement

📍 Summary

Gold remains structurally bullish, but today’s edge lies in trading Smart Money’s range:

• A sweep into 4327–4325 may reload longs toward 4450–4490, or

• A reaction at 4492–4494 offers a sell opportunity back into discount.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD Smart Money Levels: Demand 4312, Supply 4436XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

Market Context

Gold remains structurally bullish on higher timeframes, yet short-term price action shows pullback pressure after premium liquidity was elected near 4440. As markets brace for ongoing USD direction from macro catalysts (Fed commentary, U.S. jobs data, Treasury yields), institutional participation is oscillating between liquidity hunts and controlled re-accumulation.

Global risk sentiment and safe-haven bids are intensifying as traders weigh inflation trajectory with central bank pivot expectations — leading Gold to exhibit rotational distribution behavior rather than clean continuation. Controlled swings and sweep-driven moves dominate price progression.

This environment favors engineered liquidity access and inducement, not blind breakout chasing.

Technical Framework – Smart Money Structure (1H)

Current Phase:

Higher-timeframe bullish bias with short-term corrective displacement.

Key Idea:

Expect structural engagement near HTF demand (~4312–4314) or internal supply liquidity (~4434–4436) before meaningful displacement sequences.

Structural Notes:

• HTF bullish structure remains intact

• Recent CHoCH confirms corrective leg

• Buy-side liquidity above recent highs is targeted

• Supply cluster near 4436 acts as engineered lure

• Demand confluence aligns with institutional accumulation

Liquidity Zones & Triggers

• BUY GOLD 4314 – 4312 | SL 4304

• SELL GOLD 4434 – 4436 | SL 4444

Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → internal supply retest → expansion

Execution Rules

BUY GOLD 4314 – 4312 | SL 4304

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH confirmation on M5–M30

✔ Clear upside BOS with impulse candles

✔ Entry via refined demand OB or FVG fill

Targets:

• 4370 — initial displacement

• 4410 — internal supply test

• 4440+ — extended run if USD weakens

SELL GOLD 4434 – 4436 | SL 4444

Rules:

✔ Reaction into internal supply cluster

✔ Bearish MSS / CHoCH confluence

✔ Downside BOS with momentum shift

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4390 — first discount zone

• 4350 — deeper pullback

• 4314 — HTF demand scan

Risk Notes

• False breaks favored near thin Asian session volume

• Macro catalysts (U.S. data, Fed speakers) may spike volatility

• Avoid entries without MSS + BOS confirmations

• Stops triggered by engineered liquidity hunts

Summary

Gold remains structurally bullish, but today’s edge lies in disciplined entries and liquidity awareness:

• A sweep into 4312–4314 may reload longs with targets up to 4410–4440, or

• A reaction near 4434–4436 provides a fade opportunity back into discount.

Let liquidity initiate the move. Let structure confirm.

Smart Money sets traps — retail chases them.

Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

SILVER | XAGUSD 1H Chart - Make or Break LevelsFX:XAGUSD MCX:SILVER1!

Silver is trading at a make-or-break support zone — this level will decide whether the broader uptrend survives or cracks.

🔹 Price is sitting near the 200 EMA, a level that historically acted as a launchpad

🔹 Last time Silver tested the 200 EMA (around $50), it marked the base before a multi-year breakout

🔹 Now, price has again pulled back to the same EMA near $70

📌 Key Observation:

As long as Silver holds above the 200 EMA, this move looks like a healthy retracement, not trend failure.

To Reduce the Noise switch to 4h Chart and see its forming 2 range candle just above 50EMA a break ot that will trigger the trade.

Need Confirmation from 4h chart then only go long

Keep Learning, Happy Trading.

XAUUSD Bullish Continuation | Buy the Dip @ 4400 - 4375Gold (XAUUSD) has delivered a strong bullish impulse following heightened geopolitical tensions involving the US and Venezuela. Price is holding firmly above the 4400 key support zone, signaling sustained bullish strength.

As long as gold maintains acceptance above this level, the bias remains bullish, with upside targets at 4440 and 4470.

We are patiently waiting for a healthy pullback toward support to look for high-probability buy opportunities in line with the prevailing trend.

📌 Disclaimer:

This analysis is for educational purposes only and is not financial advice. Always manage risk and follow your trading plan.

Your feedback drives our content and keeps everyone trading smarter. Let’s make those pips together! 🚀

Happy Trading,

– The InvestPro Team