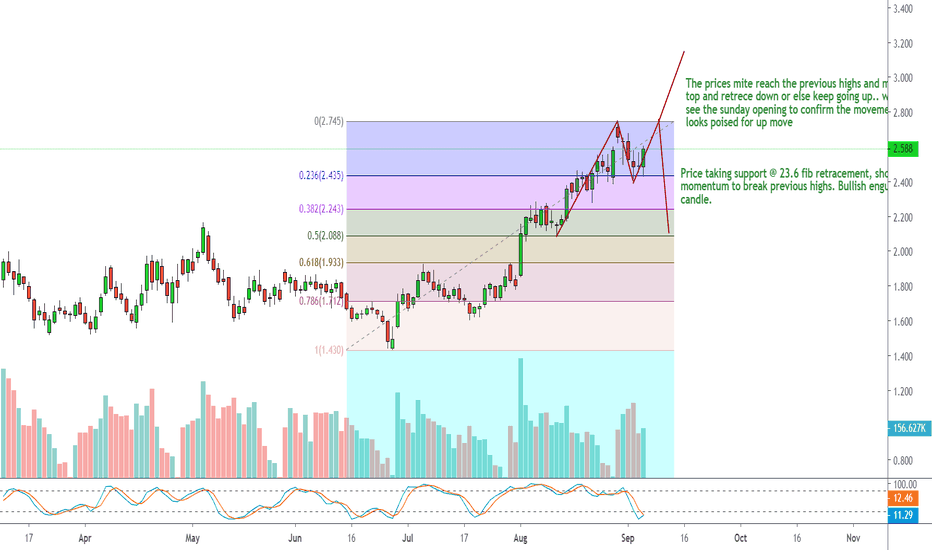

#Naturalgas important levelsMCX:NATURALGAS1!

This chart shows an analysis of Natural Gas Futures and gives us an idea of

where the price might go next:

1. Resistance Zones: There are areas around 283 and 287.5 where the price

struggled to go higher in the past. These are levels where sellers might

come in again.

2. Support Zones: The price has strong support at 271 and 267.4, which are

areas where buyers stepped in before to stop the price from falling

further.

3. Downward Trendline: The price is generally moving downward, shown by

the slanted line. If it can break above this line, it might signal the start of

an upward move.

4. Two Possible Scenarios:

Upward Move: If the price goes above the resistance and breaks the

trendline, it might head toward 287.5.

• Downward Move: If the price doesn't hold above support, it might

drop back to 267.4 or low

In simple terms, traders are waiting to see jf the price breaks above the

resistance (good for buyers) or falls below support (good for sellers) to decide

the next move.

Natural

Natural gas elliot wave analysisElonged zig zag correction pattern complete down side and wave c internal wave 2or 4 trendline break

Cup and Handle pattern right after floor is consolidated? Because of the gas supply problem europes going to face, I doubt it will keep going down, there's only up, how fast it goes up depends on the gravity of the Russian invasion or if it drags on until next fall.

Change in the downward tendency, with big volumen especialy during handle dip.

my projection is 170 USD by september.

NATURAL GAS TIME TO WATCH SELL OR BUY?

Natural gas forming head and shoulder pattern in daily timeframe. Daily trendline,demand zone,neckline coincide. so time to watch reversal candle or strong selling volume candle.if fresh selling we wait pullback to neckline

NG-Seems a shorting opportunityNatural Gas shorting around CMP

SL above today opening.

TGT near trendline around 3 points - will update if needed

Disclaimer: These are just my views, I am only SHARING my views - kindly do NOT trade blindly with these levels, please do your own research before entering/ or as per advice from your own financial adviser.