BANKNIFTY - 1D Timeframe📅 Current Market Status (as of July 18, 2025)

Closing Price: ₹56,283

Fall Today: –547 points (–0.96%)

Intraday Range: ₹56,205 (Low) to ₹56,849 (High)

52-Week Range: ₹43,199 (Low) to ₹57,817 (High)

2025 Performance So Far: Up around 9.5%

🧮 Moving Averages – All Are Negative

From 5-day to 200-day, all moving averages are giving SELL signals.

This confirms a strong downtrend.

Price is below every major moving average → means no strength for recovery yet.

📉 Support and Resistance Levels

Type Price Range

Support ₹55,800 – ₹56,000

Resistance ₹56,700 – ₹57,200

If the price falls below ₹55,800, we may see further fall toward ₹55,000.

For any upward trend to begin, Bank Nifty must close above ₹57,200.

⚠️ Market Mood – What’s Going On?

Strong Downtrend: Bears are in control; market is falling continuously.

High Volume on red candles: Big traders are selling heavily.

Oversold Condition: Market has fallen too much, may bounce a little.

High Volatility: Big movements (500–600+ points) can happen daily.

✅ Easy Summary

Overall Trend: Bearish (Downtrend)

Short-Term Possibility: Small upward bounce may come due to oversold indicators

But: No proper recovery signal until Bank Nifty moves above ₹57,200

Traders should be cautious – trend is still weak and selling pressure is high.

🔮 What to Watch Next?

RSI Above 35: Could be an early sign of recovery.

MACD Crossover: Needed for trend reversal.

Low Red Candle Volume: Means selling may be ending.

₹55,800 Support: If this breaks, further downside likely

Nifty50

Divergence Secrets✅ What is Divergence?

Divergence occurs when price action and an indicator (usually a momentum oscillator) move in opposite directions. This signals a disconnection between price and momentum, often happening before significant reversals.

Most Common Indicators Used:

RSI (Relative Strength Index)

MACD (Moving Average Convergence Divergence)

Stochastic Oscillator

CCI (Commodity Channel Index)

✅ Types of Divergence

1. Regular Divergence (Classic Divergence)

Bullish Divergence: Price makes lower lows, but the indicator makes higher lows → Suggests potential upward reversal.

Bearish Divergence: Price makes higher highs, but the indicator makes lower highs → Suggests potential downward reversal.

📌 Use Case: Best applied during downtrends (bullish divergence) or uptrends (bearish divergence) to catch reversals.

2. Hidden Divergence (The Professional’s Favorite)

Bullish Hidden Divergence: Price makes higher lows, but indicator makes lower lows → Signals trend continuation upwards.

Bearish Hidden Divergence: Price makes lower highs, but indicator makes higher highs → Signals trend continuation downwards.

📌 Use Case: Hidden divergence is used to confirm trend continuation after pullbacks, ideal for trend traders.

3. Exaggerated (Extended) Divergence

Price forms equal highs/lows, but the indicator shows higher lows/lower highs → Signals momentum build-up for reversal.

📌 Use Case: Seen at range breakouts or market tops/bottoms.

✅ Why Divergence Works (Institutional View)

Liquidity Manipulation: Institutions push price to make new highs/lows to grab liquidity, but momentum slows because real volume decreases.

Momentum Imbalance: Even as price extends, internal market strength weakens, revealed through divergence.

Smart Money Accumulation/Distribution: Divergence often appears when institutions quietly build or offload positions, creating momentum shifts.

✅ Advanced Divergence Trading Secrets

🔥 Secret #1: Multi-Timeframe Divergence

Always check divergence on higher timeframes (H4, Daily), then execute entries on lower timeframes (M15, H1).

A daily divergence holds more power than M15 divergence.

🔥 Secret #2: Confluence with Support/Resistance or Order Blocks

Divergence is strongest when it happens at a key structure level (support, resistance, order block, or imbalance zone).

Don’t trade divergence alone — combine it with price reaction at major zones.

🔥 Secret #3: Wait for Structure Break Confirmation

After divergence, wait for Break of Structure (BOS) or Change of Character (CHoCH) to confirm reversal.

This filters out many false divergence signals.

🔥 Secret #4: Volume Confirmation

Confirm divergence with volume drop or volume spike reversal.

Divergence with low participation increases reversal probability.

✅ Pro Divergence Entry Method

✅ Spot Divergence at key levels.

✅ Wait for candlestick confirmation (engulfing candle, pin bar, inside bar).

✅ Look for Break of Minor Structure.

✅ Enter on retest of BOS/CHoCH zone or order block.

✅ Stop loss below swing low/high, target next liquidity pool or imbalance zone.

✅ Common Mistakes to Avoid

❌ Trading divergence without context (e.g., countering a strong trend blindly).

❌ Ignoring higher timeframe trend direction.

❌ Entering without confirmation candle or structure break.

❌ Using lagging indicators without understanding price action.

✅ Final Thoughts

Divergence is a leading indicator, but it must be combined with market structure, key levels, and confirmation price action. Professionals use divergence as a warning sign, not an instant entry trigger. By mastering divergence, you can predict market exhaustion, capture high-reward reversals, and avoid common retail traps.

Divergence is one of the hidden secrets of market timing — master it, and your trading accuracy will improve dramatically

Trading Master Class With ExpertsWhy Choose the Trading Master Class With Experts?

In the world of trading, there’s a fine line between success and failure. The financial markets are full of opportunities but also come with significant risks. The key difference between winning traders and losing traders is education, discipline, and strategy. This masterclass is not just about learning how to trade; it’s about developing a professional trading mindset, learning proven techniques, and practicing high-probability setups under the guidance of industry experts.

This is a result-oriented program designed to give you a complete transformation from a confused trader to a disciplined market participant.

Key Highlights of the Master Class

In-Depth Market Knowledge: Learn the complete fundamentals of financial markets, including market structure, how different asset classes work, and what drives market movements.

Technical Analysis Mastery: From candlestick patterns to advanced indicators, understand how to read charts like a pro. Learn key technical tools like moving averages, RSI, MACD, Fibonacci retracements, and more.

Professional Trading Strategies: Master multiple trading styles including day trading, swing trading, scalping, and positional trading. Get access to expert-verified strategies used by institutional traders.

Options and Derivatives Trading: Understand the power of options trading, futures contracts, hedging techniques, and options strategies like iron condor, spreads, straddles, and strangles.

Institutional Trading Insights: Discover how big players operate in the market. Learn about smart money concepts, liquidity traps, stop loss hunting, and how to trade in alignment with market movers.

Risk Management and Trading Psychology: Learn how to protect your capital using strict risk management rules. Understand the psychological side of trading and how to build emotional discipline for consistent success.

Live Trading Sessions: Participate in live market analysis and live trading sessions with experts who explain their trades in real-time, helping you understand their decision-making process.

Community and Mentorship: Join a supportive community of traders where you can share ideas, discuss setups, and receive continuous guidance from mentors.

Who Should Attend This Master Class?

This masterclass is suitable for:

Aspiring traders who are looking for a solid foundation to start their trading journey.

Intermediate traders who are struggling with consistency and need structured guidance.

Investors who want to learn active trading techniques to multiply their returns.

Working professionals who want to trade part-time with smart strategies.

Full-time traders who want to sharpen their skills and expand their market knowledge.

What You Will Achieve After This Master Class

✅ You will be able to independently analyze charts and identify profitable trading opportunities.

✅ You will develop professional risk management habits that protect you from heavy losses.

✅ You will gain the confidence to trade any market condition — bullish, bearish, or sideways.

✅ You will have clear strategies to trade with discipline, eliminating guesswork and emotional mistakes.

✅ You will build a trader’s mindset focused on growth, patience, and long-term profitability.

This is not just another trading course. It is a complete transformation program that helps you think, act, and succeed like a professional trader. Step into the world of high-probability trading and change your financial future with the Trading Master Class With Experts.

Master Candle Sticks✅ Why Candlesticks Are So Powerful

Candlesticks visually represent real-time market sentiment. Every single candlestick shows you:

Who is in control (buyers or sellers).

The strength of momentum.

Potential exhaustion or continuation.

The battle between retail traders and smart money.

Unlike indicators, which lag, candlesticks are real-time market footprints, helping traders make quick, informed decisions based on pure price action.

✅ Structure of a Candlestick

Every candlestick consists of:

Body: The range between open and close prices — shows strength or weakness.

Wick/Shadow: High and low of the session — shows rejection, liquidity grabs, or manipulation.

Color: Bullish (green/white) vs. Bearish (red/black).

The size of the body and wicks tells a story about market strength or indecision.

✅ Essential Candlestick Patterns

🔵 Reversal Patterns:

Pin Bar (Hammer/Inverted Hammer): Long wick shows rejection of price and potential reversal.

Engulfing Candles: Bullish or bearish candles fully engulf previous candle → momentum shift.

Morning Star / Evening Star: Three-candle reversal at key levels → trend change confirmation.

Doji: Indecision candle, often seen before reversals or breakouts.

🔵 Continuation Patterns:

Inside Bar: Consolidation, often leading to breakouts in the direction of trend.

Bullish/Bearish Flag: Continuation after a sharp move.

Three White Soldiers / Three Black Crows: Strong multi-candle trend confirmation.

✅ Advanced Institutional Candlestick Secrets

🔥 Secret 1: Candlesticks at Key Market Levels

Candlestick signals are most reliable at:

Order Blocks

Support & Resistance Zones

Liquidity Pools

Imbalance/Fair Value Gaps

Always combine candlestick signals with higher timeframe zones for high-probability setups.

🔥 Secret 2: Wick Rejections & Stop Loss Hunts

Institutions often push price to grab liquidity beyond a support/resistance level, shown by long wicks. Wick rejections = liquidity grab = high reversal probability.

🔥 Secret 3: Multi-Timeframe Candlestick Reading

A single higher timeframe candle (Daily, 4H) is built from multiple smaller timeframe candles. Professionals:

Use HTF direction and LTF entry.

For example, Daily bullish engulfing + M15 break of structure = precise sniper entry.

✅ How to Master Candlestick Trading

✅ Focus on clean price action, avoid overcrowding charts with indicators.

✅ Study reaction at key levels, not random patterns.

✅ Always confirm with market structure (trend direction, higher highs/lows, BOS/CHoCH).

✅ Use candlestick confluence, combining patterns with liquidity zones, order blocks, or supply/demand.

✅ Avoid low-quality signals in choppy or low-volume markets.

✅ How Institutions Use Candlesticks

Institutions manipulate candles during low liquidity periods (fakeouts).

They use time-based traps, creating bullish/bearish patterns before reversing direction.

Volume + Candlestick Analysis shows true institutional intent — e.g., high volume bullish pin bars after liquidity grab = strong upside signal.

✅ Pro Tips for Candlestick Mastery

💡 Best signals occur after liquidity grabs — false breakout + rejection wick.

💡 Always combine candlesticks with market structure shifts — don’t take isolated signals.

💡 Trade in the direction of higher timeframe momentum, even if lower timeframe gives opposite signals.

💡 In sideways markets, avoid reversal signals, favor range trades.

✅ Final Thoughts

Candlesticks are the true language of the market. By mastering candlestick trading, you’ll gain the ability to predict market moves before they happen, trade with confidence, and avoid the common mistakes of indicator-dependent retail traders.

Master Candlestick Trading is your first step to becoming a consistently profitable trader, whether in forex, stocks, crypto, or commodities

renderwithme | Nifty 50 July 21-25, 2025 TechnicalFor the week of July 21-25, 2025, the Nifty 50 is expected to trade in a range-bound manner with a slightly bearish bias, influenced by mixed global cues, ongoing Q1 earnings, and macroeconomic data. Key support lies at 24,800-25,000, with resistance at 25,300-25,500. Traders should monitor sectoral performance, FII/DII activity, and global trade developments for potential market shifts.

Nifty 50 Intra day setupnifty at 4 hour support

Chart for the reference

~~ Disclaimer ~~

This analysis is based on recent technical data and market sentiment from web sources. It is for informational \ educational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

# Boost and comment will be highly appreciated.

Nifty Index 24968.40 as visible by Weekly Chart viewNifty Index 24968.40 as visible by Weekly Chart view

- Nifty 50 Index has formed a Bearish 3 Black Crow Technical Pattern indicating about the probable negative sentiment might continue

- Nifty is also closely forming a sliding Bearish Double Top from ATH 26277.35 to current top 25669.35, which again syncs with the negative sentiment trend trajectory

NIFTY50Nifty could 📉 fall to below level 24850 within 18th July 2025 or to the white line marked on the chart.

Even there's a high possibility that 24850 could break and it could even fall 📉 to below red dashed line 24370 within last week of july 2025.

Disclaimer:

It's a personal view not a financial advice and I assume no responsibility and liability whatever outcome arises.

Nifty 50 spot 24968.40 by the Daily Chart view - Weekly updateNifty 50 spot 24968.40 by the Daily Chart view - Weekly update

- Support Zone 24900 to 25100 Price Band just sustained

- Next Support Zone seen at 24325 to 24500 of the Nifty Index

- Breakdown from Falling Resistance Trendline might just continue

- Rising Price Channel Breakdown indicates weakness might continue

- Resistance Zone 25250 to 25400 then ATH 26277.35 of Nifty Index levels

Earnings in Focus Companies in the Spotlight

Reliance Industries (RIL)

Reliance’s results are among the most awaited in the Indian market. It touches almost every Indian household through its telecom (Jio), retail, and oil-to-chemicals arms.

In Q1, analysts expected strong year-on-year growth in profit, partly helped by a one-time gain from a stake sale.

Retail and digital segments were projected to post steady growth.

Oil-to-chemicals margins were expected to remain stable due to global energy price stabilization.

Since Reliance has a significant weight in both Nifty and Sensex, even a 2–3% move can swing the broader indices.

JSW Steel

JSW Steel posted stronger-than-expected operating profits. The volume growth was robust and pricing held steady despite global uncertainties.

Steel performance is considered a proxy for infrastructure and housing demand.

Better margins mean improved profitability outlook, which often lifts peer stocks like Tata Steel and SAIL too.

Wipro

Wipro surprised the street with a better-than-expected net profit growth and steady revenue.

This came after a few muted quarters, giving confidence to IT investors.

The firm also secured some large deals, which improved guidance.

When a Tier-1 IT company beats expectations, it often leads to a short-term sector-wide rally.

Axis Bank

Axis Bank reported a small decline in net profit due to an increase in provisions and asset quality slippage.

Markets reacted negatively, with the stock dropping more than 5%.

This raised some concerns for the entire banking sector, especially around retail loan delinquencies.

Bank earnings are carefully tracked for signs of economic health since they’re the first to show stress in the system.

Hindustan Zinc

Despite a year-on-year drop in profit, Hindustan Zinc beat market expectations.

The metal segment held up well.

Higher cost efficiency offset pricing pressure.

It shows that even in commodity-heavy businesses, efficiency and scale can drive earnings resilience.

3. 📈 How Markets React During Earnings

Earnings are one of the biggest catalysts for short-term market movements. Here’s how different market participants respond:

Retail Traders: Look for quick intraday or swing opportunities based on the reaction to earnings.

Institutional Investors: Focus more on guidance, margin outlook, and strategic plans.

FIIs & DIIs: Use results to rebalance portfolios across sectors.

This week, markets opened flat with mixed sector movements. Financials remained under pressure due to Axis Bank, while energy and metals were relatively stronger.

4. 🎯 Trading Strategies During Earnings Season

🔹 Intraday Traders:

Monitor stock-specific results.

A strong beat often results in gap-up opens, followed by either a continuation rally or profit-booking.

Misses often result in sharp selling pressure.

🔹 Swing Traders:

Look for strong earnings + bullish technical setup for 3–5 day momentum trades.

Weak earnings can be played with bearish options like puts or bear spreads.

🔹 Investors:

Focus on long-term stories where earnings confirm improving fundamentals.

Use dips in strong businesses as buying opportunities.

5. 💼 Sectoral Trends from Current Earnings

✅ IT Sector:

Wipro’s good performance and deal wins have created optimism.

If the rest of the IT majors follow suit, it may indicate a bottom in the tech cycle.

✅ Metals:

JSW Steel’s strong numbers confirm ongoing industrial demand.

Infra push and China’s restocking are adding tailwinds to global metal prices.

❌ Financials:

Axis Bank’s weaker asset quality is a concern.

Market will now look toward HDFC Bank, SBI, and ICICI Bank to see if this is a one-off or an emerging trend.

⚖️ FMCG & Consumer:

Awaited earnings from major players like HUL, Dabur, and Nestlé will show how rural and urban consumption are shaping up.

Margin expansion through easing input costs will be closely monitored.

6. 📊 Impact on Broader Indices

Nifty:

Reliance alone has over 10% weight in the index. A positive surprise there can lift Nifty meaningfully.

IT and metals also have significant representation, so results from Wipro and JSW Steel are important.

Bank Nifty:

Axis Bank’s fall dragged the index.

A recovery depends on upcoming results from ICICI Bank and HDFC Bank.

Sector Indices:

Nifty Metal may outperform if positive surprises continue.

Nifty IT needs more broad-based strength to reverse the downtrend.

7. 🧠 What Smart Money Is Watching

Institutional investors are focusing on:

Guidance for the rest of FY25

Cost management: Are companies protecting or growing their margins?

Volume growth: Are revenues rising due to real demand or just price hikes?

Loan growth and credit quality: Especially in the banking space

These insights help long-term investors identify early winners and avoid laggards.

8. 🧾 Key Takeaways for Traders & Investors

Earnings are the strongest short-term trigger in markets.

Reliance results can tilt the entire Nifty one way or the other.

IT is stabilizing, Metals are strong, Financials are shaky—sector rotation is visible.

Stay stock- and sector-specific rather than going fully index-based during earnings season.

9. ✅ Final Words

“Earnings in Focus” isn’t just a headline—it’s the heartbeat of market sentiment right now.

In a market driven by uncertainty (inflation, interest rates, global slowdown), real numbers from real companies matter more than ever. This is the time when:

Traders can catch powerful moves based on short-term surprises

Investors can spot trends and leaders early

Portfolio rebalancing decisions can be guided by facts, not emotions

Whether you’re in for a quick trade or a long-term position, understanding earnings and their market impact is essential.

Nifty 50 – 1 Day Timeframe✅ Closing Summary:

Closing Price: ₹24,968.30

Change: −₹143.55 (−0.57%)

Opening Price: ₹25,108.55

Intraday High: ₹25,144.20

Intraday Low: ₹24,919.10

Nifty 50 traded in a narrow but bearish range throughout the session, losing nearly 0.6%, as market sentiment remained weak due to earnings pressure and global cues.

🔍 Key Reasons for the Decline:

Banking Sector Drag:

Major private sector banks like Axis Bank reported weaker-than-expected earnings, sparking a broad sell-off in financials.

Financial stocks make up a large portion of Nifty 50, pulling the entire index lower.

Cautious Investor Sentiment:

Global uncertainty regarding U.S. Federal Reserve interest rate decisions and economic slowdown concerns weighed on overall risk appetite.

Investors are also being cautious ahead of major Indian corporate earnings from companies like HDFC Bank, ICICI Bank, Reliance Industries, and others.

Foreign Institutional Selling (FII):

FIIs continued to sell Indian equities, especially large-cap financials and IT stocks.

This added selling pressure even as some domestic institutional investors tried to buy the dips.

Technical Weakness:

The index slipped below the 25,000 psychological support level, a sign of short-term technical weakness.

Intraday recoveries were capped near resistance, confirming the bearish tone.

📈 Technical Outlook (Short-Term):

Support Zone: ₹24,900 to ₹24,850

This is the next critical area. If broken, further decline toward ₹24,600 is likely.

Resistance Zone: ₹25,150 to ₹25,300

Bulls need to reclaim this zone for the trend to turn positive again.

Momentum Indicators:

RSI: Slipping below 45, showing weakening momentum.

MACD: Bearish crossover; trend remains under pressure.

Volume: Slightly above average, indicating serious selling interest at the top.

📆 Recent Trend Performance:

1-Day Return: −0.57%

1-Week Return: −0.35%

1-Month Return: +2.10%

6-Month Return: +12.8%

1-Year Return: +10.9%

Nifty 50 remains in a medium- to long-term uptrend, but short-term correction is underway, largely due to sector-specific drag and earnings volatility.

🧠 What Traders & Investors Should Know:

Day Traders: Watch for quick reversals near support at ₹24,900; consider shorting near resistance if recovery fails.

Swing Traders: Wait for either a bullish reversal candle or RSI bounce before entering fresh long positions.

Long-Term Investors: Despite the dip, the market remains healthy. This could be a buy-on-dip opportunity, especially in sectors like auto, pharma, and capital goods that are holding well.

💬 Conclusion:

Nifty 50 showed weakness on July 18 due to negative earnings surprises and bearish sentiment in financials. While technical indicators suggest short-term downside pressure, the broader long-term trend remains intact. Key support at ₹24,900 is crucial. A bounce from that zone can trigger a recovery, but a sustained break below it could accelerate the decline

LEARN INSTITUTIONAL TRADING✅ What is Institutional Trading?

Institutional trading focuses on understanding how big money flows in the market. Institutions trade in huge quantities, and their strategies revolve around manipulating prices to collect liquidity, triggering stop-losses, and creating false breakouts. Retail traders often lose money because they follow trends without understanding the market structure set by these institutions.

✅ What You Will Learn in Institutional Trading

1. Smart Money Concepts (SMC):

Learn how smart money (institutions) traps retail traders using fake breakouts, stop hunts, and liquidity grabs.

2. Market Structure:

Higher Highs (HH), Higher Lows (HL), Lower Highs (LH), Lower Lows (LL)

Break of Structure (BOS) and Change of Character (CHOCH)

This helps you predict market direction with logic, not emotions.

3. Order Blocks:

These are zones where institutions place large orders. You’ll learn how to identify them and trade with the big players.

4. Liquidity Pools:

Find out where stop-losses and pending orders are sitting in the market so you can trade smartly by targeting liquidity zones.

5. Entry & Exit Strategies:

Master high-probability entry techniques and learn proper risk management like institutional traders.

✅ Why Learn Institutional Trading?

Retail Trading Institutional Trading

Random entries Planned entries based on logic

Easily manipulated Trades follow the footprint of big players

Low win rate Higher win rate with patience

Emotional trading Rule-based, stress-free trading

✅ Benefits of Mastering Institutional Trading

🎯 Accurate Trades – Follow the market makers.

💸 Better Risk-Reward – Small stop-loss, bigger targets.

⏰ Trade Less, Earn More – No overtrading, only quality setups.

🧠 No Indicators Needed – Pure price action and market reading.

✅ Who Can Learn Institutional Trading?

✅ Beginners who want to start right.

✅ Retail traders who keep losing.

✅ Part-time traders looking for consistency.

✅ Anyone serious about becoming a profitable trader.

✅ Final Words:

Institutional trading teaches you how to trade with the smart money instead of against it. Once you master these strategies, you will understand market moves like a professional and make more consistent profits

Technical Class✅ What You Learn in a Technical Class

1. Introduction to Technical Analysis

What is price action?

Difference between Technical and Fundamental Analysis

Basics of Candlestick Charts

2. Candlestick Patterns

Bullish and Bearish Patterns

Reversal Patterns (Doji, Hammer, Shooting Star)

Continuation Patterns (Flags, Pennants)

3. Chart Patterns

Double Top, Double Bottom

Head and Shoulders

Triangles (Ascending, Descending)

4. Indicators and Oscillators

Moving Averages (MA, EMA)

RSI (Relative Strength Index)

MACD (Moving Average Convergence Divergence)

Bollinger Bands

5. Support and Resistance

How to Identify Strong Support Zones

How to Use Resistance Levels for Entries/Exits

6. Trend Analysis

How to Spot a Trend (Uptrend, Downtrend, Sideways)

Trendlines and Channels

Breakouts and Fakeouts

7. Volume Analysis

Importance of Volume in Confirming Moves

Volume Spikes and Market Reversals

8. Risk Management

How to Protect Your Capital

Stop Loss and Take Profit Strategies

Risk-Reward Ratio

✅ Who Should Attend a Technical Class?

✅ Stock Market Beginners

✅ Intraday Traders

✅ Swing Traders

✅ Option Traders

✅ Anyone who wants practical market knowledge

Advance Option Trading✅ What is Advanced Options Trading?

At the advanced level, traders use option combinations, multi-leg strategies, and hedging techniques to:

Maximize profits

Minimize risks

Take advantage of market volatility and time decay (Theta)

You don’t just predict direction; you trade direction, volatility, and time decay together.

✅ Core Concepts in Advanced Options Trading

1. Greeks Mastery

Delta: Measures how much the option price moves with the underlying asset.

Gamma: Rate of change of Delta.

Theta: Time decay — how much the option loses value every day.

Vega: Sensitivity to volatility changes.

Rho: Impact of interest rate changes (used less by retail).

Understanding Greeks helps you manage profits and risks more precisely

3. Volatility Trading

Institutions trade implied volatility (IV), not just price direction. Advanced traders use tools like IV Rank and IV Percentile to:

Sell options when IV is high (premium rich)

Buy options when IV is low (cheap options)

4. Hedging Techniques

Use options to protect your portfolio from major losses.

Example: Holding stocks and buying Protective Puts to limit downside risk.

Example: Selling Covered Calls to generate monthly income on stock holdings.

✅ Benefits of Advanced Options Trading

💸 Profit in Any Market Condition (up, down, sideways)

⏳ Earn from Time Decay (Theta Decay)

🛡️ Control Risk with Defined Risk Strategies

🎯 Higher Probability of Consistent Returns

📉 Less Capital, More Leverage

✅ Who Should Learn Advanced Option Trading?

✅ Traders with basic options knowledge

✅ Investors wanting to hedge portfolios

✅ Intraday or positional traders

✅ Those seeking consistent monthly income

✅ Final Thoughts

Advanced Options Trading transforms you from a simple buyer/seller to a strategic trader who uses market forces smartly. You don’t chase trades — you set up calculated, high-probability positions and let the market work for you.

Option Trading✅ What is an Option?

An Option is a financial contract between a buyer and seller based on an underlying asset (stock, index, commodity).

Call Option = You have the right to Buy.

Put Option = You have the right to Sell.

You pay a premium to buy this right. You are not obligated, but you have the option to buy/sell.

✅ Example (Simple):

You buy a Call Option on Reliance at ₹2500 strike price, paying ₹50 premium.

If Reliance goes to ₹2600, you profit (your option value increases).

If Reliance stays below ₹2500, you lose only ₹50 (the premium)

Types of Options

Call Option – Profit when the market goes up.

Put Option – Profit when the market goes down.

ITM (In the Money) – Strike price already profitable.

ATM (At the Money) – Strike price close to current market price.

OTM (Out of the Money) – Strike price away from market price

✅ Advantages of Option Trading

✅ Less Capital Needed

✅ Limited Risk (when buying)

✅ High Profit Potential

✅ Profit in All Market Types (up, down, sideways)

✅ Risks in Option Trading

❗ Premium can expire worthless (buyer loses money)

❗ Selling options carries unlimited risk (if done without strategy)

❗ Time Decay – value of options reduces as expiry nears

✅ Option Trading is Best for:

✅ Traders with small capital

✅ Stock market learners

✅ Part-time traders

✅ People who want to hedge portfolios

✅ Final Summary:

Option Trading is a smart way to participate in the market using strategies, risk control, and leverage. Start with Call and Put basics, then learn strategies like covered calls, spreads, and hedging to master the gam

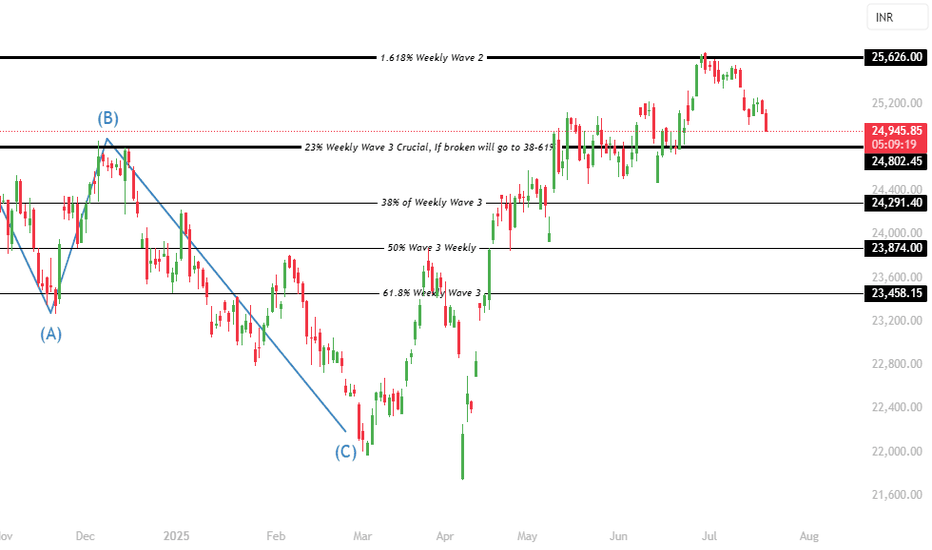

Nifty 50 Trend Analysis A detailed wave analysis in larger times frames indicates that nifty is beginning to trigger a sharp or moderate momentum deep correction. The correction & downtrend can last upto 23874 & 23458 potentially. In a downtrend, institutions will sell on every rise, hence its not the right time to make new investments directly in the stocks. Currently nifty is trading at 25073 and this swing momentum can go upto 24802 without reversals, and 24802 will play a crucial role but since the wave 3 has completed its maximum levels we need to brace for 23874 & 23458.

NIFTY KEY LEVELS FOR 18.07.2025NIFTY KEY LEVELS FOR 18.07.2025

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

If the range is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

FMCG & ConsumptionThink about your daily life — the toothpaste you use, the biscuits you eat, the shampoo you prefer, the tea you drink, the food delivery app you order from. Every one of these touches a part of the FMCG & consumption sector.

Now multiply that by 1.4 billion Indians, and you realize the size of this engine.

In 2025, the FMCG (Fast-Moving Consumer Goods) and consumption-driven stocks are at the center of a powerful story — one shaped by:

India's rising middle class

Rural income revival

Urban premiumization

Growth of e-commerce and quick commerce

Digital payments & new-age D2C (Direct-to-Consumer) brands

This isn't just a theme — it's a structural growth trend that never goes out of fashion.

Let’s break it down step-by-step.

🧼 What is FMCG & Consumption Sector?

FMCG stands for Fast-Moving Consumer Goods. These are everyday products people buy frequently:

Food & beverages (biscuits, noodles, soft drinks, snacks)

Personal care (soap, shampoo, deodorant)

Household items (detergent, floor cleaner, toothpaste)

Over-the-counter (OTC) products (balms, cough syrup, nutrition)

The Consumption theme expands on this to include:

Retail (organized & unorganized)

Quick commerce (Blinkit, Zepto)

E-commerce (Amazon, Flipkart, Nykaa)

Food delivery (Zomato, Swiggy)

Apparel & footwear (Trent, Aditya Birla Fashion)

Durables & electronics (TVs, fridges, fans, phones)

So whether it’s Maggi or Myntra, Parle-G or Paytm Mall — it all fits under Consumption.

🔥 Why FMCG & Consumption Is Trending in 2025

Let’s look at what’s driving this sector today:

1️⃣ Rural Demand Is Rebounding

After 2 years of low rural growth due to inflation and erratic monsoons, 2025 has brought strong crop output, stable agri prices, and more cash in hand.

Rural India forms over 40% of FMCG consumption, especially:

Entry-level soaps, snacks, tea

Sachet products

Local brands

Companies like Dabur, HUL, Marico, and Emami have all confirmed rural growth is picking up fast.

2️⃣ Premium Urban Consumption Is Booming

At the same time, India’s cities are upgrading:

Tier-2 cities now demand premium face creams, health foods, organic juices

Young consumers are choosing branded wear, subscription boxes, and gourmet snacks

Working women are driving personal care product sales

Urban India is moving from price to value, and that’s a goldmine for consumer brands.

3️⃣ Quick Commerce Is Changing Habits

Apps like Blinkit, Zepto, Swiggy Instamart are:

Delivering goods in 10–20 minutes

Creating new demand cycles (midnight snacking, impulse buys)

Becoming a new channel for FMCG sales

For FMCG companies, this means higher turnover and visibility, especially for smaller SKUs (sachets, ₹5/₹10 packs).

4️⃣ Direct-to-Consumer (D2C) Boom

New-age startups like:

Mamaearth (beauty, baby care)

WOW Skin Science (natural shampoos)

BoAt (audio & smart accessories)

Licious (fresh meats)

…are bypassing traditional stores and selling directly online.

This model:

Cuts middlemen

Boosts margins

Creates brand intimacy

And now many of these brands are listed or IPO-ready, adding fire to the consumption story.

5️⃣ China+1 & Make in India Push

Many global companies now manufacture in India, not China:

Personal care

Cosmetics

Packaged foods

This reduces costs, improves supply chains, and boosts exports of Indian FMCG brands too.

📈 Stock Market Performance (2023–2025)

Let’s take a look at how some top names have performed:

Stock Jan 2023 Price July 2025 Price Return

ITC ₹340 ₹460+ 35%

Hindustan Unilever ₹2,500 ₹2,800+ 12%

Dabur ₹550 ₹675+ 22%

Nestle India ₹18,000 ₹24,000+ 33%

Zomato ₹55 ₹195+ 250%+

Nykaa ₹120 ₹180+ 50%

Mamaearth (Honasa) ₹320 (IPO) ₹460+ 44%

Quick commerce, D2C and food delivery stocks have been top gainers.

Traditional FMCG majors are more slow & steady compounders.

🛒 Segments Inside FMCG & Consumption

Let’s divide this into sub-themes:

🍪 1. Packaged Foods & Beverages

Britannia (biscuits)

Nestle India (Maggi, chocolates)

Tata Consumer (tea, coffee, salt)

Varun Beverages (Pepsi bottling)

Bikaji, Prataap Snacks (local snacks)

🧼 2. Personal & Household Care

HUL (Dove, Surf Excel, Lifebuoy)

Dabur (Chyawanprash, Vatika)

Marico (Parachute, Saffola)

Godrej Consumer (Goodknight, Cinthol)

Emami (Fair & Handsome, Navratna)

🛍️ 3. Retail Chains & Apparel

Trent (Westside, Zudio)

V-Mart

Avenue Supermarts (D-Mart)

Aditya Birla Fashion (Pantaloons, Van Heusen)

Shoppers Stop

🍕 4. Online Food & Quick Commerce

Zomato

Jubilant Food (Domino’s)

Devyani International (KFC, Pizza Hut)

Zepto (IPO coming soon)

Blinkit (part of Zomato)

💄 5. Beauty & D2C Personal Care

Honasa (Mamaearth)

Nykaa

Lotus Herbals (Private)

WOW Skin Science (IPO Expected)

💡 Why Traders and Investors Love This Sector

✅ Always in Demand – Recession or boom, people still need soap and toothpaste.

✅ Strong Brand Power – Consumer loyalty = pricing power = margin stability.

✅ Low Capex Businesses – High return on capital, especially for asset-light D2C models.

✅ Growth via Premiumization – Indians are trading up from "cheap" to "value".

✅ Earnings Predictability – FMCG companies often beat or meet earnings estimates.

📊 How to Trade or Invest in This Theme

🎯 For Long-Term Investors:

Pick 3–4 companies across segments:

One traditional FMCG major (HUL, ITC)

One high-growth food player (Nestle, Varun Beverages)

One retail/delivery stock (Zomato, Trent)

One new-age D2C story (Mamaearth, Nykaa)

Hold for 3–5 years. These stocks are slow compounders with low risk + decent reward.

📉 For Traders:

Look for volume breakouts after consolidation

Track monthly updates on rural/urban growth

Trade around quarterly results and guidance

Use options strategy around earnings for volatility plays (like Zomato)

⚠️ Risks to Watch Out For

Risk Explanation

Inflation Pressure Higher input costs (milk, palm oil) hurt margins

Valuation Concerns Some D2C stocks may be overpriced

Competition from Local Players Especially in rural and Tier-3 cities

Dependency on Monsoon A weak monsoon can dent rural demand

🚀 The Road Ahead (2025–2030)

India is expected to:

Add 250 million middle-class consumers by 2030

See online retail double in size

Witness over 500 million people shop on mobile phones

Grow FMCG exports to Asia & Africa

The Indian consumption engine is just starting up. This isn't a temporary trend — it’s a secular, multi-decade opportunity.

✅ Conclusion

The FMCG & consumption story in India is:

Stable during slowdowns

Explosive during booms

Universal in reach — touching every home, city, and village

Now evolving rapidly with D2C, quick commerce, and premiumization

Whether you're an investor looking for consistent compounding or a trader looking for smart momentum plays, this is one of the most powerful sectors to focus on in 2025 and beyond

KOTAKBANK 1D TimeframeWhy KOTAKBANK?

Kotak Mahindra Bank is one of India’s most reputed private banks. It’s known for its conservative lending practices, healthy balance sheet, and strong retail plus corporate banking mix. Over the past few quarters, the bank has focused on digital transformation, stable asset quality, and maintaining margins despite rising interest rate pressures. Because of this, it’s always on the radar of long-term investors.

Now in 2025, with the financial sector showing resilience, KotakBank is gaining attention again—especially among those looking to buy on dips or add during consolidation phases.

✅ Current Price Range

As of mid-July 2025, KotakBank is trading near ₹2,185–₹2,190.

On the 1-day chart, it is showing signs of sideways consolidation with support at lower levels and limited upside pressure—this is perfect for long-term accumulation.

🔍 Key Investment Levels (Support & Resistance)

Let’s break it down into zones:

🟩 Support Zones (Ideal Buy Areas)

These are the levels where buyers often enter and prices tend to bounce back.

₹2,160 – ₹2,175

→ This is your first buy zone. It’s a cushion where the price may fall and stabilize before heading back up. Great for small quantity entry.

₹2,140 – ₹2,154

→ A stronger support zone. If the stock dips further, this is where serious long-term buyers often start accumulating. This level has held up multiple times in the past few months.

₹2,125 – ₹2,130

→ This is the last major support level on the daily timeframe. If the price falls below this zone, it might signal short-term weakness, and one should be cautious or wait for stability.

🟥 Resistance Zones (Profit Booking Areas)

These are levels where the stock might face selling pressure, especially short-term traders looking to book profits.

₹2,194 – ₹2,196

→ This is the first resistance area. If you’re already holding from lower levels, consider partial profit booking here.

₹2,209 – ₹2,228

→ A stronger resistance zone. This has acted as a ceiling for the stock recently. If KotakBank closes above this with strong volume, it may break out for fresh highs.

Above ₹2,228

→ If the stock closes above this level on the daily chart, it could start a new rally towards ₹2,260–₹2,300 zone. This level becomes a breakout confirmation point.

🧠 How to Use These Levels (Simple Plan)

🟢 If You’re a Long-Term Investor:

Start buying small quantities if KotakBank dips to ₹2,160–₹2,175.

Add more at ₹2,140–₹2,154 only if market sentiment remains stable.

Stop-loss: If price goes below ₹2,125 and stays there, pause further buying. It may need time to consolidate.

🔵 If You Already Hold the Stock:

Watch for price to approach ₹2,194–₹2,228.

Book partial profits if you’re short-term focused.

If it breaks above ₹2,228, consider holding more or adding for the breakout rally.

Keep trailing your stop-loss upward as the price moves.

📈 Price Behavior (Technical Summary)

Trend: Currently neutral to slightly bullish.

Volume: Not too aggressive, but steady—shows strong hands are holding.

Momentum: RSI (Relative Strength Index) near 50–55 zone on daily timeframe; neither overbought nor oversold.

Volatility: Controlled; perfect for accumulation, not short-term speculation.

📝 Final Thoughts – Human Summary

KotakBank is not in a breakout mode right now, but it’s forming a base.

If you’re a long-term investor, this is the kind of setup you wait for: clear supports, low volatility, and no hype.

The ₹2,140–₹2,175 area is your opportunity zone.

Just make sure to manage your risk below ₹2,125 and don’t go all-in at once. Gradual accumulation works best in these setups.

If it breaks ₹2,228, get ready for action. That’s your green signal for the next rally

Nifty Key Levels for 17.07.2025Nifty Key Levels for 17.07.2025

If Nifty breaks the upper or lower range, we can expect momentum. The consolidation zone will be favorable for option sellers,while a breakout on either side will benefit option buyers.

Disclaimer:

I'm not a SEBI Registered financial advisor. These views are purely educational in nature. You are solely responsible for any decisions made based on this research.

Nifty 50 - Symmetrical Triangle Breakout WatchNifty is currently consolidating within a symmetrical triangle pattern on the 1-hour chart. Price is respecting both the rising support and descending resistance trendlines.

Key observations:

Clear higher lows indicate underlying bullish pressure.

Lower highs show selling pressure near resistance.

Expecting a possible pullback toward the lower trendline before a potential breakout to the upside.

Trade Plan (if breakout occurs):

📈 Bullish breakout above the upper trendline could lead to a sharp rally.

✅ Confirmation needed with strong volume and candle close above resistance.

Invalid if price breaks below the support trendline.

Stay alert for a breakout or breakdown — both scenarios possible, but current structure slightly favors bulls.

Power & Utilities in 2025 Introduction: Why Power & Utilities Are Buzzing in 2025

Imagine running a growing city — there are electric buses on the roads, factories running 24/7, smart homes everywhere, and electric cars being charged in every neighborhood. Behind all of this is one invisible but powerful engine: electricity.

In 2025, India's power and utility sector is not just surviving — it is booming, evolving, and attracting massive investor interest. Whether it’s traditional power giants like NTPC or new-age energy plays like Tata Power and Servotech, this space is heating up because:

Power demand is at an all-time high

Government support is stronger than ever

Clean energy goals are transforming old players

The PLI scheme (Production Linked Incentive) is pushing domestic manufacturing

This is not just another sectoral rally — it's a structural shift. Let’s explore what’s driving this change and what it means for traders and investors in simple language.

🔌 What Is the Power & Utilities Sector?

The power and utilities sector includes companies that:

Generate electricity (thermal, hydro, solar, wind, nuclear)

Transmit and distribute it to homes, businesses, and factories

Make components like transformers, wires, batteries, solar modules

Operate infrastructure like smart grids, substations, power lines

These are the companies that light up India, literally.

Traditionally, this sector was slow-moving and PSU-dominated. But now, with renewables, EV charging, energy storage, and smart grids, it’s become a major growth story.

🌟 What’s Driving the Power Sector Boom in 2025?

Let’s break this into 6 easy-to-understand points:

✅ 1. Exploding Electricity Demand

India’s electricity demand is growing at 8–10% annually, faster than any major economy. Why?

Urbanization

More factories and data centers

EV charging needs

Heatwaves and air conditioners

Rural electrification

In short: More people + more machines = more electricity needed

✅ 2. Government Push for Renewable Energy

India is aiming for 500 GW of non-fossil fuel energy by 2030. This means huge support for:

Solar

Wind

Hydropower

Green hydrogen

Big players like NTPC, Adani Green, Tata Power, and ReNew Power are investing billions in clean energy. The budget also offers tax breaks, low-interest loans, and faster clearances.

✅ 3. PLI Scheme: Game-Changer for Power Equipment

PLI (Production Linked Incentive) is a government scheme that gives incentives to manufacturers based on their output.

In the power sector, PLI is being used for:

Solar panel/module manufacturing

Advanced battery storage

EV charging infrastructure

Smart meters and grid tech

This means companies making power equipment within India get rewarded — boosting domestic manufacturing and exports.

Examples of PLI Winners:

Tata Power Solar

Waaree Energies

Servotech Power

Amara Raja Energy

Exide Industries (battery PLI)

✅ 4. Modernization of Grid & Infrastructure

India’s power infrastructure is being upgraded and digitized.

Smart meters replacing old meters

Smart grids to manage load more efficiently

Underground cables, better transmission

PSUs like Power Grid Corporation, REC Ltd, and NHPC are leading this transformation. These upgrades improve efficiency, reduce loss, and bring more reliability.

✅ 5. EV Revolution = New Opportunity

Electric vehicles are the future. Every EV needs:

A charging station

Stable power supply

Smart grid support

So companies setting up EV charging infra (like Servotech, Tata Power, NTPC) are seeing new business models emerge. This link between mobility and energy is a major opportunity.

✅ 6. Private + PSU Partnership Model

Unlike the past, today’s power ecosystem sees collaboration between private players and PSUs. For example:

NTPC and Indian Oil working on hydrogen

Tata Power partnering with states for solar rooftops

Servotech tying up with PSUs for EV charging

This reduces risk, increases scale, and boosts trust for investors.How to Understand Different Power Stocks

🔌 Generation Stocks:

These companies produce electricity.

NTPC (thermal + renewable)

NHPC (hydropower)

SJVN (solar, hydro)

Adani Green (solar, wind)

⚡ Transmission & Distribution Stocks:

They carry electricity from plants to homes/factories.

Power Grid Corporation

Torrent Power

Tata Power

🔋 Equipment & Infra Stocks:

They make batteries, inverters, smart meters, charging stations

Servotech Power

Amara Raja Energy

Exide Industries

Hitachi Energy India

📈 Trading Strategies for Power Stocks

🛠️ For Swing Traders:

Watch for breakouts from consolidation patterns

Use indicators like volume + RSI divergence for entry

Example: Servotech consolidates for 3–5 days → breakout candle + high volume = entry

💼 For Long-Term Investors:

Pick companies with:

Consistent revenue/profit growth

Low debt

Green energy roadmap

SIP into leaders like NTPC, Tata Power, Power Grid

🔁 For Momentum Traders:

Use sector rotation charts (Nifty Energy Index)

Trade around policy news, budget updates, energy shortages, or global oil price moves

Outlook for 2025–2030

India’s power sector is not just about keeping lights on anymore. It’s about:

Powering a digital, electric, and green economy

Becoming a global energy exporter

Creating jobs and wealth through Make in India

Here’s what we can expect in coming years:

Massive growth in battery storage capacity

Rooftop solar + net metering in most cities

Hydrogen-based vehicles and fuel stations

India becoming a solar module export hub

In simple words: The power sector of tomorrow is smart, clean, connected — and investable.

✅ Final Thoughts

The Power & Utilities sector in 2025 is at a tipping point — supported by government policy, modern tech, global ESG demand, and rising consumption. It’s no longer “boring” or “slow.”

Whether it’s green energy leaders like Tata Power, efficient PSUs like NTPC, or disruptors like Servotech — this space is full of opportunity

HDFCBANK 1D Timeframe✅ Holding HDFC Bank Already?

Stay invested. The stock is in a strong daily uptrend

Expect potential partial profit-taking near ₹2,021–₹2,025 or ₹2,039–₹2,040.

🟢 Planning to Buy?

First entry zone: ₹1,977–₹1,980 — safe to buy on minor dips.

Deeper buy range: ₹1,960–₹1,963 — ideal for long-term accumulation.

Place a stop-loss just below ₹1,947, especially on deeper entries.

🔵 Breakout Play?

A clean daily close above ₹2,039–₹2,040 with strong volume could launch a fresh rally.

You can add more positions after confirmation

Day-to-Day Tips

Use dips to enter near support levels with disciplined stop-losses.

Scale out or lighten positions near resistance levels.

Add more only after a confirmed breakout with strong volume.