Niftyprediction

Meaning of Management and psychologyManagement is the process of planning, organizing, leading, and controlling resources to achieve organizational goals, while psychology is the scientific study of behavior and mental processes. Management psychology, also known as managerial psychology, applies psychological principles to understand and improve managerial practices and organizational behavior.

Support and Resistance part 2Support or resistance is determined by whether price is above or below the level identified by the trader. Generally, a trader can think of support being levels below price whereas resistance is formed above price. Levels of support and resistance can be formed in a few different ways.

Management and PsychologyAn understanding of psychological principles can profoundly enhance managerial capabilities. Recognising the various factors that influence human behaviour—including biases, perception, and social dynamics—enables managers to foster an environment that promotes efficiency, innovation, and well-being among team members.

Candle sticks pattern analysisA bullish candlestick is typically green or white and means the closing price is higher than the opening price, indicating upward momentum. Inversely, a bearish candlestick, generally red or black, signals that the closing price was lower than the opening price, reflecting downward pressure.

-If the upper wick on a red candle is short, then it indicates that the stock opened near the high of the day.

-On the other hand, if the upper wick on a green candle is short, then it indicates that the stock closed near the high of the day.

NIFTY 50 - ICT & SMC Analysis (April 9, 2025)🧠 Big Picture Context (Daily Timeframe)

🔍 Structure:

The daily structure is in a macro bearish trend, confirmed by a Change of Character (ChoCH) from a previous higher high.

A market structure shift (MSS) occurred, indicating strong bearish intent.

A major Order Block (OB) around 24,300 – 24,800 has acted as strong supply.

Recent price action shows a rejection from 23,000+ levels, creating a new bearish leg.

🔄 Key Observations:

A clean Fair Value Gap (FVG) from the recent bearish move lies between 22,900 – 23,100, which price may want to revisit.

Price tapped into liquidity pools below previous lows (Sell-side liquidity swept).

Strong reaction up suggests a potential short-term bullish retracement.

🔄 Medium-Term Outlook (4H Chart)

🔍 Structure:

After the sharp bearish move, price made a strong reaction from the 21,800s, suggesting the presence of demand.

A clean PDL (Previous Day Low) sweep followed by BOS (Break of Structure) confirms short-term bullish market structure.

🔄 Current Price Action:

Price filled part of a green FVG (imbalance) and is now retracing from resistance.

The 22,900–23,000 zone contains:

A bearish OB

FVG

VI (Volume Imbalance)

Previous Weekly High (PWH)

→ This confluence makes it a high-probability reversal zone.

📉 Execution Timeframe (1H Chart)

🔍 Structure:

Price has now formed a BOS upwards after taking out liquidity near 21,800 (PDL).

Rally filled lower imbalance (FVG), creating a strong displacement candle and BOS above PDH.

Now consolidating under a supply zone with signs of weakness near 22,550 – 22,700.

🎯 Trade Idea: Sell on Retracement into Premium

📈 Bias: Bearish from premium supply zone.

🛠️ Trade Setup (1H + 4H Confluence):

Type Level/Zone

Entry 22,900 – 23,000 (Red FVG & OB)

Stop Loss Above 23,100 (above OB & VI)

Target 1 22,250 (PDH/imbalance fill)

Target 2 21,800 (PDL sweep area)

Target 3 21,600–21,500 (daily demand zone)

📊 Risk-Reward (Approx):

Risk: ~150 pts (23,100 – 22,950 entry)

Reward: ~400–1,400 pts depending on target

RRR: Minimum 2.5:1 up to 9:1

💡 ICT/SMC Concepts Applied:

Liquidity Sweep: Sell-side liquidity below PDL taken → large move up.

Fair Value Gaps: Price filled FVG and now sits just below another premium FVG.

Order Blocks: Bearish OB around 22,900–23,100 zone expected to act as supply.

PDH/PDL Reactions: Market respected those areas.

Market Structure Shift (MSS): Bearish momentum continues on higher TFs despite short-term rally.

🧭 What to Watch For:

If price breaks and holds above 23,100, this setup becomes invalid – it signals deeper retracement or reversal.

Watch volume or strong rejection candles in supply zone to enter with confirmation (ideal on 15M/5M for sniper entry).

Any clean FVGs left behind as price retraces could be rebalanced before dropping.

📌 Final Thoughts:

This is a classic SMC + ICT short setup after price retraced into premium zone following a strong move down. The confluence of OB, FVG, VI, and PDH makes this zone a high-probability turning point. Wait for confirmation and execute with proper risk management.

NIFTY INTRADAY TARGET 200 POINTS..22350 TO 22550Nifty strong above 22350

there is no resistance upto 22500 and 22550

wait for active mode

Buy above 22350

Stoploss............22290.....60 points

Target1.............22420.....70 points

Target2.............22500.....150 points

Target3..Risk.......22550++++200 points

Disclaimer - This level only for educational purpose only. Do ur own analyis

Basic to Advance Technical AnalysisTechnical analysis seeks to predict price movements by examining historical data, mainly price and volume. It helps traders and investors navigate the gap between intrinsic value and market price by leveraging techniques like statistical analysis and behavioral economics.

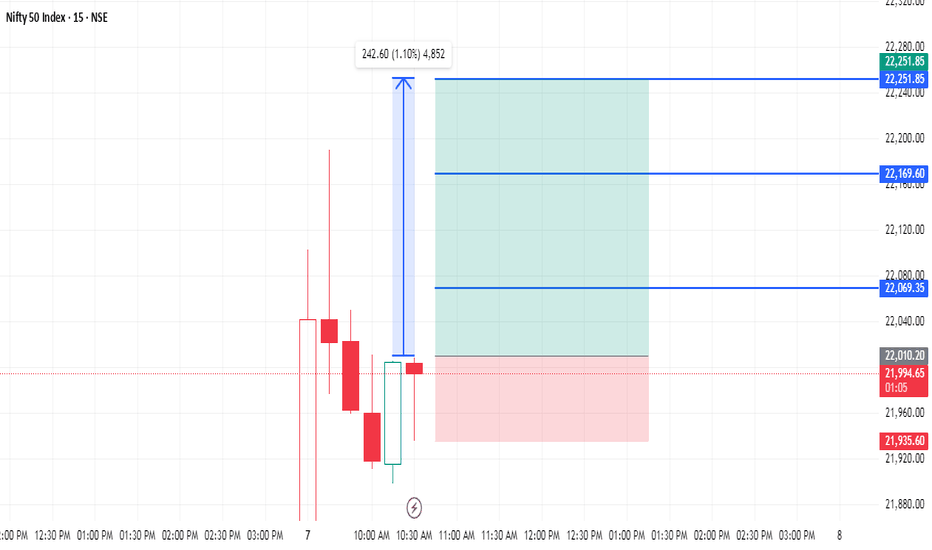

NIFTY READY TO FLY 250 points..22010 to 22250++NIFTY NEXT UPSIDE POSSIBLE above 22010

There is no resistance upto 22250

wait for active zone

Buy above 22010

Stoploss......21935..........85 points

Target1..........22070.........60 points

Target2...........22170........160 points

Target3............22250.......250 points ++

Disclaimer- This level only for education purpose only

NIFTY : Intraday Trading levels and plan for 08-Apr-2025📊 NIFTY TRADING PLAN – 08-Apr-2025

Chart Timeframe: 15-Minute

Previous Close: 22,238.00

🔍 Key Zones to Watch:

🔴 Last Intraday Resistance: 22,573 – 22,616

🟠 Opening Resistance Zone: 22,369

🟧 Lower Opening Resistance: 22,020

🟩 No Trade Zone: 21,890 – 22,020

🟢 Opening Support Zone: 21,891

🟢 Last Support Zone: 21,613

🔼 Scenario 1: Gap-Up Opening (Above 100+ points, i.e., opens above 22,339)

If Nifty opens above 22,339 , we are above the immediate Opening Resistance and nearing the Intraday Resistance Zone of 22,573 – 22,616 .

📌 Plan of Action:

Wait for the first 15–30 minutes. If the index retests 22,369 and forms a bullish reversal (hammer, bullish engulfing), one can consider going long for targets 22,500 → 22,573 → 22,616 .

If price directly opens around 22,550+ , avoid chasing highs. It may trap long positions. Look for signs of exhaustion near 22,573 – 22,616 .

A breakdown below 22,369 with a 15-min candle close can shift bias to negative — expect a move down to 22,200 → 22,020 .

Do not enter trades immediately at open. Let price develop structure, preferably a retest of breakout level.

💡 Educational Tip: A gap-up near resistance often faces selling pressure. Trade only on confirmation, not assumptions.

⚖️ Scenario 2: Flat Opening (Within 22,138 – 22,339)

A flat open around the previous close 22,238 brings price inside a reaction zone between 22,020 – 22,369 .

📌 Plan of Action:

If Nifty sustains above 22,369 with strong price action, go long for 22,500 – 22,573 – 22,616 .

If price faces resistance at 22,369 and reverses, short opportunities open with targets at 22,138 → 22,020 → 21,891 .

Avoid initiating trades inside the No Trade Zone: 21,890 – 22,020 , as it could lead to choppy price action and stop hunts.

Best strategy is to wait for breakout/breakdown of range and follow the move with a tight SL.

💡 Educational Tip: Sideways zones are often used by big players to trap retail traders. Focus on breakout trades with confirmation.

🔽 Scenario 3: Gap-Down Opening (Below 100+ points, i.e., opens below 22,138)

If Nifty opens below 22,138 , it will likely test the lower boundary of the No Trade Zone or even the Opening Support Zone at 21,891 .

📌 Plan of Action:

Look for buying opportunities only if price finds support around 21,891 – 21,613 with bullish reversal candles (e.g., morning star, double bottom).

If price breaks below 21,891 and sustains, it could fall toward 21,613 — go short on retests or lower high formations.

If reversal is confirmed from support zone, expect a bounce toward 22,020 – 22,138 .

Avoid trading the first candle unless setup is clear. Let price form a base before going long.

💡 Educational Tip: Strong support zones are best used for reversal setups, but only with confirmation and tight stop-loss.

🛡️ Options Trading Risk Management Tips

✅ Avoid Buying Far OTM Options blindly: Theta decay will eat premium fast if price consolidates.

✅ Use Spreads like Bull Call/Bear Put for safer entries: Lower cost and defined risk.

✅ Stick to Defined SL (15-min candle based): Helps avoid whipsaw exits and emotional decisions.

✅ Don’t Overtrade Inside the No Trade Zone: Wait for breakout or breakdown before initiating trades.

✅ Position Sizing is Key: Never risk more than 2% of capital on a single trade.

✅ Watch Option IV Before Entry: High IV → premiums inflated. Sell strategies work better in those conditions.

📌 Summary & Conclusion

Bullish Above: 22,369 → 22,500 → 22,573 → 22,616

Bearish Below: 22,020 → 21,891 → 21,613

No Trade Zone: 21,890 – 22,020

🧠 Best Setups: Reversal near strong support/resistance or breakout retest entries.

⏱️ First 15–30 mins are for observation: Let the market show its hand.

🧘 Discipline > Direction: Stick to process and your setup. Not every candle needs a trade.

⚠️ Disclaimer

I am not a SEBI-registered analyst . The above analysis is shared purely for educational and informational purposes . Please do your own research or consult a financial advisor before trading or investing. Trade responsibly with proper risk management.

Database Trading**Database trading** refers to the process of buying and selling databases or data-related products, often for financial or commercial purposes. This could involve trading large datasets, data assets, or even the rights to access and use specific data. In financial contexts, it could also refer to trading information or algorithms derived from data for making investment decisions. Here's a breakdown of how database trading works and its typical applications

Basic to Advance in Trading1. Open and fund your live account.

2. After careful analysis of the market, select your opportunity.

3. 'Buy' if you think that market's price will rise, or 'sell' if you think it'll fall.

4. Select your deal size, ie the number of CFD contracts.

5. Take steps to manage your risk.

NIFTY Prediction for Tomorrow – April 8, 2025What happened on last day:

As we discussed, NIFTY failed to sustain at higher levels and saw a strong rejection from the upper boundary of the falling channel, resulting in a sharp 4% intraday fall.

If we look at the chart now:

The market has decisively respected the resistance of the descending channel (marked in blue) and faced a strong bearish rejection. Price closed near the lower 22,000 zone.

It has fallen below the 13 EMA and 50 EMA , and is now nearing the support zone of 21,800–21,750 , which had previously acted as a bounce zone.

Price is below the 200 EMA and also below VWAP , confirming bearish bias.

RSI = 41 , now heading toward the oversold territory, showing growing weakness.

Volume spiked on the red candle — this shows strength on the downside move.

Support levels: 21,793, 21,162

Resistance levels: 22,200, 22,600, 23,000

If we look at the OI data:

PCR = 0.6 , clearly indicating a bearish stance.

There’s heavy Call writing at 22,000, 22,200, 22,500 and even at 22,600 levels.

Only visible Put OI is at 21,500 and 21,800 — which implies the support has shifted lower.

With INDIAVIX at 20.9 (+7.2 increase) , volatility has spiked, which aligns with today’s sharp move.

We are in the early phase of the April monthly expiry , so OI is still building up, but early bias is clearly negative.

If we look at the news & sentiment:

Global markets saw mild selling pressure due to rising bond yields and risk-off sentiment.

No major positive trigger from domestic macros.

News sentiment turned mildly cautious to negative with today’s fall and spike in volatility.

I am expecting

The market to remain bearish or sideways in the short term. If 21,800 breaks, we may see a move toward 21,160–21,100 zone. Resistance now lies at 22,200 .

Reasons:

❗Price rejected from upper trendline of falling channel

❗Price < EMA(13, 50, 200) confirms bearish momentum

✅ Volume spike on the red candle shows strong sell-off

❗PCR = 0.6 indicates dominant call writing and weak puts

❗INDIA VIX jumped 7.2 points – fear and volatility increasing

Verdict: Bearish or Sideways

Plan of action:

Sell 22,200 CE and 21,800 PE — for a bearish-biased range play.

Watch for breakdown below 21,800 for trend-following trades.

NIFTY : Trading levels and plan for 07-Apr-2025📈 NIFTY Trading Plan – 07-Apr-2025

Chart Reference: 15-Minute Timeframe

Previous Close: 22,912.05

Key Zones to Watch:

🟥 Opening Resistance Zone: 23,092

🟥 Last Intraday Resistance: 23,274

🟧 Opening Resistance/Support Zone: 22,888 – 22,931

🟩 Last Intraday Support Zone: 22,573 – 22,645

🟢 Support Below: 22,369

Let’s dive into each opening possibility with educational insights and actionable steps:

🔼 Scenario 1: Gap-Up Opening (100+ Points Above 23,092)

A gap-up above the Opening Resistance of 23,092 indicates bullish enthusiasm. However, the region around 23,274 marks a crucial Last Intraday Resistance, where supply could emerge.

📌 Plan of Action:

Wait for price to sustain above 23,092 for 15–30 minutes with strong bullish candles and volume.

If sustained, consider long positions targeting 23,274. Book partial profits here.

A breakout above 23,274 may trigger a further upmove, but only if supported by volume. Targets could be 23,370+.

If Nifty opens above 23,092 but quickly drops below, it may trap longs. Wait for a retest before re-entering.

💡 Educational Insight:

Gap-ups often get sold into if not backed by strong follow-through buying. The region between 23,092 and 23,274 will act as a liquidity zone.

⚖️ Scenario 2: Flat Opening (Between 22,888 – 22,931 Zone)

A flat opening near the Opening Resistance/Support Zone (22,888 – 22,931) suggests indecision. This is a balance area, and price action will dictate the intraday trend.

📌 Plan of Action:

Wait and watch the first 15-minute candle for clarity.

If Nifty breaks above 23,092 with strength, ride it toward 23,274.

If it slips below 22,888, the downside opens toward 22,645 → 22,573.

This zone is a No Trade Zone until a clear breakout or breakdown. Avoid early trades.

💡 Educational Insight:

When Nifty opens in a balance zone, the best trade usually forms after a breakout/rejection from that zone. Let the market show its hand first.

🔽 Scenario 3: Gap-Down Opening (100+ Points Below 22,888)

A gap-down opening below the support zone (22,888) reflects negative sentiment. The Last Intraday Support Zone (22,573 – 22,645) will be the key battlefield.

📌 Plan of Action:

Observe if Nifty holds within the 22,573 – 22,645 area. If supported, expect a bounce back toward 22,888 – 22,931.

A breakdown below 22,573 opens the way toward 22,369.

Don’t chase shorts at open. Wait for a pullback toward 22,645 – 22,700 to initiate fresh positions with better risk-reward.

If price stabilizes around 22,573, scalping opportunities on both sides may appear.

💡 Educational Insight:

Gap-downs near strong support zones often result in short-covering rallies. Watch for reversal patterns like hammer or bullish engulfing candles on 15-min chart.

🛡️ Options Trading Risk Management Tips

📍 1. Avoid Overnight Positions in Weekly Expiry Zone: Theta decay and volatility can hurt your premium positions.

📍 2. Prefer Spread Strategies: Like bull call or bear put spreads to control risk.

📍 3. Use Defined Stop-Loss: Always keep SL based on candle close (15-min or hourly).

📍 4. Limit Position Sizing: Never risk more than 1-2% of your capital in a single trade.

📍 5. Avoid Trading Inside Range: When market is choppy between 22,888 – 23,092, stay light. Wait for confirmation.

🧾 Summary & Conclusion

📌 Key Resistance Levels:

🟥 23,092 → 23,274 → 23,370+

📌 Support Levels:

🟧 22,888 – 22,931

🟩 22,573 – 22,645

🟢 22,369

📌 Bias Based on Opening:

✅ Bullish Bias: Above 23,092, momentum toward 23,274 likely.

❌ Bearish Bias: Below 22,888, risk of fall toward 22,573 → 22,369.

⏸️ Neutral Zone: Inside 22,888 – 22,931, let market decide.

🎯 Stick to the plan, manage risk like a pro, and remember – patience is the best indicator!

⚠️ Disclaimer

I am not a SEBI-registered analyst . This analysis is purely for educational purposes only . Please do your own research or consult your financial advisor before taking any trade decisions.

NIFTY 50 - ICT & SMC Analysis (April 7, 2025) 📊 CHART ANALYSIS SUMMARY (from the 4 charts)

From the charts you've given, I’ve identified a few key things:

- NIFTY is in a bullish short-term market structure , but it’s tapping into premium prices in a possible higher timeframe redistribution zone.

- There's a liquidity sweep and inducement pattern near the highs.

- Some FVGs (Fair Value Gaps) remain unfilled.

- Possible reversal sell setup from a 4H or daily bearish order block that aligns with premium pricing in a range.

🧠 Step-by-Step ICT/SMC Analysis

1. Market Structure & Bias

- 1H to 4H Structure: The market was pushing higher, making HHs (higher highs) and HLs (higher lows).

- However, the latest high was taken with a wick, showing signs of a **buy-side liquidity raid rather than strength.

- After the raid, price left a bearish FVG (Fair Value Gap) — a classic ICT signature for a reversal.

> 🔎 Interpretation:This is typical SMC inducement : retail traders get trapped buying a breakout, while smart money distributes into those buys and prepares to sell.

2. Key Liquidity Levels

- Buy-side Liquidity (BSL): Taken at recent swing high (~NIFTY 22,520 zone)

- Sell-side Liquidity (SSL): Resting below recent lows (~22,300 and then ~22,150)

> 🧠 SMC logic: Liquidity was engineered and taken at the highs. Now, the market may seek the **sell-side liquidity** next.

3. Order Blocks & Imbalances

- ✅ A clear Bearish Order Block formed near the 22,500–22,520 level on 1H/4H — this was the last up-candle before the sell-off (and a liquidity sweep).

- ✅ There's a clean FVG (Fair Value Gap) just under this OB — price wicked back into it but failed to close above.

> 🧠 ICT logic: Price fills the imbalance slightly, taps the OB, then rejects — suggesting smart money is selling from this zone.

4. Potential Trade Setup (Sell)

🎯 Trade Idea: Intraday / Swing Short

| Component | Level / Description

|--------------------|-------------------------------------------------|

| Bias | Bearish (short-term retracement expected) |

| Entry | ~22,500–22,520 (OB + FVG confluence zone) |

| Stop Loss | Above 22,570 (above the liquidity sweep wick) |

| TP1 | 22,300 (low of range, internal liquidity) |

| TP2 | 22,150 (external liquidity sweep zone) |

| TP3 (optional) | 22,000 (discount zone of full move) |

| R:R | Approx. 1:2.5 to 1:3.5 depending on exit |

🧱 Confluence Checklist

| ICT/SMC Element | Confirmed? | Notes

|----------------------------|------------|-----------------------------------------------------------------------|

| Break of Structure | ✅ | Lower high failed to break previous HH with momentum

| Liquidity Sweep | ✅ | Buy-side taken at the top with a wick

| FVG Presence | ✅ | 1H Fair Value Gap post sweep

| Bearish Order Block | ✅ | Confirmed on 1H and 4H

| Displacement | ✅ | Strong sell candle after sweep

| Retracement to OB/FVG | ✅ | Price returns to OB to mitigate orders

| Premium Pricing Zone | ✅ | Above 50% of the full range (using FIB anchoring)

🔄 Scenario Management

- If price rejects OB and sells off, you’re in good hands — standard SMC setup.

- If price closes above 22,570, the OB is invalidated → exit the short.

- If the setup works, scale partial profits at TP1 and trail to TP2/TP3.

📉 It's not a long-term bearish call on NIFTY — it’s a mean-reversion swing targeting liquidity below.

Basic to Advance in tradingHere's how to make your first trade:

1. Open and fund your live account.

2. After careful analysis of the market, select your opportunity.

3. 'Buy' if you think that market's price will rise, or 'sell' if you think it'll fall.

4.Select your deal size, ie the number of CFD contracts.

5. Take steps to manage your risk.

Candlestick PatternsThe best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. You can develop your skills in a risk-free environment by opening an IG demo account, or if you feel confident enough to start trading, you can open a live account today.