NIFTY : Trading levels and Plan for 11-Feb-2026📘 NIFTY Trading Plan – 11 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,156 – Higher Timeframe Resistance

🟢 25,917 – Immediate Resistance

🟠 25,859 – 25,917 – Opening Support / Resistance (No-Trade Zone)

🟢 25,776 – Last Intraday Support

🟢 25,677 – Major Breakdown Support

🧠 Market Structure & Price Psychology

NIFTY has shown a steady bullish recovery, forming higher highs & higher lows.

However, price is currently hovering near a supply band + breakout retest zone, indicating:

👉 Buyers are in control — but confirmation above resistance is pending.

👉 Failure to hold support can trigger profit booking pullbacks.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,980)

🧠 Psychology

Gap up reflects bullish overnight sentiment, but fresh longs should only come after resistance acceptance.

🟢 Bullish Plan

🔵 Sustaining above 25,917 (15-min close)

🔵 Upside opens towards 26,156

🔵 Acceptance above → Momentum continuation

🔴 Rejection Plan

🔴 Failure near 26,156

🔴 Pullback towards 25,917 → 25,859

📌 Why this works

Breakouts succeed only when price is accepted above supply, not just gap spikes.

➖ Scenario 2: FLAT Opening

(Opening between 25,860 – 25,950)

🧠 Psychology

Flat opening inside supply reflects indecision & liquidity absorption.

🟠 No-Trade Zone

🔸 25,859 – 25,917

🔸 Expect fake breakouts & whipsaws ❌

🟢 Upside Plan

🔵 Break & hold above 25,917

🔵 Targets: 26,156

🔴 Downside Plan

🔴 Breakdown below 25,859

🔴 Drift towards 25,776

📌 Why this works

Ranges expand after consolidation — patience improves accuracy.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,776)

🧠 Psychology

Gap down signals profit booking, but strong supports attract dip buyers.

🟢 Bounce Setup

🔵 If 25,776 holds on 15-min basis

🔵 Expect bounce towards 25,859 → 25,917

🔴 Breakdown Setup

🔴 Clean break below 25,677

🔴 Downside momentum may accelerate

📌 Why this works

Demand zones either produce sharp reversals or fast breakdowns.

🛡️ Risk Management Tips (Options Traders)

🟢 Wait for first 15-min candle confirmation

🟢 Prefer defined-risk spreads in volatile openings

🟢 Avoid trading inside No-Trade Zones ❌

🟢 Risk only 1–2% capital per trade

🟢 Book partial profits at next levels

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is in bullish structure but near resistance

📌 25,917 & 25,776 are key intraday triggers

📌 Break above 26,156 confirms continuation

📌 Trade reaction, not assumption 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

Niftytradesetup

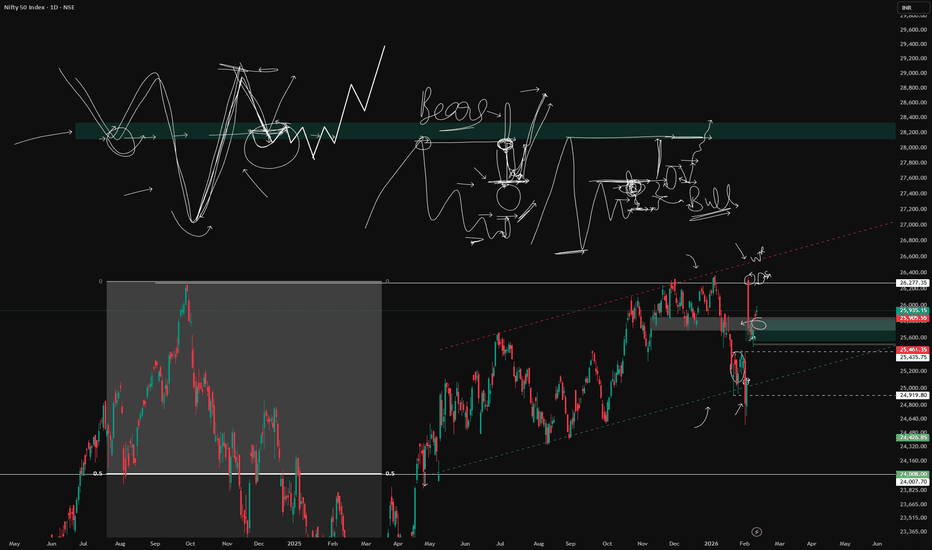

Big Vs Small Breakaway Gaps and Old concepts Revision In this video, I have revised all the old concepts I have been sharing taking only 1 thing as my main object which is Nifty, I believe 1 instrument, 1 strategy can change your life but it takes many concepts - combined together to get to that strategy, its simple yet difficult .

No Bias - No forecast only talking about general trends of the markets and concepts

NIFTY KEY LEVELS FOR 11.02.2026NIFTY KEY LEVELS FOR 11.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Nifty - Accumulation Before Expansion — One More Buy Chance NSE:NIFTY : Accumulation Before Expansion — One More Buy Chance

Today the sellers’ volume dropped to the lowest point, while trend and momentum both stayed green. You can see that on the chart attached.

That is what classic accumulation looks like just before expansion.

Pivot is up.

Breadth has improved.

Participation is rising.

⚠️ Only the volume label remains red.

In simple words, the market may give one more opportunity to buy tomorrow before the bigger move begins. Be ready.

But remember, the expansion will only start when the volume label turns green. If you want to go long on the index, wait for that confirmation.

Resistance is at 26009.

If we open with a gap above this level, even better — that would show aggression from bulls.

There is also a warning sign.

If volume again stays red tomorrow and the index breaks support at 25892, I will immediately shift to short.

Sector-wise, NSE:CNXAUTO , BSE:POWER , and NSE:CNXENERGY look next in line for momentum expansion.

From these spaces, I am tracking Bajaj Auto, Tata Power, Torrent Power, GIPCL, and TMPV.

📊 Levels at a glance:

Pivot: Rising

Resistance: 26009

Support: 25892

Bullish trigger: Volume turning green

Bearish trigger: Break of support with red volume

Bias: Prepare to buy, but wait for confirmation

Sector focus: Auto, Power, Energy

Stocks in focus: NSE:BAJAJ_AUTO NSE:TORNTPOWER NSE:TATAPOWER , NSE:GIPCL , NSE:TMPV

That’s all I can conclude from the current data.

Take care. Have a profitable tomorrow.

NIFTY 50 — This Is Not a Trend. This Is a Setup.CMP: 25,946

The panic low is in.

The bounce happened.

Now we’re at the part where amateurs get chopped.

Daily:

Still below the real supply at 26,200–26,300.

Until that level is accepted, this is repair — not breakout.

Intraday:

Tight compression between 25,930 and 25,980.

VWAP magnet.

Liquidity building on both sides.

This is where the market decides who pays.

---

The Playbook

Above 25,980 — and holding

That’s when range expands.

Target liquidity near 26,050–26,120.

Momentum players re-enter.

Below 25,930

Fast rotation into 25,850.

No drama. Just mechanics.

---

We’re sitting at a structural pivot.

Balanced number. Balanced order flow.

Markets don’t idle at balance — they transition.

No prediction.

Only positioning for the move.

#NIFTY50 #IndexTrading #MarketStructure #IntradayPlan #Liquidity #TradingView

NIFTY : Trading levels and Plan for 12-Feb-2026NIFTY Trading Plan – 12 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,156 – Last Intraday Resistance / Supply

🟢 25,993 – Opening Resistance / Pivot

🟠 25,859 – 25,917 – Opening S/R (No-Trade Zone)

🟢 25,749 – Last Intraday Support

🟢 25,677 – Major Breakdown Support

🧠 Market Structure & Price Psychology

NIFTY has shown a strong bullish recovery, forming higher highs & higher lows.

Currently, price is consolidating just below a major supply zone (26,156).

👉 Buyers are in control — but breakout confirmation is pending.

👉 Resistance acceptance = continuation

👉 Rejection = pullback rotation

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 26,000)

🧠 Psychology

Gap up near resistance shows bullish sentiment + short covering, but sellers defend supply zones aggressively.

🟢 Bullish Plan

🔵 Sustaining above 25,993 (15-min close)

🔵 Upside opens towards 26,156

🔵 Acceptance above → Momentum expansion

🔴 Rejection Plan

🔴 Failure near 26,156

🔴 Pullback towards 25,993 → 25,917

📌 Why this works

Breakouts succeed only when price is accepted above supply, not just gap driven.

➖ Scenario 2: FLAT Opening

(Opening between 25,900 – 25,980)

🧠 Psychology

Flat opening inside supply shows indecision & liquidity absorption.

🟠 No-Trade Zone

🔸 25,859 – 25,917

🔸 Expect whipsaws & fake breakouts ❌

🟢 Upside Plan

🔵 Break & hold above 25,993

🔵 Targets: 26,156

🔴 Downside Plan

🔴 Breakdown below 25,859

🔴 Drift towards 25,749

📌 Why this works

Ranges expand after consolidation — patience improves entries.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,859)

🧠 Psychology

Gap down signals profit booking, but demand zones attract dip buyers.

🟢 Bounce Setup

🔵 If 25,859 holds

🔵 Expect bounce towards 25,917 → 25,993

🔴 Breakdown Setup

🔴 Clean break below 25,749

🔴 Downside opens towards 25,677

📌 Why this works

Strong supports create either sharp reversals or fast breakdown moves.

🛡️ Risk Management Tips (Options Traders)

🟢 Wait for first 15-min candle confirmation

🟢 Prefer defined-risk spreads in volatile openings

🟢 Avoid trading inside No-Trade Zones ❌

🟢 Risk only 1–2% capital per trade

🟢 Book partial profits at next levels

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is bullish but near major resistance

📌 25,993 & 25,859 are key intraday triggers

📌 Break above 26,156 confirms continuation

📌 Trade reaction, not assumption 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

Feb 12 Setup: Consolidative, Not ComplacentFeb 12 Setup: Consolidative, Not Complacent

Nifty sits in the upper half of the 25,500–26,300 rectangle. Bulls hold the edge, but conviction is thin. Gift Nifty indicates a flat-to-green open near 25,970–26,000. Expect a narrow early range. US non-farm payrolls tonight is the only catalyst that matters. 🧵

#Nifty

2/ Technical: Breakout or Fakeout?

Price is above key EMAs. RSI at 58–60, neutral-bullish. MACD positive but histogram cooling. The tape is telling you momentum is intact but tired. 26,000–26,050 is the heavy call OI wall. A clean break here triggers short-covering toward 26,200–26,400. Without it, expect rejection.

#TechnicalAnalysis

3/ The Support Structure You Must Respect

Immediate floor: 25,900–25,850, strong put concentration. Below that, 25,800 is the line in the sand. A decisive close below 25,800 opens 25,700–25,500, where the 50-DMA sits. That is the trend-defining zone. Until then, dips are buyable—but scale, don't slam.

#Derivatives

4/ Derivatives: Resistance Is Visible, Fear Is Not

26,000 is the maximum call OI strike. Sellers are entrenched. PCR remains mildly supportive (>1 in spots). IV is compressed—ATM vol at 10–13%. Low vol in a range-bound regime favours option sellers, not buyers. Gamma is low near ATM. A vol spike requires a US data surprise.

#OptionsMarket

5/ Sector Rotation: Follow the Flow

Autos, healthcare, PSU banks, metals—these are the receiving ends of institutional rotation. IT remains under pressure; AI disruption is now a valuation reset, not a narrative. Do not short defensives aggressively, but do not catch falling knives either.

#StockMarketIndia

6/ US Non-Farm Payrolls: The Exogenous Variable

Tonight's US jobs data is the single biggest risk event. Strong print = risk-on, weak print = global sell-off. Indian IT and USD/INR will react first. Position size appropriately. This is not a night for hero trades. Survival trumps speculation.

#USJobs

7/ FII Flows: The Reversal Must Sustain

FIIs bought ₹820 Cr yesterday. A second consecutive day of buying above ₹1,000 Cr validates the reversal. Without it, this is just a short-covering blip in a longer-term selling trend. Watch the dollar and US yields. They lead, FIIs follow.

#FII

8/ My Bias: Range Expansion Favours the Upside

I am not bearish. I am also not bullish. I am range-bound with an upside tilt. 25,800–26,200 is the high-probability zone for Feb 12. A breakout above 26,050 is tradable with a 26,400 target. A breakdown below 25,800 requires immediate defensiveness. Size conservatively pre-data.

#QuantFinance

#NIFTY Intraday Support and Resistance Levels - 11/02/2026Nifty is expected to open with a clear gap-up above the 26000 mark, which keeps the broader bias positive for the day. A sustained move above this psychological level will indicate strength and may attract fresh buying interest in the early session, especially if the index holds above the opening range.

On the upside, holding firmly above 26000 can open the door for a continuation move towards 26150, 26200, and 26250+. These levels will act as immediate upside targets, and price acceptance above 26000 will be crucial to confirm bullish momentum. If the index consolidates above this zone, it may support positional long setups as well.

On the downside, traders should be cautious near the 25950–25900 zone, which is acting as a short-term supply area. Any rejection from this region can lead to a reversal short, with downside targets placed around 25850, 25800, and 25750. A decisive breakdown below 25750 would weaken the structure further and may bring additional selling pressure.

Overall, despite the gap-up opening, traders are advised to avoid chasing trades at the open. Waiting for confirmation near key levels and managing risk strictly will be important, as volatility can remain high around major resistance and support zones during the first half of the session.

NIFTY : Detailed Trading Plan for 10-Feb-2026📘 NIFTY Trading Plan – 10 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,154 – Higher Timeframe Resistance

🟢 25,858 – 25,906 – No-Trade / Supply Zone

🟠 25,782 – 25,763 – Opening Support Zone

🟢 25,676 – Last Intraday Support

🟢 25,583 – Lower Breakdown Support

🟢 25,516 – 25,747 – Broader Demand Zone

🧠 Market Structure & Price Psychology

NIFTY has shown a strong recovery from lower demand, followed by consolidation near a falling trendline & supply zone.

This indicates buyers regaining strength, but confirmation is still pending near resistance.

👉 Tomorrow’s direction will depend on acceptance above the no-trade zone or rejection back into support.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,900)

🧠 Psychology

A gap-up near resistance shows overnight optimism, but sellers often defend prior supply aggressively.

🟢 Bullish Plan

🔵 If price sustains above 25,906 on a 15-min closing basis

🔵 Upside opens towards 26,154

🔵 Strong momentum continuation only if price accepts above supply

🔴 Rejection Plan

🔴 Rejection near 25,906 – 25,858

🔴 Expect pullback towards 25,782 – 25,763

📌 Why this works

True breakouts happen with price acceptance, not just gap-driven spikes.

➖ Scenario 2: FLAT Opening

(Opening between 25,780 – 25,850)

🧠 Psychology

Flat opening inside supply shows indecision & liquidity absorption.

🟠 No-Trade Zone

🔸 25,858 – 25,906

🔸 Expect whipsaws & fake moves

🟢 Upside Plan

🔵 Break & hold above 25,906

🔵 Targets: 26,154

🔴 Downside Plan

🔴 Breakdown below 25,763

🔴 Drift towards 25,676

📌 Why this works

Markets expand after consolidation, patience gives better risk-reward.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,676)

🧠 Psychology

Gap down reflects profit booking or fear selling, but demand zones attract smart money.

🟢 Bounce Setup

🔵 If 25,676 holds on 15-min basis

🔵 Expect bounce towards 25,763 → 25,782

🔴 Breakdown Setup

🔴 Clean break below 25,583

🔴 Downside opens till 25,516 – 25,547

📌 Why this works

Strong supports either give sharp bounces or fast continuation breakdowns.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk option spreads

🟢 Avoid trading inside No-Trade Zones ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next resistance/support

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is consolidating below major supply

📌 25,906 & 25,676 are key intraday triggers

📌 Break above 25,906 confirms bullish continuation

📌 Trade price reaction, not assumptions 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

NIFTY KEY LEVELS FOR 09.02.2026NIFTY KEY LEVELS FOR 09.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY : Detailed Trading plan for 09-Feb-2026📘 NIFTY Trading Plan – 9 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,161 – Higher Timeframe Resistance

🟢 25,858 – 25,906 – Last Resistance Zone

🟠 25,616 – 25,694 – Opening Support / Resistance (No-Trade Zone)

🟢 25,747 – Opening Resistance

🟢 25,616 – 25,747 – Immediate Decision Band

🟢 25,533 – Last Intraday Support

🧠 Market Structure & Price Psychology

NIFTY has shown a recovery bounce after recent weakness, but price is currently trapped near a decision supply zone.

This indicates balance between short covering & fresh selling.

👉 Direction on 9 Feb will depend on acceptance above resistance or breakdown below support, not prediction.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,780)

🧠 Psychology

Gap up reflects overnight bullish sentiment, but sellers often defend prior resistance zones.

🟢 Bullish Plan

🔵 Sustaining above 25,747 (15-min close)

🔵 Upside opens towards 25,858 – 25,906

🔵 Break & hold above zone → Expansion towards 26,161

🔴 Rejection Plan

🔴 Failure near 25,858 – 25,906

🔴 Pullback towards 25,747 → 25,694

📌 Why this works

Breakouts succeed only when price is accepted above supply, not just gap-driven spikes.

➖ Scenario 2: FLAT Opening

(Opening between 25,620 – 25,720)

🧠 Psychology

Flat opening inside consolidation shows indecision & liquidity absorption.

🟠 No-Trade Zone

🔸 25,616 – 25,694

🔸 Expect whipsaws & fake breakouts

🟢 Upside Plan

🔵 Break & hold above 25,747

🔵 Targets: 25,858 → 26,161

🔴 Downside Plan

🔴 Breakdown below 25,616

🔴 Weakness towards 25,533

📌 Why this works

Ranges expand after consolidation — patience gives better entries.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,616)

🧠 Psychology

Gap down indicates profit booking or fear-based selling, but demand zones can trigger relief rallies.

🟢 Bounce Setup

🔵 If 25,616 holds on 15-min basis

🔵 Expect bounce towards 25,694 → 25,747

🔴 Breakdown Setup

🔴 Clean break below 25,533

🔴 Downside momentum may accelerate

📌 Why this works

Strong supports either create sharp reversals or fast continuation moves.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk spreads in volatile markets

🟢 Avoid trading inside No-Trade Zones ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next levels

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is in decision consolidation near resistance

📌 25,747 & 25,616 are key intraday triggers

📌 Break above 25,906 confirms bullish continuation

📌 Trade price reaction, not bias 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

Nifty - Heavy Accumulation Signs — Bulls Back in Control NSE:NIFTY : Heavy Accumulation Signs — Bulls Back in Control

From a negative volume of –67 million to +2 million buyers by the close, that’s a swing of nearly 69 million on the buy side.

Trend and Momentum both turned Green.

This kind of shift usually hints that stronger hands are accumulating from lower levels.

The Pivot has also climbed to 25660, which supports the idea of a developing long buildup.

Support at 25500 was tested and defended well by the bulls.

Resistance now stands at 25838.

The retail index also improved sharply, adding confirmation that participation is returning.

Putting these data points together, tomorrow can be a bullish day. If resistance breaks and sustains, we may see a move towards 26200 or higher.

On the sector front, Telecom is showing strong traction with visible catalysts. I am tracking IDEA and AIRTEL closely there.

📊 Levels at a glance:

Pivot: 25660

Support: 25500

Resistance: 25838

Upside trigger: Break above resistance

Target on breakout: 26200+

Bias: Bullish

Sector focus: Telecom

Stocks in focus: NSE:IDEA and NSE:BHARTIARTL

That’s all I can say with the data available right now.

Take care. Have a profitable tomorrow.

NIFTY KEY LEVELS FOR 06.02.2026NIFTY KEY LEVELS FOR 06.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY : Trading levels and Plan for 06-Feb-2026📘 NIFTY Trading Plan – 6 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,171 – Higher Timeframe Resistance

🟢 25,985 – 25,950 – Last Intraday Resistance Zone

🟠 25,569 – 25,696 – Opening Support / Resistance (Consolidation Zone)

🟢 25,452 – 25,309 – Last Intraday Support Zone

🟢 25,021 – 24,948 – Lower Demand / Breakdown Zone

🧠 Market Structure & Price Psychology

NIFTY has shifted from a sharp recovery phase into consolidation, indicating exhaustion of short-covering and absence of aggressive fresh buying.

Price is currently oscillating inside a wide decision zone, where acceptance or rejection will define the next trending move.

👉 For 6 Feb, opening behavior around the consolidation zone will be the key trigger.

🚀 Scenario 1: GAP UP Opening (200+ Points)

(Opening near / above 25,850)

🧠 Psychology

A big gap up after consolidation often reflects overnight optimism, but higher supply zones attract institutional profit booking.

🟢 Bullish Plan

🔵 If price sustains above 25,985 on a 15-min closing basis

🔵 Upside opens towards 26,171

🔵 Momentum continuation only after clear acceptance above resistance

🔴 Rejection Plan

🔴 Failure to hold above 25,985 – 25,950

🔴 Expect pullback towards 25,696 – 25,569

📌 Why this works

Breakouts succeed only when price is accepted at higher value, not when driven by emotional gap-up buying.

➖ Scenario 2: FLAT Opening

(Opening between 25,550 – 25,700)

🧠 Psychology

Flat opening inside consolidation shows balance between buyers and sellers. Market usually expands after liquidity is absorbed.

🟢 Upside Plan

🔵 Sustaining above 25,696

🔵 Gradual move towards 25,985

🔴 Downside Plan

🔴 Failure to hold 25,569

🔴 Drift towards 25,452 – 25,309

📌 Important Note

🟠 25,569 – 25,696 is a high-chop consolidation zone

🟠 Avoid over-trading until a clean breakout or breakdown

🔻 Scenario 3: GAP DOWN Opening (200+ Points)

(Opening near / below 25,309)

🧠 Psychology

Gap down after consolidation indicates profit booking or fresh short initiation.

🟢 Bounce Setup

🔵 If 25,452 – 25,309 holds on a 15-min basis

🔵 Expect technical bounce towards 25,569 – 25,696

🔴 Breakdown Setup

🔴 Clean break below 25,309

🔴 Downside opens till 25,021 – 24,948

📌 Why this works

Strong demand zones either produce sharp relief rallies or fast breakdown continuation.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk option spreads in gap markets

🟢 Avoid aggressive buying near resistance ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next support/resistance

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is in post-recovery consolidation

📌 25,696 & 25,309 are the most important intraday decision levels

📌 Break above 25,985 needed for bullish continuation

📌 Trade price reaction, not expectations 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

NIFTY KEY LEVELS FOR 05.02.2026NIFTY KEY LEVELS FOR 05.02.2026

Timeframe: 3 Minutes

Sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Understanding the Down Trend Line Breakout : Base chart GALLANTTUnderstanding the Down Trend Line Breakout : Base chart GALLANTT ISPAT Ltd

Introduction

Gallantt Ispat Limited, currently trading around 580.00 on its daily chart, has been moving below a persistent down trend line since August 2025. Recently, the stock has shown signs of strength by forming a double bottom pattern, a classic reversal signal, and is now attempting to break above this long-standing resistance. This setup provides an interesting case study for traders and investors on how to interpret down trend line breakouts, manage risks, and identify potential entry points.

What is a Down Trend Line?

A down trend line is drawn by connecting successive lower highs on a chart.

It acts as a resistance line, showing the prevailing bearish sentiment.

As long as price remains below this line, sellers dominate.

A breakout above the line often signals a shift in market psychology from bearish to bullish.

Importance of the Down Trend Line Breakout

Psychological Shift: A breakout indicates buyers are gaining control.

Volume Confirmation: Strong volume during breakout adds credibility.

Trend Reversal Potential: Especially when supported by reversal patterns like the double bottom.

Opportunity Zone: Traders often look for such setups to capture early stages of a new uptrend.

Risk Management in Breakout Trading

Trading breakouts can be rewarding but also risky if false signals occur. Key principles:

Wait for Confirmation: Avoid jumping in on the first candle above the line; look for sustained price action.

Use Stop Losses: Place stops below recent swing lows or the breakout level to limit downside.

Position Sizing: Never risk more than a small percentage of capital on a single trade.

Avoid Emotional Trading: Stick to a plan rather than chasing moves.

How to Enter Down Trend Line Breakouts

Aggressive Entry: Buy immediately on breakout with tight stop loss.

Conservative Entry: Wait for a retest of the trend line (now support) before entering.

Volume-Based Entry: Enter only if breakout is accompanied by above-average volume.

Pattern Confirmation: In Gallantt Ispat’s case, the double bottom adds conviction to the breakout attempt.

Key Takeaways for Investors & Traders

Trend lines matter: They reflect collective market psychology.

Breakouts need confirmation: Volume and sustained price action are crucial.

Risk management is non-negotiable: Protect capital with stops and sizing discipline.

Gallantt Ispat’s setup: The double bottom plus breakout attempt makes this chart worth monitoring closely.

Patience pays: Waiting for confirmation often saves traders from false breakouts.

Conclusion

Gallantt Ispat Limited’s daily chart is at a critical juncture. After months of trading under a down trend line, the stock is now attempting to break free, supported by a double bottom formation. For traders, this is a textbook scenario to study the dynamics of breakout trading. The lesson here is clear: respect the trend line, manage risk diligently, and enter with discipline when the breakout is confirmed.

NIFTY : Trading Plan and levels for 05-Feb-2026📘 NIFTY Trading Plan – 5 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 26,171 – Higher Timeframe Resistance

🟢 25,985 – 25,950 – Last Intraday Resistance Zone

🟠 25,569 – 25,696 – Opening Support / Resistance (Consolidation Zone)

🟢 25,452 – 25,309 – Last Intraday Support Zone

🟢 25,702 – 25,737 – Current Reference Price Area

🧠 Market Structure & Price Psychology

NIFTY has seen a sharp recovery followed by sideways consolidation near upper levels.

This behavior suggests short-covering exhaustion, where fresh buyers and sellers are waiting for confirmation.

👉 Tomorrow’s direction depends on acceptance or rejection at the consolidation zones, not on bias.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,850)

🧠 Psychology

Gap up after consolidation usually reflects breakout anticipation, but smart money often waits to sell near prior supply zones.

🟢 Bullish Plan

🔵 If price sustains above 25,985 on a 15-min closing basis

🔵 Expect continuation towards 26,171

🔵 Suitable for momentum trades only after confirmation

🔴 Rejection Plan

🔴 Rejection near 25,985 – 26,171

🔴 Expect pullback towards 25,696 – 25,569

📌 Why this works

True breakouts show acceptance above resistance, not just opening spikes.

➖ Scenario 2: FLAT Opening

(Opening between 25,650 – 25,780)

🧠 Psychology

Flat opening near resistance indicates balance and indecision. Market usually expands after testing boundaries.

🟢 Upside Plan

🔵 Sustaining above 25,696

🔵 Gradual move towards 25,985

🔴 Downside Plan

🔴 Failure to hold 25,569

🔴 Drift towards 25,452 – 25,309

📌 Important Note

🟠 25,569 – 25,696 is a consolidation zone

🟠 Expect whipsaws — trade only after clean break

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,452)

🧠 Psychology

Gap down after consolidation indicates profit booking or fresh short positions.

🟢 Bounce Setup

🔵 If 25,452 – 25,309 holds on 15-min basis

🔵 Expect technical bounce towards 25,569 – 25,696

🔴 Breakdown Setup

🔴 Clean break below 25,309

🔴 Downside momentum may accelerate sharply

📌 Why this works

Strong demand zones either give quick bounces or fast breakdowns—confirmation is critical.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer defined-risk option spreads near resistance

🟢 Avoid aggressive buying in gap-up opens ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next resistance/support

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is in high-level consolidation after sharp recovery

📌 25,696 & 25,452 are the key intraday decision levels

📌 Break above 25,985 needed for bullish continuation

📌 Trade price reaction, not emotions 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

Visualization of a Inverted Head and Shoulders ( Reality ) In this video I talk about general trends of the markets only - no bias - no directional indication - nothing - simply sharing how to create a setup / strategy building and concepts that I learned while becoming a full time trader - Giving back my experience .

Trend Channel Explained | Base chart MAX Financial Services LtdTrend channels are one of the most practical tools in technical analysis, helping traders visualize price movement within parallel boundaries. Currently, Max Financial Services (NSE: MFSL) is trading around ₹1685, and its chart shows the stock moving in an uptrend channel, offering a real-time example of how traders can anticipate moves and manage risk.

📈 What is a Trend Channel?

A trend channel is formed by drawing two parallel lines:

Upper line (resistance): Connects swing highs.

Lower line (support): Connects swing lows.

Price tends to oscillate between these boundaries, creating a visual “channel” that reflects the prevailing trend direction.

Types of channels:

Uptrend channel: Prices move higher with rising support and resistance.

Downtrend channel: Prices move lower with declining support and resistance.

Sideways channel: Prices consolidate within horizontal boundaries.

🔑 Importance of Trend Channels

Trend identification: Quickly shows whether the market is bullish, bearish, or neutral.

Entry & exit points: Traders can buy near support and sell near resistance.

Anticipating breakouts: A breakout above resistance may signal strong bullish momentum, while a breakdown below support may indicate trend reversal.

Risk control: Channels provide clear invalidation levels for stop-loss placement.

📊 Example: Max Financial Services (MFSL)

Current price: ₹1685 (NSE).

Chart observation: The stock is moving within an ascending channel, with higher highs and higher lows.

Implication:

Buying near the lower boundary (~support zone) increases probability of success.

Profit-taking near the upper boundary (~resistance zone) helps lock gains.

A breakout above the channel could indicate acceleration in bullish momentum.

⚠️ Risk Management in Trend Channels

Stop-loss placement: Always place stops just outside the channel boundary to protect against false moves.

Position sizing: Avoid over-leveraging; channels can break unexpectedly.

Confirmation tools: Use indicators (RSI, MACD, volume) to confirm signals before acting.

Avoid chasing: Enter trades near support rather than at resistance to reduce risk.

📌 Traders’ Key Takeaways

Trend channels are visual guides that simplify decision-making.

They help traders anticipate moves by showing where price is likely to bounce or reverse.

In MFSL’s case, the uptrend channel suggests bullish sentiment, but traders should remain cautious of potential breakdowns.

Risk management is essential—channels are not foolproof, and false breakouts can occur.

Combining channels with other technical indicators enhances reliability.

✅ In summary: Trend channels provide traders with a structured framework to anticipate price movement, manage risk, and make disciplined trading decisions. With Max Financial Services trading at ₹1685 in an uptrend channel, traders can use this live example to understand how channels guide entries, exits, and risk control in real-world markets.

NIFTY KEY LEVELS FOR 04.02.2026NIFTY KEY LEVELS FOR 04.02.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY : Trading levels and Plan for 04-Feb-2026📘 NIFTY Trading Plan – 4 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY 50 | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 25,985 – 26,020 – Last Intraday Resistance Zone

🟠 25,569 – 25,696 – Opening Support / Resistance (Consolidation Zone)

🟢 25,472 – Last Intraday Support

🟢 25,221 – Lower Support / Breakdown Level

🟢 25,714 – 25,745 – Current Reference Price Area

🧠 Market Structure & Price Psychology

NIFTY witnessed a strong vertical recovery from lower levels, indicating aggressive short covering and panic exit of sellers.

However, price is now approaching important supply zones, where profit booking and fresh selling pressure can emerge.

👉 Tomorrow’s direction will depend on acceptance or rejection near the opening zones, not on emotional bias.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,850)

🧠 Psychology

Gap up after a sharp rally often reflects euphoria and short covering, but institutions usually sell into higher resistance zones.

🟢 Bullish Plan

🔵 If price sustains above 25,985 on a 15-min closing basis

🔵 Expect upside extension towards 26,020 and above

🔵 Momentum trades only after clean acceptance

🔴 Rejection Plan

🔴 Rejection near 25,985 – 26,020

🔴 Expect pullback towards 25,696 – 25,569

📌 Why this works

Breakout works only when buyers accept higher prices, not when price spikes emotionally.

➖ Scenario 2: FLAT Opening

(Opening between 25,650 – 25,780)

🧠 Psychology

Flat open after a sharp rally shows temporary balance. Market usually consolidates before next expansion.

🟢 Upside Plan

🔵 Sustaining above 25,696

🔵 Gradual move towards 25,985

🔴 Downside Plan

🔴 Failure to hold 25,569

🔴 Drift towards 25,472

📌 Important Note

🟠 25,569 – 25,696 is a consolidation zone

🟠 Expect whipsaws — trade only after confirmation

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,472)

🧠 Psychology

Gap down after a sharp up-move signals profit booking or fresh short positions.

🟢 Bounce Setup

🔵 If 25,472 holds on 15-min basis

🔵 Expect technical bounce towards 25,569 – 25,696

🔴 Breakdown Setup

🔴 Clean break below 25,472

🔴 Downside opens till 25,221

📌 Why this works

Strong supports either create fast bounces or accelerated breakdowns — confirmation is critical.

🛡️ Risk Management Tips (Options Traders)

🟢 Trade only after first 15-min candle confirmation

🟢 Prefer option spreads near resistance zones

🟢 Avoid aggressive buying in gap-up opens ❌

🟢 Risk maximum 1–2% capital per trade

🟢 Book partial profits at next resistance/support

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY is in post-short-covering consolidation

📌 25,696 & 25,472 are the most important intraday decision levels

📌 Break above 25,985 needed for bullish continuation

📌 Trade price reaction, not market excitement 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

NIFTY KEY LEVELS FOR 03.02.2026NIFTY KEY LEVELS FOR 03.02.2026

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.