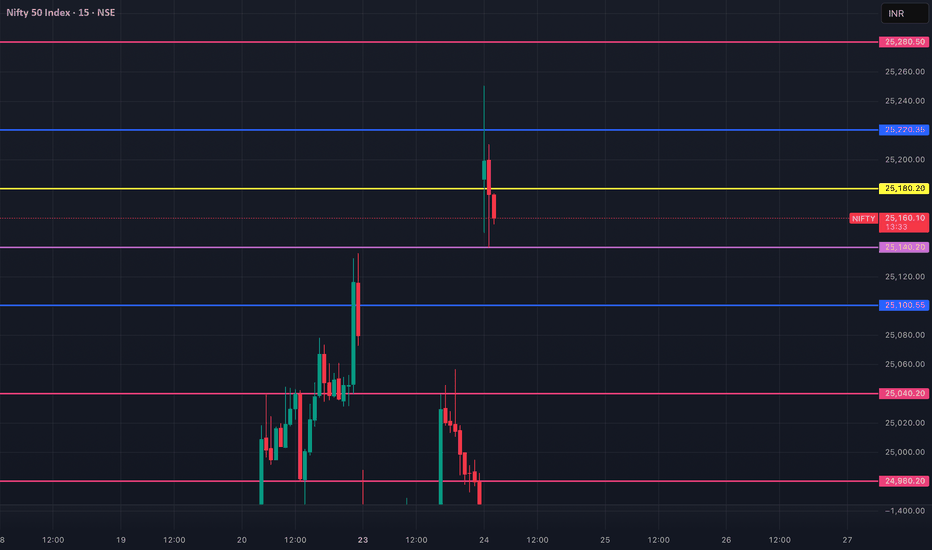

NIFTY Levels For Intraday ( Educational Purpose) 25/06/2025📊 Nifty Intraday Strategy – 25.06.2025

🔎 Structure: 15-min | Execution: 1-min

🔼 Buy Above: 25,110

🎯 Target: 25,180 / 25,240

🛑 SL: 25,060

🔽 Sell Below: 24,980

🎯 Target: 24,920 / 24,860

🛑 SL: 25,030

📈 Gap-Up Opening:

▪️ Wait near 25,180–25,240 zone

▪️ Avoid long entries until rejection or breakout confirmation (1-min + volume)

📉 Gap-Down Opening:

▪️ Watch 24,900–24,860 for reversal

▪️ Go long only after bullish engulfing / strong 1-min candle with volume

⚠️ Do’s & Don’ts:

✅ Use 1-min for trigger after breakout

❌ Don’t jump in first 5 mins

✅ Maintain 1:2 risk-reward

🚫 Avoid trading during news spike

Niftytradesetup

NIFTY : Trading levels and Plan for 25-Jun-2025\ 📊 NIFTY TRADING PLAN – 25-Jun-2025\

📍 \ Previous Close:\ 25,071.55

📏 \ Gap Opening Consideration:\ ±100 Points

🕒 \ Time Frame Analyzed:\ 5-Min Chart

📦 \ Volume Check:\ 9.16M (aiding intraday trend confirmation)

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,148):\

If Nifty opens above the \ Opening Resistance Zone (25,128 – 25,158)\ , it immediately faces \ Last Intraday Resistance\ at \ 25,248\ . Sustained buying above this level may push prices toward the \ Profit Booking / Consolidation Zone (25,356 – 25,401)\ .

✅ \ Plan of Action:\

• Avoid jumping in at open — let first 15–30 minutes settle the tone

• Breakout above 25,248 = clear bullish structure

• Watch for profit booking at 25,356–25,401

🎯 \ Trade Setup:\

– Long above 25,248 with volume confirmation

– Target: 25,356 → 25,401

– SL: Below 25,158

– Short only if rejection seen near 25,248–25,356

📘 \ Pro Tip:\ Book partial profits at 1st target and trail rest.

\ \ ⚖️ FLAT OPENING (Between 25,012 – 25,128):\

This is a reaction zone where Nifty may oscillate inside the \ Opening Resistance/Support Band\ . Directional clarity may only come post breakout from this zone.

✅ \ Plan of Action:\

• Avoid early trades inside 25,012–25,128 zone

• Break above 25,128 = upside momentum

• Breakdown below 25,012 = weakness

🎯 \ Trade Setup:\

– Long above 25,128 (strong bullish candle)

– Short below 25,012 (bearish breakdown confirmation)

– SL: 30–40 pts from entry depending on volatility

– Prefer confirmation candle with decent volume

📘 \ Pro Tip:\ Stay flexible — it may be a sideways trap if no breakout happens in the first 45 mins.

\ \ 📉 GAP-DOWN OPENING (Below 24,912):\

Gap-downs below \ Opening Support (25,012)\ could test the critical \ Buyer’s Support for Sideways Zone – 24,852 to 24,905\ . This is a make-or-break area for the bulls.

✅ \ Plan of Action:\

• Observe price behavior near 24,852

• Reversal from here offers intraday long opportunity

• Breakdown confirms bearish pressure

🎯 \ Trade Setup:\

– Long near 24,852 (if bullish candle forms)

– Short below 24,852 (breakdown scenario)

– Target: 24,780 / 24,720

– SL: Above 25,012 for shorts, below 24,830 for longs

📘 \ Pro Tip:\ This is where "smart money" often plays — watch candle structure, not emotions.

---

\ 💡 OPTIONS TRADING – RISK MANAGEMENT TIPS:\

✅ \ 1. Avoid buying options near expiry without confirmation; theta will eat premiums fast.\

✅ \ 2. Use spreads (like bull call or bear put) in choppy markets.\

✅ \ 3. Always use Stop Loss based on structure — not emotions or PnL.\

✅ \ 4. Keep risk per trade below 2% of capital.\

✅ \ 5. Use 15-min chart candle closing to exit on SL breach.\

---

\ 📌 SUMMARY – LEVELS TO MONITOR:\

🟥 \ Last Intraday Resistance:\ 25,248

🟧 \ Opening Resistance/Support:\ 25,128 – 25,158

🟩 \ Opening Support:\ 25,012

🟦 \ Sideways Support Zone:\ 24,852 – 24,905

🟫 \ Breakdown Confirmation Target:\ Below 24,852 → 24,780

---

\ 🎯 CONCLUSION:\

• 🔼 \ Bullish Bias:\ Only above 25,248 with strength

• ⏸️ \ Sideways Bias:\ 25,012–25,128 — avoid unless breakout confirmed

• 🔽 \ Bearish Bias:\ Below 25,012 → Eyes on 24,852

\ ⚖️ Discipline + Risk Management > Prediction!\ Stay aligned with price structure and manage your capital smartly. 💰🧠📉

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This analysis is purely educational and intended to assist in structured thinking. Please consult your financial advisor before acting on any trading decisions. Always apply strict stop-loss and position sizing.

Nifty 50 Weekly Technical Analysis for June 23 – June 27 , 2025# Here's a concise technical analysis of the NIFTY 50 Index based on the latest available data as of June 20, 2025:

-- Current Market Snapshot --

Closing Price: The NIFTY 50 closed at approximately 25,100, with a significant daily gain of over 1,046 points for the Sensex, indicating strong bullish momentum.

Recent Trend: The index has been trading within a tight consolidation range (24,350–25,250) since mid-May 2025, forming a rectangular pattern. A breakout above 25,100 could signal further upside.

Daily Movement: On June 18, the NIFTY rebounded strongly from an intraday low below 24,800, reclaiming 24,900, supported by broad-based buying across sectors like auto, financial services, FMCG, pharma, and realty.

Key Technical Levels

Resistance:

Immediate: 25,114–25,215 (crucial for bullish momentum). A sustained break above 25,215 could target 25,340–25,700.

Major: 25,484–25,600, where profit booking may occur.

Support:

Immediate: 24,400–24,600 (key to maintaining bullish bias).

Stronger: 24,600 (break below could attract short sellers) and 24,374 (major demand zone).

Historical Context: The index reached its all-time high of 26,277.35 on September 27, 2024, and is currently ~4.5% below that level

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

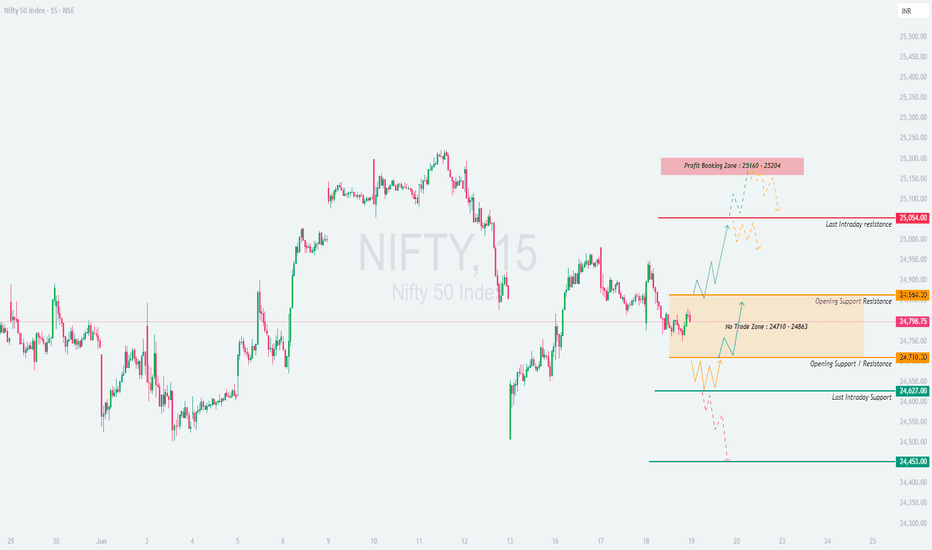

NIFTY : Trade plan and level for 24-Jun-25

\ 📈 NIFTY 50 TRADING PLAN – 24-Jun-2025\

📍 \ Previous Close:\ 24,958.20

📏 \ Gap Threshold:\ 100+ points

🕒 \ Chart Timeframe:\ 15-min

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,087):\

If Nifty opens above the \ Opening Resistance at 25,087\ , it would enter the red zone labeled \ Profit Booking / Consolidation Zone :: 25,204 – 25,243\ .

✅ \ Plan of Action:\

• Wait for 15–30 minutes to check if the price sustains above 25,087.

• If the price shows strength and crosses 25,204, it can trigger a short-term bullish move up to 25,243+.

• However, if the index shows a reversal in the red zone, profit booking may trigger a pullback to 25,087.

🎯 \ Trade Setup:\

– Buy on breakout + sustain above 25,204

– Target: 25,243–25,275

– SL: 25,080

– OR wait to short near 25,243 if reversal pattern forms

📘 \ Pro Tip:\ Avoid aggressive longs in the consolidation zone. Better to trade with breakout confirmations.

\ \ 📘 FLAT OPENING (Between 24,980 – 25,087):\

A flat opening puts Nifty in a narrow decision zone between \ Opening Resistance (25,087)\ and \ Opening Support/Resistance flip zone (24,980)\ .

✅ \ Plan of Action:\

• Avoid trading inside this range initially as volatility traps are common.

• A breakout above 25,087 = bullish continuation.

• Breakdown below 24,980 = early signs of weakness toward lower support levels.

🎯 \ Trade Setup:\

– Buy above 25,087 with volume

– Sell below 24,980 only if price sustains

– SL: 15–25 pts depending on entry type

📘 \ Pro Tip:\ Do not anticipate the breakout or breakdown—wait for confirmation and volume spikes to participate.

\ \ 📉 GAP-DOWN OPENING (Below 24,873):\

A gap-down below \ Opening Support (24,873)\ pushes Nifty into weaker terrain. The next reliable demand zone is the \ Last Important Intraday Support: 24,728–24,768\ .

✅ \ Plan of Action:\

• Look for price behavior near 24,728–24,768.

• If this zone holds, expect a bounce back toward 24,873

• If it breaks, downside may extend to \ Support for Consolidation / Sideways at 24,662\

🎯 \ Trade Setup:\

– Sell on breakdown below 24,728

– SL: 24,775

– Buy only if strong bullish reversal pattern forms around 24,728

📘 \ Pro Tip:\ Gap-down trades are riskier—patience pays. Avoid trading the first candle. Let sentiment unfold.

---

\ 💡 OPTIONS RISK MANAGEMENT TIPS:\

✅ \ 1. Avoid buying options inside tight ranges or sideways zones\

✅ \ 2. Use spreads (like Bull Call or Bear Put) when IV is high or near resistance zones\

✅ \ 3. Exit positions on major reversal signals or key levels break\

✅ \ 4. Always use stop-losses and pre-defined capital exposure per trade\

✅ \ 5. Don't overtrade on volatile days. Sit out if unclear!\

---

\ 📌 SUMMARY – KEY LEVELS FOR 24-Jun-2025:\

🔺 \ Profit Booking Zone:\ 25,204 – 25,243

🟥 \ Opening Resistance:\ 25,087

🟧 \ Opening Support/Resistance Flip:\ 24,980

🟨 \ Opening Support:\ 24,873

🟩 \ Key Intraday Support:\ 24,728 – 24,768

🟦 \ Lower Demand Zone:\ 24,662

---

\ 📚 CONCLUSION:\

• 🔼 \ Above 25,204:\ Bulls may extend to 25,243+

• ⏸ \ Between 24,980–25,087:\ Volatile – wait for clarity

• 🔽 \ Below 24,873:\ Bearish tone, support at 24,728

Patience and precision are more valuable than prediction. Wait for confirmation, and always protect your capital. 🎯📉📈

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This trading plan is prepared purely for educational purposes. Please consult your financial advisor before taking any trades based on this information. Trade responsibly and with proper risk management.

Nifty - Intraday levels & Prediction for - 24 Jun 2025Nifty Prediction for Tomorrow:

Trend : BULLISH

Sentiment : Positive

Expectation : Nifty made Bullish Harami candle today, with strong Buying momentum. So Nifty likely to open Gap up tomorrow and rally continuation. If Nifty Sustains above 25080 for 15m we can see Stron uptrend upto 25300 / 25500 levels..

Look for Buy/Sell at Demand and Supply zone for profitable trades.

Demand and Supply Zones - When price breaks the zone, Demand zone will become Resistance and Supply zone will become Support. If Nifty Sustains above 24900 tomorrow we can see good rally upto 25080 Resistance. Any breakout above 25100 and next resistance 25200

Refer the chart for detailed Intraday Support and Resistance levels.

NIFTY 24400 is TARGET!!!!!nifty is breaking levels in daily timeframes.

Now it starts to break in hourly as shown in the charts.

Past week nifty is so bullish , but I view this as a manipulation.

So my expectations from my experience is 24400 by this/or next week.

This is totally my view only , not a financial advise.

Thank you for reading this.

NIFTY Index Intraday Levels(For Educational purpose) 23/05/2025📈 Nifty Intraday Trade Setup – 23/06/2025 (Monday)

🕒 Timeframe: 1-Min Chart

📊 Market Outlook: Volatile with directional bias

🔼 Buy Above: 25,150 (with strong volume)

🎯 Target 1: 25,220

🎯 Target 2: 25,300

🛑 Stop Loss: 25,070

⚠️ Entry only after 5-min candle closes above 25,150

🔽 Sell Below: 24,960 (on breakdown)

🎯 Target 1: 24,880

🎯 Target 2: 24,800

🛑 Stop Loss: 25,040

⚠️ Only if price fails to hold 25,000 zone

📍 Key Levels to Watch:

🔹 Resistance: 25,150

🔹 S/R Flip Zone: 25,000 – 25,040

🔹 Support: 24,880 – 24,800

🔹 Demand Zone: 24,680

📌 Pro Tips:

✅ Watch opening 15 mins carefully

✅ Use VWAP & EMA (20/50) for trend confirmation

✅ Trade with discipline, not emotion

NIFTY : Trading plan and levels for 21-Jun-2025

\ 📊 NIFTY TRADING PLAN – 21-Jun-2025\

📍 \ Previous Close:\ 25,079.75

📏 \ Gap Threshold:\ 100+ points

🕒 \ Chart Reference:\ 15-minute timeframe

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,244):\

If Nifty opens above 25,244, it would break above the \ Opening & Last Intraday Resistance zone (25,204 – 25,244)\ , entering a profit-booking territory.

✅ \ Plan of Action:\

• Wait for 15–30 minutes for confirmation candles.

• If sustained above 25,244, bullish continuation is likely toward the \ Profit Booking Zone – 25,375+\ .

• However, if the index shows rejection near 25,244, expect a retest of the previous resistance zone.

🎯 \ Trade Setup:\

– Buy on a successful retest or breakout above 25,244

– Stop-loss: below 25,200

– Target: 25,350–25,375

📘 \ Pro Tip:\ Avoid impulsive longs on big gap-ups. Let price digest the gap and give a clear entry.

\ \ 📘 FLAT OPENING (Between 25,054 – 25,204):\

A flat opening places the index in a volatile consolidation zone between \ Opening Support (24,995 – 25,054)\ and resistance.

✅ \ Plan of Action:\

• Avoid trading inside the range of 25,054–25,204 due to fakeouts.

• Trade directional breakout from either side of this box:

– \ Above 25,204\ : Possible bullish breakout toward 25,350

– \ Below 24,995\ : Breakdown can push index to 24,864 or lower

🎯 \ Trade Setup:\

– Buy above 25,204 or sell below 24,995 with confirmation

– Tight SL (20–30 pts) is necessary inside this choppy zone

📘 \ Pro Tip:\ Avoid trading in the orange "Opening Support" zone unless a strong volume-based breakout or breakdown is seen.

\ \ 📉 GAP-DOWN OPENING (Below 24,864):\

A gap-down opening below the \ Last Intraday Support (24,864 – 24,830)\ signals early weakness in the market.

✅ \ Plan of Action:\

• First support to watch: \ 24,662\

• If price bounces from 24,662 with strength, short-covering may lead to a test of 24,864

• A breakdown below 24,662 can open doors to 24,500–24,420 levels

🎯 \ Trade Setup:\

– Short if price sustains below 24,830

– Stop-loss: above 24,880

– Buy only if sharp reversal seen at 24,662

📘 \ Pro Tip:\ Avoid panic selling. Wait for price to stabilize post-gap down and then decide.

---

\ 🛡 RISK MANAGEMENT & OPTIONS TRADING TIPS:\

✅ \ 1. Never chase trades at market open – observe price structure first\

✅ \ 2. For gap-ups, prefer debit spreads instead of naked calls to limit risk\

✅ \ 3. Don’t hold OTM options during range-bound action – decay is rapid\

✅ \ 4. Trail profits – especially after a breakout move hits your first target\

✅ \ 5. Respect volatility – no trade is also a trade in indecision zones\

---

\ 📌 SUMMARY – LEVELS TO WATCH FOR 21-Jun-2025:\

• 🔴 \ Resistance Zone:\ 25,204 – 25,244

• 🎯 \ Profit Booking Zone:\ 25,375

• 🟠 \ Opening Support Zone:\ 24,995 – 25,054

• 🟢 \ Last Intraday Support:\ 24,864 – 24,830

• 🔻 \ Breakdown Support:\ 24,662

💡 \ Summary Recap:\

• 🔼 Above 25,244 = Bullish momentum resumes

• ⏸ Between 25,054–25,204 = Sideways chop, avoid trades

• 🔽 Below 24,864 = Watch for sell pressure and bounce from 24,662

---

\ 📢 DISCLAIMER:\

I am not a SEBI-registered analyst. This trading plan is for educational and informational purposes only. Please consult your financial advisor before taking any market decisions. Trade safe and always manage your risk! ⚖️📉📈

NIFTY : Trading Plan and levels for 20-Jun-2025📊 NIFTY TRADING PLAN – 20-Jun-2025

📍 Previous Close: 24,744.70

📏 Gap Opening Threshold: 100+ points

🕰 Chart Timeframe: 15-min

🔼 GAP-UP OPENING (Above 24,852):

If Nifty opens more than 100 points higher, above the key zone of 24,852 (Opening Resistance/Support) , we step into a potential breakout scenario.

✅ Plan of Action:

• Let the first 15–30 min candles settle — especially if price opens near the Last Intraday Resistance zone (24,995 – 25,028) .

• Break and sustain above 25,028: Long trade possible toward Profit Booking Level – 25,203

• Price rejects 25,028 zone: Prepare for reversal trades back toward 24,852–24,750

• SL for longs can be below 24,950 if breakout sustains; use trailing SL near highs to protect profits.

📘 Educational Tip: On gap-ups, avoid chasing blindly. Wait for price to sustain above prior resistance levels. Confirmation + momentum = higher probability trades .

⚖️ FLAT OPENING (Between 24,705 – 24,852):

This is the decision zone between buyers and sellers. A flat open means market is seeking direction.

✅ Plan of Action:

• If price holds above 24,750 and breaks 24,852: Go long toward 24,995–25,028

• If price breaks below 24,705: Initiate short trades toward 24,627 zone

• Avoid trading inside the tight range of 24,705–24,750 unless volume breaks either side

• Ideal long above 24,852 with SL below 24,800; Ideal short below 24,705 with SL above 24,750

📘 Educational Tip: Flat opens inside narrow zones are best suited for breakout traders – let the market choose direction, then follow with discipline.

🔽 GAP-DOWN OPENING (Below 24,627):

Gap-downs may test the buyer’s patience — but provide clean setups if you’re patient and precise. Key support lies near 24,417 – 24,458 (Buyer’s Support for consolidation) .

✅ Plan of Action:

• If price opens near 24,627 and breaks lower: Short trade till 24,450 zone

• Inside the buyer’s support zone (24,417–24,458), look for reversal signals (hammer, bullish engulfing) for longs

• If price rebounds strongly from 24,417 zone → go long toward 24,627 again

• Only short below 24,417 if high volume breakdown is visible — else expect bounce

📘 Educational Tip: Avoid shorting blindly near major demand zones. Wait for clean breakdown candles with follow-through. This protects against trap-based reversals .

🛡 OPTIONS TRADING RISK MANAGEMENT:

✅ 1. Avoid trades in the first 5-min candle — wait for structure to build

✅ 2. Position sizing = key — don't overleverage due to emotions from gap opens

✅ 3. Time decay is real — exit out-of-money options early if momentum fails

✅ 4. Prefer spreads when IV is high (e.g., Bull Call / Bear Put)

✅ 5. Always keep exit plan ready — use 15-min candle close-based SL

📌 SUMMARY – KEY LEVELS FOR 19-Jun-2025:

• 🟢 Bullish above: 24,852 → Target: 24,995 → 25,028 → 25,203

• 🔴 Bearish below: 24,705 → Target: 24,627 → 24,458 → 24,417

• 🟧 Opening Support Zone: 24,705–24,750

• 🟥 Resistance for Booking: 25,028–25,203

• 🟩 Buyer’s Zone: 24,417–24,458 — expect demand to return

📌 Decision Level: 24,852 — above this, bulls lead; below 24,705, bears gain control.

📢 DISCLAIMER: I am not a SEBI-registered analyst. This plan is created purely for educational purposes based on price action. Please consult your financial advisor before taking any trade or investment action.

Nifty 50 Index Intraday Levels(For Educational purpose)20.5.225📉 Downside (Bearish Bias – Preferred Today)

Sell Below: ₹24,740

Entry Condition: A clean 1-minute red candlestick closing below ₹24,740, above-average volume.

Targets:

🎯 Target 1: ₹24,700

🎯 Target 2: ₹24,650

🎯 Target 3: ₹24,580 (if bearish momentum continues)

Stop Loss: ₹24,780–24,800

////📈 Upside (Bullish Reversal – Secondary Setup)

Buy Above: ₹24,820

Entry Condition: A strong 1-minute green candle breaking above ₹24,820 with volume.

Targets:

🎯 Target 1: ₹24,860

🎯 Target 2: ₹24,900

🎯 Target 3: ₹24,940

Stop Loss: ₹24,780

Nifty chart for 20th june 2025Looks like Nifty is making a flag and pole pattern in 1hr chart. It is in a range bound market from 24500 to 25000.

Disclaimer: All information provided here is for educational purposes and not a recommendation, advice, research report, or stock tip of any nature. Analysis Posted here is just our view/personal study method on the stocks, commodities or other instruments and assets.

Nifty chart for 19th june 2025Looks like Nifty is making a flag and pole pattern in 1hr chart.

Disclaimer: All information provided here is for educational purposes and not a recommendation, advice, research report, or stock tip of any nature. Analysis Posted here is just our view/personal study method on the stocks, commodities or other instruments and assets.

Nifty Thought Process and Analysis (Multi-Timeframe Breakdown)🔹 4H Timeframe (Intraday to Short-Term Swing)

Current Price: ~24,807

Price is consolidating inside a liquidity pocket just below a Fair Value Gap (FVG) zone.

Sell-side liquidity has already been swept; signs of accumulation are visible.

Three internal FVGs identified—market is respecting these inefficiencies.

Volume imbalance + EQ (Equal Lows) and previous OB (Order Block) show that price may be building a base.

Market Structure: Minor BOS (Break of Structure) observed, but no new HH yet — compression inside a range.

✅ Bullish Bias IF price breaks above the FVG range and mitigates the supply.

📌 Long Setup Idea:

Entry: Above 24,900

Stop Loss: Below EQ/FVG (~24,650)

Target: 25,200–25,400 (Buy-side liquidity/weak high zone)

📛 Invalidation: Clean break below EQ zone + OB → indicates bearish continuation.

🔹 Daily Timeframe (Swing View)

Price respected the sell-side liquidity grab and is now consolidating within a bearish FVG range.

Minor BOS confirms short-term bullish correction, but macro context is mixed.

PWL (Previous Week Low) has been swept, giving confluence to bullish short-term reversal.

Upper FVG near 25,100–25,200 remains unmitigated.

🧠 Key Observation: Smart money often reverses price after sweeping liquidity → the VI (Volume Imbalance) zone may act as a launchpad.

🔹 Weekly Timeframe (Macro Structure)

Structure remains bullish with strong upside momentum since the March-April reversal.

Change of Character (ChoCH) in April is confirmed with multiple BOS candles.

Current price is holding above the weekly FVG + VI.

A large bullish OB sits between 22,400–22,800, indicating massive institutional accumulation.

📈 Weekly Bias: As long as price stays above 24,400, bullish targets of 25,600 are possible in coming weeks.

🧩 Conclusion & Trade Idea Summary (ICT-based)

Bias: Bullish (Short-term accumulation, preparing for expansion)

Entry: Break and close above 24,900 on 4H or Daily

Stop Loss: 24,640 (Below EQ zone/FVG boundary)

TP1: 25,200 (Buy-side liquidity)

TP2: 25,400–25,600 (Weekly premium zone/weak high)

Nifty 50 Index Intraday Levels( Educational purpose only)📈 Upside (Bullish) Trade Plan:

Buy Above: 24,830

Confirmation: 1-minute candle close above 24,830 with volume support.

Targets:

🎯 Target 1: 24,880

🎯 Target 2: 24,915

🎯 Target 3: 24,980

Stop Loss (SL): 24,790

📉 Downside (Bearish) Trade Plan:

Sell Below: 24,757

Confirmation: Strong breakdown with red candle closing below 24,757.

Targets:

🎯 Target 1: 24,700

🎯 Target 2: 24,660

🎯 Target 3: 24,600

Stop Loss (SL): 24,800

NIFTY : Trading levels and plan for 18-Jun-2025📊 NIFTY TRADING PLAN – 19-June-2025

📍 Previous Close: 24,798.75 | 🕒 Timeframe: 15-min

📏 Gap Threshold Considered: 100+ points for classification

🔼 GAP-UP OPENING (Above 24,964):

If NIFTY opens above 24,964, it breaks out of the "No Trade Zone" (24,710–24,864) and suggests bullish momentum toward upper resistances.

✅ Plan of Action:

• Wait for price to sustain above 25,054 (Last Intraday Resistance).

• If 15-min candle closes strong above 25,054 with volume, initiate long trades toward the Profit Booking Zone: 25,160 – 25,204 .

• Stop-loss: Below 25,000 (15-min candle close basis).

• If prices face rejection at 25,054 or near 25,160 zone, look for short trades for a pullback toward 24,864.

📘 Tip: On gap-up days, avoid chasing the open blindly . Let the first 15–30 minutes define control – buyers vs sellers.

⚖️ FLAT OPENING (Between 24,710 – 24,864):

Opening within the No Trade Zone signifies indecision. This zone needs a breakout for directional trades.

✅ Plan of Action:

• Avoid any aggressive trade within 24,710 – 24,864.

• If price breaks and sustains above 24,864, initiate long trade toward 25,054, with SL below 24,820.

• If price breaks down below 24,710, initiate short trade toward 24,627, SL above 24,750.

• Watch for wick traps — ensure breakout happens with solid volume candle, not just one spike.

📘 Tip: In no-trade zones, your capital is safest when you wait . Let price exit the confusion before entering.

🔽 GAP-DOWN OPENING (Below 24,610):

If NIFTY opens below 24,710 by over 100 points, it’s a gap-down near the Last Intraday Support at 24,627 , which brings weakness into play.

✅ Plan of Action:

• If price breaks and sustains below 24,627, short trades can be taken toward 24,453 (next major support).

• SL for short trades above 24,680.

• If sharp buying emerges from 24,453 – 24,500 zone, look for reversal long trades back toward 24,710.

• Confirm with reversal candles like hammer/morning star on 15-min chart.

📘 Tip: Buyer’s Support zones are best for risk-reward long trades , but confirmation is key — don’t knife-catch.

🛡 OPTIONS TRADING – RISK MANAGEMENT TIPS:

✅ 1. Use Spread Strategies: Vertical spreads (Bull Call/Bear Put) help limit losses on volatile days.

✅ 2. Don’t Enter in the First 5-min Candle: Especially on gap-up/down days, let the initial volatility settle.

✅ 3. Track IV (Implied Volatility): High IV days can erode premiums fast post breakout — consider theta decay risk.

✅ 4. Set SL Based on 15-min Candle Close: Avoid panic exits due to wicks or noise.

✅ 5. Book 50% Profits Early: If your trade moves 50–70% in favor, partial exit helps lock-in gains.

📌 SUMMARY – KEY LEVELS TO WATCH:

🟩 Support Zones:

• Opening Support / Resistance: 24,710

• Last Intraday Support: 24,627

• Strong Buyer’s Support: 24,453

🟥 Resistance Zones:

• Opening Resistance: 24,864

• Last Intraday Resistance: 25,054

• Profit Booking Area: 25,160 – 25,204

⚔️ Battle Zone (No Trade): 24,710 – 24,864

📈 Trend Decision Zones:

• Above 24,864 → Bullish toward 25,160+

• Below 24,710 → Bearish toward 24,453

📢 DISCLAIMER: I am not a SEBI-registered analyst. This plan is prepared purely for educational purposes. Please consult your financial advisor before making any trading or investment decision.

NIFTY : Trading levels for 18-Jun-2025📘 NIFTY TRADING PLAN – 18-Jun-2025

🕒 Chart Timeframe: 15-min | 📍 Previous Close: 24,841.50

📏 Gap Opening Threshold: 100+ points

🔼 GAP-UP OPENING (Above 24,964):

If NIFTY opens above the No Trade Zone (24,864) by more than 100 points, the price will likely test the upper resistance zone near 25,054 (Last Intraday Resistance) .

✅ Plan of Action:

• Avoid chasing right at open. Observe the first 15–30 mins for confirmation above 25,054.

• Sustainable move above 25,054: Look for long trades toward 25,244, with SL below 25,000.

• Rejection at 25,054 zone: Consider short trades only if there’s a clear reversal pattern, targeting back toward 24,864.

• Book profits partially near 25,150 if long, as market may consolidate.

📘 Educational Tip: Sharp gap-ups often face profit booking at resistance zones. Focus on confirmation via strong candles + volume to avoid false moves.

⚖️ FLAT OPENING (Between 24,770 – 24,864):

Flat open near the No Trade Zone (24,770 – 24,864) suggests indecision or potential sideways movement early in the session.

✅ Plan of Action:

• No Trade inside this band until clear breakout or breakdown is seen.

• Break above 24,864: Consider intraday longs toward 25,054, SL below 24,820.

• Break below 24,770: Enter shorts targeting 24,626, with SL above 24,800.

• Avoid trading between 24,770–24,864 during consolidation — it’s where stop losses typically get hit from both sides.

📘 Educational Tip: Trading in the No Trade Zone is like catching a coin toss — instead, let market pick a direction, then follow it with clarity .

🔽 GAP-DOWN OPENING (Below 24,670):

A gap-down below 24,770, especially near or under the Last Intraday Support – 24,626 , brings into play the Buyer’s Support Zone (24,253 – 24,320) .

✅ Plan of Action:

• If opening is near 24,626 and shows breakdown below, ride shorts till 24,420 – 24,320.

• Look for potential reversal setups inside 24,253–24,320 zone for long trades.

• Reclaiming 24,626 with bullish candles could invite short-covering.

• Avoid new shorts inside Buyer’s Zone unless breakdown below 24,253 happens with volume and structure.

📘 Educational Tip: Gaps near support zones give best long risk/reward, but never buy blindly — wait for confirmation candle + sustained buying interest .

🛡 OPTIONS TRADING RISK MANAGEMENT TIPS:

✅ 1. Wait 15–30 mins post-open to avoid false breakouts or reversal traps.

✅ 2. Avoid over-leveraging on gap days — increase accuracy, reduce lot size.

✅ 3. Prefer spreads (Bull Call/Bear Put) if volatility is high to control premium erosion.

✅ 4. Use SL on candle close basis (preferably 15-min), not just trigger wicks.

✅ 5. Exit intraday trades 10–15 mins before close if targets aren't hit to avoid time decay spikes.

📊 SUMMARY – KEY LEVELS TO WATCH:

• 🟢 Bullish Setup:

– Above 24,864 → Target: 25,054 → 25,244

– SL: Below 24,820 (on longs)

• 🔴 Bearish Setup:

– Below 24,770 → Target: 24,626 → 24,320

– Breakdown SL: Above 24,800

• 🟧 No Trade Zone: 24,770 – 24,864 — Let direction confirm

• 🟩 Support Zones: 24,626 / 24,320 / 24,253

• 🟥 Resistance Zones: 25,054 / 25,244

📌 Decision Point: Breakout above 24,864 or below 24,770 decides momentum.

⏱ Watch the first 15-min candle structure for decisive moves.

📢 DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is purely for educational and learning purposes. Please consult your financial advisor before taking any trading or investment decision.

Nifty - Intraday levels & Prediction for - 18 Jun 2025Nifty Prediction for Tomorrow:

Trend : BEARISH Breakout

Sentiment : Negative

Expectation : Nifty closed below 24900, expecting BEARISH breakout tomorrow. Any close above 2510 only its Bullish trend, and price will move to test 25200.

Look for Buy/Sell at Demand and Supply zone for profitable trades.

Demand and Supply Zones - When price breaks the zone, Demand zone will become Resistance and Supply zone will become Support. If Nifty Sustains above 24900 tomorrow we can see good rally upto 25080 Resistance. Any breakout above 25100 and next resistance 25200

Refer the chart for detailed Intraday Support and Resistance levels.

Nifty chart for 17th june 2025Looks like Nifty is in a range. Also, it took support on 24500 level.

Disclaimer: All information provided here is for educational purposes and not a recommendation, advice, research report, or stock tip of any nature. Analysis Posted here is just our view/personal study method on the stocks, commodities or other instruments and assets.

Nifty - Intraday levels & Prediction for - 17 Jun 2025Nifty Prediction for Tomorrow:

Trend : Sideways to BEARISH

Sentiment : Positive

Expectation : Since Nifty closed above 24900, 25070 will be key resistance for tomorrow and expecting BEARISH reversal at 25070 resistance. Any close above 25100, price will move to test 25200.

Look for Buy/Sell at Demand and Supply zone for profitable trades.

Demand and Supply Zones - When price breaks the zone, Demand zone will become Resistance and Supply zone will become Support. If Nifty Sustains above 24900 tomorrow we can see good rally upto 25080 Resistance. Any breakout above 25100 and next resistance 25200

Refer the chart for detailed Intraday Support and Resistance levels.

Nifty - Intraday levels & Prediction for - 16 Jun 2025Nifty Prediction for Tomorrow:

Trend : BEARISH

Sentiment : Negative

Expectation : Nifty made BEARISH engulfing in Weekly Chart, and shows weakness. Tomorrow we can expect slight BULLISH move upto 24900 then BEARISH reversal might come and any breakout below 24550 big fall is expected this week.

Look for Buy/Sell at Demand and Supply zone for profitable trades.

Demand and Supply Zones - When price breaks the zone, Demand zone will become Resistance and Supply zone will become Support.

Refer the chart for detailed Intraday Support and Resistance levels.