NIFTY : Trading levels and Plan for 26-Dec-2025📘 NIFTY Trading Plan for 26-Dec-2025

(Chart reference: 15-min | Gap criteria considered: 100+ points)

Key Levels to Track (from chart)

Major Upside Resistance: 26,341.10

Last Intraday Resistance: 26,265.00

Opening Resistance: 26,212.00

Opening Support / Resistance (Pivot Zone): 26,099 – 26,141

Last Intraday Support: 26,040.50

Lower Support: 25,920.85

🟢 1. GAP-UP OPENING (100+ Points)

If NIFTY opens above 26,212, price starts the session in a bullish zone but close to overhead supply.

🎓 Educational Explanation:

Gap-up opens indicate positive overnight sentiment. However, when price opens near resistance, early profit-booking is common. Strong trends usually continue only after acceptance above resistance or a clean retest, not on impulsive spikes.

Plan of Action:

If price sustains above 26,212 for 10–15 minutes, look for pullback-based long entries.

First upside hurdle is 26,265 (last intraday resistance).

Acceptance above 26,265 can extend the move toward 26,341.10.

Rejection or exhaustion near 26,265–26,341 may lead to a pullback toward 26,212.

Option buyers should avoid chasing CE at the open; confirmation improves R:R.

🟡 2. FLAT OPENING

A flat open around 26,120–26,160 keeps NIFTY inside the opening pivot zone (26,099–26,141).

🎓 Educational Explanation:

Flat opens reflect balance between buyers and sellers. Direction typically emerges after the opening range breaks. Trading inside this zone without confirmation often leads to whipsaws and theta decay.

Plan of Action:

Sustaining above 26,141 keeps bullish bias intact, targeting 26,212 → 26,265.

Failure to hold 26,099 increases downside risk toward 26,040.50.

Bullish rejection near 26,099–26,141 offers a low-risk bounce back to 26,212.

Breakdown and acceptance below 26,099 shifts momentum toward 26,040.50.

🔴 3. GAP-DOWN OPENING (100+ Points)

If NIFTY opens below 26,099, early sentiment turns cautious to bearish.

🎓 Educational Explanation:

Gap-downs are often emotion-driven. Strong demand zones can attract short-covering and value buying, leading to sharp reversals. Selling blindly into support increases risk.

Plan of Action:

First support to watch is 26,040.50 — observe candle structure and volume.

Breakdown below 26,040.50 opens the downside toward 25,920.85.

Strong bullish reversal signals near 25,920.85 may lead to a sharp intraday bounce.

Any pullback toward 26,099 after breakdown can be used as a selling-on-rise opportunity.

⚙️ Risk Management Tips for Options Traders 🛡️

Avoid trading the first 5–10 minutes during gap openings.

Don’t buy options at resistance or sell at support without confirmation.

Use a time-based stop-loss (15–20 minutes) if premium doesn’t move.

Risk only 1–2% of total capital per trade.

Prefer ATM options or defined-risk spreads to manage theta decay.

Book partial profits near marked resistance/support levels.

🧾 Summary & Conclusion

Above 26,212: Bulls remain active; targets 26,265 → 26,341.

Between 26,099–26,212: Market stays balanced; patience is key.

Below 26,099: Sellers gain control unless buyers defend 26,040.50 / 25,920.85.

Trade price behaviour at levels, not predictions.

Consistency comes from discipline, confirmation, and risk control.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be considered financial or investment advice. Please consult your financial advisor before taking any trades.

Niftytrading

NIFTY : Trading levels and Plan for 09-Dec-2025📊 NIFTY TRADING PLAN — 09 DEC 2025

Nifty closed around 25,933, sitting just below Opening Resistance/Support (25,958).

Price remains in a corrective structure but is approaching major intraday support below.

Key Levels from the chart:

• Opening Resistance / Support: 25,958

• Last Intraday Resistance: 26,082

• Major Resistance: 26,136

• Last & Important Support Zone: 25,770 – 25,812

• Deeper Support: 25,732

Market sentiment is still fragile, and tomorrow’s opening will determine short-term direction.

🚀 1. GAP-UP OPENING (100+ points)

A gap-up above 26,020–26,050 places price close to the last intraday resistance cluster.

1. If price opens above 25,958 and retests it successfully

• Do NOT chase the opening candle.

• Wait for a retest of 25,958 showing bullish confirmation (wick rejection or CHoCH).

• Long entry activates → Targets: 26,082 → 26,136.

• Book partial profits near 26,082 as sellers previously reacted there.

2. If gap-up opens inside the resistance band (26,082–26,136)

• Avoid fresh longs — this zone is historically a rejection area.

• Look for bearish signs → If rejection occurs → Short only after price falls under 25,958.

• Downside targets: 25,900 → 25,850.

3. If price breaks and sustains above 26,136

• Strong bullish momentum.

• Next targets: 26,200 → 26,240.

• Trail stop-loss to protect profits.

📌 Educational Note:

Gap-ups typically require validation — breakouts without retests often fail. Always wait for a confirmation candle.

⚖ 2. FLAT OPENING (around 25,900–25,950)

Flat opens allow clean level-by-level trading and reduce whipsaw risk.

1. If price reclaims 25,958 and sustains

• Bulls gain early strength.

• Long trades activate on breakout + retest.

• Targets: 26,020 → 26,082 → 26,136.

2. If price rejects 25,958

• Lower-high formation indicates weakness.

• Short trades become valid toward 25,880 → 25,812.

3. If price trades between 25,900–25,958 initially

• Expect range-bound movement.

• Buy only near the lower range boundary with support confirmation.

• Sell only at the upper boundary with resistance confirmation.

📌 Educational Note:

Flat openings expose the true intention of the first 15–30 mins. Structural clarity matters more than speed.

📉 3. GAP-DOWN OPENING (100+ points)

A gap-down into 25,850–25,780 brings price directly into the strongest demand region on the chart.

1. If price opens inside 25,770–25,812 (Last & Important Support Zone)

• Absolutely avoid shorting this zone — strong buying expected.

• Wait for reversal candle patterns (hammer, engulfing, CHoCH).

• If reversal confirmed → Long toward 25,900 → 25,958.

2. If price opens near 25,732

• This is deeper support.

• Look for absorption of selling → If reversal appears → Long with targets:

→ 25,812 → 25,900.

3. If 25,732 breaks decisively

• Avoid catching a falling knife.

• Wait for a retest of 25,732.

• If retest rejects → Short continuation toward 25,670 → 25,620.

📌 Educational Note:

Gap-downs sweep liquidity. Smart money accumulates at support before trend reversals. Patience is key.

🛡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

1. Do NOT trade the first 5 minutes after a gap opening.

Premiums fluctuate wildly.

2. Avoid buying far OTM options after a big gap.

IV crush + theta decay = quick capital loss.

3. Use strict stop-loss based on price levels, not premium.

4. Never risk more than 1–2% of your capital on a single trade.

5. High IV → Option selling strategies (credit spreads) work better.

Low IV → Option buying becomes more effective.

6. Book partial profits near key reaction levels:

25,958 / 26,082 / 26,136.

7. Avoid revenge trading — protect capital first.

📌 SUMMARY & CONCLUSION

• Bullish bias above 25,958, with targets toward 26,082 → 26,136.

• Choppy or neutral zone between 25,900–25,958 until breakout.

• Strong bullish reversal zones:

– 25,770–25,812

– 25,732

• Always trade with confirmation — retest entries provide the highest reliability.

• Strict risk management is essential in volatile conditions.

⚠ DISCLAIMER

I am not a SEBI-registered analyst.

This trading plan is purely for educational purposes and should not be considered investment advice.

Market conditions can change rapidly — always use your own judgment and proper risk controls.

NIFTY : Trading levels and Plan for 03-Dec-2025📊 NIFTY TRADING PLAN — 03 DEC 2025

Nifty closed around 26,057, sitting just below the Opening Resistance (26,085) and far from both the day’s support and supply zones.

The chart indicates bearish pressure, but buyers still defend the 25,954 support on dips.

The behaviour at the opening will define whether the index attempts a rebound or continues the downtrend.

🔍 Key Levels For The Day

🟥 Opening Resistance: 26,085

🟥 Last Intraday Resistance: 26,139 – 26,156

🟥 Major Upside Target: 26,246

🟩 Opening Support: 25,954

🟩 Last Intraday Support: 25,798

🟩 Major Breakdown Target: 25,760 – 25,720

🟩 SCENARIO 1 — GAP-UP OPENING (100+ Points)

If Nifty opens near 26,150–26,200, it jumps straight into the resistance zone.

If price sustains above 26,085 → It will attempt the next resistance at:

26,139 → 26,156 → 26,200+

Break & retest above 26,156 gives a drive toward 26,246.

If price rejects 26,085–26,139 (upper wicks, strong red candle) →

Expect profit-booking down toward 26,020 → 25,954.

Safer Long Setup:

✔️ Breakout above 26,156 + Retest → Target 26,200 / 26,246

Early aggressive shorting is risky.

Gap-ups near resistance often create trap candles.

📘 Educational Note:

A gap-up directly into resistance is often a testing zone where institutions check if late buyers will panic.

Let the chart confirm strength before entering.

🟧 SCENARIO 2 — FLAT OPENING (25,980–26,050)

Flat openings create a balanced battlefield between bulls and bears.

Upside trigger → Break above 26,085

Targets → 26,139 → 26,156 → 26,200

Downside trigger → Break below 25,954

Targets → 25,900 → 25,850 → 25,798

Avoid trading inside the tight range 26,020–26,070 — high noise, low reward.

Two ideal setups:

✔️ Breakout & Retest above 26,085

✔️ Breakdown & Retest below 25,954

💡 Educational Tip:

Flat opens typically lead to a clean breakout after the first 2–3 candles.

Let direction reveal itself instead of predicting it.

🔻 SCENARIO 3 — GAP-DOWN OPENING (100+ Points)

If Nifty opens around 25,920–25,960, it opens near or inside support.

If buyers defend 25,954 and form higher lows →

Reversal targets:

26,020 → 26,057 → 26,085

If 25,954 breaks decisively →

Next targets → 25,900 → 25,850 → 25,798

Breakdown below 25,798 triggers stronger fall →

Targets → 25,760 → 25,720

Reversal trades should only be taken with:

✔️ bullish candle

✔️ higher low

✔️ strong wick rejection

inside the support zone.

📘 Educational Note:

Gap-downs into support attract smart money buying, but only if the zone holds.

A breakdown usually gives a clean trend day on the downside.

💼 RISK MANAGEMENT TIPS FOR OPTION TRADERS 🔐💡

Do NOT trade the first 5 minutes after open (avoid traps).

Prefer ITM/ATM options for directional moves.

Use chart-level SL, not premium-level SL.

Avoid averaging losing trades — re-entry is always safer.

Trail SL once the trade hits the first target.

During high VIX, prefer option spreads.

Avoid overtrading during volatile candle clusters.

⚠️ Golden Rule:

Protect capital first.

Exposure without risk control = guaranteed loss.

📌 SUMMARY

Bullish Above:

✔️ 26,085 → 26,139 → 26,156 → 26,200 → 26,246

Bearish Below:

✔️ 25,954 → 25,900 → 25,850 → 25,798 → 25,760

Reversal Zones:

🟩 25,954 (Opening Support)

🟩 25,798 (Intraday Support)

🟥 26,085 (Opening Resistance)

🟥 26,139–26,156 (Key Supply Zone)

Avoid Trading Inside:

⚠️ 26,020–26,070

This is the NOISE zone.

🧾 CONCLUSION

Nifty is set for a decisive day with clear vertical levels.

Trend direction will be driven by:

✔️ Sustaining above 26,085 = Bullish continuation

✔️ Breaking below 25,954 = Fresh downside

✔️ Breakout above 26,156 = Strong rally

✔️ Breakdown below 25,798 = Sharp sell-off

Trade only with confirmation, avoid guessing direction, and focus on clean structure-based entries.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is purely for educational purposes.

Please consult your financial advisor before making trading decisions.

NIFTY : Trading levels and Plan for 02-Dec-2025📊 NIFTY TRADING PLAN — 02 DEC 2025

Nifty closed near 26,175, right between the Opening Resistance (26,219) and Opening Support (26,107–26,122).

The market is currently in a low-momentum, direction-hunting phase, where the opening behaviour will determine the next trend leg.

The structure shows clean supply zones above and strong demand zones below, meaning both sides have potential — but only confirmation-based trading is safe.

🔍 Key Intraday Levels

🟥 Opening Resistance: 26,219

🟥 Last Intraday Resistance: 26,272

🟥 Major Breakout Level: 26,397

🟩 Opening Support: 26,107 – 26,122

🟩 Last Intraday Support: 26,046 – 26,062

🟩 Major Breakdown Level: 25,955

🟢 SCENARIO 1 — GAP-UP OPENING (100+ Points)

If Nifty opens near 26,260–26,300, price opens right at or above resistance.

If price sustains above 26,219 for 10–15 minutes →

Upside targets: 26,272 → 26,330 → 26,397

This zone becomes a continuation breakout if volumes support.

If Nifty rejects 26,219–26,272 (wick rejections, long red candle) →

Expect a retracement towards:

➡️ 26,175 → 26,122

Best Long Setup:

Breakout above 26,272 → Retest → Bullish candle → Target 26,330 / 26,397

Avoid early shorting on gap-ups —

fakes are common near resistance clusters.

📘 Educational Note:

A gap-up directly into resistance requires patience.

Breakouts without retests often fail.

Retests confirm whether buyers truly control the level.

🟧 SCENARIO 2 — FLAT OPENING (26,150–26,190)

A flat open places Nifty between support and resistance. Expect early indecision.

Upside trigger → Break and sustain above 26,219.

Targets → 26,272 → 26,330

Downside trigger → Break below 26,122.

Targets → 26,062 → 26,046

The zone 26,175–26,200 is a noise range. Avoid trading inside it.

Two safe setups:

✔️ Breakout & Retest above 26,219

✔️ Breakdown & Retest below 26,122

💡 Educational Tip:

Flat openings give the cleanest structure of the day.

Wait for the breakout from the initial range (first 3–4 candles).

Impulse moves from the flat zone lead to strong trends.

🔻 SCENARIO 3 — GAP-DOWN OPENING (100+ Points)

If Nifty opens around 26,050–26,090, price enters the demand zones.

If support 26,062–26,046 holds and higher-low structure forms →

Reversal upside targets → 26,122 → 26,175 → 26,219

If 26,046 breaks →

Sharp downside possible →

➡️ 26,000 → 25,955 (major support)

This is a crucial liquidity zone.

Only sell BELOW 25,955 with confirmation.

Targets: 25,900 → 25,850

Reversal trades are valid ONLY after a bullish confirmation candle in the support zone.

📘 Educational Note:

Gap-downs into strong support often cause big traps for late sellers.

Wait for price to show exhaustion before buying —

Higher low + strong bullish candle = safest reversal pattern.

💼 RISK MANAGEMENT TIPS FOR OPTION TRADERS 💡

Avoid trading the first 5 minutes after the open.

Use ATM or ITM options for directional trades.

Set SL based on chart level, not premium price.

Never average a losing trade — cut and re-enter if needed.

Trail stop-loss after first target to lock profits.

Weekly expiry days → avoid overtrading during volatility spikes.

High VIX → Prefer spreads over naked buying.

⚠️ Golden Rule:

Be a risk manager first, a trader second.

Capital safety guarantees longevity.

📌 SUMMARY

Bullish Bias Above:

✔️ 26,219 → 26,272 → 26,330 → 26,397

Bearish Bias Below:

✔️ 26,122 → 26,062 → 26,046 → 25,955

Reversal Zones:

🟩 26,107 – 26,122 (Opening Support)

🟩 26,046 – 26,062 (Last Intraday Support)

🟥 26,219 – 26,272 (Heavy Resistance)

Danger / No-Trade Zone:

⚠️ 26,165–26,200 (Choppy, low-quality zone)

🧾 CONCLUSION

Nifty is at a decisive stage where both sides are open.

The day’s trend will be controlled by these key triggers:

✔️ Bullish only above 26,219

✔️ Bearish below 26,122

✔️ Strong breakout only above 26,272

✔️ Major breakdown only below 25,955

Trade with confirmation, respect levels, and avoid emotional entries.

Let market structure guide your trades — not impulses.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is purely for educational purposes.

Please consult your financial advisor before making trading decisions.

Nifty 50 Analysis (Based on Your 4H+1D Chart ) Key Observations from Your Markups (ICT Style):

1. Price is sitting inside a 4H FVG (26,110–26,170 zone)

This is acting as intraday demand / discount region.

Price bounced here previously and is testing it again.

2. Multiple PDH levels above + Weak High at ~26,320–26,350

This cluster suggests **liquidity resting above.

If price reclaims PDH → expect a sweep toward the weak high.

3. PDL is protected (~26,070–26,090)

Clean liquidity pool below.

A sweep into PDL + FVG confluence gives high-probability long setup.

4. Daily chart shows rejection from the supply zone (26,300–26,380)

But the structure is still **bullish BOS → continuation** unless 25,950 breaks.

---

📌Tomorrow’s Probable Scenarios

🟢 Bullish Setup (Higher Probability)

Entry Zone:

➡️ 26,080–26,120 (PDL + 4H FVG + discount)

Entry Trigger:

W-pattern

BOS on 5m/15m

Stop-run below today’s low

Targets:

1. 26,240

2. 26,310 (PDH)

3. 26,350–26,380 (Weak High / liquidity sweep)

Stoploss:

➡️ Below 25,980 (structure invalidation + 4H FVG break)

---

🔴 Bearish Setup (If 26,300 is rejected again)

Entry Zone:

➡️ 26,300–26,350 (weak high + PDH cluster)

Targets:

1. 26,180

2. 26,110 (FVG midpoint)

3. 25,980 (PDL & liquidity)

Stoploss:

➡️ Above 26,380 (clean invalidation)

Nifty Prediction for 25 Nov | FII vs DII Data & Expiry 📊 Key Levels for Tuesday (Snapshot):

🔻 Bearish Crash: Below 25,867 (S1) | Target: 25,774

🚀 Bullish Reversal: Above 26,098 (R1) | Target: 26,236

⚠️ The "Chop Zone": 25,867 - 26,098 (Avoid Trading)

Institutional Data:

FII Net Sell: -₹4,071 Cr

DII Net Buy: +₹4,373 Cr

PCR: 0.65 (Oversold/Bearish)

👇 Join the Debate: FIIs sold ₹4k Cr, DIIs bought ₹4k Cr. Who wins tomorrow? Comment "BEARS" or "BULLS" below!

NIFTY : Trading levels and Plan for 20-Nov-2025📊 NIFTY TRADING PLAN — 20 NOV 2025

(Reference: 15-min chart structure & key intraday levels)

Nifty closed around 26,052, sitting just above the Opening Resistance / Support Zone (26,036 – 26,070). Price action is now heading toward a crucial supply area above 26,140–26,194, and short-term structure suggests volatility around the opening price.

Here are the major actionable levels for 20 Nov 2025:

🟧 Opening Resistance / Support Zone: 26,036 – 26,070

🟥 Last Intraday Resistance Zone: 26,146 – 26,194

🟥 Major Resistance: 26,309

🟩 Opening Support (Gap-down case): 25,964

🟩 Last Intraday Support: 25,902

Below is the complete plan for all opening scenarios 👇

🟢 SCENARIO 1 — GAP-UP OPENING (100+ Points)

If Nifty opens around 26,150–26,200, this places price directly inside or just under the Last Intraday Resistance Zone (26,146–26,194).

If price sustains above 26,194 for 10–20 minutes with strong volume →

⭐ Upside targets → 26,245 → 26,280 → 26,309

If price rejects 26,146–26,194, expect a correction toward:

➡️ 26,100 → 26,070

A bullish retest at 26,070 with reversal candles offers a safe long entry.

Avoid buying immediately at open — gap-ups near resistance often trap traders.

📘 Educational Note:

Gap-ups work best only when price makes higher lows after the open. A flat or weak first candle at resistance often signals exhaustion.

🟧 SCENARIO 2 — FLAT OPENING (Near 26,020–26,070)

A flat open places Nifty inside the Opening Resistance / Support Zone (26,036–26,070) — a decision region.

A clean breakout above 26,070 →

Targets → 26,110 → 26,146 → 26,194

If price breaks below 26,036, expect a drop to:

➡️ 25,964 (Opening Support)

Avoid trading inside the 26,030–26,070 zone until direction is clear.

Best trades will be:

— Breakout → Retest → Continuation

— Support bounce from 25,964

💡 Educational tip:

Flat openings are ideal for trend identification. The first 15-min candle usually gives strong directional clues — don’t rush in.

🔻 SCENARIO 3 — GAP-DOWN OPENING (100+ Points)

A gap-down below 25,970 puts price directly into the Opening Support zone (25,964).

If 25,964 holds with bullish wick rejection →

Upside targets → 26,020 → 26,070 → 26,110

If price breaks 25,964 decisively, next support zone:

➡️ 25,902 (Last Intraday Support)

A strong bounce from 25,902 can provide an excellent low-risk long entry.

If 25,902 breaks with momentum, downside expands to:

➡️ 25,860 → 25,820

📘 Educational Note:

Gap-downs into support often give the strongest reversal trades of the day — but only after confirmation.

💼 RISK MANAGEMENT TIPS FOR OPTION TRADERS 💡

Avoid trading the first 5–10 minutes after market opens.

Use ATM or ITM options for directional trades.

Define your stop loss BEFORE entering — never adjust it emotionally.

Avoid averaging in losing positions.

When VIX is low → option buying works better.

When VIX is high → prefer hedged option selling strategies.

Book partial profits — don’t wait for full target if momentum weakens.

⚠️ Golden Rule:

Your objective is to survive long enough to catch the big moves — protect your capital first.

📌 SUMMARY

Bullish above → 26,070

Target zone → 26,110 → 26,146 → 26,194 → 26,309

Bearish below → 25,964

Target zone → 25,902 → 25,860 → 25,820

Key No-Trade Areas:

— 26,036–26,070 (Flat opening zone)

— 26,150–26,194 (High-risk supply zone)

🧾 CONCLUSION

Nifty is trading near a heavy resistance cluster, and the market’s reaction to the 26,070 level will define the day’s trend.

The cleanest and safest trades will come from:

✔️ Breakout & retest above 26,070

✔️ Reversal from 25,964

✔️ Momentum breakout above 26,194

Avoid trading inside choppy zones and let the market reveal its direction.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst . This analysis is for educational purposes only . Please consult a certified financial advisor before making any trading or investment decisions.

NIFTY : Trading levels and Plan for 21-Nov-2025📊 NIFTY TRADING PLAN — 21 NOV 2025

(Reference: 15m chart structure & mapped zones)

Nifty closed around 26,197, right inside the Opening Support / Resistance Zone (26,152 – 26,216).

Price is consolidating after a strong uptrend, and the market is testing a critical decision zone before attempting either a breakout toward 26,300+ or a pullback toward intraday supports.

Here are the major actionable zones for 21 Nov 2025:

🟧 Opening Support / Resistance Zone: 26,152 – 26,216

🟥 Profit Booking Zone: 26,399 – 26,471

🟩 Opening Support (Gap-down case): 26,084

🟩 Last Intraday Support: 26,043

🟢 SCENARIO 1 — GAP-UP OPENING (100+ Points)

If Nifty opens around 26,260–26,320, price opens above the decision zone and heads closer to resistance.

If price sustains above 26,216 with strong volume →

🎯 Targets → 26,260 → 26,310 → 26,399

Once price enters the Profit Booking Zone (26,399 – 26,471), expect volatility & selling pressure.

💡 Safe to book profits in this region.

If gap-up gets rejected from 26,260–26,300, expect:

➡️ Pullback to 26,216 → 26,180

A bullish reversal at 26,180–26,216 gives a safe continuation long.

📘 Educational Note:

Gap-ups near major resistance can trap buyers. Always wait for confirmation (higher low or retest breakout) before entering.

🟧 SCENARIO 2 — FLAT OPENING (Near 26,150–26,210)

A flat opening places Nifty directly in the Opening Support / Resistance Zone (26,152–26,216) — a “no-direction” zone.

A breakout above 26,216 →

Targets → 26,260 → 26,310

A breakdown below 26,152 →

Targets → 26,120 → 26,084

Avoid trading between 26,152–26,216 until clear breakout or breakdown occurs.

Best trades will be:

✔️ Breakout → Retest → Long

✔️ Breakdown → Retest → Short

💡 Educational Tip:

Flat opens require patience — the first 15-minute candle usually sets the trend for the day.

🔻 SCENARIO 3 — GAP-DOWN OPENING (100+ Points)

A gap-down below 26,120 pushes Nifty toward the Opening Support (26,084) or lower.

If 26,084 holds with a wick-rejection →

Upside targets → 26,150 → 26,180 → 26,216

If price breaks below 26,084, next support:

➡️ 26,043 (Last Intraday Support)

A strong bounce from 26,043 can give an excellent low-risk long entry.

If 26,043 fails, next downside targets expand to:

➡️ 25,990 → 25,950

📘 Educational Note:

Gap-downs into support can reverse sharply — but only when confirmation (reversal candle + volume) is present.

💼 RISK MANAGEMENT TIPS FOR OPTION TRADERS 💡

Avoid trading the first 5–10 minutes if volatility is high.

Prefer ATM or slight ITM options for directional moves.

Always place SL based on structure — not based on emotional comfort.

Don’t average losing positions — trend can continue longer than expected.

Scalp profits quickly during sideways markets.

In high VIX environments → prefer spreads or hedged strategies.

Trail stop-loss if momentum breakout happens.

⚠️ Golden Rule:

Protecting capital > Catching every move. Consistency beats aggression.

📌 SUMMARY

Bullish above → 26,216

🎯 Targets → 26,260 → 26,310 → 26,399 → 26,471

Bearish below → 26,152**

🎯 Targets → 26,120 → 26,084 → 26,043

Key No-Trade Area:

— 26,152–26,216 (opening chop zone)

🧾 CONCLUSION

Nifty is at a decision zone, and the move away from the 26,152–26,216 range will guide the day’s trend.

The safest opportunities will occur from:

✔️ Breakout above 26,216 → Retest → Long

✔️ Reversal from 26,399–26,471 (for intraday short)

✔️ Bounce from 26,084 or 26,043 in gap-down scenarios

Stay patient at the open, trade with confirmation, and avoid the noisy zones.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is purely for educational purposes.

Please consult your financial advisor before taking any trades.

NIFTY KEY LEVELS FOR 12.11.2025NIFTY KEY LEVELS FOR 12.11.2025

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY KEY LEVELS FOR 04.11.2025NIFTY KEY LEVELS FOR 04.11.2025

Timeframe: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

NIFTY KEY LEVELS FOR 03.10.2025NIFTY KEY LEVELS FOR 03.10.2025

RTF: 3 Minutes

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

Nifty50 - Set to March towards 30KNifty is showing strong bullish momentum backed by multiple signals

Trendline Breakout from consolidation

Cup & Handle Formation indicating continuation

Three White Soldiers Candles

Reversal from Crucial Support near 24,300

Multi-Timeframe Alignment (Daily, 4H, Weekly)

Entry: 25,670

With strong confluence of bullish signals, Nifty50 looks set to march towards the 30K in Next 5-6 Months

Nifty Intraday Analysis, Key Levels & Trade Plan for 14 Aug 2025Good Morning Traders,

Yesterday, Nifty maintained a bullish tone throughout the session, respecting the upward support trendline and closing near the higher levels. Price action stayed above key psychological support zones, hinting at buying interest on dips. Resistance near the 24,660 area acted as a hurdle, and today’s session will decide whether bulls can take control for higher targets or sellers will step in at resistance.

Important Levels for Nifty (15-Minutes Timeframe):

Intraday Support Zone: 24,583 – 24,536

Intraday Resistance Zone: 24,659 – 24,735

Buy Setup:

Buy above 24,659 if the level sustains for at least 15 minutes .

Targets: 24,735 / 24,794

Stop Loss: 24,612

Sell Setup:

Sell below 24,583 if the level sustains for at least 15 minutes .

Targets: 24,536 / 24,485

Stop Loss: 24,650

Trend Bias: Neutral-to-bullish above 200 EMA; bearish bias if price sustains below it .

Note: Levels are for reference. When a trade setup forms, I will update it in the live market, stay tuned .

Disclaimer: This analysis is for educational purposes only. Please do your own research or consult a financial advisor before trading .

nifty1. if nifty touch raising channel resistance tomorrow then pattern will change then nifty is sideways to bullish in short-term .

2. if nifty touch resistance on 23 july then only we get perfect entry for short.

note: on 23 july we can see doji candle in daily .if not then wait.

tomorrow nifty is bullish. any day we see a doji candle above 25300. then we can sell on next day or on the same day after 3pm.

if you want to short on top then keep eye on 23 july. on 23 if touch rising channel resistance then we can short.

but,

on 23 nifty is sideways and form a doji candle in daily basis.

NIFTY : Trading plan and levels for 17-July-2025📊 NIFTY INTRADAY TRADING PLAN – 17-Jul-2025

200+ Points Gap Opening Considered Significant | Educational Structured Trading Plan

📍 KEY ZONES & LEVELS TO MONITOR

🟥 Opening Resistance Zone: 25,376 – 25,340

🔴 Last Intraday Resistance: 25,430

🟧 Opening Support Zone: 25,083 – 25,102

🟩 Last Intraday Support Zone: 24,932 – 24,970

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,376) 📈

If NIFTY opens above 25,376 with 100+ points gap-up, expect buyers to dominate initially, pushing towards 25,430 (Last Intraday Resistance) .

Avoid aggressive longs exactly at the open. Let the first 15-minute candle settle to confirm strength.

If price sustains above 25,430 with volume, look for further upside, but be mindful of exhaustion near round numbers.

Options Tip: Prefer ATM Call Options with tight stop-loss or Bull Call Spread to manage risk better.

📊 SCENARIO 2: FLAT OPENING (Between 25,102 – 25,376) ⚖️

This range marks the consolidation area between Opening Support and Opening Resistance Zone .

Price behavior here is crucial for intraday direction bias.

If price holds above 25,224.40 post-open, bias is slightly bullish towards the Resistance Zone.

If price breaks below 25,102 , sellers may drag it towards Last Intraday Support 24,932 – 24,970 .

Options Tip: Consider Iron Fly or Strangle setups if premiums are attractive. Be patient for breakouts.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,083) ⚠️

If NIFTY opens below 25,083 with 100+ points gap-down, expect weakness to persist.

Primary downside target becomes Last Intraday Support Zone: 24,932 – 24,970 .

Sell-on-rise strategy is preferred after 15-minute candle confirmation below 25,083 .

Options Tip: Focus on ATM or ITM Put Options or use Bear Put Spreads for safer execution.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

📏 Always risk only 1–2% of total capital per trade.

⏳ Avoid trades during the first 15–30 minutes to let volatility settle.

🔐 Respect Hourly Candle Close stops rather than reacting to wicks.

⚖️ Prefer Spreads and Hedged Strategies in highly volatile or uncertain conditions.

🚫 Avoid over-leveraging especially in expiry week or event-heavy days.

📌 SUMMARY & CONCLUSION

Bullish Bias: Gap-up above 25,376 → Target 25,430

Neutral Range: Between 25,102 – 25,376 → Wait for breakout confirmation

Bearish Bias: Gap-down below 25,083 → Target 24,932 – 24,970

Trade with a calm mindset, respecting the levels and waiting for candle confirmations to reduce false entries.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This plan is purely for educational and informational purposes. Always consult your financial advisor before making any investment decisions.

NIFT : INTRADAY TRADING PLAN – 15-Jul-2025📊 NIFTY 50 INTRADAY TRADING PLAN – 15-Jul-2025

Planned according to the provided chart, focusing on Gap Opening 100+ points scenarios

💡 Previous Close: 25,067.10

⏱️ Timeframe: 15-Min Chart

⚙️ Gap Opening Threshold: 100+ Points considered significant

📍 IMPORTANT LEVELS

🟥 Last Intraday Resistance: 25,340

🟥 Opening Resistance: 25,210

🟧 Opening Support Zone: 24,949 – 25,020

🟩 Last Intraday Support: 24,949

🟩 Buyer's Support: 24,774

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,210) 📈

If Nifty opens above 25,210 , it directly enters the resistance zone. Caution: Do not buy blindly on a gap-up as there is a risk of profit booking.

Wait for a 15-minute candle to close above 25,210 for confirmation. Post-confirmation, upside targets are 25,340 and possibly higher.

Failure to hold above 25,210 can lead to a quick reversal towards the Opening Support Zone 24,949 – 25,020 .

Options Tip: Prefer ITM CE options for momentum continuation. Avoid far OTM on gap-ups to manage theta decay risk.

📊 SCENARIO 2: FLAT OPENING (Between 25,020 – 25,210) 🔄

Flat openings near these levels suggest a balance between bulls and bears. Observe price behavior carefully in the first 15–30 minutes.

A sustained move above 25,210 opens room for bullish continuation up to 25,340 .

Failure to hold Opening Support 24,949 indicates weakness. Below this, prices can drift toward the Buyer's Support 24,774 .

Options Tip: Avoid buying options immediately after a flat open. Monitor structure. Focus on ATM Straddles/Strangles for premium selling if prices remain range-bound.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 24,949) ⚠️

Gap-down below 24,949 brings immediate focus on Buyer's Support 24,774 .

If this zone holds, look for reversal buying opportunities with stop-loss below 24,774 .

A breakdown below 24,774 may trigger a larger downside. Be conservative in this scenario; wait for retest/rejection candles.

Options Tip: IV spike expected. Prefer Bear Put Spreads instead of naked PEs to manage risk and avoid premium erosion on rebounds.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

Stick to maximum 1–2% risk of total capital per trade.

Always observe the first 15–30 minutes before trading aggressively.

Use ATM/ITM strikes to control theta decay.

Respect key support/resistance zones. Do not overtrade.

Avoid chasing prices; let the market confirm direction post-gap.

📌 SUMMARY & CONCLUSION

Bullish Zone: Above 25,210 → Target 25,340.

Range Zone: 25,020 – 25,210 → Watch for structure clarity.

Bearish Zone: Below 24,949 → Target 24,774.

Trade mindfully and focus on capital preservation before chasing profits.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is shared for educational purposes only. Please do your own research or consult a qualified financial advisor before trading.

NIFTY: Trading levels and plan for 11-Jul-2025📈 NIFTY INTRADAY PLAN – 11 JULY 2025 (15-min TF)

A level-based, educational breakdown to help traders plan trades across opening scenarios.

📍 Previous Close: 25,348.25

📊 Consider 100+ points for Gap classification

⏱️ Pro Tip: Allow first 15–30 mins of price action to settle and confirm direction before entering trades.

📌 KEY ZONES TO MONITOR

Resistance for Sideways: 25,574 – 25,605

Last Intraday Resistance: 25,506

Opening Resistance for Sideways: 25,439

Opening Resistance/Support Zone: 25,377

Opening Support Zone: 25,288 – 25,311

Buyer's Support Zone (Must Try Zone): 25,221 – 25,246

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,439)

Bias: Bullish but expect sideways to resistance at higher zones

If Nifty opens above 25,439 , it may retest the Last Intraday Resistance: 25,506 quickly.

Sustainable strength above this level can lead to the upper resistance zone between 25,574 – 25,605 , where profit booking is expected.

Avoid fresh CE buying if prices reach the top resistance zone too quickly after open – wait for price cooling or consolidation.

On sharp gap-up days, wait for a pullback to 25,439 to see if it acts as support before continuing higher.

📊 SCENARIO 2: FLAT OPENING (Near 25,348 – 25,377)

Bias: Neutral-to-bearish depending on early structure

If Nifty opens flat between 25,348 – 25,377 , it may face immediate selling pressure.

Support lies around 25,288 – 25,311 ; bulls will try to defend this zone.

Breakdown below this zone can trigger a drift toward Buyer’s Support Zone: 25,221 – 25,246 , which is ideal for reversal trades.

Look for strong reversal candles like hammer or engulfing patterns at buyer's zone to take call side trades.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,288)

Bias: Bearish with potential buy-on-dip opportunities

If Nifty opens below 25,288 , initial support comes in the Buyer’s Support Zone: 25,221 – 25,246 .

Watch for price reaction here – if bulls defend this zone, expect a sharp bounce-back move.

If this zone is breached with volume, don’t force counter-trades – wait for re-entry signals above 25,246 again.

On the bounce, target toward 25,311 – 25,377, but trail stop as we approach resistance.

💡 OPTIONS TRADING – RISK MANAGEMENT TIPS

Use ATM or ITM options to reduce the impact of time decay, especially in sideways zones.

Avoid trading aggressively in the first 5-minute candle — let price structure settle.

Stick to 15-min candle SL closing logic to reduce false stop-outs.

Avoid buying both CE & PE (straddle) blindly on volatile days — pick a side with confirmation.

If VIX is high, consider hedged strategies like spreads.

Secure profits early after 2:30 PM – avoid fresh entries late unless very high conviction.

📌 SUMMARY & CONCLUSION

Bullish Pathway: Above 25,439 with target toward 25,605

Neutral Zone: 25,348 – 25,377 (watch for confirmation)

Bearish Trigger: Below 25,288, eyes on reversal from 25,221 – 25,246

Observe volume, candle structure, and overall market tone to validate bias

Discipline and execution with risk control are more important than direction

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Please consult your financial advisor before taking trades.

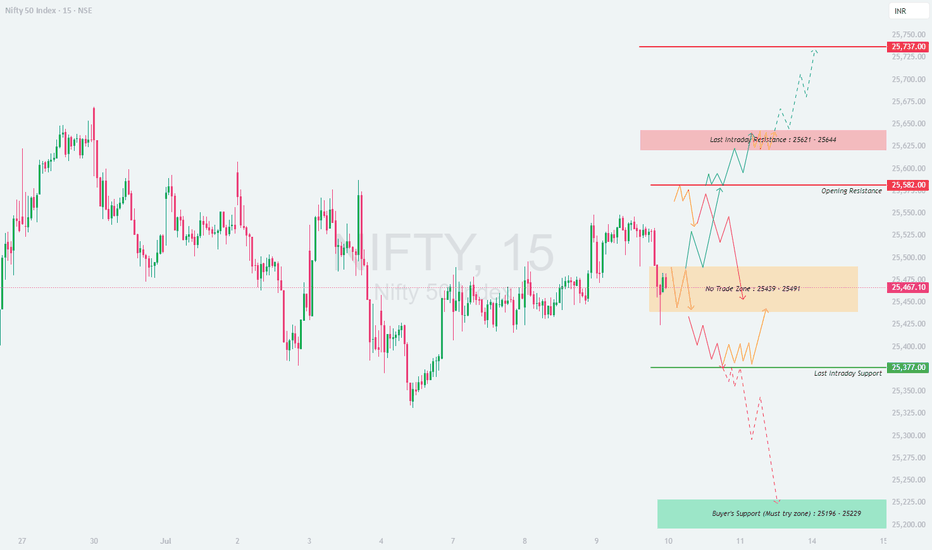

NIFTY : Trading levels and plan for 10-Jul-2025📊 NIFTY INTRADAY PLAN – 10 JULY 2025 (15min TF)

Educational setup with key intraday levels and directional bias – Based on price behavior and reaction zones

📍 Reference Close: 25,467.10

📈 Consider Gap-up or Gap-down if the opening is 100+ points away from this close.

⏱️ Allow the first 15–30 minutes for volatility to settle before taking directional trades.

🔍 KEY LEVELS TO MONITOR

Opening Resistance: 25,582

Last Intraday Resistance: 25,621 – 25,644

No Trade Zone: 25,439 – 25,491

Last Intraday Support: 25,377

Buyer’s Support (Must Try Zone): 25,196 – 25,229

Major Resistance (Profit Booking Zone): 25,737

📈 SCENARIO 1: GAP-UP OPENING (Above 25,582)

Bias: Bullish to Consolidation at upper resistance

If Nifty opens 100+ points higher and sustains above 25,582 , upside may extend to 25,621–25,644 zone.

Watch for rejection candles or indecision near 25,644 – this is a potential supply zone.

If bullish momentum is strong, price may hit 25,737 , but caution near that level for profit booking.

Shorts only if strong reversal seen at resistance with volume and price failing to hold above 25,621.

📊 SCENARIO 2: FLAT OPENING (Within 25,439 – 25,491 – the No Trade Zone)

Bias: Wait & Watch – Let the market show its hand

Flat openings inside the No Trade Zone (25,439–25,491) often lead to whipsaws and indecisive moves.

Avoid taking trades inside this zone unless price breaks out or breaks down with strength.

Upside breakout above 25,491 should retest 25,582; downside breakdown below 25,439 may lead to support testing at 25,377.

Best strategy is to wait for directional clarity before entering trades.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,377)

Bias: Bearish to Neutral – Watch for demand reaction

A 100+ point gap-down opening below 25,377 will take price closer to Buyer’s Support Zone (25,196–25,229) .

Observe buyer activity in this green zone – a bullish engulfing or hammer can provide bounce trades.

Avoid fresh shorts in this area unless there’s a breakdown below 25,195 with volume.

Any recovery from this support can revisit 25,377 or even test No Trade Zone.

💡 OPTIONS RISK MANAGEMENT TIPS:

Avoid directional trades in the first 15 minutes of the market

Don’t trade blindly inside No Trade Zones – wait for breakout confirmation

Use spreads (Bull Call/Bear Put) instead of naked options in choppy markets

Avoid overleveraging, especially around volatile zones like 25,582 and 25,196

Respect time decay – avoid buying weekly options post 2 PM unless clear momentum

Use strict SL (based on 15min candle close) to control emotional trades

📌 SUMMARY – KEY TAKEAWAYS

Bullish above 25,582 – but resistance ahead at 25,644–25,737

Sideways in 25,439–25,491 – best to stay out

Bearish or bounce watch below 25,377 – strong support at 25,196–25,229

Plan the trade, and trade the plan. React, don’t predict.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. All views shared here are for educational purposes only. Please consult your financial advisor before making any trading decisions.

NIFTY : Trading levels and plan for 27-Jun-2025📊 NIFTY TRADING PLAN – 27-Jun-2025

📍 Previous Close: 25,530

📏 Gap Opening Reference: ±100 points

🕓 Chart Timeframe: 15-Min

🧠 Approach: Actionable plan based on reaction zones + trend-following confirmation

🚀 GAP-UP OPENING (Above 25,690):

A 100+ point gap-up above 25,690 takes Nifty straight into the Opening and Last Resistance Zone — a zone marked for possible exhaustion, where further upside needs strong momentum or risk of rejection increases.

✅ Plan of Action:

• Watch early 15-min candle — strength above 25,690 = bullish extension

• A rejection with long upper wick may signal reversal

• If breakout sustains → New intraday high potential

🎯 Trade Setup:

– Long above 25,690 (on candle close)

– Target: 25,800+

– SL: Below 25,650

– Avoid shorting aggressively unless clean rejection observed

📘 Tip: Always wait for a breakout retest before jumping into longs in such extended zones. Avoid chasing in the first 5 mins.

⚖️ FLAT OPENING (Between 25,530 – 25,474):

A flat open will place Nifty just below the upper resistance. Volatility may expand in either direction from here, so patience is key.

✅ Plan of Action:

• First 15–30 mins are crucial for market direction

• If Nifty crosses 25,690 → breakout trade setup

• If it fails and comes back below 25,474 → shorting opportunity toward support zone

🎯 Trade Setup Options:

– Long above 25,690 (with volume)

– Short below 25,474 (weakness confirmation)

– Targets: 25,690 (upside) | 25,404 (downside)

– SL: Based on 15-min close above/below key level

📘 Tip: This zone demands trader discipline — don’t be early in either direction. Let the chart structure develop.

📉 GAP-DOWN OPENING (Below 25,404):

Nifty opening below 25,404 shifts the focus to the Opening Support Zone (25,404–25,356) and if broken, to the Major Support for Trend Reversal (25,239) . This creates a clean downside structure if sellers take control.

✅ Plan of Action:

• If Nifty holds within 25,356–25,404 zone and shows reversal signs → possible bounce

• Breakdown below 25,239 → could trigger trend reversal toward deeper supports

🎯 Trade Setup:

– Short below 25,356 with confirmation

– Target: 25,239 → 25,100

– Long only if bullish structure holds within support zone

– SL: Above 25,404 (for shorts)

📘 Tip: Avoid averaging down. If price bounces near 25,239, wait for reversal signal to confirm buyer interest.

📌 KEY ZONES TO TRACK:

🔴 Resistance Zone: 25,690 (Last Resistance — potential exhaustion)

🟧 Opening Support Zone: 25,404 – 25,356

🟩 Trend Reversal Support: 25,239

💡 OPTIONS TRADING & RISK MANAGEMENT TIPS:

✅ Use Vertical Spreads (Bull Call / Bear Put) in directional setups to reduce premium risk

✅ Avoid trading in overlapping zones unless a clear breakout occurs

✅ Don’t hold naked options near expiry without clear trend — use spreads

✅ Protect your capital : Never risk more than 1.5–2% of total capital per trade

✅ SL must always be respected based on candle close

✅ Keep tracking OI shifts and IV spikes — adjust strikes if momentum fades

🔍 SUMMARY:

• 🔼 Bullish Above: 25,690 → Scope for new high

• ⚠️ Flat Opening Zone: 25,530 – 25,474 → Wait and watch

• 🔽 Bearish Below: 25,404 → Breakdown may extend

• 🛑 Trend Shift Point: 25,239 — strong support, if breached = caution

⚠️ DISCLAIMER:

I am not a SEBI-registered advisor. This plan is purely for educational purposes. Please consult your financial advisor before acting on any trade ideas. Always use proper position sizing, stop-loss, and risk controls to protect your capital.

NIFTY : Trading levels and Plan for 25-Jun-2025\ 📊 NIFTY TRADING PLAN – 25-Jun-2025\

📍 \ Previous Close:\ 25,071.55

📏 \ Gap Opening Consideration:\ ±100 Points

🕒 \ Time Frame Analyzed:\ 5-Min Chart

📦 \ Volume Check:\ 9.16M (aiding intraday trend confirmation)

---

\

\ \ 🚀 GAP-UP OPENING (Above 25,148):\

If Nifty opens above the \ Opening Resistance Zone (25,128 – 25,158)\ , it immediately faces \ Last Intraday Resistance\ at \ 25,248\ . Sustained buying above this level may push prices toward the \ Profit Booking / Consolidation Zone (25,356 – 25,401)\ .

✅ \ Plan of Action:\

• Avoid jumping in at open — let first 15–30 minutes settle the tone

• Breakout above 25,248 = clear bullish structure

• Watch for profit booking at 25,356–25,401

🎯 \ Trade Setup:\

– Long above 25,248 with volume confirmation

– Target: 25,356 → 25,401

– SL: Below 25,158

– Short only if rejection seen near 25,248–25,356

📘 \ Pro Tip:\ Book partial profits at 1st target and trail rest.

\ \ ⚖️ FLAT OPENING (Between 25,012 – 25,128):\

This is a reaction zone where Nifty may oscillate inside the \ Opening Resistance/Support Band\ . Directional clarity may only come post breakout from this zone.

✅ \ Plan of Action:\

• Avoid early trades inside 25,012–25,128 zone

• Break above 25,128 = upside momentum

• Breakdown below 25,012 = weakness

🎯 \ Trade Setup:\

– Long above 25,128 (strong bullish candle)

– Short below 25,012 (bearish breakdown confirmation)

– SL: 30–40 pts from entry depending on volatility

– Prefer confirmation candle with decent volume

📘 \ Pro Tip:\ Stay flexible — it may be a sideways trap if no breakout happens in the first 45 mins.

\ \ 📉 GAP-DOWN OPENING (Below 24,912):\

Gap-downs below \ Opening Support (25,012)\ could test the critical \ Buyer’s Support for Sideways Zone – 24,852 to 24,905\ . This is a make-or-break area for the bulls.

✅ \ Plan of Action:\

• Observe price behavior near 24,852

• Reversal from here offers intraday long opportunity

• Breakdown confirms bearish pressure

🎯 \ Trade Setup:\

– Long near 24,852 (if bullish candle forms)

– Short below 24,852 (breakdown scenario)

– Target: 24,780 / 24,720

– SL: Above 25,012 for shorts, below 24,830 for longs

📘 \ Pro Tip:\ This is where "smart money" often plays — watch candle structure, not emotions.

---

\ 💡 OPTIONS TRADING – RISK MANAGEMENT TIPS:\

✅ \ 1. Avoid buying options near expiry without confirmation; theta will eat premiums fast.\

✅ \ 2. Use spreads (like bull call or bear put) in choppy markets.\

✅ \ 3. Always use Stop Loss based on structure — not emotions or PnL.\

✅ \ 4. Keep risk per trade below 2% of capital.\

✅ \ 5. Use 15-min chart candle closing to exit on SL breach.\

---

\ 📌 SUMMARY – LEVELS TO MONITOR:\

🟥 \ Last Intraday Resistance:\ 25,248

🟧 \ Opening Resistance/Support:\ 25,128 – 25,158

🟩 \ Opening Support:\ 25,012

🟦 \ Sideways Support Zone:\ 24,852 – 24,905

🟫 \ Breakdown Confirmation Target:\ Below 24,852 → 24,780

---

\ 🎯 CONCLUSION:\

• 🔼 \ Bullish Bias:\ Only above 25,248 with strength

• ⏸️ \ Sideways Bias:\ 25,012–25,128 — avoid unless breakout confirmed

• 🔽 \ Bearish Bias:\ Below 25,012 → Eyes on 24,852

\ ⚖️ Discipline + Risk Management > Prediction!\ Stay aligned with price structure and manage your capital smartly. 💰🧠📉

---

\ ⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This analysis is purely educational and intended to assist in structured thinking. Please consult your financial advisor before acting on any trading decisions. Always apply strict stop-loss and position sizing.