OLA

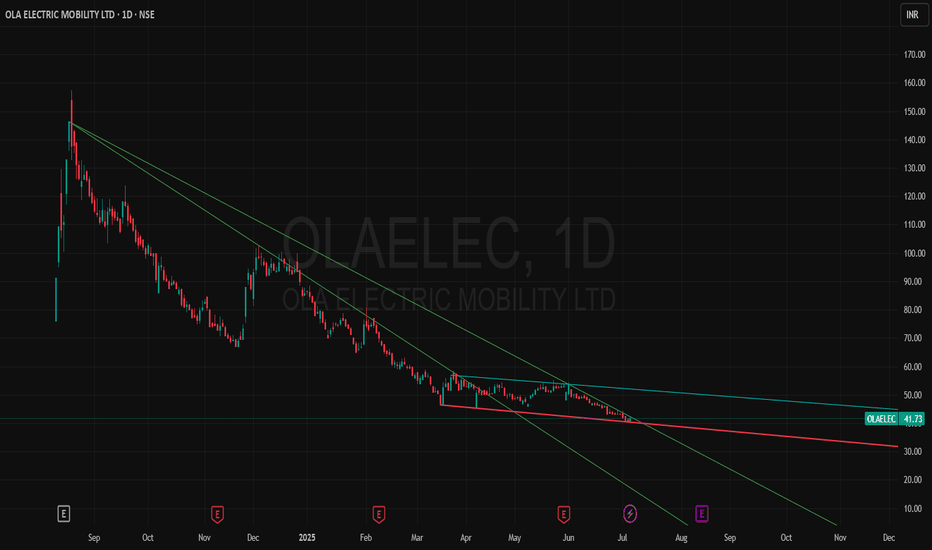

Potential 30% Upside on OLA – Breakout from Downtrend📈 Analysis Overview:

After an extended downtrend, OLA has finally broken out of the descending resistance line with strong bullish momentum. Price action has respected the major support zone around ₹39.69, which has acted as a key demand area in the past.

✅ Key Levels to Watch:

Support: ₹39.69 (strong base)

Intermediate Resistance: ₹45.44 (current retest area)

Targets: ₹54.80 and ₹58.36

Potential Upside: ~31% from current levels

📊 Trade Plan:

Entry Zone: Around current price action, ideally after a minor pullback/retest of the breakout trendline.

First Target: ₹54.80

Final Target: ₹58.36

Stop Loss: Below ₹39.00 to maintain good risk-reward

📈 Rationale:

Clear breakout after prolonged selling pressure

Strong support confirmation near ₹39.69

Volume expansion signals possible accumulation phase

Technical projection shows a potential ~30% upside within the next 3–4 weeks

📝 Note:

This is a swing trade idea based on technical structure. Always manage risk and adapt to market conditions.

"All-electric Future. From India. For the world."Ola Electric Mobility Ltd

About

Founded in 2017, Ola Electric Mobility Limited is an electric vehicle company that primarily manufactures electric vehicles and core components for electric vehicles. These components include battery packs, motors, and vehicle frames, all produced at the Ola Futurefactory.

Key Points

Market Leadership Co. is the largest E-Scooter Manufacturing company in India, with 31% market share in the E2W sector, selling 329,618 scooters in FY24.

Product Portfolio

1. Ola S1 Pro: A premium scooter with a 195 km range, 120 kph top speed, and a 7-inch touchscreen.

2. Ola S1 Air: Offers a 151 km range, 6 kW motor power, and a 7-inch touchscreen.

3. Ola S1 X+: A budget-friendly model with a 151 km range, keyless unlock, and a 5-inch display.

4. Ola S1 X: Mass-market scooters with up to 190 km range, available in 2 kWh, 3 kWh, and 4 kWh battery options, with a 3.5-inch display.

⚡ Ola Electric – Early Signs of Revival?

CMP: ₹41.73 | View: High-Risk Accumulation | Timeframe: Daily Chart | Sector: EV

🛵 Technical View:

Ola Electric has been in a steady downtrend since its listing but now showing signs of base formation near ₹40.

MACD on multiple settings is flattening and attempting crossover.

RSI has bounced from oversold zones and moving upward.

ADX/DMI showing reduction in negative strength – trend reversal possible.

Ichimoku cloud flattening – early signal for sideways to positive shift.

🔹 Key Price Levels:

🔸Support: ₹38.5 – ₹40

🔸Breakout Zone: ₹44.5 – ₹47

🔸Resistance: ₹51.5 / ₹60

📊 Volume:

Gradual rise in volumes with sideways consolidation. First green daily candle after long lower highs.

🔍 Fundamentals & Progress:

From Screener:

Not yet profitable, but business is capital-intensive and scaling.

Valuations currently not attractive, but price is near listing lows, making risk-reward favorable for high-risk investors.

🚀 Company Developments:

✅ Ola is rapidly expanding its EV scooter sales & showroom network

✅ Ola official site: Announced upcoming electric motorcycles and focus on battery innovation

✅ Government push for EV adoption will benefit Ola long-term

✅ Founder Bhavish Aggarwal aims to build an EV ecosystem (batteries + charging infra + vehicles)

🧠 Why Watch This Stock?

Sentiment may shift as markets look for beaten-down growth stories

Ola has brand recall, scale, and distribution

Any positive update (sales, production ramp-up, JV) can trigger a move

⚠️ Disclaimer:

This is a high-risk idea, suitable only for long-term investors or speculators with risk appetite. Not a recommendation. Do your own research.

📝 Note: Please do your own due diligence. This is not a recommendation, just a view based on charts and fundamentals.

🧠 Disclaimer: For educational and research purposes only. No buy/sell advice.

📝 Chart Purpose & Disclaimer:

This chart is shared purely for educational and personal tracking purposes. I use this space to record my views and improve decision-making over time.

Investment Style:

All stocks posted are for long-term investment or minimum positional trades only. No intraday or speculative trades are intended.

⚠️ Disclaimer:

I am not a SEBI registered advisor. These are not buy/sell recommendations. Please consult a qualified financial advisor before taking any investment decision. I do not take responsibility for any profit or loss incurred based on this content.

OLA - No Support yet. could fall further only as per chartAfter IPO listing, I suggested few to book profits and exit and OLA will see lower price. But few said IPO is for long term investment and not just for listing gains. chart is showing the lower price now. Reason is OLA has seen new competition, and many companies entered the same business. Its very simple logic. Moreover, OLA having so many customer complaints and going rounds in social media

Ola Electric Breaks Out at 75, Targeting 160Details:

Asset: Ola Electric (Ola Electric Mobility Private Limited)

Breakout Level: 75

Current Level: Near 90

Potential Target: 160

Stop Loss: Below 75 or as per risk management

Timeframe: Medium to long-term

Rationale: Ola Electric has experienced a fresh breakout at 75, and its price momentum suggests strong upward potential. Currently nearing 90, the stock could reach 160 in the medium to long term if it sustains this bullish trend.

Market Analysis:

Technical Setup: The breakout above 75 with strong follow-through volume indicates bullish sentiment, setting the stage for significant upward movement.

Industry Tailwinds: Growing interest in electric vehicles and supportive government policies enhance the attractiveness of Ola Electric as a key player in the EV sector.

Price Target:

Short-term: 90 (already reached)

Medium to Long-term: 160

Risk Management:

A stop loss below 75 is advised to protect against potential reversals.

Timeframe:

The move toward 160 is expected in the medium to long term, depending on market sentiment and company performance.

Risk-Reward Ratio:

The current setup presents a favorable risk-reward ratio, with clear breakout levels and strong growth potential driven by the EV market boom.

Monitor price movements and volume for sustained momentum while keeping an eye on macroeconomic and industry-specific developments affecting the EV sector.

SENSEX Levels // 2 Hours

Hello Everyone 👋

Support Levels:

First Support: 80,950

Second Support: 80,700

Third Support: 80,450

Resistance Levels:

First Resistance: 81,200

Second Resistance: 81,450

Third Resistance: 81,700

These levels are derived from technical analysis and can help identify potential entry and exit points for trading