Optionsstrategies

Derivatives and Options TradingWhat Are Derivatives?

A derivative is a financial contract whose value is derived from an underlying asset. The underlying asset can be:

Stocks

Bonds

Commodities (gold, oil, wheat)

Currencies

Interest rates

Market indexes (like the S&P 500 or Nifty 50)

In simple terms, a derivative does not have independent value; its price depends on the value of something else.

Common Types of Derivatives

Futures Contracts

Options Contracts

Forwards Contracts

Swaps

Among these, futures and options are the most actively traded on exchanges.

Purpose of Derivatives

Derivatives serve three main purposes:

1. Hedging (Risk Management)

Hedging is used to reduce or eliminate financial risk. For example, a farmer expecting to harvest wheat in three months may use a futures contract to lock in a selling price today. This protects against the risk of falling prices.

Similarly, investors use options to protect stock portfolios from market downturns.

2. Speculation

Speculators use derivatives to profit from price movements. Because derivatives often require a smaller initial investment (called margin or premium), they provide leverage, allowing traders to control large positions with less capital.

However, leverage increases both potential profits and potential losses.

3. Arbitrage

Arbitrage involves exploiting price differences between markets. Traders buy an asset in one market and sell it in another where the price is higher, locking in a risk-free profit.

Understanding Options

An option is a type of derivative contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a specific date.

There are two main types of options:

Call Option

Put Option

Call Option

A call option gives the buyer the right to buy an asset at a fixed price (called the strike price) before expiration.

Example:

Stock price: $100

Call option strike price: $105

Expiration: 1 month

If the stock rises to $120, the call option becomes valuable because the buyer can purchase at $105 and potentially sell at $120.

If the stock stays below $105, the option may expire worthless.

Put Option

A put option gives the buyer the right to sell an asset at a fixed price before expiration.

Example:

Stock price: $100

Put strike price: $95

If the stock falls to $70, the put increases in value because the holder can sell at $95 instead of the market price of $70.

If the stock stays above $95, the option may expire worthless.

Key Components of an Option

1. Strike Price

The predetermined price at which the asset can be bought or sold.

2. Expiration Date

The date on which the option contract expires.

3. Premium

The price paid to buy the option. This is the maximum loss for the buyer.

4. Intrinsic Value

The real value if exercised immediately.

5. Time Value

The extra value based on time remaining before expiration.

Option Buyers vs Option Sellers

Option Buyer (Holder)

Pays the premium

Has limited risk (loss = premium paid)

Has unlimited profit potential (for calls)

Option Seller (Writer)

Receives the premium

Has limited profit (premium received)

May face large or unlimited losses

Selling options can be riskier than buying them.

In-the-Money, At-the-Money, Out-of-the-Money

In-the-Money (ITM)

Call: Stock price > Strike price

Put: Stock price < Strike price

At-the-Money (ATM)

Stock price = Strike price

Out-of-the-Money (OTM)

Call: Stock price < Strike price

Put: Stock price > Strike price

Leverage in Options Trading

Options provide leverage because traders control large positions with smaller investments.

Example:

Buying 100 shares at $100 = $10,000 investment

Buying one call option might cost $300

If the stock rises significantly, the percentage return on the option can be much higher than owning the stock directly.

However, if the stock does not move as expected, the option can expire worthless.

Risks in Derivatives and Options Trading

While derivatives provide opportunities, they also involve risks:

1. Market Risk

Price movements can lead to losses.

2. Time Decay (Theta)

Options lose value as expiration approaches.

3. Volatility Risk

Changes in volatility affect option prices.

4. Leverage Risk

Losses can be magnified.

5. Liquidity Risk

Some contracts may be difficult to buy or sell.

Option Pricing Basics

Option prices are influenced by:

Current stock price

Strike price

Time until expiration

Volatility

Interest rates

The Black-Scholes model is commonly used to estimate theoretical option prices.

Popular Options Strategies

Traders use different strategies depending on their outlook.

1. Covered Call

Holding a stock and selling a call against it to earn income.

2. Protective Put

Buying a put to protect a stock position.

3. Straddle

Buying both a call and a put at the same strike price to profit from large moves in either direction.

4. Spread Strategies

Combining multiple options to reduce risk.

Futures vs Options

Feature Futures Options

Obligation Both parties obligated Buyer has right, not obligation

Risk Can be unlimited Buyer risk limited to premium

Upfront Cost Margin required Premium paid

Complexity Moderate More complex

Exchange-Traded vs OTC Derivatives

Exchange-Traded Derivatives

Standardized contracts

Regulated exchanges

Lower counterparty risk

Over-the-Counter (OTC)

Customized contracts

Private agreements

Higher counterparty risk

Importance in Financial Markets

Derivatives increase:

Market efficiency

Price discovery

Liquidity

Risk management capabilities

However, misuse or excessive speculation can cause instability, as seen during the 2008 financial crisis involving complex derivatives like credit default swaps.

Who Uses Derivatives?

Individual traders

Hedge funds

Banks

Corporations

Institutional investors

For example, airlines hedge fuel costs using oil futures, and multinational companies hedge currency risk using forex derivatives.

Conclusion

Derivatives and options trading are powerful financial tools that allow market participants to hedge risk, speculate on price movements, and enhance portfolio returns. Options, in particular, offer flexibility because they provide the right—but not the obligation—to buy or sell an asset at a fixed price.

However, these instruments involve complexity and significant risk, especially due to leverage and time decay. Successful derivatives trading requires strong knowledge, risk management, and disciplined strategy.

In summary, derivatives and options are essential parts of global financial markets. When used wisely, they can reduce risk and create opportunities. When misused, they can lead to substantial financial losses. Understanding their structure, purpose, and risks is the foundation for participating safely and effectively in derivatives markets.

Option Selling Strategies – Complete Guide1. Introduction to Option Selling

Option selling, also known as option writing, is a strategy where a trader sells (writes) options to earn premium income. Unlike option buyers, who need a strong price move to profit, option sellers benefit when the market moves sideways, slowly trends, or even slightly moves against them.

In option selling, time decay (Theta) works in your favor. Every passing day reduces the option’s value, allowing sellers to profit even if price does nothing.

However, option selling involves high risk if not managed properly, which is why it is considered a professional strategy, best used with strict risk management.

2. Why Traders Prefer Option Selling

Most professional traders prefer option selling because:

• Higher probability of profit (60–80%)

• Income generation through time decay

• Works best in range-bound markets

• Consistent returns if risk is controlled

Statistically, options expire worthless most of the time, which benefits sellers.

But remember:

Option selling gives small, consistent profits but can lead to large losses if risk is ignored.

3. Key Concepts Every Option Seller Must Know

Before strategies, you must understand:

a) Time Decay (Theta)

Time decay accelerates in the last 2–3 weeks before expiry. Sellers earn as option value melts daily.

b) Implied Volatility (IV)

• Sell options when IV is high

• Avoid selling when IV is extremely low

High IV means higher premium.

c) Margin Requirement

Option selling requires large margin, especially naked selling.

d) Risk Management

Never sell options without a hedge unless you’re highly experienced.

4. Popular Option Selling Strategies

4.1 Short Call (Naked Call Selling)

Market View: Bearish or sideways

Instrument: Sell Call option

How it Works:

You sell a call option expecting the price to stay below the strike price.

Example:

NIFTY at 22,000

Sell 22,200 CE

If NIFTY stays below 22,200 → profit = premium received.

Pros:

• High probability

• Fast premium decay

Cons:

• Unlimited loss if market rallies

• Requires high margin

👉 Best for experienced traders only.

4.2 Short Put (Naked Put Selling)

Market View: Bullish or sideways

Instrument: Sell Put option

How it Works:

You sell a put option expecting the price to stay above the strike price.

Example:

NIFTY at 22,000

Sell 21,800 PE

If NIFTY stays above 21,800 → profit = premium.

Pros:

• Works well in rising markets

• Time decay advantage

Cons:

• Large downside risk

• High margin requirement

4.3 Covered Call Strategy

Market View: Mildly bullish or sideways

Risk Level: Low

How it Works:

You hold shares and sell a call option against them.

Example:

You own 100 shares of RELIANCE

Sell OTM call option

You earn:

• Option premium

• Dividends (if any)

Pros:

• Limited risk

• Extra income on holdings

Cons:

• Upside capped

👉 Very popular among long-term investors.

4.4 Cash Secured Put

Market View: Bullish

Risk Level: Medium

How it Works:

You sell a put while keeping enough cash to buy shares if assigned.

Example:

Sell TCS 3,600 PE

Keep funds ready to buy TCS if assigned.

Pros:

• Safe way to enter stocks

• Premium reduces buying cost

Cons:

• Capital intensive

4.5 Bear Call Spread (Call Credit Spread)

Market View: Bearish or sideways

Risk Level: Limited

How it Works:

• Sell lower strike call

• Buy higher strike call

Example:

Sell 22,200 CE

Buy 22,400 CE

Pros:

• Limited loss

• Lower margin

• Ideal for beginners

Cons:

• Limited profit

4.6 Bull Put Spread (Put Credit Spread)

Market View: Bullish or sideways

Risk Level: Limited

How it Works:

• Sell higher strike put

• Buy lower strike put

Example:

Sell 21,800 PE

Buy 21,600 PE

Pros:

• Defined risk

• Works well in trending markets

4.7 Iron Condor

Market View: Range-bound

Risk Level: Limited

Structure:

• Sell OTM Call

• Buy further OTM Call

• Sell OTM Put

• Buy further OTM Put

Profit Zone:

Price must stay within a defined range.

Pros:

• High probability

• Risk limited

• Stable income strategy

Cons:

• Small profit

• Needs adjustment if breakout occurs

4.8 Iron Butterfly

Market View: Very low volatility

Profit: Maximum at ATM

This is an advanced strategy where both call and put are sold at ATM.

5. Best Time to Use Option Selling

✔ When market is range-bound

✔ When IV is high

✔ During weekly expiry

✔ After major news events

Avoid selling before:

❌ Budget

❌ RBI policy

❌ Global events

6. Risk Management Rules for Option Sellers

This is the most important section.

Golden Rules:

Always define max loss

Use stop-loss

Prefer hedged strategies

Avoid over-trading

Risk only 1–2% capital per trade

Exit early if target achieved

Never sell options emotionally

7. Psychology of Option Selling

Option selling tests patience and discipline.

• Small daily profits feel easy

• One bad trade can wipe weeks of gains

• Overconfidence is dangerous

Successful option sellers:

✔ Follow system

✔ Accept small losses

✔ Think in probabilities

8. Conclusion

Option selling is one of the most powerful ways to generate consistent income in the stock market when done correctly. It suits traders who understand probability, volatility, and risk management.

For beginners, start with:

• Credit spreads

• Covered calls

• Iron Condors

Avoid naked selling until you gain experience.

Remember:

Option selling is not about predicting the market, but managing risk while letting time work for you.

Part 3 Institutional Option Trading Vs. Technical Analysis What Are Options?

Options are derivative contracts whose value is derived from an underlying asset like index (Nifty, Bank Nifty), stocks, commodities, currencies, etc.

They give you the right, but not the obligation, to buy or sell the underlying at a fixed price before a specific date.

Options are mainly of two types:

Call Option (CE): Right to BUY

Put Option (PE): Right to SELL

They are widely used by traders for hedging, speculation, income generation, and risk management.

INDUSINDBK | Weekly Bullish Options Setup | 27 Jan ExpiryTrade Structure (Text Format)

• Sell 960 PE

• Buy 940 PE

• Defined-risk Bull Put Spread

NSE:INDUSINDBK

Why this setup works

INDUSINDBK is holding above the short-term support zone around 950 after a strong bounce. Price is trading above key moving averages, momentum is improving, and RSI is comfortably above the mid-zone.

Put-side OI is building near 950–960, suggesting strong downside support. With IV elevated, selling puts via a spread offers attractive risk-reward with defined downside.

View

Moderately bullish — expecting INDUSINDBK to stay above 950 and trend sideways to higher over the week.

This post is for education only. It’s not financial advice or a recommendation to trade.

#WeeklyOptions #BullishSetup #BullPutSpread #INDUSINDBK #BankNiftyStocks #NSEOptions #OptionsTradingIndia #PriceAction

CIPLA | Weekly Bearish Options Setup | 27 Jan ExpiryTrade Structure (Text Format)

• Sell 1400 CE

• Buy 1420 CE

• Defined-risk Bear Call Spread

NSE:CIPLA

Why this setup works

CIPLA is trading below the short-term trend with price failing to sustain above the 1400 zone. The recent bounce has been sold into, RSI remains weak below the mid-line, and momentum continues to fade.

Call-side OI is building around the 1400 strike, indicating strong overhead supply. With IV holding steady, call spreads offer a favourable risk-defined way to express a bearish-to-neutral view.

View

Moderately bearish — expecting CIPLA to stay below 1400 and drift sideways to lower over the week.

This post is for education only. It’s not financial advice or a recommendation to trade.

#WeeklyOptions #BearishSetup #BearCallSpread #CIPLA #NSEOptions #OptionsTradingIndia #PriceAction #StockMarketIndia #RMInvestech

Eternal Ltd – Sell Into Strength, Buy Only After Structure Conf

• CMP: ₹299.25

• Recent bounce is corrective, not impulsive — price still trading inside a broader downtrend

• Rally is running into supply near the 200 EMA / breakdown zone (~₹300–310)

• Volume expansion looks like short covering, not fresh accumulation

• This move lacks follow-through characteristics of a true trend reversal

🎯 Trade Logic

• Sell / Avoid longs into ₹300–310 zone — supply likely to cap upside

• Buy planning only if:

– Price pushes toward ₹310

– Then retraces and stabilizes in ₹305–300 range

📍 Planned Long Setup (Only on Retest):

• Entry Zone: ₹305–300

• Stop-Loss: ₹295

• Structure-based entry, not momentum chasing

💡 What most see as “breakout energy” still reads like distribution to me. I’d rather pay higher for confirmation than get early into a weak structure.

#Eternal #TradePlanning #PriceAction #RiskFirst #NSEStocks #MarketStructure #TradingView

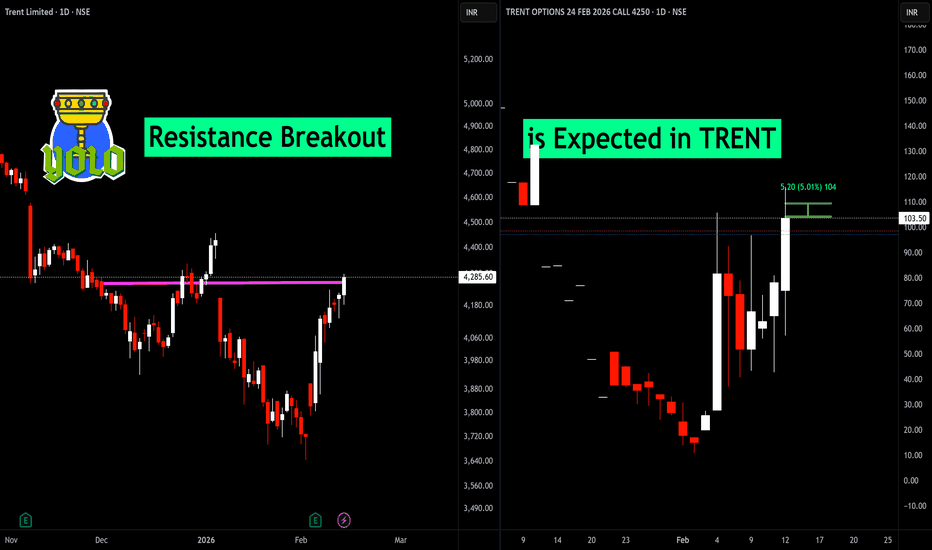

BUY TODAY SELL TOMORROW for 5% - BTST STOCK OPTIONDON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST Stock Option trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

-Resistance Breakout in ASIANPAINT

BUY TODAY, SELL TOMORROW for 5%

O

JUBLFOOD | Weekly Bearish Options Setup | 27 Jan ExpiryTrade Structure (Text Format)

• Sell 515 PE

• Buy 525 PE

• Defined-risk Bear Put Spread

Why this setup works NSE:JUBLFOOD

JUBLFOOD is trading below key short-term averages with price struggling to hold above the 520 zone. Momentum remains weak, RSI is slipping below the mid-band, and every bounce is facing selling pressure.

Put-side OI is shifting lower, suggesting downside risk remains open. With decent IV, debit spreads offer controlled risk for a directional bearish view.

View

Moderately bearish — expecting JUBLFOOD to stay below 520 and drift lower or remain under pressure.

This post is for education only. It’s not financial advice or a recommendation to trade.

#WeeklyOptions #BearishSetup #BearPutSpread #OptionsTradingIndia #NSEOptions #PriceAction #OptionsStrategy #StockMarketIndia #RMInvestech

Option Trading Advanced StrategiesA. Option Buyer

The buyer pays a premium to purchase a call or put.

Rights: Has the right, not the obligation, to exercise the option.

Risk: Limited to the premium paid.

Reward: Potentially unlimited (for calls) or large (for puts).

B. Option Seller (Writer)

The seller receives the premium upfront.

Obligation: Must fulfill the contract if the buyer exercises it.

Risk: Very high (sometimes unlimited).

Reward: Limited to premium collected.

Option sellers typically have higher probability strategies but higher margin and high risk.

BUY TODAY SELL TOMORROW for 5% - BTST STOCK OPTIONDON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST Stock Option trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

-Resistance Breakout in DIVISLAB

BUY TODAY, SELL TOMORROW for 5%

D

BUY TODAY SELL TOMORROW for 5% - BTST STOCK OPTIONDON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST Stock Option trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- Resistance Breakout in BOSCHLTD

BUY TODAY, SELL TOMORROW for 5%

B

BUY TODAY SELL TOMORROW for 5% - BTST STOCK OPTIONDON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST Stock Option trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- Head & Shoulder Breakout in IIFL

BUY TODAY, SELL TOMORROW for 5%

N