Patternbreakout

Indiabulls housing finance short buyTrade based:

in day tf it was still in up trend. just it follows the pattern. more than a month.

just now, it broken and also retested.

it indicates upcoming days, it will move up to 300

ada- cardano breaking out ada has been consolidating since 3 days within and triangle pattern,

the colored lines are pitchfork tool lines used on daily time frame to monitor the range or trading and identifying tradeable zones

the dotted whites are used for marking small trendlines and patterns so that we trade based on breakout and retest of market structure and patterns

waiting for the price to retest the resistance of triangle pattern as a entry sign

could go upto 2.300 but estimated target as per my risk to reward will be 2.200

comment and let me know what your analysis indicates about ada

Swing Trade in Hindpetro!!Hindpetro has broke out from an inverted head and shoulder pattern (weekly chart) in which it had been consolidating for years. and the stock is retesting the upper trend line for going ahead and this would be the sniper entry point for positional traders. and I would suggest to enter after a strongly bullish weekly candle and can expect a gain of 8 to 14% returns in the coming month or couple. Never enter without the confirmation candle and keep your risk reward ratio high. Happy Trading!!

Triangle Pattern Breakout in Canara Bank1. Canara bank has given a breakout from the triangle pattern with decent volume

2. Its next target is mentioned in the chart itself

3. The target was a strong support before 2020, which is now going to act as a resistance.

4. Can be a good pick for swing trade.

Banknifty Forming Symmetrical Triangle What is a Symmetrical Triangle ?

A symmetrical triangle is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. These trend lines should be converging at a roughly equal slope. Trend lines that are converging at unequal slopes are referred to as a rising wedge, falling wedge, ascending triangle, or descending triangle.

A symmetrical triangle chart pattern represents a period of consolidation before the price is forced to breakout or breakdown. A breakdown from the lower trendline marks the start of a new bearish trend, while a breakout from the upper trendline indicates the start of a new bullish trend. The pattern is also known as a wedge chart pattern.

The price target for a breakout or breakdown from a symmetrical triangle is equal to the distance from the high and low ( shown as Blue Line ) of the earliest part of the pattern applied to the breakout price point.

The stop-loss for the symmetrical triangle pattern is often just below the breakout point.

Symmetrical triangles differ from ascending triangles and descending triangles in that the upper and lower trendlines are both sloping towards a center point. In contrast, ascending triangles have a horizontal upper trendline, predicting a potential breakout higher, and descending triangles have a horizontal lower trendline, predicting a potential breakdown lower. Symmetrical triangles are also similar to pennants and flags in some ways, but pennants have upward sloping trendlines rather than converging trendlines.

RELIANCE INDUSTRIES | RR 1:2.5 | Triangle Pattern(Intraday / Swing / Positional) | RR 1:2.5+ | Type:- Pre - Breakout/Retest

Reasons To Trade🤔 :- Stock Is In Overall Uptrend, Above 200DMA, Market & Sector Leader, Ready To Break - Triangle Pattern .

Entry :- 2040 (After Breakout)

Stop Loss :- 1985

Target's :- 2175 | 2300

(Risk Must Be Managed.)

Keep Your Eyes On Index

Follow For More 🤝

Give Me A Thumbs Up.. 👍

Comment Below 👨💻

--Any Suggestions--

Indiabulls Housing Finance | RR.= 1:4(Swing / Positional Trade) | RR 1:4+ | Type :- Breakout

Reasons To Trade 🤔 :- Breakout Of = 200DMA + Flag Pattern + Pennant Pattern - Symmetrical Triangle Pattern.

Entry :- 180

Stop Loss :- 172.50

Targets :- 1st= 190 | 2nd= 200 | 3rd= 210

(Risk Must Be Managed.)

Keep Your Eyes On Index

Follow For More 🤝

Give Me A Thumbs Up.. 👍

Comment Below 👨💻

--Any Suggestions--

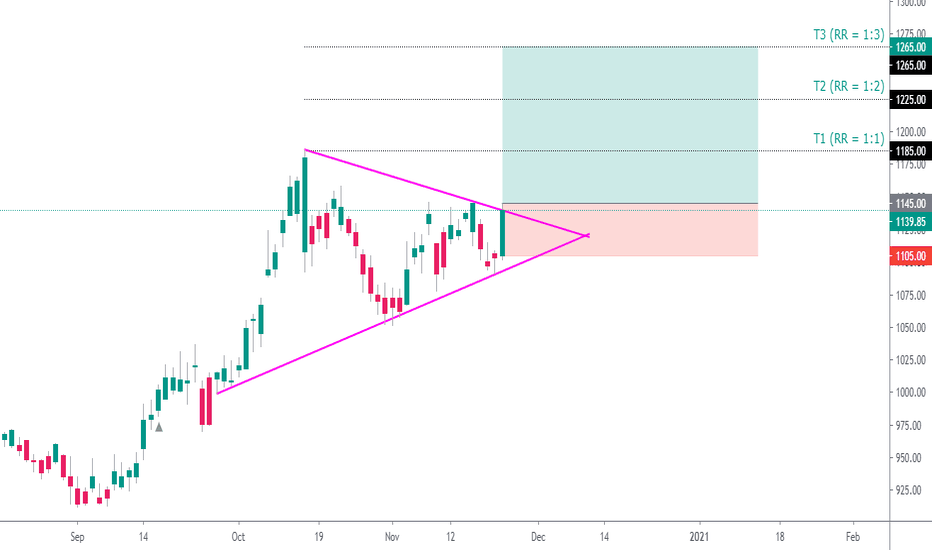

INFOSYS(Swing / Positional Trade) | RR 1:3+ | Type:- Breakout

Reasons To Trade 🤔 :- NIFTY IT(Main Index) + Stock's Triangle Pattern Breakout , Bullish Sector , Uptrend Stock , Above 200DMA.

Entry :- 1145 (Look For Clear Entry)

Stop Loss :- 1105

Targets :- 1stT. = 1185 , 2ndT. = 1225 , 3rdT. = 1265

(Risk Must Be Managed.)

Keep Your Eyes On Index

😜Follow For More ✔

Give Me A Thumbs Up...👍

--Any Suggestions--

SYMMETRICAL TRIANGLE PATTERN BREAKOUT IN AXIS BANK -the stock managed to break-out of the pattern today by taking out crucial resistance level in the market

-on lower time frames stock managed to break above the level of 440

-after lot of failed attempts it managed to surpass that level today

-the stock last traded price(ltp) is at 444

-the stock is now geared up for a big rally on the upside

-join the telegram group for live updates we have already taken trades today in "axis bank"

BTST TRADE IN AXIS BANK

BUY@442

STOP@435

TARGET@454

!!please note trade with caution!!

!!manage your risk!!

!!trade-wise!!

!!please adjust for future rates!!

(trade active already)

NEW POSITIONAL TRADE IN AXIS BANK

BUY@445-448

STOP@430

TARGET-1@465

TARGET-2@478

Go long on EURCHF : Breakout of falling channelThe pair has been moving in a falling channel pattern from the past three months. Yesterday, the pair tested the 1.08230 support level for the third time and again took a bounce, ending the day with a long bullish candle and creating a morning star pattern. Moreover, the upliftment in the pair was supported by the divergence between the prices and the RSI indicator. At the moment, the price is just below the resistance level of 1.09076. following breakthrough, the prices are expected to reach 1.10467. The support for the pair is the area between 1.07997 - 1.08229. This area is important and the stop loss should be below it or it can be the lowest level of the area i.e. 1.07997.