Pfizer_buy

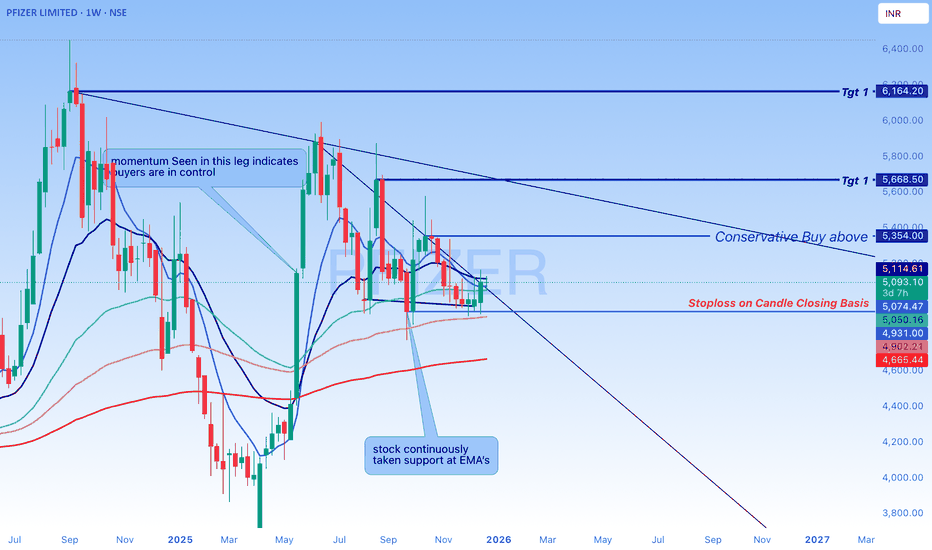

Pfizer: Sustained Channel Breakout Above 5300Details:

Asset: Pfizer Ltd (PFIZER)

Breakout Level: 4400 (Channel breakout), strong sustain above 5300

Potential Targets: 5600, 6500

Stop Loss: Below 5100

Timeframe: Medium to Long Term

Rationale: Pfizer gave a clear channel breakout at 4400 and has now convincingly sustained above 5300, indicating strong institutional accumulation and upside potential.

Market Analysis:

Technical Setup: Channel breakout with follow-through price action and no signs of weakness above 5300.

Sector Outlook: Positive long-term outlook for pharma sector with rising healthcare demand and export momentum.

Risk Management:

Use SL below 5100 to guard against potential pullbacks.

Timeframe:

Medium to long-term targets of 5600 and 6500 look achievable if current levels hold.

Risk-Reward Ratio:

Strong risk-reward with breakout structure intact and long consolidation base formed below.

Watch for continued volumes and bullish momentum to validate the move further.

PFIZER LTDPharma sector seems to be ending bearish trend

and might reverse towards bullish move.

Pfizer showing Morning star pattern which is

reversal bullish pattern on a daily time frame.

Pfizer is also taking support of 200 EMA which is

again a bullish sign.

Do your own analysis before buying trade.

What Weekly Pinbar suggesting ?-Yes! I wanna move up! Thumbs upEven in this bear markets some stocks try to move Northside - Here this is one - I personally assume. Market never minds our thoughts, It will do what it wants.

So, Please understand that never trade without self analysis. This view is only for your observation. Remember Neither your loss or Profit binds me. Do proper study

before an act.