#NIFTY Intraday Support and Resistance Levels - 20/01/2023Nifty will be slightly gap up opening in today's session. After opening nifty sustain above 18100 level and then possible upside rally up to 18200 in today's session. in case nifty trades below the 18050 level then the downside target can go up to the 17930 level.

Priceactionanalysis

Falling wedge pattern reversal in CONCORCONCOR

Key highlights: 💡

✅On 1D Time Frame Stock Showing Reversal of Falling wedge Pattern .

✅ It can give movement upto the Reversal target of above 735+.

✅There have chances of Breakout of resistance level too.

✅ After Breakout of resistance level this stock can gives strong upside rally upto above 828+ .

Descending triangle pattern breakout in PERSISTENTPERSISTENT

Key highlights: 💡⚡

✅On 1D Time Frame Stock Showing Breakout of Descending triangle Pattern .

✅ Strong Bullsih Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 4620+.

✅Can Go short in this stock by placing a stop loss below 3855-.

Falling wedge pattern breakout in BALRAMCHINBALRAMCHIN

Key highlights: 💡⚡

✅On 1Hr Time Frame Stock Showing Breakout of falling wedge Pattern .

✅ Strong Bullsih Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 430+.

✅Can Go short in this stock by placing a stop loss above 390-.

CENTRALBK - Available at Retest with good potentialCentral Bank Daily Chart -

The analysis is done on weekly as well as on Daily TF hence price may take few weeks to few months in order to reach the targets.

Trade setup is explained in image itself.

The above analysis is purely for educational purpose. Traders must do their own study & follow risk management before entering into any trade

Checkout my other ideas to understand how one can earn from stock markets with simple trade setups. Feel Free to comment below this or connect with me for any query or suggestion regarding this stock or Price Action Analysis.

BANKNIFTY TOMORROW PREDICTION...BANKNIFTY analysis. If the market break blue trendline then we see some #BEARISH movement otherwise the market follow the chamber and buyCE(CALL) First target,4257,42347,42428. if the market break 42099 zone then we can go for PE(PUT) First target 41960,41914.41847,41767....

Descending triangle pattern Reversal in COLPALCOLPAL

Key highlights: 💡

✅On 1Hr Time Frame Stock Showing Reversal of Descending triangle Pattern .

✅ It can give movement upto the Reversal target of above 1515+.

✅There have chances of Breakout of resistance level too.

✅ After Breakout of resistance level this stock can gives strong upside rally upto above 1610+ .

#Reason #BTCUSDTPERP #LIQUDITY #Accmulation distribution conceptHiii Every one .

Why this happen in Bitcoin ?

i am trying to explain .

we all know higher timeframe dominate all . i made observation .

concept Accmulation distibution , Liquidity , marketmaker chart

how does market maker works when price is droping whales or market maker are start buy because if they dont buy then how order exicuted means if some one is selling other is buying .if this not happen order doesnot exicuted this is basic logic .

btc now in down trend at this that time market maker made there buy position in the chart i highlighted by accmulation vol .

do u see how much squeezed the price by marketmaker at this zone 16 k to 17 k . . because they dont want price to go more lower from this . wright now they start selling or distribution by traping liquidation of short sellers . which cause price to go upward .

I observe same thing in 2019 price chart analysis

mar 9 saturday price queezed and then up and also breaked my white line monthly indicator line go back to see same .

let me know what u are thinking about this move by btc in comment below

Thank u

SYNGENEKey highlights: 💡⚡

✅On 1W Time Frame Stock Showing Breakout of Triangle pattern .

✅ Strong bullish Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 795.

✅Can Go long in this stock by placing a stop loss above 600.

✅ breakout this can give risk:reward upto 30%+

Falling wedge pattern reversal in JUBLFOODJUBLFOOD

Key highlights: 💡

✅On 1Hr Time Frame Stock Showing Reversal of Falling wedge Pattern .

✅ It can give movement upto the Reversal target of above 505+.

✅There have chances of Breakout of resistance level too.

✅ After Breakout of resistance level this stock can gives strong upside rally upto above 555+ .

Ascending triangle pattern breakout in NAUKRINAUKRI

Key highlights: 💡⚡

✅On 1Hr Time Frame Stock Showing Breakout of Ascending triangle Pattern .

✅ Strong Bullsih Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 3810+.

✅Can Go short in this stock by placing a stop loss above 3680-.

Tourism Finance Corporation of India LimitedTFCILTD:- The stock has also given a breakout by forming a cup and handle pattern, the volumes are also seeing good, keep an eye

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

Inverted head and shoulder pattern in NAVINFLUORNAVINFLUOR

Key highlights: 💡⚡

✅On 1Hr Time Frame Stock Showing Breakout of Inverted Head and shoulder Pattern .

✅ Strong Bullsih Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 4115+.

✅Can Go short in this stock by placing a stop loss above 3950-.

✅ breakdown this can give risk:reward upto 1:5+

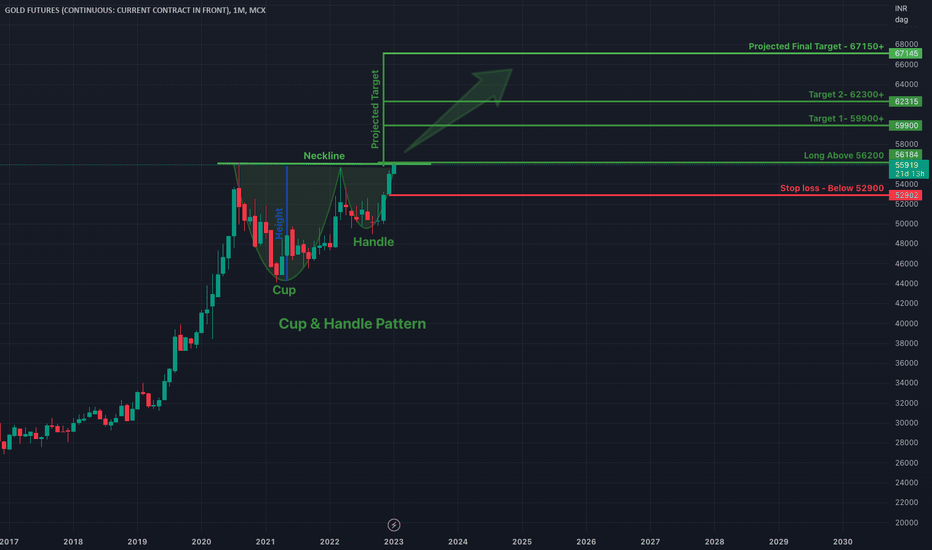

Cup & Handle Pattern In GOLD. Breakout can give 10000+ rally!!!Gold Future indicating the cup and Handle Technical Pattern. According to the pattern if this gives breakout of 56200 level then expected next target upto 67150+ in long term. This pattern will fail if gold started trading below 52900. Can see gold as a good investment opportunity in this downtrend global market session.

Disclaimer: This is my personal view on the GOLD. Consider this post as an education purpose only and not any type of recommendation. Consult your financial advisor before taking any investment decision.

Channel pattern reversal in TATACONSUMTATACONSUM

Key highlights: 💡

✅On 1Hr Time Frame Stock Showing Reversal of Channel Pattern .

✅ It can give movement upto the Reversal target of above 778+.

✅There have chances of Breakout of resistance level too.

✅ After Breakout of resistance level this stock can gives strong upside rally upto above 800+ .

AUTOAXLES - Breakout --> Consolidation --> Another BreakoutThe analysis is done on weekly TF hence price may take few weeks to few months in order to reach the targets.

Trade setup is explained in image itself.

The above analysis is purely for educational purpose. Traders must do their own study & follow risk management before entering into any trade

Checkout my other ideas to understand how one can earn from stock markets with simple trade setups. Feel Free to comment below this or connect with me for any query or suggestion regarding this stock or Price Action Analysis.

channel pattern breakout in LAURUSLABSLAURUSLABS

Key highlights: 💡⚡

✅On 1Hr Time Frame Stock Showing Breakout of channel Pattern .

✅ Strong Bullish Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 391+.

✅Can Go Long in this stock by placing a stop loss above 378-.

✅ breakout this can give risk:reward upto 1:3+

Rising wedge pattern breakdown in WHIRLPOOLWHIRLPOOL

Key highlights: 💡⚡

✅On 1Hr Time Frame Stock Showing Breakdown of Rising wedge Pattern .

✅ Strong bearish Candlestick Form on this timeframe.

✅It can give movement up to the Breakdown target of 1455-.

✅Can Go short in this stock by placing a stop loss above 1515+.

✅ breakout this can give risk:reward upto 1:5+

Head and shoulder pattern breakdown in INDUSINDBKINDUSINDBK

Key highlights: 💡⚡

✅On 1Hr Time Frame Stock Showing Breakdown of Head and shoulder Pattern .

✅ Strong bearish Candlestick Form on this timeframe.

✅It can give movement up to the Breakdown target of 1140-.

✅Can Go short in this stock by placing a stop loss above 1218+.

✅ breakdown this can give risk:reward upto 1:5+

Chance to break 2660Good move Today.. next week it will touch 2660.. only for analysis basis Try it on your own risk.