Granuels- A Chart with Multiple IndicationsThis chart reflects various aspects of technical analysis. Let's understand them

1. Price action perfectly shaping up for a move (Pink line reflecting behavior of price).

2. Price taking support at previous breakout levels(Resistance acting as support for the stock).

3. Price making a flag pattern too. (Draw a trendline below the already drawn one.) A trend Continuation Pattern which provides a lot of confidence to all the trend traders.

4. Volume picking up the pace as the price is trying to move up (What do u think who is making all these positions?).

5. A hammer with big tail/wyck reflecting strong interest of buyers which pushed it back up.

What else do we need before entering a trade?

Hope it will help you understand.....

Cheers and Happy Trading.

Disclaimer: I am not SEBI registered. Please trade with caution and manage your risk. Consult your financial advisor before entering into any trade.

Retest

Simple technical view of bank nifty(spot) Bank Nifty(spot) exactly faced resistance at 25232 where 200 day MA and gap resistance area is present, it recently broke the wedge pattern on the upside and mostly just coming back to retest , watchout for 23900 levels where 50% fib retracement level lies , if sustained further upmove is possible.

Personal view: Bullish as long as 23900 levels hold.

Disclaimer: These are just my personal observations , Please do your own research or consult an advisor before doing any investment or trading.

P.S: Constructive criticism is appreciated.

Larsen: Huge Accumulation in progressLarsen price havent moved significantly in past few weeks.

Any slight upmove followed by retest levels where it retrace near Fibonacci levels. ( Approx 38.2% in most occurrences)

Any significant volume upsurge is invisible and evenly distributed across weeks.

Heavy resistance near 1000-1020 levels.

If price crosses these levels with good volume, the result will be a breakout & rally till 1100 levels.

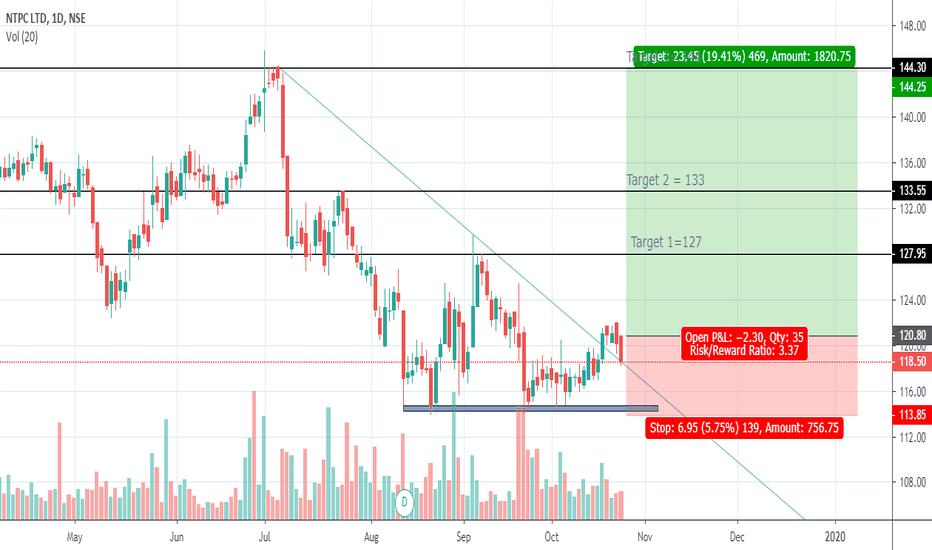

Long: Best SetupThe Call is based on Inverse head and shoulder, Trendline Breakout and Supply Zone breakout and retest. It is also Trading in parallel channel.

Best Setup

Entry between 445-460

Target 480/510

Stop Loss 437

Disclaimer: The recommendations are based on technical analysis and subject to market conditions. Please trade at your own risks. The author is not responsible for any loss.

India bulls hsgdid breakout retest....presently taken support on previous resistance which acting as a support...on shorter time frame showing positive RSI diversion sustaining todays high can give some bounce....but stock is highly volatile so i will avoid any entry only watching how TA goes....

MINDTREE , fake !!!Mindtree had given ascending breakout , but need one good closing to decide the upmove , can led to 1006 / all time high !

Happy Trading ! :)

BajF: Structurally WeakThe stock tried to bottom near March 2020 lows which also coincided with the 23 Oct 2018 gap zone at 2083.

After a couple of attempts the stock finally broke the lows in April and took support near an important monthly level at 1912, which has also been 61.8% retracement of BajF's life time bull market. The stock faced a strong upside bounce of 26%.

It tried to hold this low for some time before breaking it down in May to make a new low.

In my personal opinion although the stock is structurally weak and making new lows yet there is not much downside conviction.

If one is looking to go short, one has to wait for deep retracements. On downside there is a weekly support at 1818 for the short term.

Longs can not advised for short to medium term unless the structure changes to HH and HL. For long term, buying can be done in pieces near the support areas mentioned on the chart.

Hope this information will be useful.

Regards

#RITES - Daily ChartThere is a momentum with railway stocks, IRCTC bumper listing plus RITES giving huge returns. The stock is now retesting with lower volumes and looking at the candles near the retest zone, one can safely assume that either the consolidation is going to happen or uptrend will continue.

One can keep a stop of anything below 255-256