Vikran Engineering cmp 105.91 by Hourly Chart view since listedVikran Engineering cmp 105.91 by Hourly Chart view since listed

- Support Zone 99 to 103 Price Band

- Resistance Zone 106.75 to 111.50 Price Band

- Volumes are spiking well above avg traded quantity over past few days

- Subject to closure above Resistance Zone for few days, New ATH maybe anticipated

- Stock has formed bullish technical chart setup with Rounding Bottom and W Double Bottom

Roundingbottom

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Round Bottom Breakout and Retested in USHAMART

BUY TODAY SELL TOMORROW for 5%

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Round Bottom & Retested Breakout in

HEMIPROP

BUY TODAY SELL TOMORROW for 5%

Fineotex Chemical cmp 249.98 by the Weekly Chart viewFineotex Chemical cmp 249.98 by the Weekly Chart view

- Support Zone 210 to 234 Price Band

- Resistance Zone 271 to 295 Price Band

- Stock Price testing retest Support Zone over past few weeks

- Bullish Rounding Bottom repeated by the Support Zone foundation

- Huge Volumes surge observed over last week by demand based buying

- Falling Resistance Trendline Breakout plus Rising Support Trendline trending upside

Hindustan Zinc – Diya aur Batti Pattern📈 Pattern Analysis: Hindustan Zinc is currently shaping a "Rounding Bottom formation" on the charts, a classic reversal pattern that suggests the possibility of a long-term trend change. The stock is consolidating in a narrow range since Nov 2024 after a steep 50% decline from its top , indicating a phase of "Accumulation" .

Interestingly, alongside the rounding bottom, we also identify a newly observed structure – the “Diya and Batti Pattern” – which combines stability with a gradual build-up in price strength.

📊 Trend & Support:

The stock is trading above its 50 EMA, which is sloping upward, confirming the underlying uptrend.

Price stability over months strengthens the base formation and increases the probability of a powerful breakout.

🔎 Momentum Indicators:

Volumes remain muted during consolidation, a common sign of accumulation.

A decisive breakout must be accompanied by **rising volumes and a bullish candle** for confirmation.

🎯 Projection & Outlook: A confirmed breakout above the rounding bottom and accumulation zone will likely mark the beginning of a multi-year uptrend. Once breakout levels are crossed, Hindustan Zinc could witness significant upside momentum with potential medium- to long-term targets well beyond current levels.

⚠️ Disclaimer:

This is a technical projection intended for educational purposes, not an investment recommendation. Any trading strategy should be executed with proper risk management.

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Round Bottom Breakout in PAUSHAKLTD

BUY TODAY SELL TOMORROW for 5%

Ashok Leyland – Technical Research ReportAshok Leyland continues to maintain a strong uptrend across all time frames, forming higher tops and bottoms. The weekly chart confirms a "Rounding Bottom Breakout" above ₹134, backed by strong volume participation, which indicates sustained bullish interest.

The stock is comfortably trading above key moving averages (20, 50, 100, 200 SMA), adding further confirmation to the trend strength. A margin of safety zone has been identified near ₹134–₹136 levels, where value buying is likely to emerge in case of dips.

Strategy: Buy on dips towards support levels.

Targets: As per measurement rule

Stop-Loss: As per classic chart pattern rule

Overall outlook remains bullish with momentum indicators like RSI supporting continued upside.

Avantel cmp 189.75 by Daily viewAvantel cmp 189.75 by Daily view

- Support Zone 171 to 182 Price Band

- Resistance Zone 191 to 202 Price Band then ATH 212.70

- Volumes are in close sync with the average traded quantity over past few days

- Bullish Chart setup comprising of either back to back Rounding Bottoms or Head & Shoulders by the Resistance Zone neckline

Vascon Engineers cmp 63.50 by Daily Chart viewVascon Engineers cmp 63.50 by Daily Chart view

- Support Zone 55 to 59 Price Band

- Resistance Zone 66 to 70 Price Band

- Heavy Volumes surge based breakout above Support Zone earlier Resistance Zone

- Multiple Bullish Patterns made around Support Zone with Head & Shoulders, Rounding Bottoms, Cup and Handle

Biocon likely to see Bulls Surge!!!Yes, Charts give the indications for the upcoming long move in Biocon

Below is the daily timeframe wholesome look -

( Expanding Triangle pattern above chart)

(Inverted H&S pattern - above chart)

other points ,target, sl levels mentioned in the chart.

We can expect a Breakout (most likely)/Breakdown(less likely) by this week!!!!

Just sharing my view...not a tip nor advice!!!

Thank you,

mmjimm

Raymond Lifestyle cmp 1321.10 by Daily Chart viewRaymond Lifestyle cmp 1321.10 by Daily Chart view

- Support Zone 1215 to 1265 Price Band

- Resistance Zone 1360 to 1410 Price Band

- Bullish Rounding Bottoms by Resistance Zone neckline

- Resistance Zone tested rested prior to Breakout attempt

- Breakout sustained above the Falling Resistance Trendline

- Volumes seem subdued, need to increase for good Breakout

- Chart showing indicative positive setup for BB, EMA, MACD, RSI

Hindustan Copper cmp 280.05 by Daily Chart viewHindustan Copper cmp 280.05 by Daily Chart view

- Support Zone 244 to 264 Price Band

- Resistance Zone 285 to 305 Price Band

- Huge Volumes surge by demand based buying

- Falling Resistance Trendline Breakout sustained closure

- Support Zone got well tested and retested over past few days

- Bullish Rounding Bottoms formed by the Resistance Zone neckline

Bikaji Foods cmp 800.05 by Daily Chart viewBikaji Foods cmp 800.05 by Daily Chart view

- Support Zone 774 to 788 Price Band

- Resistance Zone 825 to 840 Price Band

- Pretty closely considerate Bullish Double Bottom formed

- Support Zone seems like going thru testing retesting mode

- Falling Resistance Trendline Breakout seems been attempted

- Price momentum seem respecting the Rising Support Trendlines

- Bullish Rounding Bottoms with Head & Shoulders below Support Zone

- Price Breakout will sustain after closure above Resistance Zone for few days

Goldiam International cmp 396.60 as seen by the Daily Chart viewGoldiam International cmp 396.60 as seen by the Daily Chart view

- Support Zone 362 to 386 Price Band

- Resistance Zone 425 to 455 Price Band

- Bullish "W" with Double Bottom formed at 340 price level

- Breakout attempted from Curved Falling Resistance Trendline

- Price momentum has well respected the Rising Support Trendline

- Volumes spiking above avg traded quantity over the past few weeks

- Multiple Bullish Rounding Bottoms formed around Support Zone neckline

- Majority of common Technical Indicator BB, EMA, MACD, RSI trending positively

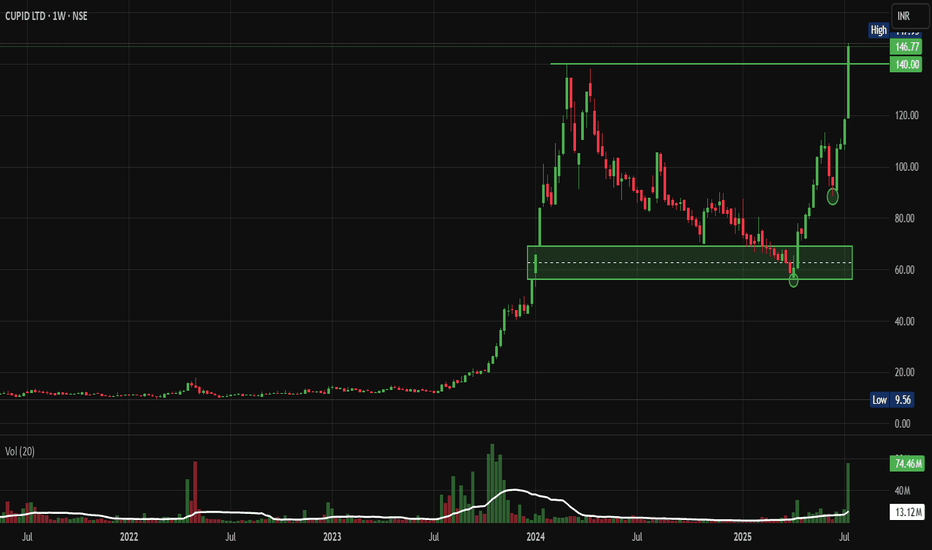

Cupid: Past Multibagger Forming Rounding Bottom BreakoutFrom ₹10 to ₹150: How CUPID Stock Became a Multibagger Dream and What's Next. Let's analyse and Deep Dive into my Chart of the Week Idea.

Price Action Analysis:

Long-term Trend Analysis:

- Primary Trend: Strongly bullish multi-year uptrend since 2023

- Trend Structure: Classic accumulation-markup-distribution pattern visible

- Price Progression: Massive rally from ₹10 levels in 2023 to ₹145+ levels

- Current Phase: Potential early stage of renewed markup phase after consolidation

Volume Spread Analysis:

Volume Profile Assessment:

- Accumulation Phases: High volume during the 2023-2024 markup phase

- Distribution Evidence: Volume spike during 2024 highs suggesting profit-taking

- Current Volume: Recent volume expansion (74.46M) confirming breakout momentum

- Volume Trend: Healthy volume participation during the current breakout phase

Volume-Price Relationship:

- Positive Correlation: Rising prices accompanied by expanding volume

- Breakout Validation: Current breakout supported by above-average volume

- Distribution Concerns: Previous high volume at peaks indicated selling pressure

Key Price Levels:

Support Levels:

- Immediate Support: ₹95-100 (recent consolidation base)

- Critical Support: ₹80-85 (previous resistance turned support)

- Major Support: ₹65-70 (rectangle pattern lower boundary)

- Ultimate Support: ₹50-55 (long-term trend line support)

Resistance Levels:

- Key Resistance: ₹145-150 (previous highs)

- Major Resistance: ₹150-155

- Target Extension: ₹170-180 (measured move projection)

Technical Indicators Assessment:

Trend Indicators:

- Moving Averages: Price clearly above major moving averages, indicatinga bullish bias

- Trend Strength: Strong upward trajectory since the consolidation base

- Momentum: Building positive momentum after prolonged consolidation

Trade Setup & Strategy:

Primary Long Setup:

- Entry Strategy: Buy on dips to ₹115-120 support zone

- Confirmation: Entry above ₹145 for momentum traders

Alternative Strategies:

Conservative Approach:

- Entry: Wait for pullback to ₹100-105 levels

- Timeframe: Medium to long-term holding period (Weekly Charts)

- Risk Profile: Lower risk, moderate reward

Aggressive Approach:

- Entry: Immediate entry at current levels (₹145)

- Timeframe: Short to medium-term momentum play (Daily Charts)

- Risk Profile: Higher risk, higher reward potential

Entry and Exit Levels:

Entry Zones:

- Zone 1: ₹115-120 (Primary entry for dip buyers)

- Zone 2: ₹145-150 (Momentum breakout entry)

- Zone 3: ₹100-105 (Deep pullback opportunity)

Target Levels:

- Target 1: ₹150-155 (Short-term objective)

- Target 2: ₹160-165 (Medium-term target based on pattern)

- Target 3: ₹180-190 (Long-term extension target)

- Ultimate Target: ₹200+ (Bull market extension)

Exit Strategy:

- Profit Booking: Book 30% at Target 1, 40% at Target 2, and the remaining at Target 3

- Trailing Stop: Implement trailing stop-loss above ₹140

- Time Stop: Review position if targets are not achieved in 8-12 months

Stop-Loss Strategy:

Stop-Loss Levels:

- Aggressive Stop: ₹110 (for entries around ₹120)

- Moderate Stop: ₹100 (for swing traders)

- Conservative Stop: ₹85 (for long-term investors)

Stop-Loss Management:

- Initial Risk: Limit to 8-10% of the entry price

- Trailing Mechanism: Move stop-loss to breakeven after 15% gains

- Pattern Stop: Below ₹95 invalidates the breakout setup

- Time-based Stop: Exit if below ₹110 for more than 2 weeks

Position Sizing & Risk Management:

Position Sizing Guidelines:

- Conservative Investors: 2-3% of portfolio

- Moderate Risk Takers: 4-5% of portfolio

- Aggressive Traders: 6-8% of portfolio (maximum)

- Sectoral Exposure: Limit total pharma/healthcare exposure to 15-20%

Risk Management Framework:

- Maximum Loss: Limit loss to 2% of total portfolio per trade

- Diversification: Don't concentrate more than 10% in a single stock

- Sector Allocation: Balance with other defensive sectors

- Time Diversification: Stagger entries over 2-3 weeks

Portfolio Integration:

- Correlation Check: Monitor correlation with other pharma stocks

- Sector Rotation: Consider the pharma sector cycle and rotation

- Market Cap Allocation: Balance small-cap exposure with large-caps

- Liquidity Consideration: Account for small-cap liquidity constraints

Risk Assessment:

Technical Risks:

- Failed Breakout: Risk of false breakout below ₹115

- Distribution Pattern: High volume at peaks may indicate selling

- Overbought Conditions: Rapid rise may lead to consolidation

- Support Breakdown: Break below ₹95 would be technically negative

Fundamental Risks:

- Valuation Concerns: High PE ratio of 96+ indicates premium valuation

- Sales Decline: The Recent 7% sales decline raises growth concerns

- Sector Competition: Increasing competition in the contraceptive market

- Regulatory Changes: Healthcare sector regulatory modifications

Market Risks:

- Small-Cap Volatility: Higher volatility compared to large-caps

- Liquidity Risk: Potential liquidity issues during market stress

- Sentiment Risk: Healthcare sector sentiment shifts

- Global Economic: Impact of global economic conditions on exports

Company Overview & Fundamental Backdrop:

Business Profile:

- NSE:CUPID is India's premier manufacturer of male and female condoms, personal lubricant, and IVD kits, established in 1993

- The company manufactures and exports contraceptives, including male and female condoms, and medical devices, with a focus on sexual health and reproductive safety, serving both domestic and international markets, supplying high-quality products to governments and NGOs

- Market capitalization: ₹3,940 crores as of July 2025, classified as a Small Cap company

Financial Performance:

- Current valuation metrics: PE ratio of 96.3 and PB ratio of 11.5

- Recent performance: Sales declined by 7.24% to Rs 61 crore in Q4 FY25 versus Rs 66 crore in Q4 FY24; however, net profit rose 2.71% to Rs 41 crore for FY25

- Long-term returns: The stock has delivered 133% returns in the last 3 years

Sectoral Growth Outlook:

- The Indian contraceptive devices market is expected to grow at a CAGR of 6.2-6.3% from 2025 to 2030

- Market size estimated at USD 264.01 million in 2025, expected to reach USD 377.61 million by 2030, at a CAGR of 7.42%

- India's pharmaceutical sector aims to grow from the current US$50 billion to US$450 billion by 2047, with India being the 3rd largest producer of drugs globally

Monitoring Parameters:

What to Look Closely at Technically?

- Weekly Close: Monitor weekly closes above ₹115 for trend continuation

- Volume Trends: Watch for volume expansion on up-moves

- Relative Strength: Compare performance with the Nifty Healthcare Index

What to Look Closely at Fundamentally?

- Quarterly Results: Track revenue growth and margin expansion

- Order Book: Monitor new contract wins and export orders

- Sector Trends: Keep track of contraceptive market growth

- Management Commentary: Follow management guidance and outlook

Now, when to exit?

- Technical Breakdown: Close below ₹95 for two consecutive days

- Volume Reversal: High volume selling at resistance levels

- Fundamental Deterioration: Significant decline in business metrics

- Sector Weakness: Broad-based healthcare sector underperformance

So, My Take:

NSE:CUPID presents a compelling technical setup with a confirmed breakout from a year-long consolidation pattern. The stock has transformed from a ₹10 stock to a multibagger, and current technical indicators suggest potential for further upside. However, premium valuation and recent sales decline warrant careful risk management. The trade offers an attractive risk-reward profile for investors willing to accept small-cap volatility in exchange for participation in a growing healthcare subsector.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Voltas Ready for a Breakout from Rounding bottom

resistance zone ₹1,416–1,420.

Breakout above 1420 = target ₹1,550 → ₹1,635.

Support: ₹1,360.

⚡ Consumer durables joining the sector rotation trend."

voltas tested ₹1,416 Fib level but faced rejection. RSI remains strong (65+), MACD supportive, indicating trend is still intact. Needs breakout above ₹1,420 for confirmation.

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Resistance Breakout in AJAXENGG

BUY TODAY SELL TOMORROW for 5%

Vaswani Inds cmp 57.07 by Daily Chart viewVaswani Inds cmp 57.07 by Daily Chart view

- Support Zone 51 to 54 Price Band

- Resistance Zone 59 to 61 Price Band

- Volumes are in good sync with average traded quantity

- Bullish Rounding Bottoms made by Support Zone neckline

- Another Large Bullish Rounding Bottom made by Resistance Zone neckline

- Darvas Box - Price trending mostly within 49 to 57 range since July 2025 3rd week

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Round Bottom Breakout and Retest in RTNINDIA

BUY TODAY SELL TOMORROW for 5%

Fedbank Financial cmp 142.03 by Daily Chart view since listedFedbank Financial cmp 142.03 by Daily Chart view since listed

- Support Zone 126.50 to 133.50 Price Band

- Resistance Zone 142.50 to 148.50 Price Band then ATH 153.60

- Volumes seen to be in good close sync with the average traded quantity

- Rising Support Trendline Channel well respected by up-trending price momentum

- Falling Resistance Trendline Breakout seemingly might be retested prior to fresh uptrend

- Price testing retesting Support Zone over the last week for probable breakout beyond ATH 153.60

- Dual Bullish Technical patterns formed of Head & Shoulders and close to 18 month long Rounding Bottom

Balmer Lawrie cmp 224.11 by Daily Chart viewBalmer Lawrie cmp 224.11 by Daily Chart view

- Support Zone 203 to 215 Price Band

- Resistance Zone 203 to 215 Price Band

- Multiple Bullish Rounding Bottoms around Support Zone

- Both Falling Resistance Trendlines Breakout seems sustained

- Heavy Volumes surge on Friday post close sync with avg traded qty

- Upwards Price momentum has well respected the Rising Support Trendline

- [ b]*Inside Bar made on Friday closure, indicates observing caution either a Breakout or Breakdown*