DRREDDY – Triangle Breakout in Play📊 DRREDDY – Technical & Educational Snapshot

Ticker: NSE: DRREDDY | Sector: 💊 Pharma

CMP: ₹1,276.60 ▲ (+2.51% | 22 Aug 2025)

Rating (for learning purpose): ⭐⭐⭐⭐ (Moderately Bullish)

Pattern Observed: 📈 Triangle Breakout with Volume Confirmation

📰 Sentiment Analysis

👉 Overall Sentiment: Positive ✅

• Bullish Drivers: Breakout from triangle formation, Morning Star on daily, bullish PinBar on monthly, strong Q1 results with revenue & profit growth, and renewed interest in pharma sector due to healthcare demand.

• Risks (Bearish Case): Any failure to sustain above ₹1,250 or renewed pressure from regulatory issues/patent challenges could trigger pullbacks.

• Short-term Outlook: Strong breakout with momentum, but some cooling-off likely due to Stochastic overbought levels.

• Long-term Outlook: Positive — consistent financial performance, strong pharma pipeline, and robust technical structure suggest higher upside potential.

📊 Technical Snapshot

DRREDDY has broken out from a triangle formation, supported by a Morning Star candlestick on the daily timeframe and a Bullish PinBar on the monthly chart — both strong reversal cues. A bullish Supertrend, RSI breakout, and Bollinger Band expansion signal renewed buying interest. Volume above the 20-SMA average further validates the breakout, suggesting institutional participation. While momentum is strong, Stochastic is near overbought, which means short-term pullbacks cannot be ruled out. However, as long as price sustains above key support zones, the broader trend bias remains upward.

📊 Volume Check

🔹 Current Volume: 2.01M

🔹 20 SMA Volume: 1.61M ✅

💥 Above-average participation → confirms breakout reliability with demand expansion.

💡 Interpretation: Higher-than-average volumes in breakout zones indicate broader market participation and improve the chances of trend continuation.

💡 Learnings

Breakouts from consolidation patterns like triangles tend to extend into trending moves when supported by momentum indicators (RSI + MACD). Elevated CCI levels indicate consistent buying pressure, but traders should remain alert to possible short pullbacks, especially when Stochastic enters the overbought zone. Defining a stop-loss and invalidation level is key for disciplined trade management.

📌 Key Levels

Resistance: 1292 | 1308 | 1334

Support: 1251 | 1225 | 1209

Fibonacci Levels: 1138.50 | 1195.40 | 1230.65 | 1259.10 | 1287.55 | 1328.10 | 1379.70

🎯 STWP Learning Reference

• Observed breakout zone: ~1281.8

• Key support level: ~1236

• Upside reference zones (if momentum continues): 1327 | 1372

• Pullback watch zone: 1224–1230 (where demand has earlier emerged)

• Invalidation reference: Below 1195 (trend may weaken)

⚠️ Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment advisor, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes exceed the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works — practice on paper trades before risking real money. If you are experienced, always assess your own risk, position sizing, and strategy suitability before entering trades.

Consult a SEBI-registered financial advisor before making any real trading decision. By engaging with this content, you acknowledge full responsibility for your trades and investments.

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

✅ Follow simpletradewithpatience for beginner-friendly setups, price action insights & disciplined trading content.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

Rsibreakout

KSCL – Technical & Educational Snapshot📊 KSCL – Technical & Educational Snapshot

Ticker: NSE: KSCL | Sector: 🌱 Seeds & Agro

CMP: ₹1,151.30 ▲ (as of 21 Aug 2025)

Rating (for learning purpose): ⭐⭐⭐⭐

Pattern Observed: 📉 Double Top + Descending Wedge (target near ₹1,000 completed)

KSCL earlier formed a Double Top followed by a Descending Wedge breakdown, with the projected bearish reference zone being successfully achieved. With that completion, the stock has now entered a new phase, displaying fresh bullish momentum. A strong bullish candle, RSI breakout, and Bollinger Band expansion from a squeeze highlight renewed buying strength.

This technical shift points towards a possible trend reversal or at least a medium-term bounce, provided the price sustains above key resistance levels. Supporting indicators (MACD, CCI, Stochastic) are aligned in favor of momentum continuation, adding weight to the bullish case.

📊 Momentum Snapshot:

Momentum indicators are tilting to the bullish side. While Stochastic (84) is moderately elevated, the confluence of RSI breakout, MACD bullish crossover, and strong CCI indicates that momentum could sustain until higher resistance levels are tested.

📊 Volume Check

🔹 Current Volume: 454.06K

🔹 20 SMA Volume: 155.22K ✅

💥 Nearly 3x average volume – confirms strong institutional / broad-based buying interest!

💡 Interpretation:

When volume is well above the 20-period average, it strengthens the reliability of a breakout.

This shows the move is not just retail-driven but likely backed by larger participants.

High-volume breakouts tend to sustain better compared to low-volume moves.

💡 Learnings:

Breakouts emerging from a Bollinger Band Squeeze often lead to strong trending moves as volatility expands. When supported by confirmations such as RSI and MACD turning positive together, the reliability of the breakout improves significantly.

Elevated CCI values reflect strong buying momentum, though traders should remain mindful of possible pullbacks. Above all, defining clear stop-loss and invalidation levels ensures disciplined trade management.

📌 Fresh bullish signals are emerging → but confirmation only comes on sustained move above ₹1,180–1,209. Failure to hold above ₹1,100 may keep it in sideways consolidation or trigger further downward pressure.

🔑 Key Levels

Resistance: 1180 | 1209 | 1256

Support: 1104 | 1057 | 1028

Fibonacci Levels: 900.65 | 1066.15 | 1168.55 | 1251.30 | 1334.10 | 1451.90 | 1602

Pullback Level: Around 1104–1110 zone (first support & prior base)

Invalidation Level: Close below 1057 (would negate the bullish setup)

📝 STWP Trade Setup

📌 Entry (Long): Above 1,162

🛡 Stop Loss: 1,059 or below

🎯 Reference Levels: 1264 | 1366

⚠️ Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment advisor, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes exceed the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works — practice on paper trades before risking real money. If you are experienced, always assess your own risk, position sizing, and strategy suitability before entering trades.

Consult a SEBI-registered financial advisor before making any real trading decision. By engaging with this content, you acknowledge full responsibility for your trades and investments.

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

✅ Follow simpletradewithpatience for beginner-friendly setups, price action insights & disciplined trading content.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

COLPAL - RSI Breakout + Bollinger Band Breakout📊 COLPAL – Technical & Educational Snapshot

Ticker: NSE: COLPAL | Sector: 🪥 FMCG

CMP: ₹ ▲ (as of 20 Aug 2025)

Rating (for learning purpose): ⭐⭐⭐⭐

Pattern Observed: 📈 RSI Breakout + Bollinger Band Breakout

COLPAL is showing strong bullish momentum supported by multiple technical indicators. The presence of a strong bullish candle, along with an RSI breakout at 61, highlights healthy buying pressure. A Bollinger Band breakout and BB Squeeze-Off indicate rising volatility and the possibility of a continuation move. The Bullish SuperTrend adds further confirmation, while momentum indicators (MACD bullish, CCI at 223, Stochastic at 96) signal strong near-term strength.

📊 Momentum Snapshot: Momentum indicators are aligned on the bullish side. While Stochastic shows overbought conditions, strong volume-backed momentum often sustains until key resistance levels are tested.

📊 Volume Check:

🔹 Current Volume: 1.01M

🔹 20SMA Volume: 710.56k ✅

💥 Significantly above average – confirms strong institutional / broad-based buying interest!

💡 Interpretation:

When volume is well above the 20-period average, it strengthens the reliability of a breakout.

It shows that the move is not just retail-driven but likely supported by larger participants.

Breakouts with high volume tend to sustain better compared to low-volume moves.

💡 Learnings:

Breakouts with Bollinger Band expansion often lead to strong follow-through moves.

RSI + MACD confirmation together strengthen trend reliability.

High CCI & Stochastic values show strong momentum but also highlight the importance of monitoring for pullbacks.

Defining pullback and invalidation levels helps in disciplined trade management.

Key Levels:

Resistance: 2393 | 2429 | 2492

Support: 2293 | 2229 | 2193

Pullback Area: 2294

Invalidation Level: Close below 2193

STWP Trade Setup:

Entry (Long): Above 2365

Stop Loss: 2262 or below

Reference Levels: 2467 | 2569

⚠️ Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment advisor, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes be larger than the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works — practice on paper trades before risking real money. If you are an experienced trader, remember to assess your own risk, position sizing, and strategy suitability before entering any trade.

Consult a SEBI-registered financial advisor before making any real trading decision.

By reading, watching, or engaging with this content, you acknowledge that you take full responsibility for your own trades and investments.

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

✅ Follow simpletradewithpatience for beginner-friendly setups, price action insights & disciplined trading content.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

PERSISTENT – Bullish Engulfing + RSI Breakout📊 PERSISTENT – Technical & Educational Snapshot

Ticker: NSE: PERSISTENT | Sector: 💻 IT Services

CMP: ₹ ▲ (as of 20 Aug 2025)

Rating (for learning purpose): ⭐⭐⭐⭐

Pattern Observed: 📈 Bullish Engulfing + RSI Breakout

PERSISTENT is displaying strong bullish momentum across multiple technical indicators. The presence of a strong bullish candle with Open = Low, combined with an RSI breakout, highlights aggressive buying pressure. A Bullish Engulfing pattern further supports the continuation bias. Meanwhile, the Bollinger Band Squeeze-Off suggests increased volatility with a likely breakout on the upside. Together with a volume-supported move, these signals indicate strength in the trend.

📊 Volume Check:

🔹 Current Volume: 628.85k

🔹 20SMA Volume: 604.21k ✅

💥 Above average – confirming genuine buying interest!

💡 Learnings:

Bullish engulfing + Open=Low candles often signal strong buyer dominance.

RSI breakouts are stronger when paired with above-average volumes.

Bollinger Band squeeze-offs frequently precede powerful directional moves.

Defining pullback areas and invalidation levels helps structure risk management.

Key Levels:

Resistance: 5410 | 5475 | 5580

Support: 5240 | 5135 | 5070

Pullback Level: 5284

Invalidation Level: Close below 5008

STWP Trade Setup:

Entry (Long): Above 5370

Stop Loss: 5173 or below

Reference Levels: 5566 | 5763

⚠️ Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment advisor, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes be larger than the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works — practice on paper trades before risking real money. If you are an experienced trader, remember to assess your own risk, position sizing, and strategy suitability before entering any trade.

Consult a SEBI-registered financial advisor before making any real trading decision.

By reading, watching, or engaging with this content, you acknowledge that you take full responsibility for your own trades and investments.

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

✅ Follow simpletradewithpatience for beginner-friendly setups, price action insights & disciplined trading content.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

TIINDIA – Technical & Educational Snapshot📊 TIINDIA – Technical & Educational Snapshot

Ticker: NSE: TIINDIA | Sector: 🏭 Industrial Manufacturing

CMP: ₹ ▲ (as of 20 Aug 2025)

Rating (for learning purpose): ⭐⭐⭐⭐

Pattern Observed: 📈 Channel Breakout

TIINDIA is showing strong bullish momentum across multiple technical indicators. The presence of a strong bullish candle, combined with an RSI breakout at 68, indicates significant buying pressure. The Bollinger Band breakout and BB Squeeze-Off suggest increased volatility and the potential for a strong upward move. Bullish VWAP confirms the trend is supported by average price strength, while MACD bullish, CCI at 178, and Stochastic at 95 all point to strong near-term momentum, signaling a likely continuation of the upward trend.

📊 Volume Check:

🔹 Current Volume: 339.93k

🔹 20SMA Volume: 334.34k ✅

💥 Slightly above average – confirming possible buying interest!

💡 Learnings:

Breakouts with above-average volume are more reliable as they indicate real buying interest.

RSI, MACD, CCI, and Stochastic together provide a strong confirmation of momentum.

Bollinger Band squeeze-offs often precede strong directional moves – a good cue for potential entry. Identifying pullback areas and invalidation levels helps manage risk effectively.

Key Levels:

Resistance: 3200 | 3248 | 3323

Support: 3077 | 3002 | 2954

Pullback Area: 3013–3070

Invalidation Level: Close below 2956

STWP Trade Setup:

Entry (Long): Above 3172.90

Stop Loss: 3039.80 or below

Reference Levels: 3306 | 3439

⚠️ Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment advisor, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes be larger than the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works — practice on paper trades before risking real money. If you are an experienced trader, remember to assess your own risk, position sizing, and strategy suitability before entering any trade.

Consult a SEBI-registered financial advisor before making any real trading decision.

By reading, watching, or engaging with this content, you acknowledge that you take full responsibility for your own trades and investments.

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

✅ Follow simpletradewithpatience for beginner-friendly setups, price action insights & disciplined trading content.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

TATA MOTORS – Technical & Educational Snapshot📊 TATA MOTORS – Technical & Educational Snapshot

Ticker: NSE: TATAMOTORS | Sector: 🚗 Automobiles

CMP: ₹ ▲ (as of 20 Aug 2025)

Rating (for learning purpose): ⭐⭐⭐⭐

Pattern Observed: 📈 Channel Breakout

Tata Motors is showing strong bullish signals across multiple technical indicators. The RSI has broken out to 62, reflecting healthy buying momentum without being overbought, while the MACD remains bullish, confirming upward momentum. The SuperTrend and VWAP are both bullish, supporting the upward trend, and the CCI at 98 along with a Stochastic of 96 indicate strong near-term strength. Additionally, the Bollinger Band squeeze has released, suggesting increased volatility and a likely breakout. Altogether, these signals point toward a potential continuation of the bullish move in the near term.

Key Levels:

Resistance: 711 | 722 | 742

Support: 681 | 662 | 651

Pullback Area: 671–685

Invalidation level: 654

STWP Trade Analysis:

Entry (Long): Above 703.35

Stop Loss: 656 or below

Reference Levels: 750 | 796

⚠️ Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment advisor, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes be larger than the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works — practice on paper trades before risking real money. If you are an experienced trader, remember to assess your own risk, position sizing, and strategy suitability before entering any trade.

Consult a SEBI-registered financial advisor before making any real trading decision.

By reading, watching, or engaging with this content, you acknowledge that you take full responsibility for your own trades and investments.

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

✅ Follow simpletradewithpatience for beginner-friendly setups, price action insights & disciplined trading content.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

APOLLOHOSP – Ranging Channel Breakout Case Study (Educational)________________________________________

📊 APOLLOHOSP – Technical & Fundamental Educational Snapshot

Ticker: NSE: APOLLOHOSP | Sector: 🏥 Hospitals & Healthcare Services

CMP: ₹7,808.50 ▲ (as of 13 Aug 2025)

Rating: ⭐⭐⭐⭐☆ (Moderately Bullish Setup – Educational Purposes Only)

Pattern Observed: 📈 Ranging Channel Breakout

________________________________________

“Apollo Hospitals is on fire! After reporting a stunning 42% rise in Q1 net profit, the stock zoomed nearly 8%, now hovering near its 52-week high. Technical charts are flashing a powerful ‘Strong Buy’ signal across multiple indicators—momentum is undeniable. With balanced options interest and analyst targets pegged around ₹8,100, the stock may still have room to run. A breakout past ₹7,800 could set the stage for the next leg higher!”

________________________________________

Chart Pattern & Technical Analysis:

Close: ₹7,808.5 — strong bullish momentum after Ranging Channel breakout.

Candle: Big bullish bar with multiple confirmations — 52-week breakout, RSI breakout, MACD crossover, Bollinger Band breakout, bullish SuperTrend.

Momentum: WVAP bullish; RSI 68, MACD Buy, CCI 235, Stochastic 96.

________________________________________

Volume Analysis:

Volume: 2.29M shares traded — 5× the 20-day average (429.86K).

Signal: Exceptional participation confirming a decisive 20-day volume breakout.

________________________________________

Support & Resistance:

Resistance: ₹7,969, ₹8,130, ₹8,420.

Support: ₹7,518, ₹7,228, ₹7,060.7.

Outlook: Possible breakout opportunity with swing trade potential.

________________________________________

Learnings:

Q1 FY26 Results: PAT ↑ ~42% YoY to ₹433 cr; revenue ↑ ~15% YoY to ₹5,842 cr; stock rallied 5–6% post-results.

AI Focus: Plans to double AI investments in 2–3 years to boost efficiency & patient outcomes.

Value Unlocking: Spin-off & listing of digital health & pharmacy unit in 18–21 months.

Share Swap: 195.2 shares in new entity for every 100 Apollo shares; Apollo to retain ~15% stake.

________________________________________

Investment Outlook & Conclusion:

📈 Bullish Case:

5th straight quarter of profit growth; Q1 beat estimates.

Expanding margins via premium care, diagnostics, and digital.

Demerger of digital health & pharmacy arm could unlock value.

AI investments to enhance efficiency & returns.

Rising insurance penetration & healthcare spending favor leaders.

________________________________________

📉 Bearish Case:

Premium valuation risks de-rating if growth slows.

Demerger success hinges on smooth execution.

Regulatory changes could impact margins.

Heavy capex & competition may delay returns.

________________________________________

📅 Short vs Long Term:

Short-term (1–3M): Possible follow-through gains from Q1 beat; track Q2 updates & demerger progress.

Long-term (12–24M): Growth from core hospitals + value creation via digital arm listing & AI-driven efficiency.

________________________________________

📊 STWP Trade Analysis:

Trend: Bullish continuation — price broke key range and sustained momentum.

Sample Trade Setup:

Entry: ₹7,840 | Stop: ₹7,011.95

Reference Levels: ₹8,668 (~1:1 RR), ₹9,496 (~1:2 RR)

💡 These prices are only for demonstrating risk–reward calculations and position planning — not for live execution.

________________________________________

Conservative Setup:

Entry Zone: ₹7,808.50–₹7,840 | Stop: ₹7,723.24

Reference Levels: ₹8,064, ₹8,235

(For learning position sizing and risk control)

________________________________________

Pullback Watch:

Zone: ₹7,717.56 | Stop: ₹7,594 | Potential retest area

Potential Use: Studying pullback retests in breakout structures.

________________________________________

Possible Demand Zone(on Daily Time Frame): 7285 - 7205 | SL 7196.45

This is for observing historical demand behaviour — not a call to buy.

________________________________________

Market View (Based on Current Data):

Overall Bias: Bullish positioning.

Trend: Uptrend likely if ₹7,800–₹7,850 holds as support.

Volatility: Moderate (IV ~22–26).

OI Insight: Strong call writing above spot & put writing below — bullish stance with support defense.

________________________________________

🔍 Option Structures – For Learning Purpose

(Prices, Greeks & OI data are from market snapshot on 13 Aug 2025)

________________________________________

7800 CE – LTP ₹155.60

📊 Delta: 0.54 | Theta: -6.27 | IV: 22.39%

💡 Breakeven: ₹7,955.60

Why it’s worth studying:

ATM strike with quick reaction to spot moves (Delta ~0.50)

Strong OI build-up (+1.52L) & high liquidity (37k contracts)

Positioned just above spot; could capture momentum on a 7,850+ breakout

________________________________________

7600 PE – LTP ₹66.60 | Contra View

📊 Delta: -0.27 | Theta: -4.19 | IV: 25.18%

💡 Breakeven: ₹7,533.40

Why study it:

Strong short build-up in Puts (+3.32L OI) shows confidence price stays above this level

~200 pts below spot, acting as a buffer support zone

Higher IV means time decay favours sellers if support holds

________________________________________

Bull Call Spread

🟢 Buy: 7800 CE @ ₹155.60

🔴 Sell: 8000 CE @ ₹72.20

💰 Net Debit: ₹83.40 | Breakeven: ₹7,883.40

Why study it:

Lowers cost vs. naked CE buy by pairing ATM buy with OTM sell

Positive delta for upside, with loss capped to net debit

8000 strike OI acts as a profit cap zone, helping define risk-reward

Reduces theta decay compared to a single long option

________________________________________

📘 My Trading Setup Rules

Avoid Gap Plays

→ Check pre-open price action to avoid trades influenced by gap-ups/gap-downs.

Breakout Entry Only

→ Enter trades only if price breaks previous day’s High (for bullish trades) or Low (for bearish trades).

Watch Volume for Confirmation

→ Monitor volume closely. No volume = No trade.

Enter on Strong Candle + Volume

→ Execute the trade only if a strong candle appears with increasing volume in the direction of the trade.

Defined Risk:Reward Only

→ Take trades only if R:R is favorable (ideally ≥ 1:2).

Premium Disclaimer

→ Option premiums shown are based on EOD prices — real-time premiums may vary during execution.

Time Frame Preference

→ Trade with your preferred time frame — this strategy works across intraday or positional setups.

________________________________________

⚠️ Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment advisor, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes be larger than the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works — practice on paper trades before risking real money. If you are an experienced trader, remember to assess your own risk, position sizing, and strategy suitability before entering any trade.

Data, prices, and analysis are based on information available as of 12 August 2025, and market conditions can change at any time. Always verify with reliable sources and consult a SEBI-registered financial advisor before making any real trading decision.

By reading, watching, or engaging with this content, you acknowledge that you take full responsibility for your own trades and investments.

________________________________________

💬 Found this useful?

Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share this post with fellow traders and beginners to spread clean, structure-based learning.

✅ Follow simpletradewithpatience for beginner-friendly setups, price action insights, and disciplined trading content.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

________________________________________

BLUE STAR LTD - Technical Analysis | Triangle Pattern ________________________________________

📊 BLUE STAR LTD – Beginner-Friendly Technical & Fundamental Snapshot

Ticker: NSE:BLUESTARCO | Sector: Consumer Durables

CMP: ₹1,827.50 ▲ (+3.23%) (as of August 7, 2025)

Chart Pattern: Symmetrical Triangle

Technical View: ⭐⭐⭐⭐ Neutral-to-Positive (Educational Purpose Only)

________________________________________

🔍 What’s Happening on the Chart?

BLUE STAR has formed a Symmetrical Triangle – a pattern where price moves within narrowing highs and lows 📉📈

This indicates consolidation and usually results in a strong breakout or breakdown.

📦 Triangle Range: ~₹1,616 to ₹1,922

👉 Current price is testing the upper edge — a breakout could be brewing!

________________________________________

🕯️ Candle & Indicator Analysis (Simplified)

Here’s what the chart and indicators show:

EMA 200 Crossover:

✅ Bullish signal – price is trading above its 200 EMA

RSI (~60):

🔼 Showing strength – not yet overbought

Stochastic (~92):

🚀 Near overbought – buyers in control

MACD:

⚠️ Still bearish – momentum confirmation is pending

VWAP:

✅ Aligned with bullish bias — suggests institutional support

📊 Volume Breakout:

🔺 Volume surged to 1.57 million, almost 3x the average of ~525.73k — a strong sign that big players may be stepping in as price nears breakout levels.

🧠 Trading Insight:

The chart looks bullish but still needs confirmation. Watch for a proper breakout above the triangle with volume.

________________________________________

📰 Recent News & Sentiment Update

Q1 FY26 Results (as of June 30, 2025):

📈 Total Income: ₹2,998.32 Cr (↑ 3.8% YoY)

💰 Net Profit: ₹122.23 Cr

(Source: Company Filings & Analyst Coverage)

Sentiment:

✅ Positive: Modest earnings growth, analyst support

⚠️ Caution: Target cut by some analysts — signals mixed expectations

________________________________________

🧭 Support & Resistance Levels

📌 Resistance Zones (Upside watch):

R1: ₹1,866

R2: ₹1,904

R3: ₹2,112 (measured move target)

📌 Support Zones (Downside watch):

S1: ₹1,750

S2: ₹1,680

S3: ₹1,616 (triangle base)

________________________________________

🔍 How to Trade a Symmetrical Triangle

A symmetrical triangle is a neutral pattern.

The breakout confirms direction:

– Above = potential upside 🟢

– Below = potential downside 🔴

📈 If Bullish Breakout Happens (above ₹1,860):

✅ Wait for a candle close above ₹1,860 with volume

🎯 Possible Price Zones: ₹2,000 → ₹2,165

🛑 Stop Loss: ₹1,750 (below triangle support)

📉 If Bearish Breakdown Happens (below ₹1,680):

✅ Wait for close below ₹1,680

🎯 Possible Price Zones: ₹1,500 → ₹1,375

🛑 Stop Loss: ₹1,750 (above triangle resistance)

________________________________________

🧠 STWP’s Educational Trade Idea (Not a Recommendation)

🎯 Long watch above: ₹1,839

🛑 Stop Loss: ₹1,719.50

📈 Risk-Reward Idea: Minimum 1:1; ideally aim for 1:2+

________________________________________

🔰 Trading Notes

✅ Always use stop losses

⏳ Be patient — wait for confirmation, not assumption

🚫 Don’t chase green candles or panic in red ones

📚 Trade based on structure, not emotions

💼 Risk only 1–2% of your capital per trade

🎯 Target minimum 1:1.5 Risk-to-Reward ratio

________________________________________

⚠️ Disclaimer (Read Carefully)

This post is for educational and informational purposes only.

The author is not a SEBI-registered investment advisor. No buy or sell recommendations are being made.

All views are based on chart patterns, publicly available data, and personal learning experience.

Trading involves risk. Losses can exceed your investment. Always consult a SEBI-registered advisor before making financial decisions.

By engaging with this content, you agree to these terms.

________________________________________

💬 Was this useful?

Drop your thoughts, questions, or setups in the comments below ⬇️ — let’s grow together!

🔁 Share this post with fellow traders and beginners to spread clean, structure-based learning.

✅ Follow simpletradewithpatience for beginner-friendly setups, price action insights, and disciplined trading content.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

________________________________________

ASIAN PAINTS LTD – Technical Analysis________________________________________

🧠 ASIAN PAINTS LTD – Technical Analysis

Ticker: NSE:ASIANPAINT | Sector: Decorative & Industrial Coatings

CMP: 2,491 ▲ (+1.9%)

Chart Pattern: Symmetrical Triangle Breakout

Technical View: ⭐⭐⭐⭐ (Neutral-to-Positive Setup – Educational Purposes Only)

________________________________________

📈 Technical Overview (For Educational & Informational Purposes Only)

🔹 Pattern Observed:

Price action indicates a breakout from a symmetrical triangle pattern on the daily timeframe – a structure often linked to volatility contraction and potential directional movement. The stock breached the upper trendline near 2,467 with an uptick in volume, indicating possible buyer interest.

🔹 Supporting Indicators:

— MACD: Bullish crossover

— 200 EMA: Price reclaimed above the long-term average

— RSI: Reading near 66, indicating strengthening momentum

— Bollinger Bands: Price broke above upper band + BB squeeze

— SuperTrend: Bullish

— Open = Low: Potential buyer strength

🔹 Volume Context:

Volume during the breakout session was ~2.02M – higher than average, suggesting institutional participation or increased trader interest.

________________________________________

🔼 Resistance Levels (Reference Zones)

R1: 2,518

R2: 2,545

R3: 2,583

🔽 Support Levels (Reference Zones)

S1: 2,452

S2: 2,413

S3: 2,387

________________________________________

📰 News Summary & Sentiment Context (Neutral View)

📌 Earnings:

Q1 FY26 PAT declined ~6% YoY to 1,100 Cr. Revenue slightly lower YoY but largely in-line with expectations. Decorative segment volume grew ~4%, which helped cushion margin pressures.

📌 Demand Trends:

Urban & project-led demand showing signs of recovery. Rural demand is stable. Some macroeconomic caution warranted due to external factors (e.g., job market uncertainties).

📌 Regulatory Update:

The CCI has initiated a probe on alleged market dominance following a complaint. The company has contested the investigation citing procedural inconsistencies.

📌 Market Mood:

Despite regulatory concerns, post-earnings sentiment appears improved. The stock has risen ~5.2% YTD and has been among recent Nifty outperformers.

________________________________________

📚 Educational Insight for Traders & Learners

The symmetrical triangle is a common consolidation pattern formed by converging trendlines. It reflects a balance of power between buyers and sellers. A breakout (especially with volume) can signify renewed directional bias.

In this case, the stock broke out above the resistance trendline, backed by volume and confirmation from technical tools (RSI > 60, MACD, BB squeeze, etc.).

Such breakouts are monitored by traders for swing or positional opportunities, provided risk is managed and external catalysts (like earnings and macro sentiment) are factored in.

✅ Key Reminder: Technical setups should be combined with proper position sizing, exit plans, and broader market context.

________________________________________

🔍 Trade Setup (For Educational Simulation Only)

Trade Details

🔹 Long Entry: ₹2,505.60

🔹 Stop Loss (SL): ₹2,406.55

🔹 Risk-Reward Ratio: 1:1 | 1:2+

Pullback Trade Setup (Optional Re-Entry)

📍 Pullback Entry Zone: ₹2,491.20 – ₹2,505.60

📍 Protective Stop Zone: ₹2,465.87 – ₹2,453.60

📍 Risk-Reward Range: 1:1 | 1:2+

________________________________________

⚠️ Disclaimer (Please Read Carefully):

This content is shared strictly for educational and research purposes only.

I am not a SEBI-registered investment advisor, and no buy or sell recommendations are being made.

All views expressed are based on personal market analysis and experience. They are not intended as financial advice.

Trading — especially in derivatives like options — involves significant financial risk. Losses can exceed your initial investment.

👉 Always do your own research and consult a certified SEBI-registered advisor before making any investment or trading decisions.

👉 Use proper risk management and only trade with capital you can afford to lose.

The author assumes no responsibility or liability for any trading losses incurred from acting on this content.

By engaging with this material, you agree to these terms.

________________________________________

💬 Found this helpful?

Drop your thoughts, questions, or insights in the comments below ⬇️ — let’s learn together!

🔁 Share this post with your trading friends and community — help them discover clean charts, structured setups, and zone-based learning.

✅ Follow simpletradewithpatience for clear setups, educational content, and a no-nonsense approach to price action, supply-demand zones, and risk-managed trades.

🚀 Trade with patience. Trust your charts. Stay clear-headed.

Because the goal is not just to trade — it's to trade better.

Be Self-Reliant | Trade with Patience | Learn with Charts & Zones 📊

HERO MOTOCORP LTD – TECHNICAL ANALYSIS________________________________________

📈 HERO MOTOCORP LTD – TECHNICAL ANALYSIS

📆 Date: July 15, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________

🔹 Price Action Zones

• 🔴 Top Range (Supply Zone / Resistance): ₹4,486.70

• 🟢 Bottom Range (Demand Zone / Support): ₹4,158.10

Price has recently broken out from a symmetrical triangle pattern, heading toward the marked supply zone. The demand zone at ₹4,158 has been tested multiple times and held firm, acting as the base for this breakout.

________________________________________

🔹 Chart Pattern: ✅

The stock formed a tight triangle consolidation, compressing between a rising support and horizontal resistance. Today’s breakout candle, backed by volume, confirms a bullish resolution of the pattern.

________________________________________

🔹 Reversal Candlestick Patterns

A large bullish engulfing candle has cleared recent highs with strength. Closing near the high, it signals conviction and opens the path for a continued up-move.

________________________________________

🔹 Technical Indicators

• RSI: Crossed above 60 — strength building

• MACD: Positive crossover confirming trend reversal

• VWAP: Price comfortably trading above — supports trend

• Bollinger Bands: Post-squeeze breakout with wide expansion

• Volume: Breakout supported by 20-day volume high — adds strong confirmation

________________________________________

📌 What’s Catching Our Eye:

The volume spike is significant — over 1.76M with breakout from both triangle resistance and VWAP. Add to that a BB Squeeze release, and the setup gets stronger technically.

________________________________________

👀 What We’re Watching For:

If price sustains above ₹4,454, it may move into the next resistance cluster: ₹4,525.97 → ₹4,599.93 → ₹4,730.87. On dips, ₹4,188 and ₹4,158 become important demand zones to monitor for re-entries.

________________________________________

⚠️ Risks to Watch:

A failed follow-up tomorrow or close below ₹4,405 could invalidate the momentum. Also, overbought conditions without volume expansion may lead to a false breakout near ₹4,486.

________________________________________

🔮 What to Expect Next:

If bullish momentum sustains, the stock may first target ₹4,599 and then ₹4,695. Resistance is expected near ₹4,525–₹4,599 range. A clean breakout above ₹4,486 could invite strong follow-up buying.

________________________________________

📊 Trade Plan (Based on Reason and Charts)

🔼 Bullish Trade Setup:

Entry Zone: ₹4,454 – ₹4,465

Stop-loss: ₹4,405.63

Risk–Reward: ~1:1 to 1:2

Reason: Triangle breakout + BB Squeeze + RSI/MACD confirmation + VWAP support

🔽 Bearish Trade Setup:

Only if the price rejects ₹4,486.7 and breaks below ₹4,405:

Entry: Below ₹4,405

SL: ₹4,465

Risk–Reward: ~1:1 to 1:2

Reason: Failed breakout + supply pressure at top range

________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

STWP is not responsible for trading decisions based on this post.

________________________________________

💬 Found this helpful?

Drop your thoughts or questions in the comments below ⬇️

🔁 Share this post with your trading community – let them benefit from clean charts, structured setups, and zone-based learning.

✅ Follow @simpletradewithpatience for chart-backed technical analysis that respects price action, demand & supply.

🚀 Trade with patience, trust your charts, and stay clear-headed!

Be Self-Reliant | Trade with Patience | Learn with Charts & Zones 📊

________________________________________

MANKIND PHARMA – Descending Triangle Breakout________________________________________________________________________________📈 MANKIND PHARMA – Falling Trendline Breakout | Strong Reversal Candle | Volume Spike

🕒 Chart Type: Daily Chart

📆 Date: July 9, 2025

________________________________________________________________________________

📌 Price Action:

MANKIND PHARMA has executed a decisive breakout above a falling trendline on the daily chart, breaking out of a multi-week descending structure. The price action had been consolidating within a triangular pattern, and on July 9, it registered a powerful wide-range bullish candle, closing at 2526.60 — well above the recent consolidation highs. This move came from a structured base with two strong pivot lows and now places the stock back into a strong bullish trajectory. The breakout is not random; it’s backed by structure, momentum, and confirmation — suggesting potential for a trend continuation if sustained.

________________________________________________________________________________

📊 Chart Pattern:

The chart shows a descending triangle breakout with compression near the apex. This setup builds pressure and usually resolves in the direction of volume. The move out of this pattern has occurred with authority, marked by a clean range expansion and bullish follow-through above resistance. This is a momentum-confirming breakout, which opens up room toward testing higher resistance zones.

________________________________________________________________________________

🕯️ Candlestick Pattern:

Strong Bullish Candle

Open = Low (Intraday strength)

Buy Today, Sell Tomorrow-type price action

Aligned with Volume Spike and Trendline Breakout

________________________________________________________________________________

🔊 Volume Analysis:

The breakout is accompanied by more than 2x the 20-day average volume, signaling real participation — not just speculative noise. Delivery volumes are notably strong, and volume came after a phase of tight consolidation, which indicates a possible transition from quiet accumulation to active participation by stronger hands.

________________________________________________________________________________

📈 Technical Indicators:

RSI (Daily): 66 – strong, trending up

MACD: Bullish crossover, both on Daily and Weekly

CCI: 220 – highly bullish momentum territory

Stochastic: 94 – overbought but confirming momentum

SuperTrend & VWAP: Clearly bullish

Bollinger Band: Price is expanding beyond upper band — volatility expansion in motion

________________________________________________________________________________

🧱 Support & Resistance:

🔻 Supports:

2448.27 – Immediate support (previous breakout zone)

2369.93 – Structure base support

2322.27 – Last defense before breakout invalidation

Bottom Range / Demand Zone: 2115.1 – Long-term accumulation zone

🔺 Resistance Zones:

2574.27 – First supply zone; watch for price reaction

2621.93 – Medium-term resistance; previously rejected here

2700.27 – Higher timeframe swing resistance

Top Range: 2998.4 – Long-term resistance; breakout confirmation if crossed

________________________________________________________________________________

👀 What’s Catching Our Eye:

What stands out is the confluence breakout — trendline, structure, volume, and indicators are all pointing in the same direction. The BB squeeze, RSI breakout, and strong candle together make this a multi-signal setup — rarely do we get such alignment across tools.

________________________________________________________________________________

🔍 What We’re Watching For:

Will the price hold above 2448–2526 for the next couple of sessions? If yes, this breakout can see momentum continuation toward 2574+. Any low-volume pullback toward the trendline or support zone could be a low-risk re-entry. If it fails to hold above the breakout candle, momentum could fade.

________________________________________________________________________________

✅ Best Buy Level for Equity (Low Risk Idea):

Entry: Above 2543.60 (post-breakout confirmation or clean retest of 2448–2455 zone)

Stop Loss: 2404.95 (on a closing basis)

Risk Reward Strategy: 1:1 initially, trail for 1:2+ if volume expands

Avoid chasing: Let the price validate with sustained volume above breakout

________________________________________________________________________________

💼 Sector Tailwinds:

The pharmaceutical sector is seeing renewed investor interest post-COVID, with growing focus on specialty products, chronic therapy lines, and export-led growth. MANKIND is among the strongest consumer-pharma brands with consistent results and brand recall — adding fundamental strength to this technical breakout.

________________________________________________________________________________

⚠️ Risk to Watch:

A close below 2448 could invalidate this setup

The overbought Stochastic means minor pullbacks or shakeouts are possible

Don’t chase — always confirm the breakout with a retest or follow-through candle

Over-positioning during volatility can lead to poor R:R trades

________________________________________________________________________________

🔮 What to Expect Next:

If this breakout holds, we may see follow-through toward 2574.27 in the short term. Strong volume above 2540+ can unlock upside toward 2621+. However, if the price closes below 2448, we may be dealing with a failed breakout — a scenario to strictly avoid. Watch next 2–3 sessions for clarity.

________________________________________________________________________________

🧠 How to Trade MANKIND PHARMA (For Educational Use Only):

🔹 Breakout Trade Plan

Entry: Above 2543.60

Stop Loss: 2404.95 (Closing basis)

Pullback Entry: Into 2448 zone with bounce candle

Risk-Reward: Start with 1:1, then trail to 1:2+

Position Sizing: Risk-calibrated, never go all-in

________________________________________________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

________________________________________________________________________________

💬 Found this helpful?

What’s your ideal approach to this setup — breakout entry or pullback into zone?

Drop your thoughts or questions in the comments below ⬇️

🔁 Share this post with your trading community

✅ Follow STWP for clean technical setups backed by price action and volume

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________________________________________________

HINDUNILVR – TECHNICAL ANALYSIS________________________________________

📈 HINDUNILVR – TECHNICAL ANALYSIS

📆 Date: July 8, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________

🔹 Price Action Zones

• 🔴 Top Range: 2602

• Resistance: 2437.07 – 2463.73 – 2511.77

• 🟢 Bottom Range: 2136

• Support: 2287.67 – 2314.33 – 2362.37

________________________________________

🔹 Chart Pattern: ✅ Bullish Marubozu Breakout

Price bounced from a demand zone near 2326.90 – 2304| SL: 2302.50 with a powerful Marubozu candle and reclaimed structure strength. This breakout aligns with STWP’s HNI setup and suggests the beginning of a strong bullish leg.

________________________________________

🔹 Reversal Candlestick Patterns:

✅ Bullish Marubozu

✅ Strong follow-through near support

✅ High conviction breakout from base – Open = Low

________________________________________

🔹 Volume Footprint:

✅ Volume spiked to 2.7M (vs average 1.63M)

✅ Indicates institutional participation backing the breakout

🚨 Watch for continuation volume above 2415 to confirm momentum

________________________________________

🔹 Trend Bias: ✅ Bullish

Clear bullish trend forming after breakout. Supports are holding, and resistance levels are now being tested with strength.

________________________________________

📌 What’s Catching Our Eye:

• STWP HNI Setup triggered at 2400–2415 range

• Breakout above strong support near 2300–2320

• OI Data and Option Chain analysis supports upward continuation

________________________________________

👀 What We’re Watching For:

• Sustained close above 2415 = bullish continuation

• Option build-up hints at possible follow-through toward higher zones

• Strong CE activity at 2420, 2440, and 2460 levels

________________________________________

🔹 OPTION CHAIN ANALYSIS – KEY TAKEAWAYS

💥 CALL Side (Bullish Builds):

• 2420 CE: 40.05 – 📈 OI up +158%, Long Build-Up

• 2440 CE: 31.25 – 📈 OI up +182%, Long Build-Up

• 2460 CE: 24.50 – 📈 OI up +345%, Long Build-Up

• 2500 CE: 14.45 – 📈 OI up +22%, Long Build-Up

🚀 Indicates participants are positioning for extended upside toward 2460–2500

📉 PUT Side (Writers in Control):

• 2300 PE: Down -60%, Short Build-Up

• 2400 PE: Down -52%, Short Build-Up

💡 Suggests confidence that price will hold above 2400

🧠 Conclusion from OI Data:

Strong bullish sentiment — Call Writers/Buyers increasing exposure at higher strikes, Puts being shorted. Volume + OI = directional strength.

________________________________________

⚠️ Risks to Watch:

• Close below 2390–2395 = early weakness sign

• Bearish divergence + volume fade risk

• Watch 2460–2512 for rejection

________________________________________

🔮 What to Expect Next:

• ⚡ Price retesting 2460 zone likely

• 🔄 Pullbacks toward 2395–2405 may offer low-risk re-entry

• ⚠️ Watch for spikes in volatility near 2500

________________________________________

📊 Trade Plan (Educational Only – Based on Logic + Volume Confirmation)

🔼 Breakout Long Setup

• Entry: Above 2415

• Stop Loss: 2339.30

• Risk–Reward: 1:1 to 1:2 +

📌 Why:

• Bullish Marubozu + Volume

• OI Long Build-Up at 2420–2460

• STWP HNI Setup alignment

🔁 Pullback Long Setup

• Entry Zone: 2395–2400

• Stop Loss: 2365

• Risk–Reward: 1:1 to 1:2 +

📌 Why:

• Breakout retest zone

• Tight SL with continuation logic

🔽 Bearish Setup (Only on Failure)

• Entry: Below 2360

• Stop Loss: 2410

• Risk–Reward: Flexible (trader-defined)

📌 Why:

• Only valid on strong breakdown with volume

• Reversal below structure

________________________________________

📊 Option Trade Ideas – For Learning Purpose Only

🔼 Best CE (Bullish Bias)

➡️ 2420 CE @ 40.05

• Risk–Reward Potential: 1:1 to 1:2+

🛑 SL: 26

📌 Why: Clean momentum zone, well-aligned with breakout

🟡 Alternate CE (Momentum Extension)

➡️ 2440 CE @ 31.25 – if expecting further move toward 2490–2510

• Slightly lower Delta, higher risk-reward

🔽 Best PE (Only if Breakdown)

➡️ 2400 PE @ 34.40

• Use only below 2390 with high-volume reversal

• Risk–Reward Potential: 1:1 to 1:2 +

🛑 SL: 21

________________________________________

❌ Invalidation Triggers:

• Daily close below 2360

• Long unwinding on CE strikes

• PE Long Build-Up + Volume = Bearish Shift

________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

“STWP HNI Setup” is a proprietary internal model shared for study and learning.

STWP is not a SEBI-registered advisor.

This is not a buy/sell recommendation.

Please consult your financial advisor before taking any action.

STWP is not responsible for trading decisions based on this post.

________________________________________

💬 Found this helpful?

Did the STWP HNI Setup help you anticipate the move?

💭 Drop your thoughts in the comments ⬇️

🔁 Share this with fellow traders

✅ Follow STWP for volume-based, logic-driven setups

🚀 Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________

BLUE STAR LTD. – TECHNICAL ANALYSIS📈 BLUE STAR LTD. – TECHNICAL ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

• 🔴 Top Range (Resistance): 2417

• 🟢 Bottom Range (Support): 1521

________________________________________________________________________________

🔹 Chart Pattern: ✅

Rectangle/Box Consolidation Breakout – Price was range-bound in a tight zone and has given a strong breakout on high volume, indicating bullish intent.

________________________________________________________________________________

🔹 Reversal Candlestick Patterns

• Top Range (2417): ⛔ No recent candlestick activity visible at the top range.

• Bottom Range (1521): Todays Candle

✅ Bullish Engulfing + Strong Bullish Candle

✅ RSI Bounce + Volume Spike

✅ Confirmed by Price Action and Momentum Indicators

________________________________________________________________________________

📊 Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade Setup:

• Entry: 1715 (Breakout Candle Close)

• Stop Loss: 1614.45 (Below consolidation and bullish candle)

• Target 1: 1850

• Target 2: 1980

• Reason:

o Strong breakout with above-average volume

o Multiple confirmations (RSI, Bollinger Band, Supertrend)

o Box breakout with previous supply cleared

________________________________________________________________________________

🔽 Bearish Trade Setup:

• If price fails to sustain above 1715 and closes back below 1680 zone

• Entry: Below 1665 (Fakeout confirmation)

• SL: Above 1715

• Target: 1615 / 1550

• Reason: Potential failed breakout & liquidity trap

________________________________________________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on Britannia?

Drop your thoughts and chart setups

________________________________________________________________________________

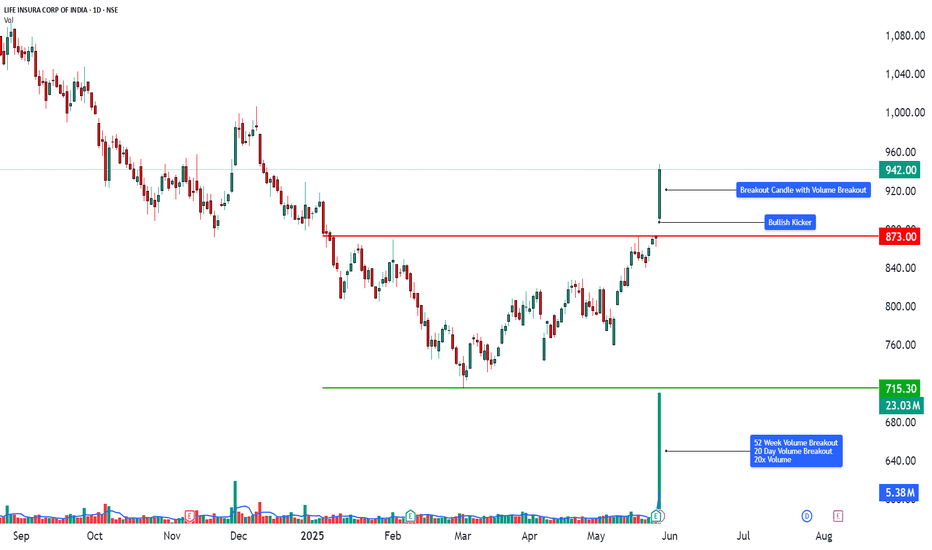

Technical Analysis | Powerful Price Action with Volume Breakout📈 LIFE INSURANCE CORPORATION OF INDIA (LICI) – TECHNICAL ANALYSIS

📆 Date: May 28, 2025

🔍 Timeframe: Daily

________________________________________

Price Action:

LICI surged over 8.12% in today’s session, registering a breakout after weeks of sideways consolidation. The breakout candle was wide-bodied, closing near the day’s high, and supported by a 20-day volume breakout – signaling fresh bullish momentum and accumulation at lower levels.

________________________________________

Chart Pattern / Candlestick Pattern:

• Sideways Consolidation Breakout

• Strong Bullish Candle (Buy Today, Sell Tomorrow setup)

• 52-Week Volume Breakout

• RSI Breakout

• BB Squeeze Exit – Volatility Expansion Phase

• Bollinger Band Expansion + Momentum Surge

• Multiple bullish candlestick patterns across all timeframes = multi-frame trend alignment.

• Gap-Up + Kicker + Long White Candle combo increases conviction of momentum breakout.

• Heikin Ashi continuity indicates a trend in motion without signs of reversal.

________________________________________

Technical Indicators:

• RSI (Daily): 79 – Bullish territory

• MACD: Bullish crossover active

• Stochastic: 97 – Overbought but confirms momentum

• CCI: 206 – Strong upside acceleration

• Volume: 23.03M – Very high vs. 2.24M average, confirms breakout

________________________________________

Support & Resistance Levels:

• Immediate Resistance: ₹964

• Next Resistance: ₹986

• Major Resistance: ₹1024

• Immediate Support: ₹904

• Secondary Support: ₹866

• Major Support: ₹844

• Weak Support Zone: ₹760–₹720

________________________________________

Chart Overview:

This visual representation highlights:

🔸 Clear resistance break with powerful volume

🔸 Bullish momentum confirmed by multiple indicators

🔸 20-day volume breakout indicating accumulation

🔸 Layered resistance levels between ₹964–₹1024

🔸 Tight squeeze breakout offering high R:R setups

________________________________________

Educational Breakdown:

This trade setup showcases:

• Breakout Confirmation: Price + Volume + Momentum Alignment

• Band Expansion: Beginning of volatility trend

• Momentum Shift: From sideways to bullish trend

• Volume Behavior: Institutional interest clearly visible

• Support Layering: Gives fallback levels for pullback traders

Such a chart is a perfect case study in breakout trading, especially post-consolidation and on high volume days.

________________________________________

How to Trade LICI (for learning purpose):

• Entry Example: ₹942.00

• Stop Loss: ₹844.00 (Risk: ₹98.00)

• Target 1: ₹964.00 (Reward: ₹22.00)

• Target 2: ₹986.00 (Reward: ₹44.00)

• Target 3: ₹1024.00 (Reward: ₹82.00)

• Sample Quantity: 50 shares

• RR Ratio: Short-term ~1:0.5; Swing ~1:1 or more

• Aggressive Traders: Can trail stop-loss as price approaches ₹986

• Conservative Traders: Wait for dip toward ₹904 or ₹866 zones

________________________________________

This breakout setup is ideal for swing trades, backed by strong volume and momentum indicators. However, since the RSI and Stochastic are in the overbought zone, traders should manage risk through stop-losses or wait for minor retracements for safer entries.

⚠️ Risk Management Tip: Always trade with a clearly defined stop loss. Avoid entering positions impulsively. It is advisable to start with a smaller quantity and increase your exposure only if the price action confirms the continuation of the trend. Capital protection should always be the priority.

📢 Disclaimer

This content is created purely for educational and informational purposes. It is not intended as investment advice, stock recommendations, or trading tips. Trading and investing in the stock market involves risk. Please consult with a SEBI-registered financial advisor before making any investment decisions. The author/creator is not registered with SEBI and shall not be held responsible for any losses incurred based on this information. Always do your own research and use proper risk management.

👉 If you found this analysis helpful, don’t forget to Follow, so you never miss out on a trade-worthy setup, breakout opportunity, or valuable educational insight again. Stay updated and trade smarter! 💡📈

Technical Analysis - 52-Week Volume Breakout📈 SCHNEIDER ELECTRIC INFRA – TECHNICAL ANALYSIS

📆 Date: May 28, 2025

🔍 Timeframe: Daily

________________________________________

Price Action:

Schneider Electric Infra soared over 11.5% today with a strong bullish candle breaking above recent consolidation levels. This wide-range breakout candle marks a 20-day and 52-week volume breakout, indicating heavy accumulation and institutional participation. The price surged from support near ₹570 to close around ₹778.70, confirming bullish momentum.

________________________________________

Chart Pattern / Candlestick Pattern:

• Breakout Setup

• 52-Week High Breakout

• Bullish Candle with strong body and large volume

• BB Squeeze Breakout (Volatility Expansion Expected)

• Bollinger Band Expansion

• Volume Spike – highest in over a year

• Daily Chart: Bullish Initiation pattern on Heikin Ashi

• Weekly Chart: Bullish Continuation pattern formed

• Monthly Chart: Spinning Top, but with bullish undertones confirmed by volume

• Recent Candles: Long White Candle patterns on daily and monthly charts (May 28, 2025)

________________________________________

Technical Indicators:

• RSI (Daily): 79 – Strong bullish territory

• MACD: Bullish crossover active

• Stochastic: 95 – Overbought but shows strong momentum

• CCI: 188 – Momentum phase, institutional buying signs

• Volume: 5.72M – Extremely high, 20-day volume breakout

________________________________________

Support & Resistance Levels:

• Immediate Resistance: ₹814.75

• Next Resistance: ₹850.80

• Major Resistance: ₹910.20

• Immediate Support: ₹719.30

• Secondary Support: ₹659.90

• Major Support: ₹623.85

• Weak Support Zone: ₹570–₹550

________________________________________

Chart Overview:

The chart highlights:

🔸 Strong bullish candle piercing prior resistance

🔸 Volume breakout aligned with price breakout

🔸 Clear resistance cluster above ₹814–₹910

🔸 Support zone well established below ₹720

🔸 Multiple confirmations from indicators and volume surge

🔸 Entry was marked at ₹791.40 with SL at ₹651.85

________________________________________

Educational Breakdown:

This is a textbook breakout with volume confirmation setup:

• Price Action: Breakout from resistance zone

• Momentum Indicators: Strongly aligned

• Volume: Institutional spike with confirmation of trend continuation

• Band Expansion: Signals beginning of high volatility trend

• Entry Confirmation: RSI + BB + Volume breakout + Trend indicators

This setup indicates a fresh trend beginning post-accumulation phase, making it suitable for swing to positional trades. The aggressive rise also suggests short-term profit-taking zones near the immediate resistance, while medium-term targets remain valid.

________________________________________

How to Trade Schneider Electric Infra (for learning purpose):

• Entry Example: ₹791.40

• Stop Loss: ₹651.85 (Risk: ₹139.55)

• Target 1: ₹930.95 (Reward: ₹139.55)

• Target 2: ₹1070.45 (Reward: ₹279.05)

• Sample Quantity: 50 shares

• RR Ratio: 1:1 to 1:2

• Aggressive Traders: Can ride trend with trailing stop

• Conservative Traders: Wait for pullback near ₹720–₹700 before entry

⚠️ Risk Management Tip: Always trade with a clearly defined stop loss. Avoid entering positions impulsively. It is advisable to start with a smaller quantity and increase your exposure only if the price action confirms the continuation of the trend. Capital protection should always be the priority.

📢 Disclaimer

This content is created purely for educational and informational purposes. It is not intended as investment advice, stock recommendations, or trading tips. Trading and investing in the stock market involves risk. Please consult with a SEBI-registered financial advisor before making any investment decisions. The author/creator is not registered with SEBI and shall not be held responsible for any losses incurred based on this information. Always do your own research and use proper risk management.

👉 If you found this analysis helpful, don’t forget to Follow, so you never miss out on a trade-worthy setup, breakout opportunity, or valuable educational insight again. Stay updated and trade smarter! 💡📈

Daily Technical Analysis & Trade Setup📊 Pfizer Ltd – Technical Chart Analysis

Date Analyzed: 27-May-2025

Time Frame: Daily

Price Action Overview:

Pfizer Ltd has recently witnessed a sharp bullish move, backed by a strong breakout candle on the daily chart. This up-move is accompanied by a significant volume spike, suggesting increased market participation and conviction in the direction of the breakout. The price has convincingly broken past a key resistance zone, turning it into a potential support zone going forward.

Chart Pattern / Candlestick Analysis:

Breakout Candle: A large green candle with strong body formation.

Volume Breakout: The stock saw a 20-Day Volume Breakout, confirming the strength of the move.

Momentum Continuation Phase: The price structure indicates a transition from accumulation to markup phase, possibly following a Volatility Contraction Pattern (VCP) that resolved on the upside.

Technical Indicators:

Stochastic (D/W/M): Strong bullish readings across daily and weekly timeframes.

CCI (D/W): Shows strength on daily and weekly charts.

MACD (D/W): Bullish crossover on daily and weekly charts.

RSI (D/W): Daily RSI is above 90, showing momentum strength.

Support & Resistance Levels:

Support Zones:

Support 1: 5240.87

Support 2: 5064.13

Support 3: 4965.57

Strong Support: 3800–4000 zone (historical demand zone)

Resistance Zones:

Resistance 1: 5516.17

Resistance 2: 5614.73

Resistance 3: 5791.47

Weak Resistance: 6177.85 and 6547.75 (based on higher timeframe pivots)

Educational Analysis:

This chart is a textbook case of a Breakout with Confirmation. Pfizer Ltd traded within a descending channel from August 2024 to April 2025, consistently forming lower highs and lower lows within two parallel downward-sloping trendlines. This phase indicated sustained bearish sentiment and acted as a long-term consolidation zone. However, in late May 2025, the stock broke out decisively above the upper resistance line of the channel, supported by a surge in volume—an essential sign of institutional participation. Such breakouts gain further credibility when accompanied by bullish signals from momentum indicators like RSI and MACD, which often turn upwards before or during the breakout. For traders tracking breakout setups, this alignment of price structure, volume, and momentum provides a strong confirmation of trend reversal potential and buying interest.

How to Trade Pfizer Ltd (For Educational Purpose Only):

How to Trade Pfizer Ltd (for learning purpose):

Entry Example: 5438.00

Stop Loss: 5068.10 (Risk: 369.90)

Target Example: 5807.90 / 6177.85 (Reward: 369.90 / 739.85)

Sample Quantity: 50 shares

RR Ratio: ~1:1 / ~1:2

Aggressive Traders: May consider riding the trend with trailing stop

Conservative Traders: Can wait for a pullback into the fresh strong demand zone (4488-4405)

⚠️ Risk Management Tip: Always trade with a clearly defined stop loss. Avoid entering positions impulsively. It is advisable to start with a smaller quantity and increase your exposure only if the price action confirms the continuation of the trend. Capital protection should always be the priority.

📢 Disclaimer

This content is created purely for educational and informational purposes. It is not intended as investment advice, stock recommendations, or trading tips. Trading and investing in the stock market involves risk. Please consult with a SEBI-registered financial advisor before making any investment decisions. The author/creator is not registered with SEBI and shall not be held responsible for any losses incurred based on this information. Always do your own research and use proper risk management.

👉 If you found this analysis helpful, don’t forget to Follow, so you never miss out on a trade-worthy setup, breakout opportunity, or valuable educational insight again. Stay updated and trade smarter! 💡📈

A Classic Case of Accumulation Turning into Momentum📈 SUPREME INDUSTRIES LTD – TECHNICAL ANALYSIS

📆 Date: May 27, 2025

🔍 Timeframe: Daily

Price Action:

Supreme Industries surged over 4% today and delivered a clean breakout after forming a consolidation triangle. The strong bullish candle closed near the day’s high with significant volume, confirming momentum on the upside.

Chart Pattern / Candlestick Pattern:

Symmetrical Triangle Breakout

Pullback Entry Zone Tested

Breakout Candle – wide range, strong body

Volume Surge – institutional interest visible

Technical Indicators:

RSI (Daily): 77 – strong bullish zone

MACD: Bullish crossover active

Stochastic: 98 – overbought but confirming strength

CCI: Above 200 – high momentum phase

Volume: 791.75K – supportive of breakout

Support & Resistance Levels:

Immediate Resistance: 4277.93

Next Resistance: 4355.47

Major Resistance: 4490.43

Immediate Support: 4065.43

Secondary Support: 3930.47

Major Support: 3852.93

Possible Fresh Demand Zone: 3837.60 – 3750.90

Chart Overview:

This visual clearly shows:

🔸 The symmetrical triangle pattern

🔸 Breakout + retest zone

🔸 Marked fresh demand zone for potential pullback opportunity

Educational Breakdown:

This setup combines:

Price Action: Triangle + Breakout

Volume Confirmation: Institutional participation

Momentum Indicators: Strong alignment

Demand Zone Mapping: Pre-breakout base

This is a classic trend continuation setup with clearly defined zones of interest. Risk control is key as price enters overbought territory.

Over the past few months, Supreme Industries displayed classic signs of an accumulation zone — a period marked by sideways movement, controlled volatility, and relatively stable volumes. This range-bound behavior typically indicates that long-term investors are quietly building positions while retail participation remains low. Recently, a strong bullish move supported by a significant rise in volume suggests the stock may have exited accumulation and entered the mark-up phase. This phase is often characterized by increased demand, higher price swings, and a clear shift in sentiment from neutral to bullish. The sharp breakout from the range, along with volume confirmation, signals the possible beginning of a new directional trend — where price tends to move swiftly as broader market participants join in.

How to Trade Supreme Industries (for learning purpose):

Entry Example: 4220.50

Stop Loss: 3781.50 (Risk: 439.00)

Target Example: 4659.50 (Reward: 439)

Sample Quantity: 50 shares

RR Ratio: ~1:1/1:2 etc.

Aggressive Traders: May consider riding the trend with trailing stop

Conservative Traders: Can wait for a pullback into the fresh demand zone (3837.60–3750.90)

⚠️ Risk Management Tip: Always trade with a clearly defined stop loss. Avoid entering positions impulsively. It is advisable to start with a smaller quantity and increase your exposure only if the price action confirms the continuation of the trend. Capital protection should always be the priority.

📢 Disclaimer

This content is created purely for educational and informational purposes. It is not intended as investment advice, stock recommendations, or trading tips. Trading and investing in the stock market involves risk. Please consult with a SEBI-registered financial advisor before making any investment decisions. The author/creator is not registered with SEBI and shall not be held responsible for any losses incurred based on this information. Always do your own research and use proper risk management.

👉 If you found this analysis helpful, don’t forget to Follow, so you never miss out on a trade-worthy setup, breakout opportunity, or valuable educational insight again. Stay updated and trade smarter! 💡📈

Price Action, Demand Zones, and Low-Risk Entry Areas📊 Tata Chemicals – Technical Chart Study

🗓️ Date: May 22, 2025 | NSE: TATACHEM | Chart Type: Daily

**Price Action:**

Since mid-April 2025, the stock has exhibited an uptrend characterized by higher lows and higher highs, which is generally considered a positive sign of market strength. The current price stands at 900.40, supported by a strong green candle that closed near its daily high. This recent price movement suggests buying interest in the stock, indicating potential for further upward movement. However, investors are advised to conduct their own analysis and consider market conditions before making any decisions.

**Chart Pattern Analysis:**

TATACHEM is showing a Volatility Contraction Pattern (VCP), with several contraction phases visible since March. The price has been trading within a tightening range of approximately 860 to 900, forming a recognizable pattern handle. During this period, volume declined gradually, which is typical in a VCP setup and may indicate absorption by stronger hands. The last few sessions before the breakout showed tight-range candles with lower volumes and mildly positive delta, often seen as a sign of accumulation. The breakout on May 27 came with approximately double the average volume, suggesting increased participation. While this pattern can indicate a higher probability of continuation, traders should evaluate risk carefully and not rely solely on any single pattern.

**Footprint Analysis:**

Footprint data for TATACHEM leading up to the breakout shows signs of increased buyer activity. The session on May 27 recorded total volume near 1.75 million and a positive delta of +174,050, suggesting buyers were more aggressive than sellers. Previous sessions showed fluctuating delta values, indicating a gradual shift from selling pressure to buying control. This trend may reflect a period of accumulation, with sellers becoming less dominant. Despite these observations, it is important to note that past volume and delta patterns do not guarantee future price movements.

**Demand Zones:**