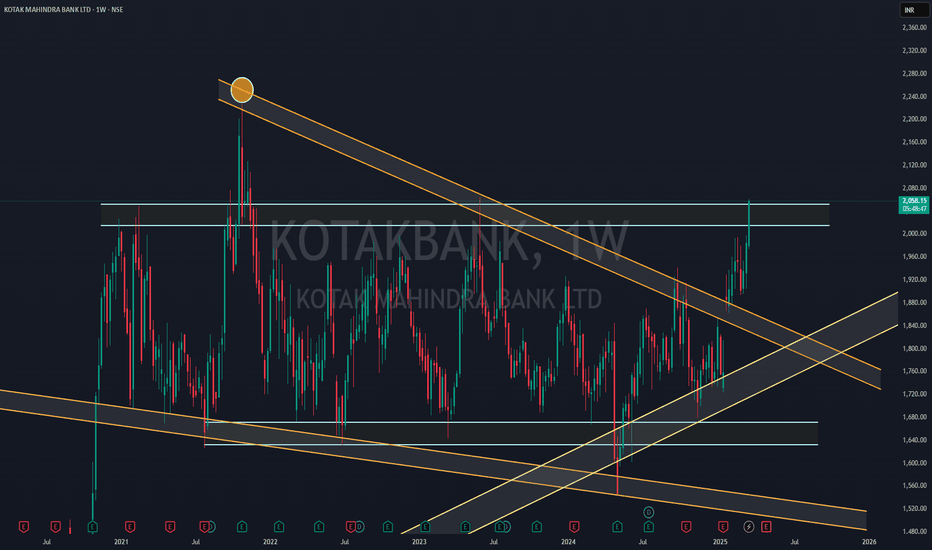

KOTAK BANK NEAR FLAG BReakoutKotakBank is nearly Flag Breakout on Monthly Candle (Wait more 7 days to Finish MOnthly Candle with Big Bull Breakout)

Wait for Proper Breakout beacuse its 4 time where Chart is going to test same Trendline.

Flag Pattern Start from 2020- After 5 years its will going to break

If we see fulll chart Stock taking support over 2013 Trendline before two months so there is more more possibility to give breakout

if we see RSI chart its also show Breakout over MOnthly RSI trendline..

## THis is my Just View, take position after all confromations and research by yourself##

also see weekly chart - weekly showing strong big bull canle ( 1more Weekly Candle Require for final conformations)

Rsibreakout

VINATI - LARGER WAVE - BREAKOUT - BULLISH - LONG TERMHi Folks,

Vinati organics has been in price as well as time correction since September 2022. Almost, corrected for 2 years and maintained a falling wedge, cooling off RSI on weekly and Monthly timeframes while correcting for almost 700 points.

Fundamentals

Stocks in chemical/speciality chemicals sector are mostly sitting on operational capex with stable Margins, good order book and good PAT figures YOY. PE de rated and cooled down to their MEdian PE as compared to 2021 levels where it zoomed off. Operational leverage is yet to be played and PE expansion might kick in.

Technicals

1. Clear breakout on Weekly timeframe from falling wedge.

2. RSI made higher highs eventually breaking from falling trendline.

3. Overall Structure of larger trend is bullish wherein we are completing wave 4 and ready fro larger wave 5.

4. Price might retest 30 WEMA or consolidate around it but shall continue its upmove.

Not a trade recommendation, please do your own due diligence.

THE NEW INDIA ASSURANCEThe setup is low risk high reward.

A nice base formation refusing to fall 5 times.

Stage 2 Stock

New India Assurance Company Ltd is India's largest non-life insurance company. It is promoted by the Government of India (GoI) holding ~86% stake

Presently, the company operates through a network of 2,200+ offices across 29 states and 7 UTs in India

Presently, the company is a market leader in health, motor, liability, fire and marine line of insurance business.

It has ~14% market share in general insurance industry in India.

The company has operations in 28 countries. It has branches and agency offices in Abu Dhabi, Australia, Bahrain, Dubai, Fiji, Hong Kong, New Zealand, Mauritius, Japan, UK, Thailand, and others.

The company is strategically important to Govt. of India because of its dominant market position and because it is the flagship Indian general insurer in the international markets, with a desk at the prestigious Lloyd's syndicate in London. It can help the govt. to materially enhance insurance penetration in the country over the long term.

TPL PLASTECH LTD. Looking hot all parameters to go longHello Friends,

Here we had shared possible Elliott wave counts on chart of TPL Plastech ltd. which is showing currently we are in impulse wave, we have completed wave (1) and wave (2) of some degree, & now possibly we are unfolding wave (3), in which we had completed wave 1 and 2 and possibly now we are unfolding wave 3 and again in which we had completed wave (i) and wave (ii) and now we are unfolding wave (iii) of wave 3 of wave (3).

Overall, chart pattern is also supporting bullish bias, cup n handle chart pattern yet to breakout, and lots of other parameters supporting same bias are shared below as a snapshots.

My studies are for educational purpose only. Please Consult your financial advisor before trading or investing. I am not responsible for any kinds of your profits and your losses.

Thanks

Cup n Handle chart pattern

Overall, Elliott wave structure

Trendline breakout along with good intensity of volume

Price challenging upper Bollinger band.

Price trading above 50DEMA, 100DEMA and 200DEMA

MACD positive in daily time frame

MACD positive in weekly

RSI in daily

RSI double breakout in weekly

DMI ADX positive strength in daily

DMI ADX positive strength in weekly

I am not sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

SAKTHI SUGARFundamentally there is nothing encouraging here however, purely on technical basis, this stock seems to be ready for a big move.

RSI breakout is an early indication, and the relative strength of the stock seems to be in a very sweet spot.

A triple bottom is adding confidence to this Low-Risk High Reward setup.

MTAR TECH – Strong Bullish BreakoutKey Points:

- Breakout from very Long period consolidation zone

- RSI > 70 and Crossed RSI MA

- All EMA crossed and good potential of up-move

- Resistance Level breakout

- Portfolio component

In Gujarati “ Bhav is Bhagwan ”

Disclaimer :

I am not a SEBI registered Analyst.

Please do your own Analysis before taking any trade/investment.

The above view is just for educational purpose only.

SUNFLAG IRON & STEELMarket Cap 1,608 Cr.

Promoter holding 51.2 %

Pledged percentage 0.00 %

Intrinsic Value 453

Stock P/E 7.72

Industry PE 16.70

ROCE 15.8 %

ROCE3yr avg 12.2 %

ROE 13.2 %

ROE 5Yr 11.6 %

OPM 12.7 %

EBIDT growth 3Years 17.5 %

Debt to equity 0.21

EPS 61 vs 12 last year

The product range includes : Rolled products, Billet/Bloom, Ingots, and Bright Bars etc. of varied shape and size range. These products are mainly used for manufacturing Automotive Transmission Gears, Drive Shafts, Steering System, Bearings, Exhaust System and other Engine Components to to various customers in South East Asian, North American and South American Countries, East African Countries, Europe, Japan, Taiwan and China.

It also supplies to Railways and Defence for critical/core applications.

The company owns and operates only 1 steel manufacturing plant in Bhandara, Maharashtra with a capacity of producing 5,00,000 tonnes p.a. of high-quality special steel. It has facilities like Sponge Iron Plant, Mini blast furnace, sinter plant, 30 MW captive power plant and other facilities.

The company is venturing into manufacturing of Super Alloy, which is an alloy for high performance applications like Aircraft Parts, Armaments, Submarine Parts, Space Vehicle and Rocket Engines, Nuclear Reactor, Supercritical Power Plants, etc. It received major machinery for commissioning its Super Alloy Project but due to lockdown the engineers from Germany at the Company's project site have been called back by their Government.

FOSECO INDIAMarket Cap 1,284 Cr.

Stock P/E 30.7

Industry PE 27.4

Dividend Yield 1.24 %

ROCE 22.2 %

ROE 16.6 %

OPM 14.5 %

Promoter holding 75.0 %

Pledged percentage 0 %

Free Cash Flow 14.4 Cr.

EPS 65.5 vs 51.2

- Foseco India Limited is engaged in the manufacture of products used in the metallurgical industry which are in the nature of additives and consumables that improve the physical properties and performance of castings.

- Key products and services include Industrial Dry Powders, Coating Products, Resin Products, Ceramic Filters and Exothermic Sleeves.

- It services the needs of Automotive, Railway and Heavy Transport, Construction and Mining, General Engineering and Petro-Chemicals and Power.

-The Co has state of the art manufacturing facilities in Pune and Pondicherry. It also imports products from its group manufacturing locations in other parts of the world. The company operates in a cellular manufacturing structure.

Keep a watch on SymphonyThe stock of Symphony has been following a descending triangle pattern. It has a strong demand zone near 800 levels and currently, its looking to give a bullish breakout from the trendline resistance. Next supply zone is around 1200-1220 levels.

The company has also announced a buyback at Rs. 2000/ share. Also, the summer heat might help boost the revenue in Q4 2023. These factors can support the breakout.

So, do keep this stock in watchlist as it is currently trading above 200 Weekly EMA and RSI breakout is also done.

Idea is shared only for educational purposes and please trade according to your research.

ONGC - Bullish BreakoutKey Points:

- On daily chart strong Bullish breakout momentum seen with potential of 15% rise from retracement price of Rs. 153

- Resistance breakout @ 153

- RSI > 70

- Tech showing buy signals

- Price is above 20,50,200 EMA

- Volume is above VMA

Bhav is “ Bhagwan ”

Disclaimer :

I am not a SEBI registered Analyst.

Please do your own Analysis before taking any trade/investment.

The above view is just for educational purpose only.

Zydus Life – Cup and Handle BreakoutKey Points:

- Bullish cup and handle patter with potential of 23% rise from current price

- Resistance breakout @ 474

- RSI near to cross 70

- Tech showing buy signals

- Price is above 20,50,200 EMA

- Volume above average

- Super trend is possitive

Bhav is “ Bhagwan ”

Disclaimer :

I am not a SEBI registered Analyst.

Please do your own Analysis before taking any trade/investment.

The above view is just for educational purpose only.

M&M Finance -Bullish Ascending TriangleKey Points:

- Ascending Triangle

- Resistance @ 234 & Support @220

- RSI crossing 63

- Tech showing buy signals

- Price is above 20,50,200 EMA

- Potential uptrend above 250 to 265 and next level 300

Bhav is Bhagwan - Find your Bhagwan

Disclaimer :

I am not a SEBI registered Analyst.

Please do your own Analysis before taking any action.

The above view is shared just for educational purpose only.

Power Grid - Start Charging with +ve1. On daily chart with technical view I have seen bullish trendline breakout with upside move.

2. The closing price is also closed above 68% FAB retracement level which also shows positive trend.

3. MA i.e. 21-11 cross over is seen upward move.

4. RSI is near to 70 i.e. 68.

I can see 20 to 25 points upside move in near short term.

P.S. This technical analysis is my personal view and for education purpose. Before taking any action pl get advise from your financial advisor

#Coforge ready to give 9% upmove, RSI breakout tradeAs per weekly chart Coforge is looking quite strong, Weekly RSI has already broken out of its resistance of 48. Personally I would want weekly RSI to be above 55 for bigger upmove or price to give pullback to 3645 levels. I will be keeping eye on this counter for quick 5-6% gain if price sustain above 3700 levels, or price to give pullback to 3645 level for great risk reward trade. In both cases my SL would be closing below 3400. Quite interesting counter to keep tab on for next few days, always respect risk.

Happy Investing & trading :)

Bull counter attack in Granules IndiaGranules India has maintained support of 340 price level after breakout.

As identified in chart, Bull has made counter attack the bear candle.

RSI is also increase by taking support of 60 levels,this shows stock is still in bullish momentum.

If volume is consider, current candle has above average volume.

Target of 395 can be achieved in upcoming days.

Traders are requested to do their own analysis before taking actual trade.

Happy Trading!!!

PEL | Trendline + RSI breakout - Trying to capture 22% (Fib)PEL | Trendline + RSI breakout - Trying to capture 22% (Fib)

CMP : 2775 (Dip : 2700)

SL : 2550

Target : 3430

1:4 risk reward setup

Dual breakout in Banknifty !!!!As, chart says banknifty have given breakout above 200DEMA where,

it has faced resistance 3 times earlier.

RSI above 60 indicating strength in breakout and confirms it's reliability.

Also, breakout from inverted head & shoulder pattern is visible.

Minimum target of this pattern comes to 36150 but it can move above this also.

I'll try to publish an elaborate idea on banknifty as it's PE stands on 17.71 below 1,3,5yrs average

and has strong buying interest at 15.54.