Long Tata Consumer 1. Price broke above the downtrend trendline and making higher lows.

2. Double Bottom confirmed as the neckline (494.20) broke with a huge volume.

3. RSI Divergence: Price making lower low but RSI making Higher High (see daily chart, low made on 14 Oct and 21 Oct 2020)

4. RSI in Harmony: Price making higher high but RSI making Higher High (see daily chart, high made on 15 Oct and 27 Oct 2020)

buy only above 510

Target 530/560/580

SL 483

Rsidivergence

Hidden RSI Divergence in AMARAJABAT for Target of 877+We can see the price making a higher low, whereas at the same time the RSI is making a lower low. This is a bullish continuation pattern where the divergence indicates the end of a temporary retracement in an overall uptrend. This could be a great moment to buy AMARAJABAT for an immediate target of 852 and next to 877+.

Possible Trade:

Buy AMARAJABAT above 835

Stop loss - 825

Target 852 877+

Bharti airtel | Line Chart analysis | stock in discount RSI made higher high (HH) that means trend reversal signal

Line charts made lower Low (LL) Thats means its a rsi divergence

Tight trendline also broke

Bullish engulfing pattern in candle charts also

All these happened at major support level

TARGET = 478

LOT SIZE = 1851

6 types of price action & technical analysis confirmation before this trade

FOLLOW FOLLOW FOLLOW

ITC Forecasting , Positive RSI divergence ITC Forecasting , Positive RSI divergence

ITC is trading at its crucial support around 165 & Now RSI is also accelerating Positive divergence towards demand zone.

We can see first moves toward 180 if it successfully cross the 174.

If it fail to hold 165 then we can see next support at 157.

TITANIt has made a Bearish Harmonic Bat in daily time frame. It could retrace till 1200/1175/1100 provided it does not start sustaining above 1270 once again.

Harmonic Patterns are derived from Fibonacci Ratios when each angle of retracement aligns to confirm a reversal probability of 38-50-62 % of the existing trend.

#LETSTALKABOUTMARKETS - Tech MahindraTech Mahindra seems exhausted now and is not participating in the Amazing IT rally that we have seen. It can be considered the weak link in the It index even though it has given a wonderful return. Technically TechM has closed with a graveyard candlestick which indicates a reversal in the uptrend. One can enter into a short position around 870-875 with a strict SL of 910 and for a target of 800. It also has a negative RSI divergence as marked in the charts.

Do like and comment your views. This is my personal opinion and purely for educational purposes.

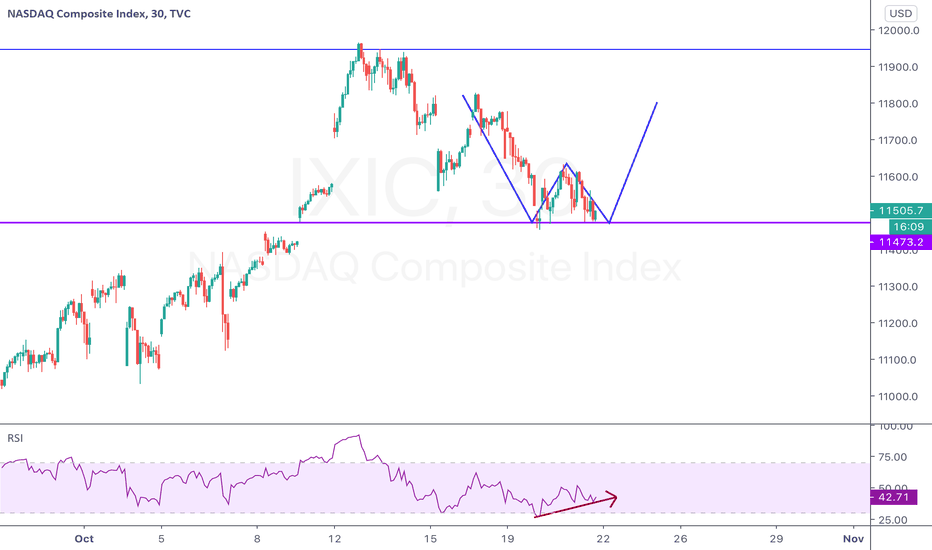

NIFTY forms RSI divergence! Rallies more than 1.5% todayNifty - Technical Analysis:

-Nifty logs a gain of 171 points, or 1.52 percent, to settle at 11,449.25

-RIL jumped over 7%

-It gaped above 11300 based on recovery in US markets after the selloff a few days back, we can see resistance at 11600 and index would need to cross above resistance zone before seeing upper levels.

Market - Driving Factors:

-Nearly 100 stocks, including Reliance Industries, Asian Paints, Tata Elxsi, Granules India, Infibeam Avenues, Laurus Labs, Adani Gas and Adani Green Energy, hit their 52-week highs on BSE.

-The Indian stock market traded higher, boosted by gains in shares of heavyweights such as Reliance Industries, Axis Bank and Asian Paints.

-Nifty Metal fell over a percent while the Pharma index settled flat. Nifty PSU Bank index jumped over 2 percent higher.

-RIL zoomed 7% as Reliance Industries' plan to sell a stake in its retail subsidiary at an equity valuation of Rs 4.21 lakh crore and its proposed acquisition of Future Group's retail businesses will solidify RIL's position in India's organised retail market and strengthen its consumer business.

Nifty - Outlook for Friday, 11th September:

NIFTY has come above the resistance at 11300 and showed strong trend intraday with support of index heavy weights. NIFTY also observed a RSI divergence as RSI makes new high but price didn't which is a bearish signal. We can see index consolidation before a move either side.