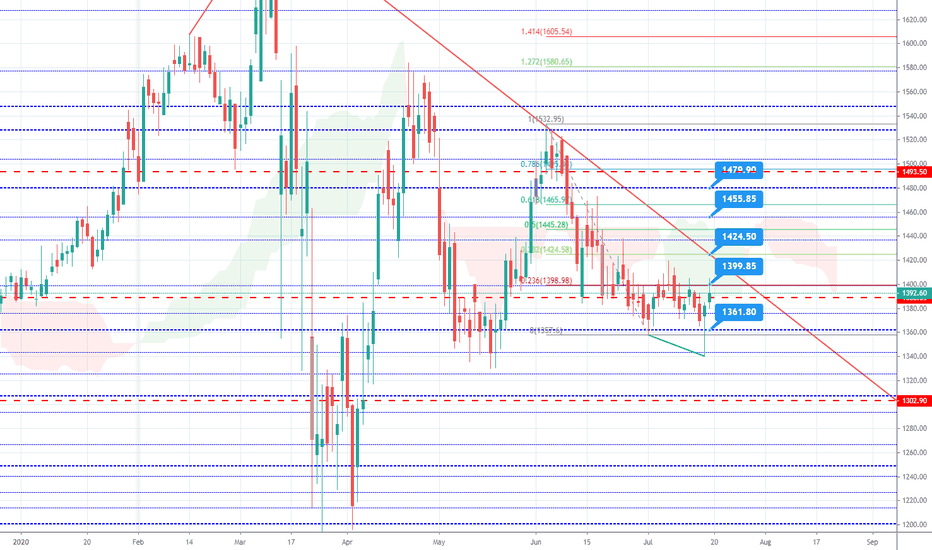

Pidilite - Stick to it - LONGProfits will stick to those who stick to Pidilite. Afterall, the company manufactures Fevicol!. The Price action has an almost perfect setup for going long - double bottom, consolidation, a nice rejection candle with a long tail. Technical indicators are positive too - RSI Bullish Divergence among other indications. The blue horizontal lines are Gann Levels - an indicator that I published and use extensively for finding S/R levels. Will go long above !400. There is a trend line resistance at 1424.5 which is also a key level for W confirmation. Targets are 1456 and 1480

Rsidivergence

ITC will go down ? What are the reasons ?Disclaimer

-----------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. Consult your financial adviser before any decision. This is only for education purpose.

ITC 4H Chart : Dark cloud cover already activated, see the following chart

Nifty - RSI divergence seen - Look for 10095 - 9980 There is something worthy of noticing w.r.t. the rising channel Nifty is moving in and RSI divergence, this time.

1. While the Nifty has made a higher top, RSI has failed to do so. This RSI divergence is seen after a long time, as RSI is considered as a leading indicator, this can't be ignored.

2. Nifty has not touched to resistance line of this channel this time too and the gap between recent top and resistance line is visibly higher than the last time it made an high (8th June).

Important levels can be seen on chart, 9840 is important to hold for a medium term prospective. Keep an eye on this rising channel, sustaining above the support line is of significant importance. It is still a bear market rally, (if and) once this support is gone, we may see a steep fall.

Today is a derivative settlement day, markets tend to move in bigger ranges on such days, in my opinion it will be better to square off or hedge long position today and initiate short side trades on rallies.

I always discourage trading using naked future or option positions, risk defined or low risk strategies are much better alternatives available to all traders. You can write to me over private chat on tradingview or other popular social media mediums using for such strategies.

Please remember to carry due diligence and consult your financial advisor / consultant before taking any position in the markets, utilising leveraged products.

Infy - Correction phase?Infosys has seen a correction and a recovery. During the recovery phase, we also observe that the third Elliott impulse wave has been completed and the corrective waves have started. The last 2 weeks has seen a consolidation in the stock with a couple of attempts to both break above and below the consolidation. The counter is now seeing some exhaustion and any break below the consolidation rectangle can lead to a 40-50 point dip towards the 650 zone. There is bearish RSI divergence and MACD crossunder too. All indicators are bearish. Will need a good trigger to push the stock up. Else, will drift to lower levels.

Multiple indicator suggesting a shortPrice as retraced at 38.2% of impulse fall from Nov 19, Touching a trend line, and local resistance area, Also there is RSI divergence on weekly chart.

We can look to sell if price hold below 87 strictly for target of 70-73. But if goes above 87-88 and holds the then we can look for buying opportunities above 90.

#LETSTALKABOUTMARKETS - ESCORTSEscorts has been the outperformer stock of this pandemic in my views. It has crossed it's previous highs already and has no aim of correcting looking at the way it is rallying. But technical indicators says something else.

1. RSI- If we have a look at the RSI, it does not give us any positive signs. There is a negative divergence that has started since 30th jan. I have marked it on the charts. I don't know whether to interpret or no as there seems to be no stopping this stock.

2. MACD- MACD has topped out or atleast it is in the overbought zone. Last time also when the MACD divergence happened from this zone, the stock corrected almost 14% before falling prey to the covid-19 hit.

To be honest i do not have a clue about it, It might not even correct but buying at this level doesn't seem to make sense. One can think of selling around 1000 mark with a strict stoploss as per your analysis and capacity for 850 levels. This stock is meant for correction according to the divergence.

Please share your views if any!

Mindtree, Good Time to Short sellAs clearly shown on charts, Mindtree is currently facing weekly timeframe resistance

1) Momentum loss clearly seen

2) RSI below 60

3) Double Top Formation

4) Negative Divergence seen on daily charts

Confirmation of the pattern if 880 Broken, One can enter into positional long for a target of 730

Amaraja Battery, Short Sell CandidateAs shown in charts

1) Currently trading Near Monthly Resistance

2) Inside Candle Formed

3) Negative Divergence Spotted

If breaks 609, One can wait for target of 580 or more

#LETSTALKABOUTMARKETS- AUROBINDO PHARMA Auropharma may still gain a bit but it will not be outperforming anymore, adding to that i feel it might under-perform as well. The basis for this are the technical indicators:

1. RSI divergence - RSI divergence is when the price slopes upwards but RSI slopes downwards, forming a negative divergence. As seen in the chart, price is moving upwards whilst RSI is sloping downwards which indicates that the upward price movement will not last for long.

2. MACD - Moving average convergence divergence as it is called, has also showed a crossover which further confirms the weakness in the stock price movement.

3. Bollinger Bands - BB also seem to be squeezing out which shows low volatility. One can wait out to see the price movement, where the Bollinger Band seems to be expanding.

The upward price movement might fade out soon and might even move sideways before cracking down. One can take a position by keeping a stoploss around 715 and wait for the target of 600 and an extended target of 560.

*This is my opinion and i am not registered with sebi*

RBL Bank trading near its Lifetime low - FPI Buy Position

Positive Points:

==============

- Stock is trading near its lifetime low.

- Also, RSI positive divergence can be seen on the weekly chart.

- A bulk deal done by FPI(erstwhile FII) for 256.48 rs.

Negative Points:

=============

- India is struggling with TRUST factor with some banks like PMC, YesBank etc. Keeping in mind, banks like RBL Bank, may be affected badly.

MINDTREE : Shifting Range? MINDTREE: On 18th July the gap down seems to be a exhaustion gap. Post gap the price did not fall aggressively down, prices started to create higher lows. The RSI has moved into neutral zones from bearish zone. There are early indications of bottoming out in the stock. Holding above 707 will be a good sign of support.

Larsen & Toubro: RSI not displaying any zeal!Larsen & Toubro: The RSI is failing to display any zeal, taking a hit at the 60 levels and turning down, may not be a favorable move for buyers. The gap created post the earnings have been closed. 1425 closing basis may act as a support, beyond this, LT may start to drift lower.

Sunpharma needs a momentum boosterSunpharma has to buck up momentum here. The advances are forming narrow candles, RSI is not quite pulling up, if the momentum fails to pick up in a session or two then this whole move up may be a corrective and a fresh sell off may be witnessed. Bearish view may be negated above 415 closing basis.