Sbinlong

SBIN | Triangle pattern observedTriangle pattern observed in SBIN. Pattern looks to have confirmed suggesting a bearish outlook. Target depth of triangle is around 25 points. With confirmation of pattern occurring at 347.50, Target of the pattern comes in at 322.70. A retracement towards the pattern before further weakness cannot be ruled out. Notice that 334 could offer a good support.

SBIN | Monthly Close Holds the KeyRecent bullishness and last week close above 350 levels in SBIN warrants more attention.

325 to 350 region has been a zone of uncertainty with many failed breakouts.

It should be noted that ATR during last week was around 18. The stock moved into a historical supply zone with 2ATR move of 35 pts. This calls for caution.

The current sharp move upwards was supported by overall market exuberance rather than stock specific trigger. Weekly close should be taken with a grain of salt since the event was towards the end of the week.

A comfortable close above 360 levels on Monthly time frame is required before adding to your high conviction Buy List.

Long SBIN|| S.L - 274.2 || T1- 286Buy State Bank Of India with a Stop Loss of 274.2 and a target of 286. Do not take a trade if it opens above 285.

Disclaimer :

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. Any opinions, news, research, analyses, prices, or other information offered is provided as general market commentary, and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

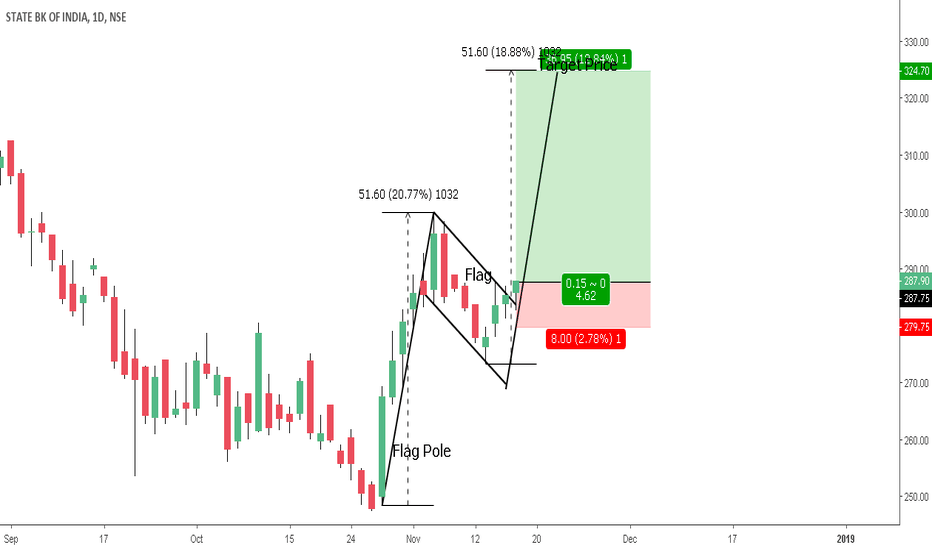

Bullish Flag Breakout - Continuation Pattern - RR Ratio 1: 4.6Long sbin Above 288

stop-loss - 279.75

Target 324.70

Risk 2.78 % & Reward 12.84%

RR Ratio - 1: 4.62

Continuation Pattern

Bullish Flag

Bullish Flag chart pattern represents consolidation. This means that it occurs after a large movement in price. As such it’s also a continuation pattern, which means that the market is likely to continue in the same direction once the pattern gives a breakout.

SBI chart Study...Guys SBIN Test Supply Zone keep watch and take profit...

Disclaimer:

The information contained in this presentation is solely for educational purposes. Does do not constitute investment advice. I may or I may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable for your own financial situation.

I am not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

Hope this idea will inspire some of you! Don't forget to hit the like/follow button if you feel like this post deserves it

SBI Long...Hi, Guys, SBIN next move Keep Watch...

Disclaimer:

The information contained in this presentation is solely for educational purposes. Does do not constitute investment advice. I may or I may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable for your own financial situation.

I am not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

Hope this idea will inspire some of you! Don't forget to hit the like/follow button if you feel like this post deserves it