Trias Growth Explosion: Buy Your Ticket to Success!**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

Search in ideas for "Chart Patterns"

Bar Rally Alert: Your l to Buy and Prosper!**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

Rats are Ready To Run Without any Cat**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

NKN Rally Alert: Your l to Buy and Prosper!"**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

FLR Illuminating the Path: Get In on the Buy Action Today!"**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

YFI Rally Alert: Your l to Buy and Prosper**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

LSK On Fire: Don't Miss Out on This Buy Trade!"**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

Flow Is Ready to Flowing UP**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

OM Next Move: Grab the Bull by the Horns!**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

Mask Is Ready To UnMask The Bulls?**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

A Bearish Outlook on ETHUSDT Amidst Technical WeaknessA bearish view on ETH/USDT (Ethereum to Tether) means that the market participants or analysts anticipate a decline in the value of Ethereum relative to Tether. Here are some factors that might contribute to a bearish outlook:

Technical Analysis:

Chart Patterns: Traders often use technical analysis to identify patterns, trendlines, and other indicators that suggest a potential downward movement.

Moving Averages: A bearish crossover of short-term moving averages below long-term moving averages could signal a negative trend.

Market Sentiment:

Negative News: Adverse news about Ethereum, such as regulatory developments, security concerns, or technological issues, can lead to a bearish sentiment.

Investor Sentiment: Monitoring sentiment indicators, such as social media discussions or surveys, can provide insights into market sentiment.

Fundamental Analysis:

Market Fundamentals: Negative developments in the Ethereum ecosystem, such as issues with smart contracts, scalability challenges, or changes in the development team, could impact the market negatively.

Economic Factors: Economic indicators, such as inflation or interest rate changes, can influence the value of cryptocurrencies.

Market Dynamics:

Trading Volume: A decrease in trading volume, especially during a price decline, may indicate weakening demand and potential for further downward movement.

Liquidity: Low liquidity in the market can amplify price movements, making it easier for the market to experience rapid declines.

Global Economic Factors:

Macro-Economic Trends: Economic events on a global scale, such as geopolitical tensions or financial crises, can impact the entire cryptocurrency market.

Remember that cryptocurrency markets are highly volatile, and predictions can be challenging. It's crucial to conduct thorough research and consider multiple factors before forming any trading decisions. Additionally, consulting with financial professionals and keeping up with the latest news can help you make more informed decisions based on the most recent information.

▰ Stock of The Month #4: SUNPHARMA ▰▰ Stock of The Month #4: SUNPHARMA ▰

📌 I have found 25 new patterns on the charts. These are original and unique patterns that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one every month. For more, you can check out my previous studies 😍 as well. Kindly see my announcement section for all the latest.

▣ Key Highlights:

➟ Time frame Weekly ₩

➟ W pattern ⓦ

➟ Trend line ⍩

➟ Rounding Arc ◡

➟ Flag Pattern 🎌

➟ Unique Confluence Ⓤ

📌 Levels are:

Entry: ▲ 710

SL: ☢ 660

Target: ➚ 920/1080

RR: ☈ 1:7.5

Return: 50%+

☆ Follow me @ tradingview for more updates. Kindly like the chart 💗 & share this analysis.

☆ Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✮ Disclaimer ✮

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

--------------------------------------------------------

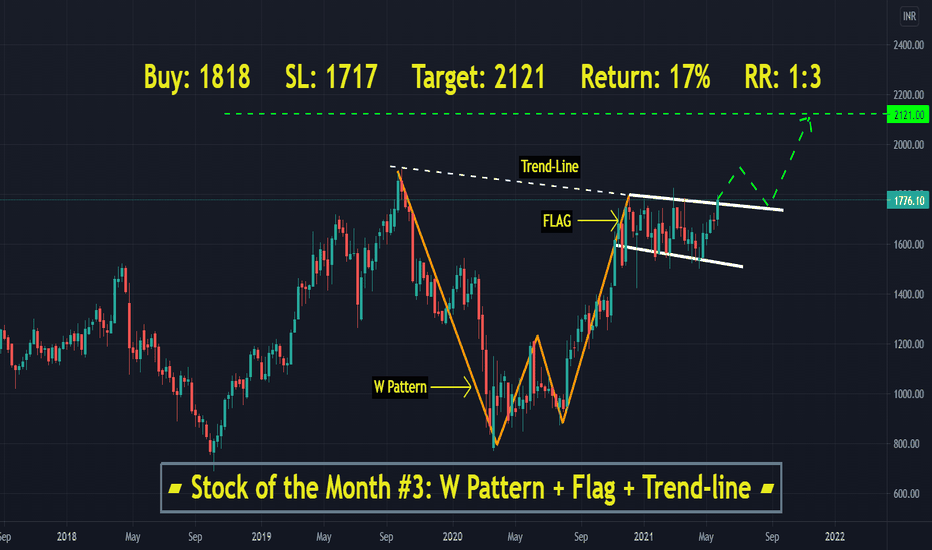

▰ Stock of the Month #3: INGIDO ▰▰ Stock of The Month #3: JUNE ▰

📌 I have found 15 new patterns on the charts. These are original and unique patterns that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one every month. For more, you can check out my previous studies 😍 as well. Kindly see my announcement section for all the latest.

▣ Key Highlights:

➟ Time frame Weekly ₩

➟ W pattern ⓦ

➟ Trend line ⍩

➟ Flag Pattern 🎌

➟ Unique Confluence Ⓤ

📌 Levels are:

Entry: ▲ 1818

SL: ☢ 1717

Target: ➚ 2121

RR: ☈ 1:3

Return: 17%+

☆ Follow me @ tradingview for more updates. Kindly like the chart 💗 & share this analysis.

☆ Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✮ Disclaimer ✮

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

--------------------------------------------------------

▰ Stock of Month #1: LUPIN ▰► Stock of Month #1 ◄

♒ E͙V͙E͙R͙Y͙T͙H͙I͙N͙G͙ ͙ O͙N͙ ͙ C͙H͙A͙R͙T͙ ♒

📌 I have found 15 new patterns on the charts. These are original and unique patterns that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one on Sunday. For your reference, you can check out my previous studies as well. Please find the stocks and comment their name in the comment ⌨ section.

☆ Follow me @ Tradingview for more updates and like the chart ❤!!!

☆ Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✮ Disclaimer ✮

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

--------------------------------------------------------

► Stock Characteristics #3: KAJARIACER ◄► Stock Characteristics #3: Flag Pattern!!! ◄

📌 I have found that some stocks follow their own pathways. These are original and unique patterns that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one on Sunday. For your reference, you can check out my previous studies as well. Please find the stocks and comment their name in the comment ⌨ section.

☆ Follow me @ tradingview for more updates and like the chart ❤ for more interesting patterns and analysis.!!!

☆ Please comment for any queries and kindly like & share this analysis and studies. Comment with what do you think.

Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✬ Disclaimer ✬

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on evaluating their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

---------------------------------------------------------

▰ Time to Learn Advance Pattern #2: CENTURYTEX ▰► Time to learn Advance Pattern #2 ◄

♒ E͙V͙E͙R͙Y͙T͙H͙I͙N͙G͙ ͙ O͙N͙ ͙ C͙H͙A͙R͙T͙ ♒

📌 I have found 15 new patterns on the charts. These are original and unique patterns that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one on Sunday. For your reference, you can check out my previous studies as well. Please find the stocks and comment their name in the comment ⌨ section.

☆ Follow me @ Tradingview for more updates and like the chart ❤!!!

☆ Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✮ Disclaimer ✮

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

--------------------------------------------------------

TGV Sraac Ltd - Looks Good!BSE:TGVSL Looks good for an uptrend!

It seems like a potential trend reversal in this stock, possibly in the context of technical analysis.

Here's a breakdown of the key elements:

Price Reaching a Bottom: This suggests that the stock price has been in a downtrend for a period, and it has recently stopped declining or slowed down significantly.

Signs of Reversal: This indicates that there are indications or patterns in the price movement that suggest the trend may be changing. These signs can include technical indicators, candlestick patterns, or other chart patterns.

Breaking Upward: This means that the stock price has moved above a specific level or trendline, often referred to as a resistance level. Breaking above this level is seen as a bullish signal.

Period of Uncertainty or Consolidation: Prior to the breakout, the price may have been moving sideways in a range, which is known as consolidation. This phase typically indicates indecision in the market.

When traders and investors observe these patterns and signs, they may interpret it as an opportunity to enter a long (buy) position, anticipating that the price will continue to rise.

However, it's important to note that technical analysis is just one approach to market analysis, and it should be used in conjunction with other forms of analysis (fundamental, sentiment, etc.) to make informed trading decisions. Additionally, not all trend reversals are successful, so risk management is crucial in trading.

Crude oil going to correct ?Crude oil appears to be bearish in the near future. This conclusion can be drawn from various data points, which we will examine sequentially:

Chart Patterns: Upon examining the continuous contract chart pattern for crude oil futures in the daily timeframe, we notice that the price has reached resistance, as depicted in the accompanying image. Furthermore, the candles have become smaller as the price reached this resistance point, with the most recent candle resembling a doji. This pattern can serve as an indicator of future trends.

Relative Strength Index (RSI): The RSI for crude oil in the daily timeframe has reached the upper band of 70, which is considered the overbought zone. This can be interpreted as an indicator that crude oil may weaken significantly over the coming period.

Trading Volumes: A careful observation of trading volumes reveals that they have flattened, or even slightly decreased. This can be another signal that crude oil may become bearish in the near future.

Crude Oil Inventory Data: By analyzing the crude oil inventory data, we can infer that the supply is not as low as expected. This suggests that while the supply remains consistent, the demand is decreasing, which could lead to a drop in crude oil prices in the future.

In summary, considering all these points, we can conclude that the price of crude oil may decrease in the near future.

◩ Harmonic Pattern #1: BANKNIFTY ◪► Harmonic Pattern #1 ◄

📌 I have found that some stocks follow their own pathways. These are ❝ original and unique patterns ❞ that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one on Sunday. For your reference, you can check out my previous studies as well. Please find the stocks and comment ✍ their name in the comment ⌨ section.

☆ Follow me @ tradingview for more updates and like the chart ❤!!!

☆ Please direct message ✉ or comment for any queries and kindly like & share this analysis and studies. Comment with what do you think.

Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✬ Disclaimer ✬

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on evaluating their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

---------------------------------------------------------

► Advance Pattern #2: HINDPETRO ◄► Advance Pattern #2 ◄

📌 I have found that some stocks follow their own pathways. These are ❝ original and unique patterns ❞ that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one on Sunday. For your reference, you can check out my previous studies as well. Please find the stocks and comment ✍ their name in the comment ⌨ section.

☆ Follow me @ tradingview for more updates and like the chart ❤!!!

☆ Please direct message ✉ or comment for any queries and kindly like & share this analysis and studies. Comment with what do you think.

Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✬ Disclaimer ✬

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on evaluating their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

---------------------------------------------------------

▰Stock Characteristics #2: INDUSINDBK▰► Stock Characteristics #2: Triangle Pattern!!! ◄

📌 I have found that some stocks follow their own pathways. These are original and unique patterns that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one on Sunday. For your reference, you can check out my previous studies as well. Please find the stocks and comment their name in the comment ⌨ section.

☆ Follow me @ tradingview for more updates and like the chart ❤!!!

Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✬ Disclaimer ✬

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on evaluating their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

---------------------------------------------------------

►Stock Characteristics #1: ASHOKLEY !!! ◄►Stock Characteristics #1: Head & Shoulder !!! ◄

📌 I have found that some stocks follow their own pathways. These are original and unique patterns that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one on Sunday. For your reference, you can check out my previous studies as well. Please find the stocks and comment their name in the comment ⌨ section.

☆ Follow me @ tradingview for more updates and like the chart ❤!!!

☆ Please direct message ✉ or comment for any queries and kindly like & share this analysis and studies. Comment with what do you think.

Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✬ Disclaimer ✬

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on evaluating their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

---------------------------------------------------------

Nifty Bank Index Chart Analysis

#### Chart Overview

The chart shows the Nifty Bank Index on a 1-day (1D) time frame, with candlestick patterns representing price movements. It includes technical indicators such as MACD, RSI, and volume, as well as additional tools like ATR Trailing Stops, support and resistance zones, and chart patterns. This setup is for analyzing market trends and making informed trading decisions.

---

#### Key Chart Features and Pattern Observations

1. **Price Trend**:

- The chart shows a significant downtrend in recent sessions, with red candlesticks dominating.

- A rejection at a key resistance zone (marked in pink) led to a sharp decline.

2. **Support and Resistance Zones**:

- Multiple **resistance levels** are highlighted near **53,888.30** and **52,000**, showing rejection.

- A strong support zone is visible at **49,787.10** (blue line), where buyers might show interest.

3. **Gaps**:

- A price gap is visible, which might be a potential magnet for price or resistance area.

---

#### Indicator Analysis

1. **Volume**:

- Negative volume bars indicate strong selling pressure in the last few sessions.

- Declining green volume in the uptrend signals weakening bullish momentum.

2. **MACD (12,26,9)**:

- **MACD Line (62.91)** is below the **Signal Line (140.63)**, confirming bearish momentum.

- The histogram shows increasing red bars, signaling a strong bearish divergence.

3. **RSI (4)**:

- The RSI value is **53.46**, indicating a neutral zone but leaning bearish.

- It's declining from overbought levels, which often signals a potential downtrend continuation.

4. **ATR Trailing Stops**:

- The indicator shows the price below the trailing stop, signaling a bearish sentiment.

- ATR highlights increased volatility in the recent downward move.

---

#### Key Levels or Price Levels

1. **Resistance Levels**:

- **53,888.30**: Major resistance where price reversed sharply.

- **52,000**: Intermediate resistance zone for potential short-term bounces.

2. **Support Levels**:

- **50,000**: Psychological round number and immediate support.

- **49,787.10**: A critical support zone where the price may consolidate or bounce.

---

#### Overall Summary

The chart suggests the Nifty Bank Index is in a bearish phase, with strong selling pressure dominating recent sessions. Indicators like MACD, volume, and RSI confirm bearish sentiment. The price is trading below major resistance levels, and sellers are in control. However, critical support at **49,787.10** might provide some relief.

---

#### Trading Strategy

1. **For Bears**:

- Enter short positions on pullbacks near **52,000** or **53,000** with a stop-loss above **53,888.30**.

- Target **50,000** and **49,787.10** for profits.

2. **For Bulls**:

- Wait for confirmation of a reversal at **49,787.10** before going long.

- Target **52,000** in case of a reversal, with a stop-loss below **49,500**.

3. **Neutral Strategy**:

- Avoid trading in the current high-volatility phase unless a clear direction emerges.

- Use a breakout or breakdown beyond key levels like **53,888.30** (upside) or **49,787.10** (downside).

---

#### Conclusion

The Nifty Bank Index is under strong bearish control, with sellers pushing prices lower after rejecting resistance zones. Traders should adopt a cautious approach, favoring bearish setups unless the price shows a clear reversal signal at the support levels.