Inverted Cup & Handle pattern in monthly timeframeHello All,

Market is at very important point where it can take support and go higher and if rejection we have big fall.

My expectation is at least 3000 points if cup and handle broke.

FED hike warnings really bothering the market and on Friday it broke previous low and touches 20% fall from Jan 2022. However if it closed with the same momentum on Friday then we would’ve seen big gap down on Monday opening.

Please note this is just my observation only and for purely for educational purposes.

Trade at your own risk.

Search in ideas for "DJIA"

DJI AnalysisDJI technically downtrend

Analysis 1

DJI doesn't break the DAY and 1HR Trend line.

seems sell retracement.

once cross down and sustain 33500 means the fall down to 33350.... 33350 to 33200 is demand zone...if the demand zone invalided means the price fall down to 33000...

(a) sell stop risk entry 33600 safe entry 33450

targets 33350/33250/33150/33050

buy stop 33800.

Analysis 2

DJI breaks the trend line and sustain means.

Rally continues up to 34300.

there will be a 2 Supply zones.

1st Supply zone 33950 to 34050

2nd Supply zone 34160 to 34250

(b) buy stop risk entry 33820... Safe entry also same but after retracement from the trend line

targets 33950/34050/34150/34250/34320/34500

Stop loss 33650.

DOW JONES FUTURES CHART ANALYSISThis is just a brief idea of what could happen in the week. If any positive news from the FED, the markets could take a nice bullish reversal.

Don't carry any short positions just yet. Because shorting from here has very less risk-reward ratio. The harmonics work better when the RSI also concurs. The bullish ABCD pattern when the RSI indicating undervaluation.

Happy trading :)

This is just for educational purposes.

Dow JonesI am known to STICK my NECK out and then Stick to it. I do this because None other here will ENLIGHTEN the MASSES with taking any PAYMENT. The DJIA explained in detail ...... There is MORE and MORE panic in the US markets than ever before. There is an influential Twitter @ HENRY ZEBER. He is known to make BOLD calls. Yesterday he came out with a figure of 6100 on the S&P 500...... Go back to my previous posts and see when I gave the figure of 6100 ??? A few weeks ago if not a few months ago. It is not easy to make a BOLD CALL because People TROLL/CURSE/ABUSE ........... Its OK with Me. I have been through much WORSE than taking a few Abuses. Stay INVESTED for a RALLY towards 39000 on the NIFTY and 67000 odd on the DJIA. The Handle Bottom will come IN at 32800 odd..... the Dow did 32873 last night...

Trader's Roadmap Jan, 2022 - What I expect on Indian Market?Few market moves will destroy 99% of the Traders who are involved in them that why I arranged to give you a whole week or month of NSE's Perspective.

The spot nifty hourly chart:"at an exciting juncture". it is difficult to say at this juncture for other analyst whether this upturn can be sustained.

But, I'm going to share few important levels where you can take position or create a trade-setup.

First observation should, the trend is down. By the looking at chart from left to right hand-side, the price is defining lower low(W,Y and Z) and low high (1X and X2). So I picked, Oct. 18605 high and Dec. 16410 low and found "Bullish Triple Zigzag corrective pattern".

If you expect the trend is continue lower or downward, equality ratio can give you a important Resistance levels. After the ending of point of Z wave, ((w))=((y)) at 17574. The 17600 is equal of wave a and c but 17503 is first upcoming resistance a=c 0.789 ratio.

Trend reversal key level wherein we need to reconsider our wave count : 17640 lower high.

So, currently the is expected downward because the price is under 17640. If any of above resistances registered, the next first targets 17077 and ...

Let's little attention toward the DJIA.

Can we see new high on DJIA?

Bullish Divergence in Dow Jones Industrial AverageRSI Bullish Convergence was there on weekly charts of Dow Jones only 5 times in last 20 years, which was always followed by average 15-18% market rally

similar RSI convergence is visible on weekly Dow Jones chart Right now, pre-covid highs are acting as a support

Disclaimer: Chart, data and levels for study purpose only. I am not a financial advisor. Use your intelligence before investing.

Dow Jones technical analysis ahead of FOMCThe US headline CPI data released last week surprised the market with a smaller drop than expected. As such, a higher chance is being given to a 75-basis-points rate hike in the upcoming September FOMC meeting. The US stock market reacted with a major sell-off last week, signalling that the summer rally has overstayed its welcome.

The Dow Jones plunged by 1,300 points or 4.2% last week. The S&P500 dropped by 5.2%, while the NASDAQ declined by 6.0%.

The interest rate decision from the Fed due this Wednesday (UTC -4) will be a significant event for US markets this week. The market is currently pricing in an 85% chance of a 75bps rate hike and a 15% chance of a 100bps hike.

Looking at the current price action for the Dow Jones in combination with the Schaff Trend Cycle indicator, indicates that the downside's strength still present and may continue to stick around. The Schaff Trend Cycle is currently sitting far below the 25 level at sub-5.

However, this indicator’s current condition may also be a sign that the Dow Jones may be oversold. In such a case, we might expect the index to perform a reversal and retest the 31,200 level, before continuing the downtrend. Traders looking for a counter-trend trade might want to watch and wait for the Schaff Trend Cycle to close above the 25 levels.

With the upcoming FOMC meeting and the expectation of a 75bps or greater rate hike, we may expect a reaction to the downside during the day and a hitting of the 30,000-support area. Breaking below the 30,000-demand zone will open up the 29,500 to 29,000 targets.

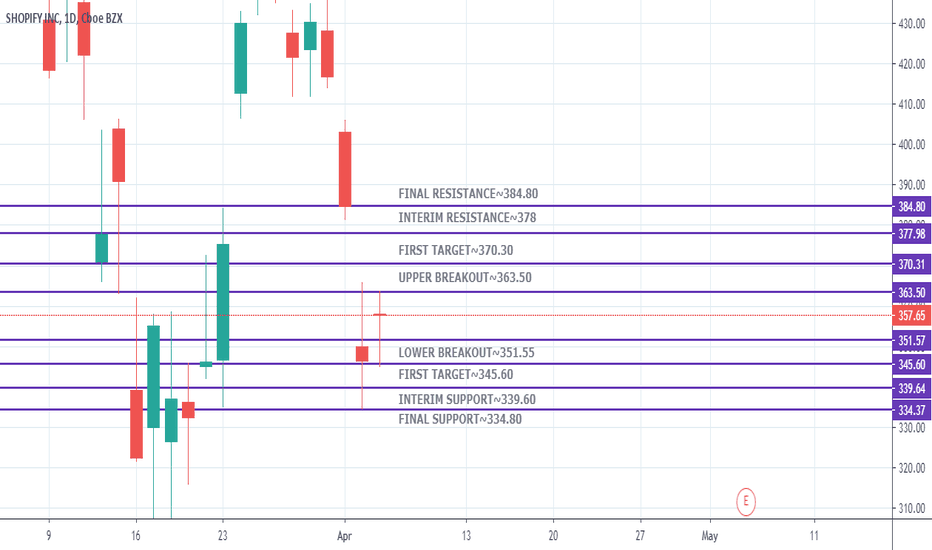

SHOPIFY KEY LEVELS SUPPORT AND RESISTANCE 04/06/2020Key Levels for SHOPIFY INC NYSE for INTRADAY TRADING are :

Upper Breakout~363.50

First Target~370.30

Interim Resistance~378

Final Resistance~384.80

**Lower Levels**

Lower Breakout~351.55

First Target~345.60

Interim Support~339.60

Final Support~334.80

Please trade with caution and consult your financial adviser before trading.

dow futuresThe Chart Must be co-related at your end to the DJIA spot chart and seen accordingly. AB=CD done on Daily basis on the DJIA futures, and a Jump/Bounce followed. I cautioned you all yesterday that the BOUNCE would be sooo LETHAL ... None of you would believe it, just as None believed Nifty at 15190 odd. DJIA future is at its 23.6% fib retracement which is the 1st RESISTENCE. Since Price never reacts at the specific point.... I have given it a Buffer of 100-120 odd points to see what happens. I have also marked a LEVEL, above which and SUSTAINING ...................................... CATCH ME IF YOU CAN

I HOPE YOU GUYS MADE MONEY TODAY ...... I would be happy to hear the YESS'S

Dow JonesBased on Some Comples Fibonacci calculations to get the BOTTOM IN...I have given a Bottom Range of hardly 60-70 points apart. Once this Bottom is IN...... The MOVE UP on DJIA I believe will be LETHAL. Not Many will even believe the MOVE UP . Once this happens... the DJIA must cross over the 2 Areas marked in Blue Arrows. DJIA will not look back once it crosses over and will Move towards the upper 4 targets. Nothing will happen within a day or a week... So be patient as MArket will TEST YOU

Top 10 Index View of Indian Equity Market

The Nifty Index, also known as the Nifty 50, is a benchmark stock market index representing the weighted average of the top 50 companies listed on the National Stock Exchange of India (NSE). It is one of the two main stock indices used in India, alongside the BSE Sensex.

### Key Features of the Nifty 50 Index:

- **Composition**: The Nifty 50 includes 50 of the largest and most liquid Indian companies across various sectors.

- **Calculation**: The index is calculated using the free-float market capitalization-weighted method, which means it considers only the shares available for public trading.

- **Sectors**: The Nifty 50 covers a diverse range of sectors such as financial services, information technology, consumer goods, energy, and more, providing a broad representation of the Indian economy.

- **Rebalancing**: The index is reviewed semi-annually, with changes made based on market capitalization and trading frequency to ensure it remains an accurate benchmark of the market.

- **Usage**: The Nifty 50 is widely used by investors as a benchmark for portfolio performance, and it is also the basis for various financial products like ETFs and index funds.

### Recent Performance:

The Nifty 50 Index's performance reflects the overall market sentiment and the health of the Indian economy. It is subject to fluctuations based on macroeconomic factors, corporate earnings, global events, and domestic policies.

Would you like detailed information on the current performance or historical trends of the Nifty 50?

**Nifty FMCG Index**:

- **Performance**: The Nifty FMCG Index, representing the Fast-Moving Consumer Goods sector in India, has shown a slight decline recently. Over the past month, it decreased by 0.56%, and over the past year, it declined by 3.92%.

**Nifty Auto Index**:

- **Performance**: The Nifty Auto Index, tracking the automobile sector in India, experienced a positive movement on January 16, 2025, with a percentage change of 0.65%.

**Nifty Pharma Index**:

- **Performance**: The Nifty Pharma Index, reflecting the pharmaceutical sector in India, has shown a decline. Over the past month, it decreased by 1.04%, and over the past year, it declined by 4.51%.

**Dow Jones Industrial Average (DJIA)**:

- **Performance**: The DJIA, a major U.S. stock market index, closed at 43,116.89, marking a slight decrease of 0.24%. Over the past year, it has increased by 11.63%.

**NASDAQ Composite Index**:

- **Performance**: The NASDAQ Composite Index, heavily weighted towards technology stocks, closed at 19,489.44, showing a minor decline of 0.11%.

Please note that stock market indices are subject to fluctuations due to various factors, including economic data releases, corporate earnings reports, and geopolitical events. For the most current information, it's advisable to consult real-time financial news sources or brokerage platforms.

IMPORTANT BUY/SELL zones for DOW JONES ahead of powell speechTVC:DJI sharing important buy sell zones derived from analysing resistance/support zones on major timeframe to smaller time frame study.

dow has been struglling to move upward since it entered the monthly/daily sell zone and resistance are which dow has been unsuccefull to break since few weeks in past, unless we get something positive and strong news , dow may remain sideways or retest the support/buy zone belowe current market price before moving upside again or

if the news outcome is bad and worrysome, we may see the supportbreak under panick selling pressure and dow may drop till the next buy zone .

Dow Jones FuturesI marked the chart on the DJIA futures by mistake. But the marking will co - relate with the DJIA spot as well. I have marked just the CURRENT WAVE, to show you what the wave swill look like. Inspite of the fact that I have marked ABC, showing C breaking below the Recent Low, there is just 1 contra call here. I will need that to happen before I say we are done.

DOW JONESI have put more focus on the current wave on ""DJIA"", wherein I see that wave 1 up is done and we are in wave 2 down. Makes me also believe that when I see the pattern/ structure of NIFTY, both DJIA and NIFTY have more or less IDENTICAL setups. Assuming this to be TRUE, I am personally of the opinion that the Markets are in a Tearing Hurry to achieve Higher Highs hereon. With Fed Chairman Powell having made it clear in no lesser terms, that the FED Does not care about what the markets want to do and that it is ONLY focused in bringing down Inflation No matter what. It is just a question of Time before the Markets realize this and go higher.