Search in ideas for "SUPPORTANDRESISTANCE"

Sensex - Apr 8 expiry analysisPrice is opening gap down daily and our analysis needs different approach.

Let us see the important support resistance zones to trade.

Support levels 71300 - 71340, 72020 - 72060 and 73000.

How to use this level?

If price open above these levels, then buy above 73060 with the stop loss of 72960 for the targets 73160, 73240, 73360, 73480, 73660 and 73740.

If price open gap down below any of these levels, plan as per the price action.

Always do your own analysis before taking any trade.

Nifty - Ping Pong 22800Price is nearing another support zone 22800. This zone can change the direction too. Near by resistance is 23000.

Buy above 23000 with the stop loss of 22960 for the targets 23040, 23080, 23140, 23180 and 23220.

Sell below 22880 with the stop loss of 22920 for the targets 22840, 22800, 22760, 22720, 22660 and 22620.

Always do your own analysis before taking any trade.

Sensex - Weekly review Apr 7 to Apr 11Price is falling for the past few days and 75200 is an important zone in deciding direction.

Buy above 75400 with the stop loss of 75300 for the targets 74500, 75620, 75700, 75820, 75960, 76040, 76200 and 76320.

If price opens gap down 75000 will act as resistance and price may fall from that zone.

Resistance levels are 75400, 75200 and 75000. Understanding how price is reacting at these levels is important to trade better.

Sell below 75200 with the stop loss of 75100, 74980, 74860, 74700, 74580, 74460, 74300, 74220, 74100 and 73960.

Always do your own analysis before taking any trade.

Nifty - Testing an important zonePrice tested the important support/resistance zone 23200 - 23300 and closed below it today. In January, price tested this zone for many days before deciding the direction. I am expecting the price will try to move above the zone. If it sustains above 22300, we can expect some relief rally. If price stays below 23200 zone, then we can expect the move towards 23000 and then to 22800. We have triple bottom support at 22800 zone.

Always do your own analysis before taking any trade.

Sensex - Apr 1 expiry analysisPrice is moving in the range of 77100 to 77800 for the past few days. Price is bullish as long as it sustains above 77100.

Buy above 77120 with the stop loss of 77040 for the targets 77200, 77320, 77400, 77520, 77640, 77800, 77920 and 78040.

Sell below 76960 with the stop loss of 77040 for the targets 76880, 76780, 76700, 76560, 76480, 76380 and 76300.

Always do your analysis before taking any trade.

Pottential Retest Support to be formed around 3105$Gold is on sprint to rise high and achieve newer heights. for those who could not enter the rally wait for 3105 levels to breach once and on bounce back re entry can be taken.

If buyers retain control, the next target on the topside is seen at the $3,150 threshold.

Fresh buying opportunities would emerge above that level, opening doors for a fresh uptrend toward the $3,200 round figure.

Technical sell in the Gold price also cannot be ruled out as buyers have already achieved the ascending triangle target, measured at $3,080, last Friday.

Additionally, the 14-day Relative Strength Index (RSI) is trending in the highly overbought region above 75, warranting caution for buyers.

If a correction unfolds, the immediate support is seen at the intraday low of $3,077, below which the $3,050 psychological barrier will be tested.

If the selling momentum intensifies, the March 26 low of $3,012 could come to buyers’ rescue.

Nifty - Weekly review Apr 1 to Apr 4Last week price was testing 23400 zone and sustaining above it. However it has formed resistance at 23600 zone and unable to break it in the last trading sessions. When price is moving within the range 23400 to 23600,there will be tough competition between bulls and bears.

Buy above 23540 with the stop loss of 23500 for the targets 23580, 23620, 23680, 23720 and 23780.

Sell below 23400 with the stop loss of 23440 for the targets 23360, 23320, 23260, 23220, 23180 and 23120.

Always do your own analysis before taking any trade.

Nifty - Expiry analysisPrice broke 23500 today. We are having support at 23400 - 23440 zone. Price have to sustain above this to be bullish.

Buy above 23440 with the stop loss of 23400 for the targets 23480, 23520, 23560, 23620 and 23660.

Sell below 23360 with the stop loss of 23400 for the targets 23320, 23280, 23240, 23200, 23140 and 23100.

Always do your own analysis before taking any trade.

Bank Nifty - Expiry analysisPrice faced resistance at 52000 zone, fall down and now it is testing 51500 support zone. Sustaining above this support is important to be bullish.

Buy above 51540 with the stop loss of 51460 for the targets 51620, 51700, 51820, 51900, 51980, 52060 and 52200.

Sell below 51380 with the stop loss of 51460 for the targets 51300, 51220, 51140, 51040, 50960 and 50820.

Always do your analysis before taking any trade.

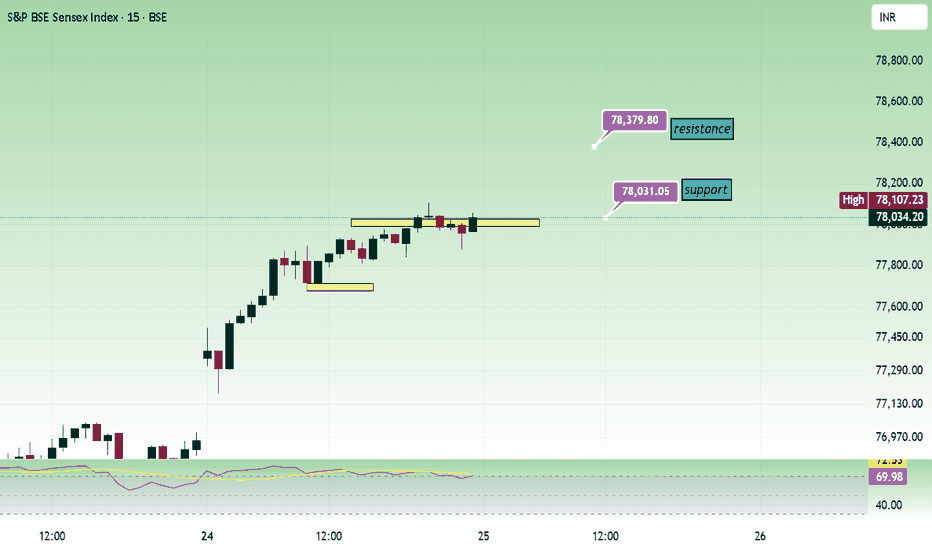

Sensex - Expiry day analysisWe had a trending movement today in morning session and consolidation in afternoon session. Now price is testing the important zone 78000. Near by support is at 77600.

Buy above 78040 with the stop loss of 77940 for the targets 78120, 78200, 78320, 78400, 78520, and 78660.

Sell below 77800 with the stop loss of 77900 for the targets 77720, 77600, 77520, 77400, 77320 and 77200.

Always do your own analysis before taking any trade.

Nifty - Expiry day analysisWe had a very narrow range movement, which can give break out or big move once the range is broken. Near by resistance is 23000.

Buy above 22920 with the stop loss of 22880 for the targets 22960, 23000, 23040, 23080 and 23140.

Sell below 22840 with the stop loss of 22880 for the targets 22800, 22760, 22720 and 22660.

Always do your own analysis before taking any trade.