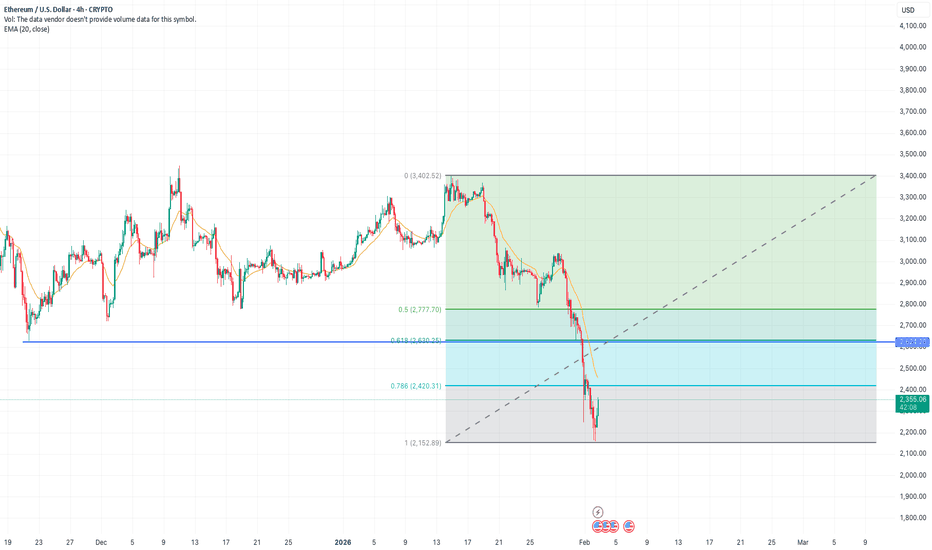

ETH Reversal or just a pullback?CRYPTO:ETHUSD

Looking at the 4hr TF of ETH. it looks taking a minor pullback from the downward trend.

Yet it has to close Above $2620 to break the character of the current downtrend.

Highly likely it will chase this number successfully as more people are coming in with sentiment of buying the dip.

but Keeping technical analysis as a primary tool here. I am still bearish for long term.

But a Long(buy) swing opportunity can be seen.

For long term I would wait for more cheap price.

till then going short on pullbacks.

:) Happy Trading.

Shortposition

Sensex INDEXSensex is in bearish trend

We can see strong RESISTANCE in between 84,800 & 85,000 range. If SENSEX breaksdown 84,800 level we can expect sensex at 84,600 and further down side till 83,100 level

Strong support regions are at 84,900, 84,500, and 83,950.

After reaching 84,600 we can expect retracement till 84,900 and if resistance was not taken then only it can move till 84,000 level

This is just my analysis to best of my knowledge

SIEMENS BEARISH TREND ANALYSIS (SHORT)NSE:SIEMENS

SIEMENS BEARISH TREND ANALYSIS

Key Levels:

Entry Point: ₹6,559.45

Stop Loss (SL): ₹6,732.85

Target Points:

TP1: ₹6,339.95

TP2: ₹6,143.60

TP3: ₹5,747.50

Analysis:~

Trend Overview:

Siemens is showing a bearish trend, confirmed by the price breaking an 8-month support level. The chart highlights potential downside targets with a disciplined stop-loss placement.

Support and Resistance:

The price has failed to sustain above the long-term support level, which has now turned into resistance.

The trend suggests potential further decline toward the specified targets.

Risk Management:~

Stop Loss at ₹6,732.85 ensures risk is minimized if the trade goes against the trend.

Target levels are spaced for progressive profit booking.

Chart Insights:~

Bearish Confirmation:

Siemens has turned bearish, breaking below its 8-month support zone, signaling potential further downside movement.

Resistance:~

The previous support level now acts as resistance.

A stop loss is placed slightly above this level to mitigate risk in case of trend reversal.

Profit Targets:~

TP1 and TP2 offer conservative profit levels, while TP3 provides a more aggressive downside target.

Trend Direction:

The 50-day and 200-day moving averages are sloping downwards, indicating sustained bearish momentum.

Disclaimer:

I am not a SEBI-registered advisor. This analysis is for educational purposes only. Trade at your own risk. Please consult a professional financial advisor before making trading or investment decisions. Thank you! Like and share if you found this helpful.

Like,share,subscribe @Alpha_strike_trader

A plan SHORT for BTC

1. I saw a "Break Down cloud" - follow trend signal on the chart in Time Frame M15

2. I saw Main Trend on M15 timeframe showed that : main trend = DownTrend

3. I saw Main trend on H1 - M30 - M15 also : Downtrend

Conclusion:

Setup a SHORT plan with RR= 3 BINANCE:BTCUSDT.P

Entry Zone : From 97300 to 97900

Target : 92699

Stoploss = trailing SL with the Cloud trending system SL on M15 TF.

ICICI bank to test Pivot Levels , Selling may Continue till 1280After two Consecutive Selling sessions , it may or may not be a bearish moment in immediate session but to test pivot levels at 1280 and may bounce back to Higher Prices ,

Forming Lower lows consecutively , but didn't step into oversold zone still as per RSI ,

the 3 month trendline and Moving averages on daily chart shows it may test the pivot levels sooner ,

FII net buyer today but still prices were lower , if trend continues the FII may become selllers too , before going up , the prices may see some correction till 1280 in near future .

May hold buying or go short for short term .

INFOSYS - POSITIONAL TRADE WITH VERY GOOD R:RSymbol - INFY

INFY is currently trading at 1942 & approaching ATH resistance zone.

I'm seeing a trading opportunity on sell side.

Shorting INFY Futures at CMP 1942

I will be adding more position if 1980 comes & will hold with SL 2025

Targets I'm expecting are 1780 - 1700 - 1580

P.S. : INFY is approaching ATH resistance zone after a long time. ATH resistances are usually hard to break in one go. To break this resistance, INFY must spend some time here (2-3 weeks) before breaking out. Only then we will see more price growth towards the upside. As of know, given modestly high valuations of INFY & overall market, The setup looks more towards negative side & It is highly likely that the price will take resistance from here & change its course to south. I've shorted far month futures already.

Disclaimer - Do not consider this as a buy/sell recommendation. I'm sharing my analysis & my trading position. You can track it for educational purposes. Thanks!

MFSLENTRY TARGET SL Mention in the chart.

ALWAYS TAKE TRADE WITH CONFIRMATION

Note : Trading in any financial market is very risky. I post ideas for educational purpose only. It is not financial advice. Do not hold us responsible for any potential loss you may incur. Please consult your financial adviser before trading.

MCX GOLD - Profit Booking on Cards?MCX Gold has rallied one way from 62000 to 66000 in last 8 days without any major retracements.

This sharp up move can not sustain without a good retracement.

Dollar Index is also trading at a major support zone of 102.500 so there's very high chance that we might see a correction very soon.

Here's a trading opportunity.

GOLD CMP - 65950

I'm taking short position in Gold April Future at CMP 65935.

Will add more position if 66100 comes.

Holding with Stoploss 66300.

I'm expecting minimum 1000 point correction in Gold very soon.

Gold 65000 PE is currently trading at 345. I'm taking some position in it too. I'm expecting it to get double by next week.

Disclaimer - Do not consider this as a buy/sell recommendation. I'm sharing my analysis & my trading position. You can track it for educational purposes. Thanks!

Short potentialOn day chart

I see the support around $2.4

On 4h TF

After OP breakdown $2.9 it made another structure from up to down if OP close below swing low $2.615 so need to wait for confirmation

OP has resistance around $3.25 and strong support around $2.4 this level is target for short position

Time will tell

EUR/USD Price AnalysisThe EUR/USD pair is currently trading around 1.0970, facing slight losses in the early European session after pulling back from a four-month high of 1.1017. Traders are awaiting inflation data from Italy, France, and the Eurozone, with the Eurozone Harmonized Index of Consumer Prices (HICP) expected to show a 3.9% YoY growth in November.

From a technical standpoint, the EUR/USD maintains a positive outlook, staying above the 50- and 100-hour Exponential Moving Averages (EMA) on the four-hour chart. The Relative Strength Index (RSI) is in bullish territory, suggesting a favorable trend for the pair.

Immediate resistance is observed at 1.1000, marked by the Bollinger Band boundary and a psychological round figure. The next resistance levels are at 1.1017 and 1.1042, followed by a potential rally to 1.1150 if buying momentum persists.

On the downside, a key support level lies at 1.0930, indicated by the lower limit of the Bollinger Band and the 50-hour EMA. Further support is found at 1.0895 (low of November 24), 1.0867 (100-hour EMA), and 1.0825 (low of November 17). Monitoring these levels can provide insights into potential price movements.

GOLD 27/6!! The bulls are still trying to hold the price around Gold price struggles to make any significant progress on Tuesday and trades within a narrow range, just above the $1,920 level during the Asian session. The XAU/USD pair remains close to a three-month low reached last Friday and could potentially drop below the 100-day Simple Moving Average (SMA).

The upside for Gold price is limited by the hawkish stance of major central banks. The initial market reaction to the failed mutiny in Russia over the weekend was short-lived due to the strong stance taken by these central banks. It is important to note that the Reserve Bank of Australia (RBA) and the Bank of Canada (BoC) surprised the market by raising interest rates by 25 basis points earlier this month. Additionally, the European Central Bank (ECB) raised rates to the highest level in 22 years last week. Furthermore, the Bank of England (BoE), the Swiss National Bank (SNB), and Norges Bank increased their benchmark interest rates last Thursday.

Gold price prediction today is still sideways around $1910 - $1950, the downtrend still prevails

SELL GOLD zone at: $1940 - $1943 SL $1953

Based on technical analysis indicators EMA 34, EMA 89 with strong resistance zone $1940 - $1943

ICICIPRUENTRY TARGET SL Mention in the chart.

ALWAYS TAKE TRADE WITH CONFIRMATION

Note : Trading in any financial market is very risky. I post ideas for educational purpose only. It is not financial advice. Do not hold us responsible for any potential loss you may incur. Please consult your financial adviser before trading.

BAC Analysis(Bearish Flag and Pole Pattern)!Bank of America Corporation Analysis on Daily Timeframe!

Bearish Flag and Pole Pattern Formation in BAC

Flag Breakdown in BAC

Bank of America Corporation made Bearish Flag and Pole pattern. We can see the sharp fall in Bank of America Corporation after price made a flag and moving inside the flag. The price given a breakdown to the flag support and able to closed below it. I have marked important levels in chart which is Fib level 1.618 will be act as a possible support level(23.49). For the target I have projected the pole length from the flag breakout point so the downside target would be 19.39.

Trade Psychology and Setup =

Entry = One can enter after Retesting and Aggressive traders can initiate short at current level

Target = Projected Downside Target Will be 19.41

Stop Loss = Above 29.55

Disclaimer = All my analysis are for Educational Purpose only. Before entering into any trade - 1) Educate Yourself 2) Do your own research and analysis 3) Define your Risk to Reward ratio 4)Don't trade with full capital

The Elliot wave pattern continues? Yes or No? Lets watchin my previous analysis, i have mentioned that BTC is testing important resistance zone. and Yes, BTC was rejected from 30600 levels and now trading around 26500. It was my stop loss point in the analysis.

But Now, BTC is looking bullish as pattern in 1 Day chart indicating towards the Elliot Wave Pattern. But also BTC is testing 100 MA support levels in a Day candle. Previously ( Highlighted in Orange circle ) it was tested at 20400 levels and you can see a bullish pump in BTC. are we going to face the same? well, i have feeling that Yes. but there are few conditions;

1) If we see the same pump as per previous time from the 100 MA support line, We are good and BTC can test the levels of 33K to 35K . Its a very strong resistance in terms of volume, as per my VRVP indicator.

2) If we see more downtrend, BTC going to test levels of 23K to 25K . from there we can see a pump in BTC to levels of 30K to 33K .

Now, i was following my previous analysis, i have taken Short Position from 30200 levels and closed at 27500. Good Profit. BINANCE:BTCUSDT 😃😝. again, i have taken short position from 28700 and closed at 26200.🤩

Please dont forget to add stoploss in any of your trad. Have a safe trading!!!

EURINR SETUP.

As per my Analysis, EURINR is facing strong resistance at level inbetween 90.37-90.62,there could be a reversal from this resistance level, as a positional trader this could be a best opportunity to go short in EURINR either you can wait to reach near marked resistance or trendline resistance then you may go short.

also keep tracing 50SMA to get better view.

But make sure, do your analysis this is only for educational purpose.

Thanks,

Amit Sharma