Gold weekly rotation between 4682 supply and 4420 demand🟡 XAUUSD – Weekly Smart Money Plan | by Ryan_TitanTrader (17/01)

📈 Market Context

Gold remains structurally bullish on the higher timeframe, but weekly price action has clearly transitioned into a controlled Smart Money rotation. After delivering buy-side liquidity into premium, continuation has stalled.

This week’s hot drivers — USD volatility, U.S. yield repricing, and renewed Fed rate-cut expectations amid sticky inflation data and geopolitical hedging flows — are creating ideal conditions for inducement and liquidity engineering rather than clean trend expansion.

With risk sentiment fragile and positioning crowded, Gold is behaving typically at extremes: sweeps, fake breaks, and mean reversion, not impulsive continuation.

🔎 Technical Framework – Smart Money Structure (H4–H1)

Current Phase:

HTF bullish bias remains valid, but internal structure shows distribution from premium after liquidity delivery.

Key Idea:

Sell reactions from premium supply, or wait patiently for a deeper pullback into HTF demand to reload longs.

Structural Notes:

• HTF BOS confirms bullish dominance

• Buy-side liquidity already taken above highs

• Clear rotation channel forming

• Liquidity shortage zone acting as magnet

• Discount demand aligns with prior OB + channel support

💧 Liquidity Zones & Key Levels

• 🔴 SELL GOLD 4680 – 4682 | SL 4690

• 🟢 OB BUY GOLD 4420 – 4418 | SL 4410

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB / FVG retest → expansion or deeper rotation

🎯 Execution Rules

🔴 SELL GOLD 4680 – 4682 | SL 4690

Rules:

✔ Price taps premium channel supply

✔ Buy-side liquidity taken above recent highs

✔ Bearish MSS / CHoCH on H1–M15

✔ Downside BOS confirms distribution

✔ Entry via bearish FVG or supply OB

Targets:

• 4620 — internal reaction

• 4560 — liquidity shortage

• 4480 — deeper weekly rotation

• Trail aggressively (distribution play)

🟢 OB BUY GOLD 4420 – 4418 | SL 4410

Rules:

✔ Sweep into weekly discount zone

✔ Strong confluence: HTF OB + channel support

✔ Bullish MSS / CHoCH on M15–H1

✔ Impulsive BOS with displacement

✔ Entry via refined bullish OB

Targets:

• 4560 — first reaction

• 4620 — mid-range liquidity

• 4680+ — continuation if expansion resumes

⚠️ Risk Notes

• Premium zones = liquidity traps

• Expect false breaks during macro headlines

• No entry without MSS + BOS

• Reduce risk near HTF extremes

📍 Summary

Gold is bullish by structure, but this week is about precision execution, not prediction:

• Premium may deliver a Smart Money sell from 4680–4682, or

• Discount at 4420–4418 may reload longs for the next impulsive leg.

Let liquidity move first.

Let structure confirm second.

Smart Money controls — patience pays. ⚡️

📌 Follow @Ryan_TitanTrader for weekly Smart Money gold breakdowns.

SMC

Gold fluctuates between 4672 resistance and 4560 support.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (16/01)

📈 Market Context

Gold remains structurally bullish on the higher timeframe, but intraday price action has shifted into controlled rotation. With today’s hot drivers — USD volatility, U.S. yield fluctuations, and ongoing Fed rate-cut speculation — Smart Money is no longer pushing continuation. Instead, liquidity is being engineered around premium and discount zones.

Ahead of U.S. macro headlines and inflation-linked expectations, Gold is behaving typically at extremes: inducement, stop-hunts, and mean reversion rather than impulsive trend extension.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish bias intact, while intraday structure shows corrective rotation after buy-side liquidity was taken.

Key Idea:

Look for distribution from premium supply or a deeper pullback into discount demand for buying/entry reloads.

Structural Notes:

• HTF BOS confirms bullish dominance

• Buy-side liquidity already delivered

• Price rotating, not expanding impulsively

• Internal FVG acting as downside magnet

• Discount demand aligns with prior OB support

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4670 – 4672 | SL 4680

• 🟢 BUY GOLD 4561 – 4559 | SL 4551

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4670 – 4672 | SL 4680

Rules:

✔ Price taps premium supply

✔ Buy-side liquidity taken above highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS

✔ Entry via bearish FVG or supply OB

Targets:

• 4620 — internal reaction

• 4585 — liquidity pool

• Trail aggressively (distribution play)

🟢 BUY GOLD 4561 – 4559 | SL 4551

Rules:

✔ Sweep into discount demand

✔ Confluence with OB + FVG

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB

Targets:

• 4620 — first reaction

• 4670 — internal liquidity

• 4700+ — continuation if expansion resumes

⚠️ Risk Notes

• Premium zones = liquidity traps

• Expect fake breaks during news volatility

• No entry without MSS + BOS

• Reduce size near extremes

📍 Summary

Gold is bullish by structure, but today is about execution, not prediction:

• Premium may deliver a Smart Money sell from 4670–4672, or

• Discount at 4561–4559 may reload buying/entry for the next leg higher.

Let liquidity move first.

Let structure confirm second.

Smart Money controls — patience pays. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD H1 – Range Bound MarketSideways Consolidation, Waiting for a Range Break

Gold on the H1 timeframe is currently trading inside a clear sideways range near the ATH, showing signs of balance after the recent impulsive move. At this stage, the market is not trending — it is building liquidity and waiting for a breakout.

MARKET STRUCTURE

Price is consolidating inside a wide sideways box after failing to continue higher from the ATH.

Multiple rejections on both sides of the range confirm that neither buyers nor sellers have full control yet.

This behaviour typically appears before a volatility expansion.

KEY ZONES & LIQUIDITY

Upper range – Resistance / Breakout trigger:

~4620 – 4640

Acceptance above this zone would signal renewed bullish strength and open the path toward new highs.

Mid-range equilibrium:

Current price is hovering around the balance area, where false signals are common. Patience is required here.

Lower range – High liquidity support:

~4580 – 4590

This zone has absorbed selling pressure multiple times. A clean reaction here could support a bounce back into the range.

Deeper liquidity support:

~4515 – 4520

If the range breaks to the downside, this is where strong demand and liquidity are likely to sit.

SCENARIOS TO WATCH

Bullish breakout scenario:

Price holds above the lower range and breaks cleanly above 4620–4640.

Acceptance above the range confirms continuation toward new ATH levels.

Bearish liquidity sweep scenario:

Price sweeps below 4580–4590, tapping deeper liquidity.

A failure to reclaim the range would shift short-term bias to the downside.

SUMMARY

Current state: Sideways / consolidation

Market is compressing and building liquidity

Best trades come after the range breaks, not inside it

Let price show direction before committing

In this environment, discipline matters more than activity — wait for the breakout, and trade the reaction, not the noise.

Gold oscillates between 4690 supply and 4576 demand.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (14/01)

📈 Market Context

Gold remains structurally bullish after printing fresh ATH territory, but price action has clearly slowed into rotation. With markets reacting to today’s hot drivers — U.S. inflation expectations, USD volatility, and shifting Treasury yields — Smart Money is no longer chasing upside. Instead, liquidity is being engineered around premium and discount zones.

Ahead of key U.S. data and rate-cut speculation, Gold is behaving exactly as expected at extremes: stop hunts, inducement, and controlled rebalancing rather than clean continuation.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish bias intact, while intraday structure shows corrective rotation after buy-side liquidity was delivered near ATH.

Key Idea:

Expect distribution from premium supply near ATH, or a deeper pullback into discount demand to reload longs.

Structural Notes:

• HTF BOS confirms bullish dominance

• ATH zone has delivered buy-side liquidity

• Price rotating, not expanding impulsively

• Internal FVG acting as downside magnet

• Discount demand aligns with HTF EMA support

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4688 – 4690 | SL 4700

• 🟢 BUY GOLD 4578 – 4576 | SL 4568

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4688 – 4690 | SL 4700

Rules:

✔ Price taps premium ATH supply

✔ Buy-side liquidity taken above highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS

✔ Entry via bearish FVG or supply OB

Targets:

• 4635 — internal reaction

• 4600 — liquidity pool

• Trail aggressively (distribution play)

🟢 BUY GOLD 4578 – 4576 | SL 4568

Rules:

✔ Sweep into discount demand

✔ Confluence with OB + FVG

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB

Targets:

• 4620 — first reaction

• 4680 — internal liquidity

• 4720+ — ATH extension if expansion resumes

⚠️ Risk Notes

• ATH zones are liquidity traps

• Expect false breaks during news volatility

• No entry without MSS + BOS

• Reduce size near ATH — range expansion risk

📍 Summary

Gold is bullish by structure, but today is about execution, not prediction:

• Premium may deliver a Smart Money sell from 4688–4690, or

• Discount at 4578–4576 may reload longs for the next ATH push.

Let liquidity move first.

Let structure confirm second.

Smart Money controls — patience pays. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold reaches new ATH — Smart Money rotates.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (13/01)

📈 Market Context

Gold has officially printed a new All-Time High (ATH), confirming higher-timeframe bullish dominance. However, after delivering buy-side liquidity into premium, price action is no longer impulsive. Instead, Smart Money is transitioning into controlled distribution and rotation, engineering liquidity rather than chasing continuation.

With price stretched deep into premium and resting above prior structure, today’s environment favors liquidity sweeps, inducement, and mean reversion, not blind breakout trading. Execution must be precise, level-based, and confirmation-driven.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish structure intact, but intraday corrective rotation active from premium after ATH print.

Key Idea:

Expect Smart Money to distribute near ATH supply (4630–4632), or rebalance deeply into discount (4492–4490) before the next expansion leg.

Structural Notes:

• Clear HTF BOS confirms bullish dominance

• New ATH delivered buy-side liquidity

• Price reacting from premium with corrective characteristics

• Internal FVG + liquidity pocket acting as magnet below

• Discount OB zone aligns with higher-timeframe demand

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4630 – 4632 | SL 4640

• 🟢 BUY GOLD 4492 – 4490 | SL 4482

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4630 – 4632 | SL 4640

Rules:

✔ Price taps ATH premium supply

✔ Buy-side liquidity taken above highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4588 — internal reaction

• 4560 — FVG mitigation

• Trail aggressively (intraday distribution play)

🟢 BUY GOLD 4492 – 4490 | SL 4482

Rules:

✔ Liquidity sweep into discount demand

✔ Confluence with OB + FVG + strong liquidity pool

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4520 — first reaction

• 4580 — internal liquidity

• 4630+ — ATH retest if expansion resumes

⚠️ Risk Notes

• New ATH zones are liquidity traps by nature

• Expect false breakouts and aggressive stop hunts

• No trades without MSS + BOS confirmation

• Size down near ATH — volatility can expand rapidly

📍 Summary

Gold is bullish by structure, but today is about rotation, not continuation:

• A reaction at 4630–4632 may deliver a Smart Money sell back into liquidity, or

• A sweep into 4492–4490 may reload longs for the next ATH extension.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD (M30) – Trading slightly below resistance level⚡️ Weekly plan using Volume Profile + Liquidity (Liam)

Quick summary:

Gold has just delivered a strong impulsive push and is now consolidating right beneath the highs, which is classic “compression” behavior before the next expansion. With macro conditions still sensitive (USD, yields, Fed expectations + geopolitical headlines), the best approach this week is don’t chase — trade liquidity zones and value areas (POC/VAL) instead.

1) Macro context (why price behaves like this)

When headlines are heavy, gold often moves in two phases:

run to buy-side liquidity → pull back to value → then decide whether to trend or range.

That’s why this week I’m focused on:

selling reactions in premium, and

buying dips into value (POC/VAL)

rather than buying mid-range candles.

2) What Volume Profile is showing on your chart

Your M30 chart highlights the key “money zones” very clearly:

🔴 SELL Liquidity (premium reaction)

4577 – 4579: a sell-liquidity / reaction area (good for scalp or short swing if rejection prints).

🟢 BUY Liquidity (shallow pullback)

4552 – 4555: the clean pullback zone to stay aligned with the bullish structure.

🟦 POC zones (value – where the market does the most business)

Buy POC 4505 – 4508: a major value magnet; price often revisits this area.

Buy POC 4474 – 4477: deeper value / reset zone if we get a sharper liquidity sweep.

➡️ Simple VP logic: POC = price magnet. When price is in premium, the probability of a rotation back into value is always on the table.

3) Trading scenarios for the week (Liam style: trade the level)

✅ Scenario A (priority): BUY the pullback into 4552–4555

Buy: 4552 – 4555

SL: below 4546

TP1: 4577 – 4579

TP2: continuation towards the highs if we break and hold above 4580 cleanly

Best “trend-following” entry if the pullback stays shallow.

✅ Scenario B (best VP entry): BUY at POC 4505–4508

Buy: 4505 – 4508

SL: below 4495

TP: 4552 → 4577 → higher if momentum returns

If the market runs liquidity and drops back into value, this is the area I want most.

✅ Scenario C (deep sweep): BUY POC 4474–4477

Buy: 4474 – 4477

SL: below 4462

TP: 4505 → 4552 → 4577

This is the “panic wick” setup — not frequent, but high quality when it appears.

⚠️ Scenario D (scalp): SELL reaction at 4577–4579

Sell (scalp): 4577 – 4579 (only with a clear rejection/weak close)

SL: above 4586

TP: 4560 → 4552

This is a short-term reaction sell, not a long-term bearish call while structure remains supported.

4) Execution checklist (to avoid getting swept)

No entries in the middle of the range — only at the zones.

Wait for M15–M30 confirmation: rejection / engulf / MSS.

Scale out in layers — highs often deliver fast up-sweeps and sharp pullbacks.

If I had to pick one “clean” setup this week: BUY the 4552–4555 pullback, and if we get a deeper reset, I’ll be waiting at POC 4505–4508.

xauusd gold tradingplan volumeprofile poc liquidity priceaction marketstructure intraday swingtrading

XAUUSD (H1) – Following the bullish channelpatience before continuation ✨

Market structure

Gold remains in a well-defined ascending channel on the H1 timeframe. Despite recent intraday pullbacks, the overall structure is still bullish with higher highs and higher lows preserved. Current price action shows consolidation inside the channel rather than any sign of trend reversal.

Technical outlook (Lana’s view)

Price is rotating around the midline of the rising channel, indicating healthy digestion after the previous impulsive leg.

The recent pullback appears to be a controlled correction, likely aimed at collecting buy-side liquidity before the next expansion.

Market is still respecting structure and trendline support — no breakdown confirmed so far.

Key levels to watch

Buy-side focus

FVG Buy zone: 4434 – 4437

A clean reaction here could offer a good continuation entry within the trend.

Major buy zone: 4400 – 4404

This is the stronger demand area aligned with channel support and previous structure.

Sell-side reaction (short-term only)

4512 – 4515

This zone aligns with Fibonacci extension and channel resistance, where short-term profit-taking or reactions may appear.

Scenario outlook

As long as price holds above the lower channel boundary, bullish continuation remains the primary scenario.

A pullback into FVG or the lower buy zone followed by confirmation would favor another push toward channel highs and liquidity above.

Only a clean break and acceptance below 4400 would force a reassessment of the bullish bias.

Lana’s trading mindset 💛

No chasing price near resistance.

Let price come back into value zones inside the channel.

Trade reactions, not predictions.

Trend is your friend — until structure says otherwise.

This analysis reflects a personal technical perspective for educational purposes only. Always manage risk carefully.

XAUUSD H3 – Liquidity Dominates Near ATHGold is trading in a sensitive zone just below all-time highs, where liquidity, Fibonacci extensions, and trend structure are converging. Price action suggests a controlled rotation rather than a clean breakout, with clear reaction levels on both sides.

TECHNICAL STRUCTURE

Gold remains in a broader bullish structure, with higher lows supported by an ascending trendline.

The recent impulse confirmed bullish intent, but price is now stalling near premium liquidity, signaling potential short-term distribution.

Market behavior shows buy-the-dip dynamics, while upside extensions are being tested selectively.

KEY LEVELS FROM THE CHART

Upper liquidity / extension zone:

Fibonacci 2.618 extension near the top band

This area represents profit-taking and sell-side liquidity, especially if price reaches it with weak momentum.

Sell reaction zone:

4412 – 4415 (Fibonacci 1.618 + prior ATH reaction)

A classic area for short-term rejection if price fails to break and hold above.

Buy-side focus:

4480

This level acts as a buy-on-pullback zone, aligned with trendline support and prior bullish structure.

Expected flow:

Price holds above 4480 → attempts to push toward ATH → potential extension into the 2.618 zone.

Failure to hold 4480 → rotation back toward lower structure for liquidity rebalance.

MARKET BEHAVIOR & LIQUIDITY LOGIC

Current structure favors reaction-based trading, not chasing breakouts.

Liquidity above ATH is attractive, but the market may need multiple attempts or a deeper pullback before a sustained breakout.

As long as higher lows are respected, pullbacks remain corrective.

MACRO CONTEXT – DXY BACK ABOVE 99

The US Dollar Index (DXY) has climbed above 99 for the first time since December 10, gaining 0.14% on the day.

A firmer USD can slow gold’s upside momentum in the short term.

However, gold’s ability to hold structure despite a stronger dollar highlights underlying demand and strong positioning.

This divergence suggests gold is not purely trading off USD weakness, but also off liquidity, positioning, and risk hedging flows.

SUMMARY VIEW

Gold remains structurally bullish on H3

Short-term price action is driven by liquidity near ATH

4480 is the key level defining bullish continuation

Upside extensions may require consolidation or pullbacks before a clean break

In this environment, patience and level-based execution matter more than directional bias.

Gold pauses; rotation, not continuation.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (07/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, following a strong impulsive expansion that delivered price deep into premium. However, recent price action signals a transition from expansion into distribution, with Smart Money beginning to engineer corrective rotations rather than chasing continuation.

As the market digests USD flows, U.S. yield sensitivity, and positioning ahead of upcoming U.S. data, Gold is currently rotating between internal liquidity zones. This environment typically favors liquidity sweeps, inducement, and mean reversion, rather than clean directional breakouts.

Today’s session is best approached with level-based execution, patience, and confirmation — not prediction.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

HTF bullish structure with an active intraday corrective leg from premium.

Key Idea:

Expect Smart Money to react at internal supply (4428–4430) for short-term distribution, or at discount demand (4412–4410) for re-accumulation before the next leg.

Structural Notes:

• HTF bullish structure remains intact

• Clear BOS printed during the upside expansion

• Price rejected from premium and is rotating lower

• Internal supply at 4428–4430 acts as sell-sensitive zone

• Demand at 4412–4410 aligns with OB + EMA support + liquidity pocket

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4412 – 4410 | SL 4402

• 🔴 SELL SCALP 4428 – 4430 | SL 4438

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4412 – 4410 | SL 4402

Rules:

✔ Liquidity sweep into discount demand

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4425 — initial reaction

• 4435 — internal liquidity

• 4480–4500 — premium retest if momentum expands

🔴 SELL SCALP 4428 – 4430 | SL 4438

Rules:

✔ Price taps internal supply / EMA resistance

✔ Bearish MSS / CHoCH on lower timeframe

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4418 — first imbalance

• 4410 — demand interaction

• Trail aggressively (scalp setup)

⚠️ Risk Notes

• Premium zones favor stop hunts and fake continuations

• Volatility may expand during U.S. session

• No entries without MSS + BOS confirmation

• Scalp sells require strict risk control

📍 Summary

Gold remains structurally bullish, but today’s edge lies in Smart Money’s intraday rotation:

• A sweep into 4412–4410 may reload longs toward premium, or

• A reaction at 4428–4430 offers a controlled scalp sell back into demand.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD liquidity changes amid 2026 Black Swan risksXAUUSD H1 – Liquidity Rotation Under Black Swan Risks in 2026

Gold is once again being driven by liquidity and macro uncertainty. While short-term price action is rotating around key Volume Profile levels, the broader backdrop for 2026 is increasingly shaped by underestimated systemic risks, often ignored during periods of market optimism.

TECHNICAL STRUCTURE

On H1, gold has completed a sharp downside liquidity sweep followed by a strong rebound, signalling aggressive absorption from buyers at lower levels.

Price is now rotating inside a short-term recovery structure, with liquidity clusters clearly defining where reactions are likely to occur.

The market is currently trading between sell-side liquidity above and buy-side liquidity below, favouring range-based execution rather than chasing momentum.

KEY LIQUIDITY ZONES

Sell-side liquidity / resistance:

4513 – POC sell zone

4487 – VAL sell scalping area

These zones represent heavy historical volume where sellers previously defended price. Reactions here may trigger short-term pullbacks before continuation.

Buy-side liquidity / support:

4445 – Buy POC

4409 – Major buy zone and liquidity support

These levels align with value areas where demand has stepped in strongly, making them critical zones for price stabilisation.

EXPECTED PRICE BEHAVIOUR

Short term: price is likely to continue rotating between buy and sell liquidity, creating two-way opportunities.

A sustained hold above buy-side liquidity keeps the bullish structure intact.

A clean break and acceptance above sell-side liquidity would open the path toward a retest of ATH levels.

MACRO & BLACK SWAN CONTEXT – WHY 2026 MATTERS

2026 is shaping up to be a year of hidden tail risks, including:

Increasing political pressure from President Trump on the Federal Reserve

Key elections in the US and multiple emerging markets

Elevated risk of an AI-driven technology stock bubble due to excessive valuations

Historically, environments marked by political stress, central bank credibility concerns, and asset bubbles tend to strengthen demand for hard assets, particularly gold.

BIG PICTURE VIEW

Gold remains structurally supported by liquidity and macro uncertainty

Short-term price action is tactical and level-driven

Long-term, gold continues to act as insurance against systemic and political risk

When markets underestimate risk, liquidity quietly shifts. Gold tends to move first.

XAUUSD H1 - Liquidity reaction post-geopolitical spikeGold surged strongly at the start of the week as escalating geopolitical tensions boosted safe-haven demand, while expectations of further Fed rate cuts continued to support the broader bullish narrative. From a technical perspective, price is now reacting around key liquidity and Fibonacci zones rather than trending impulsively.

TECHNICAL OVERVIEW

On H1, gold experienced a sharp sell-off followed by a recovery, forming a V-shaped reaction that suggests aggressive liquidity clearing.

Price is currently trading below prior breakdown zones, indicating that supply remains active at higher levels.

The market structure favors selling on rallies in the short term, while deeper pullbacks may attract fresh buyers.

KEY LEVELS & MARKET BEHAVIOR

Upper sell zones (supply & Fibonacci confluence):

4497 – 4500 (FVG sell zone, premium area)

4431 – 4435 (Fibonacci + former support turned resistance)

These zones represent areas where sellers previously stepped in aggressively, making them important reaction levels if price rebounds.

Lower buy-side liquidity:

4345 – 4350 (Value Low / buy-side liquidity zone)

This area aligns with trendline support and prior accumulation, making it a key level to monitor for a bullish reaction if price rotates lower.

EXPECTED PRICE FLOW

Short term: price may continue to consolidate and rotate between resistance and liquidity below, with choppy price action likely.

A rejection from the upper resistance zones could lead to another leg lower toward buy-side liquidity.

If buy-side liquidity is absorbed and defended, the market may attempt another recovery move.

FUNDAMENTAL CONTEXT

Gold’s strength is underpinned by two major factors:

Rising geopolitical risk, which increases demand for safe-haven assets.

Dovish expectations from the Federal Reserve, as markets continue to price in additional rate cuts, reducing the opportunity cost of holding non-yielding assets like gold.

These fundamentals support gold on higher timeframes, even as short-term technical corrections play out.

BIG PICTURE VIEW

Medium-term bias remains constructive due to macro and geopolitical support.

Short-term price action is driven by liquidity and reaction zones rather than trend continuation.

Patience is key—allow price to interact with major levels before committing to the next directional move.

Let the market show its hand at liquidity.

XAUUSD Smart Money Levels: Demand 4325, Supply 4494🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, but current price action reflects a premium-side liquidity operation rather than clean continuation. After a strong upside leg, price is now rotating inside premium where Smart Money typically distributes positions before initiating corrective delivery.

Today’s focus revolves around USD strength, U.S. yield sensitivity, and ongoing Fed rate path speculation, with traders positioning ahead of upcoming U.S. macro releases and Fed commentary. As real yields fluctuate and risk sentiment remains fragile, Gold continues to attract safe-haven flows — but not without engineered pullbacks.

This environment favors liquidity sweeps, false continuation, and inducement above highs, rather than impulsive breakout buying.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

Higher-timeframe bullish structure with an active short-term corrective leg from premium.

Key Idea:

Expect Smart Money interaction either at internal supply (4492–4494) for distribution, or HTF demand (4327–4325) for re-accumulation before the next expansion.

Structural Notes:

• HTF bullish structure remains valid

• Recent CHoCH confirms corrective rotation

• Buy-side liquidity above highs has been partially tapped

• Supply cluster at 4492–4494 acts as distribution zone

• Demand zone at 4327–4325 aligns with OB + liquidity pool

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4327 – 4325 | SL 4317

• 🔴 SELL GOLD 4492 – 4494 | SL 4500

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4327 – 4325 | SL 4317

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH confirmation on M5–M30

✔ Strong upside BOS with impulsive candles

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4390 — initial displacement

• 4450 — internal liquidity

• 4490+ — premium retest if USD weakens

🔴 SELL GOLD 4492 – 4494 | SL 4500

Rules:

✔ Reaction into premium supply zone

✔ Bearish MSS / CHoCH on lower timeframe

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4455 — first imbalance fill

• 4395 — internal discount

• 4327 — HTF demand sweep

⚠️ Risk Notes

• Premium zones favor fake breakouts and stop hunts

• Volatility may spike around U.S. data and Fed remarks

• No entries without MSS + BOS confirmation

• Stops often triggered before real displacement

📍 Summary

Gold remains structurally bullish, but today’s edge lies in trading Smart Money’s range:

• A sweep into 4327–4325 may reload longs toward 4450–4490, or

• A reaction at 4492–4494 offers a sell opportunity back into discount.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD Smart Money Levels: Demand 4312, Supply 4436XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

Market Context

Gold remains structurally bullish on higher timeframes, yet short-term price action shows pullback pressure after premium liquidity was elected near 4440. As markets brace for ongoing USD direction from macro catalysts (Fed commentary, U.S. jobs data, Treasury yields), institutional participation is oscillating between liquidity hunts and controlled re-accumulation.

Global risk sentiment and safe-haven bids are intensifying as traders weigh inflation trajectory with central bank pivot expectations — leading Gold to exhibit rotational distribution behavior rather than clean continuation. Controlled swings and sweep-driven moves dominate price progression.

This environment favors engineered liquidity access and inducement, not blind breakout chasing.

Technical Framework – Smart Money Structure (1H)

Current Phase:

Higher-timeframe bullish bias with short-term corrective displacement.

Key Idea:

Expect structural engagement near HTF demand (~4312–4314) or internal supply liquidity (~4434–4436) before meaningful displacement sequences.

Structural Notes:

• HTF bullish structure remains intact

• Recent CHoCH confirms corrective leg

• Buy-side liquidity above recent highs is targeted

• Supply cluster near 4436 acts as engineered lure

• Demand confluence aligns with institutional accumulation

Liquidity Zones & Triggers

• BUY GOLD 4314 – 4312 | SL 4304

• SELL GOLD 4434 – 4436 | SL 4444

Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → internal supply retest → expansion

Execution Rules

BUY GOLD 4314 – 4312 | SL 4304

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH confirmation on M5–M30

✔ Clear upside BOS with impulse candles

✔ Entry via refined demand OB or FVG fill

Targets:

• 4370 — initial displacement

• 4410 — internal supply test

• 4440+ — extended run if USD weakens

SELL GOLD 4434 – 4436 | SL 4444

Rules:

✔ Reaction into internal supply cluster

✔ Bearish MSS / CHoCH confluence

✔ Downside BOS with momentum shift

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4390 — first discount zone

• 4350 — deeper pullback

• 4314 — HTF demand scan

Risk Notes

• False breaks favored near thin Asian session volume

• Macro catalysts (U.S. data, Fed speakers) may spike volatility

• Avoid entries without MSS + BOS confirmations

• Stops triggered by engineered liquidity hunts

Summary

Gold remains structurally bullish, but today’s edge lies in disciplined entries and liquidity awareness:

• A sweep into 4312–4314 may reload longs with targets up to 4410–4440, or

• A reaction near 4434–4436 provides a fade opportunity back into discount.

Let liquidity initiate the move. Let structure confirm.

Smart Money sets traps — retail chases them.

Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

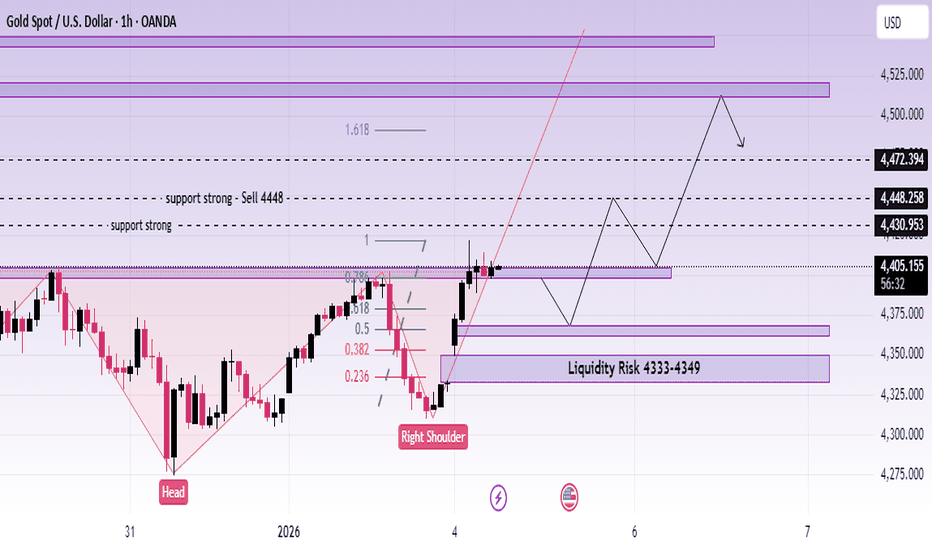

XAUUSD (H1) – Inverse Head & Shoulders formingLana focuses on pullback buys above key liquidity 💛

Quick overview

Timeframe: H1

Pattern: Inverse Head & Shoulders confirmed on the chart

Bias: Bullish continuation while price holds above neckline

Strategy: Buy pullbacks into liquidity zones, avoid chasing highs

Technical view – Inverse Head & Shoulders

On H1, gold has completed a clean Inverse Head & Shoulders structure:

Left shoulder: Formed after the first sharp sell-off

Head: Deeper liquidity sweep, followed by strong rejection

Right shoulder: Higher low, showing weakening selling pressure

Neckline: Around the 4030–4040 resistance zone (now being tested)

The recent breakout and strong follow-through suggest buyers have regained control. As long as price holds above the neckline, the structure favors continuation to the upside.

Key levels Lana is watching

Primary buy zone – Pullback entry

Buy: 4363 – 4367

This area aligns with prior structure support and sits inside a healthy pullback zone. If price revisits and shows acceptance, it offers a good risk-to-reward buy.

Liquidity risk zone – Deeper pullback

Liquidity risk: 4333 – 4349

If volatility increases and price sweeps deeper liquidity, this zone becomes the secondary area to watch for bullish absorption.

Upside targets & resistance

High liquidity area: 4512 – 4517

ATH zone: Above the previous all-time high

These zones are expected to attract profit-taking or short-term reactions, so Lana avoids chasing price near these levels.

Fundamental context (market drivers)

Geopolitics: Rising tension after comments about potential military intervention in Colombia adds background support for gold as a safe haven.

Goldman Sachs: Views Venezuela-related developments as having limited impact on oil, keeping broader commodity sentiment stable.

ISM Manufacturing PMI (US): Any sign of slowing manufacturing can pressure USD and indirectly support gold.

Overall, fundamentals remain supportive for gold, reinforcing the bullish technical structure.

Trading plan (Lana’s approach)

Prefer buying pullbacks into 4363–4367 while structure holds.

Be patient if price dips into 4333–4349 and wait for confirmation before entering.

If price falls back below the neckline and fails to reclaim it, Lana steps aside and reassesses.

This is Lana’s personal market view and not financial advice. Please manage your own risk before trading. 💛

XAUUSD D1 – Liquidity Rotation in Bullish ChannelLiquidity Rotation Inside a Strong Bullish Channel

Gold remains in a clear long-term uptrend on the daily timeframe, trading inside a well-defined ascending channel. Recent volatility, however, suggests the market is entering a liquidity-driven correction phase rather than a trend reversal.

TECHNICAL STRUCTURE

On D1, price is still respecting the rising channel, with higher highs and higher lows intact.

The rejection from the upper channel highlights profit-taking and sell-side liquidity absorption near premium levels.

Current price action suggests a rotation between upper liquidity (distribution) and lower value zones (accumulation).

KEY LIQUIDITY ZONES TO WATCH

Sell-side liquidity (premium zone):

4480 – 4485

This area represents a strong liquidity cluster near the upper channel and prior expansion highs, where price has shown clear rejection.

Buy-side liquidity (value zones):

4180 – 4185

A psychological level and mid-channel support where buyers may re-enter if price rotates lower.

4000 – 4005

Major long-term liquidity and Fibonacci confluence near the lower channel boundary, acting as a key structural support.

EXPECTED PRICE BEHAVIOUR

Short term: price may continue to fluctuate and rebalance between liquidity pools, with choppy conditions likely.

Medium term: as long as price holds above the lower channel, pullbacks are considered corrective within the broader bullish trend.

A clean rejection from sell liquidity followed by a move into buy liquidity would be a healthy reset for continuation later.

FUNDAMENTAL & GEOPOLITICAL BACKDROP

Geopolitical risk has sharply increased after former President Trump announced a large-scale US operation against Venezuela, including the arrest of President Maduro. This event adds a new layer of uncertainty to global markets and reinforces safe-haven demand.

Historically, rising geopolitical tensions, combined with a softer US dollar environment, tend to support gold prices, especially on higher timeframes.

BIG PICTURE VIEW

Gold’s long-term bullish narrative remains intact

Current moves are driven by liquidity rotation, not weakness

Geopolitical risk could accelerate upside once the corrective phase completes

Patience remains key. Let price move between liquidity zones before committing to the next directional leg.

XAUUSD (H2) – Liam Plan (Jan 02)Price is compressing in a structure, wait for the trendline break to choose direction 🎯

Quick summary

After the strong bearish BOS, gold is rebounding and compressing inside a diagonal structure (triangle/flag-like). Today the clean approach is confirmation trading:

SELL only after a confirmed break of the trendline (4348–4350) as marked on your chart.

SELL reactions at the upper supply / VAL zones (4460–4463 and 4513–4518).

BUY is secondary — only if price holds the 4400–4405 key support and shows a clear reaction on lower timeframes.

Macro backdrop (CME FedWatch)

Probability Fed holds rates in January: 85.1%

Probability of a 25 bps cut in January: 14.9%

By March: probability of 25 bps cumulative cut: 51.2%, hold 42.8%, 50 bps cut 5.9%

👉 This keeps markets sensitive to USD / yields expectations. Gold can bounce technically, but volatility spikes are likely — so we stick to levels + confirmation.

Key Levels (from your chart)

✅ Sell zone 1: 4513 – 4518

✅ Sell VAL: 4460 – 4463

✅ Reaction / flip zone: 4400 – 4405

✅ Breakdown trigger: 4348 – 4350 (sell upon confirmed trendline breakout)

Trading scenarios (Liam style: trade the level)

1) SELL scenarios (priority)

A. SELL on trendline breakdown confirmation

Trigger: clean break + close below 4348–4350

Entry: sell the retest back into the broken trendline

TP1: 4320–4305

TP2: 4260–4240

TP3: deeper extension (towards the 41xx area) if momentum expands

Logic: This is the clearest “trend confirmation” on your chart. No chasing — let price confirm first.

B. SELL reaction at supply

Sell: 4460–4463 (VAL)

Stronger sell: 4513–4518 (premium supply)

Only sell with visible weakness / rejection on M15–H1.

2) BUY scenario (secondary – reaction only)

Buy zone: 4400–4405

Condition: hold the zone + print higher lows on lower TF

TP: 4460 → 4513 (scale out)

Logic: This is a key support/flip area. If it holds, price can rotate up to test supply above before the next decision.

Key notes

Compression often creates false breaks — don’t trade mid-range.

Two clean plays only: break 4348–4350 to sell with confirmation, or retrace to 4460/4513 to sell the reaction.

What’s your bias today: selling the 4348 breakdown, or waiting for 4460–4463 for a cleaner pullback sell?

XAUUSD (H1) – Early 2026 ForecastShort-term recovery inside a larger bullish cycle 💛

Quick market recap

2025 performance: Gold surged ~64%, the strongest annual gain since 1979

Recent move: Sharp year-end correction driven by profit-taking and margin adjustments, not trend reversal

Big picture: The multi-year bull market in precious metals remains intact

Fundamental context (why the trend still matters)

Despite the late-2025 pullback, the broader precious metals complex remains structurally strong. Gold, silver, platinum, and palladium all benefited from:

Fed rate-cut cycle expectations

Persistent geopolitical tensions

Strong central bank buying

Industrial demand and supply constraints (especially for silver and platinum)

Most analysts agree the recent correction was technical in nature. The long-term outlook still points toward gold potentially testing 5,000 USD/oz and silver approaching 100 USD/oz in 2026, although short-term volatility is expected to remain high.

Technical view (H1) – Based on the chart

After failing to hold above the ATH, gold experienced a sharp bearish displacement, followed by a stabilization phase near a strong support zone. Price is now attempting a recovery, but the structure suggests this is still a corrective move within a broader range.

Key observations:

Strong sell-off broke short-term bullish structure

Price is rebounding from major support, forming a potential higher low

Overhead liquidity and Fibonacci zones remain key reaction areas

Key levels Lana is watching

Buy zone – Strong liquidity support

Buy: 4345 – 4350

This is a strong liquidity zone where price already reacted. If price revisits this area and holds structure, it offers a favorable risk-to-reward buy aligned with the larger bullish cycle.

Sell zone – Short-term resistance (scalping)

Sell scalping: 4332 – 4336

This zone aligns with short-term resistance and Fibonacci reaction levels. If price fails here, a brief pullback toward support is possible.

Important overhead liquidity

Key liquidity: 4404 area

A clean break and hold above this level would signal stronger bullish continuation toward higher targets.

Scenarios to consider

Scenario 1 – Range correction continues

Price reacts at short-term resistance, rotates back into liquidity, and builds a base before the next directional move.

Scenario 2 – Bullish continuation resumes

A break above overhead liquidity opens the path toward higher levels, potentially retesting prior highs as the new year unfolds.

Lana’s approach 🌿

Trade zones, not headlines

Focus on price reaction at liquidity levels

Accept short-term volatility while respecting the long-term bullish structure

This analysis reflects Lana’s personal market view and is not financial advice. Please manage risk carefully and trade responsibly 💛

XAUUSD (H1) – Short-term Correction After ATH Lana focuses on sell rallies, waiting for a deeper buy zone 💛

Quick overview

Market state: Sharp sell-off after failing to hold above ATH

Timeframe: H1

Current structure: Strong bearish impulse → corrective rebound in progress

Intraday bias: Sell on pullbacks, buy only at major support

Technical picture (based on the chart)

Gold printed a clear distribution top near ATH, followed by a strong bearish displacement. This move broke the short-term bullish structure and shifted momentum to the downside.

Price is now attempting a technical rebound, but so far this looks corrective rather than impulsive. As long as price stays below key resistance, Lana treats this as a sell-the-rally environment.

Key observations:

Strong bearish candle confirms loss of bullish control

Current rebound is moving into prior liquidity + Fibonacci reaction zone

Market is likely building a lower high before the next move

Key levels to trade

Sell zone – priority setup

Sell: 4392 – 4395

This zone aligns with:

Prior structure resistance

Fibonacci retracement area

Liquidity resting above current price

If price reaches this zone and shows rejection, Lana will look for sell continuation.

Buy zone – only at strong support

Buy: 4275 – 4278

This is a higher-timeframe support zone and the first area where buyers may attempt to step back in. Lana only considers buys here if price shows clear reaction and stabilization.

Intraday scenarios

Scenario 1 – Rejection at resistance (preferred)

Price retraces into 4392–4395, fails to break higher, and rolls over → continuation to the downside, targeting deeper liquidity.

Scenario 2 – Deeper correction then recovery

If selling pressure extends, price may sweep liquidity into 4275–4278 before forming a base for a larger rebound into the new year.

Market tone

The recent move reflects profit-taking and risk reduction after an extended rally. With year-end liquidity thinning out, price action can remain volatile and deceptive, making zone-based trading essential.

This analysis reflects Lana’s technical view and is not financial advice. Always manage your own risk and wait for confirmation before entering trades 💛

Smart Money reloading Gold after liquidity sweep?🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (30/12)

📈 Market Context

Gold remains structurally supported on higher timeframes, but current price action reflects controlled volatility and liquidity engineering rather than trend continuation.

With markets reacting to fresh U.S. data expectations, USD yield fluctuations, and ongoing geopolitical uncertainty, Gold continues to attract safe-haven interest — yet extended intraday ranges suggest Smart Money is actively positioning rather than chasing price.

Recent headlines around Fed rate path uncertainty and mixed U.S. macro signals keep Gold bid on pullbacks, while thinning liquidity into the year-end session increases the likelihood of stop hunts and engineered traps on both sides of the range.

Smart Money behavior favors drawing liquidity first, confirming structure later — not clean breakouts.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

HTF bullish structure with short-term corrective compression

Key Idea:

Expect liquidity interaction at discount (4320–4318) or reaction from internal supply (4465–4467) before any sustained displacement.

Structural Notes:

HTF bullish BOS remains valid

Prior CHoCH triggered a corrective leg

Price is compressing under bearish trendline

Discount zone aligns with potential accumulation

Buy-side liquidity rests above internal highs

Sell-side liquidity recently probed and absorbed

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4320 – 4318 | SL 4310

• 🔴 SELL GOLD 4465 – 4467 | SL 4475

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4320 – 4318 | SL 4310

Rules:

✔ Liquidity grab into discount zone

✔ Bullish MSS / CHoCH on M5–M15

✔ Clear upside BOS with impulsive displacement

✔ Entry via bullish FVG fill or refined demand OB

Targets:

4360

4400

4465 – extension if USD weakens and risk sentiment deteriorates

🔴 SELL GOLD 4465 – 4467 | SL 4475

Rules:

✔ Reaction into internal supply / premium imbalance

✔ Bearish MSS / CHoCH on LTF

✔ Downside BOS with momentum shift

✔ Entry via bearish FVG refill or supply OB

Targets:

4430

4385

4320 – extension if USD strengthens or yields rise

⚠️ Risk Notes

Compression favors false breakouts

No execution without MSS + BOS confirmation

Expect volatility during U.S. session

Reduce risk around USD yield spikes or Fed-related headlines

Thin liquidity amplifies stop hunts

📍 Summary

Gold remains bullish by structure, but today’s edge lies in patience, not prediction.

Smart Money is likely to engineer liquidity before committing:

• A sweep into 4320–4318 may reload longs toward 4400–4465, or

• A reaction near 4465–4467 could fade price back into discount.

Let liquidity move first. Let structure confirm.

Smart Money waits — retail reacts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD (H1) – Liam View: Strong Bullish Breakout→ short-term bearish shift, prefer selling the pullback | Quick reaction buy at 4330–4333

Quick summary

Gold just printed a very aggressive dump with clear BOS (Break of Structure) — a short-term bearish shift is now in play. Price is currently in a technical rebound, so the cleaner plan is:

Don’t chase shorts at the lows

Wait for a pullback into 4458–4462 to sell from a premium supply zone

If price sweeps back down, look for a quick reaction buy at 4330–4333

1) Technical view (based on your chart)

The sell-off looks like a classic liquidity dump: large bearish candles, multiple supports broken → confirms bearish pressure intraday.

After a dump, the market often retraces into supply (re-distribution) before the next leg.

The 4330–4333 area is marked as a support that already “tested liquidity” — it can still provide a bounce, but it’s more of a scalp zone, not a full reversal yet.

2) Key Levels

✅ Sell zone: 4458 – 4462 (supply / pullback short)

✅ Buy zone: 4330 – 4333 (support / quick reaction)

3) Trading scenarios (Liam style: trade the level)

Scenario A (priority): SELL the pullback

✅ Sell: 4458 – 4462

SL guide: 4470 (or above the most recent lower-TF swing high)

TP1: 4400 – 4390

TP2: 4333

TP3: extension lower if structure continues to break down

Logic: After a strong BOS, 4458–4462 is where you get a better short entry — avoid selling late.

Scenario B: BUY reaction at support (scalp only)

✅ Buy: 4330 – 4333

SL guide: 4322–4325

TP: 4370 → 4400 (scale out)

Logic: This zone can spark a technical bounce. Only buy with clear holding signals on lower timeframes (M5–M15) — no catching falling knives.

4) Confirmation rules (avoid noise)

If price reaches 4458–4462 and fails to reclaim above → SELL bias stays strong.

If 4330 breaks and closes below → stop looking for buys and focus on pullback sells.

5) Risk notes

No mid-range entries — only act at 4330–4333 or 4458–4462.

Risk per trade: max 1–2%.

After a dump, spreads and wicks can expand — reduce size.

Which side are you leaning today: selling 4458–4462, or waiting for 4330–4333 to buy the reaction bounce?

XAUUSD (H1) – Bearish Correction After ATHLana focuses on selling rallies, waiting for a deeper buying zone 💛

Quick overview

Market state: Sharp sell-off after failing to hold above ATH

Timeframe: H1

Current structure: Strong bearish impulse → corrective rebound in progress

Intraday bias: Sell on pullbacks, buy only at major support

Technical picture (based on the chart)

Gold printed a clear distribution top near ATH, followed by a strong bearish displacement. This move broke the short-term bullish structure and shifted momentum to the downside.

Price is now attempting a technical rebound, but so far this looks corrective rather than impulsive. As long as price stays below key resistance, Lana treats this as a sell-the-rally environment.

Key observations:

Strong bearish candle confirms loss of bullish control

Current rebound is moving into prior liquidity + Fibonacci reaction zone

Market is likely building a lower high before the next move

Key levels to trade

Sell zone – priority setup

Sell: 4392 – 4395

This zone aligns with:

Prior structure resistance

Fibonacci retracement area

Liquidity resting above current price

If price reaches this zone and shows rejection, Lana will look for sell continuation.

Buy zone – only at strong support

Buy: 4275 – 4278

This is a higher-timeframe support zone and the first area where buyers may attempt to step back in. Lana only considers buys here if price shows clear reaction and stabilization.

Intraday scenarios

Scenario 1 – Rejection at resistance (preferred)

Price retraces into 4392–4395, fails to break higher, and rolls over → continuation to the downside, targeting deeper liquidity.

Scenario 2 – Deeper correction then recovery

If selling pressure extends, price may sweep liquidity into 4275–4278 before forming a base for a larger rebound into the new year.

Market tone

The recent move reflects profit-taking and risk reduction after an extended rally. With year-end liquidity thinning out, price action can remain volatile and deceptive, making zone-based trading essential.

This analysis reflects Lana’s technical view and is not financial advice. Always manage your own risk and wait for confirmation before entering trades 💛

Gold 1H – Smart Money Traps Near 4540–4450 Range🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (23/12)

📈 Market Context

Gold remains structurally bullish on the higher timeframes, but price is now trading inside a compression zone after a clear impulsive expansion. With year-end liquidity thinning and traders positioning ahead of fresh Fed rate expectations and USD yield fluctuations, Gold is vulnerable to liquidity manipulation rather than clean continuation.

Recent USD softness and mixed macro headlines keep Gold supported, yet extended pricing near highs increases the probability of stop hunts on both sides before the next decisive move.

Smart Money behavior here favors range engineering — drawing in breakout traders above highs and shaking out impatient long positions below key demand — before revealing true intent.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Bullish HTF structure with short-term distribution

Key Idea: Expect liquidity interaction at premium (4540–4542) or discount (4450–4448) before displacement

Structural Notes:

• Higher-timeframe bullish BOS remains intact

• Recent CHoCH signals short-term distribution risk

• Price is trading in premium, extended from equilibrium

• Clear impulsive leg left unmitigated inefficiencies below

• A defined scalping range has formed between premium and discount

• Liquidity rests clearly above 4540 and below 4450

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4540 – 4542 | SL 4560

• 🟢 BUY GOLD 4450 – 4448 | SL 4440

🧠 Institutional Flow Expectation:

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4540 – 4542 | SL 4560

Rules:

✔ Sweep above premium buy-side liquidity

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4510

2. 4485

3. 4450 – extension if USD strengthens or yields push higher

🟢 BUY GOLD 4450 – 4448 | SL 4440

Rules:

✔ Liquidity grab into discount and prior demand

✔ Bullish MSS / CHoCH confirms demand control

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FGV fill or demand OB retest

Targets:

1. 4480

2. 4510

3. 4540 – extension if USD weakens and bullish flow resumes

⚠️ Risk Notes

• Premium trading increases fake breakout probability

• No entry without MSS + BOS confirmation

• Expect volatility during U.S. session and thin year-end liquidity

• Reduce risk around Fed-driven or USD yield headlines

📍 Summary

Gold is still bullish by structure, but current price action signals liquidity games inside a defined range. Smart Money is likely to engineer stops before expansion:

• A sweep above 4540 may fade back toward 4485–4450, or

• A liquidity grab near 4450 could reload long positions toward 4510–4540+

Let price show intent — Smart Money waits, retail reacts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 1H – CPI Ambiguity Sets Liquidity Traps Near 4400🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (22/12)

📈 Market Context

Gold is trading near the upper boundary of a well-defined bullish channel as markets react to renewed uncertainty surrounding U.S. inflation data and the Fed’s policy outlook.

Recent CPI-related commentary has reignited debate over whether inflation is cooling fast enough to justify near-term easing, keeping USD flows unstable and risk sentiment mixed.

This macro backdrop favors liquidity engineering over clean continuation, with Smart Money likely targeting both premium and discount extremes to induce breakout traders before the next directional expansion.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Bullish structure approaching premium exhaustion

Key Idea: Expect liquidity interaction at 4400–4402 (premium) or 4340–4338 (discount) before meaningful displacement

Structural Notes:

• Higher-timeframe bullish BOS remains valid

• Price is pressing into buy-side liquidity near channel highs

• Clear impulsive leg up created an unmitigated FVG above 4370

• Rising structure shows signs of short-term distribution, not confirmed reversal

• Liquidity rests clearly above 4400 and below 4340

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4400 – 4402 | SL 4410

• 🟢 BUY GOLD 4340 – 4338 | SL 4330

🧠 Institutional Flow Expectation:

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4400 – 4402 | SL 4410

Rules:

✔ Sweep above psychological 4400 buy-side liquidity

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4370

2. 4350

3. 4340 – extension if USD strengthens on CPI reassessment

🟢 BUY GOLD 4340 – 4338 | SL 4330

Rules:

✔ Liquidity grab into discount and channel support

✔ Bullish MSS / CHoCH confirms demand control

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4360

2. 4385

3. 4400 – extension if USD weakens amid CPI doubt

⚠️ Risk Notes

• CPI-driven uncertainty increases fake breakouts

• No entry without MSS + BOS confirmation

• Expect volatility during U.S. session

• Reduce risk around unexpected Fed or inflation headlines

📍 Summary

Gold is trading at a decisive premium within a bullish structure, but CPI ambiguity keeps conviction fragile. Smart Money is likely to engineer liquidity at the extremes before committing:

• A sweep above 4400 may fade toward 4350–4340, or

• A liquidity grab near 4340 could reload bullish flow toward 4385–4400+

Let structure confirm — Smart Money reacts, retail anticipates. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.