XAUUSD – Brian | H2 Technical AnalysisXAUUSD – Brian | H2 Technical Outlook – Consolidation & Range-Building Phase

After the recent sharp sell-off, gold is now transitioning into a consolidation phase on the H2 timeframe. The strong bearish impulse has slowed, and current price action suggests the market is shifting from directional movement into range-building and accumulation, rather than continuing lower immediately.

This type of behavior is typical after aggressive volatility, as the market reassesses value and balances supply and demand.

Market Structure & Current Behavior

Structurally, price has broken below the prior bullish leg and is now trading within a defined value range:

Selling pressure has eased following the downside expansion.

Price is rotating around the VAL and lower value areas, indicating acceptance rather than rejection.

Momentum is no longer impulsive, pointing to sideways development rather than trend continuation.

As long as price remains inside this value range, range trading conditions dominate.

Key Value & Liquidity Zones Upper Resistance / Supply

Sell Liquidity: 5,330

Sell Zone POC: 5,045

These zones act as overhead supply where upside attempts may be capped during consolidation.

Lower Support / Demand

VAL zone

Buy scalping POC: 4,673

This lower area represents short-term demand, where downside moves are more likely to stall during the accumulation phase.

Intraday Expectation

For today’s session:

Primary expectation: Sideways consolidation within the established range

Price is likely to rotate between value extremes rather than trend strongly

Breakouts require clear acceptance above resistance or below support to shift bias

Until such acceptance occurs, patience and range awareness are more effective than directional conviction.

Key Takeaway

After strong volatility, markets often pause to rebuild structure. For now, gold appears to be absorbing orders and forming balance, making consolidation the higher-probability scenario.

Refer to the chart for highlighted value zones and projected range behavior.

✅ Follow the TradingView channel to receive early market structure updates and intraday outlooks.

Smctrading

EURUSD | 15M | Smart Money Concept OutlookMarket Structure:

Price is currently delivering a short-term bullish repricing following a displacement from the internal range low near 1.1775. The sequence of higher highs and higher lows confirms an intraday shift in structure, suggesting that buy-side liquidity has been engineered to facilitate a move into premium pricing.

Liquidity Narrative:

The recent impulsive leg cleared multiple internal liquidity pools, including prior equal highs and resting stop clusters. Price is now trading directly into a well-defined supply zone that aligns with a higher-timeframe premium array. This region is a classic smart money distribution pocket where late buyers often become liquidity for institutional positioning.

Order Flow & Imbalance:

The rally shows clear displacement characteristics with minimal overlap, leaving behind inefficiencies that may act as a magnet should price rotate lower. Additionally, the current consolidation beneath resistance resembles a potential buy-side liquidity build-up. A sweep of these highs would complete the liquidity engineering phase before a probable bearish expansion.

POI (Point of Interest):

Premium supply zone: ~1.1830 to 1.1845

Internal resistance acting as a distribution ledge

Untapped sell-side liquidity resting below 1.1780

Execution Model:

The preferred scenario involves a liquidity sweep above the short-term highs followed by bearish market structure shift on the lower timeframe. Confirmation through displacement and fair value gap formation would strengthen the short thesis.

Draw on Liquidity:

If the distribution unfolds as anticipated, price is likely to rebalance toward the sell-side liquidity pool near 1.1775, completing a premium-to-discount delivery cycle.

Invalidation:

Sustained acceptance above the supply zone with strong displacement would indicate continuation, signaling that the market is seeking higher external liquidity rather than distributing.

Summary:

Price is trading in premium territory after a liquidity-driven expansion. The environment favors patience, allowing smart money to reveal intent. Watch the highs carefully; what appears as breakout fuel often becomes the trapdoor.

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Scenario 3 – Corrective Rebound Before the Next Decision | Lana ✨

Gold is showing signs of stabilization after a strong sell-off, and today’s price action may favor Scenario 3: a corrective rebound. This is not a full trend reversal yet, but a likely recovery phase into key imbalance zones, where the market will decide whether to continue lower or rebuild structure for a broader rebound.

📈 Market Structure & Context

The recent move down was impulsive, clearing multiple supports and creating a clear bearish displacement.

Price is now reacting from a lower base, suggesting selling pressure is slowing and a technical retracement can develop.

In this environment, the focus is on how price reacts at FVG/supply zones above, not on chasing moves in the middle of the range.

🔍 Key Zones to Watch Today

Buy Liquidity / Base Support: 4640 – 4645

This is the current stabilization area and the most important zone to defend for any rebound scenario.

FVG Support Zone: 4953 – 4958

First major upside target for a corrective rebound. This zone may act as a magnet for price, but also as a reaction area.

Sell FVG (Upper Supply): ~5250 – 5320

If the rebound extends, this becomes the next resistance zone where selling pressure may return.

Strong Resistance: ~5452

A higher objective only possible if price shows clear acceptance and trend rebuilding above key levels.

Structural Pivot: ~5104

A key mid-level. Acceptance above it would strengthen the rebound thesis.

🎯 Scenario 3 – Corrective Rebound Plan

If price holds above 4640–4645 and continues to build higher lows, the market may attempt a push back into imbalance:

First recovery path: 4640–4645 → 4953–4958

If price accepts above the mid-structure: → 5104

Extension (only with strong acceptance): → 5250–5320

Higher target (less likely today): → 5452

This is a structure-first environment: the rebound is valid as long as price defends the base and prints cleaner bullish follow-through.

🧠 Lana’s View

Today’s setup leans toward a retracement-driven rebound, where price rebalances into key zones after a sharp drop. The best approach is to stay patient, track reactions at 4953–4958 and 5250–5320, and let structure confirm whether this rebound is only corrective or the start of a broader recovery.

✨ Stay calm, respect the zones, and let price confirm the next move.

US100 | 15MNarrative Overview:

Following an aggressive sell-side liquidity raid, price delivered a reactive displacement from a higher-timeframe demand cluster, signaling the presence of institutional buy orders defending discount pricing. The rejection wick into the demand zone suggests a classic liquidity engineering event rather than genuine bearish continuation.

Market Structure:

The broader intraday flow remains rotational; however, the recent reaction establishes a potential short-term structure shift. The failure to achieve sustained acceptance below the demand zone implies seller exhaustion and the likelihood of a mean reversion toward premium.

Liquidity Map:

Sell-Side Liquidity: Resting below 25,250, now partially mitigated after the sweep.

Internal Liquidity: Compression above current price indicates stop accumulation from early longs.

Buy-Side Targets: 25,380 to 25,420 aligns with prior distribution and inefficient pricing.

Imbalance & Order Flow:

The impulsive bullish candle emerging from the zone created a micro fair value gap, reinforcing the probability of algorithmic repricing higher. When displacement originates from discount, it often signals smart money transitioning from accumulation to expansion.

Trade Logic:

The optimal execution model favors continuation toward premium, provided price maintains acceptance above the reclaimed demand.

Bullish Path:

A controlled retracement into the imbalance or the upper boundary of demand could offer refined entries targeting external liquidity. This would complete a discount-to-premium delivery cycle.

Risk Scenario:

A decisive break with displacement below the demand zone would invalidate the accumulation thesis and expose deeper sell-side liquidity, likely inviting bearish continuation.

Key Insight:

What appears to be a simple bounce is structurally more significant; institutions rarely defend a level without intent. Monitor how price behaves during pullbacks. Strong markets do not revisit deeply mitigated demand unless distribution is underway.

XAUUSD – Brian | H4 Technical AnalysisXAUUSD – Brian | H4 Technical Outlook – Selling Bias After Exhaustion Rally

Gold has completed a strong upside expansion and is now showing clear signs of trend exhaustion on the H4 timeframe. After printing a sharp impulse leg higher, price failed to sustain acceptance above the recent highs and quickly transitioned into a deep corrective move, signalling a shift in short-term market control.

From a structural perspective, the market has moved from impulse → distribution → correction, favouring a selling bias while price remains capped below key resistance.

Market Structure & Fibonacci Context

The recent rally stalled near the upper resistance zone, followed by an aggressive rejection.

Price has retraced deeply into the Fibonacci 0.618–0.75 area, confirming that the move lower is not a minor pullback but a meaningful correction.

Current price action suggests lower highs are forming, keeping selling pressure active on rebounds.

As long as price fails to reclaim and accept above the prior breakdown levels, the bearish structure remains valid.

Key Zones to Watch

Primary SELL Zone

5,716 – 5,866

This is the major supply and sell-liquidity zone on H4. Any corrective rally into this area is likely to attract sellers, especially if price shows hesitation or rejection.

Intermediate Reaction Zone

Around the 0.5–0.618 Fibonacci retracement area, where short-term rebounds may stall before continuation lower.

Downside Targets / Demand

The lower support zone near 4,800–4,850 remains the first key downside area to monitor.

Deeper continuation would expose the 4,600–4,500 region, where broader demand may attempt to absorb selling pressure.

Macro Context (Brief)

Fundamentally, gold is facing headwinds from persistent uncertainty around interest rate expectations. Recent central bank commentary continues to signal caution toward near-term rate cuts, keeping real yields supported and limiting gold’s upside in the short term. This backdrop aligns with the current technical correction and distribution phase.

Trading Outlook

Bias: Selling / sell-on-rallies

Focus: Selling corrective rebounds into resistance zones

Risk note: Avoid chasing price at lows; let structure and levels guide entries

In this phase, patience is key. Selling strength at predefined zones offers higher probability than predicting bottoms.

Refer to the chart for Fibonacci levels, structure shift, and highlighted sell zones.

✅ Follow the TradingView channel to receive early updates on market structure, liquidity shifts, and high-probability zones.

XAUUSD (H2) – Liam Bearish TrendXAUUSD (H2) – Liam Bearish Outlook

Structure broken | Selling pressure remains dominant

Quick summary

Gold has shifted into a clear bearish phase after failing to hold key support levels. The strong sell-off has broken the prior bullish structure, and recent rebounds show signs of weakness rather than accumulation.

At this stage, the market is no longer in a buying/entry environment. The priority is selling rallies, not catching bottoms.

Market structure

The previous uptrend has been decisively invalidated by a sharp downside impulse.

Price is now trading below former support, which has flipped into resistance.

Recent recovery attempts lack follow-through and are corrective in nature.

This keeps the broader intraday-to-short-term bias bearish.

Key technical zones

Primary sell zone: 5100 – 5110

Former support turned resistance. This area favours sell reactions if price retests.

Secondary sell / liquidity zone: 4860 – 4900

A corrective bounce into this zone is likely to attract sellers again.

Near-term support: 4690 – 4700

A weak support area that may give way if selling pressure resumes.

Deeper downside targets:

4400 – 4450, then 4120 if the bearish momentum expands.

Trading plan (Liam style: sell the structure)

Primary scenario – SELL rallies

As long as price remains below 5100, any rebound should be treated as corrective. Sell reactions are preferred at resistance and liquidity zones, targeting further downside continuation.

Secondary scenario – Breakdown continuation

Failure to hold 4690 – 4700 would confirm continuation lower, opening the path toward deeper value zones.

Invalidation

Only a strong reclaim and acceptance back above 5100 – 5150 would force a reassessment of the bearish bias.

Key notes

Volatility remains elevated after the breakdown.

Avoid premature buying/entry against structure.

Let price come into resistance, then execute.

Trend and structure first, opinions second.

Focus for now:

Selling rallies while structure remains bearish.

No bottom fishing.

— Liam

XAUUSD – H4 Outlook: Liquidity ResetFebruary has opened with heightened volatility across global markets, and gold is no exception. After a strong upside run, XAUUSD has experienced a sharp corrective move, driven largely by deleveraging flows rather than a structural trend reversal.

Current price action suggests gold is entering a rebalancing phase, where liquidity is being cleared before the market can attempt a renewed push higher.

📈 Market Structure & Higher-Timeframe Context

Gold previously traded in a strong bullish structure, but the recent sell-off marked a clear market structure shift (MSS) on the H4 timeframe.

The impulsive decline swept sell-side liquidity below prior consolidation zones, a typical behavior after an extended rally.

Despite the speed of the drop, price is now approaching key support and demand areas, where selling pressure may begin to slow.

This type of move often reflects position reduction and risk-off behavior, not the end of the broader bullish narrative.

🔍 Key Zones to Monitor

Primary Support / Buy Zone: ~4,280 – 4,350

This area represents a strong demand zone where price may stabilize and form a base.

Short-Term Reaction Zone: ~4,450 – 4,500

A zone where price could oscillate during consolidation, suitable for short-term reactions rather than trend trades.

Sell-Side Liquidity Cleared:

The recent drop has already taken liquidity below previous lows, reducing immediate downside pressure.

Upside Rebalance Zones (FVG / Supply):

~4,850 – 4,900

~5,200 – 5,350

These areas are likely to act as resistance during any recovery phase.

🎯 Market Scenarios

Scenario 1 – Controlled Correction (Base Case):

Gold may continue to range or dip modestly into the 4,280–4,350 support zone, allowing the market to complete its liquidity reset. Holding this area would keep the broader bullish structure intact.

Scenario 2 – Recovery After Stabilization:

Once selling pressure is absorbed, price may begin a gradual recovery, targeting the 4,850–4,900 zone first. Acceptance above this level would open the door toward higher resistance areas.

Scenario 3 – Deeper Reset (Lower Probability):

A clean break below the main support would suggest a deeper correction, but at this stage, such a move would still be viewed as corrective within a larger cycle, not a full trend reversal.

🌍 Macro Backdrop (Brief)

The sharp sell-off in gold, silver, equities, and crypto reflects a global deleveraging wave, intensified by rising geopolitical risks and shifting risk sentiment. In such environments, gold often experiences short-term drawdowns, even as its longer-term role as a hedge remains intact.

This reinforces the idea that the current move is more about resetting positioning than changing long-term direction.

🧠 Lana’s View

Gold is not in a hurry.

After a powerful run, the market often needs to pause, rebalance, and absorb liquidity before the next meaningful expansion.

Lana remains patient, focusing on how price behaves around key H4 support zones, rather than reacting emotionally to volatility.

✨ Let the correction do its work. Structure will guide the next move.

XAUUSD - Brian | H1 AnalysisXAUUSD – Brian | H1 Technical Outlook – SELL Bias Aligned With the Main Trend

Gold is entering a strong corrective phase after forming a short-term top, with the H1 structure clearly shifting to the downside. The latest bearish leg is impulsive in nature, reflecting active position unwinding and short-term distribution following the prior extended rally.

In this environment, the preferred approach is to prioritize sell setups in line with the dominant intraday trend, focusing on reactions around key psychological and value-based levels.

Market Structure & Price Behaviour

The previous bullish structure has been invalidated by a sharp downside break, confirming a structure shift on H1.

Price is now trading below prior value areas, suggesting a transition from expansion into pullback and continuation to the downside.

Upward moves at this stage are likely to be corrective rallies rather than trend reversals, offering potential sell opportunities.

Key Psychological & Technical Zones

1) Trend-Following SELL Zone

Sell VAL: 5,048 – 5,051

This zone represents the lower value area of the most recent distribution range and is acting as a psychological resistance within the current bearish context. Reactions here are critical for assessing sell-side continuation.

2) Near-Term Balance Level

The 5,000 psychological level remains a focal point for intraday volatility. How price behaves around this round number will help determine momentum continuation.

3) Deeper BUY Zone (Not a Day-Trade Focus)

Buy Zone VAL: 4,450 – 4,455

This is a broader structural support area and should be treated as an observation zone rather than an active buying entry during the current session.

Intraday Trading Bias

Primary bias: SELL, aligned with the current H1 trend

Strategy: Look to sell corrective pullbacks into key psychological and value zones

Risk note: Avoid counter-trend buying positions while the bearish structure remains intact

In volatile conditions, following the dominant structure and waiting for price reactions at key levels is more effective than attempting to pick bottoms.

Refer to the chart for a detailed view of structure and highlighted zones.

Follow the TradingView channel for early market structure updates and ongoing analysis.

If you want:

a shorter intraday note,

a more neutral tone, or

an alternative version in UK / Indian English,

just say the word and I’ll adjust it for you 👌

XAUUSD – D1 Mid-Term AnalysisXAUUSD – D1 Mid-Term Outlook: Volatility Reset Before the Next Structural Move | Lana ✨

Gold has just experienced a sharp and aggressive sell-off from the highs, marking a clear shift from expansion into a volatility reset phase. While the broader bullish trend has not been fully invalidated, price action now suggests the market is entering a medium-term rebalancing process, where liquidity and structure will play a decisive role.

At this stage, the focus moves away from short-term noise and toward key daily levels that will define the next swing direction.

📈 Higher-Timeframe Structure (D1)

The strong vertical rally has been followed by a deep corrective candle, indicating distribution and profit-taking at premium levels.

Price has broken below short-term momentum support but is still trading above major higher-timeframe trend structure.

This behavior is typical after an extended rally, where the market needs time to absorb supply and reset positioning before choosing the next medium-term direction.

The current structure favors range development or a corrective swing, rather than immediate continuation to new highs.

🔍 Key Daily Zones to Watch

Major Resistance Zone: ~5400 – 5450

This area represents strong overhead supply. Any recovery into this zone is likely to face selling pressure and should be treated as a reaction zone, not a breakout zone.

Strong Liquidity Level: ~5100

A key magnet for price. Acceptance above or rejection below this level will heavily influence medium-term bias.

Sell-Side Liquidity Zone: ~4680 – 4700

This is a critical downside target where stops and unfilled liquidity are resting.

High-Liquidity Buy Zone: ~4290

A major higher-timeframe demand area. If price reaches this zone, it would complete a deep correction within the broader bullish cycle and open the door for medium-term accumulation.

🎯 Medium-Term Trading Scenarios

Scenario 1 – Corrective Recovery, Then Sell Pressure (Primary):

Price may attempt a rebound toward 5100 or even the 5400–5450 resistance zone. As long as price remains below this resistance, rallies are more likely to be corrective, offering opportunities to reassess shorts or reduce long exposure.

Scenario 2 – Continuation of the Correction:

Failure to reclaim 5100 increases the probability of a continued move lower toward 4680–4700, where sell-side liquidity is resting.

Scenario 3 – Deep Reset and Structural Buy:

If downside momentum accelerates, a move toward the 4290 high-liquidity zone would represent a full medium-term reset. This area is where stronger buyers may re-enter and where the next swing-long narrative could begin to form.

🌍 Market Context (Medium-Term View)

Such sharp daily moves often occur during periods of macro repricing and sentiment shifts, forcing the market to rebalance expectations. In these environments, gold tends to oscillate between liquidity zones, rather than trend cleanly in one direction.

This makes patience and level-based execution more important than prediction.

🧠 Lana’s Perspective

The market is no longer in a “buy-every-dip” phase.

This is a transition environment, where gold needs to finish its liquidity work before the next sustained move develops.

Lana stays neutral-to-cautious in the medium term, focusing on reactions at daily liquidity zones, not emotional bias.

✨ Let the structure reset, let liquidity clear, and wait for the market to show its hand.

XAUUSD (H4) – Liam Weekly ForecastXAUUSD (H4) – Liam Weekly Outlook

Uptrend under pressure, but not broken | Focus on retests and reactions

Quick summary

Gold has experienced a sharp corrective move after an extended bullish run. The recent sell-off has broken the steep short-term uptrend, but price has not confirmed a full trend reversal on H4.

At this stage, the market is transitioning into a rebalancing phase. For the coming week, the edge is not in predicting direction, but in trading reactions at key structure, Fibonacci, and FVG levels.

Market structure overview

The prior bullish trend has lost momentum after a vertical expansion.

Price has broken below the aggressive trendline, signaling trend exhaustion, not automatic reversal.

Current price action suggests a corrective structure with potential for range development or trend resumption after liquidity is rebalanced.

➡️ Bias remains neutral-to-bullish, conditional on how price reacts at key levels.

Key technical zones for the week

Primary buy-on-retest zone: trendline retest area around 4850 – 4900

This area has already shown reaction and acts as the first decision point for buyers.

Fibonacci 0.618 / key reaction zone: 5030 – 5050

A pivotal mid-range level. Acceptance above favors continuation; rejection keeps price corrective.

FVG + Fibonacci confluence: 5235 – 5260

This is a major imbalance zone. If price rallies into this area, expect strong reaction and two-sided trade.

Lower liquidity / value zone: 4540 area

This remains the deeper downside objective if higher levels fail to hold and the correction expands.

Weekly scenarios (Liam style: trade the level)

Scenario A – Trendline retest holds (bullish continuation)

If price continues to hold above the trendline retest zone and builds higher lows:

Look for bullish continuation toward 5030 → 5235

Break and acceptance above the FVG zone would reopen upside continuation potential.

Logic: This confirms the move as a healthy correction within a broader bullish structure.

Scenario B – Rejection from mid-range (extended correction)

If price fails to reclaim and hold above 5030 – 5050:

Expect choppy, corrective price action

Risk shifts toward a deeper pullback into 4540

Logic: Failure to hold the 0.618 zone keeps the market in rebalancing mode.

Scenario C – FVG test and rejection

If price rallies aggressively into 5235 – 5260:

This zone favors reaction and profit-taking

Acceptance above is required for any sustained bullish continuation.

Logic: FVG zones after strong sell-offs often act as distribution or reaction points before direction is decided.

Key notes for the week

Volatility remains elevated after the sell-off — expect false breaks.

Avoid mid-range trades without confirmation.

Let price prove acceptance or rejection at levels before committing.

This is a week for patience and execution, not conviction.

Weekly focus:

Will gold hold the trendline retest and rebuild higher, or fail at the 5030–5050 zone and rotate deeper into value?

— Liam

XAUUSD – Brian | 30M – Value Shift AfterXAUUSD – Brian | 30M – Value Shift After a Sharp Volatility Move

Gold has just experienced a significant volatility event, with price selling off aggressively from the highs before rebounding sharply. The market is now trading around a newly formed value area, a typical behavior when price transitions from expansion into a rebalancing phase. In this environment, value and POC levels tend to guide price more effectively than individual candles.

Macro Context (Brief)

Market sentiment remains sensitive to macro risks, including commodity volatility, geopolitical tensions, and monetary policy expectations. Gold ETF holdings have shown no meaningful change recently, suggesting no clear signs of institutional liquidation. The current volatility therefore appears more consistent with a positioning adjustment rather than a broader trend reversal.

Technical Analysis from the Chart (30M)

Following the sharp sell-off, price is now forming a well-defined trading range, with value areas acting as key reference points:

1) Upper Supply / Reaction Zones

POC – SELL: 5,531–5,526

The previous high-value zone, where selling pressure may re-emerge if price retraces higher.

Sell VAH: 5,365–5,369

The value area high, typically a reaction zone if distribution pressure remains present.

2) Current Balance Area

The 5,180–5,200 region is currently acting as a balancing zone after the volatility. Acceptance and consolidation above this area would increase the probability of a move back towards the VAH.

3) Lower Demand / Support Zones

POC Buy (scalping): 5,187

A short-term support area for technical reactions.

Buy VAL – Support: 5,058–5,064

The most important lower support zone. If a deeper liquidity sweep occurs, this area is likely to attract attention for potential absorption and short-term reversal.

Price Scenarios (Structure-Based)

Scenario A (Preferred if value holds):

Price holds above 5,180–5,200 → recovery towards 5,365–5,369 (VAH).

Scenario B (Rejection from above):

Price retraces into the VAH zone but faces clear rejection → rotation back towards the 5,187 / 5,180 area.

Scenario C (Deeper liquidation):

Loss of 5,180 → liquidity sweep into 5,058–5,064 (VAL) before attempting to rebuild.

Key Takeaway

In a rebalancing phase, value acceptance matters more than directional prediction. Focus on how price behaves around 5,180–5,200, the reaction at 5,365–5,369, and whether deeper support at 5,058–5,064 attracts meaningful buying interest.

Refer to the chart for detailed POC, VAH and VAL levels.

Follow the TradingView channel to receive early structure insights and join the discussion.

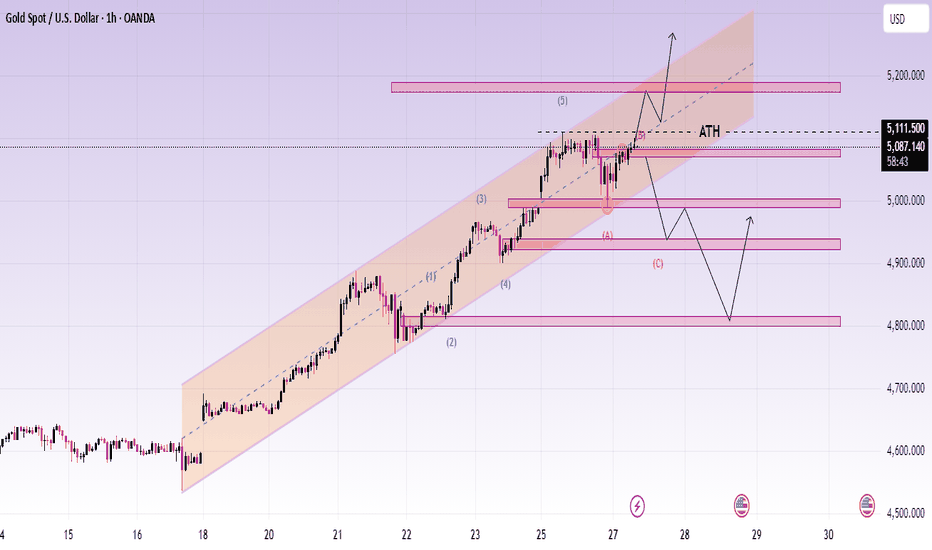

XAUUSD (H2) - Liam Plan (Jan 28)XAUUSD (H2) – Liam Plan (Jan 28)

New ATH, strong safe-haven flow | Follow trend, buy FVG pullbacks only

Quick summary

Gold continues to print new all-time highs as global capital rotates into safe-haven assets amid persistent economic and geopolitical uncertainty tied to recent US policy decisions. Additional support comes from concerns around Fed independence and expectations of lower US rates, keeping real yields capped.

Despite the bullish backdrop, price is now extended above equilibrium. The edge is not in chasing strength, but in waiting for pullbacks into imbalance and liquidity zones.

➡️ Bias stays bullish, execution stays patient.

Macro context (why gold stays bid, but volatile)

Ongoing geopolitical uncertainty keeps structural demand for gold intact.

Rate-cut expectations and doubts around Fed autonomy weaken the USD’s long-term appeal.

USD is attempting a technical bounce, but this has not shifted gold’s underlying bid.

➡️ Conclusion: macro supports higher prices, but short-term moves will likely rotate to rebalance inefficiencies.

Technical view (H2 – based on the chart)

Price is trending cleanly higher after multiple bullish BOS, riding an ascending structure and expanding into premium.

Key levels from the chart:

✅ Major extension / sell-side target: 5280 – 5320 (2.618 fib expansion)

✅ FVG / continuation buy zone: 5155 – 5170

✅ Structure support: 5000 – 5050

✅ Trend invalidation (deeper): below 4950

Current price action suggests a likely path of push → pullback → continuation, rather than straight-line expansion.

Trading scenarios (Liam style: trade the level)

1️⃣ BUY scenarios (priority – trend continuation)

A. BUY the FVG pullback (cleanest setup)

✅ Buy zone: 5155 – 5170

Condition: price taps FVG and shows bullish reaction (reclaim / HL / displacement on M15–H1)

SL (guide): below 5125 or below reaction low

TP1: recent high

TP2: 5280

TP3: 5320+ if momentum expands

Logic: This FVG aligns with prior buy-side liquidity and structure — a high-probability continuation zone.

B. BUY deeper structure support (only if volatility spikes)

✅ Buy zone: 5000 – 5050

Condition: liquidity sweep + strong rejection

TP: 5170 → 5280

Logic: This is value within trend. No interest in longs above premium if this level breaks.

2️⃣ SELL scenarios (secondary – reaction only)

SELL at extension (scalp / tactical only)

✅ Sell zone: 5280 – 5320

Condition: clear rejection / failure to hold highs on lower TF

TP: 5200 → 5170

Logic: Extension zones are for profit-taking and short-term mean rotation, not trend reversal calls.

Key notes

New ATHs invite FOMO — don’t be that liquidity.

Best trades come after pullbacks, not during impulse candles.

Reduce size around Fed headlines.

What’s your plan: buying the 5155–5170 FVG pullback, or waiting for a stretch into 5280–5320 to fade the reaction?

— Liam

XAUUSD – M45 Tech AnalysisXAUUSD – M45 Technical Outlook: Strong Momentum, Now Watch Liquidity Reactions | Lana ✨

Gold has surged above $5,250, extending its buying position with strong momentum. Price action remains constructive, but as the market pushes deeper into premium territory, liquidity reactions become more important than raw momentum.

📈 Market Structure & Price Action

Gold continues to trade inside a well-defined ascending channel, confirming a strong bullish structure.

Multiple BOS (Break of Structure) points on the chart highlight persistent buyer control.

The recent leg higher was aggressive, indicating momentum-driven buying, but also increasing the likelihood of short-term reactions.

At current levels, the market is extended above value, which often precedes either consolidation or a controlled pullback.

🔍 Key Technical Zones on M45

Upper Supply / Reaction Zone: 5280 – 5310

This area represents a premium zone where price may face profit-taking or liquidity sweeps before choosing direction.

Immediate Support (Channel Mid / Retest Zone): 5200 – 5220

A key area where price could pull back and attempt to hold structure.

Strong Sell-Side Liquidity Zone: around 5050

Marked clearly on the chart, this is a deeper level where liquidity is resting and where stronger buyer reactions could emerge if the pullback extends.

As long as price remains inside the channel, the broader bullish bias stays intact.

🎯 Trading Scenarios

Scenario 1 – Extension With Caution:

If price continues higher into the 5280–5310 zone, expect increased volatility and potential short-term rejection. This area is better suited for risk management and observation, not aggressive chasing.

Scenario 2 – Healthy Pullback (Preferred):

A pullback toward 5200–5220 would allow price to rebalance liquidity while maintaining structure. Holding this zone supports continuation within the channel.

Scenario 3 – Deeper Liquidity Sweep:

If volatility expands, a move toward the ~5050 sell-side liquidity zone could occur before a stronger continuation leg develops.

🌍 Market Context (Brief)

Gold’s sharp move above $5,250 reflects ongoing demand for safe-haven assets amid persistent macro and geopolitical uncertainty. Strong daily gains reinforce bullish sentiment, but such vertical moves also tend to attract short-term profit-taking, making structure and liquidity levels critical.

🧠 Lana’s View

The trend is bullish, but not every bullish move is a buy.

At extended levels, Lana focuses on how price reacts at liquidity zones, not on chasing momentum.

✨ Respect the structure, stay patient near extremes, and let the market come to your levels.

XAUUSD (H1) – Liam Plan (Jan 27) Bullish TrendQuick summary

Gold is still trending higher inside a clean rising channel, but price is now approaching a weak high / liquidity pocket where stop-runs are likely.

Macro backdrop adds fuel for volatility: reports suggest the US is pressuring Ukraine toward territorial concessions as part of peace talks — this kind of uncertainty often keeps safe-haven demand supported, but it can also create fast spikes + fake breaks.

➡️ Today’s rule: follow the uptrend, but only buy at liquidity test points. No chasing highs.

1) Macro context (why spikes are likely)

If markets start pricing a forced compromise in the Ukraine conflict:

risk sentiment can swing quickly,

headlines can trigger instant pumps, then sharp retraces.

✅ Safe approach: let price hit your zones first, then trade the reaction — not the headline.

2) Technical view (H1 – based on your chart)

Price is respecting an ascending channel and building liquidity around key levels.

Key levels (from the chart):

✅ Support / buy liquidity zone: 4,995 – 5,000

✅ Flip / reaction zone: 5,047

✅ Upper resistance / supply: 5,142

✅ Weak High / liquidity target: 5,192.6

✅ Extension target (1.618): 5,240.8

Bias stays bullish while inside the channel, but near 5,192–5,240 we should expect liquidity sweep → pullback behavior.

3) Trading scenarios (Liam style: trade the level)

A) BUY scenarios (priority – trend continuation)

A1. BUY the pullback into the flip zone (cleanest R:R)

✅ Buy: 5,045 – 5,050 (around 5,047)

Condition: hold + bullish reaction (HL / rejection / MSS on M15)

SL (guide): below 5,030 (or below the reaction low)

TP1: 5,085 – 5,100

TP2: 5,142

TP3: 5,192.6

Logic: This is the best “trend-following” entry — buy support, sell into liquidity above.

A2. BUY deep liquidity sweep (only if volatility hits)

✅ Buy: 4,995 – 5,000

Condition: sweep + strong reclaim (fast rejection / displacement up)

SL: below 4,980

TP: 5,047 → 5,142

Logic: This is the strongest liquidity test zone on your chart — ideal for a bounce if price flushes.

B) SELL scenarios (secondary – reaction scalps only)

B1. SELL the weak high sweep (tactical scalp)

✅ If price runs 5,192.6 and shows rejection:

Sell: 5,190 – 5,200

SL: above the sweep high

TP: 5,142 → 5,085

Logic: Weak highs often get swept first. Great for quick mean reversion back into the channel.

B2. SELL extension (highest-risk, but best location)

✅ Sell zone: 5,235 – 5,245 (around 5,240.8)

Only with clear weakness on M15–H1

TP: 5,192 → 5,142

Logic: 1.618 extension is a common exhaustion pocket — don’t short early, short the reaction.

4) Key notes

Don’t trade mid-range between 5,085–5,142 unless you’re scalping with tight rules.

Expect false breakouts near 5,192 and 5,240 during headlines.

Best execution today = buy support, take profits into liquidity.

Question:

Are you buying the 5,047 pullback, or waiting for the 5,192 sweep to sell the reaction?

— Liam

XAUUSD - H1 Gold structurally bullishXAUUSD – H1 Gold remains structurally bullish near all-time highs| Lana ✨

Gold is extending its bullish momentum for a second consecutive session and continues to trade near all-time highs. Price action remains constructive, with the market holding above key structure while deciding between continuation or a deeper pullback into value.

📈 Market Structure & Trend Context

The short-term and medium-term structure remains bullish, with price respecting the ascending channel.

The recent push above previous highs confirms strong demand, but current price action also shows signs of consolidation near ATH.

This behavior is typical after an impulsive rally, where the market pauses to build acceptance or rebalance liquidity before the next directional move.

As long as price holds above the rising structure, the bullish thesis remains valid.

🔍 Key Technical Zones to Watch

ATH Reaction Zone: 5080 – 5110

This is a sensitive area where price may consolidate, fake out, or briefly reject before choosing direction.

Primary Pullback / Buy Zone: 5000 – 5020

A key structural level aligned with prior resistance-turned-support and the midline of the bullish channel.

Secondary Support (Deeper Pullback): 4920 – 4950

A stronger value area if volatility increases or liquidity is swept below the channel.

Upside Expansion Zone: 5180 – 5200+

If price accepts above ATH, this becomes the next upside objective within the channel.

🎯 Trading Scenarios (H1 Structure-Based)

Scenario 1 – Continuation Above ATH:

If price consolidates above 5080–5110 and shows acceptance, gold may extend toward 5180–5200. This scenario favors patience and confirmation rather than chasing immediate breakouts.

Scenario 2 – Pullback Into Structure (Preferred):

A pullback toward 5000–5020 would allow the market to rebalance liquidity and offer a higher-quality continuation setup. Holding this zone keeps the bullish structure intact.

Scenario 3 – Deeper Correction:

If price loses the primary support, the 4920–4950 zone becomes the next key area to watch for buyer response and trend defense.

🌍 Macro Context (Brief)

Gold continues to benefit from heightened geopolitical risks and ongoing trade uncertainty, reinforcing its role as a safe-haven asset.

At the same time, market attention is shifting toward the outcome of the two-day FOMC policy meeting on Wednesday, which may introduce volatility and short-term repricing.

This backdrop supports gold structurally, while also increasing the likelihood of sharp intraday swings around key levels.

🧠 Lana’s View

Gold remains bullish, but near ATH levels, discipline matters more than conviction.

Lana prefers buying pullbacks into structure, letting price confirm, and avoiding emotional trades during headline-driven volatility.

✨ Respect the structure, stay patient near the highs, and let the market come to your levels.

XAUUSD (H2) – Liam Weekly Risk StrategyXAUUSD (H2) – Liam Weekly Risk Plan

Late-stage rally into macro risk | Sell premium, buy liquidity only

Quick summary

Gold continues to push higher, driven by escalating geopolitical and macro risk:

🇺🇸🇮🇷 US–Iran tensions remain elevated

🏦 FOMC: ~99% Fed holds rates, with a high chance of hawkish guidance from Powell

🇺🇸 US government shutdown risk later this week

This is a classic environment for headline spikes and liquidity grabs. Price is now trading at premium levels, so the edge shifts to reaction trading, not chasing strength.

Macro context (supportive, but dangerous to chase)

Geopolitical stress keeps safe-haven demand alive.

A hawkish Fed message can trigger sharp USD/yield reactions, even if rates are unchanged.

Government shutdown headlines often produce fast whipsaws, not clean trends.

➡️ Conclusion: volatility will increase, but direction will be decided at liquidity levels — not by the news itself.

Technical view (H2 – based on the chart)

Gold is in a strong bullish structure, but price has entered a late-stage expansion after multiple impulsive legs.

Key levels from the chart:

✅ Major SELL zone (premium / exhaustion): 5155 – 5234

✅ Current impulsive high area: ~5060

✅ Buy-side liquidity (already built): 4700 – 4800

✅ Sell-side liquidity / value zone: 4550 – 4600

The structure suggests a high probability path: push higher to clear buy-side liquidity → rotate lower into sell-side liquidity.

Trading scenarios (Liam style: trade the level)

1️⃣ SELL scenarios (priority – distribution at premium)

A. SELL at premium extension (primary idea)

✅ Sell zone: 5155 – 5234

Condition: rejection / loss of momentum on M15–H1

SL: above the high

TP1: 5000

TP2: 4800

TP3: 4600 (sell-side liquidity)

Logic: This zone represents late buyers and FOMO entries. Ideal area for distribution and mean rotation, especially during macro headlines.

B. SELL failed continuation

✅ If price spikes above 5060 but fails to hold (fake breakout):

Sell on lower-TF breakdown

TP: 4800 → 4600

Logic: Headline-driven spikes often fail after liquidity is taken.

2️⃣ BUY scenario (secondary – value only)

BUY only at sell-side liquidity

✅ Buy zone: 4550 – 4600

Condition: liquidity sweep + strong bullish reaction

TP: 4800 → 5000+

Logic: This is the first area where long-term buyers regain R:R advantage. No interest in buying above value.

Key notes for the week

Expect false breaks around FOMC.

Reduce size during Powell’s speech.

Avoid mid-range entries between 4800–5000.

Patience pays more than prediction.

What’s your bias this week: selling the 5155–5234 premium zone, or waiting for a deeper pullback into 4600 liquidity before reassessing?

— Liam

XAUUSD – H1 Outlook: New All-Time HighXAUUSD – H1 Outlook: New ATH, Now Watch the Pullback Structure | Lana ✨

Gold has printed fresh all-time highs and is now trading near the $5,100 psychological area. After six consecutive bullish sessions, the trend is still strong — but at these levels, the market often needs a controlled pullback to rebalance liquidity before the next expansion.

📌 Quick Summary

Trend: Bullish (strong momentum, new ATH)

Timeframe: H1

Focus: Don’t chase highs → wait for pullback into structure

Key idea: Pullback → hold support → continuation toward upper supply

📈 Market Structure & Price Action

Price is moving inside a bullish expansion leg, and the current area is a typical “extended” zone where volatility can increase.

A pullback toward the first clean structural support is healthy and often needed after a steep rally.

As long as price holds above key supports, the bias remains continuation, not reversal.

🔍 Key Zones From the Chart

1) Upper Supply / Profit-taking Area

5100–5130 (approx.)

This is the area where price is likely to face selling pressure / profit-taking, especially after a vertical rally.

2) Primary Support (Pullback Buy Zone)

5000–5020

This is the most important “structure retest” area on the chart — a logical zone for price to rebalance before continuation.

3) Deeper Value Zone (If Pullback Extends)

4750–4800 (Fibo value cluster on chart)

If the market pulls deeper, this becomes the more attractive value zone to watch for stronger reactions.

4) Major Demand Zone (Extreme Support)

4590–4630 (lower purple demand area)

This is a deeper base zone if the market shifts into a larger correction.

🎯 Trading Scenarios (Structure-Based)

✅ Scenario A (Primary): Buy the Pullback Into Structure

Buy Entry: 5005 – 5015

SL: 4995 – 5000 (8–10 points below entry)

TP Targets (scale out):

TP1: 5065 – 5075 (retest of recent high)

TP2: 5100 (psychological milestone)

TP3: 5125 – 5135 (upper supply / extension zone)

TP4: 5150+ (if breakout accepts)

Idea: Let price come back to support, confirm, then ride the trend — no chasing.

✅ Scenario B (Alternative): Deeper Pullback Into Value

If price fails to hold 5000–5020 and dips deeper:

Buy Entry: 4760 – 4790

SL: 4750 – 4755

TP Targets:

TP1: 4900

TP2: 5000

TP3: 5100

TP4: 5125 – 5135

🌍 Macro Context (Short & Relevant)

Gold’s upside momentum is being supported by:

Safe-haven flows amid ongoing geopolitical and trade uncertainty

Expectations of further Fed easing

Continued central bank buying

Strong inflows into ETFs

This backdrop helps explain why pullbacks are more likely to be profit-taking and positioning, not a structural trend change.

✨ Lana’s View

Gold is bullish — but the best trades usually come from patience, not excitement.

At ATH levels, Lana prefers buying pullbacks into structure, scaling out into targets, and letting the market do the work.

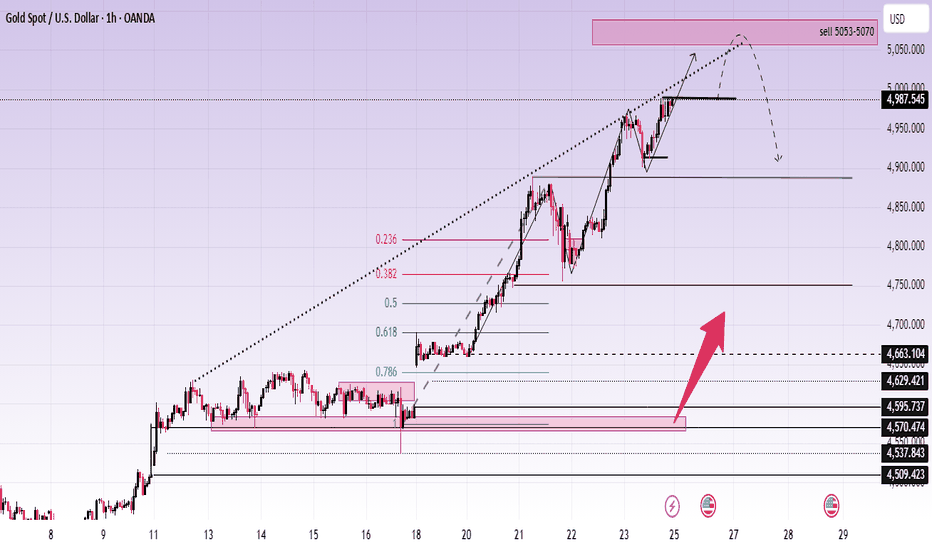

XAUUSD – H1: Strong UptrendXAUUSD – H1 Technical Outlook: Extension Risk Near Highs as Geopolitical Tension Builds | Lana ✨

Gold continues to trade in a strong bullish structure, with price pushing higher along an ascending trendline. However, as the market approaches upper resistance zones, price action suggests the rally may be entering a more sensitive phase, where extension risk and volatility increase.

📈 Market Structure & Price Action

The short-term trend remains bullish, with price respecting the rising trendline.

Recent price action shows strong impulsive buying, followed by shallow pullbacks — a sign of aggressive demand.

However, price is now trading near the upper boundary of the trend channel, where upside continuation often becomes less efficient and more reactive.

The current structure favors continuation, but risk increases as price stretches further from value.

🔍 Key Technical Zones on H1

Immediate resistance / reaction zone: 4987 – 5000

This area represents a short-term ceiling where price may hesitate or form a temporary consolidation.

Sell zone (extension area): 5053 – 5070

A premium zone where upside becomes increasingly extended and profit-taking or corrective reactions are more likely.

Key support & value zones below:

4663 – 4629 (prior acceptance + structural support)

4595 – 4570 (deeper value area aligned with Fibonacci retracement)

These lower zones remain important reference points if price transitions from extension into correction.

🎯 Trading Scenarios

Primary scenario (bullish continuation):

If price consolidates above 4987 and accepts higher, the market may extend into the 5053–5070 zone. Any move into this area should be monitored closely for exhaustion signals rather than late breakout chasing.

Alternative scenario (pullback into structure):

Failure to hold above 4987–5000 could trigger a corrective move back toward 4663–4629, where buyers may look to re-engage at better value.

Lana prefers waiting for reactions at key zones, not chasing price when it is already extended.

🌍 Geopolitical Context (Why Volatility Matters Now)

Recent reports indicate that the USS Abraham Lincoln carrier strike group has entered the Indian Ocean, with expectations of moving toward the Arabian Sea in the coming days. The increased U.S. military presence in the Middle East, amid concerns of potential escalation involving Iran, adds a layer of geopolitical uncertainty.

Historically, such developments tend to:

Increase short-term volatility in gold

Support gold as a hedge, while also triggering sharp profit-taking swings

This backdrop reinforces the importance of risk management and patience, especially when price is trading near premium zones.

🧠 Lana’s Perspective

Gold remains bullish, but not every bullish phase is a good place to buy. As price trades higher into premium and extension zones, Lana focuses on structure, value, and reaction, not emotional momentum.

✨ Respect the trend, manage extension risk, and let price come to your levels.

XAUUSD (H3) – Liam PlanXAUUSD (H3) – Liam Plan

Late-stage expansion | Look for distribution and sell reactions

Quick summary

Gold has rallied aggressively and is now trading in late-stage bullish expansion, sitting near premium pricing after multiple impulsive legs.

On the macro side, political commentary from Europe highlights a structural shift in global power:

Europe’s influence is weakening as US–Russia discussions bypass Brussels.

BRICS and SCO now represent over half of the world’s population.

Calls for renewed EU–Russia energy cooperation underline long-term uncertainty in Europe’s geopolitical positioning.

This backdrop keeps gold structurally supported, but at current levels, risk shifts toward distribution rather than clean continuation.

Macro context (supportive, but asymmetric risk)

The global balance of power continues to shift from West to East, reinforcing long-term demand for hard assets.

However, much of the near-term geopolitical premium is already priced in after the recent vertical move.

Result: upside continuation is possible, but risk/reward now favors reaction sells over fresh buys.

➡️ Conclusion: don’t fight the macro trend, but don’t chase price either.

Technical view (H3 – based on the chart)

Gold remains in a broader uptrend, but price action shows signs of deceleration and potential distribution near the highs.

Key levels from the chart:

✅ Premium sell zone: 5000 – 5050 (upper range / distribution area)

✅ Sell reaction zone: 4920 – 4950 (local highs / rejection area)

✅ Bullish retracement support: 4700 – 4750 (fib + structure)

✅ Major liquidity / deep support: 4350 – 4450

Price is trading far above equilibrium, increasing the probability of rotation back into value or sell-side liquidity.

Trading scenarios (Liam style: trade the level)

1️⃣ SELL scenarios (priority – late-stage reaction)

A. SELL at premium / distribution zone

✅ Sell: 5000 – 5050

Condition: clear rejection / loss of momentum on M15–H1

SL: above the high

TP1: 4920

TP2: 4750

TP3: 4450 (if distribution expands)

Logic: Late-stage rallies often form rounded tops or distribution patterns before rotating lower. This zone favors risk-defined shorts, not breakout buys.

B. SELL lower high / reaction

✅ Sell: 4920 – 4950

Condition: failure to hold highs + bearish shift on lower TF

TP: 4750 → 4450

Logic: This area acts as a reaction zone inside the distribution range — ideal for tactical sells.

2️⃣ BUY scenario (secondary – value only)

BUY only at deep retracement

✅ Buy zone: 4350 – 4450

Condition: liquidity sweep + strong bullish reaction

TP: 4700 → 4920

Logic: This is the first area where long-term buyers regain a clear R:R edge. No interest in buying above value.

Key notes

Late-stage trends punish impatience.

Avoid mid-range entries.

Expect false breakouts near the highs.

Confirmation > conviction.

What’s your bias here:

selling distribution near the highs, or waiting patiently for a deeper pullback into 4700–4450 value?

— Liam

XAUUSD (H4) – Liam Buying StrategyXAUUSD (H4) – Liam Continuation Plan

Trend remains strong, but price is extended | Buy pullbacks, not highs

Quick summary

Gold continues to trade firmly within a strong bullish structure. Macro pressure on safe-haven demand has eased slightly as US–EU geopolitical and trade tensions cool, while rising oil prices (supported by Saudi Aramco’s demand outlook) keep inflation expectations alive.

Despite the bullish trend, price is currently extended near the upper range, so execution today should focus on buying pullbacks at structure, not chasing breakouts.

Macro context (supportive, but less explosive)

Reduced geopolitical friction between the US and Europe has eased panic-driven flows.

Oil prices pushing higher keeps inflation expectations sticky, limiting downside pressure on gold.

USD remains relatively stable (USD/CAD holding firm), suggesting gold strength is structure-driven rather than pure fear trade.

➡️ Conclusion: trend-friendly environment, but volatility is now more technical than headline-driven.

Technical view (H4 – based on the chart)

Gold is respecting a clean ascending trendline, with impulsive legs followed by shallow pullbacks.

Key levels from the chart:

✅ Upper extension / continuation target: 5000+ zone

✅ Bullish continuation buy zone: 4580 – 4620 (previous breakout + fib support)

✅ Trendline support: dynamic (ascending)

✅ Deeper correction support: 4400 – 4450

Price is currently trading above the 1.618 fib expansion, which increases the probability of short-term consolidation or pullback before continuation.

Trading scenarios (Liam style: trade the level)

1️⃣ BUY scenarios (priority – trend continuation)

A. BUY pullback into structure (preferred setup)

✅ Buy zone: 4580 – 4620

Condition: hold above trendline + bullish reaction on M15–H1

SL: below structure / trendline

TP1: recent high

TP2: 4900

TP3: extension toward 5000+

Logic: This zone aligns with prior resistance turned support and fib retracement — a higher-probability continuation entry than buying highs.

B. BUY deeper dip (only if volatility increases)

✅ Buy zone: 4400 – 4450

Condition: strong rejection / liquidity sweep

TP: 4580 → 4800+

Logic: This is the last clean structural support within the current trend. A dip here would likely be corrective, not trend-ending.

2️⃣ SELL scenario (counter-trend, tactical only)

❌ No swing SELL bias while price holds above the ascending trendline. Shorts only make sense as very short-term scalps at highs with clear lower-TF rejection.

Key notes

Strong trends punish impatience — wait for pullbacks.

Avoid entries mid-leg after impulsive candles.

If price accelerates vertically without retrace, stand aside.

What’s your approach: waiting for the 4580–4620 pullback to join the trend, or staying flat until a deeper correction toward 4450?

— Liam

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Liquidity Pullback Within a Strong Bullish Structure | Lana ✨

Gold continues to trade within a well-defined bullish structure on the H2 timeframe. The recent surge was impulsive, followed by a healthy retracement that appears to be rebalancing liquidity rather than signaling a trend reversal.

Price action remains constructive as long as the market respects key structural levels and the ascending trendline.

📈 Market Structure & Trend Context

The overall trend remains bullish, with higher highs and higher lows still intact.

Price continues to respect the ascending trendline, which has acted as reliable dynamic support throughout the uptrend.

The recent pullback occurred after an aggressive upside expansion, fitting the classic sequence:

Impulse → Pullback → Continuation

No clear distribution pattern is visible at this stage. As long as structural support holds, the bias remains BUY on pullbacks, not selling strength.

🔍 Key Technical Zones & Value Areas

Primary Buy POC Zone: 4764 – 4770

This area represents a high-volume node (POC) and aligns closely with the rising trendline.

It is a natural zone where price may rebalance before resuming the bullish trend.

Secondary Value Area (VAL–VAH): 4714 – 4718

A deeper liquidity zone that could act as support if sell pressure temporarily increases.

Near-term resistance: 4843

Acceptance above this level strengthens the continuation scenario.

Psychological reaction zone: 4900

Likely to generate short-term hesitation or profit-taking.

Higher-timeframe expansion targets:

5000 (psychological level)

2.618 Fibonacci extension, where major liquidity may be resting.

🎯 Trading Plan – H2 Structure-Based

✅ Primary Scenario: BUY the Pullback

Buy Entry:

👉 4766 – 4770

Lana prefers to engage only if price pulls back into the POC zone and shows bullish confirmation on H1–H2 (trendline hold, strong rejection of lower prices, or bullish follow-through).

Stop Loss:

👉 4756 – 4758

(Placed ~8–10 points below entry, beneath the POC zone and the ascending trendline)

🎯 Take Profit Targets (Scaled Exits)

TP1: 4843

First resistance zone — partial profit-taking recommended.

TP2: 4900

Psychological level with potential short-term reactions.

TP3: 5000

Major psychological milestone and upside expansion target.

TP4 (extension): 5050 – 5080

Area aligned with the 2.618 Fibonacci extension and higher-timeframe liquidity.

The preferred approach is to scale out gradually and protect the position, adjusting risk as price confirms continuation.

🌍 Macro Context (Brief)

According to Goldman Sachs, central banks in emerging markets are expected to continue diversifying reserves away from traditional assets and into gold.

Average annual central bank gold purchases are projected to reach around 60 tons by 2026, reinforcing structural demand for gold.

This ongoing accumulation supports the idea that pullbacks are more likely driven by positioning and profit-taking, rather than a shift in long-term fundamentals.

🧠 Lana’s View

This remains a pullback within a bullish trend, not a bearish reversal.

The focus stays on buying value at key liquidity zones, not chasing price at highs.

Patience, structure, and disciplined execution remain the edge.

✨ Respect the trend, trade the structure, and let price come to your zone.

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Pullback Builds Value Before the Next Expansion | Lana ✨

Gold continues to trade within a strong bullish structure on the H2 timeframe. The recent rally was clearly impulsive, and the current move looks like a technical pullback to rebalance liquidity, not a trend reversal.

📈 Market Structure & Trend Context

XAUUSD remains bullish, with the higher-high / higher-low structure still intact. Price is also respecting the ascending trendline, which has acted as key dynamic support throughout this uptrend.

The current sequence aligns well with a classic bullish cycle: Impulse → Pullback → Continuation. As long as structural support holds, Lana’s primary bias remains: BUY with the trend, not sell against it.

🔍 Key Technical Zones & Value Areas

Buy POC (Value Zone): 4764 – 4770 This area aligns with a high-volume node (POC/VAH) and the rising trendline, making it a strong value zone for dip-buying opportunities.

Near-term resistance: 4843 A key level that needs to be re-accepted to confirm the next continuation leg.

Psychological reaction zone: 4900 Likely to produce hesitation, profit-taking, or short-term volatility.

Upper expansion targets: 5000 and potentially the 2.618 Fibonacci extension, where higher-timeframe liquidity may be resting.

🎯 Trading Plan (H2 Structure-Based) ✅ Primary Scenario: BUY the Pullback

Buy entry: 👉 4766 – 4770

Lana prefers to engage only if price pulls back into the POC zone and shows bullish confirmation on H1–H2 (trendline hold, clear rebound / rejection of lower prices).

Stop Loss: 👉 4756 – 4758 (Placed ~8–10 points below entry, under the POC zone and below the ascending trendline)

🎯 Take Profit Targets (Scaled Exits)

TP1: 4843 First resistance — scale partial profits and reduce risk.

TP2: 4900 Psychological level — expect possible reactions.

TP3: 5000 Major psychological objective and expansion milestone.

TP4 (extension): 5050 – 5080 Potential 2.618 Fibonacci extension / higher-timeframe liquidity zone.

Lana’s approach is to scale out into targets, then protect the position by managing risk (e.g., moving SL to breakeven once price confirms continuation).

🌍 Macro Context (Brief)

Gold remains supported by its role as a safe-haven and strategic reserve asset amid ongoing geopolitical and financial uncertainty. Recent headlines highlighting the rise in the value of large gold reserves reinforce that institutional demand for gold as a long-term hedge remains active, which supports the medium-term bullish bias.

🧠 Lana’s View

This is a pullback within an uptrend, not a bearish reversal. Lana focuses on buying value, not chasing highs. Stay patient, trade the structure, and let price come into your zone.

✨ Respect the trend, stay disciplined, and let the market come to your levels.

Gold Rotating After CHoCH – Liquidity Controls the FlowGold is currently trading in a post-impulse, post-breakout environment.

After the earlier expansion and BOS, price did not continue trending cleanly.

Instead, it transitioned into sideways consolidation, signaling Smart Money rebalancing rather than continuation.

This is not indecision — this is liquidity management.

Market Structure & Liquidity Context

• Higher-timeframe structure shows a breakout followed by hesitation, a classic sign of distribution and absorption.

• Price spent time ranging, engineering liquidity on both sides before expansion.

• A clear CHoCH formed after the sell-off, confirming the shift from expansion into controlled rotation.

• The 4610–4608 zone aligns with prior structure and demand, where Smart Money defended price aggressively.

• From this discount reaction, price expanded strongly, targeting upper liquidity.

This confirms that rotation → expansion was liquidity-driven, not emotional buying.

Key Trading Scenarios

🟢 Buy Reaction at Discount (Already Played)

The 4610–4608 demand zone acted as a protected discount area.

Strong rejection here confirmed Smart Money defense and initiated upside expansion.

🔴 Sell Reaction at Premium (Next Focus)

If price revisits 4742–4744, this premium zone aligns with:

• Prior expansion highs

• Buy-side liquidity resting above range

• Potential distribution area

Weak acceGold is currently trading in a post-impulse, post-breakout environment.

After the earlier expansion and BOS, price did not continue trending cleanly.

Instead, it transitioned into sideways consolidation, signaling Smart Money rebalancing rather than continuation.

This is not indecision — this is liquidity management.

Market Structure & Liquidity Context

• Higher-timeframe structure shows a breakout followed by hesitation, a classic sign of distribution and absorption.

• Price spent time ranging, engineering liquidity on both sides before expansion.

• A clear CHoCH formed after the sell-off, confirming the shift from expansion into controlled rotation.

• The 4610–4608 zone aligns with prior structure and demand, where Smart Money defended price aggressively.

• From this discount reaction, price expanded strongly, targeting upper liquidity.

This confirms that rotation → expansion was liquidity-driven, not emotional buying.

Key Trading Scenarios

🟢 Buy Reaction at Discount (Already Played)

The 4610–4608 demand zone acted as a protected discount area.

Strong rejection here confirmed Smart Money defense and initiated upside expansion.

🔴 Sell Reaction at Premium (Next Focus)

If price revisits 4742–4744, this premium zone aligns with:

• Prior expansion highs

• Buy-side liquidity resting above range

• Potential distribution area

Weak acceptance or rejection here would signal that buy-side liquidity has been delivered, opening room for rotation or consolidation.

Expectation & Bias

This is not a chase market.

• Expansion only follows liquidity delivery

• Continuation requires acceptance above premium

• Failure to accept favors rotation back toward equilibrium

Until then:

Liquidity > Indicators

Reaction > Prediction

Structure > Emotion

Let price confirm intent — Smart Money always shows its hand first.

💬 Do you expect acceptance above premium, or another rotation back to discount?ptance or rejection here would signal that buy-side liquidity has been delivered, opening room for rotation or consolidation.

Expectation & Bias

This is not a chase market.

• Expansion only follows liquidity delivery

• Continuation requires acceptance above premium

• Failure to accept favors rotation back toward equilibrium

Until then:

Liquidity > Indicators

Reaction > Prediction

Structure > Emotion

Let price confirm intent — Smart Money always shows its hand first.

💬 Do you expect acceptance above premium, or another rotation back to discount?