SRF LTD: Price Compression at Key Resistance|Clean Breakout Play📌 Structure: Daily Timeframe

SRF has been consolidating inside a clean descending channel, printing lower highs while demand holds near the channel base.

Price is now pressing against well-tested channel resistance — a clear decision zone.

🔴 Key Reads

Descending resistance respected multiple times

Tight price compression near supply → volatility contraction

Buying interest visible near demand

Muted volume during consolidation → pre-expansion behaviour

This is structure-led, not momentum-driven.

🟢 Breakout Rules (Strict)

Trade triggers only if:

Strong green Marubozu / near-Marubozu

Daily close above descending resistance

Clear volume expansion

No close above resistance = no trade.

🎯 Trade Plan

Entry: Breakout close

SL: Low of breakout candle

Target 1: ₹3300, then trail

Management: Trail via higher lows / structure

Defined risk. Reward from range expansion, not prediction.

🧠 Why It Works

- Long consolidation builds energy

- Repeated rejections weaken supply

- Channel breakouts often expand fast

Clean price + volume = institutional participation

⚠️ Invalidation

Weak breakout

Low volume

Rejection wick with close back inside channel

→ No trade

📊 Final Word

SRF is coiled, not weak.

Patience first. Execution only on confirmation.

➡️ Let price prove strength. 👍 Appreciate if this helps.

⚠️ Disclaimer

This is a technical study for educational purposes only, based purely on price action and volume.

Not financial advice. Please manage risk as per your own trading plan.

🔔 Follow

If you like clean, no-indicator, price–volume based setups,👉 Follow for more structure-led trade ideas and chart studies.

💬 Your Turn

Have a stock you want analysed using pure price action & volume?

Drop the name in the comments — I’ll pick a few and share clean charts.

SRF

SRF on the Edge of a Sharp BreakoutSRF seems to have finished its ABC correction near the 2770–2800 support zone, and the price has bounced back above 2859 , which now acts as a short-term trigger. If the stock stays above this level, it can move toward 3000 first, then 3160 , and possibly 3200 . The chart shows buyers gradually taking control again after the correction, but the outlook stays positive only as long as price holds above the support region.

Stay Tuned!

@Money_Dictators

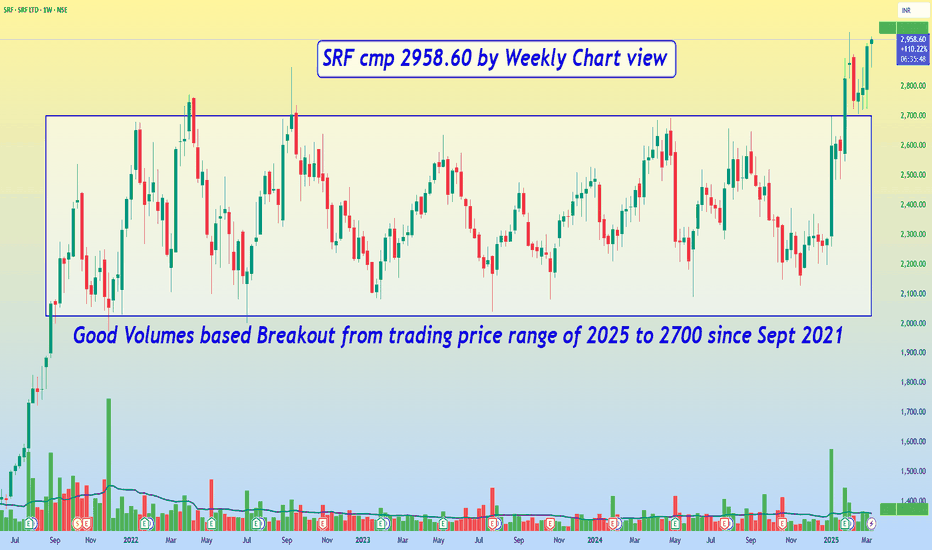

SRF LTD - Weekly

Pattern: The chart shows a very long period of Box Consolidation or a Rectangular Range. The price has been trading within a broad range roughly between 2,060 and 2,700 from late 2021/early 2022 until early 2025.

Breakout: In early 2025, the stock has decisively broken out above the upper boundary of this multi-year consolidation range (around 2,700).

Volume: There's a significant increase in volume accompanying the breakout, which is a strong bullish confirmation.

Target: The height of the consolidation box (approximately 658.50 points) is projected upwards from the breakout point. This suggests a target of around 3,358.60.

Support: The upper boundary of the consolidation range (around 2,700) is now a very strong support level.

Resistance: The immediate resistance is the recent high around 3,060.35. The primary target is 3,358.60.

Interpretation: The breakout from a multi-year consolidation on a weekly chart is a very significant bullish development. This suggests the beginning of a new, potentially strong uptrend. The stock is likely to head towards its target of 3,358.60, with the 2,700 level acting as a robust base.

SRF Stock Analysis📊 SRF Sentiment Analysis: Key Levels & Market Outlook

Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Market conditions are subject to change, and participants should conduct their own research before making any decisions.

🏦 Market Overview

SRF opened at 2,860.9 and traded within a range, hitting a high of 2,945.1 and a low of 2,847.1, before closing at 2,935.35, marking a significant gain from its previous close of 2,851.6. The stock exhibited strong upward momentum throughout the session, approaching key resistance levels. As it nears these levels, the upcoming sessions will be crucial in determining whether it sustains the positive momentum or faces resistance-driven consolidation.

📈 Technical Outlook – Key Levels to Watch

SRF is approaching its immediate resistance at 2,971 🚧, where some supply pressure might be observed. A breakout above this level could lead to further strength, with the next resistance at 3,007 📈, which serves as a crucial breakout zone. If the stock sustains above this level, it may accelerate towards 3,069 🚀, indicating a strong upward trend.

On the downside, 2,873 ✅ acts as immediate support, where buying interest has been observed previously. If this level fails to hold, the next critical support is at 2,811 ⚠️, a zone that could determine further price movement. A breach below 2,775 🚨 may lead to increased downside pressure, potentially shifting sentiment toward bearish territory.

📌 Moving Averages & Trend Analysis

SRF is currently trading well above its key moving averages, reinforcing a strong bullish trend. The 50 EMA at 2,691.24, 100 EMA at 2,574.9, and 200 EMA at 2,493.1 are all positioned significantly below the current market price, signaling continued strength in the stock.

💡 With SRF maintaining levels above these critical EMAs, the uptrend remains intact. As long as the price holds above these averages, bullish sentiment is likely to persist. However, traders should monitor resistance levels for signs of potential reversals or consolidation. ⚠️🔍

📊 Market Sentiment Overview

SRF has shown strong bullish momentum, closing significantly higher than the previous session. The stock is trading well above key moving averages (50, 100, and 200 EMA), reinforcing positive sentiment. Additionally, it is approaching R1 (2,971), which could act as a crucial breakout level. If SRF sustains above this resistance, further upside potential may be unlocked. However, traders should remain cautious as R1 (2,971) may act as a supply zone, leading to some temporary selling pressure. If the stock fails to hold above S1 (2,873), it could indicate short-term weakness and trigger a retracement toward lower support levels. ❌⚠️

📈 Overall Sentiment: Bullish with Caution ⚠️ While the trend remains positive, traders should closely watch resistance and support levels for confirmation of further movement. 🚀

🎯 Market Observation

SRF is approaching a key resistance level at 2,971 🔼, and if it crosses this mark, we could see further movement toward 3,007 - 3,069 📈. A sustained breakout above 3,069 may indicate stronger bullish momentum 🚀. On the downside, if SRF drops below 2,873 ⚠️, it could test the 2,811 - 2,775 levels. A sustained move below 2,775 might trigger increased selling pressure 📉, leading to potential weakness.

📌 Note: This analysis is based on historical price movements and should not be considered a buy or sell recommendation. Always exercise caution and risk management when making trading decisions.

📢 Conclusion

📌 SRF remains above key moving averages, indicating strong bullish sentiment. However, resistance levels should be closely watched for further movement confirmation. Market participants should remain cautious and manage risk effectively in case of volatility.

🚀 Stay informed and trade responsibly!

SRF cmp 2958.60 by Weekly Chart viewSRF cmp 2958.60 by Weekly Chart view

- Good Volumes based Breakout from trading price range of 2025 to 2700 since Sept 2021

- Stock is on verge to create New Lifetime High Milestone beyond ATH 2983.90 of 05-Feb-2025

- Bullish Rounding bottom has been formed with the neckline at current ATH 2983.90 price level

SFF - All time High Breakout - LongTrend Analysis

The stock has broken out of a long consolidation range, moving above a key resistance level. It is trading above the 50-week and 200-week moving averages, confirming a strong uptrend. Recent bullish candles suggest buying momentum.

Volume Analysis

A notable increase in volume accompanies the breakout, indicating strong institutional participation. Higher volume on breakout weeks confirms the validity of the breakout.

Structure Analysis

The stock has successfully broken past previous resistance around ₹2750-2800. It is now in a price discovery mode, with potential for further upside if it sustains above this level. Support is likely to form near the breakout level of ₹2750-2800, which can act as a retest zone.

RSI (Relative Strength Index): RSI is at 70.52, which indicates the stock is in bullish momentum but approaching overbought territory. Sustaining above 60-65 levels is generally positive for an uptrend.

MACD (Moving Average Convergence Divergence): MACD line is above the signal line, indicating a bullish crossover. Increasing histogram bars suggest strengthening momentum.

Trade Plan: Entry, Exit & Stop Loss

Entry Points: Aggressive Entry: At the current market price (₹2935) with a tight stop loss.

Conservative Entry: On a pullback to the breakout level (₹2750-2800) if it retests.

Stop Loss (SL): For Aggressive Entry: ₹2750 (below breakout zone).

For Conservative Entry: ₹2600 (below moving average support).

Target Levels (Exit)

First Target (Short-Term): ₹3200

Second Target (Mid-Term): ₹3500

Long-Term Potential: ₹4000+ if momentum sustains.

Conclusion: The stock is in a strong uptrend with a successful breakout and volume confirmation. RSI is suggesting a possible short-term pullback before further upside.

MACD supports bullish momentum.

A buy-on-dips strategy near ₹2750-2800 with SL at ₹2600 can provide a better risk-reward ratio.

This analysis is for educational and informational purposes only and should not be considered financial or investment advice. Always conduct your own research and consult with a professional financial advisor before making any trading or investment decisions. Stock market investments are subject to risks, including loss of capital. Past performance is not indicative of future results. The author is not responsible for any financial losses incurred based on this analysis.

SRF - BREAKOUT TRADE OPPORTUNITYSymbol - SRF

CMP - 2750

SRF Limited, a diversified global player, operates in segments like chemicals, textiles, packaging films, and fluorochemicals. The company is a leader in its respective industries, offering products across industries ranging from automotive to pharmaceuticals. With a strong presence in both domestic and international markets, SRF has built a reputation for delivering innovation and sustainable solutions.

SRF stock has recently broken out of a significant resistance zone that had held for the last 3.5 years, signaling a potential shift in its price action. This breakout is a critical technical event, as it suggests that the stock may now enter a new phase of upward momentum, having overcome a major hurdle. Currently, the stock is in the process of retesting this breakout zone, which is a natural price action behavior that presents an attractive entry point for long positions. The stock is now trading at around 2750, providing a solid opportunity for investors who are looking for a favorable risk to reward setup.

Looking at the broader technical picture, the target for this breakout is 3500, which aligns with past resistance levels and technical projections. Given the strength of the breakout and the current retest of the breakout zone, this suggests that the stock could head toward the target level over the medium term. The stop loss for this trade can be placed at 2500, which provides a reasonable cushion in case the price action reverses.

From a fundamental perspective, SRF's consistent performance across its diverse business segments, strong market positioning, and impressive growth outlook support the case for a potential long-term bullish trend. The company’s fundamentals, coupled with this technical breakout, provide a solid base for investors to initiate long positions at these levels.

In conclusion, SRF’s recent price action and technical breakout suggest a promising opportunity for medium to long term investors. The stock offers a favorable risk to reward ratio at its current price level, and the target of 3500 looks achievable over the medium term. The downside risk appears manageable, with the stop loss placed at 2500

Disclaimer - Do not consider this as a buy/sell recommendation. I'm sharing my analysis & my trading position. You can track it for educational purposes. Thanks!

SRF LTD - Long Range Breakout ?Simple Chart - Long Consolidation ( Flag Pattern ). Targets could be higher as well but taking it one by one due to overall market volatility.

Fundamentally :

The company has declared Negative results for the last 7 consecutive quarters

PAT(9M) At Rs 724.72 cr has Grown at -20.67 %

INTEREST(9M) At Rs 286.57 cr has Grown at 21.09 %

ROCE(HY) Lowest at 10.25

However looking at the chart, something has changed fundamentally which is why there is demand coming in from big players.

Specialty Chemical Outlook:-

Anticipate good Agro Demand in Q4 with significant improvement over Q3

Fluorochem Outlook:-

Q4 to perform significantly better ; Supported by higher HFC Volumes.

Packaging Film Outlook:-

Demand -Supply imbalance to continue but will soften.

SRF cmp 2680.50 by Weekly Chart viewSRF cmp 2680.50 by Weekly Chart view

- Volumes seen as stable and steady in sync with avg traded quantity

- Technically Stock Chart has made multiple Bullish Rounding Bottoms that are within the trading price range

- Stock is trading within Price Range 2080 to 2735 since September 2021 and waiting for good breakout

SRF Chart Signals Big Breakout OpportunityThe chart shows a weekly timeframe analysis of SRF Ltd (NSE) with a focus on a potential breakout. Here’s a breakdown of the analysis:

Pattern Identification

1. Symmetrical Triangle Pattern:

• The chart highlights a symmetrical triangle, where the price has been consolidating within converging trendlines.

• This pattern generally indicates a continuation or reversal, depending on the breakout direction.

2. Fair Value Gap (FVG):

• There is a Fair Value Gap (FVG) marked, which represents an imbalance in price action. It could act as a liquidity zone for price retracement.

3. Order Block (OB):

• An order block is highlighted, which is a strong demand zone. This suggests that buyers could step in, pushing prices higher.

Future Outlook

1. Bullish Breakout Expected:

• The arrows and target zones indicate that a bullish breakout from the triangle is anticipated.

• The projected upside move is around 665 points (25%-30%), aiming for targets near ₹3,300-₹3,400.

2. Potential Retest:

• A retest of the breakout level or a pullback into the order block (around ₹2,400-₹2,500) could occur before continuing upward momentum.

3. Secondary Triangle:

• Another smaller triangle formation is shown for the medium-term outlook, suggesting a consolidation phase before further movement.

Key Levels

• Support Zones: ₹2,357 (stop-loss region) and ₹2,486 (demand zone).

• Immediate Resistance: ₹2,606 (current breakout level).

• Target Zones: ₹2,791 and ₹3,300+ in the medium to long term.

This chart suggests a positive outlook for SRF Ltd, with a focus on confirming a breakout and maintaining the marked support levels.

DISCLAIMER- PLEASE DO YOUR OWN RESEARCH BEFORE INVESTING . THIS IS FOR EDUCATIONAL PURPOSES ONLY

Specialty Chemicals Sees Sharp Rise on Refrigerant Price Hike◉ Key Takeaways

● The phasing down of HFCs in the U.S. is driving significant changes in the refrigerant market.

● Indian specialty chemicals companies, particularly those involved in refrigerant production, are poised to benefit from this market shift.

● The demand-supply imbalance in the refrigerant gas segment is expected to persist, creating favourable conditions for industry growth.

◉ Introduction

On January 9, 2025, the Indian specialty chemicals sector witnessed a significant surge, driven by a sharp increase in refrigerant gas prices. This surge was primarily attributed to the phasing down of hydrofluorocarbons (HFCs) in the United States, as mandated by the U.S. Environmental Protection Agency (EPA).

◉ Market Dynamics

● Phasing down HFCs: The EPA aims to reduce hydrofluorocarbon (HFC) emissions by 85% over the next 15 years. This will impact the production and pricing of refrigerants.

● Refrigerant price increases: As HFC production declines, prices for existing refrigerants like R-410A and R-22 may rise. This could lead to higher costs for consumers and businesses.

● New refrigerant alternatives: The industry is shifting towards alternative refrigerants with lower global warming potential (GWP), such as R-32, R-454B, and R-1234yf. These alternatives may become more widely adopted and affordable.

◉ Impact on Indian Companies

The surge in refrigerant gas prices significantly benefited leading Indian players:

● SRF NSE:SRF and Navin Fluorine NSE:NAVINFLUOR : These companies were prominent beneficiaries, witnessing a remarkable 14% increase in their stock prices.

● Financial Gains: Analysts estimate that every $1/kg increase in R32 prices could boost SRF's EBITDA by ₹260 crore and Navin Fluorine's by ₹77 crore.

● Capacity Expansion: With SRF's production capacity for R32 at approximately 29,000 to 30,000 tons and plans for Navin Fluorine to double its capacity from 4,500 tons to 9,000 tons by February 2025, both companies are well-positioned to capitalize on this market shift.

◉ Wider Market Impact

The price hike triggered a broader rally in the specialty chemicals sector, with companies like Balaji Amines NSE:BALAMINES and Alkyl Amines NSE:ALKYLAMINE also witnessing stock price increases.

◉ Future Outlook

As the U.S. transitions to more environmentally friendly refrigerants, the dynamics of supply and pricing for these alternatives are likely to continue evolving. This evolving landscape presents significant opportunities for Indian specialty chemicals companies that are well-positioned to capitalize on the growing demand for these new-generation refrigerants.

SRF - Still Consolidating - AVOID!Price Analysis & Overview:

1. Trading within a zone.

2. PA is choppy

3. Consolidation is continuing.

4. No bullish confirmation.

5. Earnings are very poor.

6. STRCITLY AVOIDING THIS STOCK!

- Stay tuned for further insights, updates and trade safely!

- If you liked the analysis, don't forget to leave a comment and boost the post. Happy trading!

Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learning purposes only. Please, do your due diligence before investing.

Thanks & Regards,

Anubrata Ray

#srf - multiple lower high formation since Apr-22 on weekly TF#srf - multiple lower high formation since Apr-22 on weekly TF.

Looking at market conditions - support seems to be broken and target of 1480 is open.

In case, any LH is broker then we can new Life high.

PS : Only for learning purposes. Pls observe.

SRF - Low Risk SetupThe stock has taken support at the shown trendline third time in the last year. If bounces back again, it can be a good opportunity with a good risk-reward setup.

If goes bullish, humble targets may be 2350/2470. Sustaining below 2130 will weaken the strength.

Only for learning and sharing purposes, not a bit of trading advice in any form.

All the best.