Institution Trading Strategies part 5Institutional traders incorporate strategies that emphasize both long-term value and diversification in their trading practices. They leverage significant amounts of capital to build portfolios diversified across multiple assets, which helps reduce risk while seeking improved market prices.

Technical

Institutional Trading part 4Institutional trading involves buying and selling securities by organizations on behalf of other investors, typically in large volumes. These traders, often working for entities like mutual funds, pension funds, and hedge funds, manage significant capital and can influence market prices. Institutional trading differs from retail trading, which involves individual investors making smaller trades for their own accounts.

Database Trading"Database trading" refers to using structured databases, often containing financial market data, to make trading decisions. This involves analyzing historical data, identifying patterns, and potentially automating trading strategies based on those findings. It can also encompass the idea of trading access to data itself on a platform similar to a stock exchange.

Advanced RSI "Advanced RSI" typically refers to strategies or techniques that go beyond the basic interpretation of the Relative Strength Index (RSI) indicator in trading. It involves using the RSI in more sophisticated ways, such as combining it with other indicators, exploring different RSI settings, and identifying advanced trading patterns.

STEEL AUTHORITY OF INDIASTEEL AUTHORITY OF INDIA

Sail long.....

SAIL Technical Breakout Setup

Current Price: *125.74 (+2.66%)

Date: May 23, 2025

Key Technical Levels

Entry Zone: Above yellow support zone (*125-130 range) Stop Loss: Red line at *96.33

Target 1: Green dotted line at *173.76 (+38% upside) Target 2: Green dotted line at *259.10 (+106% upside)

Technical Analysis

Pattern Recognition:

SAIL is forming a long-term triangular consolidation pattern

Stock is approaching the apex of a multi-year triangle

Blue diagonal trendline acts as major resistance since 2008 highs

Yellow horizontal zone provides strong support

Current Market Structure:

Price is holding above the critical yellow support zone

Recent bounce shows buying interest at these levels

Volume appears to be picking up on the recent move

Probability Assessment

Target 1 (*173.76) Probability: Moderate to High

This level represents the previous resistance zone

If breakout sustains above ₹130, this becomes achievable

Risk-reward ratio: Approximately 1:1.6

Target 2 (*259.10) Probability: Lower

This is an ambitious target requiring significant momentum

Would need broader market support and sector rotation

Risk-reward ratio: Approximately 1:5.5

Trading Strategy

For Aggressive Traders:

Enter on sustained close above *130

Partial booking at Target 1

Trail stop loss for Target 2

For Conservative Traders:

Wait for weekly close above *135

Smaller position size given the risk

Risk Management:

Strict stop loss at *96.33 (23% downside risk)

Position sizing should reflect the volatility

Important Notes:

Steel sector performance depends on infrastructure spending

Global commodity prices impact fundamentals

This is a technical setup - fundamental analysis required separately

This analysis is for educational purposes. Trade at your own risk.

SHARDA CROPCHEM LTD.SHARDA CROPCHEM LTD.

#SHARDACROP

Asset: Sharda Cropchem Ltd (SHARDACROP)

Breakout Level: 657

Potential Target: 760

Stop Loss: 622

Timeframe: Short to Medium term

Risk to Reward ratio: 1:2.7

Rationale:

Fundamentals-

Fundamentally decent stock with the following attributes:

* ROCE - 19.3%

* ROE - 12.8%

* Debt to Equity - 0

* Stock PE 19.3 / Industry PE - 29.5 || Stock PBV 2.35 / Industry PBV 2.5- Company is underpriced

* EPS / Revenue - Increasing over last 6 months

Technicals -

* Overall structure - Forming a large cup on weekly charts

* Multiple timeframe analysis - Stock poised for up move as the daily/weekly/ monthly charts are showing formation of a cup (over 5 months)

* On daily charts, the price surged ~3.3% yesterday and surfing the 200 DMA

* The 10 DMA is above the 20 DMA and hints towards continued up move

* Increasing momentum / RS

* ADR 5.5%

Market analysis

* Forecasted for ~33% further increase

* Promoter holding high at 74.82% and remains steady

* Fils increasing holding

*MFs and Dils are increasing stake

* Retail reducing

Cons

* Considering that the price has gapped up, there could be some pull back but overall structure of the 200 DMA line remains up

This analysis is for educational purposes only and should not be considered as financial advice. Trading and investing in financial markets involve significant risk, and past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any trading or investment decisions. The author is not responsible for any financial losses or damages that may result from the use of this information.

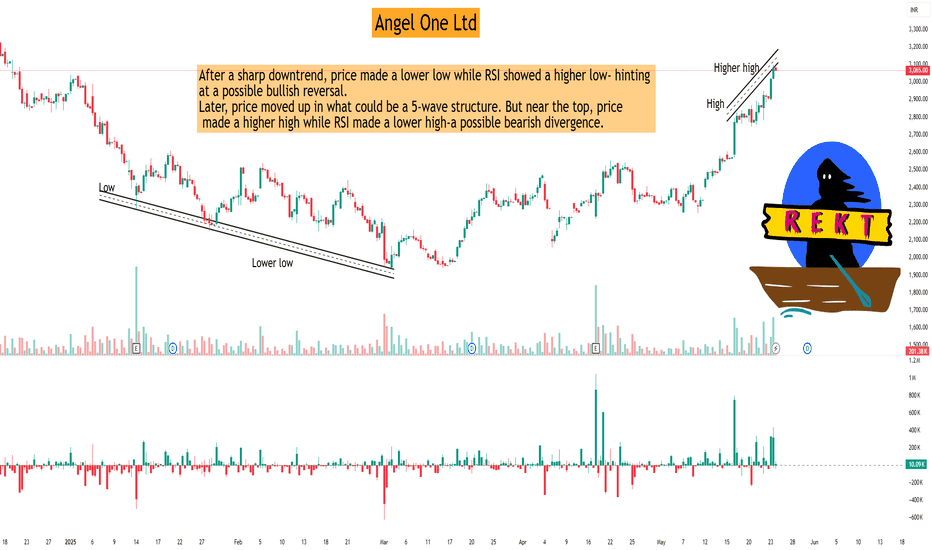

ANGEL ONE LTDANGEL ONE LTD

Finding Market Clues with Simple Tools

This is not a trade I took - just an observation I found fascinating and wanted to share.

In ANGEL ONE's recent price action, I applied a simple 3-step process:

Identify a turning point

Spot a potential 5-wave Elliott Wave structure

Look for RSI divergence at key highs/lows

After a sharp downtrend, price made a lower low while RSI showed a higher low- hinting at a possible bullish reversal.

Later, price moved up in what could be a 5-wave structure. But near the top, price made a higher high while RSI made a lower high-a possible bearish divergence.

I didn't trade this setup - but it's fascinating how often these simple techniques reveal potential market shifts. It's not about being right every time, but about learning to read the market structure better.

Books like Elliott Waves Made Simple by Steve Sinclair have helped me more than any social media post. They teach you to think with structure, not noise.

This isn't a buy/sell recommendation. Just sharing something I'm practicing. Mistakes will happen, but that's part of the learning curve. The market is always there - it's on us to keep improving our technical reading.

MARUTI SUZUKI INDIA LTD.MARUTI SUZUKI INDIA LTD.

How to Trade Maruti Suzuki Using Supply Zones

NSE: MARUTI | Date: May 22, 2025

Maruti Suzuki has formed two key supply zones - price areas where sellers are likely to step in and push the stock lower. Understanding these zones helps you identify potential entry and exit points for your trades.

Supply Zone 1: 13,086 -12,912 & Supply Zone 2: 12,808 - 12,594

Bearish Scenario:

Maruti is currently trading near 12,445, below both identified supply zones. Recent price action shows a strong bearish candle accompanied by above- average volume, indicating active selling pressure around these resistance levels. If the price continues to remain below 12,800, selling pressure may persist. Traders could consider cautious short-selling strategies either at current levels or wait for the price to move back into the supply zones for confirmation before initiating short positions. It is important to follow proper risk management practices, including placing stop-loss orders above the supply zones, to manage potential downside risks.

Bullish Scenario:

A sustained breakout above 13,100 with strong volume confirmation would indicate that buying interest has surpassed selling pressure within the supply zones. Such a breakout may invalidate the resistance levels and signal renewed upward momentum in the stock, presenting potential opportunities for long positions. Traders may consider initiating or increasing long positions once the breakout is confirmed through price action and volume. It is important to use appropriate risk management measures, such as placing stop-loss orders below the breakout level.

For Learners:

Think of supply zones like traffic jams for bulls - when the price enters these zones, you can expect potential slowdowns or reversals unless there's strong momentum to push through. Always combine supply zone analysis with other confirmations like volume, candlestick patterns, and broader market context.

▲ Risk Management Tip: Always trade with a clearly defined stop loss. Avoid entering positions impulsively. It is advisable to start with a smaller quantity and increase your exposure only if the price action confirms the continuation of the trend. Capital protection should always be the priority.

Disclaimer

This content is created purely for educational and informational purposes. It is not intended as investment advice, stock recommendations, or trading tips. Trading and investing in the stock market involves risk. Please consult with a SEBI- registered financial advisor before making any investment decisions. The author/creator is not registered with SEBI and shall not be held responsible for any losses incurred based on this information. Always do your own research and use proper risk management.

If you found this analysis helpful, don't forget to Follow, so you never miss out on a trade-worthy setup, breakout opportunity, or valuable educational insight again. Stay updated and trade smarter!?

Tech Mahindra LimitedTech Mahindra Limited is a leading Indian multinational information technology (IT) services and consulting company, part of the Mahindra Group. Headquartered in Pune, Maharashtra, with its registered office in Mumbai, the company operates globally, offering a wide range of services across various industries.

🏢 Company Overview

Founded: October 24, 1986, as Mahindra British Telecom, a joint venture between Mahindra & Mahindra and British Telecommunications.

Headquarters: Pune, Maharashtra, India.

Global Presence: Operations in over 90 countries, serving more than 1,100 clients worldwide.

Employees: Approximately 148,731 as of March 2025.

Leadership:

Chairman: Anand Mahindra.

Managing Director & CEO: Mohit Joshi (appointed in December 2023).

Stock Listings: Listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) of India; part of the NIFTY 50 index.

💼 Business Segments

Tech Mahindra offers a comprehensive suite of services, including:

Digital Transformation & Consulting: Helping businesses modernize and innovate their operations.

Enterprise Applications: Implementing and managing enterprise software solutions.

Engineering Services: Providing design and development services across industries.

Network Services: Offering network design, implementation, and management.

Customer Experience & Design Services: Enhancing user experiences through design thinking.

AI & Analytics: Leveraging artificial intelligence and data analytics for business insights.

Cloud & Infrastructure Services: Delivering cloud computing solutions and IT infrastructure management.

Business Process Services (BPS): Outsourcing business processes to improve efficiency.

The company serves various industries, including telecommunications, banking, financial services, insurance (BFSI), healthcare, manufacturing, and retail.

Reuters

📈 Financial Highlights

Revenue: As of the fiscal year ending March 31, 2025, Tech Mahindra reported consolidated revenues (specific figures not provided in the available sources).

Net Income: In Q4 FY2025, the company reported a consolidated profit after tax (PAT) of ₹1,166.7 crore, marking a 76.5% year-on-year increase.

Strategic Focus: Under CEO Mohit Joshi, Tech Mahindra aims to increase its revenue share from the BFSI sector from the current 16% to 25% by March 2027.

🧩 Key Developments

Merger with Mahindra Satyam: In 2013, Tech Mahindra merged with Mahindra Satyam (formerly Satyam Computer Services), enhancing its capabilities and market position.

Acquisitions: The company has made several strategic acquisitions to bolster its service offerings, including the acquisition of Pininfarina (automotive and industrial design), SOFGEN Holdings (financial services IT), and The HCI Group (healthcare IT consulting).

Leadership Transition: In December 2023, Mohit Joshi, formerly with Infosys, took over as CEO and MD, succeeding C. P. Gurnani.

🌐 Global Presence

Tech Mahindra operates in over 90 countries, with a significant presence in North America, Europe, Asia-Pacific, and the Middle East. The company serves a diverse clientele, including Fortune 500 companies, across various sectors.

BAJAJ FINANCE LTDAs of the market close on May 23, 2025, Bajaj Finance Ltd. (NSE: BAJFINANCE) was trading at ₹9,243.50. Based on recent technical analyses, here are the key daily support and resistance levels:

📊 Daily Support and Resistance Levels

Classic Pivot Points:

Support Levels:

S1: ₹9,140.83

S2: ₹9,038.17

S3: ₹8,965.33

Resistance Levels:

R1: ₹9,316.33

R2: ₹9,389.17

R3: ₹9,491.83

Pivot Point: ₹9,213.67

Fibonacci Pivot Points:

Support Levels:

S1: ₹9,146.63

S2: ₹9,105.21

S3: ₹9,038.17

Resistance Levels:

R1: ₹9,280.71

R2: ₹9,322.13

R3: ₹9,389.17

Pivot Point: ₹9,213.67

Camarilla Pivot Points:

Support Levels:

S1: ₹9,227.41

S2: ₹9,211.33

S3: ₹9,195.24

Resistance Levels:

R1: ₹9,259.59

R2: ₹9,275.67

R3: ₹9,291.76

Pivot Point: ₹9,213.67

📈 Technical Indicators Overview

Moving Averages:

20-day EMA: ₹9,046.05

50-day EMA: ₹8,838.25

100-day EMA: ₹8,444.91

200-day EMA: ₹7,961.51

Current Price: ₹9,243.50

Interpretation: The current price is above all major moving averages, indicating a bullish trend.

Technical Summary:

Overall Rating: Strong Buy

Moving Averages: Buy

Technical Indicators: Strong Buy

🔍 Key Observations

The stock is trading above its pivot point and all major moving averages, suggesting bullish

Immediate resistance is observed around ₹9,316.33 (Classic R1), with further resistance at ₹9,389.17 (Classic R2).

Immediate support lies at ₹9,140.83 (Classic S1), with stronger support at ₹9,038.17 (Classic S2).

Please note that these levels are based on historical data and technical analysis, and actual market conditions may vary. It's advisable to use these levels in conjunction with other indicators and market news when making trading decisions.

Learn Institutional Level Trading part 6Institutional trading involves the buying and selling of financial instruments for large organizations and entities, like mutual funds, pension funds, and insurance companies, on behalf of their clients or members. These entities trade large volumes, potentially influencing market prices and liquidity.

Learn Institutional Level Trading part 3Trading institutions operate through entities which combine multiple investment funds from investors to invest in financial markets. These firms operate differently from people who maintain brokerage accounts since they oversee massive asset portfolios while their market-shaping trading volume defines their operations.

PCR Trading Strategy part 2Typically, a put-call ratio is a derivative indicator. It is designed to enable traders to determine the sentiment of the options market effectively. This ratio is computed either by factoring in the open interest for a given period or based on the volume of options trading

PCR Trading Strategy part 1The Put-Call Ratio (PCR) is a technical indicator used by traders to gauge market sentiment and identify potential trend reversals. It's calculated by dividing the total open interest of put options by the total open interest of call options. A high PCR (above 1) suggests bearish sentiment, while a low PCR (below 1) indicates bullish sentiment. Traders often use PCR as a contrarian indicator, meaning they might look to buy when the PCR is high, anticipating a reversal, or sell when it's low, expecting a downturn.

Option and Database TradingIn financial terms, "option trading" and "database trading" refer to distinct activities. Option trading involves buying and selling contracts that grant the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain timeframe. Database trading, on the other hand, is not a standard financial term. It likely refers to trading or managing data within databases, which could include activities like data analysis, querying, or manipulation.

RSI and RSI Divergence RSI: Divergence appears when the RSI's highs or lows diverge from price. For example, if the price makes new lows but the RSI bottoms at higher levels, it signals bullish divergence; if the price makes new highs but the RSI peaks at lower levels, it signals bearish divergence.

SENSEX INDEX As of the close on May 22, 2025, the BSE Sensex stood at 80,951.99, marking a decline of 0.79% from the previous session.

📊 Daily Support and Resistance Levels

Based on technical analysis, the following support and resistance levels have been identified for the BSE Sensex:

Classic Pivot Points:

Pivot Point: ₹80,921.72

Resistance Levels:

R1: ₹81,353.51

R2: ₹81,755.04

R3: ₹82,186.83

Support Levels:

S1: ₹80,520.19

S2: ₹80,088.40

S3: ₹79,686.87

Fibonacci Pivot Points:

Resistance Levels:

R1: ₹81,240.04

R2: ₹81,436.71

R3: ₹81,755.04

Support Levels:

S1: ₹80,603.39

S2: ₹80,406.72

S3: ₹80,088.40

Camarilla Pivot Points:

Resistance Levels:

R1: ₹81,028.38

R2: ₹81,104.77

R3: ₹81,181.15

Support Levels:

S1: ₹80,875.60

S2: ₹80,799.21

S3: ₹80,722.83

📈 Technical Outlook

The Sensex has entered a negative trend in the last trading session. It is considered bearish until it trades above ₹81,974 on a daily closing basis.

🔍 Summary

Current Price: ₹80,951.99

Immediate Resistance Levels: ₹81,353.51, ₹81,755.04, ₹82,186.83

Immediate Support Levels: ₹80,520.19, ₹80,088.40, ₹79,686.87

Bearish Threshold: A daily close below ₹81,974 indicates a bearish trend.

Traders should monitor these levels closely and consider broader market trends and economic indicators when making investment decisions.

APTUS VALUE HSG FIN (I) LTDAs of May 22, 2025, Aptus Value Housing Finance India Ltd (NSE: APTUS) closed at ₹336.65, marking a 1.89% increase from the previous session.

📊 Daily Support and Resistance Levels

Based on technical analysis, the following support and resistance levels have been identified for Aptus Value Housing Finance India Ltd:

Classic Pivot Points:

Pivot Point: ₹328.32

Support Levels:

S1: ₹298.13

S2: ₹264.57

S3: ₹234.38

Resistance Levels:

R1: ₹361.88

R2: ₹392.07

R3: ₹425.63

Fibonacci Retracement Levels (from recent downtrend):

Resistance Levels:

23.6%: ₹319.49

38.2%: ₹323.75

50%: ₹327.20

61.8%: ₹330.65

76.4%: ₹334.91

📈 Technical Indicators Overview

Relative Strength Index (RSI): 43.56 (indicates a bearish trend)

Stochastic RSI: 11.05 (oversold condition)

MACD: 0.47 (bullish crossover)

Average Directional Index (ADX): 31.01 (indicates a strong trend)

Commodity Channel Index (CCI): -165.91 (suggests the stock is oversold)

📌 Summary

Current Price: ₹336.65

Immediate Support Levels: ₹328.32, ₹298.13

Immediate Resistance Levels: ₹361.88, ₹392.07

Given the current technical indicators and support/resistance levels, traders should exercise caution. Monitoring the stock's movement around these key levels can provide insights into potential trading opportunities. It's advisable to consider these technical factors in conjunction with broader market trends and fundamental analysis before making investment decisions.

NIFTY 50 INDEXPre Market analysis for 23/05/2025

#NIFTY50

If market opens flat and breaks 24650 will plan for buying for target 24750.

If market opens gap down, and sustains below 24550 plan for selling for target 24450.

If market opens gap up and sustains above 24650 plan for buying for target 24800.

Disclaimer:-All views are my personal and only for educational purpose.