Strong Bullish Momentum or a Short-Term Setback?XAUUSD Analysis – 02/07: Strong Bullish Momentum or a Short-Term Setback?

Gold has made a strong recovery after a brief period of consolidation last month, and it continues to show signs of strong bullish momentum. The price has been fluctuating, yet the overall trend remains positive. Let’s dive into the technical setup for today’s trading session.

📊 Market Overview:

Recent Price Action: After confirming a bullish reversal on the H1 timeframe earlier this week, Gold has surged significantly. Yesterday, it reached 3358, completing wave 3 of an Elliott structure on the M30 chart, followed by a slight correction during the US and Asian sessions.

Short-Term Correction: Wave 4 is currently underway, and there are two potential outcomes for this correction:

It could find support at 3328-3330, leading to a continuation of the bullish trend.

Alternatively, it may dip further to the 330x range before resuming the uptrend.

🧭 Key Levels to Watch:

Support: 3328 – 3313 – 3304 – 3294

Resistance: 3344 – 3360 – 3368 – 3388

🧠 Trading Strategy for Today:

Buy Scenario:

Watch for a potential bounce around the 3328-3330 range. If this area holds, we can look for buying opportunities with a target towards 3358 and 3360.

If the price breaks through the 3340 level, consider entering long positions and setting targets around 3350-3360.

Sell Scenario:

Sell Near Resistance: A quick scalping opportunity could arise near the 3388-3390 resistance zone. Tight SL and reasonable TP at 3384-3380 are the targets to aim for.

For a longer-term Sell position, wait for a clearer breakdown below 3370 to target deeper levels like 3360.

🎯 Trading Plan for Today:

BUY ZONE:

Entry: 3306 – 3304

SL: 3300

TP: 3310 → 3315 → 3320 → 3325 → 3330 → 3340

SELL ZONE:

Entry: 3388 – 3390

SL: 3394

TP: 3384 → 3380 → 3376 → 3370 → 3365 → 3360 → 3350

⚡️ Key Considerations:

The US macroeconomic data release and potential volatility from ADP NonFarm Payrolls today could provide significant movement, so stay alert and monitor the data closely.

In Summary:

Bullish bias remains intact with strong buy opportunities around key support levels like 3328-3330.

For short-term traders, focus on quick scalping within the resistance zones, but don’t forget to follow the trend for the longer-term buy strategy.

💡 Stay cautious with your Stop Loss (SL) and Take Profit (TP) to manage risk effectively. Happy trading! 🌟

Technical Analysis

XAUUSD jumps 4,873 pips – Is the bullish momentum back?Yesterday, gold surged by 4,873 pips, equivalent to a $48.73 gain, signaling strong buying pressure after a technical correction. Price rebounded from Support 1 near $3,264 — a key support zone in previous sessions. The current price structure suggests a high probability of breaking above the $3,347 resistance and continuing toward the $3,389 target. Notably, the filled green FVG zone confirms the recovery and reinforces confidence in the bullish outlook.

On the news front, the de-escalation of the Iran–Israel conflict caused a brief drop in gold earlier. However, the US dollar remains at its weakest level in three years, and rising concerns over a potential budget deficit from the $3.3–3.9 trillion US tax reform package continue to support gold as a safe-haven asset.

Trade strategy: Look for long opportunities if price holds above $3,264 and clearly breaks through $3,347. The next upside target lies around the $3,389 resistance zone.

MAHSEAMLES - Symmetrical Triangle Breakout📊 MAHSEAMLES – Symmetrical Triangle Breakout | RSI Bullish | Volume Surge | Daily Timeframe

📅 Chart Date: June 26, 2025

📈 CMP: ₹736.55 (+7.20%)

📍 Ticker: NSE:MAHSEAMLES

🔍 Technical Analysis Overview

🔺 Symmetrical Triangle Breakout

After months of consolidation within a symmetrical triangle pattern, MAHSEAMLES has broken out with a strong bullish candle

Breakout level: Above ₹725, confirmed with strong price momentum

Breakout marks potential trend reversal and beginning of new bullish phase

📊 Volume

Volume spike to 1.77M, significantly higher than recent average – validates breakout strength

📈 RSI Indicator (14)

RSI at 65.26, trending upwards – bullish zone

Previous RSI Bullish signals noted at key turning points, providing confluence

📍 Key Technical Levels

✅ Breakout Level: ₹725

🚀 Potential Upside Targets (based on pattern height projection):

₹770

₹800

₹840+

🛡️ Support Zones:

₹700 (retest zone)

₹670 (lower trendline support)

₹635 (triangle base)

💡 Trade Setup Idea

Entry: On breakout close above ₹725 with confirmation

Stop Loss: Below ₹695 (just under triangle resistance)

Targets: ₹770 → ₹800 → ₹840+

Risk-Reward: Favorable with pattern breakout and rising momentum

⚠️ Disclaimer

This chart analysis is for educational purposes only. Always DYOR (Do Your Own Research) and consult a financial advisor before making investment decisions.

SOUTHBANK – Breakout From Cup & Handle | Daily Chart📊 SOUTHBANK – Breakout From Cup & Handle | RSI Bullish | High Volume | Fibonacci Levels | Daily Chart

📅 Chart Date: July 2, 2025

📍 CMP: ₹31.60 (+2.63%)

📈 Symbol: NSE:SOUTHBANK

🔍 Technical Breakdown

✅ Cup & Handle Breakout

A perfect cup & handle pattern breakout is visible

Price breaks out above the neckline at ₹31.08, which was a strong resistance zone

Breakout supported by rising volume (25.1M) adds conviction

📊 RSI Momentum

RSI (14) reading at 67.96 signals bullish strength, approaching overbought but not yet extreme

RSI crossover and previous bullish divergence helped initiate the move

📐 Fibonacci Retracement Levels (Swing: ₹22.21 to ₹36.46)

38.2% – ₹27.65

50.0% – ₹29.33

61.8% – ₹31.08 ✅ (Breakout zone)

78.6% – ₹33.41

100% – ₹36.46 🎯

🏁 Key Levels

Breakout Zone (Neckline): ₹31.08

CMP: ₹31.60

Resistance Levels: ₹33.41 → ₹36.46

Support Levels: ₹29.33 → ₹27.65

💡 Trade Idea

Entry: Above ₹31.10 on volume confirmation

SL: Below ₹29.30

Targets: ₹33.40 → ₹36.40+

Momentum + Breakout = High Conviction Setup

⚠️ Disclaimer

This analysis is for educational purposes only. Always do your own research and consult a registered advisor before investing.

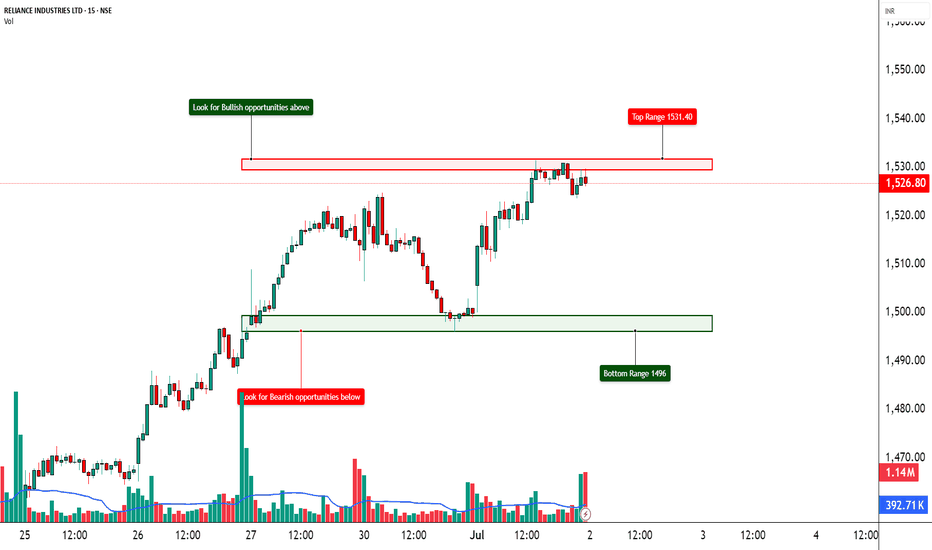

RELIANCE – Short Covering Fueling a Reversal?📈 RELIANCE – Short Covering Fueling a Reversal?

🔍 Heavy Action Across 1500–1570 CEs | Bullish Reversal on the Cards?

Chart Type: 15-min / 1H / Daily

Indicators: STWP Zones, Option Chain Activity, Volume Clusters, Demand-Supply

🔹 What’s Catching Our Eye?

✅ Aggressive Long Build-Up across multiple CEs (1550–1580)

✅ Massive Short Covering on 1500–1530 Calls – Bears exiting fast

✅ Huge OI Additions at 1550, 1560, 1570 CEs – Smart money positioning ahead?

✅ Put Writers Building Base at 1500–1520 PE → Strong support developing

✅ Spot Price at ₹1528.4 – Right at the heart of breakout zone

✅ IVs remain in control (~15.9–16.3%) = room for expansion

📊 What We’re Watching for:

📍 Breakout Zone: 1530–1540

📍 Targets: 1560 → 1580 → 1600

📍 Invalidation Below: 1490

📍 Momentum Confirmation: Price closing above 1540 with volume & OI spike

📍 Option Chain Support: 1500 PE (OI: 29.3L) + short build-up in multiple puts

📌 Trade Plan (Educational Purpose Only):

🔹 Bullish Idea: Buy above 1530–1540 with SL below 1490

🔹 Options Play: 1550 or 1560 CE suitable for short-term directional trades

🔹 Positional Angle: Momentum may sustain toward 1600 if 1540 holds

⚠️ Disclaimer:

This post is for educational and learning purposes only.

It does not constitute buy/sell advice or investment recommendation.

Always consult your financial advisor before taking any positions.

STWP is not liable for any financial decisions based on this content.

📚 “When bears cover in panic, bulls prepare their charge.”

💬 What’s your take on Reliance? Is 1600 on the radar, or is this just a squeeze?

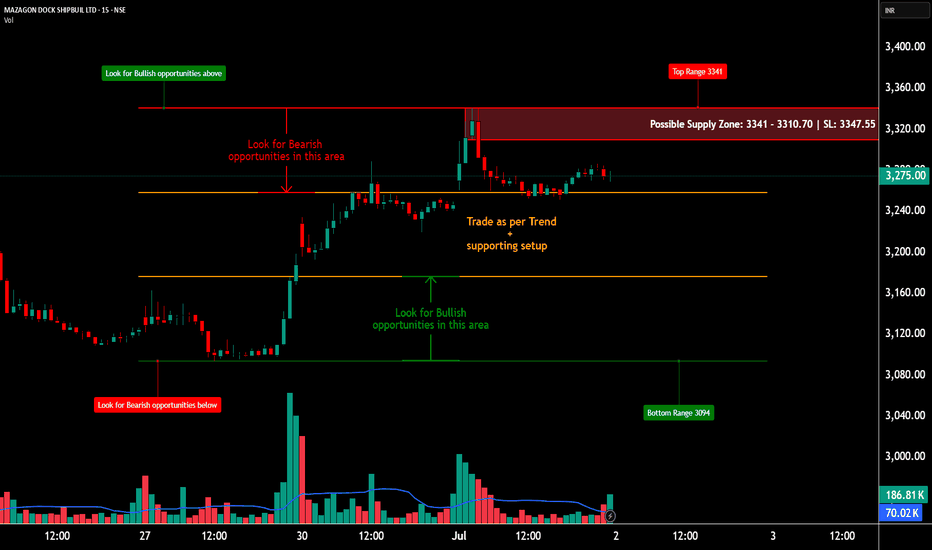

MAZDOCK - – INTRADAY ZONE ANALYSIS________________________________________________________________________________📈 MAZAGON DOCK SHIPBUILDERS LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

🔴 Top Range (Resistance): ₹3341

🟢 Bottom Range (Support): ₹3094

⚪ No Trade Zone: (Trade only with trend + confirmation in this zone)

________________________________________________________________________________

🧩 Chart Pattern: No visible chart pattern seen.

________________________________________________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range:

✅ Multiple strong rejection candles near ₹3341 along with long upper wicks and volume drop — suggesting supply zone holding.

🟢 Bottom Range:

✅ Bullish Marubozu and wide-range green candles seen around ₹3094, confirming strong buyer interest and a potential reversal zone.

________________________________________________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: Go long if price retests ₹3120–₹3094 demand zone with bullish confirmation (strong bullish candle, reversal candles, volume support, long wick)

Stop Loss: Below ₹3090

Risk-Reward: 1:1 | 1:2+

Logic: Strong buyer reaction from demand zone previously suggests continued interest if tested again.

________________________________________________________________________________

🔽 Bearish Trade:

Idea: Short if price retests ₹3341–₹3310 and rejects with bearish candle formation (strong bearish candle, reversal candles, volume support, long wick).

Stop Loss: Above ₹3347.55

Risk-Reward: 1:1 | 1:2+

Logic: Supply zone confirmed with rejections earlier. Reversal here can lead to downside till mid or demand zone.

________________________________________________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone: ₹3341 – ₹3310

SL: ₹3347.55

Plan: Enter short if price shows rejection with bearish confirmation at this zone.

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: ₹3120 – ₹3094

SL: ₹3090

Plan: Enter long on bullish reversal setup from this demand area.

Risk-Reward: 1:1 | 1:2+

________________________________________________________________________________

📌 Disclaimer

This analysis is for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before trading. Always use strict risk management and act only on confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on MAZDOCK?

Will it break the supply zone and rally higher, or revisit the demand zone before bouncing back?

Share your thoughts and chart setups below 👇

________________________________________________________________________________

Breakout Confirmation Above ₹2491 - Trend Reversal in Play?After months of downtrend, Asian Paints is showing signs of reversal. A clear Change of Character (CHoCH) has been marked, and the price is approaching a key resistance at ₹2491.

🔍 Trade Idea:

Entry (Trigger): Weekly close above ₹2491 (break of recent BSL)

Target: ₹3203 (Previous high + Weekly Fair Value Gap zone)

Stop Loss: Below swing low around ₹2110

Risk-Reward: Approx. 1:2.8+

📌 Technical Confluences:

CHoCH confirmed in mid-2025

Weekly FVG above offers price imbalance that price may seek to fill

Current structure forming a higher low with bullish momentum

💬 Idea: Wait for a strong weekly close above ₹2491 for confirmation. Once confirmed, a potential rally towards ₹3200+ is in play, targeting the FVG zone and liquidity above the previous swing high.

⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Always do your own research and use proper risk management.

BLUE STAR LTD. – TECHNICAL ANALYSIS📈 BLUE STAR LTD. – TECHNICAL ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

• 🔴 Top Range (Resistance): 2417

• 🟢 Bottom Range (Support): 1521

________________________________________________________________________________

🔹 Chart Pattern: ✅

Rectangle/Box Consolidation Breakout – Price was range-bound in a tight zone and has given a strong breakout on high volume, indicating bullish intent.

________________________________________________________________________________

🔹 Reversal Candlestick Patterns

• Top Range (2417): ⛔ No recent candlestick activity visible at the top range.

• Bottom Range (1521): Todays Candle

✅ Bullish Engulfing + Strong Bullish Candle

✅ RSI Bounce + Volume Spike

✅ Confirmed by Price Action and Momentum Indicators

________________________________________________________________________________

📊 Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade Setup:

• Entry: 1715 (Breakout Candle Close)

• Stop Loss: 1614.45 (Below consolidation and bullish candle)

• Target 1: 1850

• Target 2: 1980

• Reason:

o Strong breakout with above-average volume

o Multiple confirmations (RSI, Bollinger Band, Supertrend)

o Box breakout with previous supply cleared

________________________________________________________________________________

🔽 Bearish Trade Setup:

• If price fails to sustain above 1715 and closes back below 1680 zone

• Entry: Below 1665 (Fakeout confirmation)

• SL: Above 1715

• Target: 1615 / 1550

• Reason: Potential failed breakout & liquidity trap

________________________________________________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on Britannia?

Drop your thoughts and chart setups

________________________________________________________________________________

Indian Overseas Bank (IOB) - Falling Channel Breakout Setup📈 Indian Overseas Bank (IOB) – Falling Channel Breakout Setup

Watching a classic falling channel on the daily timeframe with multiple touches on both trendlines. Recent breakout above ~38.8 confirms the channel break.

✅ Planned Trade Details:

- Entry above 38.8 (confirmation)

- Stop-loss: 35.90

- ATR-based stop option: ~37.45 for tighter risk control

- Target zone: 48.80 based on channel height projection

Volume confirmation and follow-through will be key for validating the breakout. Tracking this for a positional swing trade.

ENVIRO INFRA ENGINEERS (NSE: ENVIRO)View: Strongly Bullish.

Bias: Trend reversal confirmed.

Strategy:

BUY: Initiate around ₹240-₹245 or on retest of ₹230-₹235.

Targets (T):

T1: ₹262

T2: ₹287

T3: ₹312

Stop-Loss (SL): ₹220 (on daily closing basis).

Reasoning:

Decisive breakout from a significant long-term descending trendline.

Strong volume confirming the breakout.

RSI indicating robust bullish momentum.

Potential for significant upside as stock recovers from prior fall.

Note: This is an educational analysis and not financial advice. Do your own due diligence before investing.

BRITANNIA INDUSTRIES LTD. – INTRADAY ZONE ANALYSIS📈 BRITANNIA INDUSTRIES LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________

🔹 Price Action Zones

🔴 Top Range (Resistance): ₹5869.50

🟢 Bottom Range (Support): ₹5721

⚪ Neutral Zone: Between ₹5732 – ₹5804 (No clear directional bias until breakout from either zone)

________________________________________

🧩 Chart Pattern: No

There’s no prominent chart pattern (e.g., flag, wedge, triangle) seen in the current snapshot. This is primarily a demand-supply structure with price action analysis.

________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range: No textbook reversal candle observed yet. However, the previous rejection from ₹5822–₹5804 still makes this zone valid for bearish observation.

🟢 Bottom Range: ✅ Morning Star pattern identified near ₹5721.

This is a strong bullish reversal pattern indicating potential buyer strength emerging from the demand zone.

________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: Go long if price retests ₹5732–₹5721 and holds with bullish confirmation (preferably another higher low or volume spike).

Stop Loss: Below ₹5715

Risk-Reward: 1:1 | 1:2+

Logic: Presence of a valid Morning Star reversal at demand zone suggests buyer strength and potential upside toward ₹5800+.

________________________________________

🔽 Bearish Trade:

Idea: Short if price rallies to ₹5822–₹5804 and shows rejection (bearish wick, reversal candle, volume drop).

Stop Loss: ₹5827.25

Risk-Reward: 1:1 | 1:2+

Logic: Previously reacted supply zone with strong rejection. If tested again without volume confirmation, short setup is valid.

________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone: ₹5822 – ₹5804

SL: ₹5827.25

Plan: Enter short only if price rejects the zone again with bearish confirmation.

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: ₹5732 – ₹5721

SL: ₹5715.60

Plan: Enter long if the zone holds, ideally using the Morning Star as confirmation.

Risk-Reward: 1:1 | 1:2+

________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________

💬 Comments

What’s your view on Britannia?

Will the Morning Star at the demand zone lead to a reversal, or will supply pressure dominate again?

Drop your thoughts and chart setups below 👇

________________________________________

BTCUSD Short Opportunity – Bearish Channel Resistance TestPair: BTCUSD

Timeframe: 4H

I’m planning a short position on Bitcoin based on this well-defined descending channel structure.

🔹 Setup Explanation:

Price has been respecting a downward-sloping channel, with multiple touches at both the upper and lower bounds.

Currently, BTC is testing the upper trendline resistance of this channel near the $108,000–$109,000 area.

This area also aligns with prior supply zones where strong selling pressure emerged.

The recent impulsive move up appears overextended, increasing the likelihood of a technical pullback.

🔹 Potential Reversal Area:

Upper channel boundary: ~108,500–109,000 USD

Confluence with previous horizontal resistance

Weak momentum candles forming near this resistance

🔹 Trade Plan:

Entry Zone: Between 108,000–109,000 (as price consolidates near the channel top)

Stop-Loss: Above 110,000 to protect against breakout and invalidation of the pattern

Target Zone:

First Target (TP1): 104,500 (gray support zone mid-channel)

Second Target (TP2): 97,000 (lower channel boundary)

🎯 Risk-to-Reward:

Targeting a 1:2 to 1:3 R:R, depending on execution

This means risking ~1,500–2,000 points for a potential reward of 4,000–10,000 points

🛡️ Important Notes:

Watch for strong bullish momentum or a clean breakout above 110,000—this invalidates the setup.

Confirm rejection with lower timeframe bearish signals (e.g., bearish engulfing or supply zone rejection).

Be prepared to trail stop after TP1 is hit to secure profits.

✅ Summary:

This setup aims to capitalize on the potential rejection from the upper boundary of a long-standing descending channel, expecting BTCUSD to retest the mid and lower range support zones.

BHARAT FORGE LTD. – INTRADAY ZONE ANALYSIS________________________________________________________________________________

📈 BHARAT FORGE LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

🔴 Top Range(Resistance): 1324.50

🟢 Bottom Range(Support): ₹1270

⚪ No Trade Zone: Mid-range, no clear directional bias

________________________________________________________________________________

🧩 Chart Pattern: No

There is no visible or marked chart pattern (e.g., flag, triangle, head and shoulders) on the chart.

________________________________________________________________________________

🔁 Reversal Candlestick Patterns:

🔴 Top Range: No visible reversal candle pattern at the supply zone on this chart snapshot, but the area has been marked for potential rejection.

🟢 Bottom Range: No textbook reversal candlestick (like pin bar, hammer, or engulfing) is clearly visible at ₹1270. However, the price bounced strongly from this level, indicating possible short-term support or buyer interest.

________________________________________________________________________________

🧠 1. Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade:

Idea: If price retests ₹1270 and forms a bullish structure (strong bullish candle, reversal candles, volume support, long wick)

Stop Loss: Below ₹1269

Risk-Reward: 1:1 | 1:2+

Logic: you need to give an actual logic to this

________________________________________________________________________________

🔽 Bearish Trade:

Idea: If price rejects 1324.50 and forms a bearish structure (strong bearish candle, reversal candles, volume support, long wick)

Stop Loss: ₹1325

Risk-Reward: 1:1 | 1:2+

Logic: Historically rejected area as marked on chart.

________________________________________________________________________________

📦 2. Trade Plan Based on Demand/Supply Zones

🟥 Supply Zone Trade:

Zone: ₹1293.30 – ₹1299.90

SL: ₹1301.45

Plan: Trade the Supply Zone (only on rejection confirmation)

Risk-Reward: 1:1 | 1:2+

🟩 Demand Zone: No defined demand zone.

________________________________________________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on Bharat Forge?

Will it reject from the supply zone or hold the bottom range?

Share your charts or thoughts below 👇

________________________________________________________________________________

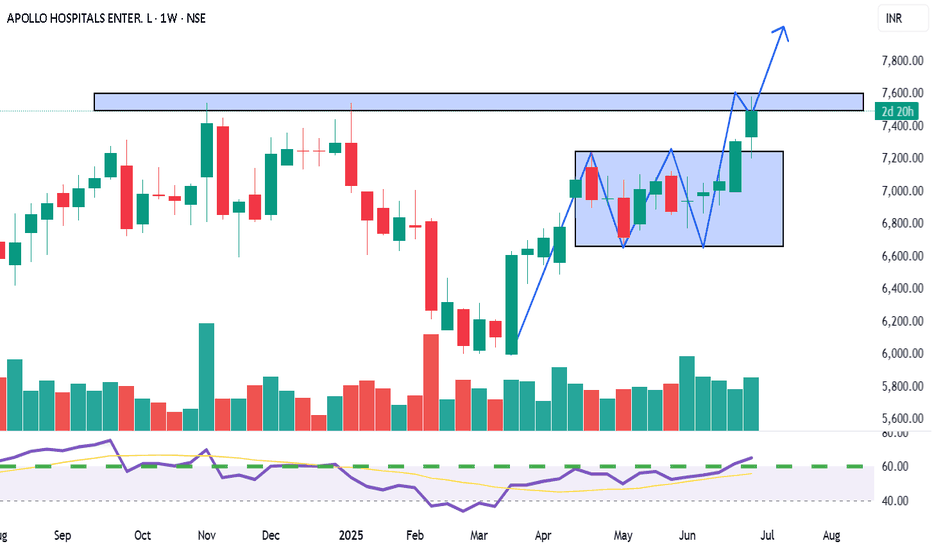

APOLLO HOSPITALS (NSE: APOLLOHOSP)View: Strongly Bullish.

Bias: High momentum uptrend.

Strategy:

BUY: Initiate at current levels (around ₹7500) or on dips towards ₹7250-₹7300, or on a confirmed daily close above ₹7600.

Targets (T):

T1: ₹7800-₹8000

T2: ₹8250-₹8500

Stop-Loss (SL): ₹7150 (on daily closing basis).

Reasoning:

Confirmed breakout from a significant Rectangle/W-pattern consolidation.

Exceptional volume accompanying the breakout.

Strong bullish momentum indicated by RSI.

Potential for a new leg of the uptrend after clearing ₹7600.

Note: This is an educational analysis and not financial advice. Do your own due diligence before investing.

CESC Ltd. (NSE: CESC) - Weekly Chart AnalysisView: Bullish on confirmed breakout.

Bias: Positive momentum.

Strategy:

BUY: Above ₹178-180 (on weekly closing basis, confirming trendline and resistance breakout).

Targets (T):

T1: ₹195-200

T2: ₹210-220+

Stop-Loss (SL): ₹168 (on weekly closing basis).

Reasoning:

Attempting a breakout from a significant descending trendline.

Cleared horizontal resistance at ₹175.

Bullish crossover in moving averages with price above all MAs.

Strong RSI and supportive volume.

Potential for a major trend reversal.

Note: This is an educational analysis and not financial advice. Do your own due diligence before investing.

TORRENT PHARMACEUTICALS LTD. (TORPHARM) View: Bullish on confirmed breakout.

Bias: Positive momentum building.

Strategy:

BUY: Above ₹3600 (on weekly closing basis with strong volume confirmation).

Targets (T):

T1: ₹3750

T2: ₹3950+

Stop-Loss (SL): ₹3400 (on weekly closing basis).

Reasoning:

Strong support at ₹3000-₹3050.

Challenging multi-month descending trendline resistance.

Positive RSI divergence and increasing volume.

Potential for a significant trend reversal if breakout is confirmed.

XAUUSD 01/07: GOLD'S RELIEF RALLY FROM A MONTHLY LOWXAUUSD 01/07: GOLD'S RELIEF RALLY FROM A MONTHLY LOW – USD WEAKENS, BUT CLEAR MOMENTUM IS STILL MISSING

🌍 Market Overview – USD Weakness & Gold's Rebound Potential

After a significant drop to a one-month low, Gold is beginning to recover slightly, partly due to a weaker USD, improving market sentiment. However, the rally remains cautious and still lacks a strong momentum to push gold decisively higher.

💵 USD Weakness: Can Gold Continue to Rebound?

Recent US economic data has shown a slight decline in consumer spending, which has led to speculations that the Federal Reserve may take a more dovish stance on interest rates in the near future. This has weakened the USD, providing room for Gold to rebound slightly.

That said, there hasn't been a significant catalyst to push Gold into a strong breakout yet.

📉 The Fed is Still the Key Player

The market is closely watching the Fed's next moves. However, there’s a divide on whether interest rates will be cut or maintained. The recent US data isn’t weak enough to warrant a policy change from the Fed, but it’s also not strong enough for the Fed to keep its hawkish stance intact.

This leaves Gold in a limbo, with no clear direction in the near term. Gold is caught between weak expectations of further rate cuts and the ongoing strength of the USD.

🧠 Analysis for Traders:

Gold is responding lightly to macroeconomic factors but hasn’t established a strong trend. This is a period prone to market noise—Gold may jump up and down on news, but the momentum required to establish a consistent trend is lacking.

Traders should monitor USD movements and US labor data closely this week, especially the NFP report, as this could provide more clarity for Gold’s future direction.

✍️ Conclusion:

Gold is recovering from its lows, but it remains uncertain.

The Buy side hopes for rate cuts by the Fed.

The Sell side is betting on USD strength.

As for us traders, let’s stay patient, observe closely, and be ready for the next move. The big wave may still be coming, but smaller price actions right now could give us clues for the upcoming trend.

🔶 Key Levels & Strategy:

Current Support Zone: Gold is holding above the critical psychological support levels of 3300-3304. If the upward momentum continues, a move towards 335x-337x is highly possible in the near term.

Liquidity Gap: Currently, there’s a liquidity gap at the higher levels. The goal is for Gold to rise further to fill this gap before any deeper retracement occurs.

📈 Trading Plan:

BUY ZONE: 3303 – 3301

‼️ SL: 3297

✔️ TP: 3306 → 3310 → 3315 → 3320 → 3325 → 3330 → ???

SELL ZONE: 3358 – 3360

‼️ SL: 3364

✔️ TP: 3354 → 3350 → 3345 → 3340 → 3320

⚡ Final Thoughts:

As the market awaits further data, keep an eye on these key support and resistance levels for your trading setups.

The overall trend is still upward, but short-term volatility is expected. Make sure to follow your risk management strategies.

VOLTAMPVOLTAMP may give a good upside move if it gives breakout.

It's been making HH-HL formation, broke resistance and re-tested it, now seems ready.

Keep following it.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

Powerful Monthly Channel | Clean Price Structure Across📉 Description:

-This is a classic example of a broadening falling channel on the Monthly Time Frame (MTF), where the counter-trendline (CT) has just been taken out by a strong bullish candle. Volume confirms the strength

📌What makes this setup particularly interesting:

-MTF structure: Despite a series of lower lows on the monthly, it has respected the broad structure of the falling channel throughout.

-WTF/DTF structure: Weekly and Daily timeframes are making higher lows (HLs),

-Price behavior: Clean reaction to the trendline and no choppiness around breakout — this reflects a well-absorbed selling zone

⚠️ This is not a forecast, not a call or tip — just me charting what I see. Drop any doubts in the comments.

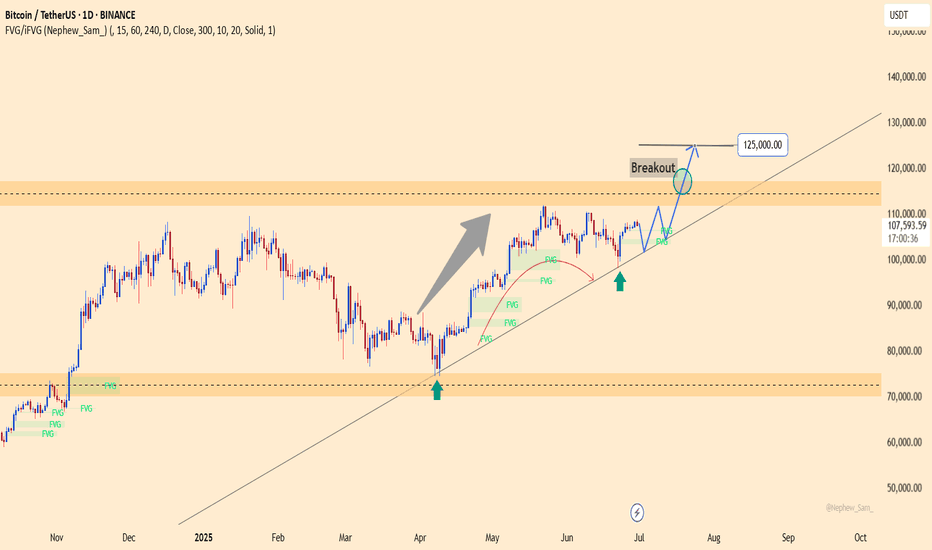

BTCUSDT – Targeting 125,000 if Resistance BreaksBTCUSDT is holding a strong uptrend, with price respecting the ascending trendline and consistently filling fair value gaps. The pair is approaching key resistance around 110,000 and may form a breakout–retest pattern, potentially unlocking a move toward 125,000.

On the news front, institutional inflows are returning, spot ETFs continue to attract capital, and the Fed is keeping rates steady — all supporting bullish momentum. As long as price holds above 101,200, the upside scenario remains in play.

SIEMENS LTD. – INTRADAY ZONE ANALYSIS________________________________________

📈 SIEMENS LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Analysis for Learning Purposes Only

________________________________________

📊 Zone Breakdown:

• 🔴 Top Range Resistance – 3,271.90

Marked in Red: This is a clearly defined supply zone where the price faced sharp rejection after testing highs. Bearish opportunity zone if a reversal pattern appears — watch for signs like bearish engulfing, double top, or rising volume + long upper wicks.

• 🟠 No Trade Zone – Around 3,225–3,260

Marked in Orange: This range has seen volatile, choppy action without clear bias. Traders may avoid fresh positions here unless directional strength emerges with volume confirmation.

• 🟢 Demand Zone – 3,182.60 to 3,165 | SL: 3,160.35

Marked in Green: Price reversed sharply from this area in the past with strong bullish candles. Acts as a low-risk buying area on retest with bullish confirmation. Risk-managed entries possible here.

• 🟩 Bottom Support – 3,101.10

Marked in Dark Green: Crucial structural support zone. Breakdown below this level could change the short-term trend to bearish. Currently a “last line of defense” for bulls.

________________________________________

🔍 Candlestick & Chart Pattern Observation:

✅ Bearish Rejection Near Top Zone:

A strong upper rejection candle (long wick) appeared right at the top resistance (3,271.90), followed by consistent lower highs and lower closes. This confirms seller presence. No double top yet, but early signs of a potential short-term top formation are visible.

✅ Bullish Reversal from Demand Zone:

The candle near 3,170 zone shows a sharp bullish engulfing move on higher volume — signaling potential institutional interest. This zone has repeatedly offered bounce opportunities.

📉 Volume Clue:

Volume expanded during the bounce from demand zone and tapered near resistance — confirming participation during dips and caution near highs.

________________________________________

⚙️ Educational Trade Ideas (Study Purpose Only)

▶️ Reversal Setup – Bearish Bias

• Entry: Below 3,245 on bearish continuation candle

• Stop Loss: Above 3,272 (Top Range)

• Risk-Reward: 1:1 | 1:2+

________________________________________

🧠 Ideal for studying exhaustion after a resistance test and confirmation through lower highs.

▶️ Pullback Setup – Bullish Bias

• Entry: Between 3,170–3,182 (Demand Zone)

• Stop Loss: 3,160.35

• Risk-Reward: 1:1 | 1:2+

🧠 Classic demand zone bounce setup. Strong volume + engulfing candle supports bullish case.

________________________________________

⚠️ Disclaimer (SEBI-Compliant):

This content is strictly for educational and informational purposes. It is not investment advice or a recommendation to buy/sell any securities. Always consult a SEBI-registered financial advisor before making any financial decisions.

STWP | Learn. Trade. Grow.

________________________________________

💬 Do you think the top is strong enough for a short? Or will bulls take control at demand again?

Drop your thoughts and analysis below ⬇️

________________________________________

Shorting BTCUSD After Trendline Failure & Bearish RetestPlanning to short BTCUSD as price has rejected from the descending trendline resistance after breaking the minor ascending trendline support. The confluence of trendline rejection and bearish retest suggests potential downside continuation.

Entry Zone: ~107,300–107,350

Stop-Loss: Above 107,550 (recent high)

Target: 106,550 support area

Risk-to-Reward Ratio: ~1:2 (Min) 1:4 (Final Target)

Quote:

"Trendline confluence and failed bullish continuation often lead to deeper pullbacks."

📊 Summary of the Idea

✅Reason for Entry: Multiple rejections at trendline + structure breakdown.

✅Confirmation: Retest rejection candle.

✅Invalidation: A clean breakout and hold above the descending trendline.

30/06: WILL WE SEE A RECOVERY ON THE LAST DAY OF THE MONTH? GOLD PLAN – 30/06: WILL WE SEE A RECOVERY ON THE LAST DAY OF THE MONTH? ☄️

✅ Macro Context – Focus on USD Debt and Political Pressure

As June comes to a close, the US faces a major $6 trillion debt maturity from COVID-era borrowings, creating potential stress on USD liquidity and overall market sentiment.

Gold saw a sharp dip to the 32xx range during the Asian session but has bounced back and is currently hovering near last week's closing levels.

While the medium-term outlook remains bearish, short-term signals are showing signs of a potential recovery.

✅ Political Catalyst:

Trump’s Pressure on Fed: Trump is pushing the Federal Reserve to cut interest rates to 1%-2%, saying he won’t appoint anyone unwilling to ease monetary policy.

This has sparked expectations for potential rate cuts, which could provide support for gold prices in the near term.

✅ Technical Outlook – Multi-timeframe Structure

Gold continues its downward correction on higher timeframes. However, short-term candles are indicating recovery momentum, with buying activity near the 327x zone.

Today's Strategy: Focus on short-term BUY setups that align with the recovery wave.

✔️ Key Resistance & Support Levels

🔺 Resistance: 3283 – 3291 – 3301 – 3322

🔻 Support: 3277 – 3271 – 3259 – 3247

🔖 Trade Scenarios

✅ Buy Scalping

🔺 Entry: 3272 – 3274

🔹 SL: 3268

✔️ TP: 3282 → 3288 → 3298

✅ Buy Zone

🔺 Entry: 3249 – 3251

🔹 SL: 3244

✔️ TP: 3265 → 3282 → 3295 → 3310

💠 Sell Scalping

🔺 Entry: 3298 – 3300

🔹 SL: 3304

✔️ TP: 3292 → 3282 → 3270

💠 Sell Zone

🔺 Entry: 3327 – 3329

🔹 SL: 3333

✔️ TP: 3322 → 3310 → 3298 → 3282

⚡️ Final Note

As we near the end of the month, expect possible volatility due to USD flows and institutional rebalancing, which could create further opportunities in the gold market.