SIEMENS LTD. – INTRADAY ZONE ANALYSIS________________________________________

📈 SIEMENS LTD. – INTRADAY ZONE ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Analysis for Learning Purposes Only

________________________________________

📊 Zone Breakdown:

• 🔴 Top Range Resistance – 3,271.90

Marked in Red: This is a clearly defined supply zone where the price faced sharp rejection after testing highs. Bearish opportunity zone if a reversal pattern appears — watch for signs like bearish engulfing, double top, or rising volume + long upper wicks.

• 🟠 No Trade Zone – Around 3,225–3,260

Marked in Orange: This range has seen volatile, choppy action without clear bias. Traders may avoid fresh positions here unless directional strength emerges with volume confirmation.

• 🟢 Demand Zone – 3,182.60 to 3,165 | SL: 3,160.35

Marked in Green: Price reversed sharply from this area in the past with strong bullish candles. Acts as a low-risk buying area on retest with bullish confirmation. Risk-managed entries possible here.

• 🟩 Bottom Support – 3,101.10

Marked in Dark Green: Crucial structural support zone. Breakdown below this level could change the short-term trend to bearish. Currently a “last line of defense” for bulls.

________________________________________

🔍 Candlestick & Chart Pattern Observation:

✅ Bearish Rejection Near Top Zone:

A strong upper rejection candle (long wick) appeared right at the top resistance (3,271.90), followed by consistent lower highs and lower closes. This confirms seller presence. No double top yet, but early signs of a potential short-term top formation are visible.

✅ Bullish Reversal from Demand Zone:

The candle near 3,170 zone shows a sharp bullish engulfing move on higher volume — signaling potential institutional interest. This zone has repeatedly offered bounce opportunities.

📉 Volume Clue:

Volume expanded during the bounce from demand zone and tapered near resistance — confirming participation during dips and caution near highs.

________________________________________

⚙️ Educational Trade Ideas (Study Purpose Only)

▶️ Reversal Setup – Bearish Bias

• Entry: Below 3,245 on bearish continuation candle

• Stop Loss: Above 3,272 (Top Range)

• Risk-Reward: 1:1 | 1:2+

________________________________________

🧠 Ideal for studying exhaustion after a resistance test and confirmation through lower highs.

▶️ Pullback Setup – Bullish Bias

• Entry: Between 3,170–3,182 (Demand Zone)

• Stop Loss: 3,160.35

• Risk-Reward: 1:1 | 1:2+

🧠 Classic demand zone bounce setup. Strong volume + engulfing candle supports bullish case.

________________________________________

⚠️ Disclaimer (SEBI-Compliant):

This content is strictly for educational and informational purposes. It is not investment advice or a recommendation to buy/sell any securities. Always consult a SEBI-registered financial advisor before making any financial decisions.

STWP | Learn. Trade. Grow.

________________________________________

💬 Do you think the top is strong enough for a short? Or will bulls take control at demand again?

Drop your thoughts and analysis below ⬇️

________________________________________

Technical Analysis

Shorting BTCUSD After Trendline Failure & Bearish RetestPlanning to short BTCUSD as price has rejected from the descending trendline resistance after breaking the minor ascending trendline support. The confluence of trendline rejection and bearish retest suggests potential downside continuation.

Entry Zone: ~107,300–107,350

Stop-Loss: Above 107,550 (recent high)

Target: 106,550 support area

Risk-to-Reward Ratio: ~1:2 (Min) 1:4 (Final Target)

Quote:

"Trendline confluence and failed bullish continuation often lead to deeper pullbacks."

📊 Summary of the Idea

✅Reason for Entry: Multiple rejections at trendline + structure breakdown.

✅Confirmation: Retest rejection candle.

✅Invalidation: A clean breakout and hold above the descending trendline.

30/06: WILL WE SEE A RECOVERY ON THE LAST DAY OF THE MONTH? GOLD PLAN – 30/06: WILL WE SEE A RECOVERY ON THE LAST DAY OF THE MONTH? ☄️

✅ Macro Context – Focus on USD Debt and Political Pressure

As June comes to a close, the US faces a major $6 trillion debt maturity from COVID-era borrowings, creating potential stress on USD liquidity and overall market sentiment.

Gold saw a sharp dip to the 32xx range during the Asian session but has bounced back and is currently hovering near last week's closing levels.

While the medium-term outlook remains bearish, short-term signals are showing signs of a potential recovery.

✅ Political Catalyst:

Trump’s Pressure on Fed: Trump is pushing the Federal Reserve to cut interest rates to 1%-2%, saying he won’t appoint anyone unwilling to ease monetary policy.

This has sparked expectations for potential rate cuts, which could provide support for gold prices in the near term.

✅ Technical Outlook – Multi-timeframe Structure

Gold continues its downward correction on higher timeframes. However, short-term candles are indicating recovery momentum, with buying activity near the 327x zone.

Today's Strategy: Focus on short-term BUY setups that align with the recovery wave.

✔️ Key Resistance & Support Levels

🔺 Resistance: 3283 – 3291 – 3301 – 3322

🔻 Support: 3277 – 3271 – 3259 – 3247

🔖 Trade Scenarios

✅ Buy Scalping

🔺 Entry: 3272 – 3274

🔹 SL: 3268

✔️ TP: 3282 → 3288 → 3298

✅ Buy Zone

🔺 Entry: 3249 – 3251

🔹 SL: 3244

✔️ TP: 3265 → 3282 → 3295 → 3310

💠 Sell Scalping

🔺 Entry: 3298 – 3300

🔹 SL: 3304

✔️ TP: 3292 → 3282 → 3270

💠 Sell Zone

🔺 Entry: 3327 – 3329

🔹 SL: 3333

✔️ TP: 3322 → 3310 → 3298 → 3282

⚡️ Final Note

As we near the end of the month, expect possible volatility due to USD flows and institutional rebalancing, which could create further opportunities in the gold market.

EDELWEISS FIN SERV LTD – Weekly Structure A few key observations on this weekly chart without any forecast bias:

🔹 White Solid Trendline – Marks the active CT (counter-trend) level which has now been decisively taken out.

🔹 Blue Zone – A previously tested supply and demand area has been regained and price is now sustaining above it.

🔹 White Dotted Lines – Multiple short-term weekly hindrances lie just above, acting as micro-resistances.

🔹 Orange Line – Reflects multi-timeframe level confluence and a known volume cluster region to watch ahead.

🔹 Volume has seen a healthy pickup during this breakout, suggesting participation.

📌 Not a recommendation. Just sharing chart structure and price behavior.

XAUUSD – Bearish Momentum Builds Amid Risk-On MoodGold continues to trade within a clearly defined descending channel, forming lower highs and leaving several Fair Value Gaps unfilled. After rebounding from the 3,238 USD support, price is now approaching key resistance near 3,297 USD — aligning with the main descending trendline.

If price fails to break above this resistance, a drop back toward the 3,238 USD support is likely, with a deeper target around 3,200 USD at the lower boundary of the channel.

Fundamentals currently support the bearish bias: improving US–China trade relations and rare earth agreements have triggered “risk-on” sentiment, pulling capital away from gold. Meanwhile, strong USD momentum is driven by robust Core PCE data and the Fed’s hawkish stance, showing no rush to cut rates.

Strategy outlook: Watch for price reaction at 3,297 USD. If bearish rejection occurs, short setups toward 3,238 USD and below could be considered.

USD/INR Weekly Chart Analysis 📌 USD/INR Weekly Chart – Double Top Analysis

After a sustained uptrend, USD/INR is showing potential signs of a reversal with a well-defined Double Top pattern on the weekly timeframe.

✅ Pattern: Double Top (Weekly)

✅ Key Resistance: ~87.00 (tops)

✅ Breakdown Level: 83.76 (watch for confirmed weekly close below)

✅ Target Projection: ~80.76 (based on measured move)

✅ Stop-loss: ~84.70 (ATR-based level)

📉 Bias: Bearish on confirmed weekly close below 83.76 with increased selling volume.

🔎 Volume Note: Look for higher volume on breakdown to confirm selling pressure and pattern validity.

✅ Commentary:

This classic double top setup suggests potential trend exhaustion after an extended move up. A weekly close below the 83.76 neckline with strong volume would strengthen the bearish signal, targeting ~80.76 in the medium term. ATR-based stop-loss placement provides tactical risk management above recent support

ASIAN PAINTS LTD. – INTRADAY ZONE ANALYSIS________________________________________________________________________________

📈 ASIAN PAINTS LTD. – INTRADAY ZONE ANALYSIS

📆 Date: June 29, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Analysis for Learning Purposes Only

________________________________________________________________________________

📊 Zone Breakdown:

• 🔴 Top Range Resistance – 2,364.50

Marked in Red: This is a potential supply zone, where price may face resistance after a strong move up. Ideal for observing bearish reversal patterns like a shooting star, bearish engulfing, or a doji — especially if volume drops or candles show exhaustion.

• 🟠 Neutral Zone – Avoid Trade Area (2,320–2,340)

Marked in Orange: Historically indecisive. Avoid trades here as price often moves sideways or with false breakouts.

• 🟢 Demand Zone – 2,302.90 to 2,293.70 | SL: 2,292

Marked in Green: Price broke out with strong volume from this area. A retest may offer bullish pullback opportunities with proper confirmation candles.

• 🟩 Bottom Support – 2,275.40

Important base level. Breakdown below this zone may change overall short-term bias.

________________________________________________________________________________

🔍 Candlestick Observation:

At the resistance zone, the last candle shows slight upper rejection and reduced body size.

🧠 Interpretation: A possible early signal of exhaustion. Traders can watch for confirmation via volume drop or follow-up bearish candle for a short bias — or wait for breakout strength for long continuation.

________________________________________________________________________________

⚙️ Educational Trade Ideas (Study Purpose Only)

▶️ Reversal Setup – Bearish Bias

• Entry: Below ₹2,358 on bearish candle confirmation

• Stop Loss: Above ₹2,365

• Risk-Reward: 1:1 | 1:2+

• 🧠 Ideal for studying price rejection after a rally into resistance

________________________________________________________________________________

▶️ Pullback Setup – Bullish Bias

• Entry: Near ₹2,300 with bullish confirmation at demand zone

• Stop Loss: ₹2,292

• Risk-Reward: 1:1 | 1:2+

• 🧠 Useful example of “breakout → retest → continuation” pattern

________________________________________________________________________________⚠️ Disclaimer (SEBI-Compliant):

This content is shared strictly for educational and informational purposes. It is not investment advice or a trading recommendation. Please consult a SEBI-registered financial advisor before taking any investment decisions.

STWP | Learn. Trade. Grow.

________________________________________________________________________________

💬 What do you think about this setup?

Did you observe any other key patterns or zones?

👇 Drop your thoughts in the comments — let’s grow together!

________________________________________________________________________________

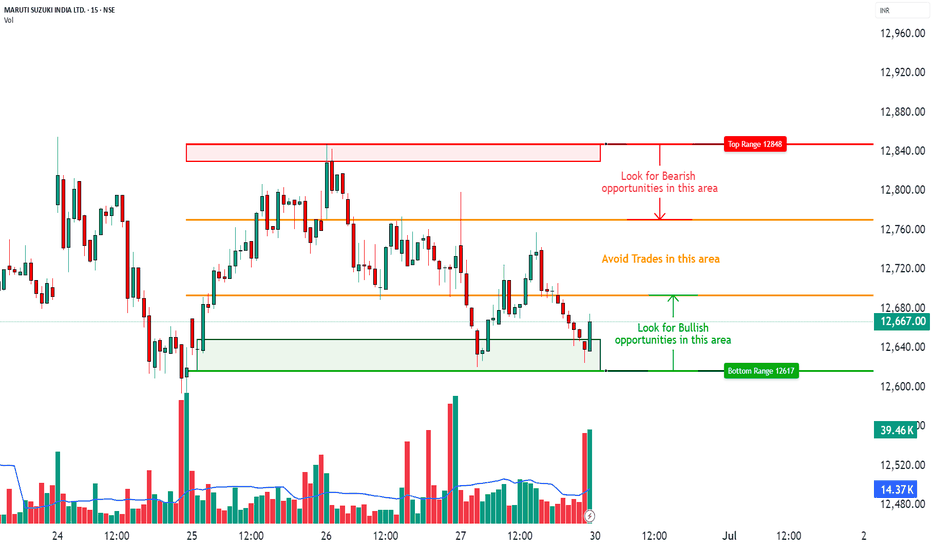

MARUTI SUZUKI INDIA LTD. – INTRADAY ZONE ANALYSIS________________________________________________________________________________📈 MARUTI SUZUKI INDIA LTD. – INTRADAY ZONE ANALYSIS

📆 Date: June 29, 2025 | ⏱ Timeframe: 15-Minute Chart

🔍 Educational Analysis for Learning Purposes Only

________________________________________________________________________________

📊 Zone Breakdown:

• 🔴 Top Range Resistance – 12,848

Marked in Red: This area has previously acted as a supply zone, where prices were rejected sharply. It is a potential region to watch for bearish reversal patterns, especially if price rises into this zone on weak volume or shows rejection candles like shooting star or bearish engulfing.

• 🟠 Neutral Zone (No Trade Zone) – Between ~12,720 to ~12,680

Marked in Orange: This is an indecision zone, where price has shown choppiness in the past. It is advisable to stay cautious and avoid trades here, as clear momentum is often missing in this range.

• 🟢 Support Zone – 12,617

Marked in Green: This is the demand zone, where price previously reversed on higher volume. It is a good region to observe for bullish candlestick confirmation patterns (e.g., hammer, bullish engulfing, morning star) on intraday timeframes.

________________________________________________________________________________

🔍 Candlestick Pattern Observation:

At the support zone (12,617), the most recent candle (the last one) shows a long lower wick with a bullish body, forming a bullish hammer-like structure.

• 🧠 Interpretation: This suggests possible buying interest at lower levels, especially since it coincides with volume spike, indicating potential reversal.

• 📌 However, confirmation from the next candle (closing above 12,670 with decent volume) would be required before validating it as a bullish reversal.

________________________________________________________________________________

⚙️ Educational Trade Idea (For Study Purpose Only):

▶️ Potential Long Trade Setup (Bullish Bias)

• Entry (Low-Risk Learner Zone): Around 12,670–12,675, only if next candle shows bullish strength

• Stop Loss: Below 12,617 (zone low) → e.g., 12,600

🧠 Reasoning:

• Price is reacting from a well-identified demand zone

• Volume spike confirms possible accumulation

• Candle with rejection wick hints at reversal interest

• Risk-reward approx. 1:2 or better depending on exit point

________________________________________________________________________________

⚠️ Disclaimer (SEBI-Compliant):

This analysis is shared strictly for educational and informational purposes. It does not constitute investment advice or a recommendation to trade. Viewers are encouraged to use this for learning technical chart reading and should consult a registered advisor before making any financial decisions.

STWP | Learn. Trade. Grow.

________________________________________________________________________________

What do you think about this setup?

Did you spot any other patterns or zones?

👇 Drop your comments below — let’s grow together!

________________________________________________________________________________

EURUSD – Bearish Pressure Resumes After Rejection at 1.17500EURUSD has rejected the 1.17500 resistance zone and is now forming lower highs on the H4 chart, signaling weakening bullish momentum within the ascending channel.

Stronger-than-expected Core PCE data from the US reinforces the Fed’s cautious stance, keeping the USD strong. Meanwhile, political rumors about Trump potentially replacing Powell have triggered market volatility but still support the dollar in the short term.

As long as price fails to break above 1.17500, EURUSD is likely to decline toward the 1.15900 zone. A bullish scenario would only be validated if price closes above 1.1760.

XAUUSD – Bearish Pressure Intensifies, New Lows in SightGold remains firmly within a well-defined descending channel, consistently forming lower highs and lower lows. After a breakout of the minor channel, price appears to be pulling back toward the 3,300 zone before potentially resuming its downtrend.

The temporary ceasefire between Iran and Israel and the US–China rare earth trade deal have dampened safe-haven demand, with capital rotating back into equities. At the same time, stable core PCE data supports the USD, adding further pressure on gold.

If price fails to hold above the 3,260 area, the next target lies near 3,218.

XAUUSD Bullish Reversal from Channel Support | Gold Buy SetupAnalysis Overview:

Gold has been trading inside a clearly defined descending channel (marked by the orange trendlines). After a strong bearish move, price has reached the lower boundary of this channel, which is acting as dynamic support.

Key Technical Details:

Descending Channel Support: XAUUSD has tested the lower trendline multiple times and is currently showing rejection wicks, suggesting potential exhaustion of selling pressure.

Demand Zone: The shaded horizontal area represents a prior consolidation and minor support level that aligns with the channel bottom, adding strong confluence.

Entry: Planned buy entry at the current level near channel support, anticipating a bounce.

Stop Loss: Placed below the recent swing low and outside the channel, to allow room for volatility while protecting against continuation of the downtrend.

Target: The mid-to-upper boundary of the descending channel, aiming for a favorable risk-reward ratio.

Market Context: The higher timeframe trend remains bearish overall, so this is a short-term reversal (counter-trend) setup within the channel structure.

Trade Plan Rationale:

Expecting a corrective move upward within the descending channel as price retests previous supply zones and dynamic resistance. This setup is based on:

Confluence of channel support and demand zone

Multiple rejection wicks showing buyers stepping in

Potential mean reversion towards the channel midpoint

Disclaimer:

This is my personal analysis on XAUUSD and not financial advice. Always do your own research and manage risk carefully.

Gold at Crucial 325x Support – What's Next for the Yellow Metal?XAUUSD D1 Forecast: Gold at Crucial 325x Support – What's Next for the Yellow Metal?

Namaste, fellow traders!

Today, let's zoom out and look at the bigger picture for Gold (XAUUSD) on the Daily (D1) timeframe. Our analysis indicates that Gold has hit a very strong, hard support level around the 325x region. This is a pivotal point that could dictate Gold's medium to long-term direction!

🌍 Macroeconomic Context: The Forces at Play for Gold

While we've seen some USD weakness due to speculations surrounding the Fed (like the rumors about replacing Powell) and expectations of rate cuts, these factors haven't completely prevented Gold's recent decline on the daily chart. Also, the sustained ceasefire between Israel and Iran is reducing Gold's safe-haven appeal.

However, the current price action at the robust 325x support level is a significant technical signal. The influence of upcoming US macroeconomic data (especially the PCE Index on Friday) and speeches from FOMC members will be crucial in confirming or negating Gold's next moves. If positive news for Gold aligns with this support holding, it could act as a strong catalyst.

📊 XAUUSD Technical Analysis (D1): Predicting Gold's Next Move

Based on the fact that Gold has encountered strong support at 325x, we can anticipate the following scenarios:

Bounce from 325x (Potential Upside Phase):

If the 325x area (which reinforces the 3264.400 support from image_e9d325.png) holds firm, we expect a strong reaction and an upward move for Gold.

The initial target for this bounce would be the 332x region, which aligns with resistance levels 3313.737 - 3330.483 from our previous analysis. On a broader timeframe (as shown in image_83845c.png), this corresponds to the resistance zone around 3326.022. This 332x area could represent a continuation pattern, meaning it might be a corrective rise before the resumption of the larger trend.

Resumption of Downtrend (After Reaching 332x):

Once Gold reaches and tests the 332x zone (3313.737 - 3330.483 / 3326.022) and shows bearish confirmation signals (e.g., a strong bearish engulfing candle, a pin bar, or a clear top formation), we anticipate a resumption of the downward movement.

The next major target for this fall would be the 317x area, which correlates well with the strong support at 3173.052 on the larger timeframe (as depicted in image_83845c.png).

🎯 XAUUSD D1 Trading Plan: Your Long-Term Strategy Ahead!

Considering the current D1 analysis, here's our actionable plan:

1. BUY PHASE (Bounce from Support):

Entry: Observe price reaction in the 325x - 326x zone (especially 3264.400). Only buy if there are clear bullish confirmations (e.g., a confirmed bullish pattern on the daily or 4-hour candle, a strong bounce from the zone with volume).

SL: Just below the 325x support zone (e.g., 3245-3240, depending on confirmation).

TP: 3280 - 3290 - 3300 - 3313.737 - 3326.022 (key 332x zone). This will be our primary target for the bounce.

2. SELL PHASE (Downtrend Resumption):

Entry: After the price reaches the 332x zone (3313.737 - 3330.483 / 3326.022) and shows bearish confirmation signals (e.g., strong bearish engulfing, pin bar, or top formation).

SL: Slightly above the 332x zone (e.g., 3335-3340).

TP: 3300 - 3290 - 3280 - 3270 - 3260 - 3250 - 3200 - 3173.052 (final 317x target).

XAUUSD – Bull Trap Revealed, Drop Toward 3,304 Incoming?Gold is retesting the descending trendline around 3,366, but rejection signals are starting to emerge. The recent bounce only tapped into a Fair Value Gap – a hidden liquidity zone – and is now losing momentum.

The structure remains bearish with lower highs, and the downtrend channel continues to dominate price action. If 3,366 gets rejected again, a sharp move toward 3,304 could be triggered – or even lower.

Fresh news supports the bearish case:

U.S. jobless claims beat expectations → USD strengthens

Iran–Israel ceasefire → Gold loses safe-haven appeal

ISLAMIC NEW YEAR OR RATHYATRA PICKTechnical View

Stock is clearly formed Cup&Handle pattern. Privious major SR Line break. Pattern made near major SR line. complete reversal formation.

RESPONIND

CMP 219

TARGET 250/275/300+++

BUY ON DIPS NEAR 200-204

SL 190( DAILY CLOSING BASIS)

Fundamental View

ROE and ROE BOTH ARE GOOD. Quaterly and Yearly boh Revenue and PAT are Highest Ever. positive cashflow..

I Am Not SEBI Registered Research Analyst. It Is Giving Only Educational Purpose. Buying in RESPONIND After Discussing With Your Financial Advisor.

Weekly CT & Hiddenline Cracked – Supply/Demand Zones In PlayThis weekly chart shows a well-defined price structure shaped around multi-timeframe supply and demand dynamics:

🟩 Green Zone – Broad demand zone, price has respected this area multiple times recently.

🟥 Red Zone – Long-standing WTF supply zone, tested multiple times in the past.

⚪️ White Solid Line – Active CT (corrective trendline), which has been broken cleanly on this week’s candle. Being a weekly close (Friday), the breakout carries more weight.

⚪️ Dotted White Line – A hidden resistance trendline, possibly acting as a confluence level for prior rejections. That too has been convincingly breached.

📊 Notice the strong volume spike on the breakout – always worth watching in a structure like this.

🔁 No predictions. Not a call. Just chart structure and context.

XAUUSD: Gold's Golden Glow Fades Below $3350 XAUUSD: Gold's Golden Glow Fades Below $3350 – Navigating Key Levels Amidst USD Weakness!

Let's dive into the fascinating world of Gold (XAUUSD) today. The yellow metal is showing subtle positive movement, primarily influenced by a weaker US Dollar, but a convincing bullish breakout above the $3350 mark remains elusive.

🌍 Macroeconomic Snapshot: USD's Woes & Gold's Mild Support

Gold has seen a slight positive bias for the second consecutive day, yet it's struggling to find significant follow-through, staying below the $3350 level in early European trading.

USD Under Pressure: Reports indicating that US President Donald Trump is considering replacing Fed Governor Jerome Powell have sparked concerns regarding the future independence of the US central bank.

Cautious Outlook: This mixed bag of news calls for caution before confirming a definitive bottom for Gold or positioning for a substantial recovery from levels below $3300 (or Tuesday's two-week low). Traders are currently focused on upcoming US macroeconomic data and speeches from FOMC members, which could influence XAU/USD ahead of Friday's crucial US Personal Consumption Expenditures (PCE) Price Index release.

📊 XAUUSD Technical Analysis & Intraday Trading Plan:

Current Trend: Gold has recently experienced a sharp decline and is now in a consolidation phase, trading around the $329X mark. Price is currently below shorter-term moving averages, indicating lingering bearish pressure or an accumulation phase.

Key Levels Identified:

Strong Support Zones (Potential BUY Areas): Levels around 3294.414, 3276.122, and particularly 3264.400 are crucial demand areas.

Key Resistance Zones (Potential SELL Areas): Levels at 3313.737, 3321.466, 3330.483, and 3341.947 are identified as significant supply zones.

🎯 XAUUSD Trading Plan (Based on your specified levels):

BUY ZONE (Strong Support - Long-Term Bias):

Entry: 3266 - 3264

SL: 3270

TP: 3280 - 3284 - 3290 - 3295 - 3300 - 3305 - 3310 - 3320

BUY SCALP (Quick Buy at Intermediate Support):

Entry: 3284 - 3282

SL: 3278

TP: 3288 - 3292 - 3296 - 3300 - 3305 - 3310 - 3320 - 3330

SELL ZONE (Key Resistance):

Entry: 3331 - 3333

SL: 3337

TP: 3326 - 3320 - 3316 - 3310 - 3305 - 3300

SELL SCALP (Quick Sell at Near Resistance):

Entry: 3313 - 3315

SL: 3320

TP: 3310 - 3305 - 3300 - 3295 - 3290 - 3280

⚠️ Key Factors to Monitor Closely:

US Macro Data: The upcoming US Personal Consumption Expenditures (PCE) Price Index on Friday is critical.

FOMC Member Speeches: Any comments on monetary policy or inflation outlook will directly impact USD and Gold.

Geopolitical Stability: Developments regarding the Israel-Iran ceasefire can influence safe-haven demand.

Titan | Swing | Breakout Titan has just given a clean trendline breakout followed by a successful retest, which makes this setup quite interesting from a positional swing trade perspective.

✅ Trendline Breakout

• The stock broke a strong descending trendline that had been acting as resistance for several months.

✅ Retest and Bounce

• After the breakout, Titan came back to retest the breakout level near ₹3,380, which held well — a classic bullish sign. This bounce happened around the 38.2% Fibonacci retracement zone — another technical confluence that adds weight to the trade idea.

⸻

📈 Entry, Targets & Stop Loss

• Entry Zone: Around ₹3,665 – ₹3,695

• Stop Loss (SL): Below ₹3,202

Important note: If price breaks below ₹3,500 without RSI crossing 75, it might lead to negative RSI divergence — a warning of weakening momentum. In that case, better to exit to avoid capital getting stuck.

⸻

🎯 Targets Based on Fibonacci Extensions:

• Target 1: ₹4,123

• Target 2: ₹4,324

• Target 3: ₹4,580

These targets are calculated using Fibonacci extension levels, with the final one being the 1.618 golden ratio zone.

⸻

Disclaimer: Do your own analysis before putting money in investment. Idea is for education purpose to share and learn within trading view community. Not a suggestion to put your hard earn money.

OPTIEMUS | Reclaiming Zones, Respecting Trendlines🟩 Price is navigating a critical structure:

White Line = Major CT (Control Trendline) — currently acting as resistance.

White Zone = MTF Supply ➡ Demand Flip Zone — price is holding above it.

Blue Zone = WTF Demand Pocket — also reclaimed recently.

📌 After reclaiming both the blue and white zones, price is now consolidating just under the CT, possibly coiling up.

🧠 Not a prediction. No tips. Just structure-based storytelling.

EURUSD – Short-term pullback before potential recoveryOn June 21, EURUSD edged down 0.12% to close at 1.15222 following mixed PMI data from the Eurozone. The H4 chart shows that price remains within the main ascending channel, forming a lower high around 1.16300 — a signal of a short-term corrective phase.

Currently, EURUSD is consolidating sideways near an unfilled Fair Value Gap (FVG) resistance zone. If price fails to break above this level, a short-term drop toward the ascending channel support at 1.14860 is likely, before a potential rebound toward 1.15860 and possibly 1.16300.

Short-term strategy: Watch price action near the trendline support. If clear bullish rejection appears, this could offer a buying opportunity in line with the broader trend, targeting a recovery to recent highs.

BTCUSDT – Buying Resumes, Bullish Momentum Targets 120,000Bitcoin is flashing strong bullish signals as it continues to hold within a well-defined long-term ascending channel. After a technical bounce from the nearby support zone around 99,614, BTC has regained momentum and is now approaching a key resistance FVG cluster — a potential launchpad for a breakout.

The price structure shows a series of higher lows combined with healthy pullbacks, indicating accumulation and capital rotation back into BTC. A “break–pullback–continuation” pattern is forming, pointing to a likely move toward the psychological resistance level at 120,000 — a target highlighted by many professional traders since the start of the quarter.

Fundamental factors supporting the uptrend:

Large capital inflows are returning to U.S. Bitcoin ETFs, signaling renewed institutional confidence in the bull cycle.

Expectations that the Fed will hold rates steady are weighing on the USD, creating a favorable environment for risk assets like BTC.

Altcoin volatility is fading — often a sign that capital is rotating back into BTC as the market’s leading asset.

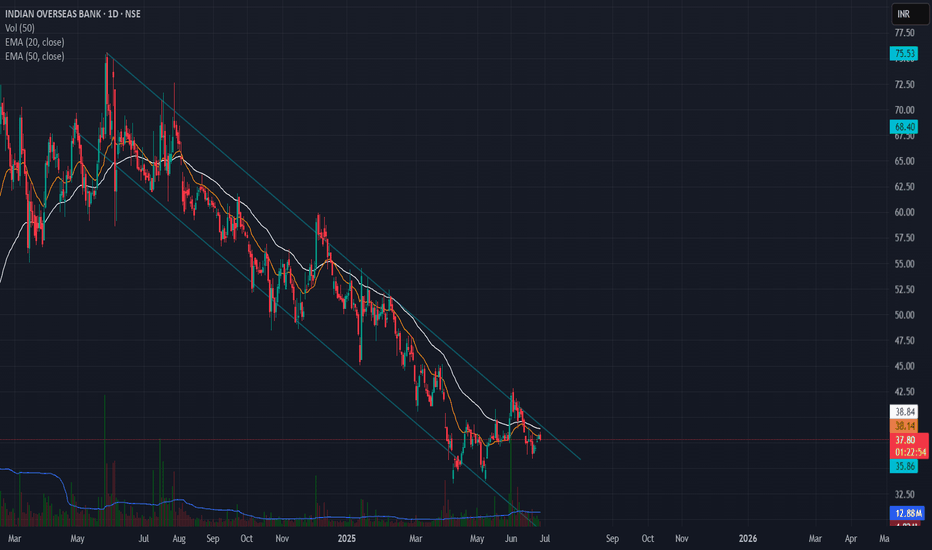

Falling Channel Pattern in Indian Overseas Bank📉 IOB (Indian Overseas Bank) - Falling Channel Setup

🔍 Daily Chart Analysis – June 26, 2025

IOB has been trading within a well-defined falling channel since early 2024. Price is currently testing the upper boundary of the channel but hasn’t confirmed a breakout yet.

🔑 Key Observations:

Structure: Clearly respecting the falling channel.

Moving Averages: Price is hovering around short-term EMAs (20 & 50) and below the both EMA, indicating weak momentum.

Volume: No significant volume surge yet to support a breakout.

Confirmation needed: A close above the trendline (~₹39–40) with volume would be an early sign of bullish reversal.

🎯 Watch for:

Breakout above ₹40 with increased volume = potential short-term rally.

Failure to break may result in retesting lower channel support near ₹33–34.

🧠 Adding this to my breakout watchlist. Will reassess if it closes outside the channel.