Textilestocks

Trend Continuation in SANATHAN TEXTILES LTDNSE:SANATHAN

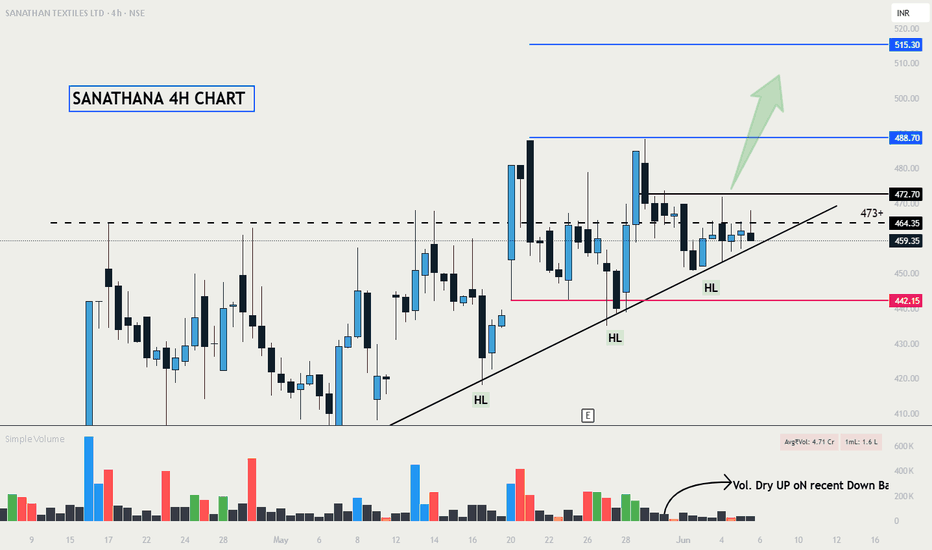

Timeframe - 4H CHART 📊

Base after Breakout 📈

An early entry above - @473 will make Good good RR.

Stock is maintaining clear HH HL structure.

And Recent Down candles are on very low Volume signals sellers getting absorbed.

Keep on radar. ⏳

Keep Learning, Happy Trading.

Pearl Global: Riding the Textile TailwindsNSE:PGIL is a solid pick at these levels in my opinion. Fundamentally we are seeing the story turn around for the textile sector and hence textile companies are on radar for me.

Pearl Global has also come out of a solid consolidation and can be looked at with Stop Loss at 680-715. I feel this can be a great performer in the coming days as we continue to see tailwinds in this sector.

I will not be surprised if it doubles from the breakout levels in 6-8 months.

Elliott Waves and Beyond Decoding DCM Nouvelle Ltd.DCM Nouvelle Limited Overview

Company Background

DCM Nouvelle Limited is an India-based company operating primarily in the textile sector. The company is engaged in the manufacturing and sale of cotton yarn, operating within the Textile segment. DCM Nouvelle stands out as a manufacturer and exporter specializing in cotton carded and combed yarns, offered in both single and two-ply forms.(source Google)

Technical Analysis Highlights

Triangle Breakout with Volumes

There is a triangle breakout with a strong surge in trading volumes, suggesting a potential shift in market sentiment and increased buying interest.

Bullish Divergence and U-Turn

The price, along with technical indicators, has exhibited a bullish divergence, signaling a reversal in the trend. The market has made a U-turn, moving from a bearish to a bullish trajectory.

Elliott Wave Structure

The Elliott Wave analysis suggests that the stock has completed wave (1) and wave (2) on the weekly chart. Currently, it appears to be unfolding wave (3), which has the potential to reach 161.8% of the length of wave (1) from the low of wave (2).

Wave (3) Subdivisions

Within wave (3), there are likely five subdivisions. The analysis indicates that wave (i) within wave 1 has been completed, suggesting further upward movement.

Third Wave in Elliott Waves

The third wave in Elliott Wave theory is often the most powerful and extended wave. It is the primary driving force in a trending market, characterized by strong and sustained price movement in the direction of the overall trend. Traders and investors often look for opportunities to capitalize on the significant price gains associated with the third wave.

Invalidation and Potential Risks:

Invalidation Level

There is an identified invalidation level at 129, which is the low of wave (2). If the price falls below this level, it may indicate a deviation from the expected Elliott Wave pattern.

Assumption Risks

It's crucial to acknowledge that all technical analyses involve a degree of uncertainty. Assumptions may go wrong, and unexpected market developments can lead to different outcomes. In this case, the analysis is based on Elliott Wave principles, and deviations from these patterns are not uncommon.

Disclaimer:

Risk Warning

Trading and investing in financial markets involve risk. Past performance is not indicative of future results. The analysis provided is for informational purposes only and should not be considered as financial advice.

Market Volatility

Markets can be unpredictable, and conditions may change rapidly. Investors should conduct their own research and consider consulting with a financial advisor before making any investment decisions.

Elliott Wave Disclaimer

Elliott Wave analysis is a subjective tool that relies on the interpretation of patterns. The market may not always conform to these patterns, and outcomes may vary.

I am not Sebi registered analyst. My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing. I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Triangle Breakout with Good intensity of volumes

Price with indicator got bullish divergence and got U turned

Elliott wave structure on daily chart

Possible Elliott wave structure on weekly chart

Having potential of being 2x

Buy Trident - One Of The Best Textile Stock Right NowHi guys we will buy trident because it has fallen quite a lot after the crash and has stabilised a little bit and if we look at the Us and

the India markets they are looking bullish so trident will also show signs of bullishness and it would be pretty good trade.

That's all make sure to follow and like

Bye

Lambodhara Textile | C&H in formation | BO Awaited | 25%-90%NSE:LAMBODHARA

Cup and Handle Pattern under formation in Weekly Charts.

Awaiting Breakout above 96-98 Zone WCB

Buy after BO

Target : 122 - 149 - 175

SL : 72

Golden CrossOver in Weekly Chart

RSI > 55

High Risk High Return Bet Similar to Ginni Filaments (sharing the Link to Ginni charts below)

INDO COUNT INDUSTRIES DAILY CHART ANALYSIS 19.12.21INDO COUNT INDUSTRIES as per daily chart analysis is in a brief consolidation zone and stock above 267 level for a target 272. Do note nifty50 tomorrow will fall initial hours and it should take support either at 16891 or 16791 for it bounce back. So buy only after the reversal.