Range break, 1:3 Risk reward, Expecting 10% move in few daysTRITURBINE: Again coming up with swing trade idea. tight consolidation in range of 3% within last 5-6 days. Price is hovering around 10 and 20 EMA. Rejection on 27th Jun shows weak hands going away. Breaking above the pivot line could lead to significant push when crossing with good volume.

SL is somewhere around 3% (Refer the long position drawn over the chart).

One can invest 10% portfolio size as per following calculations

Position sizing and managing risk is the key.

Portfolio is: 1,00,000

Position size: 10,000

Risk 3%: 300. Which means only 0.3% of overall portfolio value is under risk.

Stay connected for commentary for coming days

Disclaimer:

The information provided herein is for educational and informational purposes only and should not be construed as investment advice. The stock analysis and recommendations are based on publicly available information, data sources believed to be reliable, and our interpretation at the time of writing.

Investing in equities involves risks, including the risk of loss of capital. Past performance is not indicative of future results. Readers and investors are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

The author(s), affiliates, or associated entities may hold positions in the stocks mentioned, and such positions are subject to change without notice.

We do not guarantee the accuracy, completeness, or timeliness of any information presented, and we disclaim any liability for financial losses or damages resulting from the use of this content.

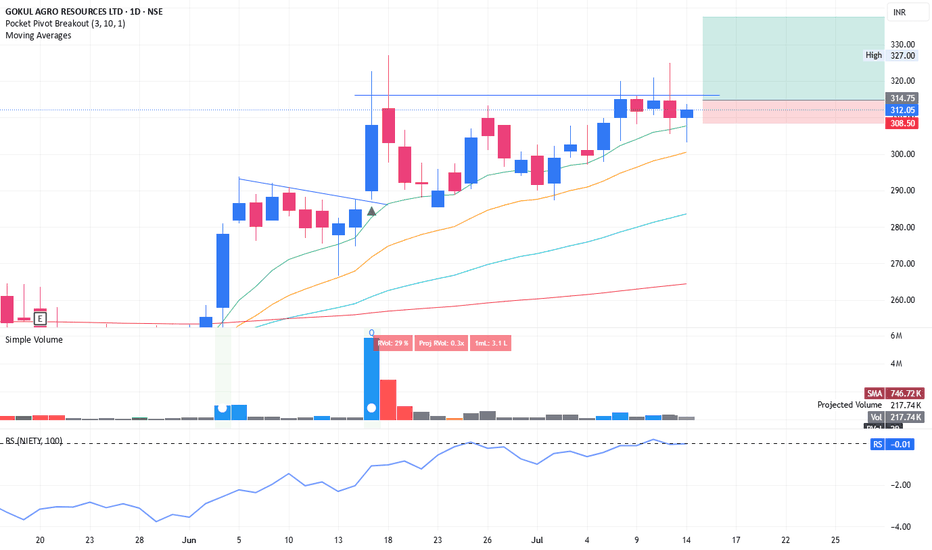

Tightness

Swing trading opportunity with good risk : reward in GOKULAGROAgain coming up with swing trade idea. tight consolidation in range of 2-4% within last 5-6 days. Price is hovering around short term EMA. Looks like weak hands are exiting. Breaking above the pivot line could lead to significant push when crossing with good volume.

SL is somewhere around 3% (Refer the long position drawn over the chart).

One can invest 10% portfolio size as per following calculations

Position sizing and managing risk is the key.

Portfolio is: 1,00,000

Position size: 10,000

Risk 3%: 300. Which means only 0.3% of overall portfolio value is under risk.

Stay connected for commentary for coming days.

Disclaimer:

The information provided herein is for educational and informational purposes only and should not be construed as investment advice. The stock analysis and recommendations are based on publicly available information, data sources believed to be reliable, and our interpretation at the time of writing.

Investing in equities involves risks, including the risk of loss of capital. Past performance is not indicative of future results. Readers and investors are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

The author(s), affiliates, or associated entities may hold positions in the stocks mentioned, and such positions are subject to change without notice.

We do not guarantee the accuracy, completeness, or timeliness of any information presented, and we disclaim any liability for financial losses or damages resulting from the use of this content.

MOTISONS, positive outlook in coming daysNSE:MOTISONS

Again coming up with trade idea. tight consolidation in range of 3-4% within last 5-6 days. Price is taking support on short term EMA. Looks like weak hands are exiting. Breaking above the pivot line (22.08) could lead to significant push when crossing with good volume. Good volume is observed today.

SL is somewhere around 5-6% (Refer the long position drawn over the chart).

One can invest 10% portfolio size as per following calculations

Position sizing and managing risk is the key.

Portfolio is: 1,00,000

Position size: 10,000

Risk 5%: 500. Which means only 0.5% of overall portfolio value is under risk.

Stay connected for commentary for coming days.

Disclaimer:

The information provided herein is for educational and informational purposes only and should not be construed as investment advice. The stock analysis and recommendations are based on publicly available information, data sources believed to be reliable, and our interpretation at the time of writing.

Investing in equities involves risks, including the risk of loss of capital. Past performance is not indicative of future results. Readers and investors are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

The author(s), affiliates, or associated entities may hold positions in the stocks mentioned, and such positions are subject to change without notice.

We do not guarantee the accuracy, completeness, or timeliness of any information presented, and we disclaim any liability for financial losses or damages resulting from the use of this content.

Swing trading opportunity, 1:4 Risk reward NSE:MUTHOOTFIN : Again coming up with swing trade idea. tight consolidation in range of 2% within last 5-6 days. Price is hovering around short term EMA. Looks like weak hands are exiting. Breaking above the pivot line (2655) could lead to significant push when crossing with good volume.

SL is somewhere around 3% (Refer the long position drawn over the chart).

One can invest 10% portfolio size as per following calculations

Position sizing and managing risk is the key.

Portfolio is: 1,00,000

Position size: 10,000

Risk 3%: 300. Which means only 0.3% of overall portfolio value is under risk.

Stay connected for commentary for coming days.

Disclaimer:

The information provided herein is for educational and informational purposes only and should not be construed as investment advice. The stock analysis and recommendations are based on publicly available information, data sources believed to be reliable, and our interpretation at the time of writing.

Investing in equities involves risks, including the risk of loss of capital. Past performance is not indicative of future results. Readers and investors are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

The author(s), affiliates, or associated entities may hold positions in the stocks mentioned, and such positions are subject to change without notice.

We do not guarantee the accuracy, completeness, or timeliness of any information presented, and we disclaim any liability for financial losses or damages resulting from the use of this content.

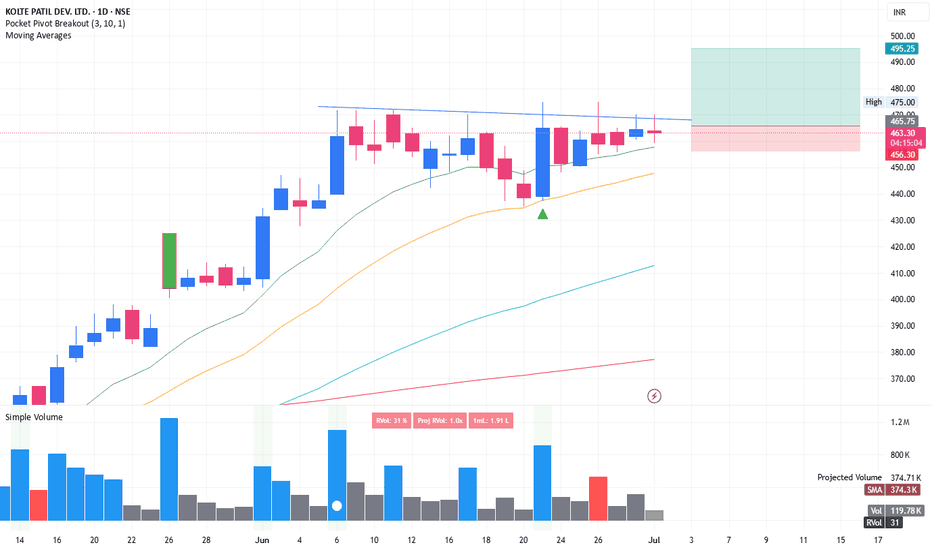

Swing trade opportunity in KOLTEPATILKOLTEPATIL: Tight consolidation with inner bar structure is formed in last 5-6 days. Breaking above the pivot line could lead to significant push when crossing with good volume.

SL is somewhere around 3% (Refer the long position drawn over the chart).

One can invest 10% portfolio size as per following calculations

Position sizing and managing risk is the key.

Portfolio is: 1,00,000

Position size: 10,000

Risk 3%: 300. Which means only 0.3% of overall portfolio value is under risk.

Stay connected for commentary for coming days

Disclaimer:

The information provided herein is for educational and informational purposes only and should not be construed as investment advice. The stock analysis and recommendations are based on publicly available information, data sources believed to be reliable, and our interpretation at the time of writing.

Investing in equities involves risks, including the risk of loss of capital. Past performance is not indicative of future results. Readers and investors are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

The author(s), affiliates, or associated entities may hold positions in the stocks mentioned, and such positions are subject to change without notice.

We do not guarantee the accuracy, completeness, or timeliness of any information presented, and we disclaim any liability for financial losses or damages resulting from the use of this content.

Volatility contraction, breakout and tightnessKFINTECH: Recent breakout which was marked as 1st entry. It is the safest entry, good thing is, post breakout it is forming tightness in price. This acts like spring. Once it bounce from this level, then there are high chance of blasted move.

2nd entry could be above the tightness breakout with 200-300x RVOL during early starting of trading session. This could give huge intraday returns and good topup over existing position

Stay connected for upcoming development and notes.

Disclaimer:

The information provided herein is for educational and informational purposes only and should not be construed as investment advice. The stock analysis and recommendations are based on publicly available information, data sources believed to be reliable, and our interpretation at the time of writing.

Investing in equities involves risks, including the risk of loss of capital. Past performance is not indicative of future results. Readers and investors are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

The author(s), affiliates, or associated entities may hold positions in the stocks mentioned, and such positions are subject to change without notice.

We do not guarantee the accuracy, completeness, or timeliness of any information presented, and we disclaim any liability for financial losses or damages resulting from the use of this content.

ICIL (Indo Count) near major resistance, breakout?Indo Count:

-One simple horizontal line setup (80 days consolidation after good move)

-Signal Candle (white dot candle when 5%+ move and Vol: 1m+) suggesting institution vol kickin in

-tightness after signal candle

-Good shakeout (when price go below major ema (here 100 ema) and rally up, kicking out weak players), check what it did last it udercuts)

But right now market is little tricky for swing traders as stocks are breaking out but no follow-through coming and lots of squats (wick above major resistance breakout, fake-out in same session) too. So one can wait for confirmation what market wants or if have anticipation then best time to build positions.

Capacite Infra, another good Infra stock-Posted good results

-Why i am liking this setup so much is : Its rejection from 200 ema(yellow line), that means its staying very little in Stage 4, means strong buying by Institutions (Lots of white dots : 5% move with 1M vol)

-Recovered fast from 4th June (election result day) bloodbath, again strong stock sign.

-in Tightness phase (volume drying), needed consolidation as already moved 25-30% from 200 ema

-21 ema slope up

ABBOTINDIA - Short term trade based on tightness in priceThe analysis is done on Daily TF hence price may take few weeks to few months in order to reach the targets.

Trade setup is explained in image itself.

One should also look at its peers in Pharma sector for more opportunities -

check below charts -

#CIPLA

#STAR

#SANOFI

The above analysis is purely for educational purpose. Traders must do their own study & follow risk management before entering into any trade

Checkout my other ideas to understand how one can earn from stock markets with simple trade setups. Feel Free to comment below this or connect with me for any query or suggestion regarding this stock or Price Action Analysis.

TRIL, a stock setting up from strong sector.-Strong sector with tailwinds

-After strong move from base:152% in jjust 35 days, didnt fell much.

-Consolidating with tight closes n low vol.

-Strong Relative Strength

-Growth Company: Sales up, OPM improved, EPS growth.

Great Pick, Ready to blast.

GPPL, waiting for results to perform?Another stock from Shipping n Port family yet to perform after good move by Cochin Shipyard, SCI, Mazagon Dock, GRSE, Adani Ports.

-Green Vol > Red Vol, clearing on falls vol is low compare to up days.

-Good recovery from May start correction.

-Tight closes near Down Trendline Breakout (DTL BO), tested multiple times.

-VCP (Volatility Contraction Pattern by sir Mark Minervini) also playing out: 13W-23/4-3T

Lets see how it perform after results (before results trade can be risky so always waiting for results)

Federal-Mogul Goetze getting ready for a breakout FMGOETZE is forming an interesting pattern, this scrip has been trading around 375-350 for a log time now, looks like good accumulation has taken place in this area of interest. The scrip has also entered in a VCP structure with a good shakeout candle, looks like the scrip is all set for a 15-20% move from here on.

Stoploss 345

*DISCLAIMER*

This analysis is only for educational purpose. I am not a SEBI Registered Analyst/Advisor. Please consult your financial advisor before taking any position and please use a Stop Loss for any Investments/Trading Positions. It is your hard earned money so give risk management your highest attention. Do take this disclaimer seriously.

INDIA SHELTER 📌SWING TRADE FOR NEXT WEEK🚀

Hello guys,

I am a swing trader by passion i only trade on swing stocks.

📌I post daily SWING CHARTS analysis on my trading view profile..

so let's start

📌TRADE ANALYSIS OF India shelter :-

•IPO base trade

•Tightness' on daily candles

•Volume Contractions

📌 If you have any questions about any stock you can comment on post 📱

📌Disclaimer:-

This all chatrs analysis are only for educational purposes only

I do not provide any CALL or Tips

VCP development #DHINDIATight VCP can be seen developing in DHINDIA, looks like its setting up for a impulse move now. All the scrips in Capital Goods seem to be in trend. I'll be keeping my position low in this trade.

Stoploss 75

*DISCLAIMER*

This analysis is only for educational purpose. I am not a SEBI Registered Analyst/Advisor. Please consult your financial advisor before taking any position and please use a Stop Loss for any Investments/Trading Positions. It is your hard earned money so give risk management your highest attention. Do take this disclaimer seriously.